Real time Bidding Market by Auction Type (Open and Invited), Ad Format (RTB Image and RTB Video), Application (Media & Entertainment, Games, Retail & eCommerce, Travel & Luxury, Mobile Apps), Device (Mobiles, Desktops) and Region - Global Forecast to 2024

Real time Bidding Market analysis Size, Share,Industry, latest Trends and forecast 2024

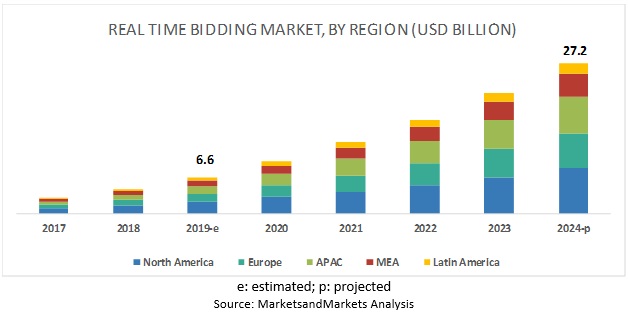

[123 Pages Report] The global real time bidding market to grow from USD 6.6 billion in 2019 to USD 27.2 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 32.9% during forecast period. Growing number of smartphone users and a focus on improved campaign performance and increased RoI are expected to drive the RTB market.

Retail and ecommerce application to grow at the highest CAGR during the forecast period

Retail and ecommerce companies focus on making a lot of investment in marketing solutions to reduce human errors, inefficiency, and time wastage. By deploying RTB platform into the operations, retail and ecommerce companies can display personalized ads to individual users based on their online activity. Also, it enables personalized retargeting, and buying and selling of individual page views in real time.

Open auction type to hold a larger market size during the forecast period

By auction type, the real time bidding market is segmented into open auction and invited auction. Among these, open auction is expected to hold a larger market size during the forecast period. Open auction is a type of auction where ad impression is bought and sold in real time and inventory prices are also determined in real time. Unlike the private auction process, open auction is available publicly, wherein any publishers or advertisers can participate in the process.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global real time bidding market, as the region has a large number of smartphone users. Also, the time spent by these users on watching online contents is also increasing. Hence, to target these customers, advertisers are focusing on deploying RTB solutions into their operations. Whereas, APAC is expected to grow at the highest rate during the forecast period. The growth across APAC is attributed to the increasing adoption of advanced marketing technologies among enterprises.

Top Real Time Bidding Market Companies

Major RTB vendors include Google (US), WPP plc (UK), Adobe (US), CRITEO ADVERTISING (France), Facebook (US), PubMatic (US), Smaato (US), Yandex (Russia), Salesforce (US), and Rubicon Project (US). These companies have adopted various organic and inorganic growth strategies, such as new product launches, product enhancements, partnerships, agreements, mergers, and acquisitions, to further expand their presence in the global RTB market.

Google primarily offers advertising services and generates maximum revenue from the same (over 85% of its revenue from advertising in 2018). Google is undertaking various organic and inorganic growth strategies to enhance its market boundaries across the globe. The US-based search engine provider has partnered with various companies to help them solve challenges associated with RTB. For instance, in January 2018, Google partnered with Publift, to help the latter launch Exchange Bidding in countries, such as New Zealand and Australia across 50 publishers. By deploying Google Ad Manager’s server-to-server solution, Publift could grow its Ad Manager revenue.

Adobe, a specialist in delivering digital marketing and media solutions, is undertaking various growth strategies to stay competitive and increase its market share. In the RTB market, Adobe is undertaking partnerships, acquisitions, and product enhancements strategies to compete with various other solution providers. For instance, in May 2016, Adobe introduced various updates to its Adobe Marketing Cloud solution, where the company integrated Adobe Dynamic Creative Optimization (DCO) feature into its Adobe Marketing Cloud solution.

Smaato follows both organic and inorganic growth strategies. In line with its organic growth strategies, the company has launched new products. For instance, Smaato has launched ATC product, which helps Smaato reduce the costs of programmatic bidding for Demand Side Platforms. The company is expanding its geographic reach to Germany by establishing a development office in Berlin. The company has also partnered with a cybersecurity solution company, Protected Media, to protect its network of publishers, app developers, and advertisers.

Scope of the report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

application, auction, ad format type, device and regions |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Real Time Bidding Market Companies covered |

Google (US), WPP (UK), Adobe (US), Criteo (France), Facebook (US), Smaato (US), Yandex (Russia), PubMatic (US), Salesforce (US), Rubicon Project (US), MediaMath (US), MoPub (US), AppNexus (US), Platform One (Japan), and Verizon Media (US) |

This research report categorizes the RTB market based on application, component, deployment mode, and region.

Based on Application, the Real Time Bidding Market has the following segments:

- Media and entertainment

- Games

- Retail and eCommerce

- Travel and luxury

- Mobile apps

- Others (Telecom, Education, BFSI, Music, Social and Politics)

Based on Auction, the RTB Market has the following segments:

- Open Auction

- Invited Auction

Based on ad Format, the Real Time Bidding Market has the following segments:

- RTB Image

- RTB Video

Based on Device, the RTB Market has the following segments:

- Mobiles

- Desktops

- Others (Laptops and Tablets)

Based on Regions, the RTB Market has the following segments:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In April 2018, Google introduced Exchange Bidding solution for its customers that use DoubleClick for Publishers (DFP) solution. Exchange Bidding solution provides multiple options to publishers to help them monetize their display ad inventory.

- In October 2018, Criteo acquired Silicon Valley-based app install advertising solution provider Manage, to support its existing app business as well as strengthen its advertising solution. The acquisition would help Criteo expand its client base across sectors, such as food delivery and ride-sharing.

- In December 2018, Smaato launched the hybrid auction model to offer a more flexible and profitable programmatic environment for both media buyers and publishers

Critical questions the report answers:

- What are the current trends in the Real Time Bidding Market driving the demand for technological advancements?

- What are the regulations that are impacting the market and use cases of various vendors providing RTB solution and platforms?

- What are various developments undertaken by key players in the RTB market and competitive analysis of vendors?

- How is the adoption of RTB across regions?

Frequently Asked Questions (FAQ):

What is Real-time Bidding?

What are the prominent players in the TTB market?

What are the top trends in the RTB?

Following are current market trends impacting the RTB:

Driving factors for the RTB market:

- Growing internet penetration and increase in the number of smartphone users

- Improved campaign performance and increased RoI

Opportunities for the Real time Bidding market:

- Increasing use of AI and ML in Real-time Bidding

- Increasing budgets for digital display advertising

What are the different auction types and AD formats in the RTB market?

Following are the different auction types and AD formats in the Real time Bidding market

-

Auction type

- Open Auction

- Invited Auction

-

AD format

- RTB Image

- RTB Video

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

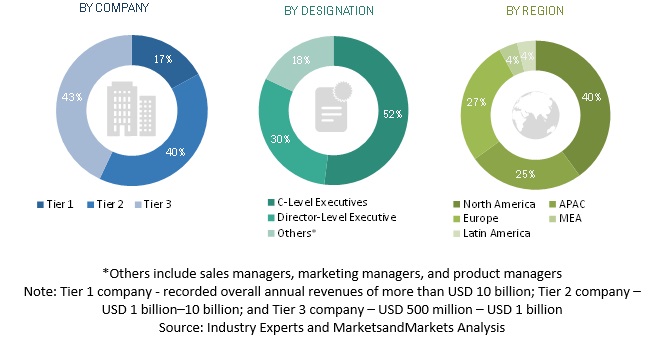

2.1.2.1 Breakup of Primary Participants’ Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Real Time Bidding Market

4.2 RTB Market Top 3 Applications

4.3 Market Top 3 Applications and Regions

4.4 Market By Application

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Internet Penetration and Increase in the Number of Smartphone Users

5.2.1.2 Improved Campaign Performance and Increased Roi

5.2.2 Restraints

5.2.2.1 Data Privacy Policies and Regulations

5.2.3 Opportunities

5.2.3.1 Increasing Use of AI and ML in RTB

5.2.3.2 Increasing Budgets for Digital Display Advertising

5.2.4 Challenges

5.2.4.1 Challenges Associated With Mobile Advertisement Frauds

5.2.4.2 Issues Related to Transparency

5.2.4.3 Concerns Related to AD Block and Skip AD Functionality

5.3 Regulatory Implications

5.3.1 General Data Protection Regulation (GDPR)

5.3.2 Data Protection Authority (DPA)

5.3.3 Information Technology (IT) Act, 2000

5.4 Regulatory Associations

5.4.1 Advertising Standards Authority (ASA)

5.4.2 Digital Advertising Alliance (DAA)

5.4.3 European Advertising Standards Alliance (EASA)

5.4.4 Australian Competition and Consumer Commission (ACCC)

5.4.5 Network Advertising Initiative (NAI)

5.5 Use Cases

5.5.1 Use Case: Scenario 1

5.5.2 Use Case: Scenario 2

5.5.3 Use Case: Scenario 3

5.5.4 Use Case: Scenario 4

5.5.5 Use Case: Scenario 5

6 Real Time Bidding Market By Auction Type (Page No. - 41)

6.1 Introduction

6.2 Open Auction

6.2.1 Growing Trend of Digital Display Advertising to Drive the Demand for Open Auction

6.3 Invited Auction

6.3.1 Invited Auction to Become Crucial in Providing More Control for Publishers Over AD Inventory

7 RTB Market By AD Format (Page No. - 45)

7.1 Introduction

7.2 RTB Image

7.2.1 Growing Demand for RTB Image Format to Effectively Deliver the Advertising Message

7.3 RTB Video

7.3.1 RTB Video is the Most Powerful Way to Engage Target Audience

8 Real Time Bidding Market By Application (Page No. - 49)

8.1 Introduction

8.2 Media and Entertainment

8.2.1 Need for Improving AD Performance and Reducing Media Wastage to Drive the Media Companies to Invest in RTB

8.3 Games

8.3.1 RTB is Becoming A Bigger Part of Games for Advertising

8.4 Retail and Ecommerce

8.4.1 Real-Time Bidding to Provide Better Targeting Capabilities for Improving AD Performance and Engaging Potential Customers

8.5 Travel and Luxury

8.5.1 RTB Helping Travel and Luxury Enterprises to Effectively Expand Their Reach and Increase Their Visibility of Offers

8.6 Mobile Apps

8.6.1 RTB Promoting Mobile Apps to Users Based on Their Interests

8.7 Others

9 Real Time Bidding Market By Device (Page No. - 56)

9.1 Introduction

9.2 Mobiles

9.2.1 Mobile Devices to Drive the Adoption of Real-Time Bidding Platforms and Solutions

9.3 Desktops

9.3.1 Video Advertising Becomes A Significant Component of Digital Advertising Strategy for Desktops

9.4 Others

10 Real Time Bidding Market By Region (Page No. - 60)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Increase in Use of Internet Applications to Boost the Demand for RTB Solutions Across the United States

10.2.2 Canada

10.2.2.1 Increasing Focus on Digital AD Campaigns to Fuel the Adoption of RTB Solutions in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Advertisers’ Increasing Focus on Digital Display Advertisement to Drive the Adoption of RTB Platforms and Solutions in the United Kingdom

10.3.2 France

10.3.2.1 Growing Focus of Advertisers and Publishers on the Adoption of RTB Solutions to Drive the Growth of RTB Market in France

10.3.3 Germany

10.3.3.1 Demand for Mobile Programmatic Advertisement to Drive the Growth of Market in Germany

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Growing Internet Users and Improvements in Advertising Industry to Drive the RTB Market

10.4.2 Japan

10.4.2.1 Growing Investments of RTB Solution Providers in the Region to Drive the Growth of RTB Market in Japan

10.4.3 Australia

10.4.3.1 Increasing Investments in Digital Advertising to Fuel the Adoption of RTB Solutions in Australia

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 United Arab Emirates (UAE)

10.5.1.1 On-The-Go Marketing Fostered By Mobile Gadgets Across Marketing Channels to Boost the Adoption of RTB Solutions Among Enterprises in the UAE

10.5.2 Israel

10.5.2.1 Increasing Adoption of Advanced Technologies to Fuel the Need for RTB Technology

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Emerging Technology Trends in Brazil to Drive the Growth of the Market in the Coming Years

10.6.2 Mexico

10.6.2.1 Improving Customer Experience Throughout the Buying Journey and Identifying Effective Marketing Channels to Propel the Adoption of RTB Solutions in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 83)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Visionaries

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

11.3 Strength of Product Portfolio

11.4 Business Strategy Excellence

12 Company Profiles (Page No. - 87)

12.1 Google

12.1.1 Business Overview

12.1.2 Platforms Offered

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 WPP

12.2.1 Business Overview

12.2.2 Platforms and Services Offered

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Adobe

12.3.1 Business Overview

12.3.2 Platforms Offered

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Facebook

12.4.1 Business Overview

12.4.2 Platforms Offered

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 CRITEO

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 MnM View

12.6 Smaato

12.6.1 Business Overview

12.6.2 Platforms Offered

12.6.3 Recent Developments

12.6.4 MnM View

12.7 Yandex

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.8 Rubicon Project

12.8.1 Business Overview

12.8.2 Solutions Offered

12.8.3 Recent Developments

12.8.4 MnM View

12.9 Pubmatic

12.9.1 Business Overview

12.9.2 Solutions Offered

12.9.3 Recent Developments

12.9.4 MnM View

12.10 Salesforce

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 MnM View

12.11 Mediamath

12.12 Mopub

12.13 Appnexus (A Xandr Company)

12.14 Platform One

12.15 Verizon Media

12.16 Match2one

13 Appendix (Page No. - 114)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: MarketsandMarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (51 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Global RTB Market Size and Growth, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Real Time Bidding Market Size, By Auction Type, 2017–2024 (USD Million)

Table 5 Open Auction: Market Size By Region, 2017–2024 (USD Million)

Table 6 Invited Auction: Market Size By Region, 2017–2024 (USD Million)

Table 7 Market Size, By AD Format, 2017–2024 (USD Million)

Table 8 RTB Image: Market Size By Region, 2017–2024 (USD Million)

Table 9 RTB Video: Market Size By Region, 2017–2024 (USD Million)

Table 10 Market Size, By Application, 2017–2024 (USD Million)

Table 11 Media and Entertainment: Market Size By Region, 2017–2024 (USD Million)

Table 12 Games: Market Size By Region 2017–2024 (USD Million)

Table 13 Retail and Ecommerce: Market Size By Region, 2017–2024 (USD Million)

Table 14 Travel and Luxury: Market Size By Region, 2017–2024 (USD Million)

Table 15 Mobile Apps: Market Size By Region, 2017–2024 (USD Million)

Table 16 Others: Market Size By Region, 2017–2024 (USD Million)

Table 17 Market Size, By Device, 2017–2024 (USD Million)

Table 18 Mobile: Market Size By Region, 2017–2024 (USD Million)

Table 19 Desktops: Market Size By Region, 2017–2024 (USD Million)

Table 20 Others: Market Size By Region, 2017–2024 (USD Million)

Table 21 Market Size, By Region, 2017–2024 (USD Million)

Table 22 Total Media AD Spending in North America, 2017–2024 (USD Billion)

Table 23 North America: Market Size By Auction Type, 2017–2024 (USD Million)

Table 24 North America: Market Size By AD Format, 2017–2024 (USD Million)

Table 25 North America: Market Size By Application, 2017–2024 (USD Million)

Table 26 North America: Market Size By Device, 2017–2024 (USD Million)

Table 27 North America: Market Size By Country, 2017–2024 (USD Million)

Table 28 Total Media AD Spending in Europe, 2017–2024 (USD Billion)

Table 29 Europe: Real Time Bidding Market Size, By Auction Type 2017–2024 (USD Million)

Table 30 Europe: Market Size By AD Format, 2017–2024 (USD Million)

Table 31 Europe: Market Size By Application, 2017–2024 (USD Million)

Table 32 Europe: Market Size By Device, 2017–2024 (USD Million)

Table 33 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 34 Total Media AD Spending in Asia Pacific, 2017–2024 (USD Billion)

Table 35 Asia Pacific: Market Size, By Auction Type, 2017–2024 (USD Million)

Table 36 Asia Pacific: Market Size By AD Format, 2017–2024 (USD Million)

Table 37 Asia Pacific: Market Size By Application, 2017–2024 (USD Million)

Table 38 Asia Pacific: Market Size By Device, 2017–2024 (USD Million)

Table 39 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 40 Total Media AD Spending in Middle East and Africa, 2017–2024 (USD Billion)

Table 41 Middle East and Africa: Market Size, By Auction Type, 2017–2024 (USD Million)

Table 42 Middle East and Africa: Market Size By AD Format, 2017–2024 (USD Million)

Table 43 Middle East and Africa: Market Size By Application, 2017–2024 (USD Million)

Table 44 Middle East and Africa: Market Size By Device, 2017–2024 (USD Million)

Table 45 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 46 Total Media AD Spending in Latin America, 2017–2024 (USD Billion)

Table 47 Latin America: Market Size, By Auction Type, 2017–2024 (USD Million)

Table 48 Latin America: Market Size By AD Format, 2017–2024 (USD Million)

Table 49 Latin America: Market Size By Application, 2017–2024 (USD Million)

Table 50 Latin America: Market Size By Device, 2017–2024 (USD Million)

Table 51 Latin America: Market Size By Country, 2017–2024 (USD Million)

List of Figures (40 Figures)

Figure 1 Global Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 North America to Account for the Highest Market Share in 2019

Figure 4 Market Snapshot By Auction Type, 2018

Figure 5 Market Snapshot By AD Format, 2018

Figure 6 Market Snapshot By Application, 2018

Figure 7 Market Snapshot By Device, 2018

Figure 8 Growing Use of Smartphones to Drive the Adoption of Real-Time Bidding

Figure 9 Retail and Ecommerce Application to Have the Highest CAGR During the Forecast Period

Figure 10 Retail and Ecommerce Application, and North America to Account for the Highest Market Shares in the Market in 2019

Figure 11 Banking, Financial Services, and Insurance Application to Register the Highest Market Share in 2019

Figure 12 Market Investment Scenario: Asia Pacific to Be the Best Region for Investments During the Forecast Period

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Real Time Bidding Market

Figure 14 Mobile Phone Internet User Penetration Worldwide (2014–2019)

Figure 15 Open Auction to Grow at A Higher CAGR During the Forecast Period

Figure 16 RTB Video Segment to Record A Higher CAGR During the Forecast Period

Figure 17 Retail and Ecommerce Application to Grow at the Highest CAGR During the Forecast Period

Figure 18 Mobiles Segment to Grow at the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 20 Japan to Register the Highest CAGR During the Forecast Period

Figure 21 Asia Pacific to Account for the Highest CAGR During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Retail and Ecommerce Application to Grow at the Highest CAGR During the Forecast Period

Figure 24 Retail and Ecommerce to Account for the Largest Market Size During the Forecast Period

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Retail and Ecommerce to Account for the Largest Market Size During the Forecast Period

Figure 27 Retail and Ecommerce to Account for the Largest Market Size During the Forecast Period

Figure 28 Retail and Ecommerce to Account for the Largest Market Size During the Forecast Period

Figure 29 Real Time Bidding Market (Global) Competitive Leadership Mapping, 2019

Figure 30 Google: Company Snapshot

Figure 31 SWOT Analysis: Google

Figure 32 WPP: Company Snapshot

Figure 33 Adobe: Company Snapshot

Figure 34 SWOT Analysis: Adobe

Figure 35 Facebook: Company Snapshot

Figure 36 SWOT Analysis: Facebook

Figure 37 CRITEO: Company Snapshot

Figure 38 Yandex: Company Snapshot

Figure 39 Rubicon Project: Company Snapshot

Figure 40 Salesforce: Company Snapshot

The study consists of 4 major activities to estimate the current market size of the real time bidding market. An exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the RTB market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; and databases.

Primary research

Various primary sources from both supply and demand sides of the real time bidding market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide the RTB solutions and associated service providers operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Real time Bidding Market Size Estimation

For making market estimates and forecasting the RTB market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global RTB market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the size of the Real time Bidding Market by application (media and entertainment, games, retail and eCommerce, travel and luxury, mobile apps, others (telecom, education, BFSI, music, and social and politics), auction type (open auction and invited auction), Ad format type (RTB Image and RTB Video), Device (Mobile, Desktops, and Others [laptops and tablets]) and region (North America, Asia Pacific [APAC], Europe, Latin America, and Middle East and Africa [MEA]).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the RTB market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of RTB market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the RTB ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches, such as product/solution/service launches, acquisitions, contracts, agreements, and partnerships, in the RTB market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Real Time Bidding Market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the Latin American RTB market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Real time Bidding Market

Reports looks interesting. Would like to know the business model of the all the major players.

The report looks interesting