Aircraft Wire and Cable Market Size, Share & Industry Growth Analysis Report by Type (Wire, Harness, Cable), Application (Power Transfer, Data Transfer, Flight Control System, Avionics, Lighting), Aircraft Type, Conductor Material, Insulation Type, End User, and Geography- Global Growth Driver and Industry Forecast to 2026

Update: 11/05/2024

Aircraft wire and cable systems are essential for transmitting electrical power, data, and signals throughout an aircraft, ensuring reliable operation of critical systems such as navigation, communication, avionics, lighting, and in-flight entertainment. These wires and cables are designed to withstand extreme conditions, including high temperatures, vibrations, and electromagnetic interference, which are common in aerospace environments. Materials like copper and aluminum, often with insulation made from materials like PTFE or Teflon, are used to provide durability and resistance to harsh conditions. Key trends in the aircraft wire and cable market include the development of lightweight materials to reduce aircraft weight, advancements in fire-resistant materials for enhanced safety, and the increasing use of fiber optics to handle high-speed data transmission needs.

Aircraft Wire and Cable Market Size & Growth

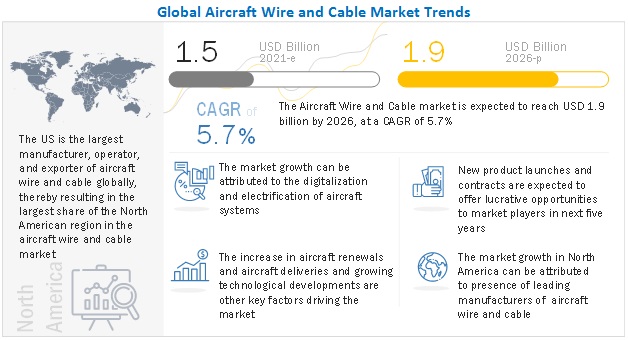

The Global Aircraft Wire and Cable Market Size was valued at USD 1.5 billion in 2021 and is estimated to reach USD 1.9 billion by 2026, growing at a CAGR of 5.7% during the forecast period. The growth of Aircraft Wire and Cable Industry is mainly driven by the digitalization and electrification of aircraft systems, increase in aircraft renewals and aircraft deliveries and growing technological developments.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Aircraft Wire and Cable Market

The aircraft wire and cable market includes major players Amphenol Corporation (US), Carlisle Interconnect Technologies (US), Collins Aerospace (US), TE Connectivity (Switzerland), and Nexans SA. (France). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect aircraft wire and cable production and services by 7–10% globally in 2020.

The COVID-19 pandemic has impacted the end-use industries adversely, resulting in a sudden dip in 2020 aircraft orders and deliveries. This is expected to negatively impact the aircraft market in the short term, with slow recovery expected in Q1 of 2021.

Aircraft Wire and Cable Market Trends

Drivers: Digitalization and electrification of aircraft systems

Digitalization improves operational efficiency and eases pilot functions. Strategic digital advancements deliver a range of intuitive airline software and services. It provides immediate and future benefits to airlines for flight operations by assisting the responsibilities involved at each stage, thereby improving overall operations. Work operations in the cockpit have been completely computerized due to digitalization. A networked ecosystem of apps, services, and documents defining the future flight deck is becoming more accessible to pilots. Data and power cables are required to connect these digital systems in every aircraft section.

Alternative energy is required because of higher fuel costs and carbon emissions. Thus, electrifying aircraft provides more efficient, silent, and sustainable flight. It also reduces fuel consumption and operating costs for aircraft operators. Electric aircraft systems need wire and cables for faster, more flexible, and efficient transmission.

Thus, both digitalization and electrification of aircraft would increase the demand for aircraft wires and cables. In October 2020, W.L. Gore & Associates released GWN3000 Series of high-performance aerospace wires with tolerance for greater voltages and superior mechanical strength and electrical reliability, capable of delivering the power that could replace systems reliant on combustion, hydraulics, and pneumatics.

Opportunities: Demand for electric aircraft and glass cockpits

Demand for electric technology is expected to contribute to the fiber optic cables market for military and aerospace. Incorporating more electric technology reduces fuel consumption and provides a reliable power source for aircraft. Electrically driven systems are an effective substitute for mechanically driven engine accessories, pumps, and generators. Aircraft systems have had revolutionary design and power distribution changes over the last few decades. Companies such as Boeing (US), Bombardier (Canada), and Airbus (France) are working on developing electrical systems to replace the traditional systems for optimized aircraft performance and limited maintenance costs. In September 2021, Airbus moved toward hybrid-electric propulsion system development. The Airbus Flight lab helicopter has started flight tests with a backup engine system that would function as an emergency electrical power system in case of turbine failure.

The demand for glass cockpits has been rising due to increased aircraft accident rates with traditional cockpits. Flight instrumentation displays in traditional cockpits have analog dials and gauges, whereas glass cockpit displays have large LCD screens. All displays used in a glass cockpit incorporate data bus technology, using fiber optic cables for high-speed data transfer. Data bus technology implements line-replaceable units (LRUs) integrated with sensors and fiber optic cables throughout the aircraft. This technology improves communication between aircraft systems and the cockpit. Thus, the adoption of glass cockpit in aircraft influences the growth of the fiber optic cables market for military and aerospace. In November 2021, Collins Aerospace and GMF decided to transform the Indonesian Air Force C-130H aircraft with a modern digital cockpit.

Challenges: Additional weight of insulation and shielding

Electric wires and cables constitute the largest weight portion of aircraft electrical power systems and a significant fraction of entire aircraft weight. Thus, replacing Copper (Cu) or Aluminum (Al) wires with lighter conductors which are substantially lighter would improve the fuel economy of an aircraft while also increasing the maximum take-off weight. The major challenge is effectively shielding sensitive electronic equipment from electromagnetic interference without adding significant weight to aircraft or spacecraft. This makes the EMI shielding components of wires and cables an area of improvement to reduce the weight of aerospace systems. Thus, manufacturers have developed substitutes such as carbon nanotube fibers & films, metalized polymeric, carbon fibers, and fiber optics to overcome this challenge.

Airline companies are collaborating with aircraft wire and cable manufacturers for lightweight cables and wires. For instance, in January 2021, Nexans signed a contract with Airbus to supply specialized aerospace cables and wires for civilian & military aircraft and helicopters. According to the new contract, Nexans will supply high-performance, lightweight cables that play a major role in aircraft efficiency, passenger comfort, and safety. It would focus on new solutions for electric and hybrid aircraft generation. It will provide most of the cables required for Airbus aircraft, covering applications such as cockpit, engine, cabin, in-flight entertainment, and wings. The cable types include hook-up, wire, power, data, avionics, and fire-resistant cables. In May 2020, GKN Aerospace and Eviation signed an agreement for the advanced lightweight wing, empennage, and wiring systems with Alice All-Electric Aircraft. The agreement covers designing and manufacturing wings, empennage, and Electrical Wiring Interconnection Systems (EWIS). The aircraft aims to make journeys of distances up to 650 miles more sustainable.

Aircraft Wire and Cable Market Segments

Multiple application of aircraft harness is expected to fuel the growth of the aircraft wire and cable market during the forecast period.

The harness segment is estimated to lead the market during the forecast period, with a share of 47% in 2021. Wire harness is an assembly of electrical cables or wires which transmits signals or electrical power throughout an aircraft. In the aerospace industry, aircraft contains miles of wiring harnesses. Applications in aerospace industry include engine, fuselage, wing, landing gear, avionics, and a host of other functions. Aircraft wire harness also includes composite, Ethernet, data bus, RF coaxial and specialty cable assemblies such as MS3154.

The UAV segment is projected to witness the highest CAGR during the forecast period.

Based on aircraft type, the UAV segment is projected to be the highest CAGR rate for the aircraft wire and cable market during the forecast period. Unmanned aircraft systems (UAS) or drones, these smaller aircraft help ground troops cover more territory more safely. The increased surveillance and reconnaissance capabilities of these small UAS depend on payloads that may include multiple cameras and sensors for a variety of frequencies, such as infrared, thermal, and visible light, as well as sophisticated embedded computing and storage devices. Since flight time depends on how much weight the aircraft carries, these increased payloads can make keeping weight down a challenge. As a result of efforts to optimize swap, trends in connectors and cabling include lighter weight materials, quick disconnects, multiple ports and multi-functions, and compact cabling.

The avionics segment is projected to witness the highest CAGR during the forecast period.

Based on the application, the avionics segment is projected to grow at the highest CAGR rate for the aircraft wire and cable market during the forecast period. As the aircrafts have changed their avionic systems to digital the aircraft wire and cable companies need to provide new avionics systems for the aerospace industry.

The copper alloy segment is projected to witness the highest CAGR during the forecast period

Based on the conductor material, the copper alloy segment is projected to grow at the highest CAGR rate for the aircraft wire and cable market during the forecast period. Copper wires are widely used in aerospace industry because of its electrical properties. In aircraft, copper is used primarily in the electrical system for bus bars, bonding, and as lockwire. Copper is the electrical conductor in many categories of electrical wiring. Copper wire in aircraft is used for power generation, power transmission, power distribution for telecommunications, electronics circuitry, and countless types of electrical equipment.

The thermoplastic segment is projected to witness the highest CAGR during the forecast period

Based on insulation type, the thermoplastic segment is projected to grow at the highest CAGR rate for the aircraft wire and cable market during the forecast period. A new class of thermoplastic composites has strength and modulus (stiffness) values comparable to metals and thermosets. The technology involves continuous glass fibers or carbon fibers embedded in a thermoplastic polymer matrix, usually consisting of polyetheretherketone (PEEK) or Ultem PEI (polyetherimide). The composites are made from high-performance, thermally stable plastics, hence can be used at elevated temperatures.

The OEM segment is projected to witness the highest CAGR during the forecast period

Based on end user, the OEM segment is projected to grow at the highest CAGR rate for the aircraft wire and cable market during the forecast period. OEMs are responsible for the integration of wire and cables onto aircraft systems during the assembly stage. After reduction in the market in 2020, the aircraft industry is recovering gradually with an increase in air passenger traffic, which is driving the aircraft wire and cable sector.

Aircraft Wire and Cable Market Regions

The North American market is projected to contribute the largest share from 2021 to 2026

Aircraft wire and cable market in North America is projected to hold the highest market share during the forecast period. North America accounted for the largest share of 35.5% of the aircraft wire and cable market and is expected to grow at a CAGR of 5.8% during the forecast period. The presence of major wire and cable manufacturers like Amphenol Corporations and CarlisleIT is one of the major reasons for the growth. The presence of aircraft manufacturers like Boeing and Lockheed Martin which are the major military players in the world is also one of the reasons for the growth of the market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Wire and Cable Companies: Top Key Market Players

The Aircraft Wire and Cable Companies are dominated by globally established players such as:

- Amphenol Corporation (US)

- Carlisle Interconnect Technologies (US)

- Collins Aerospace (US)

- TE Connectivity (Switzerland)

- Nexans SA. (France)

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.5 billion in 2021 |

|

Projected Market Size |

USD 1.9 billion by 2026 |

|

Growth Rate (CAGR) |

5.7% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, By Application, By Aircraft Type, By Conductor Material, By Insulation Type, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Companies covered |

Amphenol Corporation (US), Carlisle Interconnect Technologies (US), Collins Aerospace (US), TE Connectivity (Switzerland), and Nexans SA. (France) |

The study categorizes the aircraft wire and cable based on component, application, aircraft type, conductor material, insulation type, end user and by region.

By Component

- Aircraft Harness

- Aircraft Wire

- Aircraft Cable

By Application

- Flight Control Systems

- Lighting

- Data Transfer

- Power Transfer

- Avionics

- Others

By Conductor Material

- Stainless Steel Alloys

- Copper Alloys

- Aluminum Alloys

- Others

By Insulation Type

- Thermoplastic

- Thermosetting

By Aircraft Type

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles

- AAM

By End Use

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Latin America

- Africa

Recent Developments

- In November 2021, Collins aerospace, a unit of Raytheon technologies, announced the acquisition of Dutch Thermoplastic Components (DTC), a leader in the development and fabrication of structural thermoplastic composite parts. With this acquisition, collins will expand the use of advanced thermoplastics to make aircraft lighter and more fuel-efficient.

- In July 2021, TE Connectivity has launched its Rochester Greaseless Cable Technology, which provides more efficient field operation for downhole logging applications. This solution replaces steel cables in cased hole operations. It provides a lower coefficient of friction over traditional wireline cables, which uses a specially formulated cable jacket material. It has improved rig up and rig down efficiencies. It has faster run speeds than traditional wireline. It is cleaner and more environmentally friendly than conventional downhole wireline cables.

- In January 2021, Carlisle announced its new UTiPHASE microwave cable assembly series, an innovative solution that delivers outstanding electrical phase stability versus temperature without compromising microwave performance. UTiPHASE is ideal for defense, space, and testing applications.

Frequently Asked Questions (FAQ):

What Are Your Views on the Growth Prospect of the Aircraft Wire and Cable Market?

The aircraft wire and cable market is expected to grow substantially. The growth of this market is mainly driven by the digitalization and electrification of aircraft systems, increase in aircraft renewals and aircraft deliveries and growing technological developments.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Aircraft Wire and Cable Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft wire and cable market. The major players include Amphenol Corporation (US), Carlisle Interconnect Technologies (US), Collins Aerospace (US), TE Connectivity (Switzerland), and Nexans SA. (France), these players have adopted various strategies, such as acquisitions, contracts, new product launches, and partnerships & agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aircraft wire and cable market?

The development of electrical power is creating new opportunities for manufacturers to increase the efficiency of aircraft power systems by reducing the weight and volume of aircraft. Advancements in aerospace materials, technologies, mechanisms, and various other design specifications motivate players in this market to build aircraft wires and cables with different applications in different fields. Advanced technologies in manufacturing processes, such as Industry 4.0, 5G connectivity, single pair Ethernet, multiplane light conversion, IoT, and model-based engineering, benefit aircraft wire and cable manufacturers.

Who Are the Key Players and Innovators in the Ecosystem of the Aircraft Wire and Cable Market?

The key players in the aircraft wire and cable market include Amphenol Corporation (US), Carlisle Interconnect Technologies (US), Collins Aerospace (US), TE Connectivity (Switzerland), and Nexans SA. (France).

Which Region is Expected to Hold the Highest Market Share in the Aircraft Wire and Cable Market?

Aircraft wire and cable market in North America is projected to hold the highest market share during the forecast period. North America accounted for the largest share of 35.5% of the aircraft wire and cable market and is expected to grow at a CAGR of 5.8% during the forecast period. The presence of major wire and cable manufacturers like Amphenol Corporations and CarlisleIT is one of the major reasons for the growth. The presence of aircraft manufacturers like Boeing and Lockheed Martin which are the major military players in the world is also one of the reasons for the growth of the market in this region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AIRCRAFT WIRE AND CABLE MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AIRCRAFT WIRE AND CABLE MARKET

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 2 AIRCRAFT WIRE AND CABLE MARKET TO GROW MORE THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.1.2.2 Key Primary Insights

2.2 MARKET SIZE ESTIMATION

2.3 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.2 AIRCRAFT WIRE AND CABLE MARKET FOR OEM

FIGURE 5 MARKET SIZE CALCULATION FOR OEM

2.4.3 AIRCRAFT WIRE AND CABLE MARKET AFTERMARKET

FIGURE 6 MARKET SIZE CALCULATION FOR AFTERMARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.4 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 TRIANGULATION & VALIDATION

FIGURE 9 DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS FOR THE RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 10 HARNESSES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

FIGURE 11 AIRCRAFT WIRES AND CABLES MARKET, BY CONDUCTOR MATERIAL, 2021

FIGURE 12 THERMOPLASTIC SEGMENT TO DOMINATE IN 2021

FIGURE 13 AFTERMARKET SEGMENT TO COMMAND LARGER SHARE IN 2021

FIGURE 14 EUROPEAN MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AIRCRAFT WIRE AND CABLE MARKET

FIGURE 15 DEMAND FOR INFLIGHT EXPERIENCE TO DRIVE MARKET FROM 2O21 TO 2026

4.2 AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE

FIGURE 16 FIXED-WING AIRCRAFT SEGMENT PROJECTED TO LEAD MARKET, 2021-2026

4.3 AIRCRAFT WIRE AND CABLE MARKET, BY APPLICATION

FIGURE 17 FLIGHT CONTROL SYSTEM SEGMENT PROJECTED TO DOMINATE MARKET FROM 2021 TO 2026

4.4 AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY

FIGURE 18 FRANCE PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 AIRCRAFT WIRE AND CABLE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased demand for wires & cables with rise in aircraft orders

5.2.1.2 Digitalization and Electrification of aircraft systems

5.2.1.3 Development of Innovative Aircraft Solutions

5.2.2 RESTRAINTS

5.2.2.1 Delay and backlog in aircraft deliveries

5.2.2.2 Reduced demand for wires due to wireless transmission

5.2.3 OPPORTUNITIES

5.2.3.1 Aircraft wiring demand for interconnect solutions

5.2.3.2 Demand for electric aircraft and glass cockpits

5.2.3.3 Rising MRO Activities in Developing Economies

5.2.4 CHALLENGES

5.2.4.1 Complexities with installing & upgrading wire harnesses

5.2.4.2 Additional weight of insulation and shielding

5.2.4.3 Accidents caused due to aircraft wiring failure

5.2.4.4 Impact of COVID-19

5.3 OPERATIONAL DATA

TABLE 2 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019–2040

5.4 RANGE AND SCENARIOS

FIGURE 20 RANGE AND SCENARIOS FOR AIRCRAFT WIRE AND CABLE

5.5 AIRCRAFT WIRE AND CABLE MARKET ECOSYSTEM

FIGURE 21 AIRCRAFT WIRE AND CABLE MARKET ECOSYSTEM

TABLE 3 AIRCRAFT WIRE AND CABLE MARKET ECOSYSTEM

5.6 DISRUPTION IMPACTING CUSTOMER BUSINESSES

FIGURE 22 AIRCRAFT WIRE AND CABLE MARKET ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS

5.8 CASE STUDY ANALYSIS

5.9 TRADE DATA ANALYSIS

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 AVERAGE SELLING PRICE

TABLE 5 AVERAGE SELLING PRICE OF TOTAL WIRE USED IN AIRCRAFT TYPE 2021 AND 2026 (USD MILLION)

5.12 VOLUME DATA

TABLE 6 TOTAL WIRE USED PER APPLICATION IN DIFFERENT AIRCRAFT TYPES

5.13 TARIFF AND REGULATORY LANDSCAPE

TABLE 7 UL MARKS

TABLE 8 WIRE & CABLE REFERENCE STANDARDS

6 INDUSTRY TRENDS (Page No. - 68)

6.1 INTRODUCTION

6.2 EMERGING TRENDS

FIGURE 25 EMERGING TRENDS IN AIRCRAFT WIRES AND CABLES

FIGURE 26 MODEL-BASED ENTERPRISE: DIGITALIZATION, AUTOMATION, AND DATA REUSE

6.3 TECHNOLOGY ANALYSIS

6.3.1 FIBER OPTICS

6.4 INNOVATION & PATENT ANALYSIS

TABLE 9 INNOVATION AND PATENT REGISTRATION

6.5 IMPACT OF MEGATREND

7 AIRCRAFT WIRE AND CABLE MARKET, BY COMPONENT (Page No. - 76)

7.1 INTRODUCTION

FIGURE 27 AIRCRAFT WIRES SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

TABLE 10 AIRCRAFT WIRES AND CABLES MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 11 AIRCRAFT WIRES AND CABLES MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

7.2 AIRCRAFT HARNESSES

7.2.1 INCREASING DEMAND FOR WIRE HARNESSES IN AEROSPACE APPLICATIONS

7.3 AIRCRAFT WIRES

7.3.1 NEED FOR LIGHTWEIGHT WIRES FOR AIRCRAFT SYSTEMS

7.4 AIRCRAFT CABLES

7.4.1 INCREASING DEMAND FOR CABLES FOR ELECTRIC AIRCRAFT

8 AIRCRAFT WIRE AND CABLE MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 28 FLIGHT CONTROL SYSTEMS TO BE DOMINANT SEGMENT, 2021–2026

TABLE 12 AIRCRAFT WIRE AND CABLE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 13 AIRCRAFT WIRE AND CABLE MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 FLIGHT CONTROL SYSTEMS

8.2.1 INCREASING DEMAND FOR FLY-BY-WIRE SYSTEMS TO REPLACE TRADITIONAL FLIGHT CONTROL SYSTEMS

8.3 LIGHTING

8.3.1 DEMAND FOR ENHANCED PASSENGER EXPERIENCE THROUGH AMBIENT LIGHTING DRIVES SEGMENT

8.4 DATA TRANSFER

8.4.1 INCREASING DEMAND FOR HIGH-SPEED DATA CABLES BOOSTS SEGMENT

8.5 POWER TRANSFER

8.5.1 INCREASING NEED FOR POWER TRANSFER CABLES FOR ELECTRIC AIRCRAFT

8.6 AVIONICS

8.6.1 REPLACEMENT OF ANALOG AVIONICS INTO DIGITAL SYSTEMS TO DRIVE MARKET GROWTH

8.7 OTHERS

8.7.1 INCREASING DEVELOPMENTS TO ENHANCE INFLIGHT EXPERIENCE FUEL OTHER APPLICATIONS

9 AIRCRAFT WIRE AND CABLE MARKET, BY CONDUCTOR MATERIAL (Page No. - 85)

9.1 INTRODUCTION

FIGURE 29 COPPER ALLOYS SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 14 AIRCRAFT WIRES AND CABLES MARKET, BY CONDUCTOR MATERIAL, 2017–2020 (USD MILLION)

TABLE 15 AIRCRAFT WIRES AND CABLES MARKET, BY CONDUCTOR MATERIAL, 2021–2026 (USD MILLION)

9.2 STAINLESS STEEL ALLOYS

9.2.1 USE OF STAINLESS STEEL ALLOYS ON THE RISE DUE TO HIGH QUALITY AND CORROSION RESISTANCE

9.3 COPPER ALLOYS

9.3.1 DEMAND FOR COPPER ALLOYS FOR ELECTRICAL PROPERTIES IS HIGH

9.4 ALUMINUM ALLOYS

9.4.1 EXPERIMENTS CONDUCTED ON ALUMINUM ALLOYS TO REDUCE AIRCRAFT WEIGHT

9.5 OTHERS

9.5.1 INCREASED USE OF NICKEL AND SILVER-COATED ALLOYS DUE TO HIGH CORROSION RESISTANCE PROPERTY

10 AIRCRAFT WIRE AND CABLE MARKET, BY INSULATION TYPE (Page No. - 90)

10.1 INTRODUCTION

FIGURE 30 THERMOPLASTIC SEGMENT TO GROW AT A HIGHER RATE DURING FORECAST PERIOD

TABLE 16 AIRCRAFT WIRES AND CABLES MARKET, BY INSULATION TYPE, 2017–2020 (USD MILLION)

TABLE 17 AIRCRAFT WIRES AND CABLES MARKET, BY INSULATION TYPE, 2021–2026 (USD MILLION)

10.2 THERMOPLASTIC

10.2.1 REDUCED WEIGHT AND IMPROVED EFFICIENCY BY USING THERMOPLASTIC

10.3 THERMOSETTING

10.3.1 THERMOSETTING WIDELY USED IN HIGH-TEMPERATURE APPLICATIONS

11 AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE (Page No. - 94)

11.1 INTRODUCTION

FIGURE 31 UAV SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 20 AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2 FIXED-WING AIRCRAFT

11.2.1 COMMERCIAL AVIATION

11.2.1.1 Narrow-body aircraft

11.2.1.1.1 Increase in passenger traffic to drive segment growth

11.2.1.2 Wide-body aircraft

11.2.1.2.1 Introduction of newer wide-body aircraft to boost market

11.2.1.3 Regional transport aircraft

11.2.1.3.1 Growing regional aircraft fleet fuels segment growth

TABLE 21 COMMERCIAL AVIATION: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 22 COMMERCIAL AVIATION: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2.2 BUSINESS & GENERAL AVIATION

11.2.2.1 Business jets

11.2.2.1.1 Rise in private aviation companies providing low cost business travel to drive market growth

11.2.2.2 Light aircraft

11.2.2.2.1 Increasing usage of light aircraft in new applications to drive market growth

TABLE 23 BUSINESS & GENERAL AVIATION: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 24 BUSINESS & GENERAL AVIATION: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2.3 MILITARY AVIATION

11.2.3.1 Fighter aircraft

11.2.3.1.1 Rising need to gain airborne dominance will drive segment growth

11.2.3.2 Transport aircraft

11.2.3.2.1 Segment driven by increasing demand for transport aircraft across regions

11.2.3.3 Special-mission aircraft

11.2.3.3.1 Increasing need for aircraft that support strategic and tactical purposes boosts market

TABLE 25 MILITARY AVIATION: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 26 MILITARY AVIATION: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3 ROTARY-WING AIRCRAFT

11.3.1 COMMERCIAL HELICOPTERS

11.3.1.1 Increase in operational capabilities of commercial helicopters drives segment growth

11.3.2 MILITARY HELICOPTERS

11.3.2.1 Segment driven by increasing usage for ISR missions and rescue operations

TABLE 27 ROTARY WING: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 28 ROTARY WING: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4 UNMANNED AERIAL VEHICLES (UAV)

11.4.1 FIXED-WING UAVS

11.4.1.1 Increasing usage in ISR and tactical operations to drive market growth

11.4.2 FIXED-WING HYBRID VTOL UAVS

11.4.2.1 Ability to carry heavy payloads and fly longer durations to drive market growth

11.4.3 ROTARY-WING UAVS

11.4.3.1 Increasing development of new rotary wing UAVs boosts segment

TABLE 29 UAV: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 30 UAV: AIRCRAFT WIRES AND CABLES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.5 ADVANCED AIR MOBILITY (AAM)

11.5.1 PROVIDING CUSTOMIZED SOLUTIONS FOR ADVANCED AIR MOBILITY VEHICLES

12 AIRCRAFT WIRE AND CABLE MARKET, BY END USER (Page No. - 105)

12.1 INTRODUCTION

FIGURE 32 AFTERMARKET SEGMENT PROJECTED TO GROW AT HIGHEST CAGR, 2021–2026

TABLE 31 AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 32 AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

12.2 OEM

12.2.1 INCREASING DEMAND BY OEMS DUE TO HIGHER FLIGHT DEMAND

12.3 AFTERMARKET

12.3.1 REPLACEMENT OF WIRING SYSTEMS TO FUEL MARKET

13 REGIONAL ANALYSIS (Page No. - 108)

13.1 INTRODUCTION

FIGURE 33 AIRCRAFT WIRE AND CABLE MARKET: REGIONAL SNAPSHOT

13.2 IMPACT OF COVID-19 ON AIRCRAFT WIRE AND CABLE MARKET

TABLE 33 AIRCRAFT WIRE AND CABLE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 AIRCRAFT WIRE AND CABLE MARKET, BY REGION, 2021–2026 (USD MILLION)

13.3 NORTH AMERICA

FIGURE 34 NORTH AMERICA AIRCRAFT WIRE AND CABLE MARKET SNAPSHOT

13.3.1 PESTLE ANALYSIS: NORTH AMERICA

TABLE 35 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 36 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 38 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 40 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 44 NORTH AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.3.2 US

13.3.2.1 Presence of leading OEMs to drive US market

TABLE 45 US: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 46 US: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 47 US: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 48 US: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 49 US: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 50 US: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 51 US: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 52 US: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.3.3 CANADA

13.3.3.1 Aircraft modernization programs to drive market

TABLE 53 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 54 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 55 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 56 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 57 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 58 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 59 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 60 CANADA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.4 EUROPE

FIGURE 35 EUROPE AIRCRAFT WIRE AND CABLE MARKET SNAPSHOT

13.4.1 PESTLE ANALYSIS

TABLE 61 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 62 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 64 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 65 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 66 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 67 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 68 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 69 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 70 EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.4.2 UK

13.4.2.1 Growing air traffic in UK to drive market growth

TABLE 71 UK: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 72 UK: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 73 UK: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 74 UK: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 75 UK: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 76 UK: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 77 UK: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 78 UK: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.4.3 FRANCE

13.4.3.1 Heavy investments in aerospace to fuel market

TABLE 79 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 80 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 81 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 82 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 83 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 84 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 85 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 86 FRANCE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.4.4 GERMANY

13.4.4.1 Investments in air travel and connectivity to boost German market

TABLE 87 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 88 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 89 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 90 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 91 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 92 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 93 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 94 GERMANY: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.4.5 ITALY

13.4.5.1 High demand for civil and corporate helicopters to drive Italian market

TABLE 95 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 96 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 97 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 98 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 99 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 100 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 101 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 102 ITALY: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.4.6 RUSSIA

13.4.6.1 Improved military budget to manufacture advanced aircraft

TABLE 103 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 104 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 105 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 106 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 107 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 108 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 109 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 110 RUSSIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.4.7 REST OF EUROPE

13.4.7.1 Aviation development initiatives to increase market growth

TABLE 111 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 112 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 113 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 114 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 115 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 116 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 117 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 118 REST OF EUROPE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.5 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC AIRCRAFT WIRE AND CABLE MARKET SNAPSHOT

13.5.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 119 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 120 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 124 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 126 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.5.2 CHINA

13.5.2.1 Demand for aerospace products to boost market

TABLE 129 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 130 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 131 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 132 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 133 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 134 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 135 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 136 CHINA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.5.3 INDIA

13.5.3.1 Five-year modernization plan for armed forces to dominate market growth

TABLE 137 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 138 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 139 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 140 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 141 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 142 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 143 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 144 INDIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.5.4 JAPAN

13.5.4.1 Market growth led by in-house development of aircraft

TABLE 145 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 146 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 147 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 148 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 149 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 150 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 151 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 152 JAPAN: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.5.5 AUSTRALIA

13.5.5.1 Air traffic and new aircraft deliveries to improve market position

TABLE 153 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 154 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 155 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 156 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 157 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 158 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 159 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 160 AUSTRALIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.5.6 SOUTH KOREA

13.5.6.1 Modernization programs for aviation to lead market

TABLE 161 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 162 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 163 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 164 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 165 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 166 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 167 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 168 SOUTH KOREA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.5.7 REST OF ASIA PACIFIC

13.5.7.1 Replacement of aging aircraft to generate demand in market

TABLE 169 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.6 MIDDLE EAST

13.6.1 PESTLE ANALYSIS

TABLE 177 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 178 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 179 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 180 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 181 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 182 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 183 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 184 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 185 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 186 MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.6.2 ISRAEL

13.6.2.1 Increased spending in R&D of UAVs for military & commercial applications

TABLE 187 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 188 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 189 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 190 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 191 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 192 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 193 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 194 ISRAEL: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.6.3 UAE

13.6.3.1 Increasing upgrades of commercial airlines to drive market

TABLE 195 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 196 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 197 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 198 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 199 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 200 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 201 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 202 UAE: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.6.4 SAUDI ARABIA

13.6.4.1 High military expenditure to drive the market

TABLE 203 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 204 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 205 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 206 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 207 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 208 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 209 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 210 SAUDI ARABIA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.6.5 TURKEY

13.6.5.1 Substantial rise in military spending & development of UAVs to boost market

TABLE 211 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 212 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 213 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 214 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 215 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 216 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 217 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 218 TURKEY: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.6.6 REST OF MIDDLE EAST

13.6.6.1 Increasing expenditure on UAVs and military equipment to drive regional market growth

TABLE 219 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 220 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 221 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 222 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 223 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 224 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 225 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 226 REST OF MIDDLE EAST: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.7 LATIN AMERICA

13.7.1 PESTLE ANALYSIS

TABLE 227 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 228 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 229 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 230 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 231 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 232 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 233 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 234 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 235 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 236 LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.7.2 BRAZIL

13.7.2.1 Presence of OEMs and growth opportunities for airlines to drive market growth

TABLE 237 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 238 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 239 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 240 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 241 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 242 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 243 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 244 BRAZIL: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.7.3 MEXICO

13.7.3.1 Government usage of UAVs to fight organized crime and carry surveillance to lead market demand

TABLE 245 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 246 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 247 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 248 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 249 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 250 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 251 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 252 MEXICO: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.7.4 REST OF LATIN AMERICA

13.7.4.1 Increasing aircraft fleet size to drive market growth

TABLE 253 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 254 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 255 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 256 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 257 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 258 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 259 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 260 REST OF LATIN AMERICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

13.7.5 AFRICA

TABLE 261 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 262 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 263 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 264 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY FIXED-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 265 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2017–2020 (USD MILLION)

TABLE 266 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY ROTARY-WING AIRCRAFT, 2021–2026 (USD MILLION)

TABLE 267 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 268 AFRICA: AIRCRAFT WIRE AND CABLE MARKET, BY END USER, 2021–2026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 189)

14.1 INTRODUCTION

14.2 MARKET SHARE ANALYSIS, 2020

TABLE 269 DEGREE OF COMPETITION

FIGURE 37 MARKET SHARE OF TOP PLAYERS IN AIRCRAFT WIRE AND CABLE MARKET, 2020

14.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

14.4 COMPANY EVALUATION QUADRANT

14.4.1 STAR

14.4.2 EMERGING LEADER

14.4.3 PERVASIVE

14.4.4 PARTICIPANT

FIGURE 38 AIRCRAFT WIRE AND CABLE MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

TABLE 270 COMPANY FOOTPRINT

TABLE 271 COMPANY FOOTPRINT BY APPLICATION

TABLE 272 COMPANY FOOTPRINT BY AIRCRAFT TYPE

TABLE 273 COMPANY FOOTPRINT BY END USER

TABLE 274 COMPANY FOOTPRINT BY COMPONENT

TABLE 275 COMPANY REGION FOOTPRINT

14.5 COMPETITIVE SCENARIO

14.5.1 DEALS

TABLE 276 DEALS, 2018 - 2021

14.5.2 PRODUCT LAUNCHES

TABLE 277 PRODUCT LAUNCHES, 2018-2021

14.5.3 OTHERS

TABLE 278 OTHERS, 2018- 2021

15 COMPANY PROFILES (Page No. - 204)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

15.1 KEY PLAYERS

15.1.1 COLLINS AEROSPACE

TABLE 279 COLLINS AEROSPACE: BUSINESS OVERVIEW

FIGURE 39 COLLINS AEROSPACE: COMPANY SNAPSHOT

TABLE 280 COLLINS AEROSPACE PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 281 COLLINS AEROSPACE: DEALS

15.1.2 TE CONNECTIVITY

TABLE 282 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 40 TE CONNECTIVITY: COMPANY SNAPSHOT

TABLE 283 TE CONNECTIVITY: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 284 TE CONNECTIVITY: NEW PRODUCT DEVELOPMENTS

TABLE 285 TE CONNECTIVITY: DEALS

15.1.3 AMPHENOL CORPORATION

TABLE 286 AMPHENOL CORPORATION: BUSINESS OVERVIEW

FIGURE 41 AMPHENOL CORPORATION: COMPANY SNAPSHOT

TABLE 287 AMPHENOL CORPORATION PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 288 AMPHENOL CORPORATION: DEALS

15.1.4 NEXANS SA

TABLE 289 NEXANS SA: BUSINESS OVERVIEW

FIGURE 42 NEXANS SA: COMPANY SNAPSHOT

TABLE 290 NEXANS SA: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 291 NEXANS SA: DEALS

15.1.5 CARLISLE INTERCONNECT TECHNOLOGIES

TABLE 292 CARLISLE INTERCONNECT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 43 CARLISLE INTERCONNECT TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 293 CARLISLE INTERCONNECT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 294 CARLISLE INTERCONNECT TECHNOLOGIES: NEW PRODUCT DEVELOPMENTS

TABLE 295 CARLISLE INTERCONNECT TECHNOLOGIES: DEALS

TABLE 296 CARLISLE INTERCONNECT TECHNOLOGIES: OTHERS

15.1.6 AMETEK SMP

TABLE 297 AMETEK SMP: BUSINESS OVERVIEW

FIGURE 44 AMETEK: COMPANY SNAPSHOT

TABLE 298 AMETEK SMP: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

15.1.7 HUBER+SUHNER

TABLE 299 HUBER+SUHNER: BUSINESS OVERVIEW

FIGURE 45 HUBER+SUHNER: COMPANY SNAPSHOT

TABLE 300 HUBER+SUHNER: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 301 HUBER+SUHNER: NEW PRODUCT DEVELOPMENTS

TABLE 302 HUBER+SUHNER: DEALS

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15.2 OTHER PLAYERS

15.2.1 PIC WIRE & CABLE

TABLE 303 PIC WIRE & CABLE: COMPANY OVERVIEW

15.2.2 A.E. PETSCHE

TABLE 304 A.E. PETSCHE: COMPANY OVERVIEW

15.2.3 W.L. GORE & ASSOCIATES INC.

TABLE 305 W.L. GORE & ASSOCIATES INC.: COMPANY OVERVIEW

15.2.4 LEXCO CABLE, INC.

TABLE 306 LEXCO CABLE, INC.: COMPANY OVERVIEW

15.2.5 AXON CABLE

TABLE 307 AXON CABLE: COMPANY OVERVIEW

15.2.6 SANGHVI AEROSPACE (P.) LTD.

TABLE 308 SANGHVI AEROSPACE (P.) LTD.: COMPANY OVERVIEW

15.2.7 TYLER MADISON, INC.

TABLE 309 TYLER MADISON, INC.: COMPANY OVERVIEW

15.2.8 BERGEN CABLE

TABLE 310 BERGEN CABLE: COMPANY OVERVIEW

15.2.9 PRYSMIAN GROUP

TABLE 311 PRYSMIAN GROUP: COMPANY OVERVIEW

15.2.10 MOLEX

TABLE 312 MOLEX: COMPANY OVERVIEW

15.2.11 EATON CORPORATION

TABLE 313 EATON CORPORATION: COMPANY OVERVIEW

15.2.12 GLENAIR, INC

TABLE 314 GLENAIR, INC.: COMPANY OVERVIEW

15.2.13 JUDD WIRE, INC.

TABLE 315 JUDD WIRE, INC.: COMPANY OVERVIEW

15.2.14 HARBOUR INDUSTRIES

TABLE 316 HARBOUR INDUSTRIES: COMPANY OVERVIEW

15.2.15 GRIPLOCK SYSTEM

TABLE 317 GRIPLOCK SYSTEMS: COMPANY OVERVIEW

15.2.16 CARL STAHL SAVA INDUSTRIES, INC.

TABLE 318 CARL STAHL SAVA INDUSTRIES, INC.: COMPANY OVERVIEW

15.2.17 RADIALL

TABLE 319 RADIALL: COMPANY OVERVIEW

15.2.18 LEVITON

TABLE 320 LEVITON: COMPANY OVERVIEW

16 APPENDIX (Page No. - 249)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

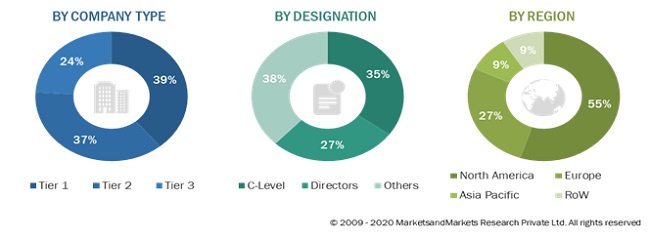

The research study involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg, and Factiva to identify and collect information relevant to the aircraft wire and cable market. Primary sources include industry experts from the aircraft wire and cable market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the aircraft wire and cable market as well as to assess the growth prospects of the market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); the Federal Aviation Administration (FAA); the General Aviation Manufacturers Association (GAMA); corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft wire and cable manufacturers; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using aircraft wire and cable were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft wire and cable and future outlook of their business which will affect the overall market.

The breakup of Primary Research:

|

EVTOL AIRCRAFT OEMs |

AIR CHARTER SERVICE PROVIDERS |

OTHERS |

|

Lilium GmbH |

Rotana Jet |

Flying Whales |

|

Archer Aviation Inc. |

Imperial Jet Europe GmbH |

Bangalore Aircraft Industries Pvt. Ltd. |

|

|

SpiceJet |

CAPA |

|

|

|

Aero360 |

|

|

|

Ideaforge |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

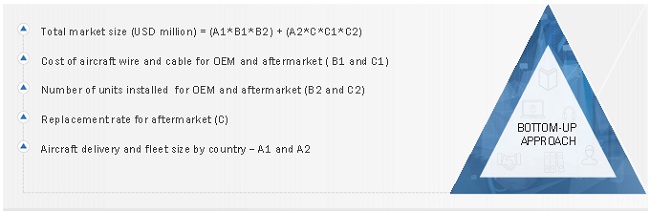

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft wire and cable market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Aircraft Wire and Cable Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the aircraft wire and cable market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends. Along with this, the market size was validated using the top-down and bottom-up approaches.

Importance of Data Transfer Cables in Aircraft Applications

Aircraft data transfer cables and the aircraft wire and cable market are correlated as data transfer cables are a type of wire and cable used in aircraft applications. The demand for data transfer cables is closely linked to the growth of the aircraft wire and cable market, which is driven by the adoption of new technology and the expansion of the aviation industry. The increasing demand for new aircraft, both in commercial and military sectors, is also a significant factor driving the demand for aircraft wire and cable products.

Improved Braking Performance and Operational Efficiency

Bucket-type thrust reversers can improve braking performance, reduce landing distance and increase operational efficiency, making the aircraft more attractive to airlines. This can result in an increased demand for aircraft nacelle and thrust reverser systems that can accommodate bucket-type reversers. Additionally, the adoption of bucket-type reversers can lead to the development of more innovative and lightweight nacelle designs that can integrate with the larger size of the reverser. The increasing trend towards eco-friendly aircraft designs can create new opportunities for the aircraft nacelle and thrust reverser market, as bucket-type reversers can help reduce the carbon footprint of an aircraft by improving operational efficiency.

Report Objectives

- To define, describe, segment, and forecast the aircraft wire and cable market based on type, application, aircraft type, conductor material, insulation type, end user and by region.

- To forecast the size of various segments of the aircraft wire and cable market based on six regions—North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa¯along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze technological advancements and product launches in the market

- To analyze micromarkets with respect to their growth trends, prospects, and contribution to the overall market

- To provide a detailed competitive landscape of the market, along with market share analysis of key players

- To strategically profile key players and comprehensively analyze their market position in terms of shares and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the aircraft wire and cable market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aircraft Wire and Cable Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Wire and Cable Market

I am interested in cable and harness manufacturers serving the mil/aero segment and general construction types i.e., crimped, clamshell (potted) molded, and insert molded.

I would like to know what is the average percentage of requirement of Power Cable Harness and Data Transfer Harness

We would like to better understand the aerospace wire harness market—market size and growth by application and by type of aircraft, current players, and supply chain, and more. Thank you!

Looking to have a more recent update to this report and forecast into 2026-28 based on upcoming civil and military platforms due for initial production in 2022-23. Also, looking to understand the current slowdown trend in aircraft retirements and how it will affect the MRO for modernization, retrofit, and completion.