Radiation Detection, Monitoring & Safety Market: Growth, Size, Share, and Trends

Radiation Detection, Monitoring & Safety Market by Product (Personal Dosimeter, Monitor: Area Process, Environment, Surface: Material, Software), Detector: Gas-filled, Scintillator, Solid-state, Type (Body, Face, Hand, Apron) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global radiation detection, monitoring & safety market is expected to reach USD 5,452.4 million by 2030 from USD 3,381.2 million in 2024, growing at a CAGR of 8.3%. The global radiation detection, monitoring, and safety market is witnessing robust growth driven by the growing demand for radiation protection in medical imaging, nuclear power generation, homeland security, and industrial applications. Rising public health concerns around exposure to ionizing radiation, the expansion of nuclear medicine procedures, and stringent government mandates for radiation monitoring in healthcare and nuclear facilities are shaping the industry outlook. Moreover, the growing deployment of personal dosimeters, area monitors, and radiation survey meters across hospitals, research laboratories, and defense facilities has expanded the market’s installed base. Advancements in scintillation and semiconductor detection technologies, coupled with digital integration in safety systems, are transforming radiation management into a real-time, data-driven domain.

KEY TAKEAWAYS

-

BY PRODUCTRadiation detection & monitoring products (personal dosimeters, area process monitors, environmental radiation monitors, surface contamination monitors), Material Monitors (radioactive material monitors, and other radiation detection and monitoring products) and radiation monitoring software. Radiation detection and monitoring products account for the largest share in the radiation detection, monitoring, and safety (RDMS) market due to their widespread use across multiple sectors, including healthcare, nuclear power, defense, and industrial applications.

-

BY COMPOSITIONDetectors (Gas-filled detectors (GM counters, ionization chambers, and proportional counters), scintillators (inorganic and organic scintillators), and solid-state detectors (semiconductor and diamond detectors), Radiation Protection Products (full-body protection products, face protection products, hand safety products, and other radiation safety products), Radiation Shielding Products (Lead Lined Radiation Shielding Walls, Others). Detectors account for the highest share in the Radiation Detection, Monitoring, and Safety (RDMS) market because they are the core components used across all radiation monitoring applications—from medical imaging and nuclear power plants to homeland security and environmental safety.

-

BY APPLICATIONIndustry (Nuclear Power Plant, Manufacturing, Radionucleotide), Safety & Security (Environmental, Homeland Saecurity & Defense), Diagnostics & therapy (Healthcare, Forensic), and other applications.Diagnostics and therapy account for the largest market share drivers in the medical sector because they directly address the growing demand for accurate disease detection and effective treatment solutions.

-

BY REGIONThe radiation detection, monitoring & safety market covers Europe, North America, Asia Pacific, LatinAmerica, the Middle East, and Africa. The Asia-Pacific region is the fastest-growing segment in the radiation detection, monitoring, and safety (RDMS) market due to rapid industrialization, expanding nuclear energy programs, and increasing healthcare investments. Countries such as China, India, Japan, and South Korea are actively developing nuclear power infrastructure and strengthening radiation safety regulations, driving significant demand for advanced detection and monitoring technologies.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Fortive (US), Thermo Fisher Scientific Inc. (US), Mirion technologies inc. (US), Fuji Electric C0 ltd (Japan), Ludlum measurements, inc (US), AMETEK INC.(US), have entered into a number of agreements and partnerships to cater to the growing demand for radiation monitors across innovative applications.

Key trends defining the market include the integration of AI and IoT-enabled radiation sensors, enabling remote monitoring and predictive safety alerts, and the miniaturization of radiation detectors for personal and wearable applications. There is a strong shift toward solid-state detectors and hybrid scintillators that provide superior energy resolution and durability compared to conventional gas-filled detectors. In medical domains, the growing number of PET/CT, SPECT, and interventional radiology procedures has amplified the use of radiation detection badges and patient dose monitoring solutions. Additionally, digital dosimetry systems integrated with hospital information systems (HIS) and cloud-based safety platforms are revolutionizing compliance workflows and regulatory reporting.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Disruptions are emerging from three major directions: (i) AI-driven radiation mapping and autonomous safety platforms enabling predictive analytics for radiation hotspots; (ii) transition toward eco-friendly scintillators such as cerium bromide and perovskite-based materials reducing toxicity and improving sensitivity; and (iii) integration of radiation monitoring in smart infrastructure and defense systems to counter radiological threats. Customers across nuclear and healthcare segments are facing pressure to adopt automated monitoring due to stricter ALARA (As Low As Reasonably Achievable) compliance norms and to address skilled workforce shortages through smart, self-calibrating detectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing number of PET/CT scans

-

Increasing usage of nuclear medicine and radiation therapy

Level

-

Increasing use of alternatives for nuclear energy

-

Shift in nuclear energy policies and increased nuclear phase-out

Level

-

Technological advancements in radiation detection

-

Rising focus on nuclear power in developing countries

Level

-

High cost of lead for manufacturing radiation safety products

-

Shortage of workforce and skilled professionals in nuclear power industry

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Growing number of PET/CT Scans

The use of radiological imaging is increasingly important for diagnosing and managing a range of medical conditions, including cancers, strokes, cardiovascular diseases, traumatic injuries, and neurological disorders. According to the World Health Organization (WHO), about 50 million people worldwide were diagnosed with dementia in 2022, with 10 million new cases expected to occur annually in the near future. Alzheimer's disease alone affects roughly 7 million people in the US, with projections suggesting this could rise to 13 million by 2050. The projected health costs related to dementia are estimated to reach USD 360 billion in 2024, potentially nearing USD 1 trillion by 2050. The global cancer burden is significant, with nearly 20 million new cases and 9.7 million deaths each year. By 2022, around 53.5 million cancer survivors had lived at least five years post-diagnosis. The American Cancer Society estimates 2,001,140 new cancer cases in 2024 in the US, with a mortality of 611,720. These trends highlight the growing need for advanced diagnostic imaging to manage Alzheimer's, cancer, and cardiovascular diseases.

Restraint: Increasing use of alternatives for nuclear energy

While nuclear power could resolve global electricity needs, there are concerns about its safety, such as the threat of a nuclear meltdown and the challenges involved in storing radioactive waste. Owing to human health and safety concerns, cities and nations are installing small and large-scale renewable power sources. Nuclear energy substitutes such as renewable energy (energy from sunlight, wind, rain, tides, waves, and geothermal heat) are expected to be a major threat to nuclear energy production, which, in turn, could hamper the growth of the radiation detection, monitoring, and safety market

Opportunity: Technological advancements in radiation detection

The potential for R&D in the market is poised for significant advancements, particularly concerning novel applications and functionalities in radiation detection, monitoring, and safety products across medical, homeland security & defense, and nuclear power sectors. In November 2024, researchers at the King Abdullah University of Science and Technology introduced a groundbreaking device designed to enhance the safety of X-ray operations by significantly mitigating background noise, referred to as “dark current,” in detection systems. This innovation utilizes methylammonium lead bromide perovskite crystals arranged in a specific cascade electrical configuration. The application of this cascading setup has been shown to reduce dark current by nearly two-thirds, resulting in a fivefold increase in sensitivity compared to previous detector configurations using similar crystal materials without cascade architecture. This advancement heralds the emergence of more sensitive, real-time monitorable devices for radiation detection. By integrating AI analytics with IoT radiation sensors and cloud-based monitoring solutions, various types of radiation can now be quantified in industrial settings with minimal human intervention. Enhanced spectroscopic radiation detectors facilitate improved isotope identification and greater accuracy for nuclear security and environmental monitoring applications. Furthermore, solid-state detectors, including silicon photomultipliers (SiPMs) and cadmium zinc telluride (CZT), are delivering superior resolution and mobility over conventional Geiger-Muller counters. The evolution of personal dosimeters, radiation-sensing drones, and machine learning algorithms is set to transform the landscape of radiological security across diverse fields, from healthcare and nuclear energy to home security applications.

Challenge: High cost of manufacturing radiation safety products

Lead remains the primary raw material for the production of radiation safety equipment, including gloves, aprons, and eyewear. Its application extends beyond this sector, encompassing fire protection systems and the manufacture of lead-acid batteries. The growing demand for lead across various industries suggests a looming escalation in its market value, which necessitates the exploration of alternative raw materials. As of 2024, lead prices have been projected in the range of USD 2,000–2,100 per ton. The rising cost of lead poses significant challenges for the global radiation detection, monitoring & safety sectors throughout the forecast period. Countries that are major lead producers, particularly China, Australia, and the US, have stringent environmental regulations governing mining and refining processes. Government organizations have created specific rules and regulations to ensure that these processes are conducted ethically and with the least environmental harm. These regulations could further tighten supply chains and amplify cost pressures within the market. Consequently, there is an urgent need to identify and innovate alternative radiation shielding materials. Promising candidates, including tungsten, bismuth, and polymer-based composites, are essential for achieving sustainability and cost-effectiveness in radiation protection solutions.

radiation protection market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Fortive’s RaySafe personal radiation dosimetry systems are used in more than 2,000 operating rooms worldwide to provide real-time insight into staff radiation exposure. | Helps maintain radiation levels within safe limits, reducing long-term health risks for medical and industrial personnel. |

|

Mirion supplied their SPIR Detect area monitors to the Italian Civil Defense Authority for monitoring critical infrastructure access points, thus enhancing perimeter monitoring and threat detection.. | Automated monitoring reduces manual dose recording, streamlines workflow, and improves response time in critical environments. |

|

AMETEK secured a contract with the U.S. Department of Homeland Security to deliver portable high-resolution germanium-based gamma ray detectors for screening cargo and vehicles at border crossings. | High-resolution detectors enable quick identification of radioactive sources, enhancing safety and threat response. |

|

From individual personnel dosimetry to large-scale vehicle or cargo monitoring, Thermo Fisher’s broad product portfolio meets diverse radiation safety needs. | Supports individual personnel dosimetry, area monitoring, environmental surveillance, and vehicle/cargo screening, meeting diverse radiation safety needs. |

|

From wearable personal dosimeters to large-scale environmental monitoring systems, Fuji Electric covers multiple exposure scenarios workers, patients, equipment areas, stray radiation. | Their personal dosimeters and monitoring stations provide immediate visual/audible alarms, along with telemetry capabilities for remote tracking and supervisory oversight. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem comprises a tightly interlinked network of component manufacturers, OEMs, software providers, service integrators, and end-users. Detector material suppliers (scintillators, semiconductors, gas chambers) form the base, followed by system integrators providing fixed and portable radiation monitoring systems. Software vendors deliver data management, visualization, and compliance tracking tools. Key end-users include hospitals, nuclear facilities, defense agencies, research laboratories, and environmental monitoring agencies. Collaborations between hardware manufacturers and digital safety platform providers are reshaping the value chain toward integrated radiation safety management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Radiation detection, monitoring & safety Market, By Product

In 2024, the radiation detection and monitoring products segment represents the most substantial market segment, primarily driven by the increasing reliance of the healthcare sector on advanced imaging modalities such as X-ray, CT, and PET scans, as well as radiation therapy. This trend necessitates the deployment of sophisticated dosimeters and radiation monitoring systems to ensure the safety of both patients and healthcare personnel. Moreover, nuclear power facilities and various industrial applications require continuous radiation level monitoring to adhere to the safety protocols established by regulatory bodies like the IAEA, NRC, and EPA. In the context of heightened concerns over radiological terrorism and the potential for nuclear incidents, there has been a marked increase in demand for both portable and fixed radiation detection systems, particularly within homeland security and defense sectors. Simultaneously, advancements in technology are propelling the market forward. Innovations such as AI-integrated radiation sensors, IoT-enabled remote monitoring capabilities, and real-time spectroscopic detectors are enhancing the effectiveness of radiation detection solutions, thereby further fueling growth in this sector.

Radiation detection, monitoring & safety Market, By Composition

In 2024, the detectors segment is currently experiencing the most rapid growth within the market. These detectors are crucial for accurately identifying and quantifying radiation levels across various sectors, including healthcare, nuclear energy, defense, and industrial safety. The increasing utilization of radiological imaging techniques, advanced radiotherapy methodologies, and nuclear medicine necessitates enhanced dosimeters, Geiger-Muller counters, and scintillation detectors for effective monitoring of exposure among patients and healthcare professionals in medical environments. Additionally, both fixed and portable radiation detection devices are essential for nuclear power facilities, industrial entities, and homeland security agencies to adhere to stringent safety regulations set forth by organizations such as the IAEA, NRC, and EPA. The rising demand for these detectors is largely driven by heightened concerns surrounding the potential risks of nuclear incidents, radiological terrorism, and environmental radiation exposure. This climate of uncertainty has prompted substantial investment from government bodies and industries into high-precision spectroscopic detectors, AI-integrated monitoring frameworks, and IoT-enabled real-time detection solutions. Consequently, the market position of radiation detectors has been further reinforced by these developments.

Radiation detection, monitoring & safety Market, By Application

Diagnostics and therapy account for the largest market share in the Radiation Detection, Monitoring & Safety market because these applications rely heavily on accurate radiation measurement and control to ensure patient safety and treatment efficacy. In medical imaging, radiotherapy, and nuclear medicine, precise monitoring of radiation doses is critical for both diagnostics and therapeutic procedures.

REGION

Asia Pacific to be fastest-growing region in global radiation detection, monitoring & safety market during forecast period

North America dominates the market owing to strong regulatory enforcement (U.S. NRC, OSHA, EPA), a mature nuclear energy sector, and the presence of key manufacturers such as Mirion Technologies, Thermo Fisher Scientific, and Fortive. The region also leads in advanced dosimetry adoption across medical and industrial settings. Conversely, Asia Pacific is the fastest-growing region, propelled by expanding nuclear power generation in China, India, and South Korea, the rising number of diagnostic imaging centers, and government investments in radiation safety infrastructure. Growing awareness around radiation protection standards in healthcare and industrial sectors is also catalyzing rapid technology adoption across emerging APAC economies.

radiation protection market: COMPANY EVALUATION MATRIX

The competitive landscape is moderately consolidated, led by Mirion Technologies, Fortive Corporation (Fluke Biomedical), Thermo Fisher Scientific, Ludlum Measurements, and Polimaster. These players compete on technology innovation, reliability, and compliance. Tier-1 companies are focusing on AI-enabled smart dosimeters, cloud-based radiation tracking platforms, and portable detection devices to strengthen recurring revenue models through service-based offerings. Strategic partnerships with hospitals, nuclear operators, and defense agencies are driving market leadership, while Tier-2 firms are differentiating via low-cost, region-specific products and modular integration capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific Inc (US)

- AMETEK, Inc. (US)

- Mirion Technologies, Inc. (US)

- Fortive (US)

- Fuji Electric Co., Ltd. (Japan)

- Ludlum Measurements, Inc.(US)

- Arktis Radiation Detectors Ltd (Switzerland)

- UAB Polimaster Europe (Republic of Belarus)

- Amray Group (Ireland)

- Infab, LLC (US)

- IBA Worldwide (Belgium)

- Bertin technologies (France)

- Radiation detection company (US)

- Arrow-tech, Inc (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.38 Billion |

| Market Forecast in 2030 (Value) | USD 5.45 Billion |

| Growth Rate | CAGR of 8.3% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Radiation detection & monitoring products (personal dosimeters, area process monitors, environmental radiation monitors, surface contamination monitors), Material Monitors (radioactive material monitors, and other radiation detection and monitoring products) and radiation monitoring software. Detectors (Gas-filled detectors (GM counters, ionization chambers, and proportional counters), scintillators (inorganic and organic scintillators), and solid-state detectors (semiconductor and diamond detectors), Radiation Protection Products (full-body protection products, face protection products, hand safety products, and other radiation safety products), Radiation Shielding Products (Lead Lined Radiation Shielding Walls, Others). End User: Industry (Nuclear Power Plant, Manufacturing, Radionucleotide), Safety & Security (Environmental, Homeland Saecurity & Defense), Diagnostics & therapy (Healthcare, Forensic), and other applications |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

Asia-Pacific radiation detection monitoring safety market European radiation detection monitoring safety market Radiation detectors market US radiation detection monitoring safety market |

WHAT IS IN IT FOR YOU: radiation protection market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Detailed analysis of detector technologies | Provided comprehensive report on latest detector types (scintillation, semiconductor, gas-filled) | Enables clients to understand technology trends and select optimal detector solutions |

| Market segmentation by end-use application | Customized segmentation by healthcare, nuclear, industrial, security sectors | Helps clients target high-growth verticals and tailor marketing strategies |

| Regional market forecasts and trends | Delivered forecasts with data for North America, Europe, Asia-Pacific, and emerging markets | Supports geographic expansion and investment planning |

| Competitive landscape profiling | Provided detailed profiles and SWOT analysis of key players like Fortive, Infab, IBA | Facilitates competitor benchmarking and strategic positioning |

| Regulatory impact assessment | Customized analysis on regional radiation safety regulations and compliance needs | Assists clients in aligning products with regulatory requirements |

RECENT DEVELOPMENTS

- February 2025 : Framatome and IBA announced they have signed a Memorandum of Understanding to start a strategic partnership aimed at advancing industrial-scale production of Astatine-211, an alpha-emitting radioisotope across Europe and the US.

- November 2024 : IBA signed a contract with BENEBION, a sterilization service provider, to install a Rhodotron TT1000 at the new cutting-edge irradiation site in San Luis Potosí, Mexico. The facility will function as a service center for phytosanitary treatments and medical device sterilization in the region.

- June 2024 : Bertin Technologies acquired VF Nuclear, a manufacturer of radiation protection and monitoring systems. Together, Bertin Technologies and VF Nuclear will be in a unique position in Europe and will be able to propose a fully compliant portfolio of radiation detection equipment for health physics and nuclear safety.

Table of Contents

Methodology

The study has used primary and secondary sources; the research involved investigating different factors influencing the industry to examine segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player approaches.

Secondary Research

Secondary research extensively uses secondary sources such as directories, databases (e.g., Bloomberg Businessweek, D&B Hoovers, Factiva), white papers, annual reports, company house documents, investor presentations, and SEC filings attached to companies. The secondary research assistance is used to source and collate general and technical data related to the market study and commercial analysis of the radiation detection, monitoring & safety market. It also acquired vital data relating to the key players, market taxonomy, and segmentation per industry trend as far as the base level and key developments related to market and technology perspectives. Secondary research has also prepared a database of key industry leaders.

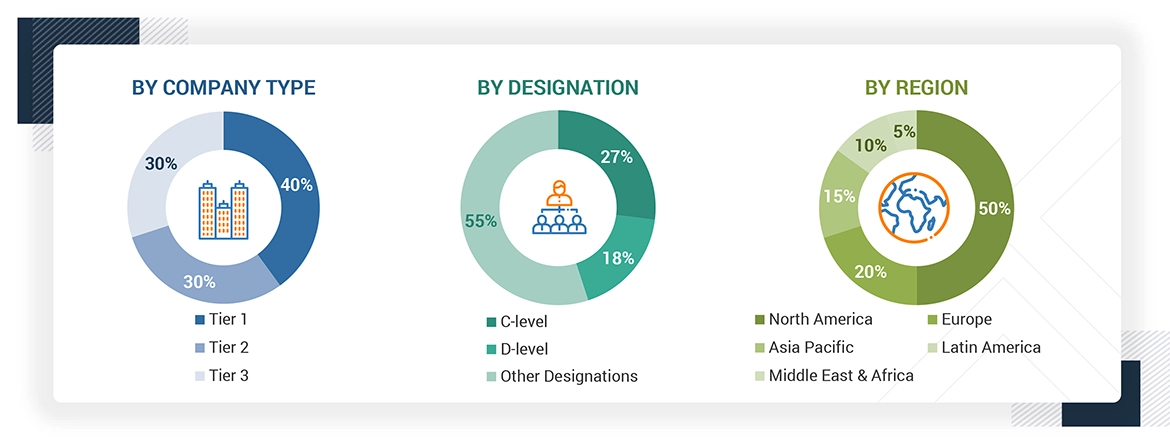

Primary Research

Varied sources from the supply and demand sides have been interviewed in the primary research process to gather qualitative and quantitative information for this report. Supply-side primary sources include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other major executives from various key companies and organizations in product therapy markets. Some primary sources on the demand side include medical OEMs, analytical instrument OEMs, CDMOs, and other service providers. The purpose of primary research is to validate the market segmentation, discover major players in the market, and gain insight into key industry trends and key market dynamics.

Note 1: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 2 billion,

Tier 2 = USD 50 million to USD 2 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

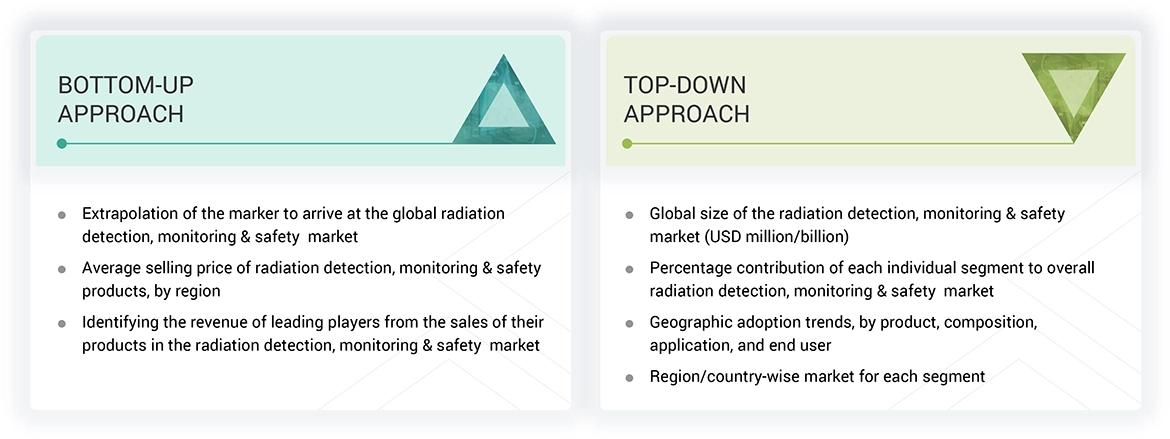

Market Estimation Methodology

The market size for radiation detection, monitoring & safety is determined in this report based on revenue estimates of significant market players. The scope included identifying the major players and determining their revenues from the market business through several insights gathered from the primary and secondary research phases. Secondary research involved looking into the annual and financial reports of leading players in the market. Primary research includes interviews with key opinion leaders such as CEOs, directors, and marketing executives.

This process calculated segmental revenues to arrive at the global market value using revenue mappings from major solution/service providers. This process involved the following steps:

- Establishing a list of major global players in the environmental testing products market.

- Mapping the annual revenues from the environmental testing products market (or nearest reported business unit/product category) generated from the major global players.

- Revenue mapping of key players to cover a major global market share as of 2023.

- Extrapolating the global value of the radiation detection, monitoring & safety market.

Radiation Detection, Monitoring & Safety Market : Top-Down and Bottom-Up Approach

Data Triangulation

After deriving the total market size from the aforementioned sizing process, the radiation detection, monitoring & safety market was subdivided into segments and subsegments. Data triangulation and market breakdown methodologies were employed to complete the market engineering process and to derive the exact market numbers for all segments and subsegments. The data was triangulated by analyzing several parameters and trends, including demand and supply. In addition, the radiation detection, monitoring & safety market was validated via combined top-down and bottom-up approaches.

Market Definition

The radiation detection, monitoring & safety market includes technologies and devices for measuring and protecting against harmful radiation across various industries, such as healthcare, nuclear power, defense, and environmental monitoring. Key products include radiation detectors, dosimeters, area monitors, and safety equipment that ensure regulatory compliance and safety for workers, patients, and the public. Market growth is driven by the rising use of radiation in medical imaging, advancements in nuclear energy, concerns about nuclear threats, and strict regulations. Innovations in real-time radiation monitoring and AI-based detection further propel this market forward.

Stakeholders

- Manufacturers and distributors of radiation detection, monitoring, and safety detectors & monitors

- Healthcare institutions

- Research institutions

- Research and consulting firms

- Medical device suppliers, distributors, channel partners, and third-party suppliers

- Clinicians and healthcare professionals

- Global and national health agencies

- Academic medical centers and universities

- Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

- Academic medical centers and universities

- Market research and consulting firms

- Clinical research organizations

- Group Purchasing Organizations (GPOs)

- Academic Medical Centers and Universities

- Accountable Care Organizations (ACOs)

Report Objectives

- To define, describe, and forecast the radiation detection, monitoring & safety market on product, composition, and application.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To profile the key market players and comprehensively analyze their market shares and core competencies.

- To forecast the revenue of the market segments concerning five main regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and Rest of Middle East & Africa)

- To track and analyze competitive developments such as new product launches and approvals; agreements, partnerships, expansions, acquisitions; and collaborations in the radiation detection, monitoring & safety market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the present global environmental testing products market.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top eleven companies.

Geographic Analysis as per Feasibility

- Further breakdown of the Rest of European radiation detection, monitoring & safety market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, Portugal, and other Rest of European countries

- Further breakdown of the Rest of Asia Pacific radiation detection, monitoring & safety market Singapore, Taiwan, New Zealand, the Philippines, Malaysia, and other Rest of Asia Pacific countries

- Further breakdown of the Rest of the World radiation detection, monitoring & safety market Latin America, the Middle East, and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to 11)

Frequently Asked Questions (FAQ)

What is the expected addressable market value of the global radiation detection, monitoring & safety market over a 5-year period?

The global mass spectrometry market is estimated to reach USD 5,452.4 million by 2030 from USD 3,654.5 million in 2025, at a CAGR of 8.3% during the forecast period

Which product segment is expected to garner the highest traction within the radiation detection, monitoring & safety market?

Based on product, the radiation detection and monitoring products segment held the largest market share in 2024.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, expansion, acquisitions, and collaborations as important growth tactics.

What are the major factors expected to limit the growth of the radiation detection, monitoring & safety market?

The market growth can be limited due to the increasing use of alternatives for nuclear energy, such as renewable energy (energy from sunlight, wind, rain, tides, waves, and geothermal heat).

Are there any challenges that detectors and monitors manufacturers are facing?

A shortage of workforce and skilled professionals in the nuclear power industry can be one of the challenges that may be affecting the manufacturing of radiation detectors and monitors.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Radiation Detection, Monitoring & Safety Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Radiation Detection, Monitoring & Safety Market

Randy

Mar, 2022

Which factors majorly hampers the global growth of Radiation Detection Market?.

Roy

Mar, 2022

How much percent share, does the products segment holds, of the Radiation Detection Market?.

Vincent

Mar, 2022

Which of the key players holds the major share of the global Radiation Detection Market?.