Power Plant Control System Market by Plant Type (Coal, Natural Gas, Hydroelectric, Nuclear, Oil, and Renewable), Solution (SCADA, DCS, Programmable Controllers), Component, Application, and Region - Global Forecast to 2026

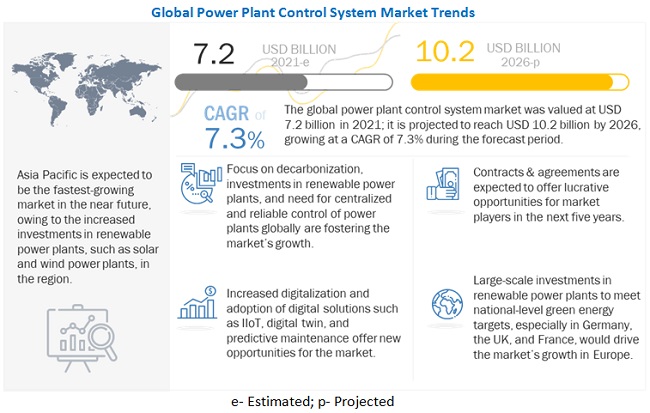

The global power plant control system market in terms of revenue was estimated to worth $7.2 billion in 2021 and is poised to reach $10.2 billion by 2026, growing at a CAGR of 7.3 % from 2021 to 2026.

The growing need for zero downtime power supply solutions for critical power applications is the major driver of the rotary or power plant control system market. The advantages of rotary UPS such as high efficiency, fewer space requirements, and low lifetime costs are expected to further drive the demand. Increasing data center investments are expected to be the single biggest contributing factor to the growth of market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Power plant control system market

The most significant near-term impacts on power plant control systems that are already contracted or under manufacturing process may be felt through supply chains. Industry executives are anticipating delivery and construction slowdowns, either because of the closure of industries to reduce the spread of coronavirus or because the workers start getting sick. Many components/parts for manufacturing power plant control system come from China, Asia Pacific, Europe, and the US. Manufacturing disruptions in China and the US could contribute to a significant short-term decline in the power plant control system market.

Moreover, due to the COVID-19 outbreak, the value of the local currencies of many countries have depreciated. There is a misalignment of supply and demand, which leads to financial losses to the manufactures, also the key components used in manufacturing power plant control system are typically procured in US dollars, which could result in increased component costs.

Power plant control system market Dynamics

Driver: Rising trend of decarbonization and increased investments in renewable power plants

Electricity is a critical resource to drive the growth of any country. According to the International Energy Outlook by EIA, the global electricity demand is expected to increase by 2.11% per year until 2040. A major part of the growth is expected to occur in non-OECD countries, such as China and India. These countries rely heavily on fossil fuels for power generation. The increasing use of fossil fuels presents potential hazards to the regional and global environment. Realizing this, governments and utilities across the world have announced their intentions to decarbonize the power sector and to heavily invest in renewable power plants. This trend of decarbonization and increased investments in renewable power plants are evident from the annual global investments in power plants data published by the IEA. The investments for fossil fuel-based power plants have been steadily declining since 2012. During the same time, the global investments in renewable power plants have outpaced the investments in fossil fuel plants. Global commitment to clean energy and the signing of the Paris climate agreement by all major nations are among the major reasons for increased investments. These increased investments are expected to be the major driver for market growth.

Restraints: Lack of standardization and interoperability in power plant control system solutions

The power plant equipment or devices communicate through various interfaces, technologies, and protocols. The lack of standardization of these communication interfaces and protocols may result in a misrepresentation of data. Lack of standardization with regard to technology complicates the integration of systems and hinders the plug-and-play capabilities between unrelated systems. For example, a majority of equipment in power plants use their interface protocols for communication, which leads to incompatibility between devices belonging to different equipment manufacturers. Interoperability is the ability of different systems to operate together without compatibility issues. Due to the presence of several major players, each with its solutions, the customer can be at a disadvantage as they will be locked into the product ecosystem of one manufacturer. This limits the customer choice and the ability of customers to switch to or integrate better solutions offered by other manufacturers. For example, in several cases, the key power plant equipment such as turbines and generators come with the equipment OEM’s own control systems. If various key components are procured from different OEMs then interoperability is a huge concern. All the individual control systems in the power plant should be able to communicate and be controlled properly by the centralized plant management solution may it be SCADA or DCS. This lack of interoperability can be a restraint for market growth.

Opportunities: Increasing adoption of digital solutions such as industrial internet of things, digital twin, and predictive maintenance

The emergence of technologies such as the Industrial Internet of Things (IIoT) has enabled decision-making based on accurate real-time information. The IIoT has created a new generation of automation systems that have unparalleled capability and extensibility. These systems are expected to play an important role in power plant automation and the control arena with leaner and flatter architectures, which are expected to bridge the gap between operational technologies (OT) and information technologies (IT). For instance, Emerson offers wireless and instant access to the distributed control system (DCS) and maintenance data, which helps in reducing overall operational costs in a longer time frame. The IIoT provides holistic insights and helps in faster decision making and is, hence, expected to drive the power plant control system market.

Challenges: Threat of cyberattacks on modern power plant control systems

With increased automation and the digital interconnectedness of power plant assets, the threat of cyberattacks is increased. Electricity is one of the critical infrastructures for the proper functioning of modern society. Power plants and their equipment are the key components, which when exposed to cyberattacks can bring down entire nations to their heels. Cyberattacks are among the primary issues to be addressed while developing a sensor-based network to monitor and control critical infrastructures. As power plant control systems comprise a network of sensors, mainframe computers, communication systems, and storage systems, they are vulnerable to cyberattacks. Power plant control systems manage the operational aspects of critical infrastructures by using logical processes and physical operations. The failure of these systems can affect an organization, a community, and subsequently an economy. Cyberattacks on power plant assets can have a long-term negative effect on plant operations.

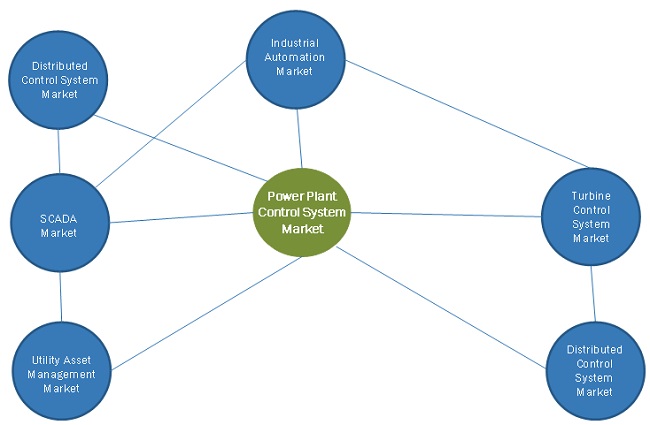

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

The DCS segment by solution is expected to be the largest market during the forecast period

The power plant control system market, by solution, is segmented into SCADA, DCS, programmable controllers, and others which includes product lifecycle management, plant asset management, and plant optimization solutions. DCS solutions are preferred in large, complex power plants such as coal-, gas-, and oil-fired power plants. The increased adoption of DCS solutions across fossil-fueled plants due to high reliability and ease of use is the major driver for the demand.

The renewable segment by plant type, of power plant control system is expected to be the largest contributor to the power plant control system market, by plant type, during the forecast period

The power plant control system market is segmented, by power plant type, coal, natural gas, oil, hydroelectric, nuclear, and renewable. The renewable segment is likely to account for the largest share of the market during 2021–2026. The global shift in power generation technology from fossil fuel to renewables in the key markets of Europe, North America, and Asia Pacific is expected to be the major driver for this segment during the forecast period.

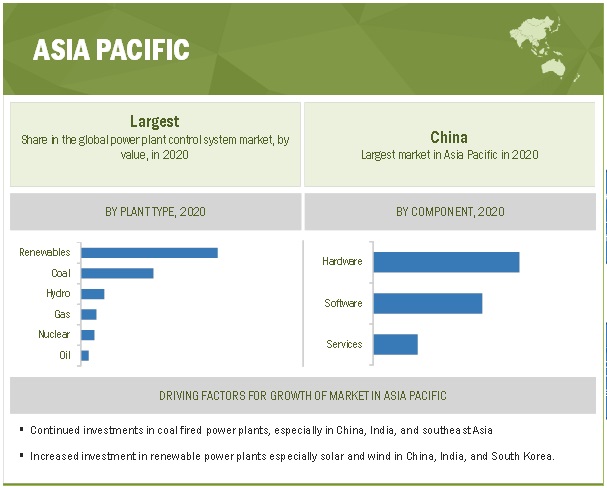

Asia Pacific is expected to be the fastest-growing market during the forecast period

In this report, the power plant control system market has been analyzed with respect to six regions, namely, Asia Pacific, North America, Europe, Middle East, Africa, and South America. The market in Asia Pacific, led by China, is expected to grow at the highest CAGR during the forecast period. Continued investments in fossil fuel power plants, especially in China, India, and Southeast Asia, along with the increased renewable power plant investments in countries such as China, India, Japan, and South Korea, are expected to drive the demand for power plant control systems in the region.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Plant Type, Solution, Application, component, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East, Africa, and South America |

|

Companies covered |

Siemens Energy (Germany), ABB (Switzerland), Emerson (US), Rockwell (US), GE (US), Schneider Electric (France), Honeywell (US), Mitsubishi Electric (Japan), Yokogawa Electric Corporation (Japan), Hitachi (Japan), Endress+Hauser (Switzerland), OMRON(Japan), INDRA Sistemas (Spain), Motorola Solutions (US), Bentek Systems (Canada), EFFACEC Power Solutions (Portugal), Toshiba (Japan), Valmet (Finland), Meteocontrol (Germany), Ingeteam (US), Schweitzer Engineering Laboratories (US), Wago (Germany), and ETAP (US) |

This research report categorizes the power plant control system market by plant type, solution, application, component, and region.

by plant type:

- Coal

- Natural Gas

- Oil

- Hydroelectric

- Nuclear

-

Renewable

- Solar

- Wind

- Biofuels

by solution:

- SCADA

- DCS

- Programmable Controllers

- Others

by application:

- Boiler & Auxiliaries Control

- Turbine & Auxiliaries Control

- Generator Excitation & Electrical Control

- Others

by region:

- Asia Pacific

- North America

- Europe

- Middle East

- Africa

- South America

Recent Developments

- In April 2021, Siemens Energy signed an agreement contract with TSK—a Spanish engineering, procurement, and construction (EPC) contractor for the Atinkou CCGT power plant project. Under this contract, Siemens Energy is expected to provide its SPAA-T300 control system for a CCGT plant built in Jacqueville, Côte d'Ivoire.

- In August 2020, Schneider acquired Larsen and Toubro's Electrical And Automation business division, partnering with Temasek. Schneider Electric owns a 65% stake of the acquired L&T's business division and the rest by Temasek. This acquisition will strengthen low-voltage offerings and the Industrial Automation business and will help Schneider Electric to grow in the Middle East, Africa, and East Asia as L&T offers strong R&D and engineering capabilities.

- In March 2019, ABB launched its Distributed Control System 800xA 6.1. The new DCS solution introduces Ethernet I/O solutions, high-integrity controllers, and series of engineering tools such as Ethernet I/O Field Kit and Ethernet I/O wizard for field commissioning.

Frequently Asked Questions (FAQ):

What is the projected market size of the Power Plant Control System Market?

USD 10.2 Billion is Projected for the forecast year 2026 for the Power Plant Control System Market

What are the major drivers of Power Plant Control System Market?

Rising decarbonization and increased investments in renewable power plants is the major driver of the power plant control system market. Growing need for centralized and reliable control of power plants are expected to further drive the demand.

Which is the fastest-growing region during the forecasted period of the Power Plant Control System Market?

Asia Pacific is the fastest-growing region during the forecasted period.

Which is the largest segment, by plant type during the forecasted of Power Plant Control System Market?

The renewable segment is projected to hold the largest market share during the forecast period. Increased investments in renewable power plants especially in Europe, North America and Asia Pacific are expected to contribute to the growth.

Which is the largest segment, by solution during the forecasted period of the Power Plant Control System Market?

The DCS segment is projected to hold the largest market share during the forecast period. DCS solutions are preferred in large, complex power plants such as coal-, gas-, and oil-fired power plants. The increased adoption of DCS solutions across fossil-fueled plants due to high reliability and ease of use is the major driver for the demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 POWER PLANT CONTROL SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS

TABLE 1 MARKET, BY PLANT TYPE: INCLUSIONS AND EXCLUSIONS

TABLE 2 MARKET, BY SOLUTION: INCLUSIONS AND EXCLUSIONS

TABLE 3 MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 POWER PLANT CONTROL SYSTEM MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES

2.3 IMPACT OF COVID-19

2.4 MARKET SIZE ESTIMATION

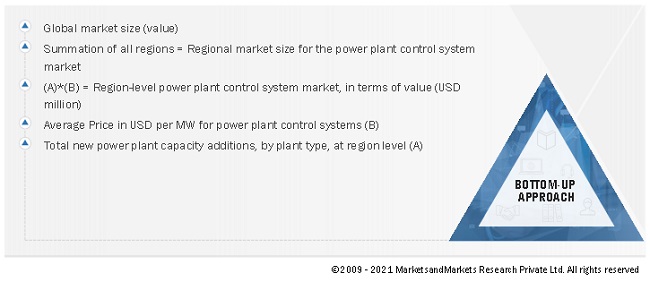

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 DEMAND-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR POWER PLANT CONTROL SYSTEM

2.4.3.1 Demand-side calculation

2.4.3.2 Assumptions for demand-side analysis

2.4.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR MARKET

FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

2.4.4.1 Supply-side calculation

2.4.4.2 Assumptions for supply side

2.4.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 4 SNAPSHOT OF POWER PLANT CONTROL SYSTEM MARKET

FIGURE 9 DCS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY SOLUTION, DURING FORECAST PERIOD

FIGURE 10 TURBINE & AUXILIARIES CONTROL SEGMENT, BY APPLICATION, TO LEAD MARKET BY 2026

FIGURE 11 RENEWABLE SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET, BY PLANT TYPE, THROUGHOUT FORECAST PERIOD

FIGURE 12 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET, BY COMPONENT, THROUGHOUT FORECAST PERIOD

FIGURE 13 ASIA PACIFIC MARKET TO EXHIBIT HIGHEST CAGR DURING 2021–2026

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN POWER PLANT CONTROL SYSTEM MARKET

FIGURE 14 INCREASING INVESTMENTS IN RENEWABLES GLOBALLY AND CONTINUING COAL PLANT INVESTMENTS TO DRIVE MARKET DURING 2021–2026

4.2 MARKET, BY REGION

FIGURE 15 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY COMPONENT

FIGURE 16 HARDWARE SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.4 MARKET, BY PLANT TYPE

FIGURE 17 RENEWABLE SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.5 MARKET, BY APPLICATION

FIGURE 18 TURBINE & AUXILIARIES CONTROL SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.6 MARKET, BY SOLUTIONS

FIGURE 19 DCS SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COVID-19 GLOBAL PROPAGATION

FIGURE 21 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 GLOBAL ROAD TO RECOVERY FROM COVID-19

FIGURE 22 GLOBAL RECOVERY ROAD FROM COVID-19 FROM 2020 TO 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 24 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Rising trend of decarbonization and increasing investments in renewable power plants

FIGURE 25 ANNUAL GLOBAL INVESTMENTS IN POWER PLANTS, 2010–2020 (USD BILLION)

5.5.1.2 Growing need for centralized and reliable control of power plants

FIGURE 26 INVESTMENTS IN POWER PLANTS, BY REGION, 2015–2021 (USD BILLION)

5.5.1.3 Increasing global investments in digital grid infrastructures

FIGURE 27 GLOBAL ELECTRICITY INVESTMENTS, 2014–2019 (USD BILLION)

5.5.2 RESTRAINTS

5.5.2.1 High lifetime costs and need for reinvestment in power plant control systems

5.5.2.2 Lack of standardization and interoperability in power plant control system solutions

5.5.3 OPPORTUNITIES

5.5.3.1 Growing interest of grid operators in dynamic resource allocation and real-time power management

5.5.3.2 Increasing adoption of digital solutions such as Industrial Internet of Things, digital twin, and predictive maintenance

5.5.4 CHALLENGES

5.5.4.1 Threat of cyberattacks on modern power plant control systems

FIGURE 28 ENTRY POINTS FOR CYBERATTACKS

5.5.4.2 Impact of COVID-19 on market

5.6 YC-SHIFT

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 29 REVENUE SHIFT FOR POWER PLANT CONTROL SYSTEMS

5.7 MARKET MAP

FIGURE 30 MARKET MAP OF POWER PLANT CONTROL SYSTEMS

5.8 AVERAGE SELLING PRICE TREND

FIGURE 31 AVERAGE SELLING PRICE OF POWER PLANT CONTROL SYSTEMS

5.9 VALUE CHAIN ANALYSIS

FIGURE 32 MARKET: VALUE CHAIN ANALYSIS

5.9.1 RAW MATERIAL SUPPLIERS

5.9.2 COMPONENT MANUFACTURERS

5.9.3 SYSTEM INTEGRATORS/ASSEMBLERS

5.9.4 DISTRIBUTORS AND POST-SALES SERVICE PROVIDERS

TABLE 5 MARKET: ECOSYSTEM

5.10 TECHNOLOGY ANALYSIS

5.10.1 MARKET: CODES AND REGULATIONS

5.10.2 INNOVATIONS AND PATENT REGISTRATIONS

5.11 CASE STUDY ANALYSIS

5.11.1 POWER PLANT CONTROL SYSTEM UPGRADE FOR NEW ZEALAND’S HYDRO POWER PLANT, 2020

5.11.1.1 Problem statement

5.11.1.2 Solution

5.11.2 IMPROVED POWER PLANT PERFORMANCE AT RICHARD J. MIDULLA GENERATING STATION, 2016

5.11.2.1 Problem statement

5.11.2.2 Solution

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 DEGREE OF COMPETITION

6 POWER PLANT CONTROL SYSTEM MARKET, BY SOLUTION (Page No. - 78)

6.1 INTRODUCTION

FIGURE 34 DCS SEGMENT ACCOUNTED FOR LARGEST SHARE OF SYSTEM MARKET, IN TERMS OF VALUE, IN 2020

TABLE 7 MARKET, BY SOLUTION, 2019–2026 (USD MILLION)

6.2 SCADA

6.2.1 INCREASED NEED FOR CENTRALIZED CONTROL AND MONITORING SOLUTIONS IN POWER PLANTS TO FUEL DEMAND FOR SCADA SOLUTIONS

TABLE 8 SCADA: MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 DCS

6.3.1 INCREASED INVESTMENTS IN FOSSIL FUEL POWER PLANTS, ESPECIALLY IN ASIA PACIFIC, ARE MAJORLY DRIVING MARKET GROWTH

TABLE 9 DCS: MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 PROGRAMMABLE CONTROLLERS

6.4.1 ADVANTAGES SUCH AS MODULARITY AND SPACE ARE MAJOR DRIVERS FOR GROWTH OF THIS SEGMENT

TABLE 10 PROGRAMMABLE CONTROLLERS: MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5 OTHERS

TABLE 11 OTHER SOLUTIONS: MARKET, BY REGION, 2019–2026 (USD MILLION)

7 POWER PLANT CONTROL SYSTEM MARKET, BY APPLICATION (Page No. - 85)

7.1 INTRODUCTION

TABLE 12 POWER PLANT CONTROL SYSTEM APPLICATION, BY PLANT TYPE

FIGURE 35 TURBINE & AUXILIARIES CONTROL SEGMENT LED MARKET, IN TERMS OF VALUE, IN 2020

TABLE 13 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 BOILER & AUXILIARIES CONTROL

7.2.1 CONTINUED ADDITION OF FOSSIL FUEL PLANTS IN ASIA PACIFIC, RUSSIA, AND ITALY TO FUEL DEMAND

TABLE 14 MARKET FOR BOILER & AUXILIARIES CONTROL, BY REGION, 2019–2026 (USD MILLION)

7.3 TURBINE & AUXILIARIES CONTROL

7.3.1 INCREASING WIND CAPACITY ADDITIONS IN EUROPE AND CONTINUED FOSSIL FUEL PLANT ADDITIONS IN ASIA PACIFIC TO FUEL DEMAND

TABLE 15 MARKET FOR TURBINE & AUXILIARIES CONTROL, BY REGION, 2019–2026 (USD MILLION)

7.4 GENERATOR EXCITATION & ELECTRICAL CONTROL

7.4.1 NEED FOR MONITORING AND CONTROLLING ELECTRICAL SYSTEMS ACROSS ALL PLANT TYPES TO DRIVE GROWTH

TABLE 16 MARKET FOR GENERATOR EXCITATION & ELECTRICAL CONTROL, BY REGION, 2019–2026 (USD MILLION)

7.5 OTHERS

TABLE 17 MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

8 POWER PLANT CONTROL SYSTEM MARKET, BY PLANT TYPE (Page No. - 92)

8.1 INTRODUCTION

FIGURE 36 RENEWABLES SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET, IN TERMS OF VALUE, IN 2020

TABLE 18 MARKET, BY PLANT TYPE, 2019–2026 (USD MILLION)

8.2 COAL

8.2.1 CONTINUED COAL POWER PLANT INSTALLATIONS IN ASIA PACIFIC, ESPECIALLY IN CHINA, INDIA, AND SOUTHEAST ASIA, TO FUEL DEMAND

TABLE 19 COAL MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 NATURAL GAS

8.3.1 INCREASING GAS POWER PLANT ADDITIONS FOR PEAKING POWER APPLICATIONS IN US AND MIDDLE EAST ARE MAJOR DRIVERS FOR DEMAND

TABLE 20 NATURAL GAS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 OIL

8.4.1 RAISE IN OIL POWER PLANT ADDITIONS IN ASIA PACIFIC FOR DECENTRALIZED POWER GENERATION TO DRIVE DEMAND FOR POWER PLANT CONTROL SYSTEMS

TABLE 21 OIL MARKET, BY REGION, 2019–2026 (USD MILLION)

8.5 HYDROELECTRIC

8.5.1 INCREASING HYDROPOWER INSTALLATIONS, ESPECIALLY IN CHINA, MAJORLY DRIVE DEMAND FROM THIS SEGMENT

TABLE 22 HYDROELECTRIC MARKET, BY REGION, 2019–2026 (USD MILLION)

8.6 NUCLEAR

8.6.1 NEW NUCLEAR POWER PLANTS IN CHINA AND RUSSIA ARE MAJOR DRIVERS FOR DEMAND

TABLE 23 NUCLEAR MARKET, BY REGION, 2019–2026 (USD MILLION)

8.7 RENEWABLE

8.7.1 INCREASED RENEWABLE POWER PLANT INVESTMENTS, ESPECIALLY IN ASIA PACIFIC AND EUROPE, ARE MAJOR DRIVERS FOR GROWTH

TABLE 24 RENEWABLE MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 RENEWABLE MARKET, BY SUB-TYPE, 2019–2026 (USD MILLION)

8.7.2 SOLAR

TABLE 26 SOLAR: RENEWABLE MARKET, BY REGION, 2019–2026 (USD MILLION)

8.7.3 WIND

TABLE 27 WIND: RENEWABLE MARKET, BY REGION, 2019–2026 (USD MILLION)

8.7.4 BIOFUELS

TABLE 28 BIOFUELS: RENEWABLE MARKET, BY REGION, 2019–2026 (USD MILLION)

9 POWER PLANT CONTROL SYSTEM MARKET, BY COMPONENT (Page No. - 102)

9.1 INTRODUCTION

FIGURE 37 HARDWARE SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET, IN TERMS OF VALUE, IN 2020

TABLE 29 MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

9.2 HARDWARE

9.2.1 INCREASED LEVEL OF AUTOMATION AND NEED FOR REMOTE MONITORING AND CONTROL TO FUEL DEMAND

TABLE 30 POWER PLANT CONTROL SYSTEM HARDWARE MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 POWER PLANT CONTROL SYSTEM HARDWARE MARKET, BY SUBCOMPONENT, 2019–2026 (USD MILLION)

9.2.2 CONTROLLERS

9.2.3 INPUT/OUTPUT DEVICES

9.2.4 WORKSTATIONS

9.2.5 NETWORKING HARDWARE

9.3 SOFTWARE

9.3.1 INCREASED INTEREST IN PLANT LIFECYCLE MANAGEMENT, PLANT ASSET MANAGEMENT, AND PLANT OPTIMIZATION IN ARE MAJOR DRIVERS FOR MARKET GROWTH

TABLE 32 POWER PLANT CONTROL SYSTEMS SOFTWARE MARKET, BY REGION, 2019–2026 (USD MILLION)

9.4 SERVICES

9.4.1 ADVANTAGES SUCH AS MODULARITY AND SPACE ARE MAJOR DRIVERS FOR MARKET GROWTH

TABLE 33 SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 108)

10.1 INTRODUCTION

FIGURE 38 REGIONAL SNAPSHOT: MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 39 MARKET SHARE (VALUE), BY REGION, 2020

TABLE 34 MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 40 SNAPSHOT: MARKET IN ASIA PACIFIC

TABLE 35 MARKET IN ASIA PACIFIC, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 36 MARKET IN ASIA PACIFIC, BY SOLUTION, 2019–2026 (USD MILLION)

TABLE 37 MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 MARKET IN ASIA PACIFIC, BY PLANT TYPE, 2019–2026 (USD MILLION)

TABLE 39 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Continuous investments in coal power plants and increasing investments in renewable power plants to support market growth

TABLE 40 MARKET IN CHINA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 41 MARKET IN CHINA, BY PLANT TYPE, 2019–2026 (USD MILLION)

FALSE

10.2.2 AUSTRALIA

10.2.2.1 Increased wind and solar power plant installations to drive market

TABLE 42 MARKET IN AUSTRALIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 43 MARKET IN AUSTRALIA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.2.3 JAPAN

10.2.3.1 Japan’s shift from coal to renewable power plants is major driver for market growth

TABLE 44 MARKET IN JAPAN, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 45 MARKET IN JAPAN, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.2.4 INDIA

10.2.4.1 Continuous coal plant investments and aggressive renewable power plant additions to create demand for power plant control systems

TABLE 46 MARKET IN INDIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 47 MARKET IN INDIA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.2.5 SOUTH KOREA

10.2.5.1 Increasing natural gas and solar power plant capacity additions to boost market growth

TABLE 48 GENERATOR EXCITATION MARKET IN SOUTH KOREA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 49 GENERATOR EXCITATION MARKET IN SOUTH KOREA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.2.6 REST OF ASIA PACIFIC

TABLE 50 GENERATOR EXCITATION MARKET IN REST OF ASIA PACIFIC, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 51 GENERATOR EXCITATION MARKET IN REST OF ASIA PACIFIC, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3 EUROPE

FIGURE 41 SNAPSHOT: NUCLEAR MARKET IN EUROPE

TABLE 52 NUCLEAR MARKET IN EUROPE, BY SOLUTION, 2019–2026 (USD MILLION)

TABLE 53 ELECTRICAL CONTROL SYSTEM MARKET IN EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 54 ELECTRICAL CONTROL SYSTEM MARKET IN EUROPE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 55 ELECTRICAL MARKET IN EUROPE, BY PLANT TYPE, 2019–2026 (USD MILLION)

TABLE 56 ELECTRICAL MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Government initiatives to support renewable energy power plants propel market growth

TABLE 57 MARKET IN GERMANY, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 58 MARKET IN GERMANY, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 UK’s decarbonization plan and increasing investments in renewables to be major drivers for market growth

TABLE 59 ELECTRICAL MARKET IN UK, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 60 ELECTRICAL MARKET IN UK, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Continuous solar and wind power plant investments to meet energy targets are expected to propel market growth

TABLE 61 ELECTRICAL MARKET IN FRANCE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 62 MARKET IN FRANCE, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Rising solar and wind power plant investments to meet energy targets are likely to accelerate market growth

TABLE 63 ELECTRICAL MARKET IN SPAIN, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 64 MARKET IN SPAIN, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3.5 SWEDEN

10.3.5.1 Sweden’s renewable power plant investments to meet its target of 100% generation from renewables by 2040 are expected to enhance market growth

TABLE 65 MARKET IN SWEDEN, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 66 MARKET IN SWEDEN, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3.6 NORWAY

10.3.6.1 Norway’s wind and hydropower plant investments are expected to drive market

TABLE 67 ELECTRICAL MARKET IN NORWAY, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 68 MARKET IN NORWAY, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3.7 RUSSIA

10.3.7.1 Growing nuclear and fossil fuel power plants installation to drive market growth

TABLE 69 MARKET IN RUSSIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 70 MARKET IN RUSSIA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.3.8 REST OF EUROPE

TABLE 71 ELECTRICAL MARKET IN REST OF EUROPE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 72 ELECTRICAL MARKET IN REST OF EUROPE, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.4 NORTH AMERICA

TABLE 73 ELECTRICAL MARKET IN NORTH AMERICA, BY SOLUTION, 2019–2026 (USD MILLION)

TABLE 74 NUCLEAR MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 75 NUCLEAR POWER PLANT TURBINE CONTROL SYSTEM MARKET IN NORTH AMERICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 76 NUCLEAR POWER PLANT TURBINE CONTROL SYSTEM MARKET IN NORTH AMERICA, BY PLANT TYPE, 2019–2026 (USD MILLION)

TABLE 77 NUCLEAR POWER PLANT TURBINE CONTROL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.1 US

10.4.1.1 Continued investments in gas power plants and renewable power plants to accelerate demand for power plant control systems

TABLE 78 NUCLEAR MARKET IN US, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 79 NUCLEAR MARKET IN US, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.4.2 CANADA

10.4.2.1 Increasing hydro and wind power plant installations to drive market growth

TABLE 80 MARKET IN CANADA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 81 NUCLEAR MARKET IN CANADA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.4.3 MEXICO

10.4.3.1 Capacity additions to gas and renewable power plants to drive market growth

TABLE 82 POWER PLANT TURBINE CONTROL SYSTEM MARKET IN MEXICO, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 83 POWER PLANT TURBINE CONTROL SYSTEM MARKET IN MEXICO, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.5 MIDDLE EAST

TABLE 84 NUCLEAR POWER PLANT TURBINE CONTROL SYSTEM MARKET IN MIDDLE EAST, BY SOLUTION, 2019–2026 (USD MILLION)

TABLE 85 NUCLEAR POWER PLANT TURBINE CONTROL SYSTEM MARKET IN MIDDLE EAST, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 86 NUCLEAR POWER PLANT TURBINE CONTROL SYSTEM MARKET IN MIDDLE EAST, BY PLANT TYPE, 2019–2026 (USD MILLION)

TABLE 87 MIDDLE EAST: NUCLEAR MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Increasing gas power plant installations to boost market growth

TABLE 88 MARKET IN SAUDI ARABIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 89 MARKET IN SAUDI ARABIA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.5.2 UAE

10.5.2.1 Investments in gas power plants and nuclear and renewable power plants to drive growth of UAE market

TABLE 90 NUCLEAR POWER PLANT TURBINE CONTROL SYSTEM MARKET IN UAE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 91 NUCLEAR MARKET IN UAE, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.5.3 QATAR

10.5.3.1 High dependency on gas power plants to fuel growth of market in Qatar

TABLE 92 MARKET IN QATAR, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 93 MARKET IN QATAR, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.5.4 REST OF MIDDLE EAST

TABLE 94 NUCLEAR MARKET IN REST OF MIDDLE EAST, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 95 BOILER CONTROL SYSTEM MARKET IN REST OF MIDDLE EAST, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 96 BOILER CONTROL SYSTEM MARKET IN SOUTH AMERICA, BY SOLUTION, 2019–2026 (USD MILLION)

TABLE 97 POWER PLANT BOILER CONTROL SYSTEM MARKET IN SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 98 POWER PLANT BOILER CONTROL SYSTEM MARKET IN SOUTH AMERICA, BY PLANT TYPE, 2019–2026 (USD MILLION)

TABLE 99 POWER PLANT BOILER CONTROL SYSTEM MARKET IN SOUTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Hydro and wind power plant installations to drive market growth

TABLE 100 POWER PLANT TURBINE CONTROL SYSTEM MARKET IN BRAZIL, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 101 POWER PLANT BOILER CONTROL SYSTEM MARKET IN BRAZIL, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Continued gas power installations to support market growth in Argentina

TABLE 102 MARKET IN ARGENTINA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 103 POWER PLANT BOILER CONTROL SYSTEM MARKET IN ARGENTINA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.6.3 CHILE

10.6.3.1 Relentless efforts to boost power capacity to culminate into heightened demand for power plant control systems

TABLE 104 POWER PLANT BOILER CONTROL SYSTEM MARKET IN CHILE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 105 POWER PLANT BOILER CONTROL SYSTEM MARKET IN CHILE, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.6.4 REST OF SOUTH AMERICA

TABLE 106 POWER PLANT BOILER CONTROL SYSTEM MARKET IN REST OF SOUTH AMERICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 107 POWER PLANT BOILER CONTROL SYSTEM MARKET IN REST OF SOUTH AMERICA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.7 AFRICA

TABLE 108 POWER PLANT BOILER CONTROL SYSTEM MARKET IN AFRICA, BY SOLUTION, 2019–2026 (USD MILLION)

TABLE 109 POWER PLANT BOILER CONTROL SYSTEM MARKET IN AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 110 POWER PLANT BOILER CONTROL SYSTEM MARKET IN AFRICA, BY PLANT TYPE, 2019–2026 (USD MILLION)

TABLE 111 POWER PLANT BOILER CONTROL SYSTEM MARKET IN AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.7.1 SOUTH AFRICA

10.7.1.1 Growing focus on renewable power generation to fuel demand for power plant control systems in South Africa

TABLE 112 MARKET IN SOUTH AFRICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 113 MARKET IN SOUTH AFRICA, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.7.2 EGYPT

10.7.2.1 Increasing gas power plant installations, combined with renewable power plant investments, is expected to be augment market growth

TABLE 114 POWER PLANT TURBINE CONTROL SYSTEM MARKET IN EGYPT, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 115 MARKET IN EGYPT, BY PLANT TYPE, 2019–2026 (USD MILLION)

10.7.3 REST OF AFRICA

TABLE 116 POWER PLANT TURBINE CONTROL SYSTEM MARKET IN REST OF AFRICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 117 POWER PLANT TURBINE CONTROL SYSTEM MARKET IN REST OF AFRICA, BY PLANT TYPE, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 160)

11.1 OVERVIEW

FIGURE 42 KEY DEVELOPMENTS IN MARKET DURING 2017–2021

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 118 POWER PLANT TURBINE CONTROL SYSTEM MARKET: DEGREE OF COMPETITION

FIGURE 43 LEADING PLAYERS IN MARKET

11.3 MARKET EVALUATION FRAMEWORK

TABLE 119 MARKET EVALUATION FRAMEWORK

11.4 COMPETITIVE SCENARIO

TABLE 120 POWER PLANT TURBINE CONTROL SYSTEM MARKET: PRODUCT LAUNCHES, 2017–2021

TABLE 121 POWER PLANT TURBINE CONTROL SYSTEM MARKET: DEALS, 2017–2021

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 44 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

11.5.5 PRODUCT FOOTPRINT

TABLE 122 COMPANY PRODUCT FOOTPRINT

TABLE 123 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 124 COMPANY SOLUTION FOOTPRINT

TABLE 125 COMPANY REGION FOOTPRINT

12 COMPANY PROFILES (Page No. - 176)

(Business Overview, Products/solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 MAJOR PLAYERS

12.1.1 ABB

TABLE 126 ABB: COMPANY OVERVIEW

FIGURE 45 ABB: COMPANY SNAPSHOT

TABLE 127 ABB: PRODUCTS/SOLUTIONS OFFERED

TABLE 128 ABB: PRODUCT LAUNCHES, 2017–2021

TABLE 129 ABB: DEALS, 2017–2021

12.1.2 SIEMENS ENERGY

TABLE 130 SIEMENS ENERGY: COMPANY OVERVIEW

FIGURE 46 SIEMENS ENERGY: COMPANY SNAPSHOT

TABLE 131 SIEMENS: PRODUCTS/SOLUTIONS OFFERED

TABLE 132 SIEMENS: PRODUCT DEVELOPMENTS, 2017–2021

TABLE 133 SIEMENS: DEALS, 2017–2021

12.1.3 EMERSON

TABLE 134 EMERSON: COMPANY OVERVIEW

FIGURE 47 EMERSON: COMPANY SNAPSHOT

TABLE 135 EMERSON PRODUCT/SOLUTIONS OFFERED

TABLE 136 EMERSON: PRODUCT LAUNCHES, 2017- 2021

TABLE 137 EMERSON: DEALS, 2017–2021

12.1.4 SCHNEIDER ELECTRIC

TABLE 138 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

FIGURE 48 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 139 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 140 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES, 2017–2021

TABLE 141 SCHNEIDER ELECTRIC: DEALS, 2017–2021

12.1.5 ROCKWELL

TABLE 142 ROCKWELL: COMPANY OVERVIEW

FIGURE 49 ROCKWELL: COMPANY SNAPSHOT

TABLE 143 ROCKWELL: PRODUCTS/SOLUTIONS OFFERED

TABLE 144 ROCKWELL: DEALS, 2017–2021

12.1.6 GENERAL ELECTRIC

TABLE 145 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 50 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 146 GENERAL ELECTRIC: PRODUCTS/SOLUTION/SERVICES OFFERED

TABLE 147 GENERAL ELECTRIC: DEALS, 2017–2021

12.1.7 HONEYWELL

TABLE 148 HONEYWELL: COMPANY OVERVIEW

FIGURE 51 HONEYWELL: COMPANY SNAPSHOT

TABLE 149 HONEYWELL: PRODUCTS/SOLUTIONS OFFERED

TABLE 150 HONEYWELL: PRODUCT LAUNCHES, 2017–2021

TABLE 151 HONEYWELL: DEALS, 2017–2021

12.1.8 MITSUBISHI ELECTRIC

TABLE 152 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

FIGURE 52 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 153 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 154 MITSUBISHI ELECTRIC: DEALS, 2017–2021

12.1.9 YOKOGAWA ELECTRIC CORPORATION

TABLE 155 YOKOGAWA: COMPANY OVERVIEW

FIGURE 53 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 156 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 157 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES, 2017–2021

TABLE 158 YOKOGAWA ELECTRIC CORPORATION: DEALS, 2017–2021

12.1.10 HITACHI

TABLE 159 HITACHI: COMPANY OVERVIEW

FIGURE 54 HITACHI: COMPANY SNAPSHOT

TABLE 160 HITACHI: PRODUCTS/SOLUTIONS OFFERED

12.1.11 ENDRESS+HAUSER

TABLE 161 ENDRESS+HAUSER: COMPANY OVERVIEW

TABLE 162 ENDRESS+HAUSER: PRODUCTS/SOLUTIONS OFFERED

12.1.12 OMRON

TABLE 163 OMRON: COMPANY OVERVIEW

FIGURE 55 OMRON: COMPANY SNAPSHOT

TABLE 164 OMRON: PRODUCTS/SOLUTIONS OFFERED

12.1.13 INDRA SISTEMAS

TABLE 165 INDRA SISTEMAS: COMPANY OVERVIEW

TABLE 166 INDRA SISTEMAS: PRODUCTS/SOLUTIONS OFFERED

TABLE 167 INDRA SISTEMAS: PRODUCT LAUNCHES, 2017–2021

TABLE 168 INDRA SISTEMAS-DEALS, 2017–2021

12.1.14 MOTOROLA SOLUTIONS

TABLE 169 MOTOROLA SOLUTIONS: COMPANY OVERVIEW

FIGURE 56 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

TABLE 170 MOTOROLA SOLUTIONS: PRODUCTS/SOLUTIONS OFFERED

TABLE 171 MOTOROLA SOLUTIONS: DEALS, 2017–2021

12.1.15 BENTEK SYSTEMS

TABLE 172 BENTEK SYSTEMS: COMPANY OVERVIEW

TABLE 173 BENTEK SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

12.1.16 EFACEC POWER SOLUTIONS

TABLE 174 EFACEC POWER SOLUTIONS: COMPANY OVERVIEW

TABLE 175 EFACEC POWER SOLUTIONS: PRODUCTS/SOLUTIONS OFFERED

TABLE 176 EFACEC POWER SOLUTIONS: DEALS, 2017–2021

12.2 OTHER PLAYERS

12.2.1 TOSHIBA

12.2.2 VALMET

12.2.3 METEOCONTROL

12.2.4 INGETEAM

12.2.5 SCHWEITZER ENGINEERING LABORATORIES

12.2.6 WAGO

12.2.7 ETAP

*Details on Business Overview, Products/solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 233)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

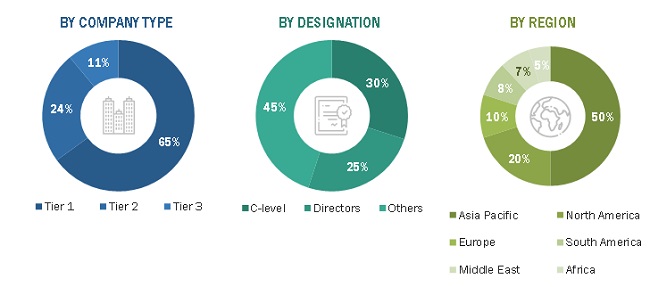

This study involved four major activities in estimating the current size of the power plant control system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power plant control system market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power plant control system market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. This market's demand-side is characterized by its end-users, such as power plant owners, power plant operators, independent power producers among others. The supply-side is characterized by power plant control system manufacturers and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global power plant control system market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The industry and market's key players have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Power plant control system market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define and describe the global power plant control system market by plant type, solution, application, component, and region.

- To provide detailed information about the major factors influencing the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the global market with respect to individual growth trends, future expansions, and each segment's contribution to the market.

- The impact of the COVID-19 pandemic on the market has been analyzed to estimate the market size.

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders.

- To forecast the growth of the global market with respect to the main regions (Asia Pacific, North America, Europe, Middle East, Africa, and South America).

- To profile and rank key players and comprehensively analyze their market share.

- To analyze competitive developments such as contracts & agreements, product launches, and mergers & acquisitions in the power plant control system market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Plant Control System Market