Retail Point of Sale Market by Product (Fixed POS, Mobile POS), Component (Hardware, Software, and Services (eployment & Integration, Support & Maintenance)), End User (Grocery Stores, Specialty Stores, Gas Stations), and Region - Global Forecast to 2026

The Retail Point of Sale Market is expected to grow from $15.8 billion in 2020 to $34.4 billion by 2026. This growth is projected to have a compound annual growth rate (CAGR) of 13.9%. Consumers' growing desire for non-cash transactions, better data accessibility thanks to POS systems built on the cloud, and improved service delivery are the main drivers of industry growth. Nevertheless, concerns over data security might pose a problem for the market's expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on online businesses has increased significantly. The retail sector is leveraging the internet to provide necessary services to consumers.

Market Dynamics

Driver: Growing interest in non-cash transactions among consumers

Some of the key benefits of going cashless that are attracting more consumers include safety, growth on saved funds in accounts, better money management, and flexibility. The ability to make different types of digital payments through banking cards is enabling consumers to opt for cashless payment modes. Users can store their card information in digital payment apps or mobile wallets to mark cashless payments. With the rising concerns over the safety of handling cash transactions due to the COVID-19 pandemic, merchants, as well as consumers, are relying on contact-less payment modes to avoid the risk of getting infected.

Restraint: Data security concerns

Retail POS systems are prone to security vulnerabilities, such as device faults, skimming, phishing, and software and network weakness. Owing to the unsecured networks, hackers can easily infiltrate the infrastructure and access valuable records, such as business account data and customer credit card details. Even if the network is well-protected, devices need to be secured too. Hence, selecting technology products with inherent security measures is critical when deploying POS devices. With more advanced technologies being deployed and the growing integrations between the enterprise system, there is a significant rise in threats, such as data thefts and cyberattacks.

Opportunity: Growing interest in POS solutions among small businesses

Small businesses are implementing POS systems to benefit from the host of benefits associated with them. Effective POS systems allow business owners to reduce time spent on business/store administration by offering relevant reports to help speed-up decision-making, in a timely fashion. The streamlined POS systems also aid in increasing store profitability through effective inventory management. Solutions also facilitate targeted and personalized marketing campaigns through customer data acquired during sales transactions. As small businesses struggle with managing capital expenses, reports produced from POS data can offer a bird’s eye view of the business operations to determine the efficiency of different departments.

Challenge: High maintenance cost of wireless POS systems

The maintenance cost associated with the wireless POS systems is very high. Fixing the hardware used in POS systems is a difficult task. Despite being able to contact the manufacturer to help the user troubleshoot the problem, it may still require a costly, time-consuming visit from a service provider to fix the problem. Unlike the web-based systems providing free upgrades that keep them updated, the software-based upgrades cost too high. As a part of business expansion, every time an upgrade is necessary, the user has to pay for new licenses and software. The monthly subscription charges associated with these systems may diminish the Return on Investment (RoI) in the long run.

Grocery stores segment to hold the largest market size during the forecast period

Grocery stores have some tough competition and large chain supermarkets use technology to make their jobs easier. A POS system helps manage the grocery stores and makes checkouts quicker. The grocery store software will help better organize the business and meet customer expectations. For instance, National Retail Solutions created the POS+ so that hard-working businesses can have the same opportunities as bigger grocery stores and it offers countless advantages. Independent stores, such as small shops, present at a single location are highly adopting retail POS terminals for providing customers with digital payment services.

To know about the assumptions considered for the study, download the pdf brochure

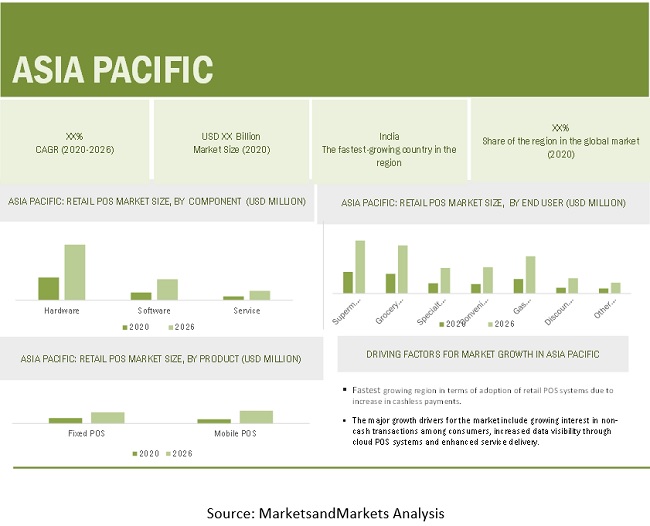

APAC to account for the highest CAGR during the forecast period

APAC countries are increasingly investing in retail POS projects. The retail POS market in APAC has been sub-segmented into China, Japan, India, and the rest of APAC. A rapidly growing customer base, due to the increasing prominence of SMEs, coupled with the reduction in TCO, is expected to drive the retail point of sale market growth in APAC. Benefits associated with retail POS systems, such as low queue time, high degree of security, paper-free receipt option, decrease in check-out space requirement, and increase in floor space, would help fuel the growth of the retail POS market in APAC. The booming retail sector and emerging infrastructures in the region would further facilitate the growth of the retail point of sale market in APAC. The major growth drivers for the market include growing interest in non-cash transactions among consumers, increased data visibility through cloud POS systems and enhanced service delivery. However, data security concerns may restrain the market growth.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the retail POS market include Diebold Nixdorf (US), Ingenico (France), Intuit (US), NCR Corporation (US), SAP (Germany), Verifone (US), PAX Technology (Hong Kong), Square (US), Shopify (Canada), NEC Corporation (Japan), Toshiba Tec Corporation (Japan), Epicor (US), Lightspeed (Canada), Clover (US), Elavon (US), Castels Technology (Taiwan), Newland Payment Technology (China), New POS Technology (China), HP (US), Cegid Grou (France), Posiflex Technology (Taiwan), Centerm (China), Revel System (US), Vend (New Zealand), Zebra Technologies (US).

The study includes an in-depth competitive analysis of these key players in the retail POS market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 15.8 Billion |

|

Market size value in 2026 |

USD 34.4 Billion |

|

Growth rate |

CAGR of 13.9% |

|

Market size available for years |

2014–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product (Fixed and Mobile), Component (Hardware, Software, and Services), End User (supermarkets/hypermarkets, grocery stores, specialty stores, convenience stores, gas stations, discount stores, and other end users), and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Diebold Nixdorf (US), Ingenico (France), Intuit (US), NCR Corporation (US), SAP (Germany), Verifone (US), PAX Technology (Hong Kong), Square (US), Shopify (Canada), NEC Corporation (Japan), Toshiba Tec Corporation (Japan), Epicor (US), Lightspeed (Canada), Clover (US) and many more. |

This research report categorizes the Retail POS market to forecast revenues and analyze trends in each of the following subsegments:

Based on Product:

- Fixed

- Mobile

Based on Component:

- Hardware

- Software

- Services

Based on End User:

- Supermarkets/Hypermarkets

- Grocery Stores

- Specialty Stores

- Convenience Stores

- Gas Stations

- Discount Stores

- Other End Users

- Others (Department Stores and Miscellaneous Retailers)

Based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2021, NCR is looking to acquire Cardtronics. The acquisition of Cardtronics will accelerate and expand the NCR-as-a-service strategy.

- In December 2020, Intuit acquired Credit Karma, the consumer technology platform with more than 110 million members in the US, Canada, and the UK.

- In November 2020, SAP acquired Emarsys, one of the leading omnichannel customer engagement platform providers.

- In September 2020, Diebold Nixdorf partnered with Co-op Group to include managed services and remote monitoring of self-service and POS systems throughout the UK. This comprehensive offering optimizes members' shopping journeys by speeding up consumer checkout and enhances the company's operational efficiency.

- In November 2019, Ingenico partnered with FinTech Pundi X to enable crypto transactions around the world. Pundi X completed the integration of its XPOS software with the Point-Of-Sale (POS) APOS A8 devices of Ingenico.

Frequently Asked Questions (FAQ):

What is the projected market value of the global retail POS market?

The global retail POS market size is projected to grow from USD 15.8 billion in 2020 to USD 34.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 13.9% during the forecast period.

Which region has the highest market share in the retail POS market?

North America followed is expected to hold the largest market share in the retail POS market.

Which end user segment is expected to witness a higher adoption rate in the coming years?

The grocery stores segment to witness a higher adoption rate in the coming years. Grocery stores have some tough competition and large chain supermarkets use technology to make their jobs easier. A POS system helps manage the grocery stores and makes checkouts quicker. The grocery store software will help better organize the business and meet customer expectations.

Which product is expected to grow at the highest CAGR during the forecast period?

The mobile POS segment is expected to grow at the highest CAGR during the forecast period. the mobile POS segment to register the highest CAGR during the forecast period. The popularity of tablets and other handheld devices and changing payment options, such as credit cards and mobile payments, have made mobile POS systems an attractive option for retailers. The emergence of new payment methods, such as Near Field Communication (NFC), Europay, MasterCard, and Visa (EMV), are urging retailers and merchants to necessarily comply with these technologies, which is expected to spur the demand for mobile POS worldwide.

Who are the major vendors in the retail POS market?

Key and innovative vendors in the retail POS market include Diebold Nixdorf (US), Ingenico (France), Intuit (US), NCR Corporation (US), SAP (Germany), Verifone (US), PAX Technology (Hong Kong), Square (US), Shopify (Canada), NEC Corporation (Japan), Toshiba Tec Corporation (Japan), Epicor (US), Lightspeed (Canada), Clover (US), Elavon (US), Castels Technology (Taiwan), Newland Payment Technology (China), New POS Technology (China), HP (US), Cegid Grou (France), Posiflex Technology (Taiwan), Centerm (China), Revel System (US), Vend (New Zealand), Zebra Technologies (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 6 RETAIL POS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM HARDWARE, SOFTWARE, AND SERVICES OF RETAIL POS VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL HARDWARE, SOFTWARE, AND SERVICES OF RETAIL POS VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, ILLUSTRATION OF COMPANY REVENUE ESTIMATION

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 4, TOP DOWN (DEMAND SIDE): SHARE OF RETAIL POS

2.4 IMPACT OF COVID-19 ON RETAIL Point of SALE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 IMPACT ON MARKET

2.4.1 IMPACT OF COVID-19 PANDEMIC

2.5 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.6 COMPETITIVE EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPETITIVE EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 ASSUMPTIONS FOR THE STUDY

2.9 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 14 RETAIL POINT-OF-SALE MARKET TO WITNESS STEADY GROWTH DURING FORECAST PERIOD

FIGURE 15 TOP THREE LEADING SEGMENTS IN RETAIL POS MARKET IN 2020

FIGURE 16 RETAIL POINT-OF-SALE MARKET: REGIONAL MARKET SCENARIO

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN RETAIL POINT OF SALE MARKET

FIGURE 17 GROWING INTEREST IN NON-CASH TRANSACTIONS AMONG CONSUMERS, RISING PENETRATION OF ECOMMERCE PLATFORMS, AND ENHANCED SERVICE DELIVERY TO FUEL GROWTH OF MARKET

4.2 MARKET, BY PRODUCT, 2020

FIGURE 18 MOBILE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET, BY COMPONENT, 2020

FIGURE 19 HARDWARE SEGMENT TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

4.4 MARKET, BY SERVICE, 2020

FIGURE 20 DEPLOYMENT AND INTEGRATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY END USER, 2020

FIGURE 21 CONVENIENCE STORES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.6 RETAIL POINT OF SALE MARKET, MARKET SHARE OF TOP THREE END USERS AND REGIONS, 2020

FIGURE 22 GROCERY STORES AND NORTH AMERICA TO HOLD HIGHEST MARKET SHARES IN 2020

4.7 MARKET INVESTMENT SCENARIO

FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW (Page No. - 53)

5.1 MARKET DYNAMICS

FIGURE 24 RETAIL POS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Growing interest in non-cash transactions among consumers

FIGURE 25 GLOBAL VOLUME OF NON-CASH TRANSACTIONS (2014–2019)

5.1.1.2 Enhanced service delivery

5.1.1.3 Increased data visibility through cloud POS systems

5.1.2 RESTRAINTS

5.1.2.1 Data security concerns

5.1.2.2 Lack of standardization

5.1.3 OPPORTUNITIES

5.1.3.1 Rising penetration of eCommerce platforms

FIGURE 26 GLOBAL RETAIL ECOMMERCE SALES (USD TRILLION)

5.1.3.2 Growing interest in POS solutions among small businesses

5.1.3.3 Strong growth in global retail industry

5.1.4 CHALLENGES

5.1.4.1 Lack of consumer awareness

5.1.4.2 High maintenance cost of wireless POS systems

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

5.2.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 RETAIL POINT OF SALE MARKET: COVID-19 IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS: RETAIL POS MARKET

5.4 ECOSYSTEM

FIGURE 28 MARKET: ECOSYSTEM

5.5 AVERAGE SELLING PRICE TREND

TABLE 4 RETAIL POS SYSTEMS: AVERAGE PRICE TREND

5.6 PORTER’S FIVE FORCES MODEL ANALYSIS

FIGURE 29 MARKET: PORTER'S FIVE FORCE ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 YC-YCC SHIFT

FIGURE 30 YC-YCC SHIFT FOR RETAIL POINT OF SALE MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE

5.8.2 NEAR FIELD COMMUNICATION

5.8.3 CYBERSECURITY

5.9 REGULATORY IMPLICATIONS AND STANDARDS

5.9.1 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD

5.9.2 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.9.3 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 10536

5.9.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 14443

5.10 USE CASES

5.10.1 OPENBRAVO AND DECATHLON STRENGTHEN THEIR POS PARTNERSHIP

5.10.2 BIG Y SELECTS NCR’S CLOUD POS

5.10.3 PAR TECH PARTNERS WITH MOBIVITY TO DRIVE DIGITAL TRANSFORMATION

5.10.4 INGENICO DELIVERS ENHANCED CUSTOMER EXPERIENCE AT CITY FURNITURE STORES

6 RETAIL POS MARKET, BY PRODUCT (Page No. - 66)

6.1 INTRODUCTION

FIGURE 31 MOBILE POS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 5 MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 6 PRODUCTS: MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 7 PRODUCTS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 8 PRODUCTS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2 FIXED POS

6.2.1 FIXED POS: RETAIL POINT OF SALE MARKET DRIVERS

6.2.2 FIXED POS: COVID-19 IMPACT

TABLE 9 FIXED POS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 10 FIXED POS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 MOBILE POS

6.3.1 MOBILE POS: MARKET DRIVERS

6.3.2 MOBILE POS: COVID-19 IMPACT

TABLE 11 MOBILE POS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 12 MOBILE POS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 RETAIL POS MARKET, BY COMPONENT (Page No. - 72)

7.1 INTRODUCTION

FIGURE 32 SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 13 COMPONENTS: MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 14 COMPONENTS: MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 15 COMPONENTS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 16 COMPONENTS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.2 HARDWARE

7.2.1 HARDWARE: RETAIL POINT OF SALE MARKET DRIVERS

7.2.2 HARDWARE: COVID-19 IMPACT

TABLE 17 HARDWARE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 18 HARDWARE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 SOFTWARE

7.3.1 SOFTWARE: MARKET DRIVERS

7.3.2 SOFTWARE: COVID-19 IMPACT

TABLE 19 SOFTWARE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 20 SOFTWARE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4 SERVICES

7.4.1 SERVICES: RETAIL POS MARKET DRIVERS

7.4.2 SERVICES: COVID-19 IMPACT

TABLE 21 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 22 SERVICES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4.3 CONSULTING

TABLE 23 CONSULTING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 24 CONSULTING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4.4 DEPLOYMENT AND INTEGRATION

TABLE 25 DEPLOYMENT AND INTEGRATION: RETAIL POINT OF SALE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 26 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.4.5 SUPPORT AND MAINTENANCE

TABLE 27 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 28 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 RETAIL POS MARKET, BY END USER (Page No. - 82)

8.1 INTRODUCTION

FIGURE 33 CONVENIENCE STORES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 END USERS: MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 30 END USERS: MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 31 END USERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 32 END USERS: RETAIL POINT OF SALE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.2 SUPERMARKETS/HYPERMARKETS

8.2.1 SUPERMARKETS/HYPERMARKETS: MARKET DRIVERS

8.2.2 SUPERMARKETS/HYPERMARKETS: COVID-19 IMPACT

TABLE 33 SUPERMARKETS/HYPERMARKETS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 34 SUPERMARKETS/HYPERMARKETS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 GROCERY STORES

8.3.1 GROCERY STORES: RETAIL POS MARKET DRIVERS

8.3.2 GROCERY STORES: COVID-19 IMPACT

TABLE 35 GROCERY STORES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 36 GROCERY STORES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.4 SPECIALTY STORES

8.4.1 SPECIALTY STORES: MARKET DRIVERS

8.4.2 SPECIALTY STORES: COVID-19 IMPACT

TABLE 37 SPECIALTY STORES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 38 SPECIALTY STORES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.5 CONVENIENCE STORES

8.5.1 CONVENIENCE STORES: RETAIL POINT OF SALE MARKET DRIVERS

8.5.2 CONVENIENCE STORES: COVID-19 IMPACT

TABLE 39 CONVENIENCE STORES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 40 CONVENIENCE STORES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.6 GAS STATION

8.6.1 GAS STATIONS: MARKET DRIVERS

8.6.2 GAS STATIONS: COVID-19 IMPACT

TABLE 41 GAS STATIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 42 GAS STATIONS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.7 DISCOUNT STORES

8.7.1 DISCOUNT STORES: RETAIL POINT OF SALE MARKET DRIVERS

8.7.2 DISCOUNT STORES: COVID-19 IMPACT

TABLE 43 DISCOUNT STORES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 44 DISCOUNT STORES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.8 OTHER END USERS

TABLE 45 OTHER END USERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 46 OTHER END USERS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 RETAIL POS MARKET, BY REGION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 34 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 47 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 48 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: RETAIL POINT OF SALE MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 49 NORTH AMERICA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: RETAIL POINT OF SALE MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4 UNITED STATES

TABLE 59 UNITED STATES: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 60 UNITED STATES: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 61 UNITED STATES: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 62 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 63 UNITED STATES: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 66 UNITED STATES: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.2.5 CANADA

TABLE 67 CANADA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 71 CANADA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: RETAIL POS MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 75 EUROPE: MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 80 EUROPE: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4 UNITED KINGDOM

TABLE 85 UNITED KINGDOM: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 86 UNITED KINGDOM: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 87 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 88 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 89 UNITED KINGDOM: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 90 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 91 UNITED KINGDOM: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 92 UNITED KINGDOM: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.3.5 GERMANY

TABLE 93 GERMANY: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 94 GERMANY: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 95 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 96 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 97 GERMANY: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 98 GERMANY: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 99 GERMANY: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.3.6 FRANCE

TABLE 101 FRANCE: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 103 FRANCE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 104 FRANCE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 105 FRANCE: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 106 FRANCE: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 107 FRANCE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 108 FRANCE: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.3.7 REST OF EUROPE

TABLE 109 REST OF EUROPE: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 111 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 112 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 113 REST OF EUROPE: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: RETAIL POS MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 122 ASIA PACIFIC: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4 CHINA

TABLE 127 CHINA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 128 CHINA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 129 CHINA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 130 CHINA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 131 CHINA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 132 CHINA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 133 CHINA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 134 CHINA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.4.5 JAPAN

TABLE 135 JAPAN: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 136 JAPAN: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 137 JAPAN: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 138 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 139 JAPAN: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 140 JAPAN: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 141 JAPAN: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 142 JAPAN: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.4.6 INDIA

TABLE 143 INDIA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 144 INDIA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 145 INDIA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 146 INDIA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 147 INDIA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 148 INDIA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 149 INDIA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 150 INDIA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.4.7 SOUTH KOREA

TABLE 151 SOUTH KOREA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 152 SOUTH KOREA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 153 SOUTH KOREA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 154 SOUTH KOREA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 155 SOUTH KOREA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 156 SOUTH KOREA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 157 SOUTH KOREA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 158 SOUTH KOREA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.4.8 REST OF ASIA PACIFIC

TABLE 159 REST OF APAC: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 160 REST OF APAC: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 161 REST OF APAC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 162 REST OF APAC: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 163 REST OF APAC: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 164 REST OF APAC: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 165 REST OF APAC: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 166 REST OF APAC: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 LATIN AMERICA: RETAIL POS MARKET DRIVERS

9.5.2 LATIN AMERICA: COVID-19 IMPACT

9.5.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 167 LATIN AMERICA: MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 172 LATIN AMERICA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4 BRAZIL

TABLE 177 BRAZIL: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 178 BRAZIL: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 179 BRAZIL: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 180 BRAZIL: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 181 BRAZIL: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 182 BRAZIL: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 183 BRAZIL: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 184 BRAZIL: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.5.5 MEXICO

TABLE 185 MEXICO: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 186 MEXICO: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 187 MEXICO: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 188 MEXICO: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 189 MEXICO: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 190 MEXICO: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 191 MEXICO: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 192 MEXICO: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.5.6 REST OF LATIN AMERICA

TABLE 193 REST OF LATIN AMERICA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 194 REST OF LATIN AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 195 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 196 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 197 REST OF LATIN AMERICA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 198 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 199 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 200 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST AND AFRICA

9.6.1 MIDDLE EAST AND AFRICA: RETAIL POS MARKET DRIVERS

9.6.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.6.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 201 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 202 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.4 KINGDOM OF SAUDI ARABIA

TABLE 211 KINGDOM OF SAUDI ARABIA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 212 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 213 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 214 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 215 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 216 KINGDOM OF SAUDI ARABIA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 217 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 218 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.6.5 SOUTH AFRICA

TABLE 219 SOUTH AFRICA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 220 SOUTH AFRICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 221 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 222 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 223 SOUTH AFRICA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 224 SOUTH AFRICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 225 SOUTH AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 226 SOUTH AFRICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.6.6 REST OF MIDDLE EAST AND AFRICA

TABLE 227 REST OF MIDDLE EAST AND AFRICA: RETAIL POS MARKET SIZE, BY PRODUCT, 2014–2019 (USD MILLION)

TABLE 228 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 229 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 230 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 231 REST OF MIDDLE EAST AND AFRICA: RETAIL POINT OF SALE MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 232 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 233 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 234 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 166)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 RETAIL POINT OF SALE: MARKET EVALUATION FRAMEWORK

10.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 38 RETAIL POINT OF SALE MARKET, REVENUE ANALYSIS

10.4 HISTORICAL REVENUE ANALYSIS

FIGURE 39 REVENUE ANALYSIS OF KEY MARKET PLAYERS

10.5 RANKING OF KEY PLAYERS IN RETAIL POS MARKET, 2020

FIGURE 40 KEY PLAYERS RANKING, 2020

10.6 COMPANY EVALUATION MATRIX

10.6.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 235 EVALUATION CRITERIA

10.6.2 STAR

10.6.3 PERVASIVE

10.6.4 EMERGING LEADERS

10.6.5 PARTICIPANTS

FIGURE 41 RETAIL POINT OF SALE MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

10.7 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN RETAIL POS MARKET

10.8 BUSINESS STRATEGY EXCELLENCE

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN RETAIL POINT OF SALE MARKET

10.9 STARTUP/SME EVALUATION MATRIX, 2020

10.9.1 PROGRESSIVE COMPANIES

10.9.2 RESPONSIVE COMPANIES

10.9.3 DYNAMIC COMPANIES

10.9.4 STARTING BLOCKS

FIGURE 44 RETAIL POINT OF SALE MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11 COMPANY PROFILES (Page No. - 175)

(Business Overview, Products & Solutions, Key Insights, Recent Developments, MnM View)*

11.1 DIEBOLD NIXDORF

FIGURE 45 DIEBOLD NIXDORF: COMPANY SNAPSHOT

11.2 INGENICO

FIGURE 46 INGENICO: COMPANY SNAPSHOT

11.3 INTUIT

FIGURE 47 INTUIT: COMPANY SNAPSHOT

11.4 NCR

FIGURE 48 NCR: COMPANY SNAPSHOT

11.5 SAP

FIGURE 49 SAP: COMPANY SNAPSHOT

11.6 VERIFONE

11.7 PAX GLOBAL TECHNOLOGY

FIGURE 50 PAX GLOBAL TECHNOLOGY: COMPANY SNAPSHOT

11.8 SHOPIFY

FIGURE 51 SHOPIFY: COMPANY SNAPSHOT

11.9 NEC

FIGURE 52 NEC: COMPANY SNAPSHOT

11.10 TOSHIBA TEC

11.11 EPICOR

11.12 ELAVON

11.13 CASTELS TECHNOLOGY

11.14 NEWLAND PAYMENT TECHNOLOGY

11.15 HP

11.16 CEGID

11.17 POSIFLEX TECHNOLOGY

11.18 CENTERM

11.19 ZEBRA TECHNOLOGIES

*Details on Business Overview, Products & Solutions, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 STARTUP COMPANY PROFILES

11.20.1 LIGHTSPEED

11.20.2 CLOVER

11.20.3 VEND

11.20.4 NEWPOSTECH

11.20.5 REVEL SYSTEM

11.20.6 SQUARE

12 ADJACENT/RELATED MARKETS (Page No. - 214)

12.1 INTRODUCTION

12.2 CONTACTLESS PAYMENT MARKET

12.2.1 MARKET DEFINITION

TABLE 236 SERVICES: CONTACTLESS PAYMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 237 NORTH AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 238 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 239 SERVICES: CONTACTLESS PAYMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.3 WIRELESS POS MARKET

12.3.1 MARKET DEFINITION

TABLE 240 WIRELESS POS TERMINAL MARKET, BY TYPE, 2014–2023 (USD MILLION)

TABLE 241 WIRELESS POS TERMINAL MARKET FOR PORTABLE COUNTERTOP AND PIN PAD, BY INDUSTRY, 2014–2023 (USD MILLION)

TABLE 242 WIRELESS POS TERMINAL MARKET FOR PORTABLE COUNTERTOP AND PIN PAD, BY REGION, 2014–2023 (USD MILLION)

TABLE 243 PORTABLE COUNTERTOP AND PIN PAD MARKET FOR RETAIL, BY REGION, 2014–2023 (USD MILLION)

12.4 CLOUD POS MARKET

12.4.1 MARKET DEFINITION

TABLE 244 CLOUD POS MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 245 TRAINING, CONSULTING, AND INTEGRATION: CLOUD POS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 246 SUPPORT AND MAINTENANCE: CLOUD POS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13 APPENDIX (Page No. - 218)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

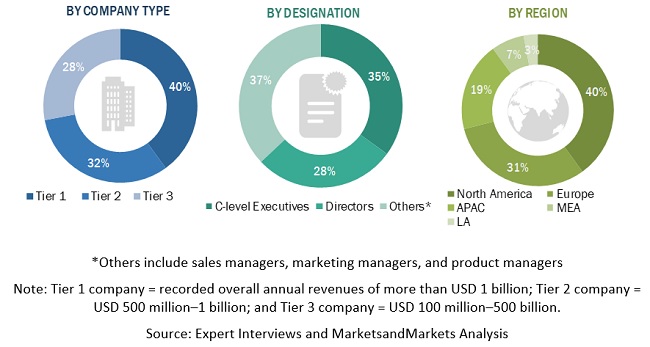

The study involved four major activities to estimate the current size of the Retail POS market. An exhaustive secondary research was done to collect information on the retail point of sale market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for companies offering Retail POS offerings was arrived at based on the secondary data available through paid and unpaid sources, by analyzing product portfolios of the major companies in the ecosystem, and rating companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; and white papers, journals, and certified publications. Secondary sources were used to identify and collect useful information for this extensive, technical, and commercial study on the global supply chain management market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from Retail POS vendors, Retail POS software and hardware providers, industry associations, independent Retail POS consultants, and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of end users using Retail POS solutions, were interviewed to understand the buyer’s perspective on the suppliers, and solution and service providers, and their current use of solutions.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Retail POS market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Retail Point-of-Sale (Retail POS) market by product, component (hardware, software, and services), end user, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Middle East and Africa (MEA), Asia Pacific (APAC), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of the COVID-19 outbreak on the growth of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of APAC into countries in Retail POS market size

- Further breakup of Latin America into countries in market size

- Further breakup of MEA into countries in market size

- Further breakup of Europe into countries in retail point of sale market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Retail Point of Sale Market