Nuclear Medicine Market Size, Growth, Share & Trends Analysis

Nuclear Medicine Market by Type [SPECT (Tc-99m, I-123, Ga-67), PET (F-18), Alpha Emitters, Beta Emitters (Y-90, Lu-177), Brachytherapy], Application (Oncology, Cardiology, Neurology), Procedure, End User (Imaging Center, Hospital), and Region -Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

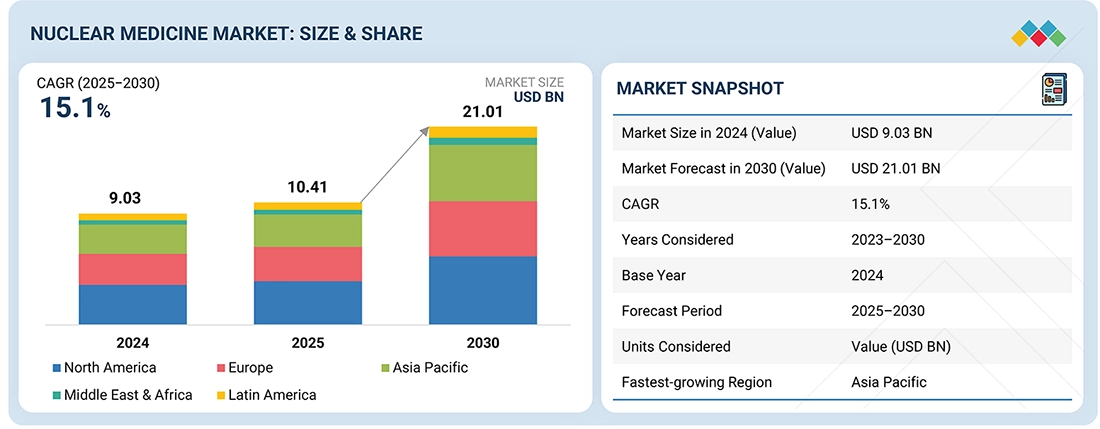

The global nuclear medicine market, valued at USD 9.03 billion in 2024, stood at USD 10.41 billion in 2025 and is projected to advance at a resilient CAGR of 15.1% from 2025 to 2030, culminating in a forecasted valuation of USD 21.01 billion by the end of the period. The growth of the market is driven by the rising prevalence of cancer and cardiovascular diseases, which is accelerating the demand for diagnostic and therapeutic radiopharmaceuticals and medical radioisotopes. Moreover, the recognition of nuclear medicine solutions is increasing at a pace worldwide due to increased investments in radioisotope production plants, nuclear pharmacies, and positive reimbursement policies in the developed countries. This is also driving the growth of the market.

KEY TAKEAWAYS

-

By RegionThe North America nuclear medicine market accounted for a 46.4% revenue share in the global nuclear medicine market 2024.

-

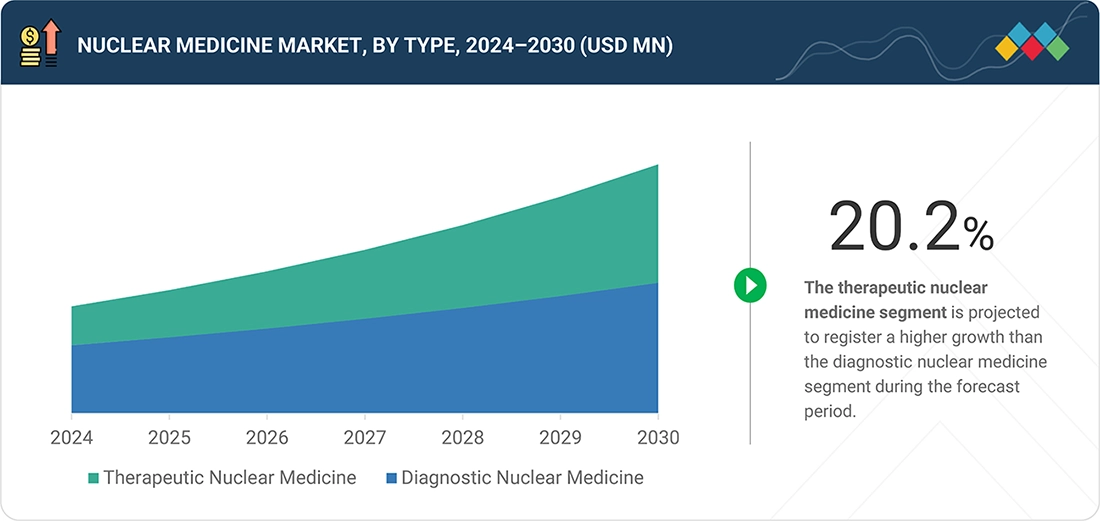

By TypeThe therapeutic nuclear medicine segment is projected to register a higher growth of 20.2% than the diagnostic nuclear medicine during the forecast period.

-

By ApplicationThe diagnostic applications segment accounted for a larger share of 63.9% than the therapeutic applications segment in 2024.

-

By Volume AssessmentThe diagnostic procedures segment is estimated to dominate the market in 2025.

-

By End UserThe hospitals segment accounted for the largest share in 2024.

-

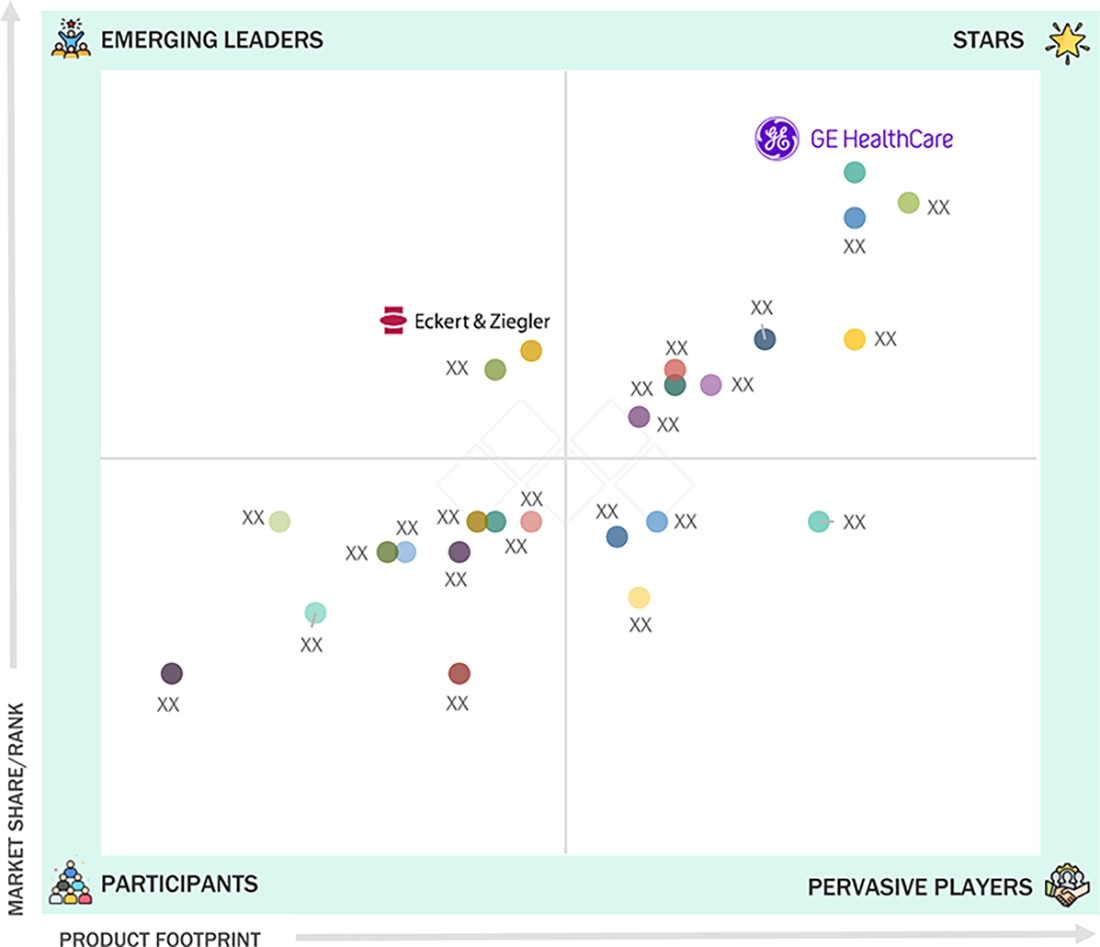

Competitive LandscapeGE HealthCare, Cardinal Health, and Bayer AG are key leaders in the global nuclear medicine market, recognized for their extensive product portfolios, robust data integration capabilities, and strong presence across healthcare ecosystems.

The nuclear medicine market is growing due to the increased investments in advanced imaging technologies, effects of radiopharmaceutical products, and increased focus on regulatory compliance and clinical accuracy in the US and EU. PET/CT, SPECT/CT and automated radio pharmacy systems continue to advance and are becoming more precise and more efficient in operation, which is also spurring growth in the market. Additionally, collaboration between pharmaceutical firms, imaging suppliers, and healthcare providers to enable completely more integrated and scalable nuclear medicine solutions can prove lucrative to the growth of the market in the coming years.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

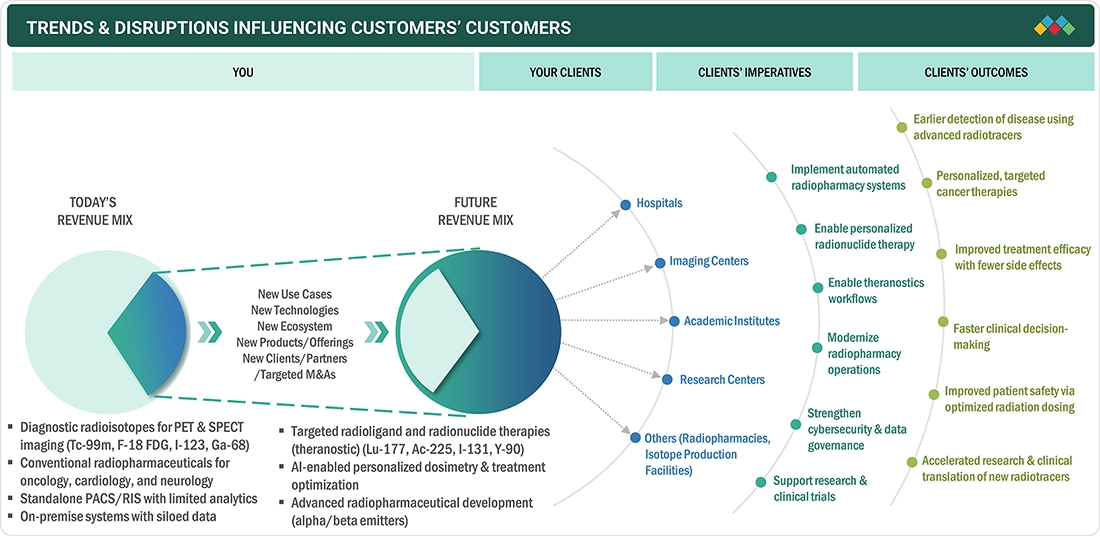

Consumer trends in the nuclear medicine market are driven by changing regulatory standards, the growing complexity of the radiopharmaceutical management, and the rising use of the advanced diagnostic and therapeutic methodology. Imaging hospitals, imaging centers, and radiopharmaceutical manufacturers are the key end users driving the demand for hybrid imaging, theranostic, and automated radio pharmacy solutions. These shifts have direct implications on clinical productivity, safety, and the management of cost, which impact purchase choices and competitiveness of nuclear medicine technology providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing incidence and prevalence of target conditions

-

Development of alpha-radioimmunotherapy-based targeted cancer treatments

Level

-

Short half-life of radiopharmaceuticals

Level

-

Use of radiopharmaceuticals in neurological applications

-

Growth opportunities in emerging economies

Level

-

Hospital budget cuts and high equipment costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing incidence and prevalence of target conditions

The growing incidence and prevalence of targeted diseases like cancer, cardiovascular diseases, and neurological diseases is a significant driving factor for the nuclear medicine market. Since these diseases can be effectively diagnosed and treated early and through specific treatment methods, the demand for nuclear imaging modalities, such as PET and SPECT, is increasing. In oncology, nuclear medicine also plays a critical role in the staging of diseases, therapy selection, and treatment monitoring. Such increasing clinical dependence on nuclear medicine processes is directly contributing to increased use of imaging systems and radiopharmaceuticals, thus propelling overall growth in the market.

Restraint: Short half-life of radiopharmaceuticals

Radiopharmaceuticals have a short half-life, which acts as a restraining factor to the nuclear medicine market. It creates challenges in production, storage, and distribution. Numerous radioisotopes have a short shelf life where they need to be near to cyclotrons or nuclear reactors and have very complex logistics. The restriction adds complexity and cost to operations of healthcare providers and restricts access to nuclear medicine procedures in remote or underserved areas. This means that the scalability of the adoption and spread of nuclear medicine services is limited.

Opportunity: Use of radiopharmaceuticals in neurological applications

The nuclear medicine market has great potential in the growing application of radiopharmaceuticals for neurology. Nuclear imaging modalities like PET and SPECT are gradually used in the diagnosis and early management of neurological diseases, including Alzheimer's, Parkinson's, and epilepsy. Advanced neuro-specific radiotracers are enhancing the potential of identifying functional and molecular alterations in the brain at the initial stages of the disease. This increasing clinical adoption will stimulate the demand for specialized radiopharmaceuticals and complex imaging systems, which would promote market growth.

Challenge: Hospital budget cuts and high equipment costs

The high cost of nuclear medicine equipment and budget cuts in hospitals is a major challenge to the growth of the nuclear medicine market. Complex imaging systems like the PET/CT and the SPECT/CT involve huge capital investment, as well as maintenance and compliance costs. Financial issues in hospitals can postpone the updating of equipment and prevent the introduction of new technologies in nuclear medicine. The issue is especially pronounced in mini-health centers and developing markets where limited budgets restrict access to the advanced nuclear medicine services.

NUCLEAR MEDICINE MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Production and supply of PET and SPECT radioisotopes and radiopharmaceuticals used in oncology, cardiology, and neurology diagnostics | Reliable access to critical isotopes | High imaging accuracy | Improved diagnostic confidence |

|

Nuclear pharmacy services and distribution of short-half-life radiopharmaceuticals to hospitals and imaging centers | Timely delivery of radiotracers | Reduced operational complexity | Consistent imaging workflows |

|

Manufacturing of diagnostic and therapeutic radiopharmaceuticals, including SPECT and PET radioisotopes for cancer and neurological imaging | Stable isotope supply | High product quality | Expanded availability of nuclear medicine procedures |

|

Development of therapeutic radiopharmaceuticals and targeted radioisotope-based treatments, particularly in oncology | Precise tumor targeting | Improved treatment outcomes | Reduced impact on healthy tissue |

|

Production of diagnostic radiopharmaceuticals and radioisotope imaging agents for cardiac and PET imaging applications | Accurate disease detection | Quick diagnosis | Improved clinical decision-making |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Major players in the nuclear medicine market include manufacturers of radiopharmaceuticals and radio pharmacy services used in diagnostic and therapeutic applications. Some of these manufacturers are GE HealthCare (US), Cardinal Health (US), Curium (France), and Bayer AG (Germany). These companies focus on advancing PET/CT and SPECT/CT technologies, theranostic, and ensuring a reliable supply of radioisotopes to improve clinical outcomes and regulatory compliance. The ecosystem is further strengthened by emerging startups and distributors expanding isotope production and radio pharmacy capabilities, supported by oversight from global and national regulatory authorities to ensure safety, quality, and compliance. End users include hospitals and imaging centers that deploy these solutions through ongoing collaborations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Nuclear Medicine Market, By Type

By type, the diagnostic nuclear medicine segment led the nuclear medicine market in 2024. This is because of the high volume of the PET and SPECT imaging services that are used in the early and precise detection of cancer, cardiovascular, and neurological diseases. The segment's dominance is also favored by widespread availability of standard diagnostic radiotracers and high use in hospitals and imaging centers. This dominant role of diagnostic nuclear medicine is further being reinforced by the constant development of new hybrid imaging technologies.

Nuclear Medicine Market, By Application

By application, the diagnostic applications segment led the nuclear medicine market in 2024. This is due to the prevalence of nuclear imaging methodology in the early detection of diseases, proper diagnosis, and the planning of treatments. Both PET and SPECT scans are widely used in the fields of oncology, cardiology, and neurology because of their functionality and molecular information. This large market share of the segment is further supported by the high frequency of the diagnostic procedures and the ongoing improvement in imaging technologies.

Nuclear Medicine Market, By Volume Assessment

By assessment, the diagnostic procedures segment led the nuclear medicine market in 2024. This is because the number of PET and SPECT scans performed globally to detect early disease detection, staging, and to monitor the treatment proceeds, is very high, which is driving the growth of the segment. Since the prevalence of cancer and cardiovascular disorders is increasing, the access to nuclear imaging services is also increasing, which, in turn, is increasing the volume of procedures. Moreover, well-established diagnostic radiotracers available to facilitate repeat and consistent use are also contributing to market growth significantly.

Nuclear Medicine Market, By End User

By end user, the hospitals segment accounted for the largest share of the market in 2024. This is because hospitals have access to advanced nuclear imaging facilities, a large number of patients attending the facility and combined diagnostic and treatment services. Additionally, the availability of qualified experts and the capability to perform complex radiopharmaceutical tasks further support high adoption of nuclear medicine services in hospital settings.

REGION

Asia Pacific to be fastest-growing region in global nuclear medicine market during forecast period

Asia Pacific is projected to be the fastest-growing region in the nuclear medicine market during the forecast period. This growth is driven by the increase in cancer incidence, expansion of the hospital networks, and rising demand for diagnostic and therapeutic radiopharmaceuticals across countries such as China, India, and Japan. Market expansion is also accelerated by government initiatives to strengthen nuclear medicine infrastructure, the increasing production of radiopharmaceuticals in the country, and better regulatory frameworks. Moreover, the rising healthcare spending and the raised awareness on early diagnosis are further boosting the adoption of this regional market.

NUCLEAR MEDICINE MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

GE HealthCare (Star) is a key player of the nuclear medicine market due to its strong focus on radiopharmaceuticals and radioisotope-enabled solutions, supported by an extensive nuclear pharmacy network and a broad portfolio of FDA-approved diagnostic and therapeutic radiopharmaceuticals. On the other hand, Eckert & Ziegler (Emerging Leader) is gaining prominence because of its expertise in the production of radioisotopes and the development of radiopharmaceuticals to serve the rising need in diagnostic and therapeutic nuclear medicines.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- GE HealthCare (US)

- Cardinal Health (US)

- Curium (France)

- Bayer AG (Germany)

- Lantheus Holdings, Inc. (US)

- Novartis AG (Switzerland)

- Jubilant Pharmova Limited (India)

- Bracco Imaging S.P.A (Italy)

- Pharmalogic Holdings Corp. (US)

- NTP Radioisotopes SOC Ltd. (South Africa)

- Nordion Inc. (Canada)

- Siemens Healthineers AG (Germany)

- NorthStar Medical Radiosiotopes, LLC (US)

- Eckert & Ziegler (Germany)

- Isotope JSC (Russia)

- Global Medical Solutions (US)

- Telix Pharmaceuticals Limited (Australia)

- PDRadiopharma Inc. (Japan)

- ITM Isotope Technologies Munich SE (Germany)

- BWX Technologies Inc. (US)

- SHINE Technologies, LLC (US)

- Isotopia (Israel)

- Institutes of Isotopes (Hungary)

- China Isotope & Radiation Corporation (China)

- IRE Elit (Turkey)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 9.03 Billion |

| Market Forecast in 2030 (Value) | USD 21.01 Billion |

| Growth Rate | CAGR of 15.1% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

US Nuclear Medicine Market Asia Pacific Nuclear Medicine Market Europe Nuclear Medicine Market |

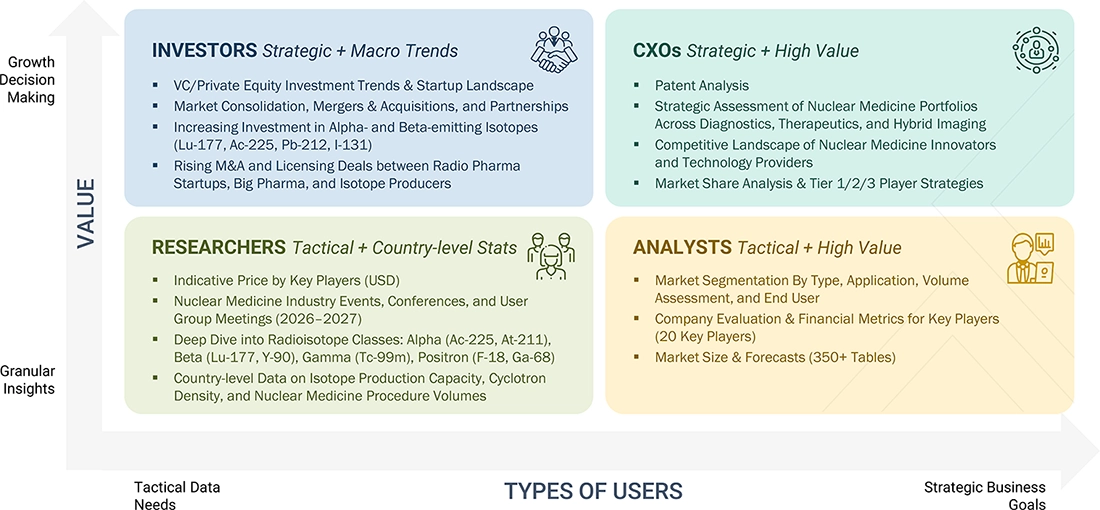

WHAT IS IN IT FOR YOU: NUCLEAR MEDICINE MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles of leading companies (GE HealthCare, Siemens Healthineers, Curium, Cardinal Health, Lantheus, and Bracco) involved in the nuclear medicine market, based on their products and services of radiopharmaceuticals, and imaging systems (PET/SPECT) |

|

| Market Entry & Growth Strategy |

|

|

| Regulatory & Operational Risk Analysis | Analysis of the approval routes for radio pharmacy products (FDA, EMA), nuclear safety standards, licensing, and risks in the supply of isotopes |

|

| Technology Adoption Trends | Understanding adoption of new radiotracers, theranostic, PET/MR imaging, radio pharmacy automation, and image analysis using artificial intelligence |

|

RECENT DEVELOPMENTS

- December 2024 : GE HealthCare acquired the remaining 50% interest in Nihon Medi-Physics Co., Ltd. from Sumitomo Chemical, obtaining full control of the company. The acquisition is expected to bolster the company’s offerings for radiopharmaceuticals in the SPECT and PET modalities, with the deal expected to be completed in early 2025, pending approvals.

- October 2024 : Jubilant Radio pharma partnered with Simplified Imaging Solutions to enhance operational efficiencies for nuclear medicine services in the US. This brought together their national radio pharmacy network and a diagnostic services organization to create one full-service offering.

- September 2024 : General Electric HealthCare announced that it has received approval from the US Food and Drug Administration for marketing an innovative PET myocardial perfusion imaging drug called Flyrcado, or flurpiridaz F 18 injection, for diagnosing coronary artery disease.

Table of Contents

Methodology

This study involved four major activities in estimating the size of the nuclear medicine market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the Organisation for Economic Co-operation and Development (OECD), European Association of Nuclear Medicine (EANM), National Institutes of Health (NIH), World Nuclear Association (WNA), International Atomic Energy Agency (IAEA), Nuclear Regulatory Commission (NRC), Society of Nuclear Medicine and Molecular Imaging (SNMMI), Nuclear Energy Agency (NEA), Australian Nuclear Science and Technology Organisation (ANSTO), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical decision support system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

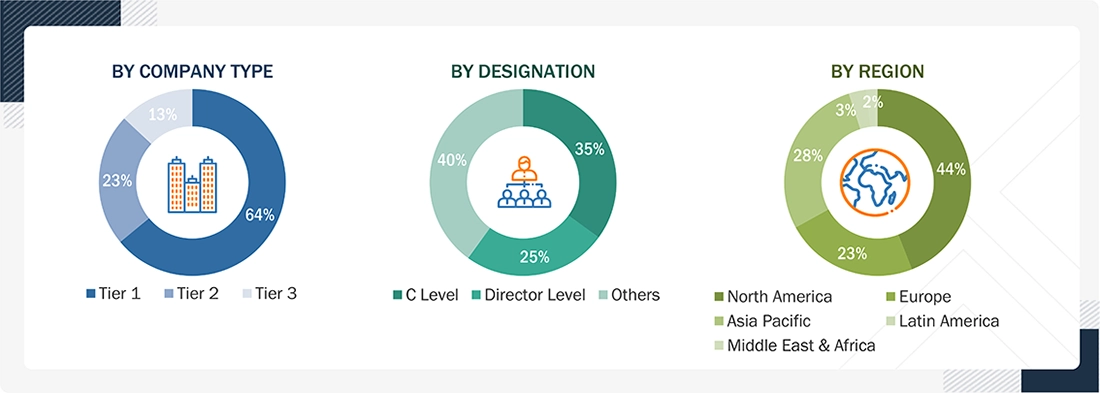

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the clinical decision support system market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Note 1: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Tiers of companies are defined on the basis of their total revenue in 2022; Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

Report Metric |

Details |

|

Siemens Healthineers |

Sr.Sales Manager |

|

Curium |

General Manager |

|

Cardinal Health |

Product Sales Specialist |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the nuclear medicine market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Market Definition

Radiopharmaceuticals are drugs that contain radionuclide-emitting ionizing radiation and are used in nuclear imaging to diagnose and treat diseases. The nuclear medicine market is bifurcated into diagnostic and therapeutic segments. Radiopharmaceuticals in the diagnostics market are categorized as SPECT and PET, while radiopharmaceuticals in the therapeutics market are categorized as beta emitters, alpha emitters, and brachytherapy isotopes.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the nuclear medicine market on the basis of type, application, procedure volume,end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as partnerships, collaborations, agreements, product approval & enhancements, expansions, and acquisitions in the nuclear medicine market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the nuclear medicine market.

- Profiling of additional market players (up to 3)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Nuclear Medicine Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Nuclear Medicine Market

John

May, 2022

Which segment accounted for the largest nuclear medicine market share?.

Kahlill

May, 2022

Which region has highest growth rate in Nuclear Medicine Market / Radiopharmaceuticals Market ?.

Rachel

May, 2022

Keen to get the updates on Nuclear Medicine Market Size Report, 2022 - 2030 .