Polymer Emulsion Market by Type (Acrylics, Vinyl Acetate Polymers, SB Latex) Application (Paints & Coatings, Adhesives & Sealants, Paper & Paperboard) End Use Industry (Buildings & Construction, Automotive, Textile & Coatings) - Global Forecast to 2025

Updated on : March 21, 2024

Polymer Emulsion Market

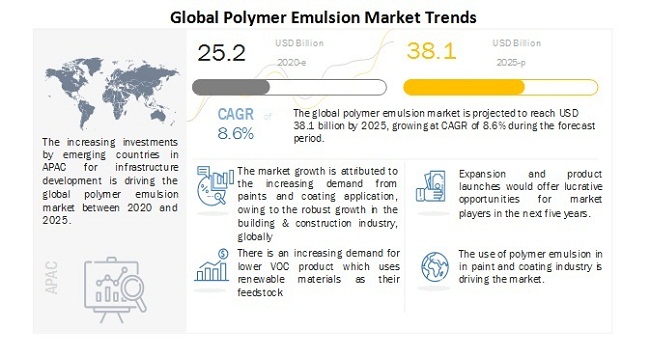

Polymer Emulsion Market was valued at USD 25.2 billion in 2020 and is projected to reach USD 38.1 billion by 2025, growing at 8.6% cagr from 2020 to 2025. The market growth is driven majorly by the increasing demand from growing end-use industries in emerging countries, stringent regulations regarding VOC emission, and rising awareness about green buildings.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global polymer emulsion market

The outbreak of COVID-19 has tightened travel restrictions in almost all countries globally. The increasing number of infected patients and total lockdown in major industrial hubs since March 2020 have brought the manufacturing industry to a halt. To curb the spread of the coronavirus, workers have either returned to their hometowns or have been quarantined. The potential upstream supply chain issues have forced the construction, automotive, chemical, textile & coatings companies to close sites. The demand for residential building construction is anticipated to be low, as negative consumer sentiment and declining incomes are discouraging people from seeking new homes. The demand for automotive has declined drastically due to uncertain future conditions. The impact on textile order for clothing and clothing accessories has dropped by 30% on average across the globe. Chemical manufacturing companies have halted their production or operating at a low utilization rate. However, gradually, the government bodies around the world are encouraging construction, automotive, chemical, and textile & coatings companies to resume work with the lifting of lockdown, and companies are working towards recovery of the market with the expected increase in sales gradually in 2021.

Polymer Emulsion Market Dynamics

Driver: Increasing demand from growing end-use industries in emerging countries

There is an increasing demand for polymer emulsion from various end-use industries such as paper, construction, textile, transportation, consumer durables, and others due to factors such as rapid urbanization, changing lifestyles, and growing disposable income. The use of polymer emulsion is rapidly increasing in these end-use industries for applications such as paints & coatings, adhesives & sealants, and others.

Restraint: Volatile raw material cost

The polymer emulsion market is restrained due to the volatile raw material prices. The manufacturers are unable to predict a price trend for raw materials. Furthermore, the manufacturers generally prefer bulk purchase of raw materials. This helps them in getting a higher profit margin.

Market Opportunity:

Opportunities: Rising demand for bio-based polymer emulsion

Rising environmental concerns and increasing competition amongst market players have encouraged manufacturers to continuously make technological advancement and increase the use of bio-based or green products. This is increasing the demand for lower VOC products, which uses renewable materials as their feedstock.

Challenges: Manufacturing cost-effective polymer emulsion

Manufacturing polymer emulsion with low VOC is one of the challenges for market players. The emission of VOC causes several harmful effects on the health of workers as well as end-users. Moreover, they lead to chronic respiratory problems such as asthma and other respiratory problems. Hence, the matured European and North American markets have made stringent laws on the use of products high VOC.

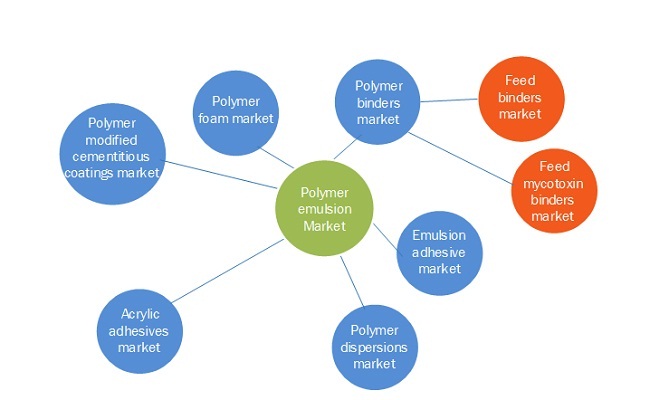

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

Acrylics segment is estimated to dominate the overall polymer emulsion market

The acrylics segment accounts for the largest share of the overall polymer emulsion market. The market for this segment is also witnessing the highest growth rate. Acrylic polymer emulsion is used widely in various applications due to its properties, such as low VOC emission and excellent durability. It is also preferred in various end-use applications due to its versatility. Acrylics are used to prepare polymers with rigid, flexible, ionic, nonionic, hydrophobic, or hydrophilic properties. They are transparent, have resistance to breakage, provide excellent finish gloss, improved adhesion to non-porous surfaces, and flow and stability. They are also commonly known as polyacrylates.

Paints & Coatings is the largest application in polymer emulsion market

The paints & coatings segment is the largest consumer of polymer emulsion. The growth of the market is attributed to the high demand in industries, such as construction and automotive. Polymer emulsion is used widely in paints & coatings as the manufacturing process of polymer emulsion paints & coatings have a lower carbon footprint. The high VOC content of solvent-based products and the implementation of government regulations regarding air pollution control has stimulated the development of low VOC paints & coatings. This increased the demand for water-based paints & coatings, which in turn, drive the growth of polymer emulsions in the paints & coatings segment.

Building & construction is the largest end-use industry in polymer emulsion market

The building & construction end-use industry is the largest consumer of polymer emulsion. The growth of the market in this segment is attributed to the high demand for polymer emulsion in architectural paints, deck & trim paints, and elastomeric wall coatings, among others. Excellent durability and high water resistance drive its demand in the end-use industries.

APAC is projected to be the largest polymer emulsion market

APAC is the largest and fastest-growing market for polymer emulsion. The region is witnessing growth in the polymer emulsion market because of the rapid expansion of building & construction, consumer durables, and transportation sectors. The manufacturers are attracted to the region as skilled labor required for the operation of manufacturing units are available at lower wages. The presence of major polymer emulsion manufacturers and stringent government regulation related to VOC emission are major factors supporting the growth of polymer emulsion in the region.

Key Market Players

DIC Corporation (Japan), Dow Chemical Company (US), BASF SE (Germany), Arkema Group (France), Celanese Corporation (US), Trinseo (US), The Lubrizol Corporation (US), Wacker Chemie AG (Germany), Synthomer Plc (UK), and Asahi Kasei Corporation (Japan) are the major players in the polymer emulsion market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for the polymer emulsion market from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD), Volume (Kiloton) |

|

Segments |

Type, Application, End-Use Industry, and Region |

|

Regions |

APAC, Europe, North America, the Middle East & Africa, and South America |

|

Companies |

DIC Corporation (Japan), Dow Chemical Company (US), BASF SE (Germany), Arkema Group (France), Celanese Corporation (US), Trinseo (US), The Lubrizol Corporation (US), Wacker Chemie AG (Germany), Synthomer Plc (UK), and Asahi Kasei Corporation (Japan) Total 25 major players are covered. |

This research report categorizes the polymer emulsion market based on type, application, end-use industry, and region.

By Type:

- Acrylic Polymer Emulsion

- Vinyl Acetate Polymer Emulsion

- SB Latex

- Others

By Application:

- Paints & Coatings

- Adhesives & Sealants

- Paper & Paperboard

- Others

By End-Use Industry:

- Building & Construction

- Automotive

- Chemicals

- Textile & Coatings

- Others

By Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2020, Celanese Corporation signed an agreement with Megafarma, an Azelis company, to supply emulsion polymers in Mexico.

- In January 2020, Celanese Corporation announced plans to expand the emulsion polymers business globally. Under this expansion, Celanese started the debottlenecking of VAE production facilities in Nanjing, China, and Geleen, Netherlands. Further, the company announced plans to expand the VAE production facility at Nanjing by 65,000 metric tons by 2022 and the Geleen facility by 50,000 metric tons per annum by 2023.

- In September 2019, Synthomer plc expanded acrylic dispersion production capacity by 30%, located at Worms, Germany. The expanded production capacity is 36,000 tons with a fully automated facility. This expansion strengthens the company’s position in end-use industries such as paints and coatings, construction chemicals, adhesives and sealants, and technical textiles.

- In April 2020, Synthomer plc acquired Omnova Solutions Inc., a specialty chemical company and a major supplier of water-based polymer solutions. With this acquisition, the company would be able to strengthen the polymer emulsion business and have strong operational capabilities across the globe.

- In May 2017, The Dow Chemical Company signed two agreements to advance Dow’s strategic innovation agenda in the Kingdom of Saudi Arabia. The agreements include the construction of a state-of-the-art manufacturing facility to manufacture a range of water-treatment and coatings applications. The new facility will serve the country’s need with an innovative range of acrylic-based polymers for architectural and industrial coatings as well as detergent and water-treatment applications.

- In February 2019, Wacker Chemie AG launched Vinneva, a polymer binder based on vinyl acetate-ethylene copolymers for application in the construction industry. These polymer binders were designed to make bitumen emulsion more flexible and more resistant and reduce the tendency to form cracks.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the polymer emulsion market?

Increasing demand from end-use industries and emerging economies is the major growth factor in the polymer emulsion market. Moreover, stringent regulations and increasing awareness about green buildings are driving the polymer emulsion market.

What are the major types of polymer emulsion market?

Based on the type, the market is divided into three categories, namely, acrylic polymer emulsion, vinyl acetate polymer emulsion, SB latex, and others.

What are the market dynamics for market alignment of polymer emulsion?

The polymer emulsion market is highly fragmented with the presence of a large number of market players. The majority of the large players in the polymer emulsion market have a global presence and a strong customer base. Companies mostly compete with one another by expanding their product portfolio for different applications. Thus, the intensity of competitive rivalry in the polymer emulsion market is high.

What are the market dynamics for different applications of polymer emulsion?

The polymer emulsion market is classified based on application as paints & coatings, adhesives & sealants, paper & paperboard, others. The paints & coatings segment is the largest consumer of polymer emulsion. The growth of the market is attributed to the high demand in industries such as construction and automotive.

Who are the major manufacturers?

DIC Corporation (Japan), Dow Chemical Company (US), BASF SE (Germany), Arkema Group (France), Celanese Corporation (US), Trinseo (US), The Lubrizol Corporation (US), Wacker Chemie AG (Germany), Synthomer Plc (UK), and Asahi Kasei Corporation (Japan) and others.

What is the biggest restraint for the polymer emulsion market?

Volatile raw material cost is one of the biggest restraints of the polymer emulsion market. The polymer emulsion market is restrained due to the volatile raw material prices. The manufacturers are unable to predict a price trend for raw materials. Furthermore, the manufacturers generally prefer bulk purchase of raw materials. This helps them in getting a higher profit margin. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY SIDE APPROACH: REGIONAL ANALYSIS

2.2.2 SUPPLY SIDE APPROACH: VALUE ANALYSIS

2.2.3 DEMAND SIDE APPROACH

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 PRIMARY DATA

2.4.1.1 Key data from primary sources

2.4.1.2 Key industry insights

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 MARKET OVERVIEW (Page No. - 29)

3.1 INTRODUCTION

3.2 MARKET DYNAMICS

3.2.1 DRIVERS

3.2.1.1 Increasing demand from growing end-use industries in emerging countries

3.2.1.2 Stringent regulations regarding VOC emission

3.2.1.3 Increasing awareness about green buildings

3.2.2 RESTRAINTS

3.2.2.1 Volatile raw material cost

3.2.3 OPPORTUNITIES

3.2.3.1 Rising demand for bio-based polymer emulsion

3.2.4 CHALLENGES

3.2.4.1 Manufacturing cost-effective polymer emulsion

4 INDUSTRY TRENDS (Page No. - 33)

4.1 PORTER'S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF SUPPLIERS

4.1.4 BARGAINING POWER OF BUYERS

4.1.5 INTENSITY OF COMPETITIVE RIVALRY

4.2 MACROECONOMIC OVERVIEW AND KEY TRENDS

4.2.1 INTRODUCTION

4.2.2 PAPER & PACKAGING INDUSTRY

4.2.3 TRENDS AND FORECAST IN THE CONSTRUCTION INDUSTRY BEFORE COVID-19 OUTBREAK

4.3 TRENDS AND FORECAST IN THE AUTOMOTIVE INDUSTRY

4.4 GROWTH TREND OF WORLD GDP BEFORE COVID-19 OUTBREAK

5 EXECUTIVE SUMMARY (Page No. - 39)

6 PREMIUM INSIGHTS (Page No. - 43)

6.1 ATTRACTIVE OPPORTUNITIES IN THE POLYMER EMULSION MARKET

6.2 POLYMER EMULSION MARKET, BY REGION

6.3 POLYMER EMULSION MARKET, BY COUNTRY

6.4 POLYMER EMULSION MARKET, BY TYPE

6.5 POLYMER EMULSION MARKET, BY END-USE INDUSTRY

7 POLYMER EMULSION MARKET, BY TYPE (Page No. - 46)

7.1 INTRODUCTION

7.2 ACRYLIC POLYMER EMULSION

7.2.1 WIDE RANGE OF APPLICATIONS AND LOW VOC EMISSIONS DRIVES THE DEMAND FOR ACRYLIC-BASED POLYMER EMULSION

7.3 VINYL ACETATE POLYMER EMULSION

7.3.1 LOW COST AND INCREASING DEMAND FROM CONSTRUCTION INDUSTRY DRIVES THE DEMAND OF VINYL ACETATE POLYMER EMULSIONS

7.4 SB LATEX

7.4.1 WIDE USAGE OF SB LATEX POLYMER EMULSION IN CARPET BACKING AND ADHESIVE APPLICATIONS DRIVES ITS DEMAND

7.5 OTHERS

8 POLYMER EMULSION MARKET, BY APPLICATION (Page No. - 61)

8.1 INTRODUCTION

8.2 PAINTS & COATINGS

8.2.1 EXPANSION IN END-USE INDUSTRIES DRIVES THE DEMAND OF POLYMER EMULSION IN PAINTS & COATINGS APPLICATIONS

8.3 ADHESIVES & SEALANTS

8.3.1 SHIFT FROM SOLVENT-BASED FORMULATIONS TO WATER-BASED FORMULATIONS TO DRIVE THE DEMAND OF POLYMER EMULSION IN ADHESIVES & SEALANTS APPLICATION

8.4 PAPER & PAPERBOARD

8.4.1 INCREASING DEMAND FROM PACKAGING INDUSTRY TO SUPPORT THE GROWTH OF POLYMER EMULSION IN PAPER & PAPERBOARD APPLICATION

8.5 OTHERS

9 POLYMER EMULSION MARKET, BY END-USE INDUSTRY (Page No. - 72)

9.1 INTRODUCTION

9.2 BUILDING & CONSTRUCTION

9.2.1 INCREASING USE OF POLYMER EMULSION DRIVES THE DEMAND IN BUILDING & CONSTRUCTION INDUSTRY

9.2.2 IMPACT OF COVID-19 ON THE BUILDING & CONSTRUCTION INDUSTRY

9.3 AUTOMOTIVE

9.3.1 WATER-BASED EMULSION POLYMER FOR USE IN THE AUTOMOTIVE INDUSTRY

9.3.2 IMPACT OF COVID-19 ON THE AUTOMOTIVE INDUSTRY

9.4 TEXTILE & COATINGS

9.4.1 SANGUINE DEMAND FROM NON-WOVEN TEXTILES DRIVES THE GROWTH OF THE POLYMER EMULSION MARKET

9.4.2 IMPACT OF COVID-19 ON THE TEXTILE & COATINGS INDUSTRY

9.5 CHEMICALS

9.5.1 INCREASING DEMAND FROM CHEMICALS INDUSTRY TO SUPPORT THE GROWTH OF POLYMER EMULSION MARKET

9.5.2 IMPACT OF COVID-19 ON THE CHEMICAL INDUSTRY

9.6 OTHERS

10 POLYMER EMULSION MARKET, BY REGION (Page No. - 85)

10.1 INTRODUCTION

10.2 ASIA PACIFIC

10.2.1 CHINA

10.2.1.1 Expanding end-use industries and stringent government regulation are expected to drive the market

10.2.2 JAPAN

10.2.2.1 Shift towards water-based formulations is supporting growth of polymer emulsion market

10.2.3 INDIA

10.2.3.1 Rapid industrialization is driving the market in India

10.2.4 MALAYSIA

10.2.4.1 Strong construction activities to drive the growth of polymer emulsion market

10.2.5 SOUTH KOREA

10.2.5.1 Government's efforts to promote technology and manufacturing industries to drive the demand for polymer emulsion

10.2.6 REST OF ASIA PACIFIC

10.3 EUROPE

10.3.1 IMPACT OF COVID-19 ON EUROPE

10.3.2 GERMANY

10.3.2.1 Strong economy and manufacturing sector drives the demand for polymer emulsion

10.3.3 FRANCE

10.3.3.1 Stringent regulations to reduce VOC emissions to drive the market

10.3.4 UK

10.3.4.1 Expansion in construction and packaging to drive the demand for polymer emulsion

10.3.5 RUSSIA

10.3.5.1 Stable economic growth and increasing investment to expand end-use industries of polymer emulsion

10.3.6 TURKEY

10.3.6.1 Strong economic growth and expansion of end-use industries to drive the polymer emulsion market

10.3.7 ITALY

10.3.7.1 Stringent regulations on VOC content and growing awareness about environment-friendly products to drive the demand

10.3.8 REST OF EUROPE

10.4 NORTH AMERICA

10.4.1 IMPACT OF COVID-19 IN NORTH AMERICA

10.4.2 US

10.4.2.1 Strong economic growth and stringent regulation for VOC emission is expected to drive the market of polymer emulsion

10.4.3 CANADA

10.4.3.1 Increase in investment in the oil & gas industry is boosting the polymer emulsion market in Canada

10.4.4 MEXICO

10.4.4.1 Expansion in end-use industries is expected to drive the market for polymer emulsion

10.5 MIDDLE EAST & AFRICA

10.5.1 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA

10.5.2 SAUDI ARABIA

10.5.2.1 Efforts to diversify oil-based economy and strong economic growth will increase the demand for polymer emulsion

10.5.3 IRAN

10.5.3.1 Lifting of sanctions is expected to boost its industrial base and construction sector

10.5.4 UAE

10.5.5 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

10.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

10.6.2 BRAZIL

10.6.2.1 Rebound in economic growth likely to boost demand for polymer emulsion in paints & coatings

10.6.3 ARGENTINA

10.6.3.1 Revival of economic growth to drive demand in automotive and construction industries

10.6.4 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 190)

11.1 INTRODUCTION

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 DYNAMICS DIFFERENTIATORS

11.2.2 INNOVATORS

11.2.3 VISIONARY LEADERS

11.2.4 EMERGING

11.3 COMPETITIVE SITUATION AND TRENDS

11.3.1 EXPANSIONS

11.3.2 ACQUISITIONS

11.3.3 AGREEMENTS

11.3.4 NEW PRODUCT DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 200)

12.1 THE DOW CHEMICAL COMPANY

12.1.1 BUSINESS OVERVIEW

12.1.2 PRODUCTS OFFERED

12.1.3 RECENT DEVELOPMENTS

12.1.4 SWOT ANALYSIS

12.1.5 WINNING IMPERATIVES

12.1.6 CURRENT FOCUS AND STRATEGIES

12.1.7 THREAT FROM COMPETITION

12.1.8 RIGHT TO WIN

12.2 BASF SE

12.2.1 BUSINESS OVERVIEW

12.2.2 PRODUCTS OFFERED

12.2.3 RECENT DEVELOPMENTS

12.2.4 SWOT ANALYSIS

12.2.5 WINNING IMPERATIVES

12.2.6 CURRENT FOCUS AND STRATEGIES

12.2.7 THREAT FROM COMPETITION

12.2.8 RIGHT TO WIN

12.3 CELANESE CORPORATION

12.3.1 BUSINESS OVERVIEW

12.3.2 PRODUCTS OFFERED

12.3.3 RECENT DEVELOPMENTS

12.3.4 SWOT ANALYSIS

12.3.5 WINNING IMPERATIVES

12.3.6 CURRENT FOCUS AND STRATEGIES

12.3.7 THREAT FROM COMPETITION

12.3.8 RIGHT TO WIN

12.4 ARKEMA GROUP

12.4.1 BUSINESS OVERVIEW

12.4.2 PRODUCTS OFFERED

12.4.3 RECENT DEVELOPMENTS

12.4.4 SWOT ANALYSIS

12.4.5 WINNING IMPERATIVES

12.4.6 CURRENT FOCUS AND STRATEGIES

12.4.7 THREAT FROM COMPETITION

12.4.8 RIGHT TO WIN

12.5 DIC CORPORATION

12.5.1 BUSINESS OVERVIEW

12.5.2 PRODUCTS OFFERED

12.5.3 RECENT DEVELOPMENTS

12.5.4 SWOT ANALYSIS

12.5.5 WINNING IMPERATIVES

12.5.6 CURRENT FOCUS AND STRATEGIES

12.5.7 THREAT FROM COMPETITION

12.5.8 RIGHT TO WIN

12.6 WACKER CHEMIE AG

12.6.1 BUSINESS OVERVIEW

12.6.2 PRODUCTS OFFERED

12.6.3 RECENT DEVELOPMENTS

12.6.4 MNM VIEW

12.7 SYNTHOMER PLC

12.7.1 BUSINESS OVERVIEW

12.7.2 PRODUCTS OFFERED

12.7.3 RECENT DEVELOPMENTS

12.7.4 MNM VIEW

12.8 TRINSEO

12.8.1 BUSINESS OVERVIEW

12.8.2 PRODUCTS OFFERED:

12.8.3 MNM VIEW

12.9 THE LUBRIZOL CORPORATION

12.9.1 BUSINESS OVERVIEW

12.9.2 PRODUCTS OFFERED

12.9.3 RECENT DEVELOPMENTS

12.9.4 MNM VIEW

12.10 ASAHI KASEI CORPORATION

12.10.1 BUSINESS OVERVIEW

12.10.2 PRODUCTS OFFERED

12.10.3 MNM VIEW

12.11 ADDITIONAL COMPANY PROFILES

12.11.1 MOMENTIVE PERFORMANCE MATERIALS INC.

12.11.2 DSM

12.11.3 ALLNEX

12.11.4 DAIREN CHEMICAL CORPORATION

12.11.5 HALLTECH INC.

12.11.6 MALLARD CREEK POLYMERS, INC.

12.11.7 STANCHEM POLYMERS

12.11.8 SPECIALTY POLYMERS, INC.

12.11.9 VISEN INDUSTRIES LIMITED

12.11.10 ZSCHIMMER & SCHWARZ

12.11.11 CYTEC (SOLVAY)

12.11.12 KAMSONS CHEMICALS PVT. LTD.

12.11.13 SCOTT BADER COMPANY LTD.

12.11.14 APCOTEX INDUSTRIES LIMITED

12.11.15 PEXICHEM PRIVATE LIMITED

13 ADJACENT MARKETS (Page No. - 234)

13.1 EMULSION ADHESIVE MARKET

13.1.1.1 INTRODUCTION

13.2 ACRYLIC EMULSION MARKET

13.2.1.1 INTRODUCTION

13.3 POLYMER DISPERSION MARKET

13.3.1.1 INTRODUCTION

14 APPENDIX (Page No. - 214)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

LIST OF TABLES (96 Tables)

TABLE 1 TRENDS AND FORECAST OF PER CAPITA GDP (USD)

TABLE 2 POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

TABLE 3 POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 4 ACRYLIC POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

TABLE 5 ACRYLIC POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

TABLE 6 VINYL ACETATE POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

TABLE 7 VINYL ACETATE POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

TABLE 8 SB LATEX POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

TABLE 9 SB LATEX POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

TABLE 10 OTHER POLYMER EMULSIONS MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

TABLE 11 OTHER POLYMER EMULSIONS MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

TABLE 12 POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 13 POLYMER EMULSION MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2016-2023 (USD MILLION)

TABLE 14 POLYMER EMULSION MARKET SIZE IN ADHESIVES & SEALANTS, BY REGION, 2016-2023 (USD MILLION)

TABLE 15 POLYMER EMULSION MARKET SIZE IN PAPER & PAPERBOARD, BY REGION, 2016-2023 (USD MILLION)

TABLE 16 POLYMER EMULSION MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2023 (USD MILLION)

TABLE 17 POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

TABLE 18 POLYMER EMULSION MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

TABLE 19 POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

TABLE 20 POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 21 POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 22 APAC: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (KILOTON)

TABLE 23 APAC: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (USD MILLION)

TABLE 24 APAC: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

TABLE 25 APAC: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 26 APAC: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 27 CHINA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 28 CHINA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 29 JAPAN: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 30 JAPAN: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 31 INDIA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 32 INDIA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 33 MALAYSIA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 34 MALAYSIA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 35 SOUTH KOREA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 36 SOUTH KOREA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 37 REST OF APAC: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 38 REST OF APAC: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 39 EUROPE: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (KILOTON)

TABLE 40 EUROPE: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (USD MILLION)

TABLE 41 EUROPE: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

TABLE 42 EUROPE: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 43 EUROPE: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 44 GERMANY: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 45 GERMANY: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 46 FRANCE: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 47 FRANCE: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 48 UK: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 49 UK: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 50 RUSSIA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 51 RUSSIA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 52 TURKEY: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 53 TURKEY: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 54 ITALY: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 55 ITALY: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 56 REST OF EUROPE: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 57 REST OF EUROPE: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 58 NORTH AMERICA: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (KILOTON)

TABLE 59 NORTH AMERICA: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (USD MILLION)

TABLE 60 NORTH AMERICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

TABLE 61 NORTH AMERICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 62 NORTH AMERICA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 63 US: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 64 US: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 65 CANADA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 66 CANADA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 67 MEXICO: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 68 MEXICO: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (KILOTON)

TABLE 70 MIDDLE EAST & AFRICA: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

TABLE 72 MIDDLE EAST & AFRICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 74 SAUDI ARABIA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 75 SAUDI ARABIA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 76 IRAN: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 77 IRAN: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 78 UAE: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 79 UAE: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 80 REST OF MIDDLE EAST & AFRICA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 81 REST OF MIDDLE EAST & AFRICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 82 SOUTH AMERICA: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (KILOTON)

TABLE 83 SOUTH AMERICA: POLYMER EMULSION MARKET SIZE, BY COUNTRY, 2016-2023 (USD MILLION)

TABLE 84 SOUTH AMERICA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 85 SOUTH AMERICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

TABLE 86 SOUTH AMERICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 87 BRAZIL: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 88 BRAZIL: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 89 ARGENTINA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 90 ARGENTINA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 91 REST OF SOUTH AMERICA: POLYMER EMULSION MARKET SIZE, BY APPLICATION, 2016-2023 (USD MILLION)

TABLE 92 REST OF SOUTH AMERICA: POLYMER EMULSION MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

TABLE 93 EXPANSIONS, 2016-2018

TABLE 94 ACQUISITIONS, 2016-2018

TABLE 95 AGREEMENTS, 2016-2018

TABLE 96 NEW PRODUCT DEVELOPMENTS, 2016-2018

LIST OF FIGURES (46 Figures)

FIGURE 1 POLYMER EMULSION: MARKET SEGMENTATION

FIGURE 2 POLYMER EMULSION MARKET: RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 6 POLYMER EMULSION MARKET: DATA TRIANGULATION

FIGURE 7 ACRYLICS SEGMENT TO LEAD THE OVERALL POLYMER EMULSION MARKET

FIGURE 8 PAINTS & COATINGS TO BE THE LARGEST APPLICATION OF POLYMER EMULSION

FIGURE 9 APAC WAS THE LARGEST POLYMER EMULSION MARKET IN 2017

FIGURE 10 INDIA TO BE FASTEST-GROWING POLYMER EMULSION MARKET DURING FORECAST PERIOD

FIGURE 11 GROWING PAINTS & COATINGS SEGMENT TO DRIVE THE POLYMER EMULSION MARKET

FIGURE 12 APAC TO BE FASTEST-GROWING POLYMER EMULSION MARKET DURING FORECAST PERIOD

FIGURE 13 ACRYLICS TO BE THE FASTEST-GROWING TYPE OF POLYMER EMULSION

FIGURE 14 INDIA TO REGISTER THE HIGHEST CAGR BETWEEN 2018 AND 2023

FIGURE 15 ACRYLICS DOMINATED THE OVERALL POLYMER EMULSION MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE POLYMER EMULSION MARKET

FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

FIGURE 18 ACRYLIC TO DOMINATE OVERALL POLYMER EMULSION MARKET BETWEEN 2018 AND 2023

FIGURE 19 APAC LED THE ACRYLIC POLYMER EMULSION MARKET

FIGURE 20 APAC PROJECTED TO BE THE FASTEST-GROWING VINYL ACETATE POLYMER EMULSION MARKET

FIGURE 21 APAC TO DOMINATE THE SB LATEX MARKET BETWEEN 2018 AND 2023

FIGURE 22 PAINTS & COATINGS ESTIMATED TO BE THE LARGEST APPLICATION OF POLYMER EMULSION BETWEEN 2018 AND 2023

FIGURE 23 APAC ESTIMATED TO BE THE LARGEST CONSUMER OF POLYMER EMULSION IN PAINTS & COATINGS

FIGURE 24 EUROPE DOMINATED THE POLYMER EMULSION MARKET IN ADHESIVES & SEALANTS SEGMENT

FIGURE 25 APAC PROJECTED TO WITNESS HIGHEST CAGR IN PAPER & PAPERBOARD SEGMENT

FIGURE 26 APAC TO REGISTER THE HIGHEST CAGR IN THE POLYMER EMULSION MARKET

FIGURE 27 APAC: POLYMER EMULSION MARKET SNAPSHOT

FIGURE 28 EUROPE: POLYMER EMULSION MARKET SNAPSHOT

FIGURE 29 MARKET RANKING ANALYSIS

FIGURE 30 COMPANIES PRIMARILY ADOPTED INORGANIC GROWTH STRATEGIES (2016-2018)

FIGURE 31 POLYMER EMULSION: COMPETITIVE LEADERSHIP MAPPING, 2018

FIGURE 32 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 33 DOW CHEMICAL COMPANY: SWOT ANALYSIS

FIGURE 34 BASF SE: COMPANY SNAPSHOT

FIGURE 35 BASF SE: SWOT ANALYSIS

FIGURE 36 CELANESE CORPORATION: COMPANY SNAPSHOT

FIGURE 37 CELANESE CORPORATION: SWOT ANALYSIS

FIGURE 38 ARKEMA GROUP: COMPANY SNAPSHOT

FIGURE 39 ARKEMA GROUP: SWOT ANALYSIS

FIGURE 40 DIC CORPORATION: COMPANY SNAPSHOT

FIGURE 41 DIC CORPORATION: SWOT ANALYSIS

FIGURE 42 WACKER CHEMIE AG: COMPANY SNAPSHOT

FIGURE 43 SYNTHOMER PLC: COMPANY SNAPSHOT

FIGURE 44 TRINSEO: COMPANY SNAPSHOT

FIGURE 45 THE LUBRIZOL CORPORATION: COMPANY SNAPSHOT

FIGURE 46 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

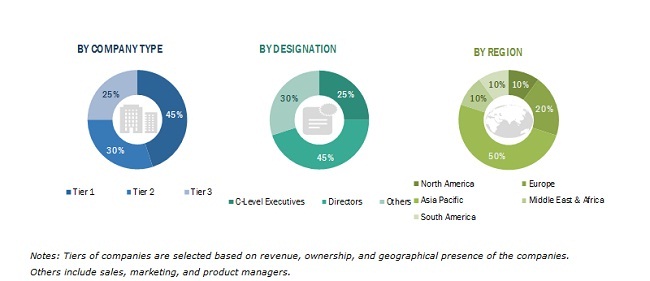

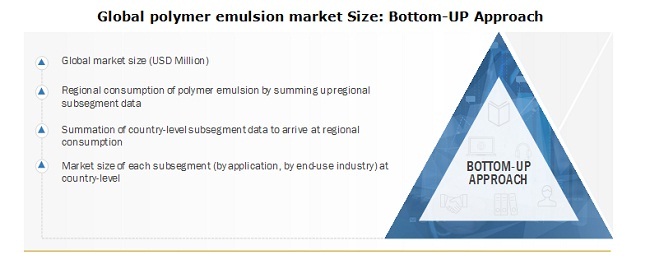

The study involved four major activities in estimating the current market size for the polymer emulsion market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The polymer emulsion market comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in paints & coatings, adhesives & sealants, paper & paperboard applications. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents-

To know about the assumptions considered for the study, download the pdf brochure

Notes: Tiers of companies are selected based on revenue, ownership, and geographical presence of the companies.

Others include sales, marketing, and product managers.

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the polymer emulsion market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global polymer emulsion market Size: Bottom-UP Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global polymer emulsion market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the polymer emulsion market based on type, application, end-use industry and region

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Growth opportunities and latent adjacency in Polymer Emulsion Market

Interested in procuring samples and knowing pricing of materials used in cementitious waterproofing

Acrylic polymers for waterproofing

Import & export information of finished products.

Polymer Emulsions for Pints application.

Flexible packaging market and acrylic emulsions use for APAC market

Want to know market size and growth rates of organic peroxides & persulfates

Specific information on additive wax emulsion with respect to various applications

List of polymer emulsion producers who consumes additive wax emulsions and quantity