Rich Communication Services (RCS) Market by Application (Advertising Campaign, Content Delivery, and Integrated Solutions), End-User (Consumers and Enterprises), Enterprise Size, Enterprise Vertical, and Region - Global Forecast to 2025

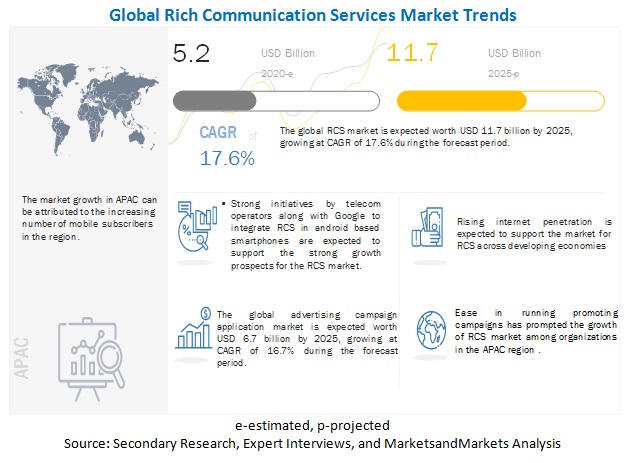

[230 Pages Report] The global Rich Communication Services (RCS) market size is projected to grow from USD 5.2 billion in 2020 to USD 11.7 billion by 2025, at a CAGR of 17.6% during 20202025. Major growth factors for the rich communication services market include Increasing investments on digital marketing across the enterprise verticals.

COVID-19 impact on RCS Market

The COVID-19 outbreak has significantly impacted several communication service providers across the globe. Major countries from North America, Europe, APAC, MEA, and Latin America are badly affected in the pandemic and industry giants from several regions are taking initiatives to enable consumers with best quality communication services and stay connected with their network of employees and customers.

Market Dynamics

Driver: Increasing number of advertising and marketing companies

RCS has been bringing a new level of interactivity to A2P and P2P messaging domains. It enables companies to visually brand their messages, allowing them to retain their corporate branding and identitywhen communicating with customers. Marketing through RCS would enable brands to offer some degree of customization, such as the ability to use custom colors, logos, and company brand names as sender IDs, allowing companies to send messages that maintain the look and feel of their apps, websites, and other digital offerings. The RCS platform has helped companies attract the attention of end users and encourage interaction between them. RCS is expected to transform digital marketing and advertising strategies. For brands and businesses, the traditional SMS method is no longer their core communications channel. These businesses require more interactive ways of communicating with their customers. With the rapidly growing hyper-connected consumers, RCS plays an increasingly prominent role in marketing and advertising efforts to provide more authentic and personalized engagement opportunities.

Restraint: Limited capability to offer end-to-end encryption

RCS is gaining momentum in replacing the current SMS protocol, as it enables individuals to create compelling, immersive, and engaging rich communication messages. Despite its benefits, it can be difficult to convince consumers to use RCS as it lacks the ability to offer end-to-end encryption of messages.Sensitive information cannot be shared via RCS, as RCS providers can see the messages of consumers. Thus, RCS is not categorized as an end-to-end encrypted messaging channel, which places it at a disadvantage against other competing chat apps, such as iMessage, WhatsApp, and Signal, with strong message encryption features.

Opportunities: Strict regulations for OTT messaging services to boost the adoption of RCS

OTT services are raising many issues and challenges for the whole telecommunication ecosystem, especially telecom operators. The national regulation bodies such as TRAI in India, or groups of regulators such as BEREC in Europe and CITC in Saudi Arabia have implemented strong compliance for limiting OTT messaging services. For instance, the UAE's Telecommunications Regulatory Authority (TRA) has banned all Voice Over Internet Protocol (VoIP) applications, such as WhatsApp calling and Skype, as they do not comply with the UAE's regulatory framework. Since RCS is supervised by GSMAs universal profile, the adoption of RCS is expected to increase in the near future. Strong compliance for limiting OTT messaging services would boost the adoption of RCS, enabling consumers to access a wide variety of online services, which go beyond traditional voice and messaging services provided by telecom operators. MNOs have planned ways to overthrow OTT apps, such as WhatsApp, WeChat, and Facebook Messenger, by replacing them with RCS. They are working to create an interoperable service across mobile devices and networks to obtain benefits from a messaging service that could compete with the above-mentioned apps, as the current SMS and Multimedia Messaging Service (MMS) systems are outdated. RCS is directly tied to consumers phone numbers; therefore, the installation of extra apps or the creation of accounts will not be necessary as third parties will be eliminated. It does not use data as MNOs are preparing to offer unlimited text messaging plans. However, this can be possible only if universal support for RCS is developed.

Challenges: Difficulty to cope with OTT service providers

The rapid adoption of smartphones provides consumers with access to a wide variety of communication services, which go beyond the traditional services of voice and messaging provided by mobile operators. The OTT service provides a far superior consumer experience. It helps control and distributes audio, video, and other media content, over the internet, without the involvement of a multiple-system operator. It also allows the delivery of film and TV content via the internet, without requiring users to subscribe to a traditional cable or satellite pay-TV service. Various OTT players that offer media platforms, voice calling, and messaging platforms include Roku, Apple TV, ChromeCast, Skype or Google Voice, WhatsApp, Viber, and Telegram. OTT services have great coverage, whereas RCS usage is relatively small. Thus, it becomes difficult to cope with OTT service providers.

Large enterprise to hold the largest market size during the forecast period

Large enterprises usually have the necessary resources to carry multiple operations, which may include separate business units to concentrate on advertising and marketing. Easy availability of resources and funds makes it easy for large enterprises to adopt upcoming technologies as a part of their marketing and advertising strategy.

RCS for healthcare enterprise vertical to record the fastest growth rate during the forecast period

Most of the hospitals and doctors are already adopting patient engagement solutions, which are primarily powered through OTT applications, which are now thereby offloaded to RCS messaging to provide diagnostic test results, appointment reminders, claim status, health tips, payment reminders, and location lookup as well as to improve the overall patient experience. The increasing world population, lifestyle change, and awareness about health-related issues have all contributed to the massive growth in healthcare.

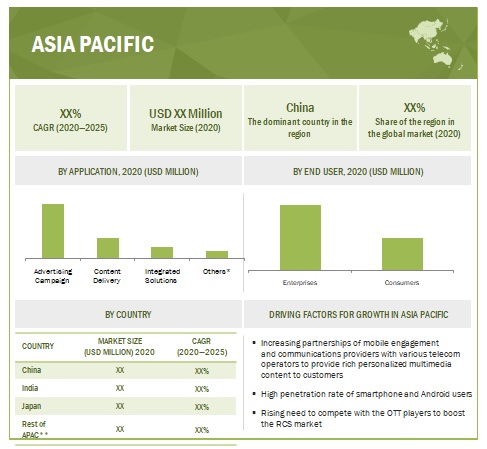

APAC to record the highest growth rate during the forecast period

The growth driver for RCS in the APAC region is increasing population, rising smartphone connections, increasing the mobile payments, growing the retail industry, and the use of advanced SMS systems for marketing and customer relationship management. Many mobile engagement and communications providers in this region have partnered with various telecom operators to provide rich, personalized multimedia content to their customers.

Market Players:

Key market players profiled in this report AT&T (US), Vodafone (Uk), Deutsche Telekom (Germany), Google (US), Verizon (US), Telefonica (Spain), and Orange Business (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20162025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Applications, End Users, Enterprise Size, Enterprise Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

AT&T (US), Vodafone (Uk), Deutsche Telekom (Germany), Google (US), Verizon (US), Telefonica (Spain), Orange Business (US), China Mobile (China), KDDI (Japan), Slovak Telekom (Slovakia), Telit (UK), SK Telecom (South Korea), Telstra (Australia), LG U+ (South Korea), Celcom (Malaysia), Freedom Mobile (Canada), Rogers (Canada), T-Mobile (US), O2 (UK), Telia Company (Sweden), Magyar Telekom (Hungary), Claro (Brazil), Swisscom (Switzerland), and Reliance Jio (India). |

The research report categorizes the rich communications services market to forecast the revenues and analyze trends in each of the following subsegments:

Applications

- Advertising Campaign

- Content Delivery

- Integrated Solutions

- Others

End users

- Consumers

- Enterprises

Enterprise Size

- SMEs

- Large enterprises

Enterprise Vertical

- BFSI

- Telecom and IT

- Media and Entertainment

- Tourism and Logistics

- Retail and eCommerce

- Healthcare

- Other Enterprise Vertical (Government and Utilities)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In April, 2020 Telstra partnered with Google to roll out RCS for more handsets in the Australia.

- In March 2019, Telefonica partnered with CK Hutchison, the renowned multinational conglomerate. The partnership aims to offer fixed, mobile, and other digital communication services to large enterprises and Multinational Companies (MNCs)

- In January 2019, Google rolled RCS chat on the Google Fi network and devices, as well as upgraded international data speeds to LTE. This service supports all Pixel phones, along with the Android One Moto X4, Moto G6, LG V35, and LG G7.

- In December 2018, Verizon launched RCS messaging and called it as Chat instead of RCS to make the feature marketable to broad audiences space. Verizon integrated its RCS messaging only with Google Pixel 3 and 3 XL.

- In December 2018, Telefonica Deutschland extended its partnership with Telefonica International Wholesale Services (TIWS). As per the deal, TIWS would be responsible for Telefonica Deutschlands all international and IPX services.

- In November 2018, AT&T upgraded an early proprietary version of RCS for Android implementation to global GSMA standards.

- In March 2018, Deutsche Telekom introduced the RCS service for Magyar Telekoms residential and enterprise customers. This new messaging service supplements the still frequently used text message, which has been available for 25 years, as well as the MMS image forwarding service, with new functions: internet-based individual and group chat, HD quality photo, video sharing, file sending, own geographical location sharing, or even group message sending options.

Frequently Asked Questions (FAQ):

What is the estimated market value of the global rich communication services market?

The global rich communication services market is expected to grow from USD 5.2 billion in 2020 to USD 11.7 billion by 2025.

What is the estimated growth rate of the global rich communication services market?

The global rich communication services market is estimated to register a moderate Compound Annual Growth Rate (CAGR) of 17.6 % during the forecast period

Which application segment of the rich communication services market expected to witness the highest growth?

The content delivery segment is expected to grow at the highest CAGR during the forecast period.

Which are the major vendors operative in the global rich communication services market?

AT&T, Vodafone, Deutsche Telekom, and Google are the key plyers in RCS market.

What are the challenges for stakeholders in rich communication services market?

Challenging factors for the stakeholders of rich communication services market includes:

- Difficulty to Cope With OTT Service Providers

- Lower User Base Due to Proliferation of Messaging Apps

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSI

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20162019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL RICH COMMUNICATION SERVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 GLOBAL RCS MARKET SIZE ESTIMATION METHODOLOGY AND KEY ASSUMPTIONS

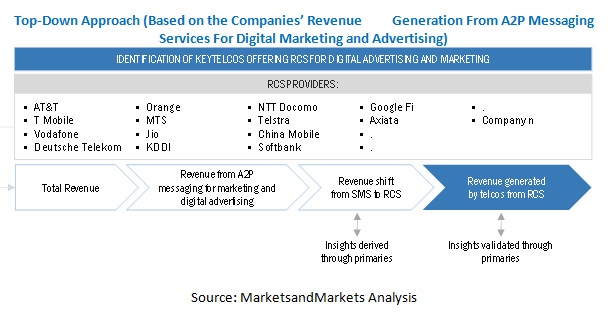

FIGURE 8 METHOD 1: TOP-DOWN APPROACH (BASED ON THE COMPANIES REVENUE GENERATION FROM A2P MESSAGING SERVICES FOR DIGITAL MARKETING AND ADVERTISING)

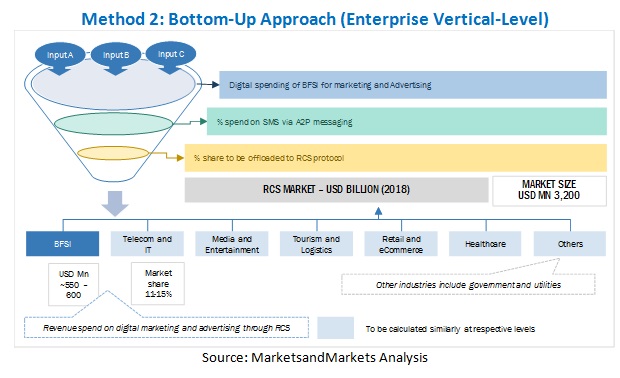

FIGURE 9 METHOD 2: BOTTOM-UP APPROACH (ENTERPRISE VERTICAL-LEVEL)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 RICH COMMUNICATION SERVICES FOR ADVERTISING CAMPAIGN TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 11 ENTERPRISES END USER TO ACCOUNT FOR A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 12 RETAIL AND ECOMMERCE ENTERPRISE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 13 LARGE ENTERPRISES SEGMENT TO RECORD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 14 ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE GLOBAL RICH COMMUNICATION SERVICES MARKET

FIGURE 15 GROWING NUMBER OF PARTNERSHIPS TO SUPPORT MARKET GROWTH

4.2 MARKET, COVID-IMPACT ANALYSIS

FIGURE 16 COVID-19 IS EXPECTED TO HAMPER THE GROWTH OF MARKET SIZE DURING THE FORECAST PERIOD

4.3 MARKET, BY APPLICATION, 2020

FIGURE 17 ADVERTISING CAMPAIGN SEGMENT TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2020

4.4 NORTH AMERICA: MARKET, BY ENTERPRISE SIZE AND END USER, 2020

FIGURE 18 LARGE ENTERPRISES SEGMENT AND ENTERPRISES END USER TO RECORD HIGH MARKET SHARES IN NORTH AMERICA IN 2020

4.5 ASIA PACIFIC: MARKET, BY ENTERPRISE SIZE AND END USER, 2020

FIGURE 19 LARGE ENTERPRISES SEGMENT AND ENTERPRISES END USER TO RECORD HIGH MARKET SHARES IN ASIA PACIFIC IN 2020

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 RICH COMMUNICATION SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing number of advertising and marketing companies

5.2.2 RESTRAINTS

5.2.2.1 Limited capability to offer end-to-end encryption

5.2.2.2 Lack of interoperability between OEMs and carrier networks

5.2.3 OPPORTUNITIES

5.2.3.1 Strict regulations for OTT messaging services to boost the adoption of RCS

5.2.4 CHALLENGES

5.2.4.1 Difficulty to cope with OTT service providers

5.2.4.2 Lower user base due to proliferation of messaging apps

5.3 CUMULATIVE GROWTH ANALYSIS

5.4 USE CASES

5.5 ENABLING TECHNOLOGIES

5.5.1 ARTIFICIAL INTELLIGENCE

5.5.2 INTERNET OF THINGS

6 RICH COMMUNICATION SERVICES MARKET, BY APPLICATION (Page No. - 56)

6.1 INTRODUCTION

6.1.1 APPLICATION: COVID-19 IMPACT

FIGURE 21 CONTENT DELIVERY SEGMENT TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 3 MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 4 MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

6.2 ADVERTISING CAMPAIGN

6.2.1 STRONG MARKETING ACTIVITIES ON DIGITAL PLATFORMS TO BOOST RCS ADOPTION FOR ADVERTISING CAMPAIGNS

TABLE 5 ADVERTISING CAMPAIGN: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 6 ADVERTISING CAMPAIGN: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 7 ADVERTISING CAMPAIGN: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 8 ADVERTISING CAMPAIGN: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 9 ADVERTISING CAMPAIGN: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 10 ADVERTISING CAMPAIGN: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 11 ADVERTISING CAMPAIGN: RICH COMMUNICATION SERVICES MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20162019 (USD MILLION)

TABLE 12 ADVERTISING CAMPAIGN: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20202025 (USD MILLION)

TABLE 13 ADVERTISING CAMPAIGN: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 14 ADVERTISING CAMPAIGN: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 15 ADVERTISING CAMPAIGN: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 16 ADVERTISING CAMPAIGN: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

6.3 CONTENT DELIVERY

6.3.1 GROWING INFLUENCE OF SOCIAL MEDIA ACROSS MULTITUDES TO SUPPORT GROWTH FOR CONTENT DELIVERY

TABLE 17 CONTENT DELIVERY: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 18 CONTENT DELIVERY: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 19 CONTENT DELIVERY: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 20 CONTENT DELIVERY: RICH COMMUNICATION SERVICES MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 21 CONTENT DELIVERY: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 22 CONTENT DELIVERY: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 23 CONTENT DELIVERY: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20162019 (USD MILLION)

TABLE 24 CONTENT DELIVERY: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20202025 (USD MILLION)

TABLE 25 CONTENT DELIVERY: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 26 CONTENT DELIVERY: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 27 CONTENT DELIVERY: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 28 CONTENT DELIVERY: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

6.4 INTEGRATED SOLUTIONS

6.4.1 EASE OF MULTICHANNEL COMMUNICATION ACROSS THE GLOBE TO BE THE MAJOR MARKET DRIVER FOR INTEGRATED SOLUTIONS

TABLE 29 INTEGRATED SOLUTIONS: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 30 INTEGRATED SOLUTIONS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 31 INTEGRATED SOLUTIONS: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 32 INTEGRATED SOLUTIONS: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 33 INTEGRATED SOLUTIONS: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 34 INTEGRATED SOLUTIONS: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 35 INTEGRATED SOLUTIONS: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20162019 (USD MILLION)

TABLE 36 INTEGRATED SOLUTIONS: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20202025 (USD MILLION)

TABLE 37 INTEGRATED SOLUTIONS: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 38 INTEGRATED SOLUTIONS: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 39 INTEGRATED SOLUTIONS: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 40 INTEGRATED SOLUTIONS: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

6.5 OTHER APPLICATIONS

TABLE 41 OTHER APPLICATIONS: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 42 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 43 OTHER APPLICATIONS: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 44 OTHER APPLICATIONS: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 45 OTHER APPLICATIONS: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 46 OTHER APPLICATIONS: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 47 OTHER APPLICATIONS: MARKET SIZE, BY APAC COUNTRY, 20162019 (USD MILLION)

TABLE 48 OTHER APPLICATIONS: MARKET SIZE, BY APAC COUNTRY, 20202025 (USD MILLION)

TABLE 49 OTHER APPLICATIONS: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 50 OTHER APPLICATIONS: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 51 OTHER APPLICATIONS: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 52 OTHER APPLICATIONS: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

7 RICH COMMUNICATION SERVICES MARKET, BY END USER (Page No. - 76)

7.1 INTRODUCTION

7.1.1 END USER: COVID-19 IMPACT

FIGURE 22 CONSUMERS SEGMENT TO RECORD A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

TABLE 53 MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 54 MARKET SIZE, BY END USER, 20202025 (USD MILLION)

7.2 CONSUMERS

7.2.1 GROWING INTERNET PENETRATION AND CONSEQUENT DEMAND FOR RICH MEDIA DELIVERY PLATFORMS WITHIN P2P TO SUPPORT THE FAVORABLE GROWTH OF RCS AMONG CONSUMERS

TABLE 55 CONSUMERS: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 56 CONSUMERS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 57 CONSUMERS: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 58 CONSUMERS: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 59 CONSUMERS: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 60 CONSUMERS: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 61 CONSUMERS: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20162019 (USD MILLION)

TABLE 62 CONSUMERS: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20202025 (USD MILLION)

TABLE 63 CONSUMERS: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 64 CONSUMERS: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 65 CONSUMERS: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 66 CONSUMERS: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

7.3 ENTERPRISES

7.3.1 GROWING PROLIFERATION OF DIGITAL CONTENT DELIVERY THROUGH A2P MESSAGING SERVICES TO SUPPORT ADOPTION AMONG ENTERPRISES

TABLE 67 ENTERPRISES: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 68 ENTERPRISES: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 69 ENTERPRISES: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 70 ENTERPRISES: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 71 ENTERPRISES: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 72 ENTERPRISES: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 73 ENTERPRISES: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20162019 (USD MILLION)

TABLE 74 ENTERPRISES: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20202025 (USD MILLION)

TABLE 75 ENTERPRISES: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 76 ENTERPRISES: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 77 ENTERPRISES: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 78 ENTERPRISES: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

8 RICH COMMUNICATION SERVICES MARKET, BY ENTERPRISE SIZE (Page No. - 87)

8.1 INTRODUCTION

8.1.1 ENTERPRISE SIZE: COVID-19 IMPACT

FIGURE 23 LARGE ENTERPRISES SEGMENT TO RECORD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 79 MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 80 MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES TO BE SIGNIFICANT REVENUE CONTRIBUTORS FOR RICH COMMUNICATION SERVICE VENDORS IN THE NEAR FUTURE

TABLE 81 SMALL AND MEDIUM-SIZED ENTERPRISES: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 82 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 83 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 84 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 85 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 86 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 87 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20162019 (USD MILLION)

TABLE 88 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20202025 (USD MILLION)

TABLE 89 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 90 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 91 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 92 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 EASY AVAILABILITY OF RESOURCES AND FUNDS TO DRIVE THE ADOPTION OF RCS AMONG LARGE ENTERPRISES

TABLE 93 LARGE ENTERPRISES: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 94 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 95 LARGE ENTERPRISES: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 96 LARGE ENTERPRISES: MARKET SIZE, BY NORTH AMERICA COUNTRY, 20202025 (USD MILLION)

TABLE 97 LARGE ENTERPRISES: MARKET SIZE, BY EUROPE COUNTRY, 20162019 (USD MILLION)

TABLE 98 LARGE ENTERPRISES: MARKET SIZE, BY EUROPE COUNTRY, 20202025 (USD MILLION)

TABLE 99 LARGE ENTERPRISES: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20162019 (USD MILLION)

TABLE 100 LARGE ENTERPRISES: MARKET SIZE, BY ASIA PACIFIC COUNTRY, 20202025 (USD MILLION)

TABLE 101 LARGE ENTERPRISES: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20162019 (USD MILLION)

TABLE 102 LARGE ENTERPRISES: MARKET SIZE, BY MIDDLE EAST AND AFRICA COUNTRY, 20202025 (USD MILLION)

TABLE 103 LARGE ENTERPRISES: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20162019 (USD MILLION)

TABLE 104 LARGE ENTERPRISES: MARKET SIZE, BY LATIN AMERICA COUNTRY, 20202025 (USD MILLION)

9 RICH COMMUNICATION SERVICES MARKET, BY ENTERPRISE VERTICAL (Page No. - 98)

9.1 INTRODUCTION

9.1.1 ENTERPRISE VERTICAL: COVID-19 IMPACT

FIGURE 24 HEALTHCARE ENTERPRISE VERTICAL TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 105 MARKET SIZE, BY ENTERPRISE VERTICAL, 20162019 (USD MILLION)

TABLE 106 MARKET SIZE, BY ENTERPRISE VERTICAL, 20202025 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1 AUTHENTICATIONS, SERVICE REMINDERS, POLICY DELIVERIES, AND OTHER USE CASES FOR CUSTOMER ENGAGEMENT TO SUPPORT STRONG ADOPTION OF RCS

TABLE 107 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 108 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.3 TELECOM AND IT

9.3.1 GROWING NUMBER OF TELECOM USERS AND INCREASING NUMBER OF IT-ENABLED SUBCRIBERS TO DRIVE THE MARKET GROWTH IN TELECOM AND IT INDUSTRY

TABLE 109 TELECOM AND IT: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 110 TELECOM AND IT: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.4 MEDIA AND ENTERTAINMENT

9.4.1 RISING PROLIFERATION OF OTT MEDIA PLAYERS TO SUPPORT THE RCS MARKET GROWTH IN MEDIA AND ENTERTAINMENT INDUSTRY

TABLE 111 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 112 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.5 TOURISM AND LOGISTICS

9.5.1 PROMINENT USE CASES, SUCH AS TICKETING, REAL-TIME LOCATION STATUS, AND DELIVERY UPDATES, TO SUPPORT RCS ADOPTION IN TOURISM AND LOGISTICS INDUSTRY

TABLE 113 TOURISM AND LOGISTICS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 114 TOURISM AND LOGISTICS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.6 RETAIL AND ECOMMERCE

9.6.1 DIGITAL MARKETING PERTAINING TO CONSUMER GOODS AND ONLINE PLATFORMS TO SUPPORT THE RCS DEPLOYMENT IN RETAIL AND ECOMMERCE INDUSTRY

TABLE 115 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 116 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.7 HEALTHCARE

9.7.1 REAL-TIME DECISION-MAKING FOR PATIENT ENGAGEMENT SOLUTIONS TO DRIVE THE NEED FOR RCS IN HEALTHCARE INDUSTRY

TABLE 117 HEALTHCARE: RICH COMMUNICATION SERVICES MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 118 HEALTHCARE: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.8 OTHER ENTERPRISE VERTICALS

TABLE 119 OTHER ENTERPRISE VERTICALS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 120 OTHER ENTERPRISE VERTICALS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10 RICH COMMUNICATION SERVICES MARKET, BY REGION (Page No. - 108)

10.1 INTRODUCTION

10.1.1 REGION: COVID-19 IMPACT

FIGURE 25 NORTH AMERICA TO HAVE THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 26 ASIA PACIFIC TO EXHIBIT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 121 MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 122 MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: COVID-19 IMPACT

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE VERTICAL, 20162019 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE VERTICAL, 20202025 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 132 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.2.2 UNITED STATES

10.2.2.1 Increasing number of mobile users and RCS-enabled devices to drive the RCS market in the US

TABLE 133 UNITED STATES: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 134 UNITED STATES: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 135 UNITED STATES: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 136 UNITED STATES: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 137 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 138 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Increasing number of RCS users on MNOs network to boost the RCS market in Canada

TABLE 139 CANADA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 140 CANADA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 141 CANADA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 142 CANADA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 143 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 144 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: COVID-19 IMPACT

TABLE 145 EUROPE: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 149 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

TABLE 151 EUROPE: MARKET SIZE, BY ENTERPRISE VERTICAL, 20162019 (USD MILLION)

TABLE 152 EUROPE: MARKET SIZE, BY ENTERPRISE VERTICAL, 20202025 (USD MILLION)

TABLE 153 EUROPE: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 154 EUROPE: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.3.2 UNITED KINGDOM

10.3.2.1 Increasing number of partnerships to propel the RCS market in the UK

TABLE 155 UNITED KINGDOM: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 156 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 157 UNITED KINGDOM: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 158 UNITED KINGDOM: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 159 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 160 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Increasing number of mergers and acquisitions by market players to propel the RCS market in Germany

TABLE 161 GERMANY: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 162 GERMANY: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 163 GERMANY: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 164 GERMANY: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 165 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 166 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Need for enhancing customer experience to drive the RCS market in France

TABLE 167 FRANCE: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 168 FRANCE: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 169 FRANCE: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 170 FRANCE: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 171 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 172 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 173 ASIA PACIFIC: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE VERTICAL, 20162019 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE VERTICAL, 20202025 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.4.2 CHINA

10.4.2.1 High investments by MNOs in their networks for excellent services to boost the RCS market in China

TABLE 183 CHINA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 184 CHINA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 185 CHINA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 186 CHINA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 187 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 188 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increase in investments among startups and push from the government to boost the growth of RCS market in India

TABLE 189 INDIA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 190 INDIA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 191 INDIA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 192 INDIA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 193 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 194 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 An increasing number of service launches and partnerships to drive the growth of the RCS market in Japan

TABLE 195 JAPAN: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 196 JAPAN: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 197 JAPAN: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 198 JAPAN: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 199 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 200 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 201 REST OF APAC: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 202 REST OF APAC: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 203 REST OF APAC: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 204 REST OF APAC: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 205 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 206 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 207 MIDDLE EAST AND AFRICA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

TABLE 213 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE VERTICAL, 20162019 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE VERTICAL, 20202025 (USD MILLION)

TABLE 215 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 216 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.5.2 KINGDOM OF SAUDI ARABIA

10.5.2.1 High penetration rate of smartphones to boost the RCS market in the KSA

TABLE 217 KINGDOM OF SAUDI ARABIA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 218 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 219 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 220 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 221 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 222 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.5.3 SOUTH AFRICA

10.5.3.1 Growing demand by marketers and brands to access RCS to enhance customer experience in South Africa

TABLE 223 SOUTH AFRICA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 224 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 225 SOUTH AFRICA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 226 SOUTH AFRICA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 227 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 228 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.5.4 REST OF MIDDLE EAST AND AFRICA

TABLE 229 REST OF MIDDLE EAST AND AFRICA : RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 230 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 231 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 232 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 233 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 234 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: COVID-19 IMPACT

TABLE 235 LATIN AMERICA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 236 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 240 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

TABLE 241 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE VERTICAL, 20162019 (USD MILLION)

TABLE 242 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE VERTICAL, 20202025 (USD MILLION)

TABLE 243 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 244 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.6.2 BRAZIL

10.6.2.1 Need to combat the OTT threat to drive the adoption of RCS in Brazil

TABLE 245 BRAZIL: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 246 BRAZIL: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 247 BRAZIL: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 248 BRAZIL: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 249 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 250 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.6.3 MEXICO

10.6.3.1 Increasing IT investments and the presence of leading players to drive the growth of the RCS market in Mexico

TABLE 251 MEXICO: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 252 MEXICO: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 253 MEXICO: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 254 MEXICO: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 255 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 256 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

TABLE 257 REST OF LATIN AMERICA: RICH COMMUNICATION SERVICES MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 258 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 259 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 260 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 261 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 262 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 162)

11.1 OVERVIEW

FIGURE 29 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE RICH COMMUNICATION SERVICES MARKET, 20182019

11.2 COMPETITIVE SCENARIO

11.2.1 NEW SERVICE LAUNCHES AND SERVICE ENHANCEMENTS

TABLE 263 NEW SERVICE LAUNCHES AND SERVICE ENHANCEMENTS, 20182019

11.2.2 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 264 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 20192020

12 COMPANY PROFILES (Page No. - 165)

12.1 INTRODUCTION

FIGURE 30 GEOGRAPHIC REVENUE MIX OF THE TOP MARKET PLAYERS

(Business Overview, Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 AT&T

FIGURE 31 AT&T: COMPANY SNAPSHOT

12.3 VODAFONE

FIGURE 32 VODAFONE: COMPANY SNAPSHOT

12.4 DEUTSCHE TELEKOM

FIGURE 33 DEUTSCHE TELEKOM: COMPANY SNAPSHOT

12.5 GOOGLE

FIGURE 34 GOOGLE: COMPANY SNAPSHOT

12.6 VERIZON

FIGURE 35 VERIZON: COMPANY SNAPSHOT

12.7 TELEFONICA

FIGURE 36 TELEFONICA: COMPANY SNAPSHOT

12.8 ORANGE BUSINESS

FIGURE 37 ORANGE S.A.: COMPANY SNAPSHOT

12.9 CHINA MOBILE

FIGURE 38 CHINA MOBILE: COMPANY SNAPSHOT

12.10 KDDI

FIGURE 39 KDDI: COMPANY SNAPSHOT

12.11 SLOVAK TELEKOM

FIGURE 40 SLOVAK TELEKOM: COMPANY SNAPSHOT

12.12 TELIT

FIGURE 41 TELIT: COMPANY SNAPSHOT

12.13 SK TELECOM

FIGURE 42 SK TELECOM: COMPANY SNAPSHOT

12.14 TELSTRA

FIGURE 43 TELSTRA: COMPANY SNAPSHOT

12.15 LG U+

*Details on Business Overview, Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12.16 CELCOM

12.17 FREEDOM MOBILE

12.18 ROGERS

12.19 T-MOBILE

12.20 O2

12.21 TELIA COMPANY

12.22 MAGYAR TELEKOM

12.23 CLARO

12.24 SWISSCOM

12.25 RELIANCE JIO

13 ADJACENT AND RELATED MARKET (Page No. - 199)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

13.1.2 LIMITATION

13.2 UNIFIED COMMUNICATION AS A SERVICE MARKET

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

FIGURE 44 UNIFIED COMMUNICATIONS AS A SERVICE MARKET HOLISTIC VIEW

13.3 UNIFIED COMMUNICATION AS A SERVICE MARKET, BY ENTERPRISE VERTICAL

13.3.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

13.3.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET DRIVERS

TABLE 265 BANKING, FINANCIAL SERVICES, AND INSURANCE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 266 NORTH AMERICA: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 267 EUROPE: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 268 ASIA PACIFIC: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.4 TELECOM AND IT

13.4.1 TELECOM AND IT: UNIFIED COMMUNICATIONS AS A SERVICE MARKET DRIVERS

TABLE 269 TELECOM AND IT: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 270 NORTH AMERICA: TELECOM AND IT MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 271 EUROPE: TELECOM AND IT MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 272 ASIA PACIFIC: TELECOM AND IT MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.5 CONSUMER GOODS AND RETAIL

13.5.1 CONSUMER GOODS AND RETAIL: UNIFIED COMMUNICATIONS AS A SERVICE MARKET DRIVERS

TABLE 273 CONSUMER GOODS AND RETAIL: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 274 NORTH AMERICA: CONSUMER GOODS AND RETAIL MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 275 EUROPE: CONSUMER GOODS AND RETAIL MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 276 ASIA PACIFIC: CONSUMER GOODS AND RETAIL MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.6 HEALTHCARE

13.6.1 HEALTHCARE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET DRIVERS

TABLE 277 HEALTHCARE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 278 NORTH AMERICA: HEALTHCARE MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 279 EUROPE: HEALTHCARE MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 280 ASIA PACIFIC: HEALTHCARE MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.7 PUBLIC SECTOR AND UTILITIES

13.7.1 PUBLIC SECTOR AND UTILITIES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET DRIVERS

TABLE 281 PUBLIC SECTOR AND UTILITIES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 282 NORTH AMERICA: PUBLIC SECTOR AND UTILITIES MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 283 EUROPE: PUBLIC SECTOR AND UTILITIES MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 284 ASIA PACIFIC: PUBLIC SECTOR AND UTILITIES MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.8 LOGISTICS AND TRANSPORTATION

13.8.1 LOGISTICS AND TRANSPORTATION: UNIFIED COMMUNICATIONS AS A SERVICE MARKET DRIVERS

TABLE 285 LOGISTICS AND TRANSPORTATION: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 286 NORTH AMERICA: LOGISTICS AND TRANSPORTATION MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 287 EUROPE: LOGISTICS AND TRANSPORTATION MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 288 ASIA PACIFIC: LOGISTICS AND TRANSPORTATION MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.9 TRAVEL AND HOSPITALITY

13.9.1 TRAVEL AND HOSPITALITY: UNIFIED COMMUNICATIONS AS A SERVICE MARKET DRIVERS

TABLE 289 TRAVEL AND HOSPITALITY: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 290 NORTH AMERICA: TRAVEL AND HOSPITALITY MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 291 EUROPE: TRAVEL AND HOSPITALITY MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 292 ASIA PACIFIC: TRAVEL AND HOSPITALITY MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.10 OTHER VERTICALS

TABLE 293 OTHER VERTICALS: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 20172024 (USD MILLION)

TABLE 294 NORTH AMERICA: OTHER VERTICALS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 295 EUROPE: OTHER VERTICALS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

TABLE 296 ASIA PACIFIC: OTHER VERTICALS MARKET SIZE, BY COUNTRY, 20172024 (USD MILLION)

13.11 CHATBOT MARKET

13.11.1 MARKET DEFINITION

13.11.2 MARKET OVERVIEW

TABLE 297 GLOBAL CHATBOT MARKET SIZE AND GROWTH RATE, 20172024 (USD MILLION AND Y-O-Y %)

13.12 CHATBOT MARKET, BY VERTICAL

13.12.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

13.12.1.1 Technologies such as ai and ml to provide banking and financial industry a platform for extended customer engagement

TABLE 298 BANKING, FINANCIAL SERVICES, AND INSURANCE: CHATBOT MARKET SIZE, BY REGION, 20172024 (USD MILLION)

13.12.2 RETAIL AND ECOMMERCE

13.12.2.1 Chatbots growing use for retaining customers, collecting feedback, and driving sales to drive their adoption in retail and ecommerce vertical

TABLE 299 RETAIL AND ECOMMERCE: CHATBOT MARKET SIZE, BY REGION, 20172024 (USD MILLION)

13.12.3 HEALTHCARE

13.12.3.1 Chatbots enable medical professionals to manage patient data and medication, help during emergencies, and provide first aid

TABLE 300 HEALTHCARE: CHATBOT MARKET SIZE, BY REGION, 20172024 (USD MILLION)

13.12.4 TRAVEL AND HOSPITALITY

13.12.4.1 Chatbots enable enhanced guest or passenger services in travel and hospitality vertical

TABLE 301 TRAVEL AND HOSPITALITY: CHATBOT MARKET SIZE, BY REGION, 20172024 (USD MILLION)

13.12.5 MEDIA AND ENTERTAINMENT

13.12.5.1 Multiple industry-driven chatbot initiatives of governments to drive adoption of chatbot solutions in media and entertainment vertical

TABLE 302 MEDIA AND ENTERTAINMENT: CHATBOT MARKET SIZE, BY REGION, 20172024 (USD MILLION)

13.12.6 TELECOMMUNICATIONS

13.12.6.1 AI-enabled chatbots would help improve contact center effectiveness and increase ROI in the telecommunications vertical

TABLE 303 COMMUNICATIONS: CHATBOT MARKET SIZE, BY REGION, 20172024 (USD MILLION)

13.12.7 OTHER VERTICALS

TABLE 304 OTHER VERTICALS: CHATBOT MARKET SIZE, BY REGION, 20172024 (USD MILLION)

14 APPENDIX (Page No. - 223)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

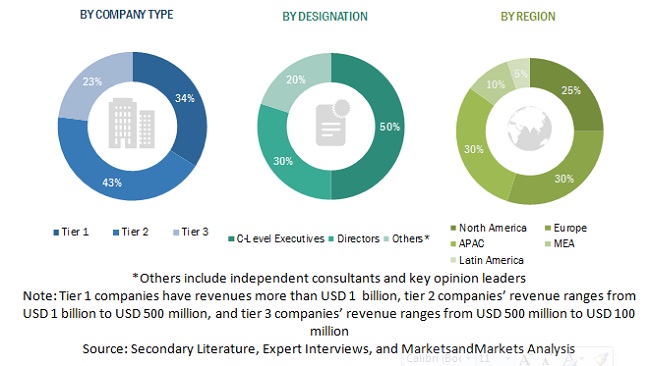

The study involved four major activities in estimating the current size of the Rich Communications Services (RCS) market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the rich communication services market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Moreover, journals and telecom blogs, such as GSMA Intelligence, Farm Journal Media, AI Time Journal, Mobile Marketing Association, and The Next Web, have been referred to for consolidating the report. Secondary research was mainly used to obtain key information about the industry insights, markets monetary chain, overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both demand and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both demand and supply sides were interviewed to obtain qualitative and quantitative information for the global RCS study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the global rich communication services market. After the complete market engineering process (which included calculations for market statistics, market breakup, market size estimation, market forecasting, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the numbers arrived at, through the estimation process. Primary research was also undertaken to identify the segmentation types, industry trends; key players; the competitive landscape of the global RCS market; and fundamental market dynamics, such as drivers, restraints, opportunities, industry trends, and key strategies. The following is the breakup of the primary respondents profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global rich communication services market and its various other dependent subsegments. The key players in the market were identified through secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The global market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine and forecast the global rich communication services market based on applications, end-users, enterprise sizes, enterprise verticals, and regions from 2016 to 2025, and analyze various macro and microeconomic factors that affect the market growth

- To forecast the size of the market segments concerning five main areas, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the RCS market

- To analyze each submarket for individual growth trends, prospects, and contribution to the total RCS market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the RCS market

- To profile key market players comprising top vendors and startups; provide comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the markets competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

- With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Rich Communication Services (RCS) Market