Robotic Welding Market by Type (Spot Welding Robots, Arc Welding Robots), Payload (>150 kilograms, 50-150 kilograms), End user (Automotive and Transportation, Electrical and Electronics), Geography (2025-2030)

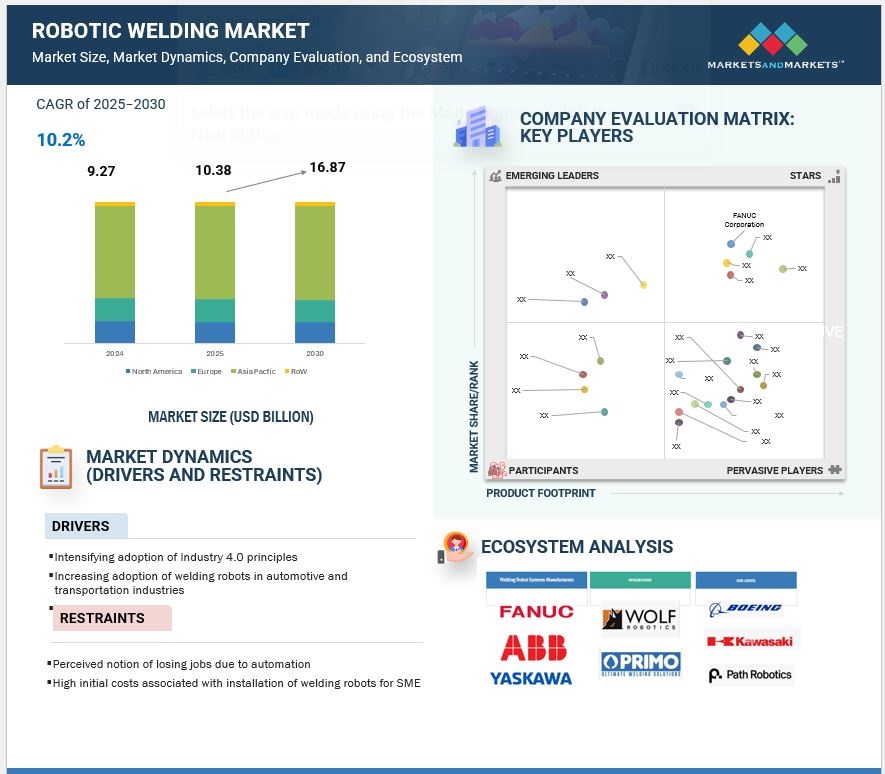

The robotic welding market (with peripherals) market is expected to grow from USD 10.38 billion in 2025 to USD 16.87 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030.

Government programs are contributing to the growth of the robotics welding market substantially by encouraging automation in many industries. Programs like "Make in India" and "Made in China 2025" are designed to improve manufacturing efficiency and competitiveness, thus propelling demand for robotic welding market. The robotics welding market is growing as companies are adopting advanced technologies to increase efficiency and precision. Additionally, state support in finance and incentives inspires manufacturers to invest in robotic welding systems, consequently fueling the robotics welding sector. This not only enhances productivity but also discourages labor shortages, solidifying the future potential for growth in the robotics welding market.

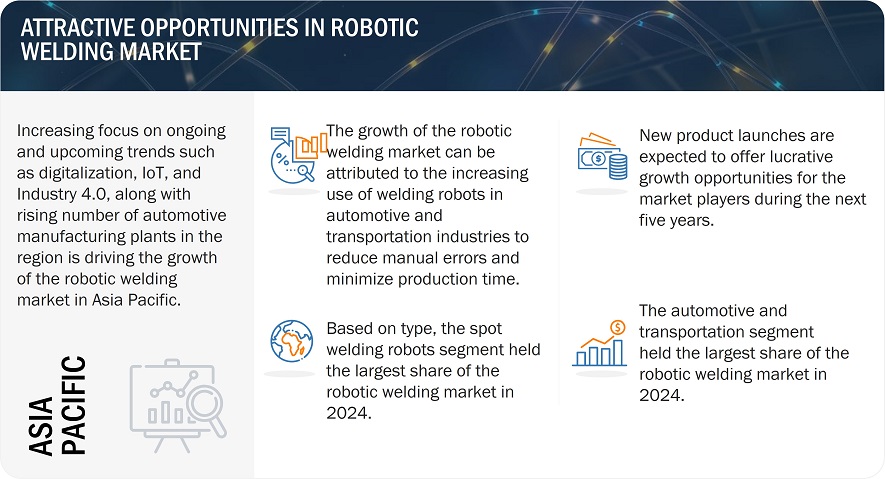

Attractive Opportunities in robotic wleding market

To know about the assumptions considered for the study, Request for Free Sample Report

Robotic Welding Market Dynamics:

Driver: Increasing adoption of welding robots in automotive and transportation industries

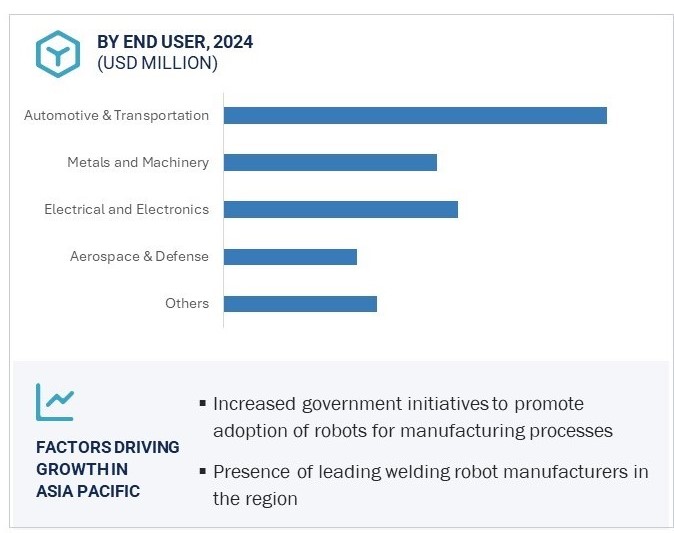

Robots for welding were first developed for the automotive and transport industries to weld small-sized, low mix, and large body parts of vehicles. Arc and spot welding robots are mostly used in welding operations in the automotive industry, whereas in the transport industry, large-sized components are welded through robotic welding cells, which include multiple welding robots. The benefits of enhanced return on investment (ROI) and fast welding offered by robot cells and welding robots are driving tremendous demand for welding robots among the automotive and transport industries. Furthermore, robot welding enables accurate and quality end products, contributes to higher productivity, and delivers maximum efficiency and flexibility.Therefore, the automotive and transport sectors are two largest end users of welding robots. Improved quality of automobiles designed, increased capability of automobile factories, and protection of workers are the 3 main reasons that stimulate the use of robotic welding in the auto sector.Welding robots like arc welding, spot welding, and laser welding robots with varying payloads are essential for the car body assembling process. The process entails welding steel sheet and metal parts by applying spot welding robots with large payload capacity and extended reach. Therefore, automobile manufacturers invest heavily in implementing innovative manufacturing technology in their facilities.

Restraint: High initial cost associated with installation of welding robots for SME

A robotic automation project requires high capital not only for the purchase of robots but also for integration, programming, and maintenance. In some cases, a custom integration may be necessary, further increasing the overall cost. Companies may not always have the space and infrastructure needed to deploy robots. As SMEs generally engage in low-volume production, return on investment (ROI) can be challenging. The existence of companies involved in seasonal or inconsistent production schedules further exemplifies the issue.

Fast-changing consumer preferences will require frequent reprogramming of robots as products must be updated yearly on average. Over-automation can also be problematic. For instance, the automotive industry in the US initially employed a higher degree of automation than the one in Japan. This led to cost overruns as product lines and consumer demand changed over time, and many robots became unnecessary or obsolete. Moreover, replacing human workers may not always decrease operational costs for an organization. An arc welding robot can cost anywhere from USD 28,000 to USD 30,000, whereas a spot welding robot is available between USD 45,000 to USD 50,000. The cost of welding robots, coupled with integration costs and the cost of peripherals such as end effectors and vision systems, makes automation a costly investment for SMEs, mainly when they are engaged in low-volume production. Hence, SMEs with more than one production line may not experience high returns on investment if they try and adopt welding robots for automatization. Apart from this, workspace requirements, reach, and payload limits also change in accordance with application changes. All these factors make the overall installation cost of welding robots high for low-volume production SMEs or SMEs with more than one production line.

Opportunity: Government initiatives to support digital transformation in Asia Pacific region

The arrival of the Internet of Things (IoT) introduced digital transformation. Before the pandemic, digitalization was partially adopted in most countries in Asia Pacific. Following the sudden emergence of the pandemic, with lockdown and a work-from-home culture, manufacturing industries and businesses are all set to apply digitalization. Owing to this, digital transformation is quickly moving beyond the realms of forecasts and overhyped speculations to become a daily reality. Asia Pacific is home to some of the world's fastest-growing economies, which host major manufacturing industries such as automotive and transportation, electrical, and electronics. Metals, machinery, and aerospace and defense Digital transformation plays a crucial role in automating the manufacturing processes in these industries. Various automation systems and technologies such as control systems, robots, sensors, artificial intelligence, cloud, big data, and blockchain are widely used across these manufacturing industries in the region.

Challenge: Lack of skilled workers for operating welding robots

The robotic welding market faces several challenges that curb its growth prospects. The most critical challenge is the shortage of personnel with the skills to operate and program welding robots. As the robotic welding market grows, the need for skilled technicians able to handle such sophisticated systems intensifies while the supply remains scarce. This skill shortage can lead to inefficiencies in operations and increased costs, as organizations cannot hire competent individuals to handle their robotic welding operations. High initial investment fees in installing robotic systems are also a significant issue for the robotics welding sector. Robotic welding entails a heavy investment in machinery, installing protection devices, and adopting sophisticated technology. The cost can be expensive for most small and medium-sized enterprises (SMEs), slowing down robotic welding solution uptake. Without adequate financial planning, such companies do not realize the return on investment within a convenient time frame, thus making their competitiveness in the market even harder.

Robotics Welding Market Ecosystem Analysis

The robotic welding market is highly competitive and includes some tier 1 companies, such as FANUC Corporation, YASKAWA Electric Corporation, KUKA AG, ABB, and Kawasaki Heavy Industries, Ltd. These companies have created a competitive ecosystem by investing in research and development to launch highly efficient and reliable welding robots. Various welding robot manufacturers offer various arc, spot, laser, and plasma welding robots for the automotive and transportation, metals and machinery, electricals and electronics, and aerospace and defense industries.

In the robotic welding market by type, spot welding is expected to have the largest market share during the forecast period.

The rise in the automobile industry is expected to drive the resistance spot welding market in the coming years. The robotic welding market, particularly the spot welding segment, is projected to hold the largest market share in 2030. Robotic spot welding offers advantages such as minimal space requirements, the ability to lift heavy machinery, and the creation of strong, accurate, high-quality welds. This welding type benefits heavy-duty applications in automobile manufacturing, as well as the metals, machinery, electronics, and semiconductors industries that require exact welding. The automotive and transportation segment is predicted to have the most significant share of the robotic welding market in 2030. Robotic welding has been a leading application of robots in the automotive and transportation industry for a long time, as every vehicle requires many welds before completion. Robotic welding enables the development of accurate and high-quality finished products, increases productivity, and enables high machine efficiency and manufacturing flexibility. The robotic welding market is also growing due to the rapid technical developments in terms of flexibility in installation, energy-efficient robots, the introduction of spot welding guns, and multi-robot welding cells.

150-kilogram payload segment is projected to account for the largest size of the robotic welding market

The robotic welding market is expected to exhibit significant growth in the 150 kg payload market, which would lead the segment during the forecasting period. Robotic systems of high payload capacity are growing in demand in the automotive, aerospace, and manufacturing industries. The 150 kg payload capacity compromises strength and versatility, so it will be best used on larger parts that need heavy-duty welding applications. With more processes being automated in industries, the robot welding market will also gain from the efficiency and accuracy of these robots.

The car industry, for example, is one of the most significant sources of this effect because vehicles require extensive welding of heavy parts. 150 kg payload robotic welding machines can easily handle the weight of these pieces while making decent-quality welds. In addition, the development of robotic technology is improving the performance of these systems so that they can do intricate welding operations more accurately and faster. Also, the increasing trend towards electric vehicles further drives the demand for high-capacity robotic welding solutions. As producers seek to automate production and reduce labor costs, applications of robotic welding technologies are becoming increasingly prevalent. Generally, the anticipated growth of this segment reflects automation and industrial efficiency trends in the robotic welding market.

China in the Asia Pacific market to grow with the highest CAGR in the robotics welding market during the forecast period.

China is one of the primary market for robotic welding market in Asia Pacific region and is expected to continue being the leader during the forecast period. China is the largest manufacturer of electrical and electronic devices, automotive, and mineral output in the world. It has low labor costs with a strong business ecosystem. Moreover, the country lacks in terms of regulatory compliances and has low taxes and duties on exported devices. China is automating and upgrading its manufacturing plants according to Industry 4.0 for enhanced efficiency and profitable growth. The Made in China 2025 initiative is a blueprint of the plan of the government of the country to transform China into a hi-tech powerhouse that dominates robotics, advanced information technology, aviation, and new energy vehicles. Welding robots are expected to play a key role in the successful implementation of this plan. Moreover, the country is among the fastest-growing economies in the world. The growth of industries such as automotive and transportation, electrical and electronics, and aerospace and defense in the country is expected to increase the demand for welding robots in China.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the robotic welding market are FANUC Corporation (Japan), YASKAWA Electric Corporation (Japan), KUKA AG (Germany), ABB (Switzerland), Kawasaki Heavy Industries, Ltd. (Japan), Panasonic Corporation (Japan), DAIHEN Corporation (Japan), NACHI-FUJIKOSHI CORP. (Japan), Comau S.p.A. (Italy), and Hyundai Robotics (South Korea), igm Robotersysteme AG (Austria), Estun Automation Co., Ltd. (China), Lincoln Electric Company (US), Kemppi Oy (Finland), Fronius International GmbH (Austria) among others.

Robotic Welding Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 10.38 Billion |

| Expected Value | USD 16.87 Billion |

| Growth Rate | CAGR of 10.2% |

|

Forecast Period |

2025–2030 |

|

On Demand Data Available |

2030 |

|

Market Size Availability for Years |

2025–2030 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

| Market Leaders | FANUC Corporation (Japan), YASKAWA Electric Corporation (Japan), KUKA AG (Germany), ABB (Switzerland), Kawasaki Heavy Industries, Ltd. (Japan), Panasonic Corporation (Japan), DAIHEN Corporation (Japan), NACHI-FUJIKOSHI CORP. (Japan), Comau S.p.A. (Italy), and Hyundai Robotics (South Korea) |

| Key Market Driver | Intensifying adoption of Industry 4.0 principles |

| Key Market Opportunity | Emergence of laser and plasma welding technologies |

| Largest Growing Region | Asia Pacific |

|

Largest Market Share Segment |

Automotive and Transportation Segment |

| Highest CAGR Segment | 51–150 Kilogram Payload Segment |

This research report categorizes the robotic welding market based on type, payload, end user, and region

Robotic welding market:

Based on type:

- Arc Welding

- Spot Welding

- Others

Note: Other welding types include plasma and laser welding

Based on payload

- <50 kg Payload

- 50-150 kg Payload

- >150 kg Payload

Based on end user:

- Automotive & Transportation

- Metals and Machinery

- Electrical and Electronics

- Aerospace & Defense

- Others

Note: Other end users include construction, plastics, rubber and chemicals, pharmaceuticals and cosmetics, and packaging industries.

Based on region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- France

- Germany

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of Asia Pacific

-

Rest of the world

- Middle East & Africa

- South America

Recent Developments

- In November 2024, FANUC Corporation introduced a new M-950IA. The FANUC M-950iA/500 is a heavy-duty industrial robot capable of lifting to 500 kg, ideal for handling automotive components, construction materials, and EV battery packs. With a reach of 2,830 mm and enhanced flexibility for tight spaces, it excels in friction stir welding, drilling, and riveting applications.

- In November 2023, Yaskawa Electric launched the MOTOMAN NEXT series, a next-generation robot with autonomous adaptivity and judgment capabilities designed to automate previously unautomated tasks. With models ranging from 4kg to 35kg payload capacity, this series leverages digital data and mechatronics to advance industrial automation. The MOTOMAN NEXT platform utilizes AI, Wind River Linux, and NVIDIA Jetson Orin to perform complex tasks in unstructured environments.

- In July 2020, ASTOR and Kawasaki Robotics signed a strategic agreement to strengthen Kawasaki Robotics’ presence in the robotics market in the Central and Eastern Europe (CEE) region. ASTOR will be responsible for developing sales, marketing, and cooperation in the partner channel in 12 countries of CEE, including Poland.

- In June 2020, Hyundai Robotics established an office in Germany to offer industrial robots and other robot line-ups to European customers and manage the robots supplied to Korean auto companies in Eastern Europe.

- In October 2019, FANUC America Corporation, a subsidiary of FANUC CORPORATION in Japan, constructed a new 461,000-square-foot North Campus robotics and automation facility in Auburn Hills, Michigan. The facility will be used for engineering, product development, manufacturing, and warehousing.

Frequently Asked Questions (FAQ):

At what CAGR is the robotic welding market expected to grow from 2025 to 2030?

The global robotic welding market is expected to register a CAGR of 10.2% from 2025 to 2030.

Which regions are expected to witness significant demand for robotic welding during the forecast period?

Asia Pacific and North America are anticipated to exhibit significant demand for robotic welding market during the forecast period. Economies such as the US, Canada, China, Japan, India, and South Korea are likely to experience high market growth soon.

Which factors will create opportunities for the players in the robotic welding market?

Factors such as the intensifying adoption of Industry 4.0 principles and the increasing demand for welding robots in the automotive and transportation industries are among the factors driving the growth of the robotic welding market. Moreover, government initiatives to support digital transformation in Asia Pacific to create lucrative opportunities in the robotic welding market.

Who are the key players in the robotic welding market?

The key players in the robotic welding market are FANUC Corporation, YASKAWA Electric Corporation, KUKA AG, ABB, and Kawasaki Heavy Industries, Ltd.among others

Who is the major end user of robotic welding components?

Automotive and transporation end user is one of the major end user for robotic welding market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SCOPE

FIGURE 1 ROBOTIC WELDING MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY

1.5 MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 ROBOTIC WELDING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1–TOP-DOWN (SUPPLY SIDE)—REVENUES GENERATED BY COMPANIES FROM SALES OF WELDING ROBOTS (WITH PERIPHERALS)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1–TOP-DOWN (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN MARKET (WITH PERIPHERALS)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—BOTTOM-UP (DEMAND SIDE)–DEMAND FOR WELDING ROBOTS (WITH PERIPHERALS)

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for obtaining market share using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for obtaining market share using top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

3.1 IMPACT OF COVID-19 ON ROBOTIC WELDING MARKET

FIGURE 9 GLOBAL PROPAGATION OF COVID-19

TABLE 1 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.2 REALISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

3.4 PESSIMISTIC SCENARIO

FIGURE 10 GROWTH PROJECTIONS OF MARKET (WITH PERIPHERALS) IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 11 PRE- AND POST-COVID-19 SCENARIOS OF MARKET (WITH PERIPHERALS)

FIGURE 12 SPOT WELDING ROBOTS SEGMENT TO HOLD LARGEST SHARE OF MARKET (WITH PERIPHERALS) IN 2021 AND 2026

FIGURE 13 >150 KILOGRAM PAYLOAD SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

FIGURE 14 AUTOMOTIVE AND TRANSPORTATION SEGMENT OF MARKET (WITH PERIPHERALS) TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 15 APAC TO LEAD MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET (WITH PERIPHERALS)

FIGURE 16 INCREASING ADOPTION OF DIGITALIZATION, IOT, AND INDUSTRY 4.0 TO FUEL MARKET GROWTH

4.2 MARKET (WITH PERIPHERALS), BY TYPE AND PAYLOAD

FIGURE 17 SPOT WELDING ROBOTS AND >150 KILOGRAM PAYLOAD SEGMENTS TO ACCOUNT FOR LARGEST SHARES OF MARKET (WITH PERIPHERALS) IN 2026

4.3 MARKET (WITH PERIPHERALS), BY END USER

FIGURE 18 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

4.4 MARKET (WITH PERIPHERALS), BY REGION

FIGURE 19 APAC TO ACCOUNT FOR LARGEST SHARE OF MARKET (WITH PERIPHERALS) IN 2021 AND 2026

4.5 MARKET (WITH PERIPHERALS), BY COUNTRY

FIGURE 20 MARKET (WITH PERIPHERALS) IN CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Intensifying adoption of Industry 4.0 principles

5.2.1.2 Increasing adoption of welding robots in automotive and transportation industries

5.2.1.3 Ongoing penetration of 5G in industrial manufacturing

FIGURE 22 MARKET: DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Perceived notion of losing jobs due to automation

5.2.2.2 High initial costs associated with installation of welding robots for SME

FIGURE 23 MARKET: RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives to support digital transformation in APAC

5.2.3.2 Emergence of laser and plasma welding technologies

FIGURE 24 ROBOTIC WELDING MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled workers for operating welding robots

FIGURE 25 MARKET: CHALLENGES AND THEIR IMPACT

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 26 ROBOTIC WELDING SUPPLY CHAIN

5.4 TRENDS/DISRUPTIONS IMPACTING BUSINESS OF CUSTOMERS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

FIGURE 27 REVENUE SHIFT IN MARKET

5.5 ROBOTIC WELDING ECOSYSTEM

FIGURE 28 ROBOTIC WELDING ECOSYSTEM

TABLE 2 LIST OF OEMS, SUPPLIERS, AND DISTRIBUTORS OF WELDING ROBOTS

5.6 PORTER’S FIVE FORCES MODEL

TABLE 3 ROBOTIC WELDING MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDY

5.7.1 UNIVERSAL WELDING CELL OFFERED BY ENKO STAUDINGER GMBH HELPED KAUTH GMBH UND CO. KG IN ACHIEVING WELDING FLEXIBILITY

5.7.2 INDIANA-BASED CROWN EQUIPMENT REPLACED ITS EXISTING MIG AND STICK WELDING PROCESSES WITH WELDING ROBOTS AND CELLS TO REDUCE PRODUCTION DOWNTIME

5.7.3 KAWASAKI MOTORS MANUFACTURING CORP. REDUCED RELIANCE ON MANUAL WELDING USING ARC WELDING ROBOTS

5.7.4 MOTION CONTROLS ROBOTICS BUILT A TURNKEY SYSTEM FOR LUK USA LLC

5.8 TECHNOLOGY ANALYSIS

5.8.1 KEY TECHNOLOGIES

5.8.1.1 TIG welding

5.8.1.2 MIG welding

5.8.1.3 Submerged arc welding

5.8.1.4 Friction stir welding

5.8.1.5 Explosion welding

5.8.2 COMPLEMENTARY TECHNOLOGY

5.8.2.1 Penetration of Industrial Internet of Things (IIoT) and AI in industrial manufacturing

5.9 AVERAGE SELLING PRICE ANALYSIS

TABLE 4 AVERAGE SELLING PRICES OF WELDING ROBOTS (WITHOUT PERIPHERALS)

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO

TABLE 5 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 EXPORT SCENARIO

TABLE 6 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENT ANALYSIS, 2015–2020

TABLE 7 TOP 20 PATENT OWNERS IN US FROM 2011 TO 2020

FIGURE 30 PATENTS GRANTED WORLDWIDE FROM 2011 TO 2020

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2011 TO 2020

5.12 TARIFFS AND REGULATIONS

5.12.1 TARIFFS

TABLE 8 MFN TARIFFS IMPOSED ON EXPORTS OF INDUSTRIAL ROBOTS BY US

TABLE 9 MFN TARIFFS IMPOSED ON EXPORT OF INDUSTRIAL ROBOTS BY CHINA

5.12.1.1 Positive impact of tariffs on industrial robot manufacturers

5.12.1.2 Negative impact of tariffs on industrial robot manufacturers

5.12.2 REGULATORY COMPLIANCE

5.12.2.1 Regulations and standards followed in countries of North America

5.12.2.2 Regulations and standards followed in countries of Europe

5.12.2.3 Regulations and standards followed in countries of APAC

6 ROBOTIC WELDING MARKET, BY TYPE (Page No. - 87)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY TYPE

FIGURE 33 SPOT WELDING ROBOTS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) IN 2021

TABLE 10 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2017–2020 (USD MILLION)

TABLE 11 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2021–2026 (USD MILLION)

TABLE 12 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2017–2020 (UNITS)

TABLE 13 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2021–2026 (UNITS)

TABLE 14 MARKET (WITH PERIPHERALS), BY TYPE, 2017–2020 (USD MILLION)

TABLE 15 MARKET (WITH PERIPHERALS), BY TYPE, 2021–2026 (USD MILLION)

6.2 ARC WELDING ROBOTS

6.2.1 ADOPTION OF ARC WELDING ROBOTS FOR USE IN APPLICATIONS THAT REQUIRE ACCURACY AND HIGH REPEATABILITY

FIGURE 34 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO HOLD LARGEST SIZE OF MARKET (WITH PERIPHERALS) IN 2021

TABLE 16 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 17 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 18 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 19 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

6.3 SPOT WELDING ROBOTS

6.3.1 DEPLOYMENT OF SPOT WELDING ROBOTS FOR HEAVY-DUTY APPLICATIONS IN DIFFERENT INDUSTRIES

TABLE 20 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 21 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 22 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 23 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

6.4 OTHERS

FIGURE 35 AEROSPACE AND DEFENSE SEGMENT OF OTHER MARKET (WITH PERIPHERALS) TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 24 OTHER MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 25 OTHER MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 26 OTHER MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 27 OTHER MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

7 ROBOTIC WELDING MARKET, BY PAYLOAD (Page No. - 98)

7.1 INTRODUCTION

FIGURE 36 MARKET, BY PAYLOAD

FIGURE 37 >150 KILOGRAM PAYLOAD SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) IN 2021

TABLE 28 MARKET (WITHOUT PERIPHERALS), BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 29 MARKET (WITHOUT PERIPHERALS), BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 30 MARKET (WITH PERIPHERALS), BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 31 MARKET (WITH PERIPHERALS), BY PAYLOAD, 2021–2026 (USD MILLION)

7.2 <50 KILOGRAM PAYLOAD

7.2.1 USE OF <50 KILOGRAM PAYLOAD WELDING ROBOTS IN LIGHT AND HIGHLY PRECISE APPLICATIONS

TABLE 32 MARKET (WITH PERIPHERALS) FOR <50 KILOGRAM PAYLOAD, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 ROBOTIC WELDING MARKET (WITH PERIPHERALS) FOR <50 KILOGRAM PAYLOAD, BY REGION, 2021–2026 (USD MILLION)

7.3 50–150 KILOGRAM PAYLOAD

7.3.1 50–150 KILOGRAM PAYLOAD SEGMENT OF MARKET (WITH PERIPHERALS) TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 34 MARKET (WITH PERIPHERALS) FOR 50–150 KILOGRAM PAYLOAD, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MARKET (WITH PERIPHERALS) FOR 50–150 KILOGRAM PAYLOAD, BY REGION, 2021–2026 (USD MILLION)

7.4 >150 KILOGRAM PAYLOAD

7.4.1 >150 KILOGRAM PAYLOAD SEGMENT TO HOLD LARGEST SHARE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

FIGURE 38 APAC TO LEAD MARKET (WITH PERIPHERALS) FOR >150 KILOGRAM PAYLOAD FROM 2021 TO 2026

TABLE 36 MARKET (WITH PERIPHERALS) FOR >150 KILOGRAM PAYLOAD, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET (WITH PERIPHERALS) FOR >150 KILOGRAM PAYLOAD, BY REGION, 2021–2026 (USD MILLION)

8 ROBOTIC WELDING MARKET, BY END USER (Page No. - 105)

8.1 INTRODUCTION

FIGURE 39 MARKET, BY END USER

FIGURE 40 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO LEAD MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

TABLE 38 MARKET (WITHOUT PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 39 MARKET (WITHOUT PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 40 MARKET (WITHOUT PERIPHERALS), BY END USER, 2017–2020 (UNITS)

TABLE 41 MARKET (WITHOUT PERIPHERALS), BY END USER, 2021–2026 (UNITS)

TABLE 42 MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 43 MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

8.2 AUTOMOTIVE AND TRANSPORTATION

8.2.1 AUTOMOTIVE AND TRANSPORTATION INDUSTRY TO BE LARGEST END USER OF WELDING ROBOTS

TABLE 44 ROBOTIC WELDING MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 45 MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 46 MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

FIGURE 41 APAC TO LEAD MARKET (WITHOUT PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION FROM 2021 TO 2026

TABLE 48 MARKET (WITHOUT PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2017–2020 (UNITS)

TABLE 49 MARKET (WITHOUT PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2021–2026 (UNITS)

8.3 METALS AND MACHINERY

8.3.1 WELDING ROBOTS ENHANCE PRODUCTIVITY OF METALS AND MACHINERY INDUSTRY AND HELP ACHIEVE MARKED GAINS IN TERMS OF TIME-TO-MARKET AND COST METRICS

TABLE 50 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 51 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 52 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 MARKET (WITHOUT PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2017–2020 (UNITS)

TABLE 55 MARKET (WITHOUT PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2021–2026 (UNITS)

8.4 ELECTRICAL AND ELECTRONICS

8.4.1 MINIATURIZATION OF ELECTRONIC DEVICES DRIVES DEMAND FOR ROBOTIC WELDING SOLUTIONS IN ELECTRICAL AND ELECTRONICS INDUSTRY

TABLE 56 MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 57 MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 42 MARKET (WITH PERIPHERALS) IN APAC PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 58 MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 ROBOTIC WELDING MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 MARKET (WITHOUT PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2017–2020 (UNITS)

TABLE 61 MARKET (WITHOUT PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2021–2026 (UNITS)

8.5 AEROSPACE AND DEFENSE

8.5.1 ROBOTIC WELDING LOWERS MANUFACTURING COSTS AND IMPROVES PRODUCT QUALITY IN AEROSPACE AND DEFENSE INDUSTRY

FIGURE 43 SPOT WELDING ROBOTS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE FROM 2021 TO 2026

TABLE 62 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 63 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 64 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 MARKET (WITHOUT PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2017–2020 (UNITS)

TABLE 67 MARKET (WITHOUT PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2021–2026 (UNITS)

8.6 OTHERS

TABLE 68 MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 70 MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY REGION, 2021–2026 (USD MILLION)

TABLE 72 MARKET (WITHOUT PERIPHERALS) FOR OTHER END USERS, BY REGION, 2017–2020 (UNITS)

TABLE 73 MARKET (WITHOUT PERIPHERALS) FOR OTHER END USERS, BY REGION, 2021–2026 (UNITS)

9 GEOGRAPHIC ANALYSIS (Page No. - 122)

9.1 INTRODUCTION

FIGURE 44 MARKET, BY REGION

FIGURE 45 MARKET (WITH PERIPHERALS) IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 74 MARKET (WITHOUT PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET (WITHOUT PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

TABLE 76 MARKET (WITHOUT PERIPHERALS), BY REGION, 2017–2020 (UNITS)

TABLE 77 MARKET (WITHOUT PERIPHERALS), BY REGION, 2021–2026 (UNITS)

TABLE 78 MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 79 MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 46 SNAPSHOT: ROBOTIC WELDING MARKET IN NORTH AMERICA

TABLE 80 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 81 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

TABLE 82 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 83 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 84 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY END USER, 2017–2020 (USD MILLION)

TABLE 85 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY END USER, 2021–2026 (USD MILLION)

TABLE 86 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY END USER, 2017–2020 (UNITS)

TABLE 87 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY END USER, 2021–2026 (UNITS)

TABLE 88 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 89 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 90 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2017–2020 (UNITS)

TABLE 91 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2021–2026 (UNITS)

9.2.1 US

9.2.1.1 US to lead market (with peripherals) in North America from 2021 to 2026

TABLE 92 MARKET (WITH PERIPHERALS) IN US, BY TYPE, 2017–2020 (USD MILLION)

TABLE 93 MARKET (WITH PERIPHERALS) IN US, BY TYPE, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growth of manufacturing sector in Canada to drive adoption of welding robots in country

TABLE 94 MARKET (WITH PERIPHERALS) IN CANADA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 MARKET (WITH PERIPHERALS) IN CANADA, BY TYPE, 2021–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Large automobile exports from Mexico under NAFTA contribute to rising demand for welding robots in country

TABLE 96 MARKET (WITH PERIPHERALS) IN MEXICO, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 MARKET (WITH PERIPHERALS) IN MEXICO, BY TYPE, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 47 SNAPSHOT: MARKET IN EUROPE

TABLE 98 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 99 MARKET (WITH PERIPHERALS) IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 100 MARKET (WITH PERIPHERALS) IN EUROPE, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 101 MARKET (WITH PERIPHERALS) IN EUROPE, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 102 MARKET (WITH PERIPHERALS) IN EUROPE, BY END USER, 2017–2020 (USD MILLION)

TABLE 103 MARKET (WITH PERIPHERALS) IN EUROPE, BY END USER, 2021–2026 (USD MILLION)

TABLE 104 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY END USER, 2017–2020 (UNITS)

TABLE 105 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY END USER, 2021–2026 (UNITS)

FIGURE 48 GERMANY TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

TABLE 106 MARKET (WITH PERIPHERALS) IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 107 MARKET (WITH PERIPHERALS) IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 108 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY COUNTRY, 2017–2020 (UNITS)

TABLE 109 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY COUNTRY, 2021–2026 (UNITS)

9.3.1 UK

9.3.1.1 market (with peripherals) in UK to grow at highest CAGR from 2021 to 2026

TABLE 110 MARKET (WITH PERIPHERALS) IN UK, BY TYPE, 2017–2020 (USD MILLION)

TABLE 111 MARKET (WITH PERIPHERALS) IN UK, BY TYPE, 2021–2026 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Aerospace and defense industry and government initiatives to support growth of market (with peripherals) in France

TABLE 112 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN FRANCE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 MARKET (WITH PERIPHERALS) IN FRANCE, BY TYPE, 2021–2026 (USD MILLION)

9.3.3 GERMANY

9.3.3.1 Automotive and transportation industry to spur growth of market (with peripherals) in Germany

TABLE 114 MARKET (WITH PERIPHERALS) IN GERMANY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 115 MARKET (WITH PERIPHERALS) IN GERMANY, BY TYPE, 2021–2026 (USD MILLION)

9.3.4 SPAIN

9.3.4.1 Risen demand for arc and spot welding robots in automotive and transportation industry to propel market growth in Spain

TABLE 116 MARKET (WITH PERIPHERALS) IN SPAIN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 MARKET (WITH PERIPHERALS) IN SPAIN, BY TYPE, 2021–2026 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Italy witnesses highest production of automobiles in Europe, leading to growth of market (with peripherals) in country

TABLE 118 MARKET (WITH PERIPHERALS) IN ITALY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 119 MARKET (WITH PERIPHERALS) IN ITALY, BY TYPE, 2021–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 120 MARKET (WITH PERIPHERALS) IN REST OF EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 MARKET (WITH PERIPHERALS) IN REST OF EUROPE, BY TYPE, 2021–2026 (USD MILLION)

9.4 APAC

FIGURE 49 SNAPSHOT: MARKET IN APAC

TABLE 122 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 123 MARKET (WITH PERIPHERALS) IN APAC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 MARKET (WITH PERIPHERALS) IN APAC, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 125 MARKET (WITH PERIPHERALS) IN APAC, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 126 MARKET (WITH PERIPHERALS) IN APAC, BY END USER, 2017–2020 (USD MILLION)

TABLE 127 MARKET (WITH PERIPHERALS) IN APAC, BY END USER, 2021–2026 (USD MILLION)

TABLE 128 MARKET (WITHOUT PERIPHERALS) IN APAC, BY END USER, 2017–2020 (UNITS)

TABLE 129 MARKET (WITHOUT PERIPHERALS) IN APAC, BY END USER, 2021–2026 (UNITS)

FIGURE 50 MARKET (WITH PERIPHERALS) IN CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 130 MARKET (WITH PERIPHERALS) IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 131 MARKET (WITH PERIPHERALS) IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 132 MARKET (WITHOUT PERIPHERALS) IN APAC, BY COUNTRY, 2017–2020 (UNITS)

TABLE 133 MARKET (WITHOUT PERIPHERALS) IN APAC, BY COUNTRY, 2021–2026 (UNITS)

9.4.1 CHINA

9.4.1.1 China to lead market (with peripherals) from 2021 to 2026

TABLE 134 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN CHINA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 135 MARKET (WITH PERIPHERALS) IN CHINA, BY TYPE, 2021–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Emergence of Japan as predominant industrial robot manufacturer in world

TABLE 136 MARKET (WITH PERIPHERALS) IN JAPAN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 137 MARKET (WITH PERIPHERALS) IN JAPAN, BY TYPE, 2021–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Strict adherence to quality standards, along with rising costs of skilled labor, urge companies in India to invest in robotics and automation

TABLE 138 MARKET (WITH PERIPHERALS) IN INDIA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 139 MARKET (WITH PERIPHERALS) IN INDIA, BY TYPE, 2021–2026 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Electrical and electronics industry in South Korea to fuel growth of market (with peripherals)

TABLE 140 MARKET (WITH PERIPHERALS) IN SOUTH KOREA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 MARKET (WITH PERIPHERALS) IN SOUTH KOREA, BY TYPE, 2021–2026 (USD MILLION)

9.4.5 TAIWAN

9.4.5.1 Large industrial base in Taiwan drives growth of market (with peripherals) in country

TABLE 142 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN TAIWAN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 143 MARKET (WITH PERIPHERALS) IN TAIWAN, BY TYPE, 2021–2026 (USD MILLION)

9.4.6 REST OF APAC

TABLE 144 MARKET (WITH PERIPHERALS) IN REST OF APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 MARKET (WITH PERIPHERALS) IN REST OF APAC, BY TYPE, 2021–2026 (USD MILLION)

9.5 ROW

TABLE 146 MARKET (WITH PERIPHERALS) IN ROW, BY TYPE, 2017–2020 (USD MILLION)

TABLE 147 MARKET (WITH PERIPHERALS) IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 148 MARKET (WITH PERIPHERALS) IN ROW, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 149 MARKET (WITH PERIPHERALS) IN ROW, BY PAYLOAD, 2021–2026 (USD MILLION)

FIGURE 51 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

TABLE 150 MARKET (WITH PERIPHERALS) IN ROW, BY END USER, 2017–2020 (USD MILLION)

TABLE 151 MARKET (WITH PERIPHERALS) IN ROW, BY END USER, 2021–2026 (USD MILLION)

TABLE 152 MARKET (WITHOUT PERIPHERALS) IN ROW, BY END USER, 2017–2020 (UNITS)

TABLE 153 MARKET (WITHOUT PERIPHERALS) IN ROW, BY END USER, 2021–2026 (UNITS)

TABLE 154 MARKET (WITH PERIPHERALS) IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 155 MARKET (WITH PERIPHERALS) IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 156 MARKET (WITHOUT PERIPHERALS) IN ROW, BY REGION, 2017–2020 (UNITS)

TABLE 157 MARKET (WITHOUT PERIPHERALS) IN ROW, BY REGION, 2021–2026 (UNITS)

9.5.1 MIDDLE EAST AND AFRICA

9.5.1.1 Oil and gas industry to create lucrative growth opportunities for market in Middle East and Africa

TABLE 158 MARKET (WITH PERIPHERALS) IN MIDDLE EAST AND AFRICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 159 MARKET (WITH PERIPHERALS) IN MIDDLE EAST AND AFRICA, BY TYPE, 2021–2026 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Mining and automotive industry to drive market growth in South America

TABLE 160 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN SOUTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 161 MARKET (WITH PERIPHERALS) IN SOUTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 161)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

TABLE 162 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ROBOTIC WELDING COMPANIES

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC STRATEGIES

10.3 MARKET SHARE ANALYSIS, 2020

TABLE 163 DEGREE OF COMPETITION IN MARKET, 2020

TABLE 164 RANKING ANALYSIS OF KEY COMPANIES OFFERING ARC WELDING ROBOTS

TABLE 165 RANKING ANALYSIS OF KEY COMPANIES OFFERING SPOT WELDING ROBOTS

10.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 52 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET

10.5 COMPANY EVALUATION MATRIX

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 53 ROBOTIC WELDING MARKET: COMPANY EVALUATION MATRIX, 2020

10.6 START-UP/SME EVALUATION MATRIX

TABLE 166 START-UPS/SME IN MARKET

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 54 MARKET, START-UP/SME EVALUATION MATRIX, 2020

10.7 COMPANY FOOTPRINT

TABLE 167 COMPANY WELDING ROBOT TYPE FOOTPRINT

TABLE 168 COMPANY END USER FOOTPRINT

TABLE 169 COMPANY REGIONAL FOOTPRINT

TABLE 170 COMPANY FOOTPRINT

10.8 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 55 ROBOTIC WELDING MARKET WITNESSED SIGNIFICANT DEVELOPMENTS FROM JANUARY 2018 TO DECEMBER 2020

10.8.1 PRODUCT LAUNCHES

TABLE 171 PRODUCT LAUNCHES, JANUARY 2021–DECEMBER 2020

10.8.2 DEALS

TABLE 172 DEALS, JANUARY 2018–DECEMBER 2020

10.8.3 OTHERS

TABLE 173 EXPANSION, JANUARY 2018–DECEMBER 2020

11 COMPANY PROFILES (Page No. - 177)

11.1 KEY PLAYERS

(Business overview, Products/solutions offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.1.1 FANUC CORPORATION

TABLE 174 FANUC CORPORATION: BUSINESS OVERVIEW

FIGURE 56 FANUC CORPORATION: COMPANY SNAPSHOT

11.1.2 YASKAWA ELECTRIC CORPORATION

TABLE 175 YASKAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 57 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.1.3 KUKA AG

TABLE 176 KUKA AG: BUSINESS OVERVIEW

FIGURE 58 KUKA AG: COMPANY SNAPSHOT

11.1.4 ABB

TABLE 177 ABB: BUSINESS OVERVIEW

FIGURE 59 ABB: COMPANY SNAPSHOT

11.1.5 KAWASAKI HEAVY INDUSTRIES, LTD.

TABLE 178 KAWASAKI HEAVY INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 60 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

11.1.6 PANASONIC CORPORATION

TABLE 179 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 61 PANASONIC CORPORATION: COMPANY SNAPSHOT

11.1.7 DAIHEN CORPORATION

TABLE 180 DAIHEN CORPORATION: BUSINESS OVERVIEW

11.1.8 NACHI-FUJIKOSHI CORP.

TABLE 181 NACHI-FUJIKOSHI CORP.: BUSINESS OVERVIEW

FIGURE 62 NACHI-FUJIKOSHI CORP.: COMPANY SNAPSHOT

11.1.9 COMAU S.P.A.

TABLE 182 COMAU S.P.A.: BUSINESS OVERVIEW

11.1.10 HYUNDAI ROBOTICS

TABLE 183 HYUNDAI ROBOTICS: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 IGM ROBOTERSYSTEME AG

11.2.2 ESTUN AUTOMATION CO., LTD.

11.2.3 THE LINCOLN ELECTRIC COMPANY

11.2.4 KEMPPI OY

11.2.5 FRONIUS INTERNATIONAL GMBH

11.2.6 STÄUBLI INTERNATIONAL AG

11.2.7 ESAB

11.2.8 SHANGHAI STEP ELECTRIC CORPORATION

11.2.9 SIASUN ROBOT AUTOMATION CO., LTD.

11.2.10 UNITED PROARC CORPORATION

*Details on Business overview, Products/solutions offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 223)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

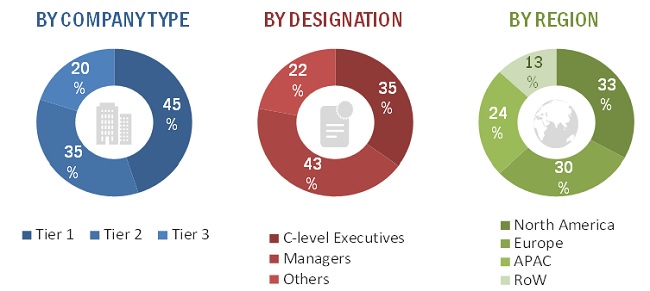

The study involved four major activities in estimating the size of the robotic welding market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data has also been collected from secondary sources such as International Federation of Robotics (IFR), Robotic Industries Association (RIA), IEEE Robotics and Automation Society (RAS), Robotics Business Review (RBR), Japan Robot Association, Chinese Association of Automation, World Trade Organization (WTO), and The International Trade Centre (ITC).

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the Robotic welding market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

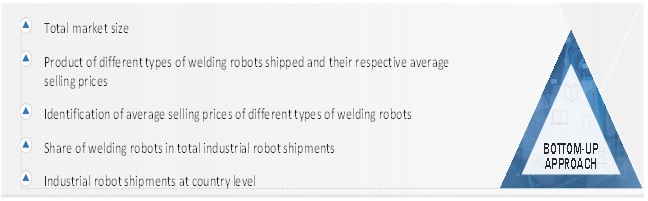

The bottom-up procedure has been employed to arrive at the overall size of the robotic welding market.

- Identifying the number of industrial robots shipped in each region

- Analyzing the global penetration of welding robots that fall under the category of industrial robots through secondary and primary research

- Identifying average selling prices of different types of welding robots

- Conducting multiple discussion sessions with the key opinion leaders to understand different types of welding robots and their deployment in multiple end-use industries; analyzing the break-up of the work carried out by each key company

- Verifying and crosschecking estimates at every level with the key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for company- and region-specific developments undertaken in the robotic welding market

To know about the assumptions considered for the study, Request for Free Sample Report

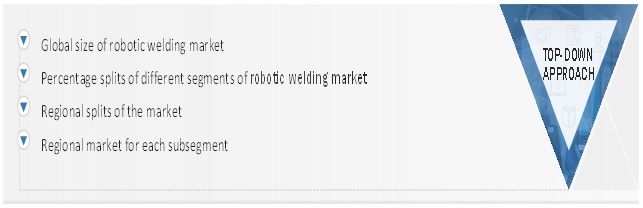

The top-down approach has been used to estimate and validate the total size of the robotic welding market.

- Focusing on top-line investments and expenditures being made in the ecosystem of the robotic welding industry; segmenting the market based on type, payload, end user, and region; and listing key developments in the leading markets

- Identifying all key players in the robotic welding market based on region and end user through secondary research that have been then duly verified through a brief discussion with the industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all the identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with the industry experts to validate the information and identify the key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the Robotic welding market.

Report Objectives

- To define, describe, segment, and forecast the robotic welding market based on type and end user in terms of value (with peripherals) and volume (without peripherals)

- To define, describe, segment, and forecast the market based on payload in terms of value (with peripherals)

- To describe and forecast the market (with peripherals and without peripherals) for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)—in terms of (with peripherals) value and volume (without peripherals)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the robotic welding market

- To provide a detailed overview of the supply chain pertaining to the robotic welding ecosystem, along with the average selling prices of welding robots

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market

- To describe the detailed impact of the COVID-19 on the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, expansions, partnerships, contracts, joint ventures, agreement, and acquisitions in the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the robotic welding supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Robotic Welding Market

i want to watch the market size of welding robot graph.