TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 RADAR SYSTEMS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

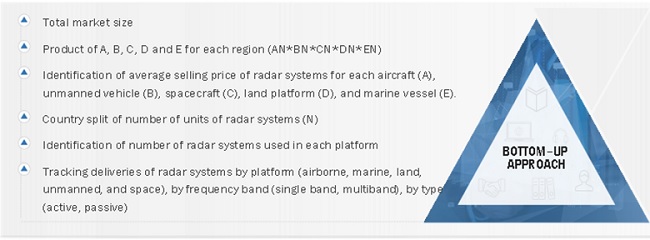

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

TABLE 1 RADAR SYSTEMS MARKET ESTIMATION PROCEDURE

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 7 LAND PLATFORM TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 8 SINGLE BAND FREQUENCY TO LEAD RADAR SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 9 RADAR RECEIVERS TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 10 ACTIVE RADAR TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 COMMERCIAL APPLICATIONS TO DOMINATE RADAR SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 12 LONG-RANGE RADAR TO ACCOUNT FOR LARGEST SIZE DURING FORECAST PERIOD

FIGURE 13 SOFTWARE-DEFINED RADAR – DOMINANT TECHNOLOGY SEGMENT

FIGURE 14 3D RADAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 15 EUROPE - LEADING RADAR SYSTEMS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 59)

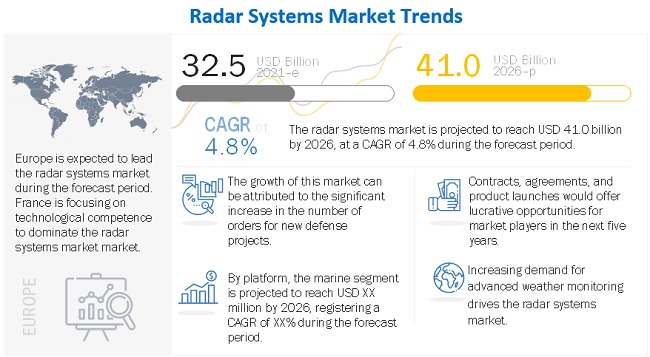

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN RADAR SYSTEMS MARKET

FIGURE 16 INCREASE IN DELIVERIES OF MARINE VESSELS DRIVES RADAR SYSTEMS MARKET GROWTH

4.2 RADAR SYSTEMS MARKET, BY PLATFORM

FIGURE 17 MARINE SEGMENT TO COMMAND RADAR SYSTEMS MARKET FROM 2017 TO 2026

4.3 RADAR SYSTEMS MARKET, BY FREQUENCY BAND

FIGURE 18 SINGLE BAND RADAR TO BE DOMINANT SEGMENT FROM 2017 TO 2026

4.4 RADAR SYSTEMS MARKET, BY COMPONENT

FIGURE 19 RADAR RECEIVERS TO DOMINATE MARKET FROM 2017 TO 2026

4.5 RADAR SYSTEMS MARKET, BY TYPE

FIGURE 20 ACTIVE RADAR TO BE LARGEST SEGMENT FROM 2017 TO 2026

4.6 RADAR SYSTEMS MARKET, BY APPLICATION

FIGURE 21 RADAR SYSTEMS MARKET TO BE LED BY COMMERCIAL APPLICATIONS FROM 2017 TO 2026

4.7 RADAR SYSTEMS MARKET, BY RANGE

FIGURE 22 LONG-RANGE RADAR SEGMENT TO DOMINATE MARKET FROM 2017 TO 2026

4.8 RADAR SYSTEMS MARKET, BY TECHNOLOGY

FIGURE 23 SOFTWARE-DEFINED RADAR TO LEAD RADAR SYSTEMS MARKET FROM 2017 TO 2026

4.9 RADAR SYSTEMS MARKET, BY DIMENSION

FIGURE 24 3D RADAR SEGMENT TO DOMINATE MARKET FROM 2017 TO 2026

4.10 RADAR SYSTEMS MARKET, BY COUNTRY

FIGURE 25 SOUTH KOREA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 RADAR SYSTEMS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Emergence of modern electronic warfare and network-centric warfare

TABLE 2 REGION-WISE MARKET SIZE OF NETWORK-CENTRIC WARFARE SYSTEMS, 2016 VS. 2021 (USD MILLION)

TABLE 3 REGION-WISE MARKET SIZE OF ELECTRONIC WARFARE SYSTEMS, 2016 VS. 2021 (USD MILLION)

5.2.1.2 Development of phased array solid-state radar

FIGURE 27 RADAR SYSTEMS MARKET SHARE, BY COMPONENT (2020)

5.2.1.3 Significant investments by governments to upgrade existing fighter aircraft radar

FIGURE 28 FIGHTER AIRCRAFT DELIVERIES, BY REGION, (2017-2025)

5.2.1.4 Increasing defense expenditure of emerging economies

FIGURE 29 DEFENCE BUDGET OF EMERGING ECONOMIES, 2005 TO 2020

5.2.1.5 Increased demand for advanced weather monitoring radar

5.2.2 RESTRAINTS

5.2.2.1 Limited bandwidth for commercial applications due to preference for military use

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in adoption of unmanned aerial vehicles and lightweight radar

FIGURE 30 DEFENSE AND GOVERNMENT UAV DELIVERIES, 2017-2026 (MILLION UNITS)

5.2.3.2 Development of low-cost and miniaturized radar

5.2.4 CHALLENGES

5.2.4.1 Stringent cross-border trading policies

5.2.4.2 Susceptibility to new jamming techniques

5.3 COVID-19 IMPACT SCENARIOS

5.4 IMPACT OF COVID-19 ON RADAR SYSTEMS MARKET

FIGURE 31 IMPACT OF COVID-19 ON RADAR SYSTEMS MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to August 2021

TABLE 4 KEY PRODUCT DEVELOPMENTS IN RADAR SYSTEMS MARKET, 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 RADAR SYSTEMS IN UNMANNED SURFACE VESSELS (USV)

FIGURE 32 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 33 RADAR SYSTEMS ECOSYSTEM

TABLE 5 RADAR SYSTEMS MARKET ECOSYSTEM

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICE ANALYSIS OF RADAR SYSTEMS IN 2020 (USD MILLION)

5.8 TARIFF REGULATORY LANDSCAPE OF MARITIME INDUSTRY

5.9 TRADE DATA

TABLE 6 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

TABLE 7 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

5.10 VALUE CHAIN ANALYSIS OF RADAR SYSTEMS MARKET

FIGURE 34 VALUE CHAIN ANALYSIS

5.10.1 RESEARCH & DEVELOPMENT

5.10.2 RAW MATERIAL

5.10.3 COMPONENT/PRODUCT MANUFACTURERS (OEMS)

5.10.4 ASSEMBLERS & INTEGRATORS

5.10.5 END USERS

5.11 PORTER’S FIVE FORCES MODEL

5.11.1 RADAR SYSTEMS MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 35 PORTER’S FIVE FORCE ANALYSIS: RADAR SYSTEMS MARKET

5.11.2 THREAT OF NEW ENTRANTS

5.11.3 THREAT OF SUBSTITUTES

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 BARGAINING POWER OF BUYERS

5.11.6 INTENSITY OF COMPETITIVE RIVALRY

5.12 TECHNOLOGY ANALYSIS

5.12.1 DEVELOPMENT OF 4D RADAR SYSTEM - THALES GROUP

5.13 USE CASES

5.13.1 TATA POWER STRATEGIC ENGINEERING DIVISION (SED) TO PROVIDE SHIPBORNE AIR SURVEILLANCE 3D RADAR TO INDIAN NAVY

5.14 OPERATIONAL DATA

TABLE 8 NEW COMMERCIAL SHIP DELIVERIES, BY SHIP TYPE, 2017-2020

TABLE 9 NEW AIRCRAFT DELIVERIES, BY TYPE, 2017-2020

6 INDUSTRY TRENDS (Page No. - 83)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 36 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

6.3.1 SOFTWARE-DEFINED RADAR

6.3.2 MIMO (MULTIPLE INPUTS/MULTIPLE OUTPUTS)

6.3.3 ACTIVE ELECTRONICALLY STEERED ARRAY (AESA)

6.3.4 INVERSE SYNTHETIC APERTURE RADAR (ISAR)

6.3.5 QUANTUM RADAR

6.3.6 DIGITAL BEAM FORMING TECHNIQUE IN RADAR

6.3.7 4D ELECTRONICALLY SCANNED ARRAY RADAR SYSTEMS

6.4 IMPACT OF MEGATRENDS

6.4.1 DIGITALIZATION AND INTRODUCTION OF INTERNET OF THINGS (IOT) SYSTEMS IN AIRBORNE RADAR

6.4.2 SHIFT IN GLOBAL ECONOMIC POWER

6.5 INNOVATIONS AND PATENT REGISTRATIONS

7 RADAR SYSTEMS MARKET, BY PLATFORM (Page No. - 89)

7.1 INTRODUCTION

FIGURE 37 LAND RADAR SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 10 RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 11 RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.2 AIR

7.2.1 AEW&C SYSTEMS USE RADAR FOR COMMAND & COORDINATION

FIGURE 38 MILITARY AIR RADAR SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

TABLE 12 AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 13 AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.2.2 COMMERCIAL AIRCRAFT

7.2.2.1 Fixed-wing Aircraft

7.2.2.1.1 High demand for radar for navigation purposes

7.2.2.2 Rotary-wing Aircraft

7.2.2.2.1 Increased demand for rescue missions and recreational use

7.2.3 MILITARY AIRCRAFT

7.2.3.1 Fixed-wing Aircraft

7.2.3.1.1 Security and air dominance - key operations performed by radar systems in fixed-wing aircraft

7.2.3.2 Rotary-wing aircraft

7.2.3.2.1 Development of large-capacity military rotary-wing aircraft boosts segment

7.3 MARINE

7.3.1 MARINE RADAR SYSTEMS WIDELY USED FOR NAVIGATION AND COLLISION AVOIDANCE

FIGURE 39 COMMERCIAL MARINE VESSELS SEGMENT TO DOMINATE DURING FORECAST PERIOD

TABLE 14 MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 15 MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.3.2 COMMERCIAL VESSELS

7.3.2.1 Demand driven by tourism and freight services

7.3.3 MILITARY VESSELS

7.3.3.1 Technological advancements underway in stealth ships equipped with modern ISR and radar systems

7.4 UNMANNED

7.4.1 UNMANNED SYSTEMS TYPICALLY EQUIPPED WITH NAVIGATION RADAR SYSTEMS

FIGURE 40 UAV TO ACCOUNT FOR LARGEST SHARE OF UNMANNED PLATFORM DURING FORECAST PERIOD

TABLE 16 UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 17 UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.4.2 UAV

7.4.2.1 Demand for scientific research boosts segment

7.4.3 UGV

7.4.3.1 Help gather information from inaccessible areas

7.4.4 USV

7.4.4.1 Increasing use in militaries to boost segment

7.5 LAND

7.5.1 INCREASED NEED FOR BORDER SURVEILLANCE DRIVES LAND SEGMENT

FIGURE 41 FIXED LAND RADAR SEGMENT TO GROW FASTEST THROUGH FORECAST PERIOD

TABLE 18 LAND RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 19 LAND RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.5.2 FIXED RADAR SYSTEMS

7.5.2.1 Demand to monitor strategic locations drives segment

7.5.2.2 Air defense systems

7.5.2.3 Weather stations

7.5.2.4 Border surveillance systems

7.5.2.5 Air traffic monitoring stations

7.5.3 PORTABLE RADAR SYSTEMS

7.5.3.1 Need to detect smuggling activities at borders - key segment driver

7.5.4 MOBILE RADAR SYSTEMS

7.5.4.1 Used widely in military and commercial applications

7.6 SPACE

7.6.1 MOVING TARGET IDENTIFICATION AND HIGH-RESOLUTION DIGITAL MAPPING - POSSIBLE WITH SPACE RADAR

FIGURE 42 SATELLITE RADAR SEGMENT TO LEAD DURING FORECAST PERIOD

TABLE 20 SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 21 SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.6.2 SATELLITES

7.6.3 SPACECRAFT

8 RADAR SYSTEM MARKET, BY FREQUENCY BAND (Page No. - 102)

8.1 INTRODUCTION

FIGURE 43 SINGLE BAND RADAR TO DOMINATE MARKET (2021-2026)

TABLE 22 RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 23 RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

8.2 SINGLE BAND

8.2.1 MICROWAVE RADAR DOMINATES SINGLE BAND RADAR MARKET

FIGURE 44 MICROWAVE SEGMENT TO HOLD DOMINANT SHARE IN SINGLE BAND RADAR MARKET DURING FORECAST PERIOD

TABLE 24 SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 25 SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

8.2.2 RADIO WAVES

8.2.2.1 U/V HF band

8.2.3 MICROWAVE

FIGURE 45 X-BAND RADAR TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2017–2020 (USD MILLION)

TABLE 27 MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2021–2026 (USD MILLION)

8.2.3.1 L-band

8.2.3.2 S-band

8.2.3.3 C-band

8.2.3.4 X-band

8.2.3.5 K-/KU-/KA-band

8.2.3.6 Others

8.2.4 MILLIMETER WAVE

8.3 MULTIBAND

8.3.1 USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGET OBJECTS

9 RADAR SYSTEMS MARKET, BY COMPONENT (Page No. - 110)

9.1 INTRODUCTION

FIGURE 46 RADAR RECEIVER SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

TABLE 28 RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 29 RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

9.2 ANTENNA

9.2.1 ELECTRONICALLY STEERED ARRAYS TO DOMINATE ANTENNA SEGMENT

9.2.2 ROTATING ANTENNAS

9.2.3 ELECTRONICALLY STEERED ARRAY

9.2.3.1 Active arrays

9.2.3.2 Passive arrays

9.2.4 MICROSTRIP ANTENNAS

9.3 TRANSMITTERS

9.3.1 SOLID-STATE RADAR TRANSMITTER SEGMENT TO LEAD TRANSMITTER SEGMENT

9.3.2 MAGNETRON

9.3.3 SOLID-STATE RADAR TRANSMITTER

9.4 RECEIVER

9.4.1 RADAR RECEIVERS OPTIMIZE DETECTION CAPACITY WITH BANDWIDTH CHARACTERISTICS

9.4.2 AMPLIFIER

9.4.3 MIXER

9.4.4 SIGNAL PROCESSOR

9.4.5 DISPLAY

9.5 DUPLEXER

9.5.1 DUPLEXER - SWITCH THAT SIMULTANEOUSLY CONNECTS ANTENNA TO TRANSMITTER AND RECEIVER

9.6 WAVEGUIDE

9.6.1 USED IN RADAR SYSTEMS TO CARRY MICROWAVE & MILLIMETER WAVE SIGNALS

10 RADAR SYSTEMS MARKET, BY TYPE (Page No. - 116)

10.1 INTRODUCTION.

FIGURE 47 ACTIVE RADAR TO LEAD AMONG RADAR SYSTEM TYPES DURING FORECAST PERIOD

TABLE 30 RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 31 RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2 ACTIVE RADAR

10.2.1 DEVELOPMENT OF ELECTRICALLY SCANNED ARRAY RADAR TO BOOST MARKET FOR ACTIVE RADAR SYSTEMS

FIGURE 48 CONTINUOUS WAVE RADAR TO DOMINATE AMONG ACTIVE RADAR

TABLE 32 ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 33 ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2.2 DOPPLER RADAR

10.2.2.1 Single wave doppler radar

10.2.2.2 Pulse-doppler radaR

10.2.3 CONTINUOUS WAVE RADAR

10.2.3.1 Frequency modulated continuous wave radar (FMCW Radar)

10.2.3.2 Moving target indicator radar (MTI Radar)

10.2.3.3 Synthetic aperture radar (SAR)

10.3 PASSIVE RADAR

10.3.1 WIDELY USED IN STEALTH AND COVERT OPERATIONS

11 RADAR SYSTEMS MARKET, BY APPLICATION (Page No. - 122)

11.1 INTRODUCTION

FIGURE 49 DEFENSE APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 34 RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 35 RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.2 COMMERCIAL

11.2.1 INCREASING USE IN WEATHER MONITORING APPLICATION TO FUEL GROWTH

11.2.2 AIRCRAFT MONITORING & SURVEILLANCE

11.2.3 WEATHER MONITORING

11.2.4 AIRPORT PERIMETER SECURITY

11.2.5 CRITICAL INFRASTRUCTURE

11.3 NATIONAL SECURITY

11.3.1 INCREASING USE IN SEARCH & RESCUE OPERATIONS FUELS SEGMENT

11.3.2 SEARCH & RESCUE

11.3.3 BORDER SURVEILLANCE

11.3.4 ISR

11.4 DEFENSE

11.4.1 RISING DEMAND FOR RADAR-BASED SECURITY & SURVEILLANCE APPLICATIONS DRIVES SEGMENT

11.4.2 PERIMETER SECURITY

11.4.3 BATTLEFIELD SURVEILLANCE

11.4.4 MILITARY SPACE ASSETS

11.4.5 AIR DEFENSE

12 RADAR SYSTEM MARKET, BY RANGE (Page No. - 127)

12.1 INTRODUCTION

FIGURE 50 LONG-RANGE RADAR SYSTEMS MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 37 RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

12.2 SHORT-RANGE RADAR

12.2.1 USED PRIMARILY IN COMMERCIAL APPLICATIONS OR MAN-PORTABLE RECONNAISSANCE MISSIONS

12.3 MEDIUM-RANGE RADAR

12.3.1 WIDELY USED ACROSS MILITARY APPLICATIONS

12.4 LONG-RANGE RADAR

12.4.1 USED FOR LONG-DISTANCE AND ACCURATE LOCATION TRACKING

13 RADAR SYSTEMS MARKET, BY TECHNOLOGY (Page No. - 130)

13.1 INTRODUCTION

FIGURE 51 SOFTWARE-DEFINED RADAR SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

TABLE 38 RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 39 RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

13.2 SOFTWARE-DEFINED RADAR (SDR)

13.2.1 SEGMENT DRIVEN BY LIGHTWEIGHT AND EASILY CUSTOMIZABLE FEATURES

13.3 CONVENTIONAL RADAR

13.3.1 MAJORLY USED IN DETECTION AND IMAGING APPLICATIONS

14 RADAR SYSTEMS MARKET, BY DIMENSION (Page No. - 133)

14.1 INTRODUCTION

FIGURE 52 3D RADAR SEGMENT TO HOLD DOMINANT SHARE DURING FORECAST PERIOD

TABLE 40 RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 41 RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

14.2 2D

14.2.1 2D RADAR USED MAINLY FOR AIR TRAFFIC MANAGEMENT

14.3 3D

14.3.1 HIGH TARGET LOCATION ACCURACY AND AUTOMATIC OPERATION MODES DRIVE 3D RADAR SEGMENT

14.4 4D

14.4.1 4D RADAR USED IN AUTONOMOUS TACTICAL SURVEILLANCE VEHICLES FOR ACCURATE TARGET MAPPING

15 REGIONAL ANALYSIS (Page No. - 137)

15.1 INTRODUCTION

FIGURE 53 EUROPE HOLDS LARGEST SHARE OF RADAR SYSTEMS MARKET IN 2021

15.2 IMPACT OF COVID-19

FIGURE 54 IMPACT OF COVID-19 ON RADAR SYSTEMS MARKET

TABLE 42 RADAR SYSTEMS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 RADAR SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

15.3 NORTH AMERICA

15.3.1 COVID-19 IMPACT ON NORTH AMERICA

15.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 55 NORTH AMERICA: RADAR SYSTEMS MARKET SNAPSHOT

TABLE 44 NORTH AMERICA: RADAR SYSTEMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 45 NORTH AMERICA: RADAR SYSTEMS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: LAND RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: LAND RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2017–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 73 NORTH AMERICA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.3.3 US

15.3.3.1 Increased investment in new prototypes and foreign military equipment sales will drive market

TABLE 78 US: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 79 US: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 80 US: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 81 US: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 82 US: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 83 US: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 84 US: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 85 US: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 86 US: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 87 US: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.3.4 CANADA

15.3.4.1 Government support drives radar systems market in Canada

TABLE 88 CANADA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 89 CANADA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 90 CANADA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 91 CANADA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 92 CANADA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 93 CANADA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 94 CANADA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 95 CANADA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 96 CANADA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 97 CANADA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

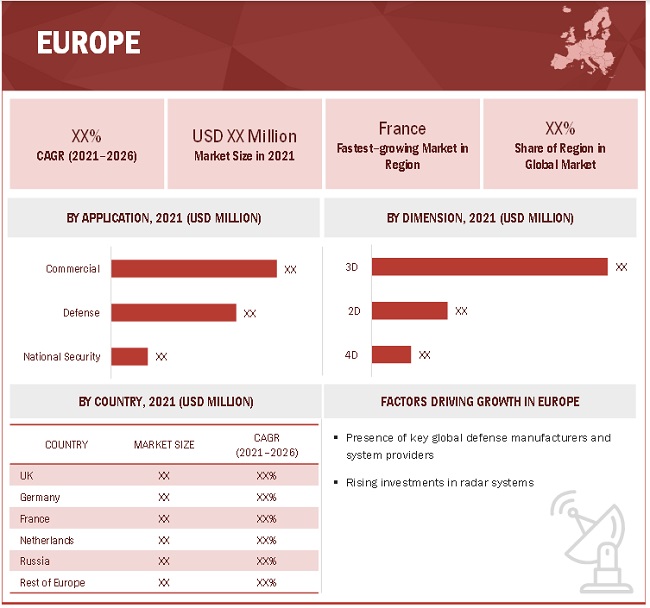

15.4 EUROPE

15.4.1 COVID-19 IMPACT ON EUROPE

15.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 56 EUROPE: RADAR SYSTEMS MARKET SNAPSHOT

TABLE 98 EUROPE: RADAR SYSTEMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 EUROPE: RADAR SYSTEMS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 100 EUROPE: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 101 EUROPE: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 102 EUROPE: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 103 EUROPE: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 104 EUROPE: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 105 EUROPE: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 106 EUROPE: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 107 EUROPE: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 108 EUROPE: LAND RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 EUROPE: LAND RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 EUROPE: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 111 EUROPE: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 115 EUROPE: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 116 EUROPE: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2021–2026 (USD MILLION)

TABLE 118 EUROPE: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 119 EUROPE: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 EUROPE: RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 123 EUROPE: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 125 EUROPE: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 127 EUROPE: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 129 EUROPE: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 131 EUROPE: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.3 UK

15.4.3.1 Radar modernization programs boost market

TABLE 132 UK: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 133 UK: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 134 UK: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 135 UK: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 136 UK: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 137 UK: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 138 UK: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 139 UK: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 140 UK: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 141 UK: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.4 FRANCE

15.4.4.1 Enhancement of internal security – main driving force of market

TABLE 142 FRANCE: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 143 FRANCE: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 144 FRANCE: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 145 FRANCE: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 146 FRANCE: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 147 FRANCE: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 148 FRANCE: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 149 FRANCE: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 150 FRANCE: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 151 FRANCE: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.5 GERMANY

15.4.5.1 Increased need for improved interoperability of armed forces and continuous monitoring of borders to drive market

TABLE 152 GERMANY: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 153 GERMANY: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 154 GERMANY: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 155 GERMANY: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 156 GERMANY: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 157 GERMANY: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 158 GERMANY: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 159 GERMANY: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 160 GERMANY: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 161 GERMANY: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.6 NETHERLANDS

15.4.6.1 Geopolitical shifts and digital information revolution – key market drivers

TABLE 162 NETHERLANDS: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 163 NETHERLANDS: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 164 NETHERLANDS: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 165 NETHERLANDS: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 166 NETHERLANDS: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 167 NETHERLANDS: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 168 NETHERLANDS: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 169 NETHERLANDS: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 170 NETHERLANDS: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 171 NETHERLANDS: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.7 RUSSIA

15.4.7.1 Developments in defense industry to meet demand from other countries to boost market

TABLE 172 RUSSIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 173 RUSSIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 174 RUSSIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 175 RUSSIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 176 RUSSIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 177 RUSSIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 178 RUSSIA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 179 RUSSIA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 180 RUSSIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 181 RUSSIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.8 REST OF EUROPE

15.4.8.1 Increasing insecurity in post-Brexit scenarios will drive market

TABLE 182 REST OF EUROPE: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 183 REST OF EUROPE: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 184 REST OF EUROPE: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 185 REST OF EUROPE: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 186 REST OF EUROPE: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 187 REST OF EUROPE: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 188 REST OF EUROPE: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 189 REST OF EUROPE: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 190 REST OF EUROPE: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 191 REST OF EUROPE: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5 ASIA PACIFIC

15.5.1 COVID-19 IMPACT ON ASIA PACIFIC

15.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: RADAR SYSTEMS MARKET SNAPSHOT

TABLE 192 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 193 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 194 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 195 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 196 ASIA PACIFIC: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 197 ASIA PACIFIC: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 199 ASIA PACIFIC: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 200 ASIA PACIFIC: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 201 ASIA PACIFIC: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 202 ASIA PACIFIC: LAND RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 203 ASIA PACIFIC: LAND RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 204 ASIA PACIFIC: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 205 ASIA PACIFIC: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 206 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 207 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 208 ASIA PACIFIC: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 209 ASIA PACIFIC: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 210 ASIA PACIFIC: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2017–2020 (USD MILLION)

TABLE 211 ASIA PACIFIC: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2021–2026 (USD MILLION)

TABLE 212 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 213 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 214 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 215 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 216 ASIA PACIFIC: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 217 ASIA PACIFIC: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 218 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 219 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 220 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 221 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 222 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 223 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 224 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 225 ASIA PACIFIC: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.3 CHINA

15.5.3.1 Instability across neighboring countries drives demand for radar systems

TABLE 226 CHINA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 227 CHINA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 228 CHINA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 229 CHINA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 230 CHINA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 231 CHINA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 232 CHINA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 233 CHINA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 234 CHINA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 235 CHINA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.4 INDIA

15.5.4.1 Ongoing military modernization, self-reliant India campaign, and infrastructural revolution to fuel market growth

TABLE 236 INDIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 237 INDIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 238 INDIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 239 INDIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 240 INDIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 241 INDIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 242 INDIA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 243 INDIA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 244 INDIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 245 INDIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.5 JAPAN

15.5.5.1 Development and procurement of new radar systems drive market

TABLE 246 JAPAN: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 247 JAPAN: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 248 JAPAN: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 249 JAPAN: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 250 JAPAN: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 251 JAPAN: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 252 JAPAN: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 253 JAPAN: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 254 JAPAN: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 255 JAPAN: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.6 SOUTH KOREA

15.5.6.1 Increasing focus on radar systems to safeguard national territory boosts market

TABLE 256 SOUTH KOREA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 257 SOUTH KOREA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 258 SOUTH KOREA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 259 SOUTH KOREA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 260 SOUTH KOREA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 261 SOUTH KOREA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 262 SOUTH KOREA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 263 SOUTH KOREA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 264 SOUTH KOREA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 265 SOUTH KOREA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.7 AUSTRALIA

15.5.7.1 Government keen on developing TADRS for self-reliance

TABLE 266 AUSTRALIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 267 AUSTRALIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 268 AUSTRALIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 269 AUSTRALIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 270 AUSTRALIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 271 AUSTRALIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 272 AUSTRALIA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 273 AUSTRALIA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 274 AUSTRALIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 275 AUSTRALIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.8 REST OF ASIA PACIFIC

15.5.8.1 Instability in region creates demand for radar systems

TABLE 276 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 277 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 278 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 279 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 280 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 281 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 282 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 283 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 285 REST OF ASIA PACIFIC: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6 MIDDLE EAST & AFRICA

15.6.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

15.6.2 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 58 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET SNAPSHOT

TABLE 286 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 287 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY COUNTRY, 2021-2026 (USD MILLION)

TABLE 288 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 289 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021-2026 (USD MILLION)

TABLE 290 MIDDLE EAST & AFRICA: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 291 MIDDLE EAST & AFRICA: AIR RADAR SYSTEMS MARKET, BY PLATFORM, 2021-2026 (USD MILLION)

TABLE 292 MIDDLE EAST & AFRICA: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 293 MIDDLE EAST & AFRICA: MARINE RADAR SYSTEMS MARKET, BY PLATFORM, 2021-2026 (USD MILLION)

TABLE 294 MIDDLE EAST & AFRICA: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 295 MIDDLE EAST & AFRICA: UNMANNED RADAR SYSTEMS MARKET, BY PLATFORM, 2021-2026 (USD MILLION)

TABLE 296 MIDDLE EAST & AFRICA: LAND RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 297 MIDDLE EAST & AFRICA: LAND RADAR SYSTEMS MARKET, BY TYPE, 2021-2026 (USD MILLION)

TABLE 298 MIDDLE EAST & AFRICA: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 299 MIDDLE EAST & AFRICA: SPACE RADAR SYSTEMS MARKET, BY PLATFORM, 2021-2026 (USD MILLION)

TABLE 300 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 301 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY FREQUENCY BAND, 2021-2026 (USD MILLION)

TABLE 302 MIDDLE EAST & AFRICA: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 303 MIDDLE EAST & AFRICA: SINGLE BAND RADAR SYSTEMS MARKET, BY WAVEFORM, 2021-2026 (USD MILLION)

TABLE 304 MIDDLE EAST & AFRICA: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2017–2020 (USD MILLION)

TABLE 305 MIDDLE EAST & AFRICA: MICROWAVE RADAR SYSTEMS MARKET, BY BAND, 2021-2026 (USD MILLION)

TABLE 306 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 307 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

TABLE 308 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 309 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 310 MIDDLE EAST & AFRICA: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 311 MIDDLE EAST & AFRICA: ACTIVE RADAR SYSTEMS MARKET, BY TYPE, 2021-2026 (USD MILLION)

TABLE 312 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 313 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

TABLE 314 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 315 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY RANGE, 2021-2026 (USD MILLION)

TABLE 316 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 317 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY TECHNOLOGY, 2021-2026 (USD MILLION)

TABLE 318 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 319 MIDDLE EAST & AFRICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021-2026 (USD MILLION)

15.6.3 TURKEY

15.6.3.1 Increasing focus on procuring low-altitude airborne surveillance radar drives market

TABLE 320 TURKEY: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 321 TURKEY: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 322 TURKEY: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 323 TURKEY: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 324 TURKEY: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 325 TURKEY: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 326 TURKEY: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 327 TURKEY: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 328 TURKEY: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 329 TURKEY: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.4 SAUDI ARABIA

15.6.4.1 Demand for fighter aircraft with airborne warning and control system capabilities fuels market

TABLE 330 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 331 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 332 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 333 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 334 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 335 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 336 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 337 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 338 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 339 SAUDI ARABIA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.5 UAE

15.6.5.1 Aim to achieve self-reliance in military industrial capabilities – key driver of market

TABLE 340 UAE: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 341 UAE: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 342 UAE: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 343 UAE: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 344 UAE: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 345 UAE: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 346 UAE: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 347 UAE: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 348 UAE: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 349 UAE: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.6 ISRAEL

15.6.6.1 Market in Israel driven by presence of major radar manufacturers

TABLE 350 ISRAEL: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 351 ISRAEL: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 352 ISRAEL: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 353 ISRAEL: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 354 ISRAEL: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 355 ISRAEL: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 356 ISRAEL: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 357 ISRAEL: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 358 ISRAEL: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 359 ISRAEL: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.7 SOUTH AFRICA

15.6.7.1 Increased geopolitical instability expected to boost market

TABLE 360 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 361 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 362 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 363 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 364 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 365 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 366 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 367 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 368 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 369 SOUTH AFRICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.3.1 Market fueled by demand for advanced fighter aircraft with airborne warning and control system capabilities

TABLE 414 MEXICO: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 415 MEXICO: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 416 MEXICO: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 417 MEXICO: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 418 MEXICO: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 419 MEXICO: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 420 MEXICO: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 421 MEXICO: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 422 MEXICO: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 423 MEXICO: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.4 BRAZIL

15.7.4.1 Ongoing military modernization propels market in Brazil

TABLE 424 BRAZIL: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 425 BRAZIL: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 426 BRAZIL: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 427 BRAZIL: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 428 BRAZIL: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 429 BRAZIL: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 430 BRAZIL: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 431 BRAZIL: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 432 BRAZIL: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 433 BRAZIL: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.3 MEXICO

15.7.3.1 Market fueled by demand for advanced fighter aircraft with airborne warning and control system capabilities

TABLE 414 MEXICO: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 415 MEXICO: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 416 MEXICO: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 417 MEXICO: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 418 MEXICO: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 419 MEXICO: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 420 MEXICO: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 421 MEXICO: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 422 MEXICO: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 423 MEXICO: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.4 BRAZIL

15.7.4.1 Ongoing military modernization propels market in Brazil

TABLE 424 BRAZIL: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 425 BRAZIL: RADAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 426 BRAZIL: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 427 BRAZIL: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 428 BRAZIL: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 429 BRAZIL: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 430 BRAZIL: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 431 BRAZIL: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 432 BRAZIL: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 433 BRAZIL: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.5 REST OF LATIN AMERICA

TABLE 434 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 435 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY PLATFORM, 2021-2026 (USD MILLION)

TABLE 436 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 437 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 438 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 439 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 440 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 441 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 442 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 443 REST OF LATIN AMERICA: RADAR SYSTEMS MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

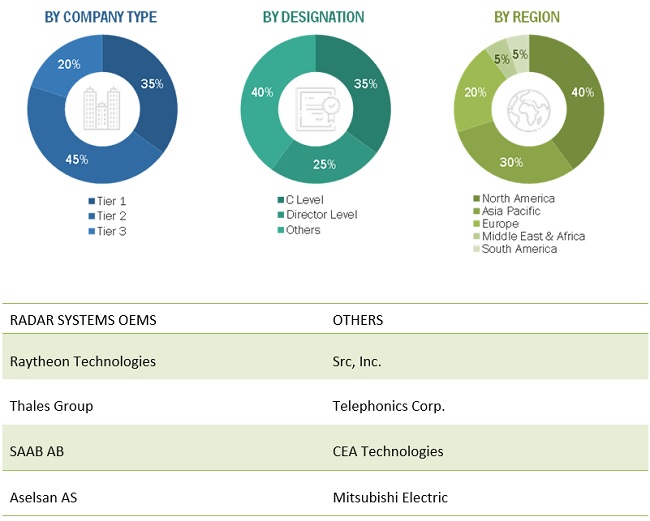

16 COMPETITIVE LANDSCAPE (Page No. - 267)

16.1 INTRODUCTION

TABLE 444 KEY DEVELOPMENTS BY LEADING PLAYERS IN RADAR SYSTEMS MARKET BETWEEN 2019 AND 2022

16.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

TABLE 445 DEGREE OF COMPETITION

FIGURE 60 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

16.3 RANK ANALYSIS, 2020

FIGURE 61 REVENUE GENERATED BY MAJOR PLAYERS IN RADAR SYSTEMS MARKET, 2020

TABLE 446 COMPANY REGION FOOTPRINT

TABLE 447 COMPANY PLATFORM FOOTPRINT

TABLE 448 COMPANY APPLICATION FOOTPRINT

16.4 COMPETITIVE EVALUATION QUADRANT

16.4.1 STAR

16.4.2 PERVASIVE

16.4.3 EMERGING LEADER

16.4.4 PARTICIPANT

FIGURE 62 RADAR SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

FIGURE 63 RADAR SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

16.4.5 PROGRESSIVE COMPANIES

16.4.6 RESPONSIVE COMPANIES

16.4.7 STARTING BLOCKS

16.4.8 DYNAMIC COMPANIES

16.5 COMPETITIVE SCENARIO

TABLE 449 RADAR SYSTEMS MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 450 RADAR SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

16.5.1 PRODUCT LAUNCHES

TABLE 451 RADAR SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2022

16.5.2 DEALS

TABLE 452 RADAR SYSTEMS MARKET: DEALS, JANUARY 2018–JANUARY 2022

16.5.3 OTHERS

TABLE 453 RADAR SYSTEMS MARKET: OTHERS, FEBRUARY 2021–JUNE 2020

17 COMPANY PROFILES (Page No. - 292)

17.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)*

17.1.1 NORTHROP GRUMMAN CORPORATION

TABLE 454 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 64 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 455 NORTHROP GRUMMAN CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 456 NORTHROP GRUMMAN CORPORATION: DEALS

17.1.2 LOCKHEED MARTIN CORPORATION

TABLE 457 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 65 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 458 LOCKHEED MARTIN CORPORATION: NEW PRODUCT DEVELOPMENT

TABLE 459 LOCKHEED MARTIN CORPORATION: DEALS

17.1.3 RAYTHEON TECHNOLOGIES COMPANY

TABLE 460 BUSINESS OVERVIEW

FIGURE 66 RAYTHEON TECHNOLOGIES COMPANY: COMPANY SNAPSHOT

TABLE 461 RAYTHEON TECHNOLOGIES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 462 RAYTHEON TECHNOLOGIES COMPANY: DEALS

17.1.4 THE BOEING COMPANY

TABLE 463 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 67 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 464 THE BOEING COMPANY: DEALS

17.1.5 GENERAL DYNAMICS CORPORATION

TABLE 465 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

FIGURE 68 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

TABLE 466 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED?

17.1.6 THALES

TABLE 467 THALES: BUSINESS OVERVIEW

FIGURE 69 THALES: COMPANY SNAPSHOT

TABLE 468 THALES: NEW PRODUCT DEVELOPMENT

TABLE 469 THALES: DEALS

17.1.7 KONGSBERG

TABLE 470 KONGSBERG: BUSINESS OVERVIEW

FIGURE 70 KONGSBERG: COMPANY SNAPSHOT

TABLE 471 KONGSBERG: DEALS

17.1.8 SAAB AB

TABLE 472 SAAB AB: BUSINESS OVERVIEW

FIGURE 71 SAAB AB: COMPANY SNAPSHOT

TABLE 473 SAAB AB: PRODUCTS OFFERED?

TABLE 474 SAAB AB: DEALS

17.1.9 HONEYWELL INTERNATIONAL INC.

TABLE 475 HONEYWELL INTERNATIONAL INC: BUSINESS OVERVIEW

FIGURE 72 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

TABLE 476 HONEYWELL INTERNATIONAL INC: PRODUCTS OFFERED?

TABLE 477 HONEYWELL INTERNATIONAL INC.: NEW PRODUCT DEVELOPMENT

TABLE 478 HONEYWELL INTERNATIONAL INC: DEALS

17.1.10 BAE SYSTEMS

TABLE 479 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 73 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 480 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

TABLE 481 BAE SYSTEMS: DEALS

17.1.11 LEONARDO S.P.A.

TABLE 482 LEONARDO S.P.A.: BUSINESS OVERVIEW

FIGURE 74 LEONARDO S.P.A.: COMPANY SNAPSHOT

TABLE 483 LEONARDO S.P.A.: DEALS

17.1.12 ISRAEL AEROSPACE INDUSTRIES

TABLE 484 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

FIGURE 75 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

TABLE 485 ISRAEL AEROSPACE INDUSTRIES: NEW PRODUCT DEVELOPMENT

TABLE 486 ISRAEL AEROSPACE INDUSTRIES: DEALS

17.1.13 ASELSAN A.S.

TABLE 487 ASELSAN A.S.: BUSINESS OVERVIEW

FIGURE 76 ASELSAN A.S.: COMPANY SNAPSHOT

TABLE 488 ASELSAN A.S.: PRODUCTS OFFERED?

TABLE 489 ASELSAN A.S.: DEALS

17.1.14 ELBIT SYSTEMS

TABLE 490 ELBIT SYSTEMS: BUSINESS OVERVIEW

FIGURE 77 ELBIT SYSTEMS: COMPANY SNAPSHOT

TABLE 491 ELBIT SYSTEMS: PRODUCTS OFFERED?

TABLE 492 ELBIT SYSTEMS: DEALS

17.1.15 INDRA COMPANY

TABLE 493 INDRA COMPANY: BUSINESS OVERVIEW

FIGURE 78 INDRA COMPANY: COMPANY SNAPSHOT

TABLE 494 INDRA COMPANY: PRODUCTS OFFERED

TABLE 495 INDRA COMPANY: NEW PRODUCT DEVELOPMENT

TABLE 496 INDRA COMPANY: DEALS

17.1.16 GARMIN LIMITED

TABLE 497 GARMIN LIMITED: BUSINESS OVERVIEW

FIGURE 79 GARMIN LIMITED: COMPANY SNAPSHOT

TABLE 498 GARMIN LIMITED: PRODUCTS OFFERED

TABLE 499 GARMIN LIMITED: NEW PRODUCT DEVELOPMENT

17.1.17 BHARAT ELECTRONICS LTD

TABLE 500 BHARAT ELECTRONICS LTD (BEL): BUSINESS OVERVIEW

FIGURE 80 BHARAT ELECTRONICS LTD (BEL): COMPANY SNAPSHOT

TABLE 501 BHARAT ELECTRONICS LTD (BEL): PRODUCTS OFFERED

TABLE 502 BHARAT ELECTRONICS LTD ((BEL): NEW PRODUCT DEVELOPMENT

TABLE 503 BHARAT ELECTRONICS LTD (BEL): DEALS

17.1.18 AIRBUS GROUP

TABLE 504 AIRBUS GROUP: BUSINESS OVERVIEW

FIGURE 81 AIRBUS GROUP: COMPANY SNAPSHOT

TABLE 505 AIRBUS GROUP: PRODUCTS OFFERED

TABLE 506 AIRBUS GROUP: DEALS

17.1.19 MITSUBISHI ELECTRIC

TABLE 507 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 82 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 508 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

TABLE 509 MITSUBISHI ELECTRIC: DEALS

17.1.20 L3HARRIS TECHNOLOGIES

TABLE 510 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 83 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 511 L3HARRIS TECHNOLOGIES: PRODUCTS OFFERED

TABLE 512 L3HARRIS TECHNOLOGIES: DEALS

17.1.21 SRC, INC.

TABLE 513 SRC, INC.; BUSINESS OVERVIEW

TABLE 514 SRC, INC.: PRODUCTS OFFERED

TABLE 515 SRC, INC.: DEALS

17.1.22 HENSOLDT AG

TABLE 516 HENSOLDT AG: BUSINESS OVERVIEW

TABLE 517 HENSOLDT AG: PRODUCTS OFFERED

TABLE 518 HENSOLDT AG: NEW PRODUCT DEVELOPMENT

TABLE 519 HENSOLDT AG: DEALS

17.1.23 TELEPHONICS CORPORATION

TABLE 520 TELEPHONICS CORPORATION: BUSINESS OVERVIEW

TABLE 521 TELEPHONICS CORPORATION: PRODUCTS OFFERED

TABLE 522 TELEPHONICS CORPORATION: NEW PRODUCT DEVELOPMENT

TABLE 523 TELEPHONICS CORPORATION: DEALS

17.1.24 AINSTEIN RADAR SYSTEMS

TABLE 524 AINSTEIN RADAR SYSTEMS: BUSINESS OVERVIEW

TABLE 525 AINSTEIN RADAR SYSTEMS: PRODUCTS OFFERED

17.1.25 OPTIMARE SYSTEMS GMBH

TABLE 526 OPTIMARE SYSTEMS GMBH: BUSINESS OVERVIEW

TABLE 527 OPTIMARE SYSTEMS GMBH: PRODUCTS OFFERED

TABLE 528 OPTIMARE SYSTEMS GMBH: DEALS

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 363)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATION

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Radar Systems Market

1599, 2000 and 2500 KM capacity Radars for space object observation and tracking in India R and D Unit of Space Organisatiojn