Polycarbonate Sheets Market by Type (Solid, Multiwall, Corrugated), End-use Industry (Building & Construction, Electrical & Electronics, Automotive & Transportation, Aerospace & Defense, Packaging), and Region - Global Forecast (2022 - 2025)

Updated on : September 03, 2025

Polycarbonate Sheets Market

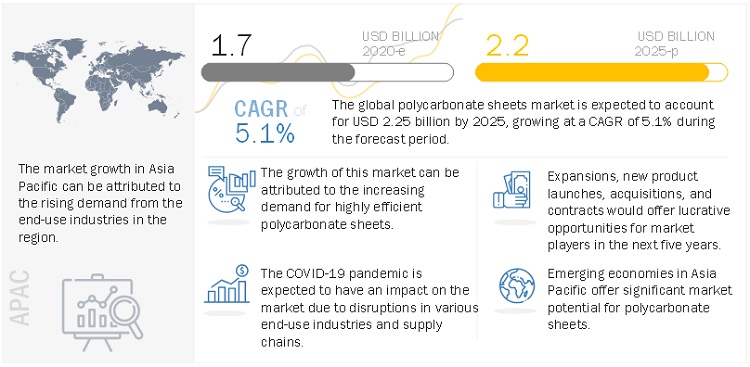

The global polycarbonate sheets market was valued at USD 1.7 billion in 2020 and is projected to reach USD 2.2 billion by 2025, growing at 5.1% cagr from 2020 to 2025. One of the major drivers of the market is the growing demand for these products in the end-use industries. The applicability of polycarbonate sheets in various end-use industries is increasing owing to their exceptional physical and chemical properties. Polycarbonate sheets have been witnessing greater adoption as a preferred thermoplastic material amongst leading global producers. Moreover, high-performance attributes of polycarbonate sheets such as superior thermal resistance, outstanding impact resistance, impressive optical clarity and dimensional stability is soaring the demand. As compared to other thermoplastics such as acrylic and polymethyl methacrylate (PMMA), polycarbonate sheets undergo minimal degradation when heated or cooled.

Attractive Opportunities in the Polycarbonate Sheets Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global polycarbonate sheets market

The COVID-19 pandemic had a significant impact on the polycarbonate sheets market. The outbreak had distorted operational efficiency and disrupted the value chains due to the sudden shutdown of national and international boundaries, which created revenue loss and damage. The disruptions in the production and supply chain had a negative impact on the polycarbonate sheets market. The implementation of lockdown in various countries along with travel restrictions lessened the global supply of products along with a reduced logistic operation.

Construction activities were completely shut down initially but in third quarter of 2020, these activities were granted permission to operate with COVID-19 operational measures. Availability of workforce and raw material supply & prices are the biggest challenges in the industry after unlocking. Raw material sector have been adversely impacted due to pandemic, which is expected to decline the growth of polycarbonate sheets market.

Polycarbonate Sheets Market Dynamics

Driver: Increase in demand for polycarbonate sheets from various end-use industries

The increasing demand from end-use industries is driving the global polycarbonate sheets market owing to their exceptional physical and chemical properties. In addition, the versatile characteristics of this material such, as its resistance to temperatures, high flexibility, durability, strength, and ease to fit without cracking, will boost the market demand for polycarbonate sheets over the period.

These sheets come in a variety of thicknesses and grades. Compared, to glass they are much lighter in weight, durable and resistant to breakage and cracks. Polycarbonates are used, in several applications such as window glazing, skylights, riot shields, medical equipment, food processing, and exhibits & displays, as they can be easily shaped, and thermoformed. Polycarbonate sheets are well-known for their strong impact resistance and durability. With strong insulating capabilities and high-quality UV protection, polycarbonates sheets are the ideal approach to enhance living spaces, both outdoors and indoors.

Restraint: Environmental impacts of polycarbonate sheets

One of the most common plastics in use is polycarbonate due to its flexibility across a wide range of industries, as well as it’s durability. However, they are not very environmentally-friendly as they contain bisphenol A. BPA is bisphenol-A which is a chemical used in plastics and resin and has traditionally been a concern for some, due to its presence in plastics used for food & beverages. The concern is that there is a chance of toxicity affecting the products from the containers that they are stored in. This includes cans and bottles or food containers, plates and baby bottles.

Accidental disposal of polycarbonate sheet waste in riverbeds or the sea is a major threat to aquatic life. The Resin Identification Code (RIC) code of polycarbonate materials is 7, which implies that these materials are difficult to recycle. Moreover, recycled polycarbonate sheets show a lower impact resistance compared to newly manufactured polycarbonate sheets.

Opportunity: Rise in demand for billboards and ID card printing

The manufacturing and fabrication of glow signboards and ID cards underwent technological advancements. The demand for polycarbonate sheets for ID cards printing is increasing because the sheet is particularly resistant to scratches, has high stability, is long-lasting, and is durable. Polycarbonate is becoming a more common choice in many countries throughout the world as it improves the security of ID cards. A variety of plastics, including polycarbonate sheets, are used to make these ID cards. Because of the interlaced layers of plastic, swapping document information or photographs is very hard without damaging the document and rendering it unusable. The rising need for glazing security will propel the polycarbonate sheets market forward in the future. Polycarbonate sheets, which are lighter and more durable than paper, are also utilized in glow sign boards for various exterior and interior applications.

Challenge: Volatile raw material prices

Fluctuating the price of polycarbonate sheets is posing a challenge to the global polycarbonate sheets market. The main factors determining the pricing of finished products are fluctuating raw material prices and the availability of raw materials. The majority of raw materials used for making polycarbonate sheets are petroleum-based, making them sensitive to commodity price volatility. Thus, the price of polycarbonate sheets has been influenced by changing crude oil prices in recent years. Therefore, customers who are price-sensitive and import threats have an impact on polycarbonate sheet suppliers.

Polycarbonate Sheets Market Ecosystem

Source: Secondary Research and MarketsandMarkets Analysis

In terms of value, the solid segment is projected to account for the largest share of the polycarbonate sheets market, by type, during the forecast period.

Solid polycarbonate sheet is superior to hollow polycarbonate sheet in light transmission and impact strength. Hence, it is especially suitable for the applications where light is urgently needed, such as lamp boxes, hood lighting, industrial shops and greenhouse. Solid polycarbonate sheet is similar to glass in clarity. These sheets possesses exceptional light transmission, high impact strength, lightweight, excellent thermal insulation, and flame resistance properties making it suitable for a wide range of applications.

Building & construction is projected to be the largest end-use industry.

The building & construction industry is projected to be the largest end-use industry segment of the polycarbonate sheets market during the forecast period. Building & construction applications are on the rise since numerous architects are realizing the benefits of polycarbonate sheets in skylight roofing, cladding, and other applications that require high aesthetic appeal with durability and sustainability. The product is also used owing to its lightweight and durability, high impact and heat resistance, high optical clarity, and other such properties. It is an effective substitute to acrylic sheets or glass materials and thus the consumption is expected to rise significantly in the foreseeable future. Glass-clad laminates also offer resistance to high-powered ballistics and are therefore extensively used in the industry.

Asia Pacific region leads the polycarbonate sheets market in terms of value.

The Asia Pacific accounted for a majority of the global market share owing to rapid industrialization and fast-growing economic conditions. Expanding end-use industries in the Asia Pacific, especially in emerging economies such as India, China, Thailand, and Indonesia are driving demand for substitution of conventional materials such as glass, wood, metal, and others. China is the leading country in the Asia Pacific in terms of the fast-growing aviation market, with a year-on-year rise of 15.1%. The requirement is majorly rising from the aviation industry for interior decorations and other such applications, to reduce the weight of the vehicle and to effectively increase fuel economy. This, in turn, is forecasted to foster the growth of the product in the region over the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Polycarbonate Sheets Market Players

Major players operating in the global polycarbonate sheets market include SABIC (Saudi Arabia), Covestro AG (Germany), Trinseo S.A. (US), Teijin Limited (Japan), Mitsubishi Gas Chemical Company, Inc. (Japan), Evonik Industries AG (Germany), Suzhou Omay Optical Materials Co., Ltd. (China), Excelite (China), Plazit-Polygal Group (Israel), Arla Plast AB (Sweden), 3A Composites GmbH (Germany), Palram Industries Ltd. (Israel), Ug-oil-Plast Ltd. (Russia), Gallina India (New Delhi), Koscon Industrial S.A. (Switzerland), Isik Plastik (Turkey), Brett Martin Ltd. (UK), and Spartech (US).

Polycarbonate Sheets Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 1.7 billion |

|

Revenue Forecast in 2025 |

USD 2.2 billion |

|

CAGR |

5.1% |

|

Years considered for the study |

2018–2025 |

|

Base year |

2018 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Type, End-use Industry |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

SABIC (Saudi Arabia), Covestro AG (Germany), Trinseo S.A. (US), Teijin Limited (Japan), Mitsubishi Gas Chemical Company, Inc. (Japan), Evonik Industries AG (Germany), Suzhou Omay Optical Materials Co., Ltd. (China), Excelite (China), Plazit-Polygal Group (Israel), Arla Plast AB (Sweden), 3A Composites GmbH (Germany), Palram Industries Ltd. (Israel), Ug-oil-Plast Ltd. (Russia), Gallina India (New Delhi), Koscon Industrial S.A. (Switzerland), Isik Plastik (Turkey), Brett Martin Ltd. (UK), and Spartech (US) |

This research report categorizes the polycarbonate sheets market based on type, end-use industry, and region.

Based on the type:

- Solid

- Multiwall

- Corrugated

- Others

Based on the end-use industry:

- Building & Construction

- Electrical & Electronics

- Automotive & Transportation

- Aerospace & Defense

- Packaging

- Others

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2021 Nusaned Investment, a wholly-owned subsidiary of SABIC that operates as an autonomous investment company, inaugurated its new office building and launched a new brand identity at a ceremony in Riyadh. This expansion was aimed at expanding its local presence to cater to the market demand.

- In February 2018, Covestro launched Makrolon Rx3440 polycarbonate for medical-grade polycarbonate applications. This launch helped the company enhance its product portfolio of polycarbonate sheets.

- In August 2018, Teijin Limited acquired Inapal Plasticos SA (Inapal), which is a leading automotive composite supplier in Portugal. This acquisition was aimed at expanding its business portfolio and cater to the unstrapped market demand.

- In January 2018, SABIC launched LEXAN CXT resin, a new line of high-clarity, high-heat, and injection moldable polycarbonate copolymer resin used in the optical electronics, consumer & industrial, and healthcare industries applications. With this launch, the company strengthened its portfolio of polycarbonate sheets.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of polycarbonate sheets market?

The growth of this market can be attributed to rising demand from the key end-use industries.

Which are the key sectors driving the polycarbonate sheets market?

Growth of building & construction industry along with the growing demand for polycarbonate sheets in the packaging industry are the key factors driving the polycarbonate sheets market.

Who are the major manufacturers?

Major manufactures include SABIC (Saudi Arabia), Covestro AG (Germany), Trinseo S.A. (US), Teijin Limited (Japan), Mitsubishi Gas Chemical Company, Inc. (Japan), and Evonik Industries AG (Germany), among others.

What is the biggest restraint for polycarbonate sheets?

The environmental impacts of polycarbonate sheets is restraining the growth of the market.

How is COVID-19 affecting the overall polycarbonate sheets market?

The market has been affected by the outbreak of the COVID-19 pandemic, as there has been decline in demand for residential and non-residential sectors. New construction and aftermarket have also been adversely affected with the pandemic. Construction activities were completely shut down initially but in third quarter these activities were granted permission to operate with COVID-19 operational measures. Availability of workforce and raw material supply & prices are the biggest challenges in the industry after unlocking.

What will be the growth prospects of the polycarbonate sheets market?

Developing countries is expected to offer significant growth opportunities to manufacturers of polycarbonate sheets. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SEGMENTATION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 1 POLYCARBONATE SHEETS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

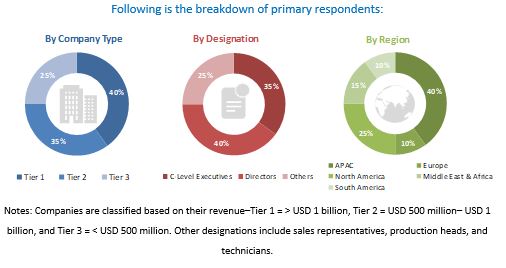

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION: POLYCARBONATE SHEETS MARKET

FIGURE 3 POLYCARBONATE SHEETS MARKET, BY REGION

FIGURE 4 POLYCARBONATE SHEETS MARKET, BY TYPE

FIGURE 5 MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

2.2.1 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 ASSUMPTIONS

2.4 LIMITATIONS

2.5 DATA TRIANGULATION

FIGURE 8 POLYCARBONATE SHEETS MARKET: DATA TRIANGULATION

3 EXECUTIVE SUMMARY (Page No. - 33)

FIGURE 9 SOLID POLYCARBONATE SHEETS SEGMENT TO DOMINATE THE MARKET THROUGH 2025

FIGURE 10 PACKAGING INDUSTRY TO GROW AT THE HIGHEST RATE IN THE NEXT FIVE YEARS

FIGURE 11 APAC TO REMAIN THE LARGEST MARKET FOR POLYCARBONATE SHEETS

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN THE POLYCARBONATE SHEETS MARKET

FIGURE 12 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR THE MARKET PLAYERS

4.2 APAC: POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 13 CHINA WAS THE LARGEST MARKET FOR POLYCARBONATE SHEETS IN APAC IN 2019

4.3 POLYCARBONATE SHEETS, BY TYPE

FIGURE 14 SOLID POLYCARBONATE SHEETS TO GROW AT THE HIGHEST CAGR

4.4 POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY

FIGURE 15 BUILDING & CONSTRUCTION INDUSTRY WAS THE LARGEST SEGMENT IN 2020

4.5 POLYCARBONATE SHEETS MARKET, BY COUNTRY

FIGURE 16 POLYCARBONATE SHEETS MARKET IN DEVELOPING COUNTRIES TO GROW AT A FASTER RATE THAN IN DEVELOPED COUNTRIES

4.6 APAC: POLYCARBONATE SHEETS MARKET

FIGURE 17 CHINA TO LEAD THE POLYCARBONATE SHEETS MARKET IN APAC

4.7 POLYCARBONATE SHEETS MARKET: REGIONAL GROWTH RATES

FIGURE 18 INDIA TO REGISTER THE HIGHEST CAGR, FOLLOWED BY CHINA

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE-CHAIN ANALYSIS

5.2.1 RAW MATERIALS

5.2.2 RESEARCH AND DEVELOPMENT

5.2.3 MANUFACTURING

5.2.4 DISTRIBUTION

5.2.5 MARKETING & SALES

5.2.6 END-USER

5.3 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE POLYCARBONATE SHEETS MARKET

5.3.1 DRIVERS

5.3.1.1 Growing demand from end-use industries

5.3.2 RESTRAINTS

5.3.2.1 Environmental impacts of polycarbonate sheets

5.3.3 OPPORTUNITIES

5.3.3.1 Increase in demand for billboards & ID card printing

5.3.4 CHALLENGES

5.3.4.1 Fluctuating raw material prices

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF SUBSTITUTES

5.4.2 THREAT OF NEW ENTRANTS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 PRICING ANALYSIS

6 POLYCARBONATE SHEETS MARKET, BY TYPE (Page No. - 48)

6.1 INTRODUCTION

FIGURE 22 SOLID SEGMENT LED THE POLYCARBONATE SHEETS MARKET IN 2019

TABLE 1 POLYCARBONATE SHEETS MARKET, BY TYPE, 2018–2025 (KILOTON)

TABLE 2 POLYCARBONATE SHEETS MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.2 SOLID

TABLE 3 SOLID POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (KILOTON)

TABLE 4 SOLID POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 MULTIWALL

TABLE 5 MULTIWALL POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (KILOTON)

TABLE 6 MULTIWALL POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 CORRUGATED

TABLE 7 CORRUGATED POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (KILOTON)

TABLE 8 CORRUGATED POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.5 OTHERS

TABLE 9 OTHER POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (KILOTON)

TABLE 10 OTHER POLYCARBONATE SHEETS MARKET, BY REGION, 2018–2025 (USD MILLION)

7 POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY (Page No. - 53)

7.1 INTRODUCTION

FIGURE 23 BUILDING & CONSTRUCTION SEGMENT TO DOMINATE THE POLYCARBONATE SHEETS MARKET THROUGH 2025

TABLE 11 POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 12 POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

7.2 BUILDING & CONSTRUCTION

TABLE 13 BUILDING & CONSTRUCTION: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 14 BUILDING & CONSTRUCTION: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 ELECTRICAL & ELECTRONICS

TABLE 15 ELECTRICAL & ELECTRONICS: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 16 ELECTRICAL & ELECTRONICS: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.4 AUTOMOTIVE & TRANSPORTATION

TABLE 17 AUTOMOTIVE & TRANSPORTATION: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 18 AUTOMOTIVE & TRANSPORTATION: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.5 AEROSPACE & DEFENSE

TABLE 19 AEROSPACE & DEFENSE: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 20 AEROSPACE & DEFENSE: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.6 PACKAGING

TABLE 21 PACKAGING: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 22 PACKAGING: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.7 OTHERS

TABLE 23 OTHERS: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 24 OTHERS: POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 POLYCARBONATE SHEETS MARKET, BY REGION (Page No. - 62)

8.1 INTRODUCTION

FIGURE 24 CHINA AND INDIA TO REGISTER HIGH GROWTH RATES, 2020–2025

TABLE 25 POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 26 POLYCARBONATE SHEETS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2 APAC

FIGURE 25 APAC: POLYCARBONATE SHEETS MARKET SNAPSHOT

TABLE 27 APAC: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 28 APAC: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 APAC: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 30 APAC: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 31 APAC: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 32 APAC: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.2.1 CHINA

8.2.1.1 China is a leading plastics manufacturer and consumer

TABLE 33 CHINA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 34 CHINA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.2.2 INDIA

8.2.2.1 India is a leading base for electrical and automotive assembly owing to a large number of plastic processing units

TABLE 35 INDIA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 36 INDIA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.2.3 JAPAN

8.2.3.1 Developed manufacturing facilities along with a highly trained workforce is expected to drive the market

TABLE 37 JAPAN: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 38 JAPAN: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 The plastics industry in South Korea has been a major driving force in building the nation’s economy

TABLE 39 SOUTH KOREA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 40 SOUTH KOREA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.2.5 REST OF APAC

TABLE 41 REST OF APAC: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 42 REST OF APAC: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.3 EUROPE

FIGURE 26 SOLID POLYCARBONATE SHEETS TO DOMINATE THE EUROPEAN MARKET DURING THE FORECAST PERIOD

TABLE 43 EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 44 EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 46 EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 48 EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Owing to the vast and mature chemical and manufacturing industries, Germany is one of the attractive markets

TABLE 49 GERMANY: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 50 GERMANY: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 France is the third-largest market for polycarbonate sheets because of its industrial hubs and presence of major international companies

TABLE 51 FRANCE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 52 FRANCE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.3.3 ITALY

8.3.3.1 Diversified industrial base and exports to the EU and Mediterranean countries positively impact the country’s economy

TABLE 53 ITALY: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 54 ITALY: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.3.4 UK

8.3.4.1 The UK is a leader in the plastics industry owing to its technological advancements and high economic strength

TABLE 55 UK: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 56 UK: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Rising consumer spending and increasing exports to drive the economic growth of Spain

TABLE 57 SPAIN: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 58 SPAIN: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 59 REST OF EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 60 REST OF EUROPE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 27 NORTH AMERICA: POLYCARBONATE SHEETS MARKET SNAPSHOT

TABLE 61 NORTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 62 NORTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 64 NORTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 66 NORTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.4.1 US

8.4.1.1 Increasing manufacturing activities and investments to produce polycarbonate sheets will drive the market in the country

TABLE 67 US: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 68 US: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.4.2 MEXICO

8.4.2.1 A large concentration of gas reserves to create petrochemicals and further plastics is driving the market

TABLE 69 MEXICO: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 70 MEXICO: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.4.3 CANADA

8.4.3.1 Canada has a diversified economy and produces about 2% of the total world volume of plastic products

TABLE 71 CANADA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 72 CANADA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

FIGURE 28 SAUDI ARABIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 73 MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 74 MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 76 MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 78 MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 An increase in the number of construction and infrastructure development activities is driving the market

TABLE 79 SAUDI ARABIA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 80 SAUDI ARABIA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.5.2 UAE

8.5.2.1 Polycarbonate sheet consumption in the UAE has been experiencing rapid growth due to the flourishing construction sector

TABLE 81 UAE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 82 UAE: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.5.3 SOUTH AFRICA

8.5.3.1 Investments by the government in the construction and industrial sectors to boost the demand

TABLE 83 SOUTH AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 84 SOUTH AFRICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.5.4 REST OF THE MIDDLE EAST & AFRICA

TABLE 85 REST OF THE MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 86 REST OF THE MIDDLE EAST & AFRICA: POLYCARBONATE SHEETS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.6 SOUTH AMERICA

FIGURE 29 INCREASING DEMAND FROM THE PACKAGING AND BUILDING & CONSTRUCTION INDUSTRIES TO DRIVE THE SOUTH AMERICAN POLYCARBONATE SHEETS MARKET

TABLE 87 SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 88 SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 89 SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 90 SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 92 SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Brazil is the largest market for polycarbonate sheets in South America and the seventh-largest consumer of plastics in the world

TABLE 93 BRAZIL: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 94 BRAZIL: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 The demand for polycarbonate sheets from construction and automotive industries to drive the market

TABLE 95 ARGENTINA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 96 ARGENTINA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 97 REST OF SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 98 REST OF SOUTH AMERICA: POLYCARBONATE SHEETS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

9 IMPACT OF COVID-19 ON POLYCARBONATE SHEETS MARKET (Page No. - 101)

9.1 OVERVIEW

9.2 COVID-19 IMPACT ON THE TYPES

9.2.1 SOLID

9.2.2 MULTIWALL

9.2.3 CORRUGATED

9.3 COVID-19 IMPACT ON THE END-USE INDUSTRIES

9.3.1 SHIFT IN CONSTRUCTION INDUSTRY

9.3.1.1 Impact on customers’ output and strategies to resume/improve production

9.3.2 SHIFT IN AUTOMOTIVE INDUSTRY

9.3.2.1 Impact on customers’ output and strategies to resume/improve production

9.3.3 SHIFT IN ELECTRONICS INDUSTRY

9.3.3.1 Impact on customers’ output and strategies to resume/improve production

9.4 BIGGEST LOSERS, BY TOP END-USE INDUSTRIES

9.4.1 CONSTRUCTION

9.4.2 AUTOMOTIVE

9.4.3 ELECTRONICS

9.5 SUPPLY CHAIN DISRUPTION

9.6 WINNING STRATEGIES OF THE COMPANY TO GAIN MARKET SHARE

9.6.1 SHORT-TERM STRATEGIES (TILL DEC 2020)

9.6.2 MID-TERM STRATEGIES (2021-2022)

9.6.3 LONG-TERM STRATEGIES (2022 ONWARDS)

10 COMPETITIVE LANDSCAPE (Page No. - 110)

10.1 INTRODUCTION

FIGURE 30 NEW PRODUCT DEVELOPMENTS/LAUNCHES WAS THE KEY GROWTH STRATEGY ADOPTED BY THE PLAYERS

10.2 COMPETITIVE LEADERSHIP MAPPING

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 EMERGING COMPANIES

FIGURE 31 POLYCARBONATE SHEETS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 32 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE POLYCARBONATE SHEETS MARKET

10.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 33 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE POLYCARBONATE SHEETS MARKET

10.5 MARKET SHARE ANALYSIS

FIGURE 34 MARKET SHARES OF COMPANIES OPERATING IN THE POLYCARBONATE SHEETS MARKET

10.6 COMPETITIVE SITUATIONS & TRENDS

10.6.1 NEW PRODUCT DEVELOPMENTS/LAUNCHES

TABLE 99 NEW PRODUCT DEVELOPMENTS/LAUNCHES

10.6.2 INVESTMENTS & EXPANSIONS

TABLE 100 INVESTMENTS & EXPANSIONS

10.6.3 MERGERS & ACQUISITIONS

TABLE 101 MERGERS & ACQUISITIONS

10.6.4 PARTNERSHIPS, CONTRACTS & AGREEMENTS, JOINT VENTURES

TABLE 102 PARTNERSHIPS, CONTRACTS & AGREEMENTS, JOINT VENTURES

11 COMPANY PROFILES (Page No. - 120)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 SABIC

FIGURE 35 SABIC: COMPANY SNAPSHOT

FIGURE 36 WINNING IMPERATIVES: SABIC

11.2 COVESTRO AG

FIGURE 37 COVESTRO AG: COMPANY SNAPSHOT

FIGURE 38 WINNING IMPERATIVES: COVESTRO AG

11.3 TRINSEO S.A.

FIGURE 39 TRINSEO S.A.: COMPANY SNAPSHOT

FIGURE 40 WINNING IMPERATIVES: TRINSEO

11.4 TEIJIN LIMITED

FIGURE 41 TEIJIN LIMITED: COMPANY SNAPSHOT

FIGURE 42 WINNING IMPERATIVES: TEIJIN LIMITED

11.5 MITSUBISHI GAS CHEMICAL COMPANY, INC.

FIGURE 43 MITSUBISHI GAS CHEMICAL COMPANY, INC.: COMPANY SNAPSHOT

FIGURE 44 WINNING IMPERATIVES: MITSUBISHI GAS CHEMICALS GROUP

11.6 EVONIK INDUSTRIES AG

FIGURE 45 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

11.7 PALRAM INDUSTRIES LTD.

11.8 ARLA PLAST AB

11.9 3A COMPOSITES GMBH

11.10 PLAZIT-POLYGAL GROUP

11.11 EXCELITE

11.12 OTHER COMPANIES

11.12.1 SUZHOU OMAY OPTICAL MATERIALS CO., LTD.

11.12.2 UG-OIL-PLAST LTD.

11.12.3 GALLINA INDIA

11.12.4 SPARTECH

11.12.5 KOSCON INDUSTRIAL S.A.

11.12.6 BRETT MARTIN LTD.

11.12.7 ISIK PLASTIK

11.12.8 ASAHI GLASS CO., LTD.

11.12.9 SAFPLAST COMPANY

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 158)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the polycarbonate sheets market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the polycarbonate sheets market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The polycarbonate sheets market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use industry, such as building & construction, electrical & electronics, automotive & transportation, aerospace & defense, and packaging among others. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the polycarbonate sheets market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the polycarbonate sheets market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the polycarbonate sheets market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the polycarbonate sheets market

- To analyze and forecast the size of the market based on type and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the polycarbonate sheets market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the polycarbonate sheets market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the polycarbonate sheets market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Polycarbonate Panels Market Overview

Polycarbonate Panels Market Trends

Top Companies in Polycarbonate Panels Market

Polycarbonate Panels Market Impact on Different Industries

Speak to our Analyst today to know more about Polycarbonate Panels Market!

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polycarbonate Sheets Market