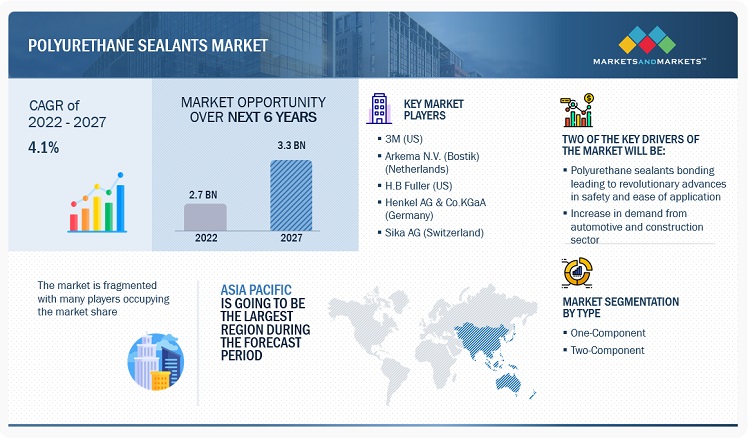

Polyurethane Sealants Market by Type (One-Component and Two-Component), End-Use Industry (Building and Construction, Automotive, General Industrial, Marine), and Region (North America, Europe, APAC, South America, MEA) - Global Forecast to 2027

The Polyurethane Sealants market is projected to grow from USD 2.7 billion in 2022 to USD 3.3 billion by 2027, at a CAGR of 4.1%. Glycol and isocyanate react to form polyurethane sealants, which are then produced. It is a compound that is well known for its flexibility and has good resistance to moisture and corrosion. The expansion and contraction of the joint is a common issue with joints. The material's flexibility makes it extremely resistant to cracking brought on by the shifting of joint components. One of the differences is that silicone sealants and adhesives are inorganic, whereas polyurethane sealants and adhesives are organic and natural. Polyurethane sealants are less durable than other high-quality silicone sealants because of their organic composition. One form of sealant that has single-component elastomeric qualities and a tendency to dry at room temperature and humidity is polyurethane sealant.

Attractive Opportunities in Polyurethane Sealants Market

To know about the assumptions considered for the study, Request for Free Sample Report

Polyurethane Sealants Market Dynamics

Driver: One of the differences is that silicone sealants and adhesives are inorganic, whereas polyurethane sealants and adhesives are organic and natural. Polyurethane sealants are less durable than other high-quality silicone sealants because of their organic composition. One form of sealant that has single-component elastomeric qualities and a tendency to dry at room temperature and humidity is polyurethane sealant. Over the next five years, housing and construction activities will gradually expand across North America and Europe. The construction industry in China is anticipated to increase more quickly than in Europe or North America, despite a significant slowdown during the previous two to three years. Construction levels are rising in nations like India, Southeast Asia, and South America to keep up with the increased rates of urbanization brought on by people moving from rural areas to cities for the better earnings. Construction activity will increase as a result of infrastructure investment. To increase the productive capacity of their economies and fuel the post-Covid economic recovery, governments around the world continue to support significant infrastructure investments. The growth in construction activity will augment the demand for polyurethane sealants.

Restraints: The price and availability of raw materials are key for sealant manufacturers to determine their products' cost structure. The raw materials used by the sealant industry include plastic resins, synthetic rubber, inorganic chemicals, industrial inorganic chemicals, and refined petroleum products. Most of these raw materials are petroleum-based derivatives and are vulnerable to fluctuations in commodity prices. Oil prices have been highly volatile since the end of September 2022, fluctuating by over 11.0%. Rising global demand and recent geopolitical unrest due to the Russia - Ukraine war have been primarily responsible for price fluctuations.

The sealant industry is also affected by higher transport costs due to rising fuel prices and higher manufacturing costs resulting from increasing energy costs. Sealant manufacturers have responded by passing on such price rises to end users, thus, resulting in a decrease in demand.

The price increase is attributed to the ongoing escalation in petrochemical-based raw material costs over the last few months. In addition, consistent global demand and capacity constraints in the production of primary chemicals, rosin, and resin feedstock have further resulted in the imbalance in the demand and supply, and prices of raw material of sealants.

Opportunity: Automotive production is mature in North America and Europe. However, the industry in emerging regions such as Asia-Pacific, South America, and the Middle East & Africa is growing. Growth of polyurethane sealants demand is expected in the automotive sector as the industry moves from lower-priced plastisols sealants to polyurethane sealants. Many sealants are presently used in passenger cars in North America and Europe. However, Asia-Pacific, South America, and the Middle East & Africa use comparatively less amount of sealants due to the adoption of traditional techniques by car manufacturers in these regions. Hence, there is a broad scope for sealant technology to penetrate these regions.

The presence of key manufacturers such as Toyota Motor Corporation (Japan), Nissan Motor Company Limited (Japan), and other top players increased polyurethane sealants consumption in these regions. This is likely to boost the growth of the global polyurethane sealants market. Emerging countries of Asia-Pacific, South America, and the Middle East & Africa are witnessing a number of developments in the automotive industry. These regions have become a hot spot for industrial products in the world.

Challenges: The polyurethane sealants market growth is attributed mainly to the demand from various end-use industries, which further depends on the micro and macroeconomic factors affecting that industry. The economic crisis of 2022 after the Russia-Ukraine war affected the U.S. and European countries substantially, reflected in the low growth in the last quarter of the year. Asia-Pacific countries were also affected, but to a lower extent. Moreover, the after impact of COVID-19 has brought economic crisis in the U.S. and led to significant decline in the growth of automotive and building & construction sectors between 2019 and 2021. As a result, the manufacturers of polyurethane sealants reported lower demand, which had a negative impact on many technologies of polyurethane sealants. Such economic cycles have also adversely affected the R&D on polyurethane sealants. The global decline in production output in 2021 among key industrial end users significantly influenced the development of polyurethane sealants, especially, in automotive, general industrial, and building & construction industries.

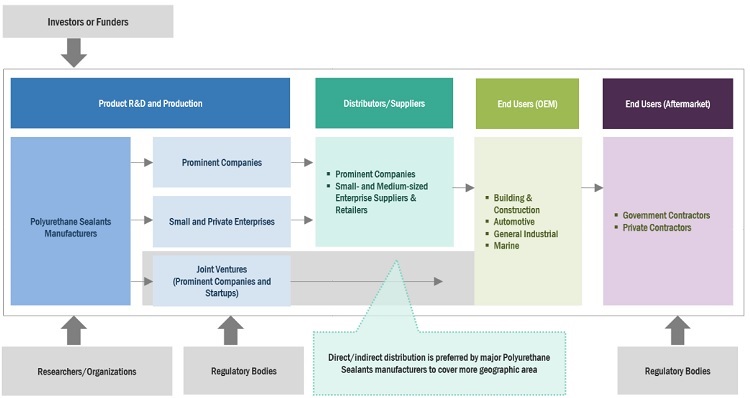

Polyurethane Sealants Market Ecosystem

Based on Type, One-Component segment is estimated to account for the largest market share of the Polyurethane Sealants market

One-component polyurethanes are famous for their elastic qualities, which allow for less shrinkage deformation during curing, greater absorption of external pressure from vibrations and impacts, strong mechanical performances, and adherence to a wide range of substrates. One-component polyurethane can be used for sealing as well as bonding. They provide great mechanical capabilities, adhesion to a wide range of substrates, improved elasticity that permits less shrinkage deformation during curing, and better absorption of external pressure from vibrations and impacts. As a result, flexible lamination, building and construction, transportation, and assembly applications benefit greatly from using one-component polyurethanes.

Based on End Use Industry, the Building and Construction segment is anticipated to dominate the market

In the building & construction segment, polyurethane sealants are mainly used in ceramic tile & flooring installation, pipe cement, roofing, and wall coverings. The revival of the building & construction industry in North America, along with the infrastructure, building & construction of smart cities, and rebuilding efforts after a spate of natural disasters such as earthquakes and tsunamis in Asia-Pacific, are expected to drive the polyurethane sealants market in the building & construction industry in the region.

Polyurethane sealants fix the car upholstery and have several other uses in automobiles. These sealants are formulated with elastomers which give them the required flexibility; they are also used to enhance the dielectric strength. The automotive industry (which includes automotive module sealing using liquid gasket sealants, electronic circuit board protection using liquid potting and encapsulants, exterior vehicle trim, interior vehicle trim, marine, powertrain & under-the-hood components, and vehicle assembly) is driving the polyurethane sealants market as the industry is moving from low-priced plastisols to polyurethane sealants.

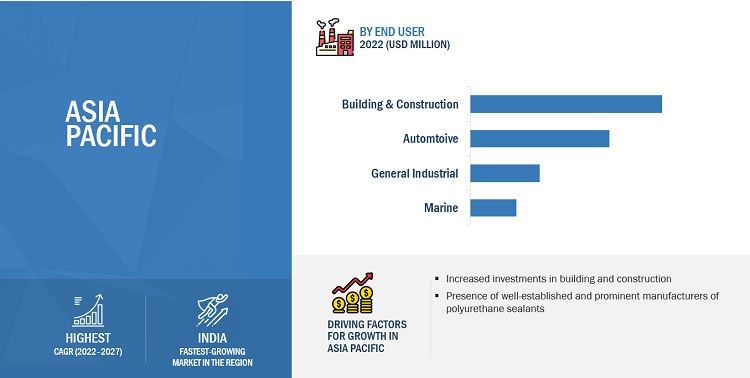

The Asia Pacific market is projected to contribute the largest share of the polyurethane sealants market.

Asia Pacific is expected to lead the paints and coatings market in 2022. Asia Pacific is increasingly becoming an important global trade and commerce center. The region is currently the fastest-growing and largest market for polyurethane sealants. With economic contraction and saturation in the European and North American markets, demand is increasing in Asia Pacific. According to the World Bank, manufacturers of polyurethane sealants are targeting this region, as it has the largest construction industry, accounting for approximately 40% of the global construction spending.

The Chinese market for polyurethane sealants has grown rapidly and is projected to witness high growth in the next 5 years due to the continuous shift of the global polyurethane sealants production facilities into the country. In addition, India, Thailand, and Indonesia are investing heavily in new construction projects, which will likely influence the market growth in these countries.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The polyurethane sealants market is dominated by a few globally established players such as 3M (US), Arkema N.V. (Bostik) (Netherlands), Sika AG (Switzerland), H.B Fuller (US), Henkel AG & Co.KGaA (Germany), BASF SE (US), The Dow Chemical Company (US), MAPEI S.p.A (Italy), Asian Paints Ltd. (India), ITW Polymers Sealants North America, Inc (US), among others, are the key manufacturers. Major focus was given to the contracts and new product development due to the changing requirements of end users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast Period |

2022-2027 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Type, By End Use Industry, By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

3M (US), Arkema N.V. (Bostik) (Netherlands), Sika AG (Switzerland), H.B Fuller (US), Henkel AG & Co.KGaA (Germany), BASF SE (US), The Dow Chemical Company (US), MAPEI S.p.A (Italy), Asian Paints Ltd. (India), ITW Polymers Sealants North America, Inc (US) |

Based on type, the polyurethane sealants market has been segmented as follows:

- One-Component

- Two-Component

Based on technology, the polyurethane sealants market has been segmented as follows:

- Building and Construction

- Automotive

- General Industrial

- Marine

- Others

Based on the region, the polyurethane sealants market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In July 2021, Bostik, the Adhesive Solutions division of Arkema, had launched an ambitious development programme strengthening its polyurethane (PU) sealants with a particular focus on Sealing & Bonding applications for the construction market. This new range of products enables Bostik to be well positioned in this business is driven by new construction in emerging countries and steady demand for higher quality solutions.

- In July 2021, Bostik, the Adhesive Solutions division of Arkema, had launched an ambitious development programme strengthening its polyurethane (PU) sealants with a particular focus on Sealing & Bonding applications for the construction market. This new range of products enables Bostik to be well positioned in this business driven by new construction in emerging countries and steady demand for higher quality solutions.

- In January 2020, 3M entered into an agreement to acquire EMFI S.A. and SAPO S.A. (“EMFI/SAPO”), manufacturers of polyurethane-based structural adhesives and sealants headquartered in Haguenau, France, that complement 3M Industrial Adhesives and Tapes Division’s core industrial adhesives product line and provide access to the fast-growing polyurethane-based structural adhesives and sealants market segment.

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the polyurethane sealants market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating globally. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

The US, China, Japan, India, Germany, the UK, and France are major countries considered in the report.

What is the total CAGR expected to be recorded for the polyurethane sealants market during 2022-2027?

The CAGR is expected to record 4.1% in terms of value from 2022-2027.

Which region is expected to hold the highest market share?

Asia Pacific region is expected to hold the largest share for 2022. The growth was supported by construction and automotive sectors.

Which are the major companies in the polyurethane sealants market? What are their major strategies to strengthen their market presence?

3M (US), Arkema N.V. (Bostik) (Netherlands), Sika AG (Switzerland), H.B Fuller (US), Henkel AG & Co.KGaA (Germany), BASF SE (US) are some of the key players in polyurethane sealants. The companies' key strategies to strengthen their polyurethane sealants market presence were contracts and product launches.

What is driving the demand for polyurethane sealants in the U.S. construction and automotive sectors?

In the United States, the demand for polyurethane sealants is primarily driven by growth in the construction and automotive sectors. In construction, polyurethane sealants are valued for their flexibility, durability, and excellent adhesion properties, making them ideal for sealing joints and cracks in infrastructure projects. Additionally, in the automotive industry, these sealants are increasingly used for bonding and sealing applications, contributing to vehicle durability and noise reduction. The U.S. market is also seeing heightened demand as builders and manufacturers seek high-performance materials that meet stringent environmental regulations and improve the lifespan of buildings and vehicles.

How are polyurethane sealants contributing to sustainable construction practices in the United Kingdom?

In the United Kingdom, polyurethane sealants are playing an important role in sustainable construction practices as the industry focuses on energy efficiency and green building standards. These sealants help enhance building insulation and prevent air leakage, which reduces energy consumption for heating and cooling. Additionally, as the UK enforces strict regulations on construction materials and sustainability, polyurethane sealants that are low in volatile organic compounds (VOCs) are increasingly preferred. This trend aligns with the UK’s sustainability targets and its commitment to reducing carbon emissions in the construction sector.

What are the primary factors driving the growth of the polyurethane sealants market in the US?

The growth of the polyurethane sealants market in the United States is primarily driven by increased demand from the building and construction industry. Polyurethane sealants are widely used in applications such as roofing, flooring installation, and wall coverings due to their excellent adhesion, flexibility, and resistance to moisture. Additionally, technological advancements and innovations in sealant formulations that enhance performance and ease of application are contributing to market expansion. The recovery of the construction sector post-COVID-19 and rising infrastructure development projects further bolster demand for these sealants.

How is sustainability influencing the polyurethane sealants market in the UK?

Sustainability is becoming a significant influence on the polyurethane sealants market in the United Kingdom. There is a growing demand for low-VOC (volatile organic compounds) and environmentally friendly sealants as consumers and industries prioritize eco-friendly products. The UK government’s initiatives towards sustainable construction practices are prompting manufacturers to develop greener formulations that reduce environmental impact while maintaining performance standards. This shift not only addresses regulatory requirements but also aligns with consumer preferences for sustainable building materials, driving growth in this segment of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONFOUR BASIC FUNCTIONS OF POLYURETHANE SEALANTSIMPORTANCE OF POLYURETHANE SEALANTS

- 5.2 VALUE CHAIN ANALYSIS

-

5.3 MARKET DYNAMICSDRIVERS- Pent-up demand for polyurethane sealants in building & construction, automotive, and consumer sectors- Rising demand from emerging countries- Technological advancements in end-use industries- Innovative advances in safety and ease of applicationRESTRAINTS- Volatility in raw material pricesOPPORTUNITIES- Growing demand for low-VOC, green, and sustainable sealants- Economic growth and rising government expenditure on infrastructure development- High growth of automotive markets in emerging countriesCHALLENGES- Established infrastructure in developed countries- Shifting rules and changing standards- Recessionary effect on end-use industries

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 MACRO INDICATOR ANALYSIS AND INDUSTRY TRENDSINTRODUCTIONTRENDS AND FORECAST OF GDPTRENDS AND FORECAST FOR APPLIANCE INDUSTRYTRENDS IN AUTOMOTIVE INDUSTRYTRENDS AND FORECAST FOR CONSTRUCTION INDUSTRYTRENDS IN AEROSPACE INDUSTRY

-

5.6 REGULATIONSLEED STANDARDS

-

5.7 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

-

6.1 INTRODUCTIONADVANTAGES OF POLYURETHANE SEALANTSDISADVANTAGES OF POLYURETHANE SEALANTS

-

6.2 ONE-COMPONENTVERSATILITY OF ONE-COMPONENT SEALANTS TO INCREASE DEMAND

-

6.3 TWO-COMPONENTFAST-CURING PROCESS TO INCREASE DEMAND FOR TWO-COMPONENT POLYURETHANE SEALANTS

- 7.1 INTRODUCTION

-

7.2 BUILDING & CONSTRUCTIONINCREASING REQUIREMENT FOR NEW CONSTRUCTION, RENOVATION, MAINTENANCE, IN RESIDENTIAL TO DRIVE MARKETBUILDING & CONSTRUCTION APPLICATION- Glazing- Flooring & joining applications- Sanitary & kitchen applications- Other building & construction applications

-

7.3 AUTOMOTIVERISE IN DEMAND FOR LIGHTWEIGHT VEHICLES TO SUPPORT MARKET GROWTH

-

7.4 GENERAL INDUSTRIALUSE OF NON-TOXIC AND ECO-FRIENDLY SEALANTS USED IN ELECTRONIC COMPONENTS TO BOOST MARKET

-

7.5 MARINEDEMAND FOR SEALANTS IN LARGE QUANTITIES FOR SHIPBUILDING TO DRIVE MARKET

- 7.6 OTHER END-USE INDUSTRIES

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICCHINA- Largest polyurethane sealants market in Asia PacificJAPAN- Infrastructural redevelopment to boost demandSOUTH KOREA- Growth of automotive industry to fuel demandINDIA- Government initiatives to boost economy contribute to market growthTAIWAN- Growth of construction industry to boost marketTHAILAND- Growing automotive sector to lead to market growthMALAYSIA- Favorable business policies to positively impact marketREST OF ASIA PACIFIC

-

8.3 NORTH AMERICAUS- Growth of major end-use industries to boost demandCANADA- Automotive sector to drive demand for polyurethane sealantsMEXICO- Growing use of polyurethane sealants in automotive industry

-

8.4 EUROPEGERMANY- Changing trends in food packaging industry to boost demandFRANCE- Demand from construction and automotive industries to boost marketITALY- Opportunities in aerospace and automotive industries to drive growthUK- Innovative and energy-efficient technologies in household appliances to increase demandREST OF EUROPE

-

8.5 SOUTH AMERICABRAZIL- Automotive end-use industry to boost demand for polyurethane sealantsARGENTINA- Increasing government initiatives to boost demandREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICASAUDI ARABIA- Increased sales of cars to support market growthSOUTH AFRICA- Increasing awareness about advantages of polyurethane sealants to drive marketREST OF MIDDLE EAST & AFRICA

- 9.1 OVERVIEW

-

9.2 COMPANY EVALUATION QUADRANT MATRIX, 2021STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.3 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021RESPONSIVE COMPANIESPROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 9.4 STRENGTH OF PRODUCT PORTFOLIO

- 9.5 COMPETITIVE BENCHMARKING

- 9.6 MARKET SHARE ANALYSIS

- 9.7 MARKET RANKING ANALYSIS

- 9.8 REVENUE ANALYSIS

-

9.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

-

9.10 STRATEGIC DEVELOPMENTSPRODUCT LAUNCHES, 2016–2023DEALS, 2016–2023

-

10.1 MAJOR PLAYERS3M- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARKEMA (BOSTIK)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIKA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewH.B. FULLER COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENKEL AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offeredDOW INC.- Business overview- Products/Solutions/Services offeredMAPEI- Business overview- Products/Solutions/Services offeredASIAN PAINTS LIMITED- Business overview- Products/Solutions/Services offeredILLINOIS TOOL WORKS INC.- Business overview- Products/Solutions/Services offered

-

10.2 OTHER COMPANIESSOUDAL N.V.- Products/Solutions/Services offeredSEL DIS TICARET VE KIMYA SANAYI A.S.- Products/Solutions/Services offeredPIDILITE INDUSTRIES LIMITED- Products/Solutions/Services offeredEMS-CHEMIE HOLDING AG- Products/Solutions/Services offeredKCC CORPORATION- Products/Solutions/Services offeredMASTER BOND- Products/Solutions/Services offeredRPM INTERNATIONAL INC.- Products/Solutions/Services offeredPCI AUGSBURG GMBH- Products/Solutions/Services offeredAKFIX- Products/Solutions/Services offeredSHENZHEN SPLENDOR INDUSTRY COMPANY LIMITED- Products/Solutions/Services offered

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHORS DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- TABLE 4 POLYURETHANE SEALANTS MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 TRENDS AND FORECAST OF GDP, 2019–2027

- TABLE 7 AUTOMOTIVE PRODUCTION, BY COUNTRY, 2018–2021

- TABLE 8 GROWTH INDICATORS OF AEROSPACE INDUSTRY, 2015–2033

- TABLE 9 GROWTH INDICATORS OF AEROSPACE INDUSTRY, BY REGION, 2015–2033

- TABLE 10 ARCHITECTURAL APPLICATIONS

- TABLE 11 SPECIALTY APPLICATIONS

- TABLE 12 SUBSTRATE-SPECIFIC APPLICATIONS

- TABLE 13 SECTOR LIMITS

- TABLE 14 SEALANT PRIMERS

- TABLE 15 US: TOP 10 PATENT OWNERS IN LAST FEW YEARS

- TABLE 16 ADVANTAGES AND DISADVANTAGES OF POLYURETHANE SEALANTS

- TABLE 17 POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 18 POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 19 POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 20 POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 21 ONE-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 22 ONE-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 ONE-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 24 ONE-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 25 TWO-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 26 TWO-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 TWO-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 28 TWO-COMPONENT POLYURETHANE SEALANTS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 29 POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 30 POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 31 POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 32 POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 33 POLYURETHANE SEALANTS MARKET IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 POLYURETHANE SEALANTS MARKET IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 POLYURETHANE SEALANTS MARKET IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2021 (KILOTON)

- TABLE 36 POLYURETHANE SEALANTS MARKET IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2022–2027 (KILOTON)

- TABLE 37 POLYURETHANE SEALANTS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 38 POLYURETHANE SEALANTS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 POLYURETHANE SEALANTS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2021 (KILOTON)

- TABLE 40 POLYURETHANE SEALANTS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2022–2027 (KILOTON)

- TABLE 41 POLYURETHANE SEALANTS MARKET IN GENERAL INDUSTRIAL END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 42 POLYURETHANE SEALANTS MARKET IN GENERAL INDUSTRIAL END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 POLYURETHANE SEALANTS MARKET IN GENERAL INDUSTRIAL END-USE INDUSTRY, BY REGION, 2018–2021 (KILOTON)

- TABLE 44 POLYURETHANE SEALANTS MARKET IN GENERAL INDUSTRIAL END-USE INDUSTRY, BY REGION, 2022–2027 (KILOTON)

- TABLE 45 POLYURETHANE SEALANTS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 46 POLYURETHANE SEALANTS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 POLYURETHANE SEALANTS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2018–2021 (KILOTON)

- TABLE 48 POLYURETHANE SEALANTS MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2022–2027 (KILOTON)

- TABLE 49 POLYURETHANE SEALANTS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 50 POLYURETHANE SEALANTS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 POLYURETHANE SEALANTS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (KILOTON)

- TABLE 52 POLYURETHANE SEALANTS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (KILOTON)

- TABLE 53 POLYURETHANE SEALANTS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 54 POLYURETHANE SEALANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 POLYURETHANE SEALANTS MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 56 POLYURETHANE SEALANTS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 57 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 58 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 59 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 60 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 61 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 62 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 63 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 64 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 65 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 66 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 67 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 68 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 69 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 70 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 72 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 73 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 74 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 76 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 77 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 80 NORTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 81 EUROPE: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 82 EUROPE: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 83 EUROPE: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 84 EUROPE: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 85 EUROPE: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 86 EUROPE: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 87 EUROPE: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 88 EUROPE: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 89 EUROPE: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 90 EUROPE: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 91 EUROPE: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 92 EUROPE: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 93 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 94 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 95 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 96 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 97 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 98 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 99 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 100 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 101 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 102 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 103 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 104 SOUTH AMERICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 105 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 108 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

- TABLE 109 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 112 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 113 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 116 MIDDLE EAST & AFRICA: POLYURETHANE SEALANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 117 OVERVIEW OF STRATEGIES ADOPTED BY KEY POLYURETHANE SEALANTS PLAYERS (2016–2023)

- TABLE 118 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 119 COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 120 COMPANY EVALUATION MATRIX

- TABLE 121 DEGREE OF COMPETITION, 2021

- TABLE 122 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 123 HIGHEST ADOPTED STRATEGIES

- TABLE 124 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 125 COMPANY INDUSTRY FOOTPRINT

- TABLE 126 COMPANY REGION FOOTPRINT

- TABLE 127 COMPANY FOOTPRINT

- TABLE 128 PRODUCT LAUNCHES, 2016–2023

- TABLE 129 DEALS, 2016–2023

- TABLE 130 3M: COMPANY OVERVIEW

- TABLE 131 3M: DEALS

- TABLE 132 ARKEMA (BOSTIK): COMPANY OVERVIEW

- TABLE 133 ARKEMA (BOSTIK): DEALS

- TABLE 134 SIKA AG: COMPANY OVERVIEW

- TABLE 135 SIKA AG: PRODUCT LAUNCHES

- TABLE 136 SIKA AG: DEALS

- TABLE 137 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 138 H.B. FULLER COMPANY: DEALS

- TABLE 139 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 140 HENKEL AG & CO. KGAA: DEALS

- TABLE 141 BASF SE: COMPANY OVERVIEW

- TABLE 142 DOW INC.: COMPANY OVERVIEW

- TABLE 143 MAPEI: COMPANY OVERVIEW

- TABLE 144 ASIAN PAINTS LIMITED: COMPANY OVERVIEW

- TABLE 145 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 146 SOUDAL N.V.: COMPANY OVERVIEW

- TABLE 147 SEL DIS TICARET VE KIMYA SANAYI A.S.: COMPANY OVERVIEW

- TABLE 148 PIDILITE INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 149 EMS-CHEMIE HOLDING AG: COMPANY OVERVIEW

- TABLE 150 KCC CORPORATION: COMPANY OVERVIEW

- TABLE 151 MASTER BOND: COMPANY OVERVIEW

- TABLE 152 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 153 PCI AUGSBURG GMBH: COMPANY OVERVIEW

- TABLE 154 AKFIX: COMPANY OVERVIEW

- TABLE 155 SHENZHEN SPLENDOR INDUSTRY COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

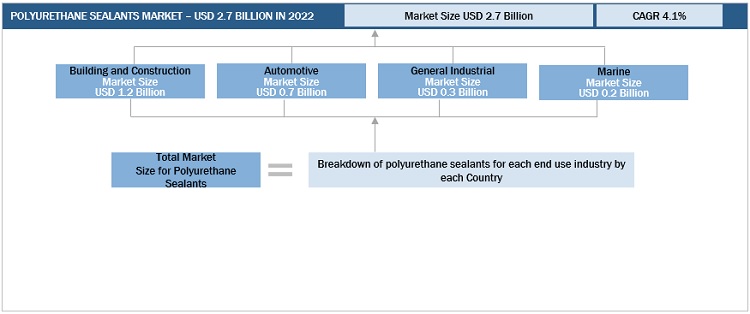

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 ONE-COMPONENT POLYURETHANE SEALANTS SEGMENT DOMINATED POLYURETHANE SEALANTS MARKET IN 2021

- FIGURE 7 BUILDING & CONSTRUCTION LARGEST END-USE INDUSTRY IN 2021

- FIGURE 8 ASIA PACIFIC REGION TO BE FASTEST-GROWING POLYURETHANE SEALANTS MARKET BETWEEN 2022 AND 2027

- FIGURE 9 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS BETWEEN 2022 AND 2027

- FIGURE 10 TWO-COMPONENT POLYURETHANE SEALANTS SEGMENT TO GROW AT HGHER CAGR BETWEEN 2022 AND 2027

- FIGURE 11 DEMAND FOR POLYURETHANE SEALANTS TO GROW FASTER IN EMERGING COUNTRIES

- FIGURE 12 BUILDING & CONSTRUCTION SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES IN ASIA PACIFIC POLYURETHANE SEALANTS MARKET IN 2021

- FIGURE 13 INDIA TO BE FASTEST-GROWING POLYURETHANE SEALANTS MARKET BETWEEN 2022 AND 2027

- FIGURE 14 VALUE CHAIN ANALYSIS

- FIGURE 15 DRIVERS, OPPORTUNITIES, AND CHALLENGES IN POLYURETHANE SEALANTS MARKET

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 REVENUE IN GLOBAL HOUSEHOLD APPLIANCE INDUSTRY (2013–2026)

- FIGURE 18 TRENDS AND FORECAST FOR APPLIANCE DISTRIBUTION CHANNEL, 2017–2025

- FIGURE 19 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 20 PUBLICATION TRENDS, 2016–2023

- FIGURE 21 NUMBER OF PATENTS PUBLISHED, 2016–2023

- FIGURE 22 LEGAL STATUS OF PATENTS, 2016–2023

- FIGURE 23 PATENTS PUBLISHED BY JURISDICTION, 2016–2023

- FIGURE 24 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2016–2023

- FIGURE 25 ONE-COMPONENT SEGMENT TO BE LARGEST TYPE SEGMENT IN POLYURETHANE SEALANTS MARKET DURING FORECAST PERIOD

- FIGURE 26 BUILDING & CONSTRUCTION SEGMENT TO BE LARGEST END-USE INDUSTRY OF POLYURETHANE SEALANTS MARKET DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 28 ASIA PACIFIC: POLYURETHANE SEALANTS MARKET SNAPSHOT

- FIGURE 29 NORTH AMERICA: POLYURETHANE SEALANTS MARKET SNAPSHOT

- FIGURE 30 EUROPE: POLYURETHANE SEALANTS MARKET SNAPSHOT

- FIGURE 31 COMPANY EVALUATION QUADRANT, 2021

- FIGURE 32 COMPANY EVALUATION QUADRANT FOR SMES, 2021

- FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN POLYURETHANE SEALANTS MARKET

- FIGURE 34 MARKET SHARE, BY KEY PLAYERS (2021)

- FIGURE 35 MARKET RANKING ANALYSIS, 2021

- FIGURE 36 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 37 3M: COMPANY SNAPSHOT

- FIGURE 38 ARKEMA (BOSTIK): COMPANY SNAPSHOT

- FIGURE 39 SIKA AG: COMPANY SNAPSHOT

- FIGURE 40 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 41 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 42 BASF SE: COMPANY SNAPSHOT

- FIGURE 43 DOW INC.: COMPANY SNAPSHOT

- FIGURE 44 MAPEI: COMPANY SNAPSHOT

- FIGURE 45 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

- FIGURE 46 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the polyurethane sealants market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering polyurethane sealants information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the polyurethane sealants market, which was validated by primary respondents.

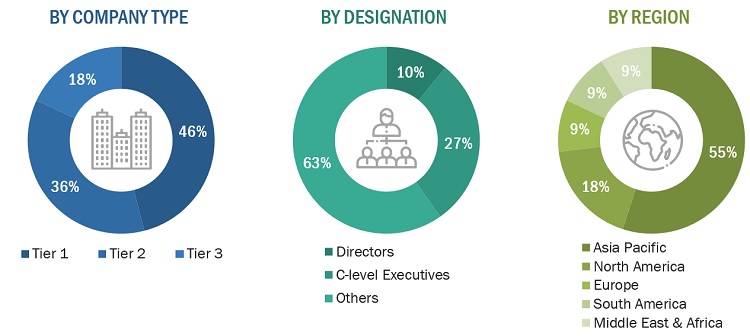

Primary Research

Extensive primary research was conducted after obtaining information regarding the polyurethane sealants market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from polyurethane sealants vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, end use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using polyurethane sealants were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of polyurethane sealants and future outlook of their business which will affect the overall market.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

3M |

Director |

|

Arkema N.V. (Bostik) |

Project Manager |

|

H.B. Fuller |

Individual Industry Expert |

|

Henkel AG & Co.KGaA |

Director |

Market Size Estimation

The research methodology used to estimate the size of the polyurethane sealants market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the building and construction, automotive, general industrial, marine and others at a regional level. Such procurements provide information on the demand aspects of polyurethane sealants.

Global Polyurethane Sealants Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Polyurethane Sealants Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into segments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Polyurethane sealants are organic compounds formed by the reaction of glycol with isocyanate and are used for sealing and waterproofing decks, wood flooring, and trims. These sealants have high moisture- and corrosion-resistance characteristics. Polyurethanes are high-performance sealants noted for their elasticity and excellent abrasion resistance. These sealants are composed of polyurethane polymer, pigments, fillers, and additives. They are used for filling and sealing joints in buildings and structures. They are highly elastic & resilient, weather durable, non-sagging, and watertight, with excellent adhesion to most building & construction materials.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the polyurethane sealants market based on type, end use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the polyurethane sealants market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the polyurethane sealants market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Polyurethane Sealants Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polyurethane Sealants Market