Safety Laser Scanner Market by Product Type (Mobile Safety Laser Scanner, Stationary Safety Laser Scanner), End-User Industry (Automotive, Food & Beverages, Healthcare & Pharmaceuticals, and Consumer Goods and Electronics) – Global Forecast to 2025-2036

Safety Laser Scanner Market Overview

The global Safety Laser Scanner Market is projected to experience significant growth from 2025 to 2036 as automation and robotics continue to advance across industries. Safety laser scanners are advanced sensing devices that use laser beams to detect objects or people within a defined area. They are essential for preventing workplace accidents, ensuring safe machine operations, and improving overall productivity. The rising demand for industrial automation, strict safety regulations, and growing awareness of worker protection are key factors driving this market. Safety laser scanners are now a standard component in manufacturing, logistics, healthcare, and several other sectors that rely heavily on automated systems.

Market Segmentation by Product Type

The Safety Laser Scanner Market is segmented into mobile safety laser scanners and stationary safety laser scanners.

Mobile safety laser scanners are designed for use in autonomous mobile robots and automated guided vehicles. These scanners enable safe navigation, obstacle detection, and collision avoidance, allowing robots to work efficiently alongside human operators. The growth of e commerce, warehouse automation, and smart logistics has fueled the demand for mobile safety scanners, which ensure reliable and safe operations in dynamic environments.

Stationary safety laser scanners, on the other hand, are installed at fixed positions to safeguard specific zones or machinery. They are commonly used around industrial robots, machine tools, and assembly lines. These scanners continuously monitor defined areas and automatically stop machinery when unauthorized entry or obstruction is detected. Stationary scanners are particularly valued in industries where fixed area protection is essential, such as automotive manufacturing and electronic assembly.

Technological Advancements in Safety Laser Scanners

Technological innovation has transformed the capabilities of modern safety laser scanners. New models now feature greater detection accuracy, wider scanning angles, and faster response times. The integration of advanced technologies such as LiDAR, artificial intelligence, and machine learning has made these scanners more intelligent and adaptable to complex industrial environments. Additionally, many scanners now support industrial communication networks, enabling seamless integration into smart factory systems. This allows for real time data sharing, predictive maintenance, and advanced system diagnostics, improving both safety and operational efficiency.

Manufacturers are focusing on reducing the size and cost of scanners while improving durability and range. The adoption of compact designs and energy efficient components has made these scanners suitable for smaller machines and mobile applications. As industries continue to digitalize, the demand for smart sensors and intelligent safety solutions is expected to rise, strengthening the role of safety laser scanners in future industrial ecosystems.

Key End User Industries

Automotive Industry

The automotive industry is one of the leading adopters of safety laser scanners. As automotive manufacturing becomes more automated, safety scanners are used extensively to protect workers and equipment in robotic assembly lines. They ensure that machinery automatically stops when a person enters a hazardous zone, minimizing accidents. The growing use of collaborative robots, autonomous guided vehicles, and smart production systems has further increased the demand for mobile safety laser scanners in this sector.

Food and Beverages Industry

In the food and beverages industry, maintaining high safety and hygiene standards is critical. Safety laser scanners are used in food processing plants, packaging lines, and material handling systems to ensure worker safety while maintaining uninterrupted operations. These scanners are designed to withstand harsh conditions such as humidity and temperature fluctuations, making them ideal for food production environments. The growing focus on automation and productivity in food and beverage manufacturing continues to drive the adoption of safety laser scanners.

Healthcare and Pharmaceuticals Industry

In the healthcare and pharmaceutical industries, automation and robotics are becoming increasingly prevalent in production and logistics. Safety laser scanners are used in pharmaceutical packaging, automated storage, and laboratory robotics to ensure safe and efficient operations. In hospitals, mobile robots equipped with laser scanners are used for the safe delivery of medical supplies and equipment. The precision, reliability, and safety offered by laser scanners make them essential in healthcare automation, where accuracy and safety standards are paramount.

Consumer Goods and Electronics Industry

The consumer goods and electronics sector relies heavily on automation for mass production and high precision assembly. Safety laser scanners are deployed in production lines to monitor work zones, prevent accidents, and ensure smooth collaboration between workers and robots. In electronics manufacturing, where the assembly process involves delicate components, scanners provide precise area monitoring that prevents damage and enhances operational safety. The growing complexity of electronics manufacturing is creating strong demand for compact, intelligent, and adaptable safety laser scanners.

Regional Insights

North America is expected to hold a significant share of the global Safety Laser Scanner Market due to early adoption of industrial automation and strict safety regulations. The presence of major automation solution providers and increasing investments in smart manufacturing technologies are key factors contributing to market growth. The rise of warehouse robotics, especially in the United States, has created additional demand for mobile safety laser scanners in logistics and e commerce sectors.

Europe remains one of the most mature markets for safety laser scanners, driven by strong industrial safety regulations and advanced automation practices. Countries such as Germany, France, and the United Kingdom are leaders in implementing Industry 4.0 initiatives, which integrate robotics, sensors, and connectivity. European industries emphasize worker safety and compliance with international safety standards, making safety laser scanners an essential part of their automation frameworks.

The Asia Pacific region is projected to experience the highest growth rate during the forecast period. Rapid industrialization, expansion of manufacturing activities, and government initiatives supporting automation are driving market growth. Countries such as China, Japan, South Korea, and India are investing heavily in smart factories, robotics, and safety systems. The growing automotive, electronics, and logistics sectors are creating immense demand for both mobile and stationary safety laser scanners.

Regions such as the Middle East, Africa, and South America are gradually adopting automation technologies and implementing workplace safety regulations. With increasing investments in manufacturing, logistics, and energy infrastructure, the adoption of safety laser scanners in these regions is expected to rise steadily in the coming years.

Key Market Drivers

Several key factors are driving the global Safety Laser Scanner Market. The growing need to ensure worker safety in automated environments and the increasing use of autonomous mobile robots are primary growth contributors. The implementation of stringent safety standards and government regulations across industries has compelled organizations to adopt advanced safety technologies. Additionally, the trend toward smart factories and connected manufacturing environments has encouraged the integration of safety laser scanners with industrial IoT and data monitoring platforms.

The rise in demand for flexible and space efficient safety solutions also supports market expansion. Unlike traditional safety barriers, laser scanners offer programmable safety zones and can be easily reconfigured, making them ideal for dynamic production environments. The cost savings associated with reduced downtime and accident prevention further enhance their value proposition for manufacturers.

Market Challenges

Despite the strong growth potential, the market faces certain challenges. The high initial cost of safety laser scanners can be a concern for small and medium enterprises. Installation and calibration require technical expertise, which may limit adoption in facilities with limited skilled personnel. Environmental conditions such as dust, vibration, and reflective surfaces can also affect scanner performance, although advancements in design are mitigating these issues. Furthermore, the availability of alternative safety devices such as safety mats and light curtains may restrain demand in specific applications.

Competitive Landscape

The global Safety Laser Scanner Market is highly competitive, with several major players investing in research, innovation, and product development. Companies are focusing on improving scanning range, response time, and connectivity features to enhance system performance. Many leading firms are also forming strategic partnerships with robotics and automation companies to offer integrated safety solutions. The emphasis on compact designs and user friendly interfaces has made new generation scanners more adaptable for a wide range of industrial and service applications.

Manufacturers are also expanding their presence in emerging markets through collaborations, distribution networks, and service centers. The ability to offer scalable safety solutions tailored to different industrial needs is becoming a key differentiating factor in the competitive landscape.

Future Outlook

The future of the Safety Laser Scanner Market looks highly promising. As industries continue to embrace automation, robotics, and digital transformation, safety laser scanners will become an indispensable part of industrial ecosystems. The integration of artificial intelligence, machine learning, and advanced analytics will lead to predictive safety systems capable of dynamically adapting to changing conditions. Additionally, the use of cloud connectivity will enable centralized monitoring and data analysis, enhancing both safety management and operational decision making.

The growing use of autonomous mobile robots in logistics and warehouse operations will further increase the demand for mobile safety laser scanners. Moreover, as smart cities and automated infrastructure projects expand, the application of safety laser scanners will extend beyond factories into areas such as transportation and construction.

Key Market Players

Key players profiled in this study include Leuze Electronics GmbH (Germany), OMRON Corporation (Japan), Panasonic Corporation (Japan), Rockwell Automation (US), SICK AG (Germany), Banner Engineering (US), Hans Turck (US), Hokuyo Automatic Co., Ltd. (Japan), IDEC Corporation (Japan), Keyence Corporation (Japan), Pilz GmbH & Co. KG (Germany), Datalogiv SpA (Italy), Arcus Automation Private Limited(India), and ReeR SpA (Italy).

IDEC Corporation

IDEC mainly focuses on automation being user-friendly technology and works on other elements such as safety features, ease of operations, reliability, and environmental considerations. This helps to add value to the existing automation technology. The company continually expands the possibilities of automation by developing effective and efficient automation, thus entering into new dimensions. IDEC aims to achieve sustainable growth and strives to meet diversifying social needs by developing innovative solutions to leverage IDEC’s proprietary technologies. IDEC has long been known for its superior safety technologies and products such as safety laser scanners. The IDEC Group has established and implemented a quality management system to provide products and services that meet the quality requirements of customers and markets. IDEC has third-party certificates in compliance with ISO 9001, the International Standard for Quality Management System.

Keyence Corporation

The company focuses on innovating and developing products in the area of automation factory to meet new demands and applications of the market and customer needs for high-performance products. The company offers full support in using products in the most effective way to its customers. KEYENCE not only develops products but also offers support to its customers. Customers benefit from working directly with KEYENCE’s highly experienced sales engineers to help solve application issues and answer technical product questions quickly. KEYENCE was among the top 10 companies in Japan regarding market capitalization as of September 2017

Recent developments

- In April 2016, Leuze Electronic introduced the RSL 400 safety laser scanner and won the GIT Safety Award and the Industry Prize for optical technologies 2016. RSL 400 has an impressive design from an economical, technological, and environmental point of view.

- In April 2017, Banner Engineering announced the opening of Turck Banner Malaysia Sdn. Bhd. (Malaysia). This office provides sales and technical support and value-added services for customers and partner companies in Malaysia and across APAC

- In June 2017, ReeR (Italy) was awarded the title of “Excellent Company 2017.” This was awarded by “4.0: technology and organization sustaining company's talent,” held in Milan, Italy, in cooperation with Borsa Italiana, Elite, and Global Strategy. The financial strength of the company and the ability of exploring niche markets, promote investment processes, internationalization, and innovation contributed majorly to win the award.

Key questions addressed by report:

- What could be the potential industrial applications of safety laser scanner market?

- What is the importance of safety laser scanners in the healthcare sector?

- What are the drivers, challenges, restraints, and opportunities pertaining to the growth of the safety laser scanner market?

- What are the opportunities for the growth of mobile safety laser scanner providers?

- Which regions will showcase the growth of the safety laser scanner market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

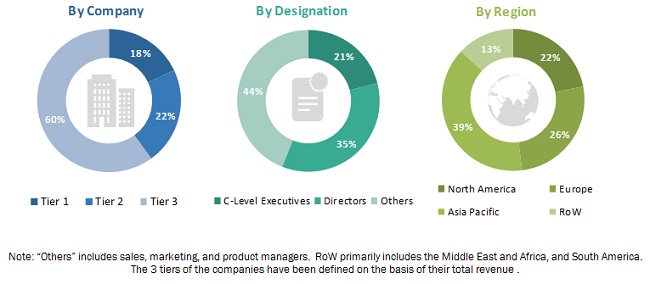

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Growth Opportunities in Safety Laser Scanner Market

4.2 Safety Laser Scanner Market, By Product Type

4.3 Safety Laser Scanner Market, By End-User Industry and Region

4.4 Safety Laser Scanner Market, By End-User Industry

4.5 Safety Laser Scanner Market, By Geography

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Scanning Angle

5.2.1 180°

5.2.2 180° to 270°

5.2.3 More Than 270°

5.3 Response Time

5.3.1 0 to 80 Ms

5.3.2 More Than 80 Ms

5.4 Number of Fields

5.4.1 Less Than 8

5.4.2 9 to 32

5.4.3 More Than 33

5.5 Laser Standards and Classifications

5.6 Value Chain Analysis

5.7 Market Dynamics

5.7.1 Drivers

5.7.1.1 Increasing Fatalities in Workplaces

5.7.1.2 Small Form Factor, High User-Friendliness, Seamless Integration, and High Power Efficiency Favor the Market for Safety Laser Scanners

5.7.1.3 Indoor Safety Laser Scanners Enhance Security Measures

5.7.2 Restraints

5.7.2.1 Safety Mats Offering Similar Protective Solutions

5.7.3 Opportunities

5.7.3.1 Evolving Safety and Security Measures Regarding Use of Machinery

5.7.4 Challenges

5.7.4.1 Non-Contact Functionality With the Object Sometimes Pose A Challenge

6 Safety Laser Scanner Market, By Product Type (Page No. - 43)

6.1 Introduction

6.2 Mobile Safety Laser Scanner

6.2.1 Growth of AGVS and AGCS Across Various Industries is Driving the Market for Mobile Safety Laser Scanner

6.3 Stationary Safety Laser Scanner

6.3.1 Safeguarding Hazardous Areas Across Various Industries is Driving the Market for Stationary Safety Laser Scanner

7 Safety Laser Scanner Market, By End-User Industry (Page No. - 47)

7.1 Introduction

7.2 Automotive

7.2.1 Safeguarding of Hazardous Areas and Collision Avoidance Led to the Major Adoption of Safety Laser Scanner in Automotive End-User Industry

7.3 Food & Beverages

7.3.1 Use of AGVS and AGCS for Material Handling and Processing to Grow the Market Across Food and Beverages End-User Industry

7.4 Healthcare & Pharmaceuticals

7.4.1 Growth of Logistics Operation in Healthcare & Pharmaceuticals to Escalate the Safety Laser Scanner Market

7.5 Consumer Goods and Electronics

7.5.1 Need of AGVS for Movements of Goods has Helped the Market to Grow in Consumer Good & Electronics End-User Industry

7.6 Others

8 Geographic Analysis (Page No. - 64)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Need of Safety Across Various Industries Such as Automotive is Driving Market Growth in the Us

8.2.2 Canada

8.2.2.1 Growth of Export Sector With the Need of Minimizing Accidents in the Warehouse Facilities is Driving the Growth of Market in Canada

8.2.3 Mexico

8.2.3.1 Demand of Safety Laser Scanners for the Safety of Machine and Workers to Drive the Market in Mexico

8.3 Europe

8.3.1 Germany

8.3.1.1 Growth of Industry 4.0 to Elevate the Market in Germany

8.3.2 France

8.3.2.1 Demand of AGVS in Automotive Industry to Drive the Market in France

8.3.3 UK

8.3.3.1 Growth of AGCS and AGCS in Warehousing and Logistics is Helping in the Adoption of Safety Laser Scanners in the UK

8.3.4 Italy

8.3.4.1 Automotive and Food & Beverages are Among the Major Adopters of the Market in Italy

8.3.5 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 Owing to One of the Largest Manufacturing Hub, Adoption of Safety Laser Scanners is Helping to Drive the Market in China

8.4.2 Japan

8.4.2.1 The Growth of Robotic Sector and Industrial Automation is Helping to Implement Safety Laser Scanners in Japan

8.4.3 India

8.4.3.1 Make in India Campaign Driving the Growth of Manufacturing Facilities is Helping to Boost the Market in India

8.4.4 South Korea

8.4.4.1 Adoption of Safety Measures at the Workplace is Driving the Market in South Korea

8.4.5 RoAPAC

8.5 Rest of the World

8.5.1 South America

8.5.1.1 Government Support Towards the Industrial Development is Responsible for the Growth of Market in South America

8.5.2 Middle East & Africa

8.5.2.1 Government Regulations and Safety Standards are Helping to Escalate the Adoption of Market in Middle East & Africa

9 Competitive Landscape (Page No. - 88)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Competitive Scenario

9.3.1 Awards

9.3.2 Joint Ventures

9.3.3 Expansions

10 Company Profiles (Page No. - 92)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.1 Key Players

10.1.1 Sick AG

10.1.2 Omron Corporation

10.1.3 Keyence Corporation

10.1.4 IDEC Corporation

10.1.5 Leuze Electronic GmbH + Co. Kg

10.1.6 Panasonic Corporation

10.1.7 Rockwell Automation, Inc.

10.1.8 Datalogic S.P.A.

10.1.9 Banner Engineering

10.1.10 Hokuyo Automatic Co., Ltd.

10.1.11 Reer SPA

10.1.12 Arcus Automation Private Limited

10.1.13 Hans Turck GmbH & Co. Kg

10.2 Other Companies

10.2.1 LKH Precicon Pte. Ltd.

10.2.2 Sentek Solutions Ltd.

10.2.3 Pilz GmbH & Co. Kg

10.2.4 Rockford Systems, LLC

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 117)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (66 Tables)

Table 1 Assumptions of the Study

Table 2 Limitations for the Study

Table 3 Classification Criteria of Different Laser Standards

Table 4 Major Directives and Standards for Use of Opto-Electronic Safety Systems in Europe

Table 5 Safety Laser Scanner Market, By Product Type, 2015–2023 (USD Million)

Table 6 Market for Mobile Safety Laser Scanner, By End-User Industry, 2015–2023 (USD Million)

Table 7 Market Stationary Safety Laser Scanner, By End-User Industry, 2015–2023 (USD Million)

Table 8 Market, By End-User Industry, 2015–2023 (USD Million)

Table 9 Market for Automotive Safety Laser Scanner, By Type, 2015–2023 (USD Million)

Table 10 Market for Automotive Safety Laser Scanner, By Region, 2015–2023 (USD Million)

Table 11 Market in North America, By Country, 2015–2023 (USD Million)

Table 12 Market in Europe, By Country, 2015–2023 (USD Million)

Table 13 Market in APAC, By Country, 2015–2023 (USD Million)

Table 14 Market in RoW, By Region, 2015–2023 (USD Million)

Table 15 Safety Laser Scanner Market for Food & Beverages, By Type, 2015–2023 (USD Million)

Table 16 Market for Food & Beverages Safety Laser Scanner, By Region, 2015–2023 (USD Million)

Table 17 Market for Food & Beverages Safety Laser Scanner in North America, By Country, 2015–2023 (USD Million)

Table 18 Market for Food & Beverages Safety Laser Scanner in Europe, By Country, 2015–2023 (USD Million)

Table 19 Market for Food & Beverages Safety Laser Scanner in APAC, By Country, 2015–2023 (USD Million)

Table 20 Market for Food & Beverages Safety Laser Scanner in RoW, By Region, 2015–2023 (USD Million)

Table 21 Safety Laser Scanner Market for Healthcare & Pharmaceuticals, By Type, 2015–2023 (USD Million)

Table 22 Market for Healthcare & Pharmaceuticals Safety Laser Scanner, By Region, 2015–2023 (USD Million)

Table 23 Market for Healthcare & Pharmaceuticals Safety Laser Scanner in North America, By Country, 2015–2023 (USD Million)

Table 24 Market for Healthcare & Pharmaceuticals Safety Laser Scanner in Europe, By Country, 2015–2023 (USD Million)

Table 25 Market for Healthcare & Pharmaceuticals Safety Laser Scanner in APAC, By Country, 2015–2023 (USD Million)

Table 26 Market for Healthcare & Pharmaceuticals Safety Laser Scanner in RoW, By Region, 2015–2023 (USD Thousand)

Table 27 Safety Laser Scanner Market for Consumer Goods & Electronics, By Type, 2015–2023 (USD Million)

Table 28 Market for Consumer Goods & Electronics Safety Laser Scanner, By Region, 2015–2023 (USD Million)

Table 29 Market for Consumer Goods & Electronics Safety Laser Scanner in North America, By Country, 2015–2023 (USD Thousand)

Table 30 Market for Consumer Goods & Electronics Safety Laser Scanner in Europe, By Country, 2015–2023 (USD Million)

Table 31 Market for Consumer Goods & Electronics Safety Laser Scanner in APAC, By Country, 2015–2023 (USD Million)

Table 32 Market for Consumer Goods & Electronics Safety Laser Scanner in RoW, By Region, 2015–2023 (USD Thousand)

Table 33 Safety Laser Scanner Market for Others, By Type, 2015–2023 (USD Million)

Table 34 Others SLS Market, By Region, 2015–2023 (USD Million)

Table 35 Others SLS Market in North America, By Country, 2015–2023 (USD Million)

Table 36 Others SLS Market in Europe, By Country, 2015–2023 (USD Thousand)

Table 37 Others SLS Market in APAC, By Country, 2015–2023 (USD Thousand)

Table 38 Others SLS Market in RoW, By Region, 2015–2023 (USD Million)

Table 39 Market, By Geography, 2015–2023 (USD Million)

Table 40 Market in North America, By End-User Industry, 2015–2023 (USD Million)

Table 41 Market in North America, By Country, 2015–2023 (USD Million)

Table 42 Market in the Us, By End-User Industry, 2015–2023 (USD Million)

Table 43 Market in Canada, By End-User Industry, 2015–2023 (USD Million)

Table 44 Market in Mexico, By End-User Industry, 2015–2023 (USD Million)

Table 45 Market in Europe, By End-User Industry, 2015–2023 (USD Million)

Table 46 Market in Europe, By Country, 2015–2023 (USD Million)

Table 47 Market in Germany, By End-User Industry, 2015–2023 (USD Thousand)

Table 48 Market in France, By End-User Industry, 2015–2023 (USD Thousand)

Table 49 Market in Uk, By End-User Industry, 2015–2023 (USD Million)

Table 50 Market in Italy, By End-User Industry, 2015–2023 (USD Million)

Table 51 Market in RoE, By End-User Industry, 2015–2023 (USD Million)

Table 52 Market in APAC, By End-User Industry, 2015–2023 (USD Million)

Table 53 Market in APAC, By Country, 2015–2023 (USD Million)

Table 54 Market in China, By End-User Industry, 2015–2023 (USD Million)

Table 55 Market in Japan, By End-User Industry, 2015–2023 (USD Thousand)

Table 56 Market in India, By End-User Industry, 2015–2023 (USD Million)

Table 57 Market in South Korea, By End-User Industry, 2015–2023 (USD Thousand)

Table 58 Market in RoAPAC, By End-User Industry, 2015–2023 (USD Million)

Table 59 Market in RoW, By End-User Industry, 2015–2023 (USD Million)

Table 60 Market in RoW, By Region, 2015–2023 (USD Million)

Table 61 Market in South America, By End-User Industry, 2015–2023 (USD Million)

Table 62 Market in Mea, By End-User Industry, 2015–2023 (USD Thousand)

Table 63 Market Ranking Analysis – Safety Laser Scanner Market (2017)

Table 64 Awards (2016 & 2017)

Table 65 Joint Ventures (2017)

Table 66 Expansions (2016)

List of Figures (31 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 Market: Research Design

Figure 4 Data Triangulation Methodology

Figure 5 Mobile Safety Laser Scanners to Gain Market Share During Forecast Period

Figure 6 Automotive End-User Industry to Hold Largest Market Size By 2023

Figure 7 Market in APAC Expected to Grow at Highest CAGR During Forecast Period

Figure 8 Market in APAC to Grow at Highest Rate During Forecast Period

Figure 9 Stationary to Lead Safety Laser Scanner Market During Forecast Period

Figure 10 APAC to Hold Largest Share of Market in 2017

Figure 11 Automotive to Hold Larger Size of Market By 2023

Figure 12 Italy to Grow at Highest CAGR in Market During the Forecast Period

Figure 13 Safety Laser Scanner: Prominent Features

Figure 14 Safety Laser Scanner Value Chain

Figure 15 Market Dynamics: Overview

Figure 16 Fatalities at Work in the Us

Figure 17 Fatal Work Injuries, By Industry (2016)

Figure 18 Major Applications of Safety Laser Scanner

Figure 19 Safety Laser Scanner: Product Type Segmentation

Figure 20 Safety Laser Scanner Segments for End-User Industries

Figure 21 Market, By Geography

Figure 22 Market Snapshot of North America: Mainly Driven By the Healthcare & Pharmaceuticals and Automotive End-User Industries

Figure 23 Market Snapshot of Europe: Supportive Government Plans and Presence of Key Players

Figure 24 Market Snapshot of APAC: China Held A Major Share of the Market in APAC in 2017

Figure 25 Companies Adopted Product Launch as Key Growth Strategy Between 2015 and 2018

Figure 26 Sick AG: Company Snapshot

Figure 27 Omron Corporation: Company Snapshot

Figure 28 Keyence Corporation: Company Snapshot

Figure 29 IDEC Corporation: Company Snapshot

Figure 30 Panasonic Corporation: Company Snapshot

Figure 31 Rockwell Automation, Inc.: Company Snapshot

The study involved 4 major activities to estimate the current size of the safety laser scanner market. Exhaustive secondary research was done to collect information on the market, including peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for the identification and collection of relevant information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain key information regarding the industry’s supply chain, market’s value chain, the total pool of key players, market segmentation according to industry trends (to the bottom-most level), geographic markets, and key developments from both, market- and technology-oriented perspectives. Secondary data were collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information relevant to this report. Several primary interviews have been conducted with market experts from both the demand (product and component manufacturer across industries) and supply sides (safety laser scanners providing companies). These primary data have been collected through questionnaires, emails, and telephonic interviews. Primary sources include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the safety laser scanners market. Approximately 30% and 70% of the primary interviews have been conducted from the demand and supply sides, respectively.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the safety laser scanner market. These methods were also used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data were triangulated by studying various factors and trends from demand and supply sides across different end-use applications.

Study Objectives

- To define, describe, and forecast the safety laser scanners market on the basis of product type, product range, application, end-user industry, and geography

- To forecast the safety laser scanners market, in terms of value, for the concerned segments with regard to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the safety laser scanners market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the safety laser scanners landscape

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the safety laser scanners market

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies,2 as well as detail the competitive landscape for market leaders

- To analyze competitive developments such as mergers and acquisitions, expansions, product and service launches, partnerships, contracts, and agreements in the safety laser scanners market

Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value, USD |

|

Segments covered |

Product type, product range, application, end-user industry and region |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Leuze Electronics GmbH (Germany), OMRON Corporation (Japan), Panasonic Corporation (Japan), Rockwell Automation (US), SICK AG (Germany), Banner Engineering (US), Hans Turck (US), Hokuyo Automatic Co., Ltd. (Japan), IDEC Corporation (Japan), Keyence Corporation (Japan), Pilz GmbH & Co. KG (Germany), Datalogiv SpA (Italy), Arcus Automation Private Limited(India), and ReeR SpA (Italy) |

Safety laser Scanner market Segmentation:

In this report, the Safety Laser Scanner market has been segmented into the following categories:

On the basis of product type, the Safety Laser Scanner market has been segmented as follows:

- Mobile Safety Laser Scanner

- Stationary Safety Laser Scanner

On the basis of product range, the Safety Laser Scanner market has been segmented as follows:

- Short Range ( less than 3 m)

- Medium Range ( 4 to 6 m)

- Long Range (more than 7 m)

On the basis of application, the Safety Laser Scanner market has been segmented as follows:

- Stationary Hazardous Area Protection

- Access Protection

- Mobile Hazardous Area Protection

On the basis of end user industry, the Safety Laser Scanner market has been segmented as follows:

- Automotive

- Food Processing

- Warehousing

- Logistics

- Packaging

On the basis of region, the Safety Laser Scanner market has been segmented as follows:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional 5 market players

- Country-level break-up for the market based on end-use application and offering

Growth opportunities and latent adjacency in Safety Laser Scanner Market