Polypropylene Foams Market by Type (EPP, XPP), Application (Automotive, Packaging, Consumer Products), Region (Asia-Pacific, North America, Europe, South America, Middle East & Africa) - Global Forecast to 2021

The polypropylene foams market is projected to reach USD 1.27 Billion by 2021, at a CAGR of 5.78%. In this study, 2015 has been considered the base year for estimating market size. This report aims to estimate the market size and future growth potential of the polypropylene foams market across different segments such as, type, application, and region. Factors influencing market growth such as, drivers, restraints, opportunities, and industry-specific challenges have been studied in the report. Also, the report analyzes the opportunities in the market for stakeholders and presents the competitive landscape for the market leaders.

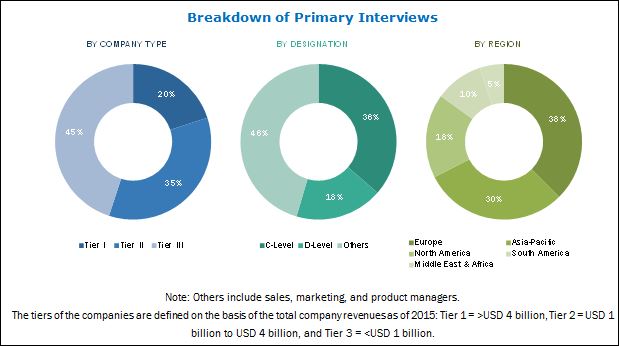

Top-down and bottom-up approaches have been used to estimate and validate the size of the global market and estimate the sizes of various other dependent submarkets in the polypropylene foams market. The research study involved the use of extensive secondary sources, directories and databases such as, Hoovers, Bloomberg, Chemical Weekly, Factiva, Related Associations/Institutes, and other government associations. Private & company websites are also used to identify and collect information useful for the technical, market-oriented, and commercial study of the global polypropylene foams market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of primaries conducted during the research study, on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Polypropylene Foams Market

In the polypropylene foams value chain, the design and prototype phase is carried out according to end-user specifications and needs. The specifications and properties change with the change in the application industry. The raw material for polypropylene foams is the base material, propylene. This base material is used to manufacture polypropylene, and polypropylene resin. These resins are used by foam manufacturers such as, BASF SE (Germany), Borealis AG (Austria), DS Smith Plc (U.K.), Furukawa Electric Co., Ltd. (Japan), JSP (Japan), Kaneka Corporation (Japan), K. K. Nag Ltd. (India), Mitsui Chemicals, Inc. (Japan), Pregis Corporation (U.S.), Sekisui Alveo AG (Switzerland), Sonoco Products Company (U.S.), SSW PearlFoam GmbH (Germany), Synbra Holding bv (Netherlands), Hanwha Corporation (South Korea), and The Woodbridge Group (Canada) to manufacture products for end-user industries, such as automotive, packaging, consumer products, and others. The value chain includes the manufacture of polypropylene foams and the delivery of products to end-users.

Key Target Audience in Polypropylene Foams Market

- Manufacturers of polypropylene foams

- Raw material suppliers

- Molded foam providers

- Industry associations

- Traders, and distributors of polypropylene foams

- Research institutes and government organizations

- Market research and consulting firms

- Manufacturers in end-use industries, i.e., automotive, packaging, and consumer products, among others

- Environment protection agencies

Polypropylene Foams Market Report Scope

This research report categorizes the global polypropylene foams market on the basis of type, application, and region.

On the basis of Type:

- Expanded Polypropylene Foams

- Extruded Polypropylene Foams

On the basis of Application:

- Automotive

- Packaging

- Consumer Products

- Others

On the basis of Region:

- Asia-Pacific

- North America

- Europe

- South America

- Middle East & Africa

Polypropylene Foams Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Polypropylene Foams Market Regional Analysis

- Country-level analysis of the polypropylene foams market by application.

Polypropylene Foams Market Company Information

- Detailed analysis and profiles of additional market players.

The global polypropylene foams market is projected to reach USD 1.27 Billion by 2021, at a CAGR of 5.78% from 2016 to 2021. The growing demand for light weight automotives is leading to an increase in the demand in the polypropylene foams market. Rising demand from end-use industries in the developed and emerging countries has triggered the growth of the polypropylene foams market.

In 2015, the automotive application segment accounted for the largest market share, in terms of volume, followed by the packaging, consumer products, and other applications. The rising demand for new products and innovations, as well as the need for research and development in polypropylene foams has encouraged companies to adopt organic and inorganic strategies and to increase their market shares in the respective regions.

Expanded polypropylene (EPP) foam is currently the leading type of polypropylene foam. However, extruded polypropylene (XPP) foam is the fastest growing type, and is preferred by many major end-use industries for different applications, due to its superior performance characteristics such as, high impact resistance, light weight, water & moisture resistance, and shape retention property.

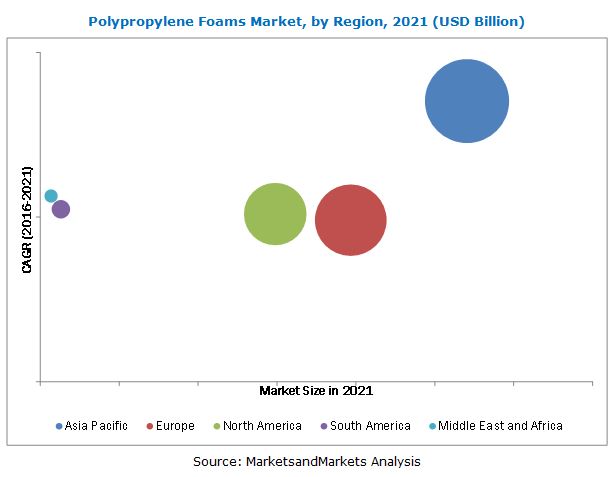

The Asia-Pacific region is expected to witness the highest growth rate in the polypropylene foams market, in terms of value and volume, from 2016 to 2021. In recent years, the demand for automotive and packaging applications has increased in the region due to the increasing population and rising disposable incomes, thus driving the need for polypropylene foams in the region. Polypropylene foams are leading the market as these foams are totally recyclable. With the superior properties, polypropylene foams enable the reduction of CO2 emissions. Due to the outstanding mechanical properties of polypropylene foams, they can be used over and over again for several years, even under extreme climatic conditions. The strong demand for high end polypropylene foams in the automotive sector from emerging nations and recuperating developed nations is expected to drive the growth of this market in the future.

The polypropylene foams market also has some restraints which restricts the growth of the market. These restraints include, the high price of polypropylene foams, as the overall cost of production for polypropylene foam is high compared to other competitive foams such as expanded polystyrene (EPS) or polyurethane (PU) foam and there is lower awareness about the product. The presence of ample competitive products in the market creates problems for the small volume products. Hence, end-users are faced with different grades and large volumes of the competitive products in the global market.

Key Polypropylene Foams Market Industry Players

Companies such as, BASF SE (Germany), Borealis AG (Austria), DS Smith Plc (U.K.), Furukawa Electric Co., Ltd. (Japan), JSP (Japan), Kaneka Corporation (Japan), K. K. Nag Ltd. (India), Mitsui Chemicals, Inc. (Japan), Pregis Corporation (U.S.), Sekisui Alveo AG (Switzerland), Sonoco Products Company (U.S.), SSW PearlFoam GmbH (Germany), Synbra Holding bv (Netherlands), Hanwha Corporation (South Korea), and The Woodbridge Group (Canada) are the key players in the global polypropylene foams market. The diverse product portfolios, strategically positioned R&D centers, continuous adoption of development strategies, and technological advancements are some of the factors that strengthen the positions of these companies in the polypropylene foams market. They have been adopting various organic and inorganic growth strategies to further strengthen their positions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Key Data From Secondary Sources

2.3 Key Data From Primary Sources

2.4 Breakdown of Primary Interviews

2.5 Key Industry Insights

2.6 Top-Down Approach

2.7 Bottom Up Approach

2.8 Data Triangulation

2.9 Market Share Estimation

2.10 Assumptions and Limitations

3 Executive Summary

4 Premium Insights

4.1 Opportunities in the Polypropylene Foams Market

4.2 Polypropylene Foams Market Size, By Type

4.3 Polypropylene Foams Market Attractiveness

4.4 Polypropylene Foams Market, Developing vs Developed Markets

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

6 Industry Trends

6.1 Value Chain of Polypropylene Foams Industry

6.2 Porter’s Five Forces Analysis of the Polypropylene Foams Market

7 Polypropylene Foams Market, By Type

7.1 Expanded Polypropylene (EPP) Foams

7.2 Extruded Polypropylene (XPP) Foams

7.3 Type (Density Basis)

8 Polypropylene Foams Market, By End-User Industries

8.1 Automotive

8.1.1 EPP Foam Use in Automotive Application

8.1.2 XPP Foam Use in Automotive Application

8.1.3 Global Automotive Production Trend 2014 vs 2015

8.1.4 Analysis: Vehicle Weight and Material Usage

8.1.5 Automotive Industry: Key Indicators

8.1.6 PP Foams: Usage in Automotive

8.2 Packaging

8.2.1 PP Foam Use in Packaging

8.2.2 Packaging Foam Comparison

8.3 Consumer Products

8.4 Others

9 Polypropylene Foams Market, By Region

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 South Korea

9.2.4 India

9.2.5 Thailand

9.2.6 Indonesia

9.2.7 Malaysia

9.2.8 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 Spain

9.3.3 France

9.3.4 U.K.

9.3.5 Italy.

9.3.6 Russia

9.3.7 Turkey

9.3.8 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Colombia

9.5.4 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 Africa

9.6.3 UAE

9.6.4 Rest of Middle East & Africa

10 Competitive Landscape

10.1 Overview

10.2 PP Foams Market: Market Share Analysis

10.3 PP Foams Market, Major Developments

10.4 PP Foams Market: Key Developments, By Company

11 Company Profiles

(Financial*, Products & Services, and Developments)

11.1 JSP.

11.2 BASF SE

11.3 Kaneka Corporation

11.4 Hanwha Corporation

11.5 Mitsui Chemicals, Inc.

11.6 Borealis AG

11.7 Furukawa Electric Co., Ltd.

11.8 Sonoco Products Company

11.9 DS Smith PLC.

11.10 K. K. NAG Ltd.

11.11 Pregis Corporation.

11.12 Sekisui Alveo AG

11.13 Ssw Pearlfoam GmbH

11.14 Synbra Holding BV

11.15 The Woodbridge Group

11.16 Other Players

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real Time Market Intelligence

12.4 Related Reports

12.5 Author Details

List of Tables (103 Tables)

Table 1 Polypropylene Foams Market Key Data 2016–2021

Table 2 EPP Foams Market Size, By Region, 2014–2021 (Kiloton)

Table 3 EPP Foams Market Size, By Region, 2014–2021 (USD Million)

Table 4 XPP Foams Market Size, By Region, 2014–2021 (Kiloton)

Table 5 XPP Foams Market Size, By Region, 2014–2021 (USD Million)

Table 6 PP Foams: Market Size, By Type (Density Basis), 2014–2021 (Kiloton)

Table 7 PP Foams: Market Size, By Type (Density Basis), 2014–2021 (USD Million)

Table 8 PP Foams Market Size in Automotive Application, By Region, 2014–2021 (Kiloton)

Table 9 PP Foams Market Size in Automotive Application, By Region, 2014–2021 (USD Million)

Table 10 Global Automotive Production Trend 2014 vs 2015 (Million)

Table 11 PP Foams Market Size in Packaging Application, By Region, 2014–2021 (Kiloton)

Table 12 PP Foams Market Size in Packaging Application, By Region, 2014–2021 (USD Million)

Table 13 Packaging Foam Comparison

Table 14 PP Foams Market Size in Consumer Products Application, By Region, 2014–2021 (Kiloton)

Table 15 PP Foams Market Size in Consumer Products Application, By Region, 2014–2021 (USD Million)

Table 16 PP Foams Market Size in Other Applications, By Region, 2014–2021 (Kiloton)

Table 17 PP Foams Market Size in Other Applications, By Region, 2014–2021 (USD Million)

Table 18 PP Foams Market Size, By Region, 2014–2021 (Kiloton)

Table 19 PP Foams Market Size, By Region, 2014–2021 (USD Million)

Table 20 Asia-Pacific PP Foams Market Size, By Country, 2014–2021 (Kiloton)

Table 21 Asia-Pacific PP Foams Market Size, By Country, 2014–2021 (USD Million)

Table 22 Asia-Pacific PP Foams Market Size, By Type, 2014–2021 (Kiloton)

Table 23 Asia-Pacific PP Foams Market Size, By Type, 2014–2021 (USD Million)

Table 24 Asia-Pacific PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 25 Asia-Pacific PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 26 China PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 27 China PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 28 Japan PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 29 Japan PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 30 South Korea PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 31 South Korea PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 32 India PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 33 India PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 34 Thailand PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 35 Thailand PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 36 Indonesia PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 37 Indonesia PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 38 Malaysia PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 39 Malaysia PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 40 Rest of Asia-Pacific PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 41 Rest of Asia-Pacific PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 42 Europe PP Foams Market Size, By Country, 2014–2021 (Kiloton)

Table 43 Europe PP Foams Market Size, By Country, 2014–2021 (USD Million)

Table 44 Europe PP Foams Market Size, By Type, 2014–2021 (Kiloton)

Table 45 Europe PP Foams Market Size, By Type, 2014–2021 (USD Million)

Table 46 Europe PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 47 Europe PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 48 Germany PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 49 Germany PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 50 Spain PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 51 Spain PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 52 France PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 53 France PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 54 U.K. PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 55 U.K. PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 56 Italy PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 57 Italy PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 58 Russia PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 59 Russia PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 60 Turkey PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 61 Turkey PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 62 Rest of Europe PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 63 Rest of Europe PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 64 North America PP Foams Market Size, By Country, 2014–2021 (Kiloton)

Table 65 North America PP Foams Market Size, By Country, 2014–2021 (USD Million)

Table 66 North America PP Foams Market Size, By Type, 2014–2021 (Kiloton)

Table 67 North America PP Foams Market Size, By Type, 2014–2021 (USD Million)

Table 68 North America PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 69 North America PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 70 U.S. PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 71 U.S. PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 72 Canada PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 73 Canada PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 74 Mexico PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 75 Mexico PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 76 South America PP Foams Market Size, By Country, 2014–2021 (Kiloton)

Table 77 South America PP Foams Market Size, By Country, 2014–2021 (USD Million)

Table 78 South America PP Foams Market Size, By Type, 2014–2021 (Kiloton)

Table 79 South America PP Foams Market Size, By Type, 2014–2021 (USD Million)

Table 80 South America PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 81 South America PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 82 Brazil PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 83 Brazil PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 84 Argentina PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 85 Argentina PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 86 Colombia PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 87 Colombia PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 88 Rest of South America PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 89 Rest of South America PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 90 Middle East & Africa PP Foams Market Size, By Country, 2014–2021 (Kiloton)

Table 91 Middle East & Africa PP Foams Market Size, By Country, 2014–2021 (USD Million)

Table 92 Middle East & Africa PP Foams Market Size, By Type, 2014–2021 (Kiloton)

Table 93 Middle East & Africa PP Foams Market Size, By Type, 2014–2021 (USD Million)

Table 94 Middle East & Africa PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 95 Middle East & Africa PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 96 Saudi Arabia PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 97 Saudi Arabia PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 98 Africa PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 99 Africa PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 100 UAE PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 101 UAE PP Foams Market Size, By Application, 2014–2021 (USD Million)

Table 102 Rest of Middle East & Africa PP Foams Market Size, By Application, 2014–2021 (Kiloton)

Table 103 Rest of Middle East & Africa PP Foams Market Size, By Application, 2014–2021 (USD Million)

List of Figures (20 Figures)

Figure 1 Segmentation & Coverage

Figure 2 Asia-Pacific Market to Register Highest CAGR During Forecast Period

Figure 3 XPP Foams to Register Highest CAGR During Forecast Period

Figure 4 Automotive Sector to Be the Fastest-Growing Application Between 2016 and 2021

Figure 5 Steady Growth of PP Foams Market Projected in 2021

Figure 6 EPP is the Largest and XPP is the Fastest-Growing Segment in the Polypropylene Foams Market, 2016–2021

Figure 7 Polypropylene Foams Market to Register High Growth in Developing Countries Between 2016 and 2021

Figure 8 India Projected to Be the Fastest-Growing Polypropylene Foams Market During Forecast Period

Figure 9 Drivers, Restraints, Opportunities, and Challenges in PP Foams

Figure 10 PP Foams: Value Chain Analysis

Figure 11 PP Foams: Porter’s Five Forces Analysis

Figure 12 EPP Foam Use in Automotive Application

Figure 13 XPP Foam Use in Automotive Application

Figure 14 Analysis: Vehicle Weight and Material Usage

Figure 15 Use of PP Foams in Packaging

Figure 16 PP Foams: Regional Market Share, By Value (2015)

Figure 17 Companies Adopted Investments & Expansions as the Key Growth Strategy Between 2013 and 2016

Figure 18 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 19 PP Foams Market, Major Developments (2013–2016)

Figure 20 PP Foams Market: Key Developments, By Company (2013–2016)

Growth opportunities and latent adjacency in Polypropylene Foams Market

Deep dive information on the foamed plastics market