Rotary and RF Rotary Joints Market Size, Share, Trends by Rotary Joints Type (Hydraulic, Pneumatic, Slip Rings, Fiber Optic), Channel (Single Passage, Multi Passage), RF Rotary Joints Type (Coaxial, Waveguide), Application, Industry and Region - Global Forecast to 2029

Updated on : October 23, 2024

Rotary and RF Rotary Joints Market Size

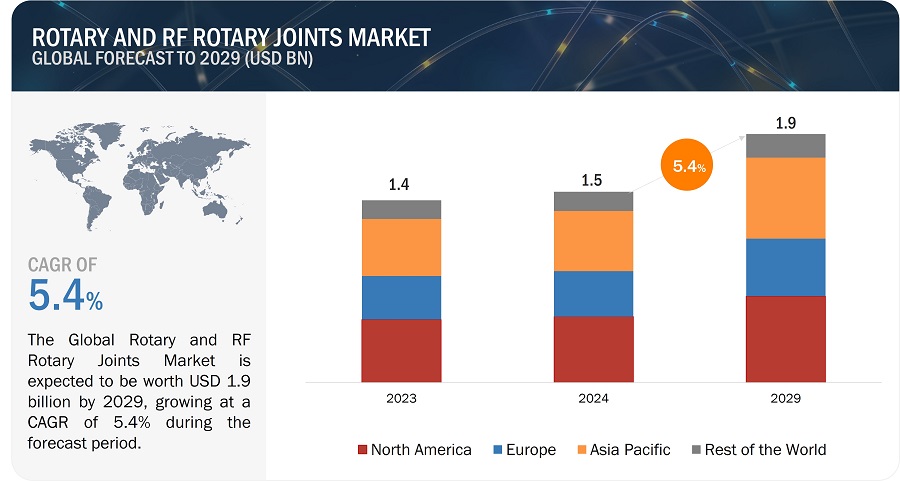

[199 Pages Report] The global Rotary and RF Rotary Joints Market was valued at USD 1.5 billion in 2024 and is projected to grow from USD 1.53 billion in 2025 to USD 1.90 billion by 2029, at a CAGR of 5.4% during the forecast period.

The market's growth is driven by technological advancements and increasing demand for high-speed communication, particularly in defense and satellite communication applications. Enhanced sealing technologies and the need for reliable rotary joints in high-temperature and high-pressure environments are also propelling market expansion.

Key Takeaways:

• The global Rotary and RF Rotary Joints Market was valued at USD 1.5 billion in 2024 and is projected to grow from USD 1.53 billion in 2025 to USD 1.90 billion by 2029, at a CAGR of 5.4% during the forecast period.

• By Technology: The adoption of sealing technology is critical for reducing fluid or gas leakage, thus improving performance and reducing operational lag.

• By Application: Increasing demand from communication systems in defense applications is a significant driver, as smooth communication is vital for modern military operations.

• By Product: Multi-passage rotary joints are seeing increased demand due to their reduced leakage and improved process control capabilities.

• By End User: The aerospace and defense sector is witnessing robust demand for RF rotary joints, driven by the need for high-frequency communication in unmanned aerial vehicles (UAVs).

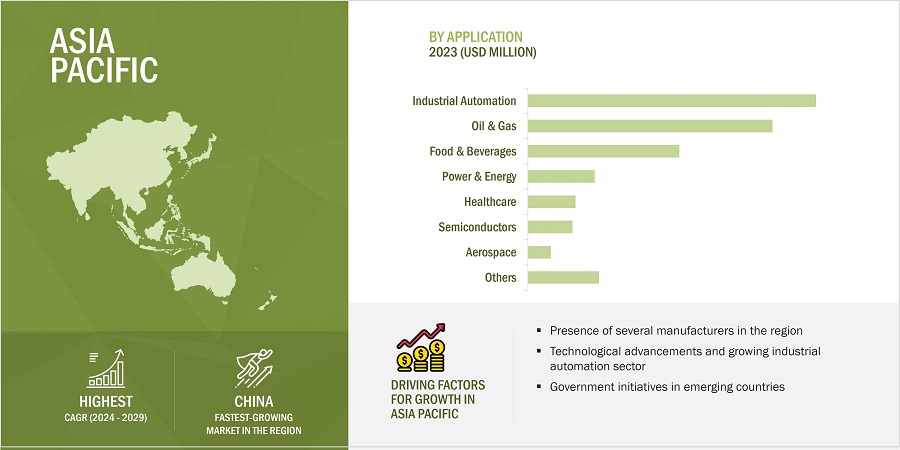

• By Region: ASIA PACIFIC is expected to grow fastest at a 6.1% CAGR, fueled by rising investments in automation and communication infrastructures.

• By Technology Analysis: The integration of advanced radar and satellite communication systems is crucial, with complementary technologies like impedance matching devices enhancing market offerings.

In conclusion, the Rotary and RF Rotary Joints Market is poised for significant growth, driven by the burgeoning demand for advanced communication systems and the need for robust and reliable technology solutions across various industries. Long-term projections indicate that ongoing investments in R&D will further enhance the efficiency and capability of rotary joints, catering to the evolving needs of sectors such as aerospace, manufacturing, and defense. The market offers substantial opportunities, especially in the satellite communication domain, where hybrid rotary joints are increasingly sought after.

Rotary and RF Rotary Joints Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Rotary and RF Rotary Joints Market Trends

Driver: Increasing demand from communication systems in defense applications

Smooth communication plays a crucial part in successful modern military operations. Therefore, slip rings and rotary joints are beneficial technologies for enhancing connection and operational effectiveness on the battlefield by transferring data continuously and delivering power between the stationary and rotational sections of military equipment. The military and defense sectors are constantly changing, with a strong focus on improving communications and surveillance. This urge for modernization calls for the use of advanced radar and satellites. This would also involve the communication systems built into various defense operations.

Unmanned aerial vehicles (UAVs) are being utilized for intelligence, surveillance, reconnaissance (ISR), and tactical missions. These platforms use RF rotary joints for high-frequency communications, and the increasing investments in these platforms are increasing the demand for RF rotary joints.

Restraint: Challenges associated with leakage, thermal irregularities, and stagnation

Rotary joints are made from various materials. For instance, stainless steel is mainly used in their construction since it offers resistance to dust and corrosion. However, in some uses, aluminum rotary joints are used for their higher flexibility and malleability than stainless steel material. The manufacturers produce these rotary joints from these materials around the globe, and each differs in its composition. For example, Chinese brands usually use 90% pure stainless steel, whereas American manufacturers would need 94% to 95% purity. That is why there are small differences in operational parameters. In addition, using different brands in the same application can cause issues such as leakage, thermal irregularities, and stagnation.

Opportunity: Rising demand for hybrid rotary joints in satellite communication applications

Satcom is an extensive field of operation wherein the need for rotary joints is ever-increasing. It is crucial in establishing communication between satellites and moving platforms such as ships, aircraft, or vehicles. Therefore, rotary joints form a very important part of satellite communications systems in realizing significant applications such as broadband internet access, videoconferencing, phone services, and seamless data transfer through mobile satellite communications systems. While civilian applications dominate, rotary joints also play a vital role in military systems, providing reliable communication across diverse operational environments. In addition, the global trend of satellite launches, including China, the US, India, and Russia, has increased manifold satcom communication infrastructure. This increase in satellite deployments boosts demand for RF rotary joints; coaxial and waveguide rotary joints are two major types utilized in satcom applications.

Challenge: Mechanical wear owing to continuous rotation and exposure to harsh environments

Rotary joints are applied in severe industrial processes; they have loads of different types and rotate almost all the time. In the long run, this causes huge mechanical wear and affects joint durability and reliability. Frictional wear may occur due to the continuous rotation of rotary joins against seals and internal components. The abrasive particles of fluid or media being transferred may accelerate the wear of sealing surfaces and bearing components. The older it becomes, the more difficult it is to maintain effective seals. Wear-induced dimensional changes or roughened surfaces may compromise the sealing effectiveness of rotary joints, which then causes fluid leakage or loss of pressure.

Rotary And RF Rotary Joints Market Ecosystem

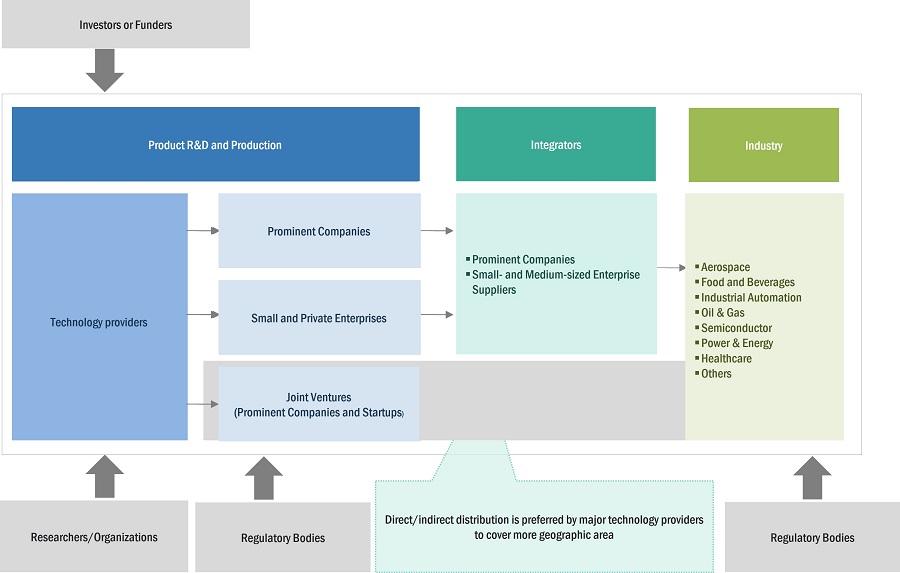

The rotary and RF rotary joints market share is fragmented, with major companies such as Moog Inc. (US), Kadant Inc. (US), Columbus McKinnon Corporation (US), Deublin Company (US), Dynamic Sealing Technologies Inc (US), Macartney Underwater Technology (Denmark), Cobham France SAS (France), Pasternack Enterprises Inc (US), Spinner GmbH (Germany), Spectrum Control (US) and numerous small- and medium-sized enterprises. Almost all players offer different types of products in the rotary and RF rotary joints market share .

Rotary and RF Rotary Joints Market Share

Slip rings segment to dominate market during forecast period.

The slip rings segment dominates the rotary and RF rotary joints market. Slip rings have broad applications in industrial equipment such as wind generators, medical equipment, and robots. This considers their power and data transmittance functionality between rotating and stationary parts. They are crucial in many industries, such as food & beverages and oil & gas. In addition, the demand for slip rings has grown with the adoption of automation in the industry. Continuous rotation in automated systems and machinery is often necessary, and the power or signals should be transferred. Slip rings are, in this respect, a critical component. These are the factors fueling growth in demand for slip rings.

Commercial segment to command market during forecast period.

The RF rotary joints market size is dominated by the commercial sector due to high growth and technological progress in the telecommunication, broadcasting, and satellite communication industries. These industries need high-performance RF rotary joints for seamless signal transmission in applications such as antenna systems, radar, and broadcasting equipment. Growing demand for high-speed data communication further fuels this market due to increasing reliance on satellite communications to connect the world.

Rotary and RF Rotary Joints Market Regional Analysis

Asia Pacific region to grow at fastest CAGR during forecast period.

The Asia Pacific region is expected to grow fastest in the rotary and RF rotary joints market for several reasons. The countries of Asia, like China, India, and South Korea, have rapid industrialization and urbanization. These nations are investing highly in manufacturing, automation, and infrastructure, generating demand for machinery and equipment that involves increased demand for rotary joints. Besides, the booming telecommunications sector in the region with massive investments in satellite communications adds to the market growth. In addition, the high demand is reflected by the expanding aerospace and defense industries and increasing government expenditure.

Rotary and RF Rotary Joints Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Rotary And RF Rotary Joints Companies - Key Market Players:

The rotary and RF rotary joints companies is dominated by a few globally established players such :

- Moog Inc. (US),

- Kadant Inc. (US),

- Columbus McKinnon Corporation (US),

- Deublin Company (US),

- Dynamic Sealing Technologies Inc (US),

- Macartney Underwater Technology (Denmark),

- Cobham France SAS (France),

- Pasternack Enterprises Inc (US),

- Spinner GmbH (Germany),

- Spectrum Control (US).

Rotary and RF Rotary Joints Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 1.5 billion in 2024 |

| Projected Market Size | USD 1.9 billion in 2029 |

| Growth Rate | CAGR of 5.4% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

Moog Inc. (US), Kadant Inc. (US), Columbus McKinnon Corporation (US), Deublin Company (US), Dynamic Sealing Technologies Inc (US), Macartney Underwater Technology (Denmark), Cobham France SAS (France), Pasternack Enterprises Inc (US), Spinner GmbH (Germany), Spectrum Control (US) |

Rotary and RF Rotary Joints Market Share and Highlights

This research report categorizes the rotary and RF rotary joints market size based on Rotary joint by channel, Rotary joint by type, RF rotary joint by type, rotary joint by industry, RF rotary joint by application, and region

|

Segment |

Subsegment |

|

By Channel |

|

|

By Type |

|

|

By Type |

|

|

By Industry |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Rotary and RF Rotary Joints Industry :

- In June 2024, Kadant Inc. completed the acquisition of Dynamic Sealing Technologies Inc. (US). The acquisition, subject to customary adjustments, was financed through borrowings under Kadant's revolving credit facility. DSTI specializes in engineered fluid sealing and transfer solutions for rotating applications. DSTI's custom-engineered rotary unions and related products align well with Kadant's existing product portfolio, enhancing Kadant's presence in adjacent industries such as aerospace and semiconductors.

- In March 2024, HOERBIGER (Austria), through its subsidiary Deublin Company, enhanced its global leadership in rotary unions and slip rings with the acquisition of Diamond-Roltran, LLC (US), a prominent manufacturer of maintenance-free slip rings known as Roll-Rings. This acquisition strengthens Deublin's market presence in the slip rings segment.

- In May 2023, Columbus McKinnon Corporation (US) acquired montratec GmbH (Germany), a leading automation solutions company. This acquisition advances Columbus's strategy to expand its presence in attractive markets such as life sciences, semiconductors, and electronics.

- In December 2021, Columbus McKinnon Corporation (US) acquired Garvey Corporation (US), which is a leading accumulation systems solutions company. This acquisition helped the company create one of the most comprehensive lines of precision conveying and accumulation technologies in the industry.

- In September 2021, SPINNER (Germany) launched a 109-channel Fiber-Optic Rotary Joint designed for offshore and FPSO applications.

Frequently Asked Questions (FAQs):

Which are the major companies in the rotary and RF rotary joints market? What are their significant strategies to strengthen their market presence?

The major companies in the rotary and RF rotary joints market are – Moog Inc. (US), Kadant Inc. (US), Columbus McKinnon Corporation (US), Deublin Company (US), and Dynamic Sealing Technologies Inc (US). The major strategies adopted by these players are product launches and developments, collaborations, acquisitions, and expansions.

What is the potential market for the rotary and RF rotary joints in terms of the region?

The North American region is expected to dominate the rotary and RF rotary joints market due to the presence of major companies in various industries.

What are the opportunities for new market entrants?

There are significant opportunities for start-up companies in the rotary and RF rotary joint market. These companies provide innovative and diverse service portfolios for industrial automation, military, aerospace, oil & gas, and other industries.

What are the drivers and opportunities for the rotary and RF rotary joints market?

Factors such as governmental strategic initiatives in developing nations and the rising adoption of industrial automation are fueling the growth.

What are the major rotary and RF rotary joints applications expected to drive the market's growth in the next five years?

The major applications for the rotary and RF rotary joints are industrial automation, food & beverage, and oil & gas. The rotary and RF rotary joints are also in demand in aerospace, semiconductor, power & energy, and healthcare. They are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Use of advanced radar and satellite communication systems- Increasing demand for single- and multi-passage rotary joints- Subsidies to encourage automation and digitization- Growing demand for multi-channel rotary joints in food & beverages industryRESTRAINTS- Leakage and stagnation issuesOPPORTUNITIES- Expanding satcom communication infrastructure- Incorporation of rotary joints into roboticsCHALLENGES- Mechanical wear due to continuous rotation and exposure to harsh operating conditions issues

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY RF ROTARY JOINT TYPEAVERAGE SELLING PRICE TREND OF RF ROTARY JOINT TYPESAVERAGE SELLING PRICE TREND OF RF ROTARY JOINTS, BY REGION

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Sealing technologyCOMPLEMENTARY TECHNOLOGIES- Impedance matching devicesADJACENT TECHNOLOGIES- Fourth-generation military radars- Satellite thermal control systems

-

5.9 PORTER'S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 CASE STUDY ANALYSISUS TISSUE MILL UPGRADED TO PT ROTARY JOINT TO EXTEND SEAL LIFE AND ENHANCE SAFETYECLIPSE ASSISTED SEMICONDUCTOR MANUFACTURER WITH ADVANCED FRICTION TOOLS TO CONTROL RADIAL SEAL WALL DIMENSIONSLOCAL MANUFACTURER HELPED GAZPROM ENHANCE DRILLING EQUIPMENTNASA ASSISTED SPACE X LAUNCH SATELLITES FITTED WITH COOLING SYSTEMS TO ENSURE OPTIMAL FLOW OF COOLANTS

-

5.12 TRADE ANALYSISIMPORT DATA (HS CODE 7307)EXPORT DATA (HS CODE 7307)

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.15 TARIFF AND REGULATORY LANDSCAPETARIFF ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

-

6.2 SINGLE PASSAGERISING IMPLEMENTATION IN CNC MACHINES TO FOSTER SEGMENTAL GROWTH

-

6.3 MULTI-PASSAGEREDUCED LEAKAGE AND IMPROVED PROCESS CONTROL TO DRIVE DEMAND

- 7.1 INTRODUCTION

-

7.2 COAXIALEXPANDING AEROSPACE & DEFENSE SECTOR TO BOOST DEMAND

-

7.3 WAVEGUIDEINCREASING DEPLOYMENT OF MOBILE SATCOM SYSTEMS TO DRIVE MARKET

-

7.4 HYBRIDGROWING GENERATION OF TIDAL ENERGY TO AUGMENT SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 HYDRAULIC ROTARY JOINTSRISING DEMAND FOR EFFICIENT FLUID TRANSFER SOLUTIONS IN CONSTRUCTION AND MANUFACTURING INDUSTRIES TO FOSTER SEGMENTAL GROWTH

-

8.3 PNEUMATIC ROTARY JOINTSINCREASING DEMAND FOR AUTOMATION AND EFFICIENCY IN MANUFACTURING SECTOR TO FOSTER MARKET GROWTH

-

8.4 WATER AND STEAM ROTARY JOINTSRISING NEED TO MANAGE HIGH-TEMPERATURE AND HIGH-PRESSURE FLUIDS TO DRIVE DEMAND

-

8.5 SLIP RINGSCONTACT-BASED- Growing application in industrial machinery and manufacturing processes to boost demandCONTACTLESS- Increasing demand for high-speed data transmission solutions to foster market growth

-

8.6 FIBER OPTIC ROTARY JOINTSSINGLE-MODE- Rising application in wind turbines and high-definition video devices to drive marketMULTI-MODE- Increasing demand for high-quality imaging CT scanners and MRI machines to offer lucrative growth opportunities

- 9.1 INTRODUCTION

-

9.2 AEROSPACEGROWING DEMAND FOR DURABLE COMPOSITE MATERIALS TO FOSTER MARKET GROWTH

-

9.3 FOOD & BEVERAGEINCREASING DEMAND FOR PROCESSED AND PACKAGED FOODS TO FUEL MARKET GROWTH

-

9.4 INDUSTRIAL AUTOMATIONRISING APPLICATION IN ROBOTIC AND MECHANICAL SYSTEMS TO SPUR DEMAND

-

9.5 OIL & GASINCREASING DEMAND FOR DEEP WELLS AND LONG PIPELINES TO FOSTER MARKET GROWTH

-

9.6 SEMICONDUCTORPRESSING NEED FOR CONSISTENT POWER SUPPLY AND UNINTERRUPTED DATA TRANSMISSION TO DRIVE MARKET

-

9.7 ENERGY & POWERSURGING DEMAND FOR RENEWABLE ENERGY TO ACCELERATE DEMAND

-

9.8 HEALTHCAREINCREASING APPLICATION IN LAPAROSCOPES AND CT SCANNERS TO DRIVE MARKET

- 9.9 OTHERS

- 10.1 INTRODUCTION

-

10.2 COMMERCIALRISING APPLICATION IN AIR TRAFFIC CONTROL AND AIRBORNE SYSTEMS TO FUEL MARKET GROWTH

-

10.3 MILITARYGROWING RELIANCE ON ADVANCED COMMUNICATION SYSTEMS AND TECHNOLOGIES TO FOSTER MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Growing emphasis on offering advanced rotary unions to boost demandCANADA- Rising focus on reducing carbon emissions to drive marketMEXICO- Expanding semiconductor industry to offer lucrative growth opportunities

-

11.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEGERMANY- Growing investment in smart manufacturing technologies to spur demandUK- Increasing adoption of Industry 4.0 practices to accelerate demandFRANCE- Rising emphasis on developing renewable energy technologies to boost demandREST OF EUROPE

-

11.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Increasing application in manufacturing and infrastructure sectors to boost demandJAPAN- Government-led initiatives to support SMEs and strengthen manufacturing sector to drive markrtSOUTH KOREA- Growing investment in aerospace and renewable energy sectors to boost demandREST OF ASIA PACIFIC

-

11.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST & AFRICA- Increasing investments in oil & gas and renewable energy sectors to boost demand- GCC- Africa and Rest of Middle EastSOUTH AMERICA- Rising focus on sustainability to drive market

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

- 12.3 REVENUE ANALYSIS, 2019–2023

- 12.4 MARKET SHARE ANALYSIS, 2O23

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

-

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Rotary joints type footprint- RF rotary joints type footprint- End use footprint- Region footprint

-

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

12.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSMOOG INC.- Business overview- Products/Solutions/Services offered- MnM viewKADANT INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOLUMBUS MCKINNON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDEUBLIN COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDYNAMIC SEALING TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- MnM viewMACARTNEY UNDERWATER TECHNOLOGY- Business overview- Products/Solutions/Services offeredCOBHAM FRANCE SAS- Business overview- Products/Solutions/Services offeredPASTERNACK ENTERPRISES, INC.- Business overview- Products/Solutions/Services offeredSPINNER GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsSPECTRUM CONTROL- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSCHRISTIAN MAIER GMBH & CO. KGSYLATECHMOFLON TECHNOLOGYROTARY SYSTEMS INC.ROTOTECHBGBHAAG + ZEISSLER MASCHINENELEMENTE GMBHA-INFO INC.OTT-JAKOB SPANNTECHNIK GMBHTENGXUAN TECHNOLOGYNURASEALRIX NORTH AMERICADIAMOND ANTENNA AND MICROWAVE CORPORATIONPENLINK ABVECTOR TELECOM PTY LTDAPOLLO MICROWAVESMEGA INDUSTRIES LLCMICROTECH, INC.MICRO SEALSSPACE MACHINE AND ENGINEERING CORP

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 ROLES OF COMPANIES IN ROTARY AND RF ROTARY JOINTS ECOSYSTEM

- TABLE 2 INDICATIVE PRICING TREND OF DIFFERENT TYPES OF RF ROTARY JOINTS OFFERED BY KEY PLAYERS (USD)

- TABLE 3 ROTARY AND RF ROTARY JOINTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 6 LIST OF APPLIED/GRANTED PATENTS RELATED TO ROTARY AND RF ROTARY JOINTS MARKET, 2021–2024

- TABLE 7 ROTARY AND RF ROTARY JOINTS MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

- TABLE 8 MFN TARIFF FOR HS CODE 7307-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROTARY JOINTS MARKET, BY CHANNEL, 2020–2023 (USD MILLION)

- TABLE 14 ROTARY JOINTS MARKET, BY CHANNEL, 2024–2029 (USD MILLION)

- TABLE 15 SINGLE PASSAGE: ROTARY JOINTS MARKET, BY END USE, 2020–2023 (USD MILLION)

- TABLE 16 SINGLE PASSAGE: ROTARY JOINTS MARKET, BY END USE, 2024–2029 (USD MILLION)

- TABLE 17 MULTI-PASSAGE: ROTARY JOINTS MARKET, BY END USE, 2020–2023 (USD MILLION)

- TABLE 18 MULTI-PASSAGE: ROTARY JOINTS MARKET, BY END USE, 2024–2029 (USD MILLION)

- TABLE 19 RF ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 20 RF ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 21 RF ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (THOUSAND UNITS)

- TABLE 22 RF ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (THOUSAND UNITS)

- TABLE 23 COAXIAL: RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 24 COAXIAL: RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 25 WAVEGUIDE: RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 26 WAVEGUIDE: RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 27 HYBRID: RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 28 HYBRID: RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 29 ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 30 ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 31 SLIP RINGS: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 32 SLIP RINGS: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 33 FIBER OPTIC ROTARY JOINTS: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 34 FIBER OPTIC ROTARY JOINTS: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 35 ROTARY JOINTS MARKET, BY END USE, 2020–2023 (USD MILLION)

- TABLE 36 ROTARY JOINTS MARKET, BY END USE, 2024–2029 (USD MILLION)

- TABLE 37 AEROSPACE: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 38 AEROSPACE: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 39 AEROSPACE: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 40 AEROSPACE: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 41 FOOD & BEVERAGE: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 42 FOOD & BEVERAGE: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 43 FOOD & BEVERAGE: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 44 FOOD & BEVERAGE: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 45 INDUSTRIAL AUTOMATION: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 46 INDUSTRIAL AUTOMATION: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 47 INDUSTRIAL AUTOMATION: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 48 INDUSTRIAL AUTOMATION: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 49 OIL & GAS: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 50 OIL & GAS: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 OIL & GAS: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 52 OIL & GAS: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 53 SEMICONDUCTOR: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 54 SEMICONDUCTOR: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 55 SEMICONDUCTOR: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 56 SEMICONDUCTOR: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 57 ENERGY & POWER: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 58 ENERGY & POWER: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 59 ENERGY & POWER: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 60 ENERGY & POWER: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 61 HEALTHCARE: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 62 HEALTHCARE: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 63 HEALTHCARE: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 64 HEALTHCARE: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 65 OTHERS: ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 66 OTHERS: ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 OTHERS: ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 68 OTHERS: ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 69 RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 70 RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 71 COMMERCIAL: RF ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 72 COMMERCIAL: RF ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 73 COMMERCIAL: RF ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 COMMERCIAL: RF ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 MILITARY: RF ROTARY JOINTS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 76 MILITARY: RF ROTARY JOINTS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 77 MILITARY: RF ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 78 MILITARY: RF ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 79 ROTARY AND RF ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 80 ROTARY AND RF ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: ROTARY JOINTS MARKET, BY END USE, 2020–2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: ROTARY JOINTS MARKET, BY END USE, 2024–2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: ROTARY AND RF ROTARY JOINTS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: ROTARY AND RF ROTARY JOINTS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 87 EUROPE: ROTARY JOINTS MARKET, BY END USE, 2020–2023 (USD MILLION)

- TABLE 88 EUROPE: ROTARY JOINTS MARKET, BY END USE, 2024–2029 (USD MILLION)

- TABLE 89 EUROPE: RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 90 EUROPE: RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 91 EUROPE: ROTARY AND RF ROTARY JOINTS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 92 EUROPE: ROTARY AND RF ROTARY JOINTS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: ROTARY JOINTS MARKET, BY END USE, 2020–2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: ROTARY JOINTS MARKET, BY END USE, 2024–2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ROTARY AND RF ROTARY JOINTS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: ROTARY AND RF ROTARY JOINTS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 99 ROW: ROTARY JOINTS MARKET, BY END USE, 2020–2023 (USD MILLION)

- TABLE 100 ROW: ROTARY JOINTS MARKET, BY END USE, 2024–2029 (USD MILLION)

- TABLE 101 ROW: RF ROTARY JOINTS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 102 ROW: RF ROTARY JOINTS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 103 ROW: ROTARY AND RF ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 104 ROW: ROTARY AND RF ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: ROTARY AND RF ROTARY JOINTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: ROTARY AND RF ROTARY JOINTS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 107 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

- TABLE 108 ROTARY AND RF ROTARY JOINTS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 109 ROTARY JOINTS MARKET: TYPE FOOTPRINT

- TABLE 110 RF ROTARY JOINTS MARKET: TYPE FOOTPRINT

- TABLE 111 ROTARY JOINTS MARKET: END USE FOOTPRINT

- TABLE 112 ROTARY AND RF ROTARY JOINTS MARKET: REGION FOOTPRINT

- TABLE 113 ROTARY AND RF ROTARY JOINTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 114 ROTARY JOINTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 115 RF ROTARY JOINTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES,

- TABLE 116 ROTARY AND RF ROTARY JOINTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 117 ROTARY AND RF ROTARY JOINTS MARKET: PRODUCT LAUNCHES, JANUARY 2021−JULY 2024

- TABLE 118 ROTARY AND RF ROTARY JOINTS MARKET: DEALS, JANUARY 2021–JULY 2024

- TABLE 119 MOOG INC.: COMPANY OVERVIEW

- TABLE 120 MOOG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 KADANT INC.: COMPANY OVERVIEW

- TABLE 122 KADANT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 KADANT INC.: DEALS

- TABLE 124 COLUMBUS MCKINNON CORPORATION: COMPANY OVERVIEW

- TABLE 125 COLUMBUS MCKINNON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 COLUMBUS MCKINNON CORPORATION: DEALS

- TABLE 127 DEUBLIN COMPANY: COMPANY OVERVIEW

- TABLE 128 DEUBLIN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 DEUBLIN COMPANY: DEALS

- TABLE 130 DYNAMIC SEALING TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 131 DYNAMIC SEALING TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 MACARTNEY UNDERWATER TECHNOLOGY: COMPANY OVERVIEW

- TABLE 133 MACARTNEY UNDERWATER TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 COBHAM FRANCE SAS: COMPANY OVERVIEW

- TABLE 135 COBHAM FRANCE SAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 PASTERNACK ENTERPRISES, INC.: COMPANY OVERVIEW

- TABLE 137 PASTERNACK ENTERPRISES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 SPINNER GMBH: COMPANY OVERVIEW

- TABLE 139 SPINNER GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 SPINNER GMBH: PRODUCT LAUNCHES

- TABLE 141 SPECTRUM CONTROL: COMPANY OVERVIEW

- TABLE 142 SPECTRUM CONTROL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 CHRISTIAN MAIER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 144 SYLATECH: COMPANY OVERVIEW

- TABLE 145 MOFLON TECHNOLOGY: COMPANY OVERVIEW

- TABLE 146 ROTARY SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 147 ROTOTECH: COMPANY OVERVIEW

- TABLE 148 BGB: COMPANY OVERVIEW

- TABLE 149 HAAG + ZEISSLER MASCHINENELEMENTE GMBH: COMPANY OVERVIEW

- TABLE 150 A-INFO INC.: COMPANY OVERVIEW

- TABLE 151 OTT-JAKOB SPANNTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 152 TENGXUAN TECHNOLOGY: COMPANY OVERVIEW

- TABLE 153 NURASEAL: COMPANY OVERVIEW

- TABLE 154 RIX NORTH AMERICA: COMPANY OVERVIEW

- TABLE 155 DIAMOND ANTENNA AND MICROWAVE CORPORATION: COMPANY OVERVIEW

- TABLE 156 PENLINK AB: COMPANY OVERVIEW

- TABLE 157 VECTOR TELECOM PTY LTD: COMPANY OVERVIEW

- TABLE 158 APOLLO MICROWAVES: COMPANY OVERVIEW

- TABLE 159 MEGA INDUSTRIES: COMPANY OVERVIEW

- TABLE 160 MICROTECH, INC.: COMPANY OVERVIEW

- TABLE 161 MICRO SEALS: COMPANY OVERVIEW

- TABLE 162 SPACE MACHINE AND ENGINEERING CORP: COMPANY OVERVIEW

- FIGURE 1 ROTARY AND RF ROTARY JOINTS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ROTARY AND RF ROTARY JOINTS MARKET: RESEARCH DESIGN

- FIGURE 3 ROTARY AND RF ROTARY JOINTS MARKET: REVENUE GENERATED BY COMPANIES FROM SALES OF ROTARY AND RF ROTARY JOINTS

- FIGURE 4 ROTARY AND RF ROTARY JOINTS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 ROTARY AND RF ROTARY JOINTS MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 MULTI-PASSAGE SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 8 COAXIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 9 INDUSTRIAL AUTOMATION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 GROWING ADOPTION OF INDUSTRIAL ROBOTICS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 12 FIBER OPTIC ROTARY JOINTS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 COMMERCIAL SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 14 INDUSTRIAL AUTOMATION SEGMENT AND NORTH AMERICA TO CAPTURE LARGEST MARKET SHARES IN 2029

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 ROTARY AND RF ROTARY JOINTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 ROTARY AND RF ROTARY JOINTS MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 18 ROTARY AND RF ROTARY JOINTS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 19 ROTARY AND RF ROTARY JOINTS: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 20 ROTARY AND RF ROTARY JOINTS MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 21 ROTARY AND RF JOINTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 ROTARY AND RF ROTARY JOINTS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 INVESTMENT AND FUNDING SCENARIO

- FIGURE 24 AVERAGE SELLING PRICE TREND OF RF ROTARY JOINT TYPES OFFERED BY KEY PLAYERS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF RF ROTARY JOINTS, BY TYPE, 2021–2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF RF ROTARY JOINTS, BY REGION, 2019–2023

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 ROTARY AND RF ROTARY JOINTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 30 BUYING CRITERIA FOR TOP THREE END USE

- FIGURE 31 IMPORT DATA FOR HS CODE 7307-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 7307-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2014−2024

- FIGURE 34 ROTARY JOINTS MARKET, BY CHANNEL

- FIGURE 35 MULTI-PASSAGE SEGMENT TO CAPTURE LARGER SHARE OF ROTARY JOINTS MARKET IN 2029

- FIGURE 36 RF ROTARY JOINTS MARKET, BY TYPE

- FIGURE 37 COAXIAL SEGMENT TO CAPTURE LARGEST SHARE OF RF ROTARY JOINTS MARKET IN 2029

- FIGURE 38 ROTARY JOINTS MARKET, BY TYPE

- FIGURE 39 SLIP RINGS SEGMENT TO DOMINATE ROTARY JOINTS MARKET IN 2029

- FIGURE 40 ROTARY JOINTS MARKET, BY END USE

- FIGURE 41 INDUSTRIAL AUTOMATION SEGMENT TO EXHIBIT HIGHEST CAGR IN ROTARY JOINTS MARKET DURING FORECAST PERIOD

- FIGURE 42 RF ROTARY JOINTS MARKET, BY APPLICATION

- FIGURE 43 COMMERCIAL SEGMENT TO DOMINATE RF ROTARY JOINTS MARKET IN 2029

- FIGURE 44 ROTARY AND RF ROTARY JOINTS MARKET, BY REGION

- FIGURE 45 NORTH AMERICA TO DOMINATE ROTARY AND RF ROTARY JOINTS MARKET IN 2024

- FIGURE 46 NORTH AMERICA: ROTARY AND RF ROTARY JOINTS MARKET SNAPSHOT

- FIGURE 47 EUROPE: ROTARY AND RF ROTARY JOINTS MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: ROTARY AND RF ROTARY JOINTS MARKET SNAPSHOT

- FIGURE 49 ROTARY AND RF ROTARY JOINTS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019–2023

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ROTARY AND RF ROTARY JOINTS, 2023

- FIGURE 51 COMPANY VALUATION, 2023

- FIGURE 52 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 ROTARY AND RF JOINTS MARKET: COMPANY EVALUATION MATRIX (KEY COMPANIES), 2023

- FIGURE 55 ROTARY AND RF ROTARY JOINTS MARKET: COMPANY FOOTPRINT

- FIGURE 56 ROTARY AND RF JOINTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 MOOG INC.: COMPANY SNAPSHOT

- FIGURE 58 KADANT INC.: COMPANY SNAPSHOT

- FIGURE 59 COLUMBUS MCKINNON CORPORATION: COMPANY SNAPSHOT

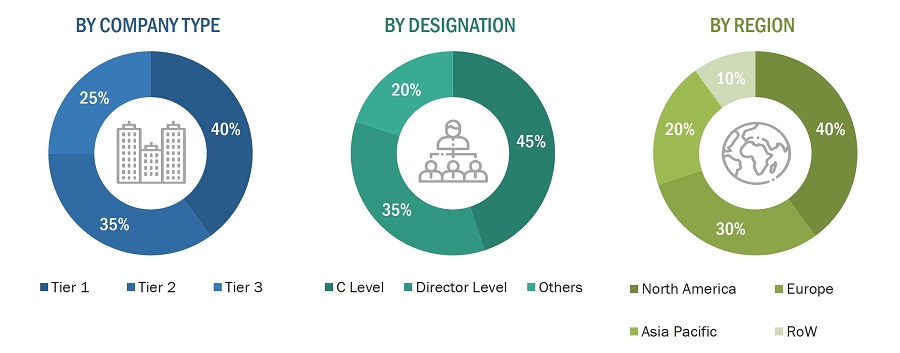

The study used four major activities to estimate the market size of the rotary and RF rotary joints. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information on the rotary and RF rotary joints market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE NAME |

WebLink |

|

Multidisciplinary Digital Publishing Institute (MDPI) |

https://www.mdpi.com/ |

|

Institute of Electrical and Electronics Engineers (IEEE) |

https://www.ieee.org/ |

|

Texas A&M University |

https://www.tamu.edu/ |

|

University of Victoria (UVic) |

https://www.uvic.ca/ |

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customers/end-users using rotary and RF rotary joints, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of rotary and RF rotary joints, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the rotary and RF rotary joints market size and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Rotary and RF Rotary Joints Market Size: Botton Up Approach

- Companies offering rotary and RF rotary joints have been identified, and their mapping with respect to different parameters, such as channel, type, application, and industry has been carried out.

- The market size has been estimated based on the demand for different rotary and RF rotary joints for different applications. The anticipated change in demand for rotary and RF rotary joints offered by these companies and company revenues have been analyzed and estimated.

- Primary research has been conducted with a few major players operating in the rotary and RF rotary joints market to validate the global market size.

- The size of the rotary and RF rotary joints market has been validated through secondary sources, which include the International Trade Centre (ITC), the World Trade Organization, and the World Economic Forum.

- The CAGR of the rotary and RF rotary joints market size has been calculated considering the historical and future market trends by understanding the adoption rate of rotary and RF rotary joints for different applications.

- The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, and with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases, have also been studied.

Global Rotary And RF Rotary Joints Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the rotary and RF rotary joints market.

- Focusing initially on R&D investments and expenditures being made in the ecosystem of the rotary and RF rotary joints market size ; further splitting the market on the basis of rotary joint channel, rotary joint type, RF rotary joint type, RF rotary joint application, rotary joint industry and region and listing key developments

- Identifying leading players in the rotary and RF rotary joints market size through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which all identified players serve products to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments.

Data Triangulation

Once the overall size of the rotary and RF rotary joints market size was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

A rotary joint, otherwise designated as a rotary union or rotating union, is a type of rotary sealing device interconnecting rotating equipment to stationary piping for the transfer of steam, water, thermal oil, coolant, hydraulic oil, air, and other media. While rotary joints come in a wide range of shapes, sizes, and configurations, all of them comprise four fundamental components: a housing unit, a shaft, mechanical bearings, and a seal. RF Rotary Joints are considered to be the most essential components in systems that require transmission of RF signals between stationary and rotating parts. The importance of these electromechanical devices has especially been realized since very early days of RF and microwave technology, particularly within radar systems.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Raw material suppliers

- Technology investors

- Electronic hardware equipment manufacturers

- Research organizations and consulting companies

- Government bodies such as regulatory authorities and policymakers

- Venture capitalists and private equity firms

- Associations, organizations, and alliances related to rotary and RF rotary joints

Report Objectives

- To describe and forecast the rotary and RF rotary joints market size , by rotary joint channel, rotary joint type, RF rotary joint type, RF rotary joint application, rotary joint industry and region, in terms of value

- To describe and forecast the market for various segments across four central regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To strategically analyze the micro markets with regard to the individual growth trends, prospects, and contribution to the market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the value chain

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios trade landscape, and case studies pertaining to the market under study

- To strategically profile key players in the rotary and RF rotary joints market and comprehensively analyze their market shares and core competencies

- To strategically profile the key players and provide a detailed competitive landscape of the market

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with research and development (R&D) in the rotary and RF rotary joints market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the rotary and RF rotary joints market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the rotary and RF rotary joints market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rotary and RF Rotary Joints Market