Precision Planting Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software, Services), System Type (High-Speed Planters, Precision Air Seeders, Drones), Drive Type (Electric Drive, Hydraulic Drive), Application, Farm Size and Region - Global Growth Driver and Industry Forecast to 2027

Updated on : October 22, 2024

The precision planting market is experiencing robust growth, fueled by increasing demand for efficient agricultural practices and the need to enhance crop yields. As farmers seek to optimize resource use and minimize waste, precision planting technologies—such as GPS-guided equipment and advanced seed placement systems—are becoming essential. Key trends in this market include the integration of data analytics and machine learning, which allow for real-time monitoring and decision-making, ensuring optimal planting conditions. Additionally, the rise of sustainable farming practices is driving the adoption of precision planting solutions, as they contribute to more environmentally friendly agriculture

Precision Planting Market Size

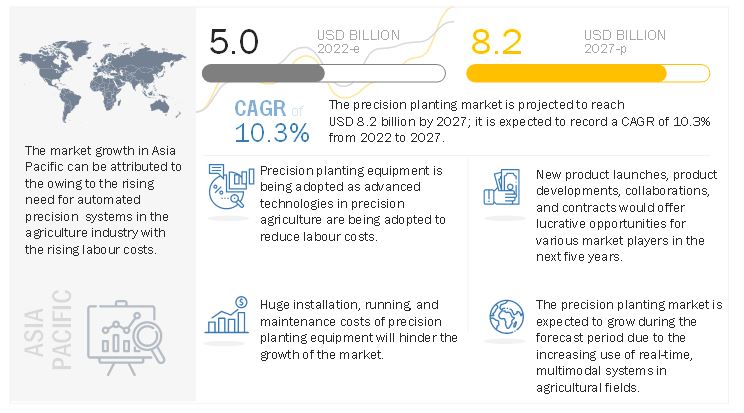

The global precision planting market size is estimated to be USD 5.0 billion in 2022 and is projected to reach USD 8.2 billion by 2027, growing at a CAGR of 10.3% from 2022 to 2027

Some of the major factors contributing to the growth of precision planting market includes the substantial cost-savings associated with precision planting and seeding equipment, surge in the adoption of advanced technologies in precision agriculture to reduce labour cost, and increasing promotion of precision planting techniques by governments worldwide. Moreover, climate change and need to meet rising demand for food will also drive the growth of the industry in the near future.

Precision Planting Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Precision Planting Market Growth Opportunities

The precision planting market offers significant growth opportunities driven by the increasing adoption of advanced technologies in precision agriculture. Key drivers include the substantial cost savings associated with precision planting and seeding equipment, the surge in labor cost reduction, and the growing emphasis on sustainable farming practices. Additionally, the need to meet rising food demand and the impact of climate change on agricultural productivity are fostering the industry's growth.

Precision Planting Market Trends

The precision planting market is witnessing significant trends that are driving its growth. One of the key trends is the increasing adoption of advanced technologies such as GPS, sensors, and automation, which are enhancing crop productivity, optimizing resource utilization, and improving environmental sustainability. Additionally, the trend towards larger farm sizes and increased mechanization is driving demand for precision planting technology among large-scale farming operations in developed regions like North America, where the market is expected to expand at a notable growth rate through 2032.

Precision Planting Market Dynamics:

Driver: Substantial cost-savings associated with precision planting and seeding equipment

Precision planting and seeding equipment, when used to their maximum potential, can ensure high returns in agribusiness. Planting and seeding equipment offer precision, which assists in ensuring accurate depth of sowing and equidistant arrangement of seeds. The launch of precision planting and seeding equipment with advanced features such as smart connector systems, controllers, and liquid control and delivery systems has also assisted in boosting the adoption of these equipment. Precision planting and seeding equipment help farmers obtain uniformity of seeds and ensure control over the depth of seed placements. They also safeguard crops from natural disasters by collecting real-time geospatial data pertaining to soil crop yield, weather conditions, and plant conditions, along with other inter- and intra-field information. Precision planting and seeding equipment also ensure the efficient use of seeds, fertilizers, nutrients, herbicides, and pesticides, thereby reducing the wastage of valuable resources. Precision planting and seeding equipment also involve the use of mapping software, variable rate technology (VRT), smart sensors, yield mapping, and other techniques that help increase crop yield and enhance land fertility and profitability. Additionally, precision planting and seeding equipment help reduce energy and fuel consumption by utilizing satellite guidance technologies, such as GPS or GIS, in navigation applications.

Restraint: The cost of purchase, operation, and maintenance is high

Precision planting equipment is expensive, which is a major constraint on the market. GPS, drones, GIS, VRT, and satellite devices, as well as skilled personnel, are all used during precision planting, which incurs additional running and maintenance costs. It costs more to run a precision planter per acre than to seed with an air seeder or to drill with an opener drill. To handle precision planting equipment efficiently, farmers or growers need technical knowledge. The poor farmers in developing countries such as India, China, and Brazil, therefore, do not use these tools and techniques.

Opportunities: Integration of smartphone applications with precision planting equipment

Presently, around 3.8 billion people in the world use smartphones, which is 48% of the global population. China, India, and the US are the countries with the highest number of smartphone users. Smartphones comprise multiple user-friendly applications that help them ease their day-to-day work. Similarly, they are helping farmers by providing information about weather and climate conditions to enable quick and effective decision-making. Most agriculture-based companies are nowadays developing mobile-based applications for farmers to make their work easier. These smartphone applications are linked to hardware, such as sensors, GPS receivers, and cameras to collect images, samples, and field data. Furthermore, they are connected to software to display the collected data and help farmers in quick decision-making. Mobile-based applications are helping farmers to save time and money. Farmers are using smartphones for routine day-to-day tasks, such as checking watering equipment, identifying weeds and pests, and checking the prices of commodities.

Challenge: Unavailability of single platform for integration of farm data

Various interfaces, technologies, and protocols are used in precision planting equipment. Data representation is hindered by the lack of technological standardization and the difficulty of integrating systems. In order for the precision planting market to grow, data integration on a single platform is a major challenge. A high volume of relevant data is regularly generated by precision planting from a variety of sources. The majority of these data relate to mapping, variable rate seeding, soil testing, weather change, yield monitoring, and historical crop rotation. Precision planting relies entirely on this data for assessing farm conditions and making decisions, so it must be properly integrated into a single platform.

The majority of equipment manufacturers use proprietary interfaces and communication protocols, making their devices incompatible with each other. In order to maximize yields, these brands must work together to develop systems that are compatible with each other. As a result, agriculturists and farmers face challenges receiving different equipment from different brands, integrating them, and building smart planting systems. In turn, this challenges the growth of precision planting.

Precision Planting Market Ecosystem

Precision Planting Market Segmentation:

By System Segment, High-speed precision planting systems to led the precision planting market during the forecast period

Precision planting market share will continue to be dominated by high-speed precision planting systems in 2022 and similar trend is expected to be continued by 2027. Farmers are becoming more aware of the benefits of using these planting systems as well as the high return on investment (ROI). With GPS-based auto-guidance planters, growers can reduce seed overlap during the planting process, thereby reducing input costs substantially.

By Offering, Hardware segment to account for largest market share of precision planting market during the forecast period

Precision planting market share is expected to remain high in the hardware segment until 2027. Increasing adoption of automation and control devices, such as drones/unmanned aerial vehicles (UAV), GPS devices, control systems, guidance systems, delivery systems, and display systems, has contributed to the growth of this segment. Planters use hardware such as delivery systems, control systems, seed meters, sensors, and GPS devices to ensure accurate seed placement and uniform seed distribution. Agricultural vehicles use GPS-based auto-guidance technology to reduce overlapping during field mapping, which in turn saves fuel, labor, and time, and compacts soil. Precision planting hardware market growth is expected to be driven by the increasing adoption of advanced planting and seeding equipment with new features such as VRT and guidance systems for precision planting.

By drive type segment, precision planting market is expected to see higher growth rate for the electric drive segment during the forecast period

The electric drive makes precision planter and seeding systems simpler. Farmers for whom corn is a secondary crop say the cost of a new planter forces them to keep fixing, modifying, and upgrading the older unit. By using electric motors, farmers or growers are able to control individual row units at a variable rate. As energy consumption on farm equipment increases, they have a clear advantage over mechanical, hydraulic, and pneumatic components. The power delivery of an electric motor is consistent and uniform. The regulation of electricity is more precise than any other power source. As a result, seed placement functions in planters and drills are more accurate. With electric drive metering, hydraulic requirements such as chains, sprockets, and gears are eliminated. With fewer parts, the metering system will be simpler. These systems also eliminate frequent maintenance, as there are no drive chains, ground wheels, shafts, clutches, and sprockets. An electric drive powers a shaft that turns a seeding meter. The electric motor can be controlled over ISO-compatible systems and offer farmers row shutoff capability. Electric drives are majorly used to simulate row crop seeds. Electric drives have fewer moving parts and can potentially respond more quickly than other drive mechanisms. In most precision planters, electric drives replace hydraulic drives. Electric drive seed meters are largely used for seed rate control and on rough fields where planter performance is hampered due to high speed. The speed of seeding of electric drive systems is almost double that of mechanical/hydraulic drive systems. Deere & Company (US), and Precision Planting (brand of AGCO) (US) are among the key players that offer precision planters and seeders with electric drive.

By Region, North America is expected to lead the precision planting market share during the forecast period.

Precision Planting Market by Region

To know about the assumptions considered for the study, download the pdf brochure

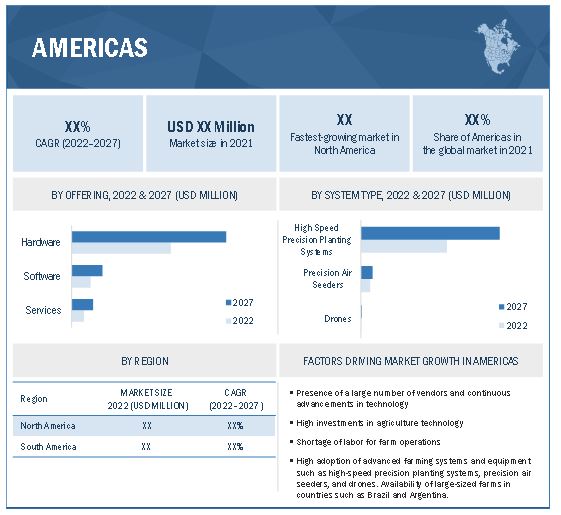

The Americas is segmented into North America and South America. North America is expected to account for the largest share of the precision planting market during the forecast period, owing to the presence of a substantial number of large-sized farms and major players, such as Deere & Company (US), Precision Planting (brand of AGCO) (US), Kinze Manufacturing Inc. (US), and Topcon Positioning Systems (US) in this region. These companies have contributed to the growth of the precision planting market by launching innovative products and services, and extensively investing in the R&D of precision planting technologies. Further, countries in this region, such as the US and Canada, are the early adopters of precision planting technologies since these countries have a large number of progressive farmers with bigger farms. South America plays a significant role in the global trade of agricultural products, especially in terms of exports. The region is a net exporter of important agricultural commodities, accounting for 18% of the total global agricultural and food exports.

Precision Planting Companies - Key Market Players

Deere & Company (US), Trimble Inc. (US), CNH Industrial N.V. (UK), Kinze Manufacturing, Inc. (US), and Precision Planting (brand of AGCO) (US) are among the major players in the precision planting companies.

Precision Planting Market Report Scope

|

Report Metric |

Details |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Offering, System Type, Drive Type, Farm Size, Application, and Region |

|

Geographies Covered |

Americas, Europe, Asia Pacific, and RoW |

|

Companies Covered |

The major players include are Deere & Company (US), Trimble Inc. (US), CNH Industrial N.V. (UK), Kinze Manufacturing, Inc. (US), and Precision Planting (brand of AGCO) (US). Other players include Topcon Positioning Systems, Inc. (US), Buhler Industries Inc. (CA), Vaderstad Industries Inc. (CA), Stara S/A (Brazil), and Kasco Manufacturing Inc. (US). |

Precision Planting Market Highlights

This research report categorizes the precision planting market, by offering, system type, drive type, farm size, application, and region available at the regional and global level

|

Aspect |

Details |

|

Based on Offering: |

|

|

Based on System Type: |

|

|

Based on Drive Type: |

|

|

Based on Farm Size: |

|

|

Based on Application: |

|

|

Based on the Region: |

|

Recent Developments

- In October 2022, Trimble Inc. introduced next-generation displays for precision agriculture applications—the Trimble GFX-1060 and GFX-1260 guidance displays. Farmers can map and monitor field information in real time with precision and complete in-field operations quickly and efficiently with these displays.

- In February 2022, CNH Industrials’ brand Case IH launched the 2150S Early Riser front-fold trailing planter to give producers a high-performance split-row configuration option to increase planting productivity.

- In February 2022, Kinze Manufacturing has introduced its new 3505 True Speed high-speed planter for the 2023 planting season, providing advanced technology and improved productivity for small farms and small fields.

- In November 2021, Vaderstad Industries Inc. launched Tempo L Central Fill can be configured with 16 or 24 rows, allowing for a row spacing of 450 to 762 mm.

- In June 2021, Deere & Company signed a partnership agreement with Mobile Track Solution to provide digital solutions for precision farming.

- In November 2020. Deere & Company acquired Harvest Profit; a leading provider of software used in precision farming.

Frequently Asked Questions (FAQs):

Who are the key players in the precision planting market? What are the major growth strategies they had taken to strengthen their position in the market?

Major companies operating in the precision planting market are Deere & Company (US), Trimble Inc. (US), CNH Industrial N.V. (UK), Kinze Manufacturing Inc. (US), and Precision Planting (brand of AGCO) (US). The companies offer advanced precision planting equipment with a presence in several countries to meet the needs of their customers. Product launches and developments, acquisitions, collaborations, contracts, and agreements were among the major strategies adopted by these players to compete in the market.

What are the new opportunities for emerging players in precision planting value chain?

For existing players, there are a number of new opportunities in the value chain of the precision planting market. Among them are the growing adoption of technologically advanced equipment and tools in agriculture industry, integration of smartphone applications with precision planting equipment, and the surge in the use of AI-based solutions in precision planting.

Which application of precision planting market is expected to drive the growth of the market in the next five years?

The row crops application is expected to hold the largest size in the precision planting market during the forecast period. Row crops such as soybean and corn are planted on large acres around the world, and hence, the demand for planting systems being deployed for these types of field crops is also very high. Forestry application, which mainly utilizes drones, is expected to witness the highest growth rate during the forecast period.

Which region to offer lucrative growth for precision planting market by 2027?

Americas is likely to lead the precision planting market during the forecast period. Whereas the Asia Pacific region is expected to witness the highest growth rate between 2022 to 2027.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

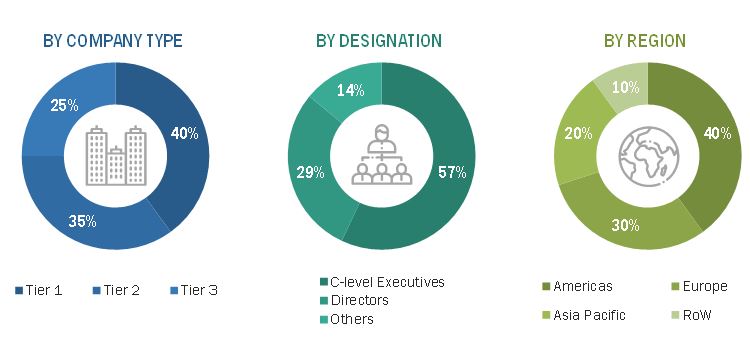

The study involved four major activities for estimating the size of the precision planting market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the precision planting market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research. Industry associations such as SPAA Precision Agriculture (Australia), International Society for Precision Agriculture (ISPA) (US), Agricultural Research Organization (Israel), and PrecisionAg Institute (US) were referred to for this study. The precision planting market report uses both top-down and bottom-up approaches to estimate and validate the size of the precision planting market, as well as other dependent submarkets. Through secondary research, the key players in the precision planting market have been identified, and their market presence has been assessed. Based on secondary sources and verified by primary sources, all percentage shares, splits, and breakdowns have been calculated.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the precision planting market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (system deployment companies at farm level, agriculture input companies) and supply-side (precision planting hardware component manufacturers) players across four major regions, namely, Americas, Europe, Asia Pacific, and Rest of the World (Middle East & Africa). Approximately 70% and 30% of primary interviews have been conducted from the supply and demand side, respectively, Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales. operations, and administration, were covered to provide a holistic viewpoint in our report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the precision planting market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying market for precision planting-based on hardware components (automation and control systems, sensing and monitoring devices, sensors, and cameras) in each country

- Identifying the major applications of precision planting systems-related products, along with the types of hardware, software, and services required for various applications

- Estimating the size of the market in each region by adding the sizes of country-wise markets

- Tracking the ongoing and upcoming implementation of precision planting systems by various companies in each region and forecasting the size of the precision planting market based on these developments and other critical parameters

- Arriving at the size of the global market by adding the sizes of region-wise markets

Global Precision Planting Market Size: Bottom-Up Approach

Global Precision Planting Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size of the precision planting market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the precision planting market, in terms of value, by offering, system type, drive type, application, and region

- To describe and forecast the market for various hardware offerings under automation and control systems, in terms of volume

- To forecast the market, for various segments with respect to 4 main regions—the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall precision planting market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the precision planting market growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the precision planting market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the precision planting market landscape

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the precision planting market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Precision Planting Market