Safety Light Curtain Market by Safety Level Type (Type 2, Type 4), Component (LEDs, Photoelectric Cells, Control Units, Display Units), Resolution (924mm, 2590mm, More Than 90mm), Application, Industry and Geography - Global Forecast to 2030

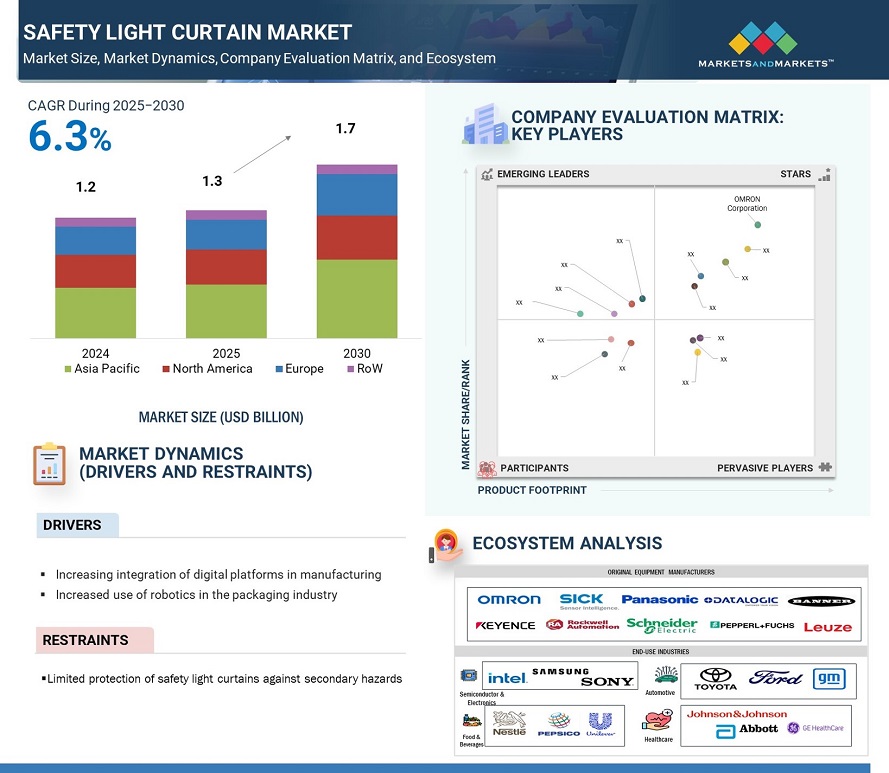

The global safety light curtain market is anticipated to grow from USD 1.3 billion in 2025 to USD 1.7 billion by 2030, recording a CAGR of 6.3% during 2025–2030. This growth is due to the increasing integration of digital platforms in manufacturing and the rising use of robotics in the packaging sector. Strict workplace safety regulations are also boosting demand for these safety solutions. Moreover, there are significant opportunities for market expansion with the introduction of safety light curtains equipped with digital indicators, offering enhanced features. The industrial growth in emerging markets, particularly across the Asia Pacific and other developing regions, presents further opportunities for the safety light curtain market to thrive and evolve.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing integration of digital platforms in manufacturing

Digital manufacturing has significantly transformed production environments, leading to the widespread adoption of automated machinery that enables factories to operate 24/7 without human intervention. These automated systems are controlled by advanced technologies such as Distributed Control Systems (DCS), Programmable Logic Controllers (PLCs), and Supervisory Control and Data Acquisition (SCADA) systems. This shift towards automation requires the integration of modern technologies, sensors, and components to ensure efficient and smooth operations. As smart machines become more prevalent, there is an increasing need for enhanced safety measures to protect workers in automated environments. In cases where human intervention is necessary, machines must be equipped with mechanisms that detect human presence and take action to prevent accidents. Safety light curtains, which create an invisible barrier of beams using sensors, play a critical role in worker protection. If the barrier is breached, the sensors immediately signal the machine to shut down, preventing potential accidents. With the ongoing growth of digital manufacturing and the increasing complexity of automated systems, the demand for safety solutions like safety light curtains is expected to rise. These safety measures are essential to maintaining a secure working environment while maximizing the benefits of automation and digital technologies in manufacturing industries.

Restraint: Limited protection of safety light curtains against secondary hazards

Safety light curtains are presence-sensing devices that shut down the operating machine in case human interference is sensed across a specified safety zone. When a safety light curtain's perimeter is breached, it immediately signals the machine to stop operation. Although the machine stops instantaneously, safety light curtains cannot offer protection from secondary hazards such as flying debris, sparks, splashes, smoke, or flashes generally associated with robotic welding. Flying debris can have disastrous consequences, such as temporary or permanent blindness, skin burns, and respiratory hazards. Other secondary hazards, such as sparks, splashes, smoke, flashes, and flying debris, also cause similar health hazards. The inability of safety light curtains to protect personnel from such hazards is expected to restrain the growth of the safety light curtain market.

Opportunity: Advent of safety light curtains with digital indicators

Safety light curtains, which rely on invisible infrared beams, cannot be manually adjusted during installation, posing challenges for optimal setup. To address these issues, developing safety light curtains equipped with digital indicators offers significant advantages. These digital indicators enable precise adjustments of the beams, ensuring that production quality aligns with operational requirements. Additionally, they help detect dirt or other contaminants on the surface, which can affect the curtain’s performance. By incorporating digital indicators, manufacturers can create more customizable and efficient safety light curtains, enhancing both the protection of machines and the overall productivity of the manufacturing process. For example, Panasonic (Japan) offers the Safety Light Curtain Type-4 SF4B Ver.2 with digital indicators, which provide digital error indications that give users a clear view of any issues. These indicators reduce installation time and maintenance requirements by simplifying adjustments and triggering alerts in case of any functional irregularities. Moreover, they allow for modifications in the beam’s distance, length, and frequency, making the system more adaptable to various needs. Including digital indicators not only improves safety but also encourages innovation in developing more advanced safety light curtains, likely contributing to the market's continued growth.

Challenge: Lack of awareness about the advantages of safety light curtains among SMEs

Small and medium-sized enterprises (SMEs) tend to use semi-automatic machinery and may not be well-versed in operational efficiency and high productivity of safety light curtains. Further, SMEs face intense competition from large enterprises, and to gain a competitive edge, SMEs are slowly moving toward Industry 4.0 as the technology provides optimization, efficiency, flexibility, and scalability, along with predictive maintenance, which would enable a quick response, timely decisions, and enhanced business productivity.

SMEs are the backbone of an economy. However, as mentioned, these organizations face challenges in scaling operations and attracting investors. Moreover, SMEs also lack the technical know-how to implement innovative technologies. In addition, SMEs lack the capital required to implement automation technologies. These factors challenge SMEs to adopt safety light curtains in their manufacturing processes. However, in the last couple of years, many businesses have recognized the value of safety light curtains. The big players in the safety light curtain market encourage manufacturing firms, including SMEs, to adopt budget-friendly and compact safety light curtains. Improved safety management and reduced downtime and security costs with the adoption of safety light curtains are likely to increase SMEs' adoption in the coming years.

Safety Light Curtain Market Ecosystem

The safety light curtain market ecosystem includes key players across various segments, such as original equipment manufacturers, end-use industries, and others, each playing a critical role in ensuring safety across industries.

Safety light curtain market for the robotics segment to register the fastest growth during the forecast period

The safety light curtain market within the robotics segment is projected to experience the fastest growth in terms of CAGR from 2025 to 2030. This growth is driven by the increasing adoption of robots across various industries, including automotive, semiconductor, electronics, and food and beverage sectors. Additionally, the rising need to comply with strict safety regulations surrounding the use of robots in workplaces is further boosting the demand for safety light curtains. For instance, the Occupational Health and Safety Act (OHSA) from the US Department of Labor sets safety requirements for industrial robot users to ensure workplace safety. Section IV, Chapter 4 of the act specifically addresses "Industrial Robots and Robot System Safety," outlining the necessary safety protocols for operating fixed industrial robots and robotic systems. It includes ensuring safe operation when robots work automatically alongside other peripheral equipment. As industries increasingly implement automation and robotics, the demand for safety light curtains to meet regulatory requirements and protect workers is expected to grow rapidly, driving the expansion of the market segment.

The safety light curtain market for the 25−90mm resolution segment is expected to grow at the highest CAGR during the forecast period

The safety light curtain market for the 25-90 mm resolution segment is anticipated to grow at the highest compound annual growth rate (CAGR) throughout the forecast period. These safety light curtains, with a resolution range of 25 mm to 90 mm, are widely used for hand and arm detection and are available in Type 2 and Type 4 models. The increasing demand for safety light curtains with this resolution in industries such as automotive and healthcare, particularly in developing countries, is driving the market’s growth. As emerging economies continue to embrace automation and modern manufacturing processes, the need for precise safety measures, including protecting hands and arms, has become more critical. These safety light curtains provide an effective solution for detecting worker presence and preventing accidents. In industries like automotive and healthcare, where safety regulations are stringent, these devices help ensure a safer working environment by detecting any potential hazards. Additionally, the growing focus on workplace safety in developing countries, combined with the expansion of industrial automation, is fueling the demand for safety light curtains with 25-90 mm resolution. This trend is expected to boost the market’s growth during the forecast period significantly.

Automotive industry is expected to dominate the safety light curtain market during the forecast period

The automotive industry is expected to lead the safety light curtain market during the forecast period, with robust growth projected between 2025 and 2030. This growth is driven by the rising global demand for automobiles, fueled by an increasing population. Automotive manufacturing plants rely on various man-machine systems, such as conveyor machines, robotic arms, welding machines, and press machines. To ensure the safe operation of these systems, stringent safety standards, equipment, and control systems are put in place. Safety light curtains and other safety measures are crucial for protecting workers and preventing accidents caused by machine malfunctions or improper operation. The increased adoption of safety light curtains in applications like assembly, pressing, and material handling is a key driver of the market’s expansion. As the automotive industry continues to embrace automation and integrate more advanced machinery, the need for reliable safety solutions like safety light curtains will continue to rise, further boosting market growth. The industry's ongoing focus on worker safety and accident prevention will sustain the demand for these vital safety systems throughout the forecast period.

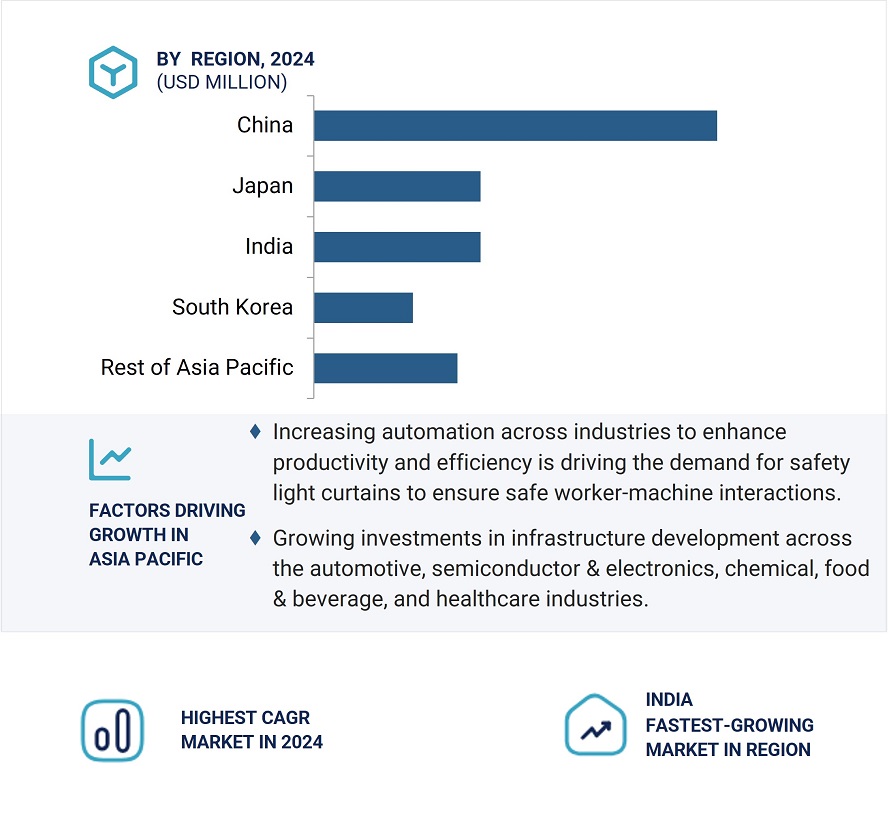

Safety light curtain market in Asia Pacific is expected to maintain the highest share during the forecast period

Asia-Pacific is expected to dominate the safety light curtain market throughout the forecast period. The region serves as a global manufacturing hub, attracting major automobile manufacturers such as Volkswagen (Germany), Toyota (Japan), Renault-Nissan (Netherlands), and Daimler (Germany), along with prominent local companies like Tata Motors (India) and Hyundai Motors (South Korea). These manufacturers are significantly investing in the smart factory market within the region. Additionally, the low operational costs in Asia-Pacific have led numerous industries to relocate their manufacturing plants to the area, further driving market growth. One of the primary factors contributing to the expansion of the safety light curtain market in Asia-Pacific is the increasing automation across both process and discrete industries. As businesses in the region embrace automation to improve operational efficiency and reduce costs, the demand for safety systems, such as safety light curtains, is growing. These systems protect workers and ensure safe operations in automated environments. The rise of smart factories and automation in various sectors, including automotive and manufacturing, is expected to fuel further the growth of the safety light curtain market in Asia-Pacific. This trend is anticipated to continue throughout the forecast period, making Asia-Pacific a key market for safety light curtains.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- OMRON Corporation (Japan)

- SICK AG (Germany)

- Panasonic Corporation (Japan)

- KEYENCE CORPORATION (Japan)

- Rockwell Automation (US)

- Schneider Electric (France)

- Datalogic S.p.A. (Italy)

- Banner Engineering Corp. (US)

- Balluff GmbH (Germany)

- Pepperl+Fuchs (Germany)

- Leuze Electronic (Germany)

- ABB (Switzerland)

- EUCHNER GmbH + Co. KG (Germany)

- ReeR S.p.A. (Italy)

- IDEC Corporation (Japan)

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2025—2030 |

|

Base year |

2021 |

|

Forecast period |

2025—2030 |

|

Units |

Value (USD Million/Billion) |

|

Segments covered |

Safety Level Type, Component, Resolution, Application, Industry, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Key players in the safety light curtain market are OMRON (Japan), KEYENCE (Japan), SICK (Germany), Rockwell Automation (US), Pepperl+Funch (Germany), Panasonic (Japan), Schneider Electric (France), Datalogic (Italy), Banner Engineering (US), Balluff (Switzerland), Smartscan (UK), Leuze Electronic (Germany), ABB (Switzerland), EUCHNER (Germany), IDEC (Japan), Pilz (Germany), ifm electronic (Germany), Wenglor Sensoric (Germany), Schmersal (Germany), Rockford Systems (US), Contrinex (Switzerland), Orbital Systems (India), Pinnacle Systems (US), HTM Sensors (US), and ISB (Canada). |

This report categorizes the Safety light curtain market based on safety level type, component, resolution, application, industry, and region.

Safety Light Curtain Market, by Safety Level Type:

- Type 2

- Type 1

Safety Light Curtain Market, by Component:

- Light-emitting Diodes (LED)

- Photoelectric Cells

- Control Units

- Display units

- Other Components

Safety Light Curtain Market, by Resolution:

- 9−24mm

- 25−90mm

- More than 90mm

Safety Light Curtain Market, by Application:

- Packaging

- Material Handling

- Robotics

- Assembly

- Other Applications

Safety Light Curtain Market, by Industry:

- Automotive

- Semiconductor & Electronics

- Food & Beverage

- Healthcare

- Other Industries

Safety Light Curtain Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- South America

Recent Developments

- In February 2023, SICK AG (Germany) introduced an innovative safety light curtain system for Smart Box Detection, marking an industry first. This system ensures the seamless and safe material flow of cartons or cuboid goods at protected zone entry and exit points while protecting workers from hazardous machinery used in material handling, conveying, or packaging.

- In May 2022, Leuze Electronic (Germany) introduced the new ELC 100 safety light curtains to the market, which provide optoelectronic safety technology for a low-cost machine design with the latest gadgets. The tools are simple to install and integrate, which makes machine designs more affordable. Manufacturers and operators of equipment and systems can now use cutting-edge Leuze safety technology for cost-effective contactless protection of operational points. The ELC 100 safety light curtains allow for guarding with close safety distances and are appropriate for applications with operating ranges up to six meters.

- In February 2022, Banner Engineering (US) introduced new 7- and 8-foot IP65-rated light curtains to its EZ-Screen LS-S series. It has a detection range of 10 meters, making it perfect for protecting wide areas in manufacturing, material handling, and packing applications. It also includes dual-scan technology to protect the sensor from electromagnetic interference (EMI), radio frequency interference (RFI), ambient light, welding flashes, and strobe lights.

- In March 2021, Datalogic acquired M.D. Micro Detectors (M.D.) with the intention of developing the largest Italian center for industrial automation. By utilizing synergies between many of the companies' products, such as sensors, safety products, and vision systems, Datalogic further aims to increase its presence in the global market.

Frequently Asked Questions (FAQ):

What is the current size of the global safety light curtain market?

The global safety light curtain market is estimated to be from USD 1.3 billion in 2025 to USD 1.7 billion by 2030, at a CAGR of 6.3% during the forecast period.

What will be the dynamics for the adoption of safety light curtain based on safety level type?

The type 4 segment is expected to account for the larger size of the safety light curtain market throughout the forecast period.

What is the fastest-growing region in the safety light curtain market?

Asia Pacific is expected to dominate the safety light curtain market during the forecast period. It is expected to grow at the highest CAGR from 2025 to 2030. The increasing adoption of automation technologies is expected to drive the growth of the regional market for safety light curtains.

What will be the dynamics for the use of safety light curtain in packaging application?

Packaging machines are often run at high speeds and need to be cleaned regularly, which can increase the possibility of injuries to workers. The Health and Safety Executives (HSE) has studied the pattern of injuries related to packaging machinery. . It has been found that conveyors, considered the simplest form of automation, are involved in most machinery-related accidents in the packaging industry. Thus, safety light curtains are used along with other safety devices to follow these safety standards and regulations. Hence, packaging machines need devices that comply with safety standards. This is one of the major drivers for the adoption of safety light curtains for packaging applications.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

The growing adoption of automated and digital technologies, the increasing penetration of robots in the packaging industry, and stringent safety standards that manufacturers must adhere to are all driving market growth. The advent of safety light curtains with digital indicators and industrial growth in Asia Pacific and emerging economies provide growth opportunities for the market players, whereas limited awareness regarding the benefits of safety light curtains among small and medium-sized enterprises (SMEs) and a shortage of certified safety professionals are the major challenges faced by the market players.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SAFETY LIGHT CURTAIN MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 SAFETY LIGHT CURTAIN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 SAFETY LIGHT CURTAIN MARKET: RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Primary sources

2.1.3.3 Key insights

2.1.3.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

FIGURE 4 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to derive market size using top-down analysis (supply side)

FIGURE 5 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: (DEMAND SIDE) — REVENUE GENERATED BY COMPANIES FROM SAFETY LIGHT CURTAIN MARKET

2.3 DATA TRIANGULATION

FIGURE 7 SAFETY LIGHT CURTAIN MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 CONTROL UNITS SEGMENT TO HOLD LARGEST SHARE OF SAFETY LIGHT CURTAIN MARKET, BY COMPONENT, DURING FORECAST PERIOD

FIGURE 9 TYPE 4 SEGMENT TO EXHIBIT HIGHER CAGR IN SAFETY LIGHT CURTAIN MARKET DURING FORECAST PERIOD

FIGURE 10 HEALTHCARE INDUSTRY TO REGISTER HIGHEST CAGR IN SAFETY LIGHT CURTAIN MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF GLOBAL SAFETY LIGHT CURTAIN MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SAFETY LIGHT CURTAIN MARKET

FIGURE 12 RAPID INDUSTRIALIZATION IN EMERGING COUNTRIES OF ASIA PACIFIC TO BOOST DEMAND FOR SAFETY LIGHT CURTAINS

4.2 SAFETY LIGHT CURTAIN MARKET, BY APPLICATION

FIGURE 13 ROBOTICS SEGMENT TO HOLD LARGEST SHARE OF SAFETY LIGHT CURTAIN MARKET DURING FORECAST PERIOD

4.3 SAFETY LIGHT CURTAIN MARKET IN ASIA PACIFIC, BY INDUSTRY AND COUNTRY

FIGURE 14 AUTOMOTIVE INDUSTRY AND CHINA TO ACCOUNT FOR LARGEST SHARES OF SAFETY LIGHT CURTAIN MARKET IN ASIA PACIFIC IN 2022

4.4 SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY

FIGURE 15 HEALTHCARE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 SAFETY LIGHT CURTAIN MARKET, BY COUNTRY

FIGURE 16 SAFETY LIGHT CURTAIN MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 SAFETY LIGHT CURTAIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rise of digital platforms in manufacturing

5.2.1.2 Increased use of robotics in packaging industry

5.2.1.3 Stringent workplace safety regulations

5.2.2 RESTRAINTS

5.2.2.1 Inability of safety light curtains to protect from secondary hazards

5.2.2.2 Need for regular maintenance

5.2.3 OPPORTUNITIES

5.2.3.1 Advent of safety light curtains with digital indicators

5.2.3.2 Industrial growth in emerging economies of Asia Pacific and other parts of world

5.2.4 CHALLENGES

5.2.4.1 Limited awareness regarding benefits of safety light curtains among SMEs

5.2.4.2 Shortage of certified safety professionals

5.3 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASE

5.4 PRICING ANALYSIS

TABLE 1 AVERAGE SELLING PRICE OF SAFETY LIGHT CURTAINS, BY SAFETY LEVEL (USD)

TABLE 2 PRICE RANGE OF SAFETY LIGHT CURTAIN COMPONENTS (USD)

6 SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE (Page No. - 55)

6.1 INTRODUCTION

FIGURE 19 SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE

FIGURE 20 SAFETY LIGHT CURTAIN MARKET FOR TYPE 4 SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 3 SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2018–2021 (USD MILLION)

TABLE 4 SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2022–2027 (USD MILLION)

6.2 TYPE 2

6.2.1 SUITABLE FOR SMALL ASSEMBLY EQUIPMENT, AUTOMATED PRODUCTION EQUIPMENT, PACKING MACHINES, ETC.

TABLE 5 TYPE 2: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 6 TYPE 2: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

6.3 TYPE 4

6.3.1 DESIGNED FOR HIGH-RISK APPLICATIONS SUCH AS CUTTING, PRESSING, AND WELDING MACHINES

TABLE 7 TYPE 4: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 8 TYPE 4: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7 SAFETY LIGHT CURTAIN MARKET, BY COMPONENT (Page No. - 61)

7.1 INTRODUCTION

FIGURE 21 SAFETY LIGHT CURTAIN MARKET, BY COMPONENT

FIGURE 22 SAFETY LIGHT CURTAIN MARKET FOR CONTROL UNITS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 9 SAFETY LIGHT CURTAIN MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 10 SAFETY LIGHT CURTAIN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 LIGHT-EMITTING DIODES (LEDS)

7.2.1 PRIMARY COMPONENT IN SAFETY LIGHT CURTAINS

TABLE 11 LEDS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2018–2021 (USD MILLION)

TABLE 12 LEDS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2022–2027 (USD MILLION)

7.3 PHOTOELECTRIC CELLS

7.3.1 HELP IMPROVE SAFETY LIGHT CURTAIN EFFICIENCY BY DETECTING INFRARED BEAMS

TABLE 13 PHOTOELECTRIC CELLS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2018–2021 (USD MILLION)

TABLE 14 PHOTOELECTRIC CELLS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2022–2027 (USD MILLION)

7.4 CONTROL UNITS

7.4.1 ENSURE PROPER FUNCTIONING OF INDUSTRIAL EQUIPMENT AND PLANT SAFETY

TABLE 15 CONTROL UNITS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2018–2021 (USD MILLION)

TABLE 16 CONTROL UNITS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2022–2027 (USD MILLION)

7.5 DISPLAY UNITS

7.5.1 HELP OPERATORS IDENTIFY OR NOTIFY ERRORS DURING OPERATIONS

TABLE 17 DISPLAY UNITS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2018–2021 (USD MILLION)

TABLE 18 DISPLAY UNITS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2022–2027 (USD MILLION)

7.6 OTHER COMPONENTS

7.6.1 ENCLOSURES

7.6.2 MIRRORS

TABLE 19 OTHER COMPONENTS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2018–2021 (USD MILLION)

TABLE 20 OTHER COMPONENTS: SAFETY LIGHT CURTAIN MARKET, BY SAFETY LEVEL TYPE, 2022–2027 (USD MILLION)

8 SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION (Page No. - 69)

8.1 INTRODUCTION

FIGURE 23 SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION

TABLE 21 COMMON APPLICATIONS AND ADVANTAGES OF SAFETY LIGHT CURTAINS, BY RESOLUTION

FIGURE 24 SAFETY LIGHT CURTAIN MARKET FOR 25–90 MM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2018–2021 (USD MILLION)

TABLE 23 SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2022–2027 (USD MILLION)

8.2 9–24 MM

8.2.1 REQUIRED FOR HIGH-RISK LOCATIONS AND OPTIMUM SPACE UTILIZATION

TABLE 24 9–24 MM: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 25 9–24 MM: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8.3 25–90 MM

8.3.1 SUITABLE FOR AREAS INVOLVING MODERATE RISKS

TABLE 26 25–90 MM: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 27 25–90 MM: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8.4 MORE THAN 90 MM

8.4.1 INSTALLED IN WAREHOUSES FOR ACCESS CONTROL AND LONG-DISTANCE SCANNING

TABLE 28 MORE THAN 90 MM: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 29 MORE THAN 90 MM: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9 SAFETY LIGHT CURTAIN MARKET, BY APPLICATION (Page No. - 76)

9.1 INTRODUCTION

FIGURE 25 SAFETY LIGHT CURTAIN MARKET, BY APPLICATION

FIGURE 26 SAFETY LIGHT CURTAIN MARKET FOR ROBOTICS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 31 SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 PACKAGING

9.2.1 USE OF SAFETY LIGHT CURTAINS TO PROTECT PERSONNEL FROM ACCIDENT-PRONE ZONES

TABLE 32 PACKAGING: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 33 PACKAGING: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.3 MATERIAL HANDLING

9.3.1 ADOPTION OF SAFETY LIGHT CURTAINS TO PREVENT INTRUSION BY PERSONS OR UNEXPECTED OBJECTS

TABLE 34 MATERIAL HANDLING: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 35 MATERIAL HANDLING: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.4 ROBOTICS

9.4.1 IMPLEMENTATION OF CURTAINS TO PROTECT AREA BETWEEN ROBOTIC WORK CELL AND REMAINING PLANT

TABLE 36 ROBOTICS: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 37 ROBOTICS: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.5 ASSEMBLY

9.5.1 DEPLOYMENT OF SAFETY LIGHT CURTAINS TO ENSURE HAZARD-FREE WORKING ENVIRONMENT IN ASSEMBLY LINES

TABLE 38 ASSEMBLY: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 39 ASSEMBLY: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.6 OTHER APPLICATIONS

TABLE 40 OTHER APPLICATIONS: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 41 OTHER APPLICATIONS: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

10 SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY (Page No. - 85)

10.1 INTRODUCTION

FIGURE 27 SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY

FIGURE 28 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF SAFETY LIGHT CURTAIN MARKET DURING FORECAST PERIOD

TABLE 42 SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 43 SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

10.2 AUTOMOTIVE

10.2.1 THRIVING AUTOMOTIVE INDUSTRY TO GENERATE NEED FOR SAFETY LIGHT CURTAINS

TABLE 44 AUTOMOTIVE: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2018–2021 (USD MILLION)

TABLE 45 AUTOMOTIVE: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2022–2027 (USD MILLION)

TABLE 46 AUTOMOTIVE: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 47 AUTOMOTIVE: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 48 AUTOMOTIVE: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 29 ASIA PACIFIC TO DOMINATE SAFETY LIGHT CURTAIN MARKET FOR AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

TABLE 49 AUTOMOTIVE: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 SEMICONDUCTOR & ELECTRONICS

10.3.1 INCREASING USE OF SMARTPHONES, SMART TELEVISIONS, AND SMART WEARABLE DEVICES PROPELS MARKET GROWTH

TABLE 50 SEMICONDUCTOR & ELECTRONICS: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2018–2021 (USD MILLION)

TABLE 51 SEMICONDUCTOR & ELECTRONICS: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2022–2027 (USD MILLION)

TABLE 52 SEMICONDUCTOR & ELECTRONICS: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 SEMICONDUCTOR & ELECTRONICS: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 54 SEMICONDUCTOR & ELECTRONICS: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 SEMICONDUCTOR & ELECTRONICS: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 FOOD & BEVERAGE

10.4.1 NEED TO SAFEGUARD PERSONNEL WHILE PROCESS HANDLING AND PACKAGING TO BOOST MARKET GROWTH

TABLE 56 FOOD & BEVERAGE: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2018–2021 (USD MILLION)

TABLE 57 FOOD & BEVERAGE: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2022–2027 (USD MILLION)

TABLE 58 FOOD & BEVERAGE: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 59 FOOD & BEVERAGE: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 FOOD & BEVERAGE: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 FOOD & BEVERAGE: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 HEALTHCARE

10.5.1 RISING USE OF SAFETY LIGHT CURTAINS TO ENSURE WORKER SAFETY TO DRIVE MARKET

TABLE 62 HEALTHCARE: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2018–2021 (USD MILLION)

TABLE 63 HEALTHCARE: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2022–2027 (USD MILLION)

TABLE 64 HEALTHCARE: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

FIGURE 30 ROBOTICS APPLICATION TO LEAD SAFETY LIGHT CURTAIN MARKET FOR HEALTHCARE INDUSTRY DURING FORECAST PERIOD

TABLE 65 HEALTHCARE: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 66 HEALTHCARE: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 HEALTHCARE: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 OTHER INDUSTRIES

TABLE 68 OTHER INDUSTRIES: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2018–2021 (USD MILLION)

TABLE 69 OTHER INDUSTRIES: SAFETY LIGHT CURTAIN MARKET, BY RESOLUTION, 2022–2027 (USD MILLION)

TABLE 70 OTHER INDUSTRIES: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 71 OTHER INDUSTRIES: SAFETY LIGHT CURTAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 OTHER INDUSTRIES: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 OTHER INDUSTRIES: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

11 SAFETY LIGHT CURTAIN MARKET, BY REGION (Page No. - 102)

11.1 INTRODUCTION

FIGURE 31 CHINA TO RECORD HIGHEST CAGR IN SAFETY LIGHT CURTAIN MARKET DURING FORECAST PERIOD

FIGURE 32 ASIA PACIFIC TO DOMINATE SAFETY LIGHT CURTAIN MARKET DURING FORECAST PERIOD

TABLE 74 SAFETY LIGHT CURTAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 SAFETY LIGHT CURTAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: SAFETY LIGHT CURTAIN MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: SAFETY LIGHT CURTAIN MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: SAFETY LIGHT CURTAIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Automotive industry in US to contribute to market growth

11.2.2 CANADA

11.2.2.1 Safety standards in automotive, food & beverage, and chemical industries to drive market

11.2.3 MEXICO

11.2.3.1 Rapid adoption of automation and digital technologies to accelerate demand

11.3 EUROPE

FIGURE 34 EUROPE: SAFETY LIGHT CURTAIN MARKET SNAPSHOT

TABLE 80 EUROPE: SAFETY LIGHT CURTAIN MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 81 EUROPE: SAFETY LIGHT CURTAIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 High automobile production and rapid developments in healthcare industry to boost market share

11.3.2 FRANCE

11.3.2.1 Expanding semiconductor & electronics and automotive sectors to create need for safety light curtains

11.3.3 UK

11.3.3.1 Prominent presence of providers and users of automation technologies to surge demand for safety light curtains

TABLE 84 AUTOMOBILE MANUFACTURING PLANTS IN UK

11.3.4 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: SAFETY LIGHT CURTAIN MARKET SNAPSHOT

TABLE 85 ASIA PACIFIC: SAFETY LIGHT CURTAIN MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 ASIA PACIFIC: SAFETY LIGHT CURTAIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 ASIA PACIFIC: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Growing adoption of robotics and industrial automation technologies to boost market

11.4.2 JAPAN

11.4.2.1 Expanding chemical industry to generate opportunities for market players

11.4.3 INDIA

11.4.3.1 Government-led initiatives toward automation and smart manufacturing to spur market growth

11.4.4 SOUTH KOREA

11.4.4.1 Increasing R&D investments in innovative manufacturing technologies to accelerate market growth

11.4.5 REST OF ASIA PACIFIC

11.5 ROW

FIGURE 36 ROW: SAFETY LIGHT CURTAIN MARKET SNAPSHOT

TABLE 89 ROW: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 ROW: SAFETY LIGHT CURTAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 91 ROW: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 ROW: SAFETY LIGHT CURTAIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Rapid adoption of automation technologies in automotive industry to facilitate market growth

11.5.2 MIDDLE EAST

11.5.2.1 Thriving chemical industry to drive market growth

11.5.3 AFRICA

11.5.3.1 Rising deployment of automation technologies to boost market growth

12 COMPETITIVE LANDSCAPE (Page No. - 126)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 93 OVERVIEW OF STRATEGIES DEPLOYED BY SAFETY LIGHT CURTAIN COMPANIES

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 INDUSTRY FOOTPRINT

12.2.4 ORGANIC/INORGANIC PLAY

12.3 TOP COMPANY REVENUE ANALYSIS

FIGURE 37 GLOBAL SAFETY LIGHT CURTAIN MARKET: REVENUE ANALYSIS OF TOP PLAYERS, 2017–2021

12.4 MARKET SHARE ANALYSIS, 2021

TABLE 94 DEGREE OF COMPETITION, SAFETY LIGHT CURTAIN MARKET (2021)

12.5 COMPANY EVALUATION QUADRANT, 2021

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE COMPANIES

12.5.4 PARTICIPANTS

FIGURE 38 COMPANY EVALUATION MATRIX/QUADRANT, 2021

12.6 SAFETY LIGHT CURTAIN MARKET: COMPANY FOOTPRINT (25 COMPANIES)

TABLE 95 COMPANY FOOTPRINT

TABLE 96 COMPANY APPLICATION FOOTPRINT (25 COMPANIES)

TABLE 97 COMPANY INDUSTRY FOOTPRINT (25 COMPANIES)

TABLE 98 COMPANY REGION FOOTPRINT (25 COMPANIES)

12.7 COMPETITIVE SCENARIOS AND TRENDS

12.7.1 PRODUCT LAUNCHES

TABLE 99 PRODUCT LAUNCHES, FEBRUARY 2021–MAY 2022

12.7.2 DEALS

TABLE 100 DEALS, DECEMBER 2020–MARCH 2021

12.7.3 OTHERS

TABLE 101 EXPANSIONS, APRIL 2020–APRIL 2022

13 COMPANY PROFILES (Page No. - 143)

13.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)*

13.1.1 OMRON

TABLE 102 OMRON: BUSINESS OVERVIEW

FIGURE 39 OMRON: COMPANY SNAPSHOT

13.1.2 KEYENCE

TABLE 103 KEYENCE: BUSINESS OVERVIEW

FIGURE 40 KEYENCE: COMPANY SNAPSHOT

13.1.3 SICK

TABLE 104 SICK: BUSINESS OVERVIEW

FIGURE 41 SICK: COMPANY SNAPSHOT

13.1.4 ROCKWELL AUTOMATION

TABLE 105 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 42 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

13.1.5 PANASONIC

TABLE 106 PANASONIC: BUSINESS OVERVIEW

FIGURE 43 PANASONIC: COMPANY SNAPSHOT

13.1.6 SCHNEIDER ELECTRIC

TABLE 107 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 44 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

13.1.7 DATALOGIC

TABLE 108 DATALOGIC: BUSINESS OVERVIEW

FIGURE 45 DATALOGIC: COMPANY SNAPSHOT

13.1.8 PEPPERL+FUCHS

TABLE 109 PEPPERL+FUCHS: BUSINESS OVERVIEW

13.1.9 BANNER ENGINEERING

TABLE 110 BANNER ENGINEERING: BUSINESS OVERVIEW

13.1.10 LEUZE ELECTRONIC

TABLE 111 LEUZE ELECTRONIC: BUSINESS OVERVIEW

* Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER KEY PLAYERS

13.2.1 WENGLOR SENSORIC

13.2.2 BALLUFF

13.2.3 ABB

13.2.4 EUCHNER

13.2.5 REER

13.2.6 IDEC

13.2.7 PLIZ

13.2.8 SMARTSCAN

13.2.9 ROCKFORD SYSTEMS

13.2.10 ORBITAL SYSTEMS

13.2.11 PINNACLE SYSTEMS

13.2.12 CONTRINEX

13.2.13 SCHMERSAL

13.2.14 IFM ELECTRONIC

13.2.15 HTM SENSORS

14 ADJACENT AND RELATED MARKETS (Page No. - 189)

14.1 FUNCTIONAL SAFETY MARKET

14.2 INTRODUCTION

FIGURE 46 FUNCTIONAL SAFETY MARKET, BY DEVICE

FIGURE 47 SAFETY SENSORS TO HOLD LARGEST SHARE OF FUNCTIONAL SAFETY MARKET DURING FORECAST PERIOD

TABLE 112 FUNCTIONAL SAFETY MARKET, BY DEVICE, 2018–2021 (USD MILLION)

TABLE 113 FUNCTIONAL SAFETY MARKET, BY DEVICE, 2022–2027 (USD MILLION)

14.3 DEVICE

14.3.1 SAFETY SENSORS

14.3.1.1 Deployed in various functional safety systems such as ESD and HIPPS

TABLE 114 SAFETY SENSORS: FUNCTIONAL SAFETY MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 115 SAFETY SENSORS: FUNCTIONAL SAFETY MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

14.3.2 SAFETY CONTROLLERS/MODULES/RELAYS

14.3.2.1 Help shut down manufacturing equipment in emergency

TABLE 116 SAFETY CONTROLLERS/MODULES/RELAYS: FUNCTIONAL SAFETY MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 117 SAFETY CONTROLLERS/MODULES/RELAYS: FUNCTIONAL SAFETY MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

15 APPENDIX (Page No. - 195)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

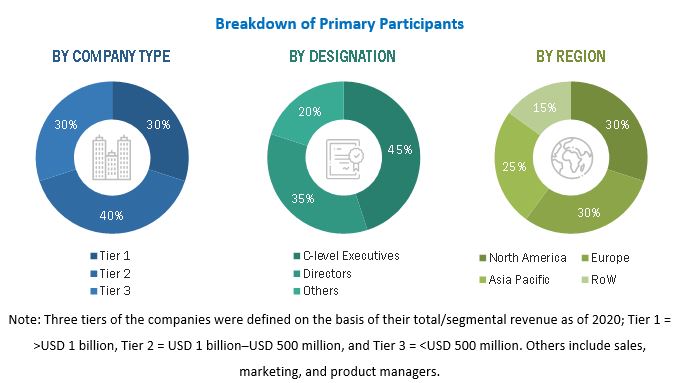

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the safety light curtain market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting information useful for the engineering of the safety light curtain market. In-depth interviews have been conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects. Key players in the safety light curtain market have been identified through secondary research, and their market rankings have been determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives. In the primary research process, various key correspondents from the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study on the safety light curtain market. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; and directories and databases. Secondary research has been conducted to gather key information regarding the value chain of the safety light curtain market, the number of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from market- and technology-oriented perspectives.

After the complete market engineering process (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

Primary research has been conducted to identify segmentation types, industry trends, and key players in the market, as well as to analyze the competitive landscape, key market dynamics such as drivers, restraints, challenges, and opportunities, and key strategies adopted by the market players. In the complete market engineering process, both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to estimate and forecast the sizes of the market and its segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been conducted on the complete market engineering process to list the key information/insights. The data gathered through secondary research has been also verified and validated through primary interviews. The figure below illustrates the way primary and secondary research has been conducted for gathering and analyzing the data collected for the safety light curtain market.

Primary Research

Extensive primary research has been conducted after obtaining information about the safety light curtain market through secondary research. Several primary interviews have been conducted with market experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 30% and 70% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to the safety light curtain market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Safety light curtain Market: Bottom-Up Approach

Market Breakdown and Data Triangulation

After arriving at the overall size of the safety light curtain market from the estimation process explained above, the total market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying numerous factors and trends from the demand and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the safety light curtain market size, safety level type, component, resolution, application, industry, and region, in terms of value

- To define, describe, and forecast the safety light curtain market size in terms of volume

- To describe and forecast the size of the safety light curtain market across four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective country-level market sizes

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the process flow of the safety light curtain market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the safety light curtain market

- To analyze opportunities for stakeholders by identifying high-growth segments of the safety light curtain market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments, such as product launches, deals (acquisitions and partnerships), and others (expansions), in the safety light curtain market

1. Micromarkets are defined as the segments and subsegments of the safety light curtain market included in the report’s scope.

2. Core competencies of companies are captured in terms of their key developments and strategies adopted to sustain their positions in the safety light curtain market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of key market players (up to 25)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Safety Light Curtain Market