This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, ICIS articles, Factiva, and Bloomberg Businessweek, to identify and gather information for a technical, market-oriented, and commercial study of the rare earth metals leaching chemicals market. The primary sources include industry experts from core and related industries and preferred suppliers, regulatory bodies, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with different primary respondents, such as key industry participants, subject matter experts (SMEs), C-Level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies; white papers; publications from recognized websites; and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

After the complete market estimation process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research has been conducted to gather information and to verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, industry trends, key players, competitive landscape, industry trends, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

In the primary research process, different primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the rare earth metals leaching chemicals market.

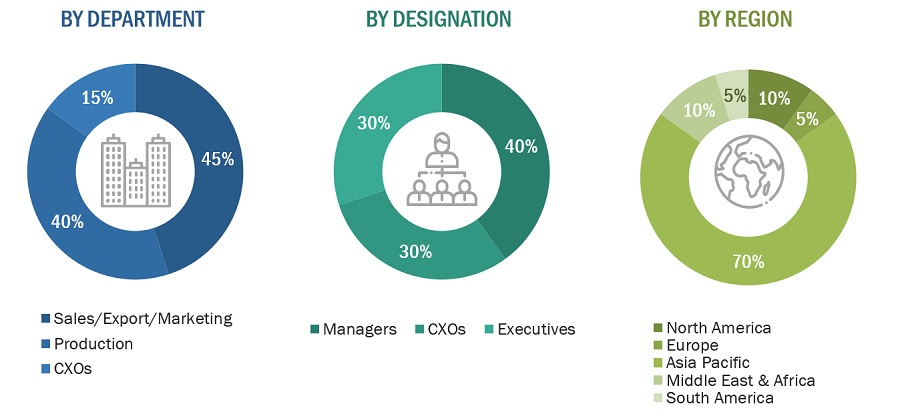

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market size estimation process, both the top-down and bottom-up approaches have been used, along with several data triangulation methods to carry out estimations and projections for the overall market and its sub-segments listed in this report. Extensive qualitative and quantitative analyses have been carried out on the complete process to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

-

The key players in the industry were identified through extensive secondary research.

-

The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

-

All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

The overall market size has been used in the top-down approach to estimate the sizes of other individual markets mentioned in the segmentation through percentage splits derived using secondary and primary sources.

For calculating each type of specific market segment, the size of the most appropriate immediate parent market has been considered for implementing the top-down approach. The bottom-up approach has also been implemented for data extracted from secondary research to validate the market sizes, in terms of value and volume, obtained for each segment.

The exact values of the overall parent and individual markets have been determined and confirmed through the data triangulation procedure and validation of data through primary interviews. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

Following the estimating process described above to determine the total market size, the market was divided into a number of segments and sub-segments. In order to complete the process of estimating the overall market size and determine the precise statistics for all segments and sub-segments, the data triangulation and market breakdown processes were used, where applicable. By examining multiple factors and trends from both the supply and demand sides, the data was triangulated. In addition, both top-down and bottom-up methods were used to validate the market size. After that, it was verified through primary interviews. As a result, there are three sources for each data segment: a top-down approach, a bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Rare earth elements are a group of 17 chemical elements that occur together. The group comprises yttrium and 15 lanthanide elements (lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium). These rare earth elements are present in small concentrations in mineral deposits (basanite and monazite) and ion clay. Therefore, the leaching process is employed to recover rare earth metals from sources. In the process of leaching, strong leaching agents that are required to separate and recover rare earth metals from their sources are known as rare earth metals leaching chemicals. These leaching chemicals are classified as hydrochloric acid, sulfuric acid, nitric acid, ammonium sulfate, citric acid, and others. The increasing demand for rare earth metals in end-use industries such as automotive and clean energy, and the increasing chemical market in Asia Pacific will lead to the growth of rare earth metals leaching chemicals in the forecast period.

Key Stakeholders

-

Manufacturers of rare earth metals leaching chemicals

-

Industry associations

-

Rare earth metals leaching chemicals traders, suppliers, and distributors

-

Regional manufacturers’ associations

-

Government and regional agencies and research organizations

Report Objectives

-

To define, describe, and forecast the rare earth metals leaching chemicals market in terms of value and volume.

-

To provide detailed information regarding the key factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges.

-

To analyze and forecast the market size in terms of value and volume, with respect to four main regions: North America, Europe, Asia-Pacific, Middle East and Africa, and South America.

-

To strategically analyze the micro markets with respect to individual growth trends, future prospects, and contribution to the total market

-

To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

-

To analyze competitive developments, such as products & services offered, and expansion, in the market

-

To strategically profile key players and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

-

Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

-

Further breakdown of the Rest of APAC Rare earth metals leaching chemicals market

-

Further breakdown of Rest of Europe Rare earth metals leaching chemicals market

-

Further breakdown of the Rest of Middle East & Africa Rare earth metals leaching chemicals market

-

Further breakdown of Rest of South America Rare earth metals leaching chemicals market

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Rare Earth Metals Leaching Chemicals Market