Quadricycle Market by Propulsion (Electric, ICE), Application (Household & Commercial), Type (Light, Heavy), End Use (Resorts & Museums, Industrial Facilities, Personal Mobility), Price Range (Economy, Mid, Premium) and Region - Global Forecast to 2032

[212 Pages Report] The quadricycle market size was valued at USD 19.1 billion in 2022 and is expected to reach USD 35.6 billion by 2032, at a CAGR of 6.4%, during the forecast period. The growth of the quadricycle market can be attributed to the growing traffic congestion, the high demand for safer mobility solutions, the trend for ride-sharing services, the rising geriatric population, and the increased importance of last-mile delivery services. Further, these quadricycles are used for personal as well as commercial application as it is compact with a simpler design and easy to maneuver and can be useful in industrial facilities, school, college & university campuses, resorts, and museum and for ride-sharing purposes

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Growing traffic congestion in urban areas

Growing traffic congestion is inescapable in city/urban areas worldwide. Peak-hour traffic is an inherent result of the way modern societies operate. According to TomTom International BV (Netherlands) report, in 2021, the congestion levels of 70 cities surpassed the 2019 benchmarks. In 2021, the long-awaited return to normality in European countries, followed by the removal of Covid-19 restrictions, foreshadowed the increase in congestion levels in 2019. Similarly, many people in the US use private automotive vehicles during rush hours. Most Americans reside in low-density areas that public transit cannot efficiently serve. Furthermore, privately-owned vehicles are more comfortable, convenient, and faster. This will propel the demand for light and compact quadricycles, which can move easily in high-traffic density routes due to their compact design.

RESTRAINT: High costs of vehicles

Irrespective of the advantages of quadricycles in terms of utility, lightweight, and easy driving features, these vehicles are struggling in developing nations. According to the brochures and prices quoted by quadricycle manufacturers, a quadricycle can range from USD 7,000 to USD 20,000. For instance, some quadricycle models, including Atom from Mahindra and Mahindra Ltd. (India), are predicted to be launched in the Indian market by 2023, with an expected price bracket of nearly USD 4,000 to USD 5,000. With slightly more pay, a regular passenger car would be available. Additionally, the availability of pre-owned small cars starting from nearly USD 1,000, which offer better space and comfort than quadricycles, would restrict the adoption of quadricycles in the market.

OPPORTUNITY: Increased demand for last-mile delivery options

Congestion in cities is a growing concern, and one of the main reasons for this is the growth in van traffic. In South Korea, delivery trucks are often banned from entering specific apartment complexes where spaces are reserved for aesthetic landscaping and children’s play areas. This creates an opportunity for compactly designed quadricycles with cargo-carrying facilities to be a suitable delivery alternative. Quadricycles efficiently deliver materials and goods around narrow lanes and help reduce business operating costs. For instance, in 2020, during the COVID-19 pandemic, Paxster (Norway), in collaboration with the Handsfree Group Ltd. (UK), supported the National Health Service (UK) frontline workers with door-to-door delivery of necessary medicines and other essentials. These factors are expected to create profitable opportunities for the growth of quadricycles.

CHALLENGE: Lack of Safety Standards

Quadricycles are not subjected to the same legislation as regular passenger cars. These vehicles look similar to small city cars and are likely to compete for sales. Their performance in Euro NCAP’s tests is far below a similarly sized passenger car, which can be bought second-hand at a lower cost. These vehicles are lightweight and designed to operate at minimum speeds for general purposes, so their safety standards are not stringent. The body design is not crash-proof and can lead to severe injuries in the case of accidents. Simple design changes could lead to significant improvements with little added weight or costs. This is a major challenge for quadricycle manufacturers to increase vehicle safety with advanced features without increasing the price of vehicles. Therefore, manufacturers face a challenge to reduce the cost of quadricycles without declining the build quality and enhancing performance. However, offering pricing incentives for purchasing quadricycles may effectively promote quadricycles and tackle the cost challenge.

Heavy quadricycle is expected to be the fastest-growing segment of the quadricycle market during the forecast period

Heavy quadricycles is projected to grow at the fastest CAGR under the review period. The heavy quadricycles offer higher power output and unladen weight capacity compared to light quadricycles, which are also preferred for cargo carriages. Furthermore, heavy electric quadricycles is gaining popularity for last-mile delivery services in Europe, Japan and South Korea due to their lower maintenance and operational costs, as cities of these countries have small and narrow lanes and can be helpful for fast and efficient delivery. For instance, Westward Industries offers electric quadricycles for the e-commerce, food, and medicine delivery industries. Further, these heavy quadricycles are offered with rapid charging and long-range capabilities in Europe and North America. For instance, Tazzari GL Imola SPA offers heavy electric quadricycles with pickup and van versions, which can be charged from 0% to 80% in less than an hour and has a 300 km travel capacity in a single charge. Some others include the AixamPro Range from Aixam (France), Pulse4 from Ligier Group (France), and the ATX range from Alke (Italy). Owing to these factors, the heavy electric quadricycle market will bring lucrative growth opportunities in the years to come

Personal mobility is estimated to be the largest-market end-use segment in the quadricycles during the forecast period

Personal mobility holds the largest market share for Quadricycles by end-use segment. The market growth is attributed to its primary usage in Asia Pacific, especially in China, Japan, Europe, and the Americas. In China, quadricycles are preferred for personal commutes in urban and rural areas and the countryside. These vehicles are affordable and equipped with basic safety technologies, resulting in low maintenance. In Japan and European countries, quadricycles are useful due to their easy maneuverability on narrow streets and can be accommodated at small parking areas. In the US, quadricycles are considered neighborhood vehicles used for daily travels to nearby shopping malls, parks, and schools by young and aged populations, at a relatively lower cost. Given these factors, the rising geriatric population and its practicality in fuel and space requirements will spur the market for quadricycles for personal mobility.

In China and Japan, these vehicles are preferred with both electric and ICE propulsion. They are affordable, compact, require lower maintenance, can be accommodated in small parking spaces, and offer improved and safer drive against mopeds, scooters, and motorcycles. Furthermore, quadricycles are best suited for older adults in Japan, Europe, and the US because of their small size, low speed, and other safety features. In the last few years, quadricycles are garnering attention from users as a lifestyle product, especially after the pandemic. Public transport or shared mobility raises concerns for social distancing, and quadricycles offer a clean and safe means of personal commute. Therefore, the personal mobility application is predicted to be the largest growing end-use segment for quadricycles during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

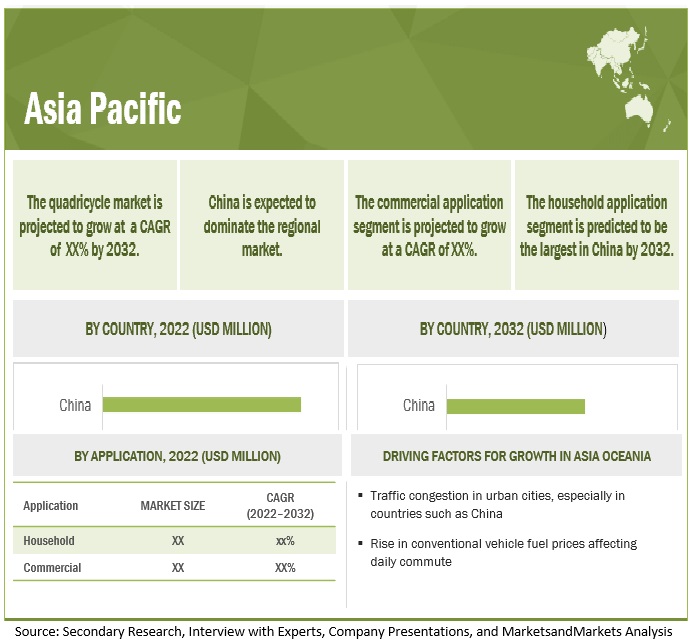

Asia is projected to be the fastest-growing market by 2032

Asia Pacific is projected to be the fastest-growing market during the forecast period. China, Japan, South Korea, and India are the major contributors to the growth of the quadricycle market in the Asia Pacific region. China has faced traffic congestion over the last few decades in cities such as Shanghai and Beijing due to rapid urbanization and increased vehicles running on roads. Most of the older cities of China are not convenient for cars as the roads are not big enough in many cities. Given these growing traffic issues, quadricycles are gaining popularity in China as they provide easy and fast mobility solutions within the cities. As per the records of the Statistics Bureau of Japan, 2021, Japan is a highly populated nation, with around 125.6 million people. With nearly 100 million vehicles running on Japanese roads, the problem of traffic congestion is severe. Thus, this has led to the growth of quadricycles in Japan as these quadricycles are used in quadricycles are preferred for personal commutes in urban as well as rural areas and countryside touring. In India, the demand for quadricycles is expected to be prominent for commercial applications and will only be majority targeted for taxi services and is expected to remain a growth prospect from this segment in the future also. Major automobile manufacturers are launching quadricycles with the latest technology and innovative designs in the Indian market. For instance, at the 2020 Auto Expo, Mahindra and Mahindra Ltd. (India) unveiled its electric quadricycle named Atom, which is predicted to be launched in the Indian market by mid-2023. The demand for electric quadricycles is growing in South Korea as these vehicles require less maintenance than ICE vehicles and thus are preferred in last-mile delivery services. For instance, Genesis Barbeque used Renault Group’s Twizy for food delivery by replacing its two-wheeled vehicles. Due to the rising demand for quadricycles in these major countries of Asia Pacific region, it is predicted to be the fastest growing market for quadricycles during the forecast period.

Key Market Players & Start-ups

The quadricycle market is dominated by global players such as Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Aixam (France), Ligier Group (France), Citroen (France), Renault Group (France), Italcar Industrial S.r.l. (Italy) and Alke (Italy). These companies have adopted comprehensive expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the growing quadricycle market.

Scope of the Report

|

Report Metrics |

Details |

| Base year for estimation | 2021 |

| Forecast period | 2022 - 2032 |

| Market Growth and Revenue forecast | $ 35.6 Bn by 2032 at a CAGR of 6.4% |

| Top Players | Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Aixam (France), Ligier Group (France) and Citroen (France) |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Segments covered | |

| By Propulsion | Electric and Internal Combustion Engine (ICE) |

| By Application | Household and Commercial |

| By Type | Light Quadricycles and Heavy Quadricycles |

| By End Use | Resorts and Museums, Industrial Facilities, Personal Mobility and Other End Uses |

| By Price Range | Economy, Mid-range and Premium |

| By Region |

|

| Additional Customization to be offered |

|

This research report categorizes the quadricycle market based on Propulsion, Applications, Type, End Use, Price Range and Region

By Propulsion

- Electric

- Internal Combustion Engine (ICE)

By Application

- Household

- Commercial

By Type

- Light Quadricycles

- Heavy Quadricycles

By End Use

- Resorts and Museums

- Industrial Facilities

- Personal Mobility

- Other End Uses

By Price Range

- Economy

- Mid-range

- Premium

By Region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

Europe

- France

- Germany

- Spain

- UK

- Italy

- Rest of Europe

-

Americas

- US

- Canada

- Brazil

Recent Developments

- In September 2022, Citroen entered a partnership with charging provider Ubitricity, wherein Citroen would offer free charging for the first 2,000 customers of Citroen Ami for three months. The partnership aims to offer a full-service package for EV drivers and local authorities.

- In January 2021, Tazzari GL Imola SPA acquired the Italian electric motorcycle manufacturer to expand the product portfolio and enter the electric motorcycle market.

- In December 2020, Toyota Motor Corporation launched the “C+Pod” ultra-compact battery electric vehicle (BEV) in Japan. The new C+Pod is an environmentally friendly two-seater BEV designed as a mobility option that improves per-person energy efficiency.

- In November 2020, Ligier Group launched the JS60 SUV-styled quadricycle with a lightweight body. The new model offers LED lights, front and rear disc brakes, and multimedia systems.

- In January 2020, Alke launched the new range of ATX electric utility vehicles with highly efficient lithium-ion batteries. The company adopted the WLTP (world harmonized light-duty vehicles) test procedure for the newly launched vehicles. One of the main goals of the WLTP is to match better the laboratory estimates of fuel consumption and emissions with the measures of an on-road driving conditions, considering different road traffic situations and speeds and different equipment variants.

Frequently Asked Questions (FAQ):

What is the current size of the quadricycle market?

The quadricycle market is estimated to be USD 19.1 billion in 2022 and is projected to reach USD 35.6 billion by 2032 at a CAGR of 6.4%.

Who are the top key players in the quadricycle market?

The quadricycle market is dominated by global players such as Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Aixam (France), Ligier Group (France), Citroen (France), Renault Group (France), Italcar Industrial S.r.l. (Italy) and Alke (Italy). Moreover, these companies develop new products per market demands and have effective supply chain strategies. Such advantages give these companies an edge over other component providers.

What are the trends in the quadricycle market?

An increasing trend of vehicle electrification is anticipated to create new revenue pockets for the quadricycle market.

Increasing trend for a lightweight, compact and safer mode of commute options are projected to drive the demand for quadricycles during the forecast period.

Which region is projected to have the largest market for the quadricycles?

Asia Pacific is projected to be the largest market for quadricycles. China, Japan, and South Korea would have a major influence for the growth of quadricycles in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES

1.2 MARKET PRODUCT DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED IN STUDY

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for quadricycle sales

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Sampling techniques and data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

2.3 FACTOR ANALYSIS

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.5.1 GLOBAL ASSUMPTIONS

2.5.2 MARKET ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

3.1 REPORT SUMMARY

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

4.2 MARKET, BY APPLICATION

4.3 MARKET, BY PROPULSION

4.4 MARKET, BY TYPE

4.5 MARKET, BY END USE

4.6 MARKET, BY PRICE RANGE

4.7 MARKET, BY REGION

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising geriatric population

5.2.1.2 Growing traffic congestion in urban areas

5.2.2 RESTRAINTS

5.2.2.1 High costs of vehicles

5.2.3 OPPORTUNITIES

5.2.3.1 Development of electric vehicle charging infrastructure

5.2.3.2 Advances in autonomous and connected car technology

5.2.3.3 Increased demand for last-mile delivery options

5.2.4 CHALLENGES

5.2.4.1 Reduced Cost and improved energy density of EV batteries

5.2.4.2 Lack of safety standards

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SCENARIOS — MARKET

5.4.1 REALISTIC SCENARIO

5.4.2 PESSIMISTIC SCENARIO

5.4.3 OPTIMISTIC SCENARIO

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.6 SUPPLY CHAIN ANALYSIS

5.7 MARKET ECOSYSTEM

5.7.1 ECOSYSTEM: MARKET

5.8 TECHNOLOGY TREND

5.8.1 FUTURE OF AUTONOMOUS VEHICLE TECHNOLOGY

5.8.2 RISING INSTALLATION OF ADVANCED SAFETY AND COMFORT FEATURES

5.9 AVERAGE SELLING PRICE (ASP) ANALYSIS

5.9.1 BY TYPE AND REGION

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO

5.10.1.1 France

5.10.1.2 Italy

5.10.1.3 Spain

5.10.1.4 India

5.10.2 EXPORT SCENARIO

5.10.2.1 France

5.10.2.2 Italy

5.10.2.3 Spain

5.10.2.4 India

5.11 PATENT ANALYSIS

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 REGULATORY ANALYSIS FOR MARKET, BY REGION/COUNTRY

5.12.2.1 Europe

5.12.2.2 India

5.12.2.3 US

5.13 CASE STUDY ANALYSIS

5.13.1 USE CASE 1: PAXSTER OFFERS VEHICLES FOR LAST-MILE DELIVERY

5.13.2 USE CASE 2: LIGHT MICRO COMMERCIAL VEHICLES FOR URBAN USAGE

5.14 TOP SELLING MODELS

6 MARKET, BY PROPULSION (Page No. - 78)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS

6.1.3 INDUSTRY INSIGHTS

6.2 ELECTRIC

6.2.1 INCREASED ADOPTION OF ELECTRIC VEHICLES

6.3 INTERNAL COMBUSTION ENGINE (ICE)

6.3.1 RANGE ANXIETY ABOUT ELECTRIC VEHICLES

7 MARKET, BY APPLICATION (Page No. - 85)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

7.2 HOUSEHOLD

7.2.1 RISING GERIATRIC POPULATION TO DRIVE DEMAND FOR HOUSEHOLD SEGMENT

7.3 COMMERCIAL

7.3.1 HIGH DEMAND FOR LAST-MILE DELIVERY

8 MARKET, BY TYPE (Page No. - 92)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

8.2 HEAVY QUADRICYCLES

8.2.1 USE IN PASSENGER AND CARGO TRANSPORT TO BOOST SEGMENT

8.3 LIGHT QUADRICYCLES

8.3.1 IMPROVED AWARENESS OF ZERO0CARBON EMISSIONS TO DRIVE DEMAND

9 MARKET, BY END USE (Page No. - 99)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

9.2 RESORTS AND MUSEUMS

9.2.1 INVESTMENTS IN HOSPITALITY SECTOR

9.3 INDUSTRIAL FACILITIES

9.3.1 DEVELOPMENT OF MANUFACTURING SECTOR TO BOOST SEGMENT

9.4 PERSONAL MOBILITY

9.4.1 GROWING GERIATRIC POPULATION

9.5 OTHER END USES

9.5.1 INCREASE IN AIRPORT OPERATIONS FUELS GROWTH

10 MARKET, BY PRICE RANGE (Page No. - 110)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

10.2 ECONOMY

10.2.1 ASIA PACIFIC TO HAVE LARGEST MARKET FOR ECONOMIC MODELS

10.3 MID-RANGE

10.3.1 USE OF ELECTRIC MODELS TO PROMOTE MID-RANGE QUADRICYCLES

10.4 PREMIUM

10.4.1 USE OF QUADRICYCLES AS A STATUS SYMBOL

11 MARKET, BY REGION (Page No. - 118)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

11.2 ASIA PACIFIC

11.2.1 ASIA PACIFIC MARKET, BY APPLICATION

11.2.2 ASIA PACIFIC MARKET, BY PRICE RANGE

11.2.3 CHINA

11.2.3.1 Growing industrial sector

11.2.4 JAPAN

11.2.4.1 Awareness of safe commute post COVID-19

11.2.5 INDIA

11.2.5.1 Widescale commercial applications

11.2.6 SOUTH KOREA

11.2.6.1 Prevalence of ride-sharing and last-mile delivery services

11.3 EUROPE

11.3.1 EUROPE MARKET, BY APPLICATION

11.3.2 EUROPE MARKET, BY PRICE RANGE

11.3.3 GERMANY

11.3.3.1 Focus on cutting carbon emissions

11.3.4 FRANCE

11.3.4.1 Compact and sleek design

11.3.5 UK

11.3.5.1 Use of quadricycles by older people

11.3.6 SPAIN

11.3.6.1 Demand for sustainable mobility solutions

11.3.7 ITALY

11.3.7.1 Growing trend of ride-sharing

11.3.8 REST OF EUROPE

11.3.8.1 Preference for safe commute options

11.4 AMERICAS

11.4.1 AMERICAS MARKET, BY APPLICATION

11.4.2 AMERICAS MARKET, BY PRICE RANGE

11.4.3 US

11.4.3.1 Popularity of quadricycles for personal mobility

11.4.4 CANADA

11.4.4.1 Shift toward electrification

11.4.5 BRAZIL

11.4.5.1 Affordable running costs and ease of use

12 COMPETITIVE LANDSCAPE (Page No. - 165)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

12.3 REVENUE ANALYSIS OF TOP PLAYERS

12.4 COMPETITIVE EVALUATION QUADRANT

12.4.1 TERMINOLOGY

12.4.2 STARS

12.4.3 PERVASIVE PLAYERS

12.4.4 EMERGING LEADERS

12.4.5 PARTICIPANTS

12.5 MARKET: COMPANY FOOTPRINT

12.6 COMPETITIVE BENCHMARKING

12.7 COMPETITIVE SCENARIO

12.7.1 PRODUCT LAUNCHES

12.7.2 DEALS

12.8 STRATEGIES ADOPTED BY KEY PLAYERS

13 COMPANY PROFILES (Page No. - 179)

13.1 KEY PLAYERS

13.1.1 AIXAM

13.1.1.1 Business overview

13.1.1.2 Products offered

13.1.1.3 Recent developments

13.1.1.4 MnM view

13.1.2 LIGIER GROUP

13.1.2.1 Business overview

13.1.2.2 Products offered

13.1.2.3 Recent developments

13.1.2.4 MnM view

13.1.3 ITALCAR INDUSTRIAL S.R.L

13.1.3.1 Business overview

13.1.3.2 Products offered

13.1.3.3 MnM view

13.1.4 ALKE

13.1.4.1 Business overview

13.1.4.2 Products offered

13.1.4.3 Recent developments

13.1.4.4 MnM view

13.1.5 CASALINI

13.1.5.1 Business overview

13.1.5.2 Products offered

13.1.5.3 MnM view

13.1.6 BELLIER AUTOMOBILES

13.1.6.1 Business overview

13.1.6.2 Products offered

13.1.6.3 MnM view

13.1.7 CITROEN

13.1.7.1 Business overview

13.1.7.2 Products offered

13.1.7.3 Recent developments

13.1.8 RENAULT GROUP

13.1.8.1 Business overview

13.1.8.2 Products offered

13.1.9 TOYOTA MOTOR CORPORATION

13.1.9.1 Business overview

13.1.9.2 Products offered

13.1.9.3 Recent developments

13.1.10 TAZZARI GL IMOLA SPA

13.1.10.1 Business overview

13.1.10.2 Products offered

13.1.10.3 Recent developments

13.2 OTHER PLAYERS

13.2.1 HONDA MOTOR CO., LTD.

13.2.2 SUZUKI MOTOR CORPORATION

13.2.3 GLOBAL ELECTRIC MOTORCAR (GEM)

13.2.4 GOUPIL

13.2.5 ESTRIMA S.P.A

13.2.6 AUTOMOBILES CHATENET

13.2.7 TRIGGO

13.2.8 PAXSTER

13.2.9 ZHIDOU ELECTRIC VEHICLE CO., LTD.

13.2.10 WEI YUN ELECTRIC VEHICLE

13.2.11 BAJAJ AUTO LTD.

13.2.12 ALBAMOBILITY S.R.L.

14 APPENDIX (Page No. - 206)

14.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.4.1 MARKET, BY PROPULSION

14.4.1.1 ELECTRIC

14.4.1.2 ICE

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

LIST OF TABLES (279 Figures)

TABLE 1 CURRENCY EXCHANGE RATES (WRT PER USD)

TABLE 2 MAJOR QUADRICYCLE OEMS AND THEIR ASP

TABLE 3 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 QUADRICYCLE MARKET (REALISTIC SCENARIO), BY REGION, 2018–2032 (USD MILLION)

TABLE 5 MARKET (PESSIMISTIC IMPACT SCENARIO), BY REGION, 2018–2032 (USD MILLION)

TABLE 6 MARKET (OPTIMISTIC SCENARIO), BY REGION, 2018–2032 (USD MILLION)

TABLE 7 ROLE OF COMPANIES IN MARKET ECOSYSTEM

TABLE 8 AVERAGE SELLING PRICE (ASP), BY TYPE AND REGION

TABLE 9 FRANCE: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

TABLE 10 ITALY: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

TABLE 11 SPAIN: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

TABLE 12 INDIA: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

TABLE 13 FRANCE: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

TABLE 14 ITALY: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

TABLE 15 SPAIN: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

TABLE 16 INDIA: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ASIA-PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 EUROPE: QUADRICYCLE REGULATIONS

TABLE 22 INDIA: QUADRICYCLE REGULATIONS

TABLE 23 US: QUADRICYCLE REGULATIONS

TABLE 24 TOP SELLING MODELS, BY OEM (2021)

TABLE 25 MARKET, BY PROPULSION, 2018–2021 (UNITS)

TABLE 26 MARKET, BY PROPULSION, 2022–2032 (UNITS)

TABLE 27 MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY PROPULSION, 2022–2032 (USD MILLION)

TABLE 29 ELECTRIC: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 30 ELECTRIC: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 31 ELECTRIC: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 ELECTRIC: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 33 ICE: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 34 ICE: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 35 ICE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 ICE: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 37 MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 38 MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 39 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 41 HOUSEHOLD: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 42 HOUSEHOLD: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 43 HOUSEHOLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 HOUSEHOLD: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 45 COMMERCIAL: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 46 COMMERCIAL: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 47 COMMERCIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 COMMERCIAL: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 49 MARKET, BY TYPE, 2018–2021 (UNITS)

TABLE 50 MARKET, BY TYPE, 2022–2032 (UNITS)

TABLE 51 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 52 MARKET, BY TYPE, 2022–2032 (USD MILLION)

TABLE 53 HEAVY MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 54 HEAVY MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 55 HEAVY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 HEAVY MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 57 LIGHT MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 58 LIGHT MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 59 LIGHT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 LIGHT MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 61 MARKET, BY END USE, 2018–2021 (UNITS)

TABLE 62 MARKET, BY END USE, 2022–2032 (UNITS)

TABLE 63 MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 64 MARKET, BY END USE, 2022–2032 (USD MILLION)

TABLE 65 RESORTS AND MUSEUMS: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 66 RESORTS AND MUSEUMS: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 67 RESORTS AND MUSEUMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 RESORTS AND MUSEUMS: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 69 INDUSTRIAL FACILITIES: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 70 INDUSTRIAL FACILITIES: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 71 INDUSTRIAL FACILITIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 INDUSTRIAL FACILITIES: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 73 PERSONAL MOBILITY: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 74 PERSONAL MOBILITY: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 75 PERSONAL MOBILITY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 PERSONAL MOBILITY: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 77 OTHER END USES: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 78 OTHER END USES: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 79 OTHER END USES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 OTHER END USES: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 81 MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 82 MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 83 MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 84 MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 85 ECONOMY: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 86 ECONOMY: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 87 ECONOMY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 ECONOMY: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 89 MID-RANGE: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 90 MID-RANGE: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 91 MID-RANGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 MID-RANGE: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 93 PREMIUM: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 94 PREMIUM: MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 95 PREMIUM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 PREMIUM: MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 97 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 98 MARKET, BY REGION, 2022–2032 (UNITS)

TABLE 99 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 MARKET, BY REGION, 2022–2032 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2032 (UNITS)

TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2032 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 106 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 107 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 110 ASIA PACIFIC: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 111 ASIA PACIFIC: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 113 CHINA: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 114 CHINA: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 115 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 CHINA: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 117 CHINA: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 118 CHINA: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 119 CHINA: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 120 CHINA: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 121 JAPAN: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 122 JAPAN: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 123 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 JAPAN: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 125 JAPAN: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 126 JAPAN: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 127 JAPAN: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 128 JAPAN: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 129 INDIA: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 130 INDIA: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 131 INDIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 INDIA: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 133 INDIA: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 134 INDIA: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 135 INDIA: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 136 INDIA: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 137 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 138 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 139 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 140 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 141 SOUTH KOREA: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 142 SOUTH KOREA: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 143 SOUTH KOREA: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 144 SOUTH KOREA: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 146 EUROPE: MARKET, BY COUNTRY, 2022–2032 (UNITS)

TABLE 147 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY COUNTRY, 2022–2032 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 150 EUROPE: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 151 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 152 EUROPE: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 153 EUROPE: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 154 EUROPE: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 155 EUROPE: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 156 EUROPE: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 157 GERMANY: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 158 GERMANY: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 159 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 160 GERMANY: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 161 GERMANY: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 162 GERMANY: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 163 GERMANY: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 164 GERMANY: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 165 FRANCE: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 166 FRANCE: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 167 FRANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 168 FRANCE: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 169 FRANCE: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 170 FRANCE: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 171 FRANCE: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 172 FRANCE: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 173 UK: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 174 UK: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 175 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 176 UK: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 177 UK: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 178 UK: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 179 UK: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 180 UK: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 181 SPAIN: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 182 SPAIN: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 183 SPAIN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 184 SPAIN: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 185 SPAIN: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 186 SPAIN: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 187 SPAIN: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 188 SPAIN: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 189 ITALY: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 190 ITALY: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 191 ITALY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 192 ITALY: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 193 ITALY: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 194 ITALY: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 195 ITALY: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 196 ITALY: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 197 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 198 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 199 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 200 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 201 REST OF EUROPE: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 202 REST OF EUROPE: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 203 REST OF EUROPE: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 204 REST OF EUROPE: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 205 AMERICAS: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 206 AMERICAS: MARKET, BY COUNTRY, 2022–2032 (UNITS)

TABLE 207 AMERICAS: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 208 AMERICAS: MARKET, BY COUNTRY, 2022–2032 (USD MILLION)

TABLE 209 AMERICAS: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 210 AMERICAS: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 211 AMERICAS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 212 AMERICAS: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 213 AMERICAS: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 214 AMERICAS: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 215 AMERICAS: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 216 AMERICAS: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 217 US: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 218 US: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 219 US: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 220 US: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 221 US: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 222 US: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 223 US: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 224 US: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 225 CANADA: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 226 CANADA: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 227 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 228 CANADA: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 229 CANADA: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 230 CANADA: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 231 CANADA: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 232 CANADA: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 233 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 234 BRAZIL: MARKET, BY APPLICATION, 2022–2032 (UNITS)

TABLE 235 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 236 BRAZIL: MARKET, BY APPLICATION, 2022–2032 (USD MILLION)

TABLE 237 BRAZIL: MARKET, BY PRICE RANGE, 2018–2021 (UNITS)

TABLE 238 BRAZIL: MARKET, BY PRICE RANGE, 2022–2032 (UNITS)

TABLE 239 BRAZIL: MARKET, BY PRICE RANGE, 2018–2021 (USD MILLION)

TABLE 240 BRAZIL: MARKET, BY PRICE RANGE, 2022–2032 (USD MILLION)

TABLE 241 MARKET: COMPANY FOOTPRINT, 2021

TABLE 242 MARKET: COMPANY PRODUCT CATEGORY FOOTPRINT, 2021

TABLE 243 MARKET: COMPANY REGION FOOTPRINT, 2021

TABLE 244 MARKET: KEY PLAYERS

TABLE 245 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 246 PRODUCT LAUNCHES, 2018–2022

TABLE 247 DEALS, 2018–2022

TABLE 248 OVERVIEW OF STRATEGIES DEPLOYED BY KEY QUADRICYCLE MARKET OEMS

TABLE 249 AIXAM: BUSINESS OVERVIEW

TABLE 250 AIXAM: PRODUCTS OFFERED

TABLE 251 AIXAM: PRODUCT LAUNCHES

TABLE 252 AIXAM: DEALS

TABLE 253 LIGIER GROUP: BUSINESS OVERVIEW

TABLE 254 LIGIER GROUP: PRODUCT LAUNCHES

TABLE 255 ITALCAR INDUSTRIAL S.R.L: BUSINESS OVERVIEW

TABLE 256 ALKE: BUSINESS OVERVIEW

TABLE 257 ALKE: PRODUCT LAUNCHES

TABLE 258 CASALINI: BUSINESS OVERVIEW

TABLE 259 BELLIER AUTOMOBILES: BUSINESS OVERVIEW

TABLE 260 CITROEN: BUSINESS OVERVIEW

TABLE 261 CITROEN: PRODUCT LAUNCHES

TABLE 262 CITROEN: DEALS

TABLE 263 RENAULT GROUP: BUSINESS OVERVIEW

TABLE 264 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

TABLE 265 TOYOTA MOTOR CORPORATION: PRODUCT LAUNCHES

TABLE 266 TAZZARI GL IMOLA SPA: BUSINESS OVERVIEW

TABLE 267 TAZZARI GL IMOLA SPA: DEALS

TABLE 268 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

TABLE 269 SUZUKI MOTOR CORPORATION: COMPANY OVERVIEW

TABLE 270 GLOBAL ELECTRIC MOTORCAR: COMPANY OVERVIEW

TABLE 271 GOUPIL: COMPANY OVERVIEW

TABLE 272 ESTRIMA S.P.A: COMPANY OVERVIEW

TABLE 273 AUTOMOBILES CHATENET: COMPANY OVERVIEW

TABLE 274 TRIGGO: COMPANY OVERVIEW

TABLE 275 PAXSTER: COMPANY OVERVIEW

TABLE 276 ZHIDOU ELECTRIC VEHICLE CO., LTD.: COMPANY OVERVIEW

TABLE 277 WEI YUN ELECTRIC VEHICLE: COMPANY OVERVIEW

TABLE 278 BAJAJ AUTO LTD.: COMPANY OVERVIEW

TABLE 279 ALBAMOBILITY S.R.L.: COMPANY OVERVIEW

LIST OF FIGURES (40 Figures)

FIGURE 1 MARKET SEGMENTATION: QUADRICYCLE MARKET

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 6 MARKET: BOTTOM-UP APPROACH (BY PRICE RANGE AND REGION)

FIGURE 7 MARKET: TOP-DOWN APPROACH (BY PROPULSION)

FIGURE 8 DATA TRIANGULATION

FIGURE 9 MARKET OUTLOOK

FIGURE 10 MARKET, BY REGION, 2022 VS. 2032 (USD MILLION)

FIGURE 11 RISING DEMAND FOR COMPACT PERSONAL MOBILITY SOLUTIONS

FIGURE 12 HOUSEHOLD APPLICATION TO ACQUIRE MAXIMUM SHARE DURING FORECAST PERIOD

FIGURE 13 ELECTRIC PROPULSION TO SURPASS ICE DURING FORECAST PERIOD

FIGURE 14 LIGHT QUADRICYCLES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 15 PERSONAL MOBILITY TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 16 ECONOMY-PRICED QUADRICYCLES COMMANDED HIGHEST DEMAND IN 2022

FIGURE 17 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 18 MARKET DYNAMICS

FIGURE 19 MEDIAN AGE OF TOTAL POPULATION, 2015–2050

FIGURE 20 NUMBER OF CHARGING STATIONS IN TOP 10 EUROPEAN COUNTRIES, 2020

FIGURE 21 NUMBER OF EV CHARGING STATIONS AND EVSE PORTS IN US, 2021

FIGURE 22 PORTER’S FIVE FORCES

FIGURE 23 MARKET SCENARIO, 2018–2032 (USD MILLION)

FIGURE 24 REVENUE SHIFT DRIVING MARKET GROWTH

FIGURE 25 SUPPLY CHAIN ANALYSIS: MARKET

FIGURE 26 MARKET: ECOSYSTEM

FIGURE 27 MARKET, BY PROPULSION, 2022 VS. 2032 (USD MILLION)

FIGURE 28 MARKET, BY APPLICATION, 2022 VS. 2032 (USD MILLION)

FIGURE 29 MARKET, BY TYPE, 2022 VS. 2032 (USD MILLION)

FIGURE 30 MARKET, BY END USE, 2022 VS. 2032 (USD MILLION)

FIGURE 31 MARKET, BY PRICE RANGE, 2022 VS. 2032 (USD MILLION)

FIGURE 32 MARKET, BY REGION, 2022 VS. 2032 (USD MILLION)

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 34 EUROPE: MARKET, BY REGION, 2022 VS. 2032 (USD MILLION)

FIGURE 35 AMERICAS: , BY REGION, 2022 VS. 2032 (USD MILLION)

FIGURE 36 MARKET SHARE, 2021

FIGURE 37 REVENUE ANALYSIS, 2019-2021

FIGURE 38 MARKET MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

FIGURE 39 RENAULT GROUP: COMPANY SNAPSHOT

FIGURE 40 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

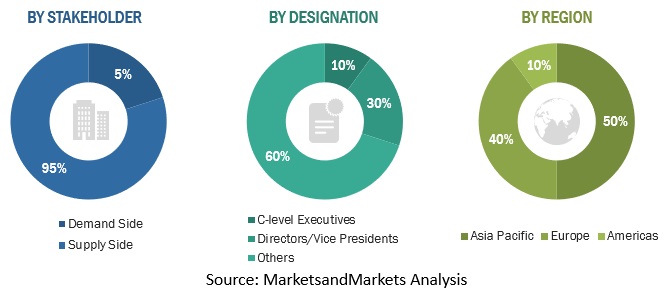

The study involved four major activities in estimating the current size of the quadricycle market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company websites, press releases, industry association publications, Intralogistics magazine articles, directories, technical handbooks, world economic outlook, trade websites, and technical articles were used to identify and collect information useful for an extensive commercial study of the quadricycle market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs; vice presidents; directors from business development, marketing, and product development/innovation teams; and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as quadricycle market forecast, current technology trends, and upcoming technologies in the market. Data triangulation of all these points was carried out with the information gathered from secondary research. Stakeholders from the supply side were interviewed to understand their views on the points mentioned above.

Primary interviews were conducted with market experts from the supply side (quadricycle manufacturers) across the major regions, namely, Asia Pacific, Europe, and Americas. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size, by value, was derived by multiplying the vehicle-wise average selling price with the respective quadricycle vehicle volume calculated in units. Each country/region’s total volume and value are then summed up to reveal each type’s total volume of the quadricycle market. The data was validated through primary interviews with industry experts. The market is further segmented into propulsion, type, price range, and end use. The penetration of different segments was derived from secondary research and primary interviews.

Quadricycle Market: Bottom-Up Approach

The bottom-up approach was used to estimate and validate the quadricycle market size. The market size, by price range and country, was derived by mapping the historical sales of quadricycles at the country level and further projected till 2032. These data points were largely fetched from country-level associations, automobile databases, and OEM data excerpts. The penetration rate of the price range (economy, mid-range, and premium) was identified at a country level leveraging secondary research and validated by industry experts. Multiplication of country-level sales with the penetration rate of price range provides the country-level market by price range in terms of volume. Further, the average selling price of quadricycles, by price range at the country level, is determined by leveraging country-level OEM websites, brochures, and secondary publications. Multiplication of country-level volume with country-level ASP gives country-level market in terms of value. Summation of the country-level market gives a regional-level market, and further addition gives market by price range in terms of volume and value. A similar approach is followed to analyse the market by application in terms of volume and value.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analysed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Report Objectives

- To define, describe, and forecast the size of the quadricycle market in terms of volume (thousand units/tons) and value (USD million).

-

To forecast the market in terms of volume and value, based on:

- By Propulsion [electric and internal combustion engine (ICE)]

- By Application (commercial and household)

- By Type [light quadricycle (L6e) and heavy quadricycle (L7e)]

- By End Use (resorts and museums, industrial facilities, personal mobility, and others)

- By Price Range (economy, mid-range, and premium)

- By Region (Asia Pacific, Europe, and Americas)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players in the market and evaluate competitive leadership mapping

- To analyze the key player strategies and company revenue

- To analyze the market with Porter’s Five Forces analysis, supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trends, top-selling models, and regulatory analysis

- To analyze recent developments, including supply contracts, new product launches, expansions, and other activities, undertaken by key industry participants in the market

- To determine realistic scenarios, pessimistic scenarios, and optimistic scenarios related to the quadricycle market

- To give a brief understanding of the market in the recommendations chapter

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

The following customization options are available for the report:

- Quadricycle Market, By Propulsion

- Electric

- ICE

Note: The Propulsion Segment would be further categorized into country-level market

Asia Pacific (China, Japan, South Korea, India), Europe (France, Germany, Spain, UK, Italy,) and Americas (US, Canada, Brazil)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Quadricycle Market