Scrubber System Market by Type (Wet, Dry), End-User (Marine, Oil & Gas, Petrochemicals & Chemicals, Pharmaceutical), Application (Particulate Cleaning, Gaseous/Chemical Cleaning), Orientation (Horizontal, Vertical) - Global Forecast to 2027

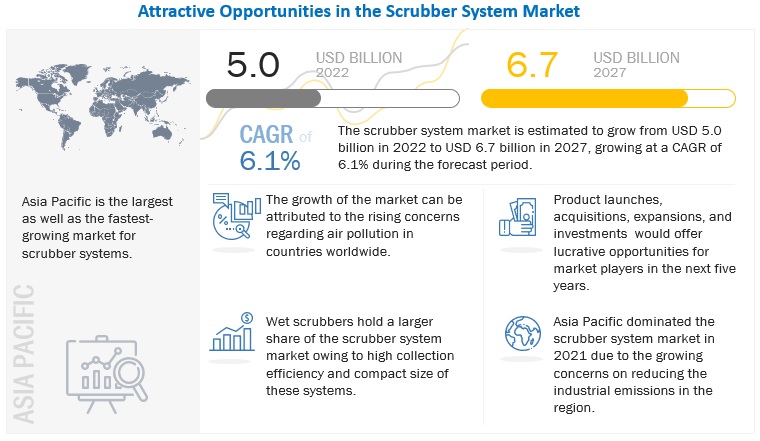

The global Scrubber System Market size was valued at $5.0 billion in 2022 and it is projected to reach $6.7 billion by 2027, growing at a CAGR of 6.1% from 2022 to 2027.

The formulation of various environmental protection laws and mandates to reduce the same on a global level have increased the need to undertake measures on air pollution control, which is likely to increase the usage of scrubbers.

To know about the assumptions considered for the study, Request for Free Sample Report

Scrubber System Market Dynamics

Driver: Air pollution prevention policies and laws enforced by government to protect environment

Environmental protection laws and mandates are gaining importance globally to reduce the impact of industrial emissions. These standards focus on promoting the use of non-toxic substances, modifying production processes, and implementing conservation techniques. They also promote the reuse or recycling of materials rather than putting them into the waste stream, which helps eliminate pollution. North America and Europe are a few early adopters of environmental protection laws across the world. The Environmental Protection Agency (EPA) controls pollution control regulations in the US. A few of the significant regulations and laws in the country include the Pollution Prevention Act, the Clean Air Act, the Clean Water Act, and the National Environmental Policy Act. The Clean Air Act focuses on regulating air emissions from stationary and mobile sources to protect public health and regulate emissions of hazardous air pollutants. The Clean Water Act regulates the discharge of pollutants into water bodies.

The European Union (EU) has set goals to achieve the desired levels of air quality to ensure that there will be no adverse impact or risks to human health and the environment. Europe's air quality emission norms focus on continuous monitoring and assessment of ambient air quality. The law also requires large-scale industrial installations to obtain operational permits for environmental protection. Developing countries in Asia Pacific, the Middle East & Africa are also setting up various environmental emission norms to curb pollution.

To comply with these norms, industries need scrubber systems. By using scrubbers, corrosive gases and dust can be neutralized. The scrubber system can handle flammable and explosive dust and is designed for several chemical, pharmaceutical, and surface treatment applications. Stringent regulations pertaining to emission control increase the need for scrubber systems in industries, boosting the growth of the market for scrubber systems

Restraint: Strict regulatory policies for disposal of contaminated effluents from scrubber systems

Operating or cleaning a wet exhaust gas scrubber for marine diesel engines and boilers generates effluent (washwater) that must be treated before discharge. Washwater contains gaseous and particulate emissions removed by the scrubber from the exhaust in the funnel. SOx and NOx dissolved in the scrubber effluent react to form sulfuric and nitric acids, which significantly reduce the pH of the effluent leaving the scrubber. The use of scrubbers causes environmental degradation through short-term and spatially limited pH value reduction, temperature and turbidity increase, and pollutant discharge of some persistent materials.

In 2008, 168 member states of the International Maritime Organization (IMO) adopted stringent regulations to control exhaust emissions from engines that power ocean-going vessels. IMO developed guidelines for using exhaust gas cleaning devices, such as SOx scrubbers, as an alternative to operating on low-sulfur fuel. As a part of its analyses, IMO has set scrubber-effluent monitoring and discharge criteria in Section 10 of the Guidelines for Exhaust Gas Cleaning System (EGCS). IMO recommends pH, polycyclic aromatic hydrocarbons PAH concentration, turbidity, and temperature to be continuously monitored and recorded when EGCS is operated in ports, harbors, or estuaries.

Opportunities: Enforcement of global sulfur cap limit by IMO

On 2020, a new limit on the sulfur content in the fuel oil used on board ships came into force, marking a significant milestone in improving air quality, preserving the environment, and protecting human health, which is known as IMO 2020. This rule limits the sulfur in the fuel oil used on board ships operating outside designated emission control areas to 0.50% m/m (mass by mass), a significant reduction from the previous limit of 3.5%. The limits were already stricter within designated emission control areas (0.10%). This new limit was made compulsory following an amendment to Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL).

The IMO MARPOL regulations limit the sulfur content in fuel oil. This means ships must use fuel oil that is inherently low enough in sulfur or install an appropriate exhaust "alternative” method to meet IMO requirements. Some ships limit air pollutants by installing exhaust gas cleaning systems, which is nothing but scrubber system. Flag states accept this as an alternative means to meet the sulfur limit requirements. These scrubbers are designed to remove sulfur oxides from the ship’s engine and boiler exhaust gases. A ship fitted with a scrubber can use heavy fuel oil since the sulfur oxides emissions will be reduced to a level equivalent to the required fuel oil sulfur limit. In July 2020, 2,359 scrubber systems were formally reported to IMO as an approved “equivalent method” by administrations. This will create a big opportunity for the scrubber system market players during the forecast period.

Challenges: Availability of substitute fuel oil such as VLSFO

According to British Petroleum (BP), implementing Marine Pollution (MARPOL) 2020 shall bring significant changes in the marine fuel landscape, with a displacement of more than 95% of the current market. Vessel owners are expected to have several options when selecting compliant marine fuels under the MARPOL 2020 standards. For instance, very low sulfur fuel oil (VLSFO) will be a new fuel option in 2020. It is expected that economic incentives shall be driving the increased use of VLSFO over a period of time. Apart from this, Shell Plc designed ultra-low sulfur fuel oil (ULSFO) to run in both main and auxiliary engines. It also runs successfully in segregated and single settling/service tank environments.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Wet scrubber system segment, by product type, is expected to grow at the highest CAGR during forecast period

The wet scrubber system segment is expected to register the highest CAGR of 6.4% during the forecast period. Wet scrubbers are the most appropriate air pollution control device for collecting both particulates and gases in a single systemMost modern wet scrubbing systems can remove up to 95% of contaminants, making them highly efficient in collection of contaminants.

By end-user industry, marine segment is expected to be the most significant contributor to the scrubber system market during the forecast period

By end user industry, the scrubber system market has been segmented into marine, oil & gas, metal & mining, power generation, chemical & petrochemical, food, beverage, & agriculture, glass, pharmaceutical, water & wastewater treatment, and others. Marine segment is expected to be the largest segment during the forecast period. IMO’s global sulfur cap of 0.5% on marine fuels, stringent regulations regarding shipping emissions are introduced in 2020. Thus, the demand for exhaust gas cleaning technology, such as Sox scrubber, is expected to increase in marine segment. This is the prime reason for the growth of this market.

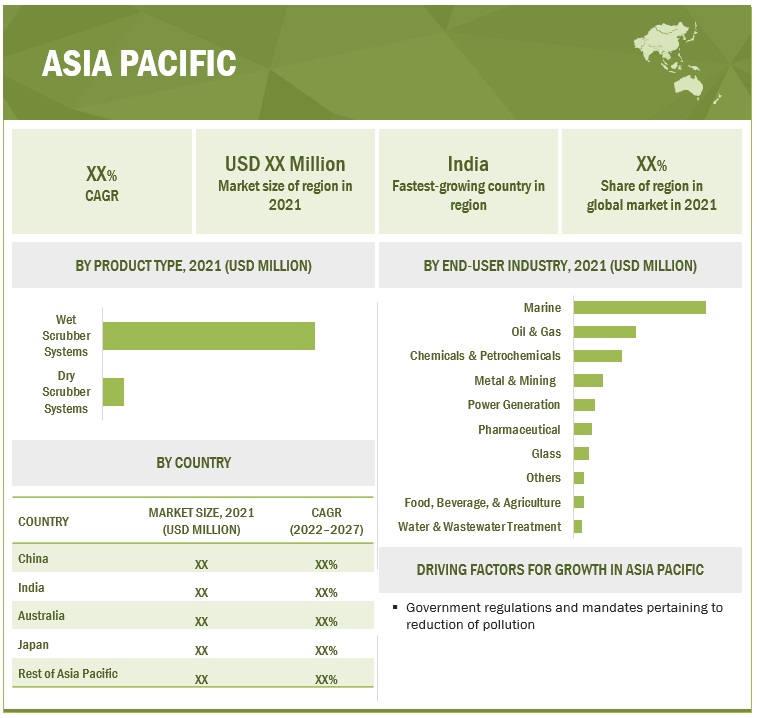

“Asia Pacific: The largest and fastest scrubber system market.”

Asia Pacific is expected to dominate the scrubber system market between 2022–2027, followed by Europe and the North America. The government regulations and mandates pertaining to reduction of pollution is the reasons for the region’s significant market size.

Key Market Players

The scrubber system market is dominated by a few major players that have a wide regional presence. The major players in the market are Alfa Laval (Sweden), Wartsila (Finland), GEA (Germany), Babcock & Wilcox (US), and Valmet (Finland). Between 2018 and 2022, the companies adopted growth strategies such as sales contracts to capture a larger share of the scrubber system market.

Scrubber System Market Report Scope

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 5.0 Billion |

|

Revenue forecast in 2027 |

USD 6.7 Billion |

|

Growth rate |

CAGR of 6.1% |

|

Segments covered |

Product Type, End-User Industry, Application, Orientation, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Major companies covered |

Alfa Laval (Sweden), Wartsila (Finland), GEA (Germany), Babcock & Wilcox (US), Valmet (Finland) and many more. |

This research report categorizes the scrubber system market by product type, end-user industry, application, orientation, and region

On the basis of by product type:

- Wet Scrubber System

- Dry Scrubber System

On the basis of end-user industry:

- Marine

- Oil & Gas

- Chemical & Petrochemical

- Pharmaceutical

- Glass

- Power Generation

- Metal & Mining

- Food, Beverage, & Agriculture

- Water & Wastewater Treatment

- Others

On the basis of application:

- Particulate Cleaning

- Gaseous/Chemical Cleaning

On the basis of orientation:

- Horizontal

- Vertical

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2022, Alfa Laval made a contract with Evergreen Marine Corporation to provide PureSOx scrubber for Ace Ever (Ship). To clean the engine's exhaust gas, the Ever-Ace need two PureSOx scrubbers on board – one for the main engine and one for the auxiliaries.

- In November 2021, Wartsila made a sales contract that it will install its open loop exhaust gas abatement technology (scrubber) on two roll-on/roll-off passenger ferries owned by Spanish company Trasmed GLE S.L., which is part of the multinational logistics company Grimaldi Group. Trasmed GLE S.L. has selected four of Wartsila ’s I-SOx open loop scrubbers with exhaust de-plume systems for the RoPax vessels Volcan del Teide and Ciudad de Granada which operate in the Mediterranean Sea.

- In October 2021, Babcock & Wilcox announced that its B&W Environmental segment has been awarded a contract for approximately USD 30 million to design and supply a full suite of environmental technologies for a US industrial facility. B&W Environmental will design and supply a spray dry absorber (SDA), dry and wet electrostatic precipitators (ESPs), dry sorbent injection (DSI) system, activated carbon injection (ACI) system, baghouse and caustic scrubbers to control the plant’s emissions, as well as a waste heat boiler, soot blowers and ash handling equipment.

- In May 2020, Valmet has signed a contract with Mitsubishi Shipbuilding Co., Ltd. Shimonoseki Shipyard to deliver hybrid scrubber systems and water treatment units to two ferries. Each vessel will be equipped with two identical Valmet Marine Scrubber towers for each main engine and a water treatment unit as well as Valmet’s marine automation system.

Frequently Asked Questions (FAQ):

What is the current size of the scrubber system market?

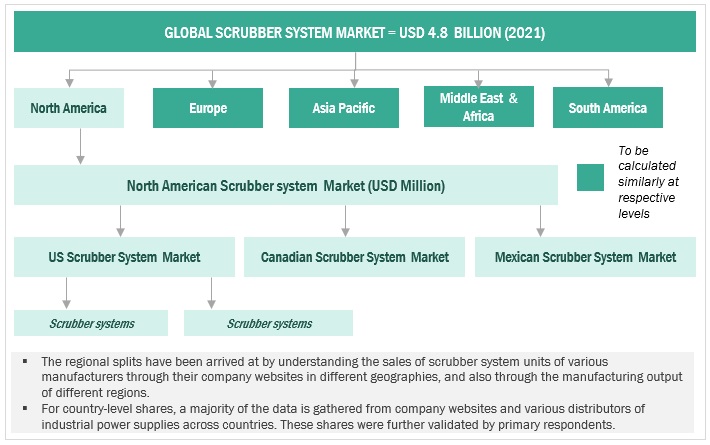

The current market size of scrubber system market is USD 4.8 billion in 2021.

What are the major drivers?

The major drivers for scrubber system market are, air pollution prevention policies and laws enforced by government to protect environment, rapid industrialization in major countries, and global increase in maritime activities

Which is the fastest-growing region during the forecasted period?

Asia Pacific is the fastest growing region in the scrubber system market between 2022–2027, followed by Europe and the North America. The government regulations and mandates pertaining to reduction of pollution is the reasons for the region’s significant market size

Which is the fastest-growing segment, by product type during the forecasted period in scrubber system market?

The wet scrubber system segment is expected to register the highest CAGR of 6.4% during the forecast period. Wet scrubbers are the most appropriate air pollution control device for collecting both particulates and gases in a single system. Most modern wet scrubbing systems can remove up to 95% of contaminants, making them highly efficient in collection of contaminants. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 SCRUBBER SYSTEM MARKET, BY PRODUCT TYPE: INCLUSIONS & EXCLUSIONS

1.3.2 MARKET, BY END-USER INDUSTRY: INCLUSIONS & EXCLUSIONS

1.3.3 MARKET, BY APPLICATION

1.3.4 MARKET, BY ORIENTATION

1.4 MARKET SCOPE

1.4.1 MARKET: SEGMENTATION

1.5 REGIONAL SCOPE

1.6 YEARS CONSIDERED

1.7 CURRENCY CONSIDERED

1.8 LIMITATIONS

1.9 STAKEHOLDERS

1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 SCRUBBER SYSTEM MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Break-up of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH (DEMAND SIDE)

FIGURE 3 MARKET: TOP-DOWN APPROACH

2.4 DEMAND-SIDE ANALYSIS

FIGURE 4 PARAMETERS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR SCRUBBER SYSTEMS

2.4.1 DEMAND-SIDE ANALYSIS OF MARKET

2.4.2 KEY ASSUMPTIONS CONSIDERED DURING DEMAND-SIDE ANALYSIS

2.4.3 SUPPLY-SIDE ANALYSIS

FIGURE 5 REVENUES OF MAJOR MANUFACTURERS FROM SALES OF SCRUBBER SYSTEMS ACROSS REGIONS ARE DETERMINED TO IDENTIFY MARKET SIZE

2.4.4 SUPPLY-SIDE ANALYSIS OF MARKET

FIGURE 6 MARKET: STEPS FOR SUPPLY-SIDE ANALYSIS

2.5 COVID-19-SPECIFIC ASSUMPTIONS

2.6 GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 1 SCRUBBER SYSTEM MARKET SNAPSHOT

FIGURE 7 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2021

FIGURE 8 WET SCRUBBER SYSTEMS TO CONTINUE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 9 VERTICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

FIGURE 10 GASEOUS/CHEMICAL CLEANING SEGMENT TO CONTINUE TO HOLD LARGER SHARE OF SCRUBBER MARKET DURING FORECAST PERIOD

FIGURE 11 MARINE SEGMENT TO CONTINUE ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 12 LAWS TO REDUCE INDUSTRIAL EMISSIONS TO FUEL DEMAND FOR SCRUBBERS

4.2 MARKET, BY REGION

FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY AND COUNTRY

FIGURE 14 MARINE INDUSTRY AND CHINA WERE LARGEST SHAREHOLDERS OF MARKET IN ASIA PACIFIC IN 2021

4.4 MARKET, BY PRODUCT TYPE

FIGURE 15 WET SCRUBBER SYSTEMS TO ACCOUNT FOR LARGER SHARE OF SCRUBBER MARKET IN 2027

4.5 MARKET, BY APPLICATION

FIGURE 16 GASEOUS/CHEMICAL CLEANING TO HOLD LARGER SHARE OF MARKET IN 2027

4.6 MARKET, BY ORIENTATION

FIGURE 17 VERTICAL SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2027

4.7 MARKET, BY END-USER INDUSTRY

FIGURE 18 MARINE INDUSTRY TO HOLD LARGEST SHARE OF MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Air pollution prevention policies and laws enforced by government to protect environment

TABLE 2 ENVIRONMENTAL PROTECTION ACTS AND LAWS IN KEY COUNTRIES

5.2.1.2 Rapid industrialization in major countries

TABLE 3 YEAR-OVER-YEAR ECONOMY GROWTH PROJECTIONS OF EMERGING COUNTRIES, 2022–2023

FIGURE 20 GLOBAL INVESTMENTS IN UPSTREAM OIL & GAS SECTOR, 2015–2021 (USD BILLION)

5.2.1.3 Global increase in maritime activities

FIGURE 21 GLOBAL MARITIME TRADE, 2016–2020 (MILLION TONS LOADED)

FIGURE 22 WORLD TRADING FLEET GROWTH, 2017–2021 (DEADWEIGHT TONNAGE)

5.2.2 RESTRAINTS

5.2.2.1 High operating and maintenance costs

5.2.2.2 Strict regulatory policies for disposal of contaminated effluents from scrubber systems

5.2.3 OPPORTUNITIES

5.2.3.1 Enforcement of global sulfur cap limit by IMO

5.2.3.2 Rising demand for dual-fuel engines

TABLE 4 FOSSIL FUEL EMISSION LEVELS OF POLLUTANTS (POUNDS PER BILLION BTU OF ENERGY)

5.2.4 CHALLENGES

5.2.4.1 Contamination due to heavy metals found in scrubber washwater

5.2.4.2 Availability of substitute fuel oil such as VLSFO

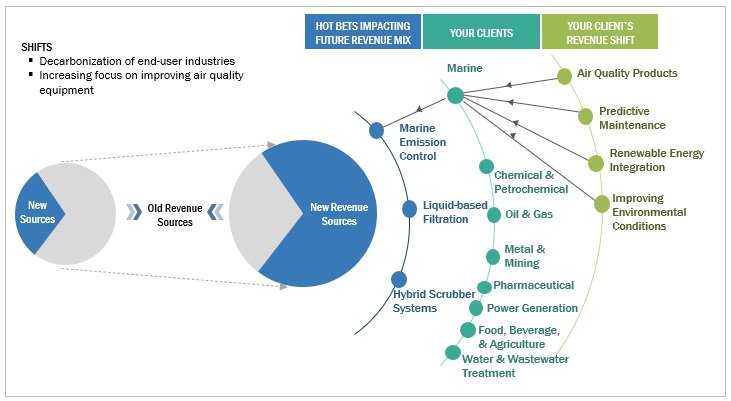

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR SCRUBBER SYSTEM PROVIDERS

FIGURE 23 REVENUE SHIFT FOR SCRUBBER SYSTEMS

5.4 MARKET MAP

FIGURE 24 MARKET MAP

TABLE 5 MARKET PLAYERS: ROLE IN ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MARKET

5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS

FIGURE 26 GLOBAL IRON ORE PRICE TREND, JULY 2020–FEBRUARY 2022

5.5.2 COMPONENT MANUFACTURERS

5.5.3 SCRUBBER SYSTEM MANUFACTURERS/ASSEMBLERS

5.5.4 DISTRIBUTORS (BUYERS)/END-USERS

5.5.5 POST-SALES SERVICE PROVIDERS

5.6 TRADE DATA

FIGURE 27 IMPORT AND EXPORT SCENARIO FOR HS CODE: 842139, 2016–2021 (USD BILLION)

TABLE 6 TRADE DATA FOR HS CODE: 8414, 2016–2021 (USD BILLION)

5.7 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 7 MARKET: LIST OF CONFERENCES & EVENTS

5.8 TARIFFS, CODES, AND REGULATIONS

5.8.1 TARIFFS RELATED TO SCRUBBER SYSTEMS

TABLE 8 IMPORT TARIFFS FOR HS 842139 IN 2019

5.8.2 CODES AND REGULATIONS RELATED TO SCRUBBER SYSTEMS

TABLE 9 SCRUBBER SYSTEMS: CODES AND REGULATIONS

5.8.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9 PATENT ANALYSIS

TABLE 15 SCRUBBER SYSTEMS: INNOVATION AND PATENT REGISTRATION

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 16 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF SUBSTITUTES

5.10.2 BARGAINING POWER OF SUPPLIERS

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 THREAT OF NEW ENTRANTS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USER INDUSTRY

TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USER (%)

5.11.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA OF TOP FOUR END-USER INDUSTRIES

TABLE 18 KEY BUYING CRITERIA OF TOP FOUR END-USER INDUSTRIES

5.12 AVERAGE SELLING PRICE TREND

TABLE 19 AVERAGE SELLING PRICE OF SCRUBBER SYSTEMS USED IN KEY END-USER INDUSTRIES, BY TYPE (USD)

5.13 CASE STUDY ANALYSIS

5.13.1 VENTURI SCRUBBER SUCCESSFULLY REMOVES GREASE AND PARTICULATES FROM EXHAUST

5.13.1.1 Problem statement

5.13.1.2 Solution

5.13.2 RIECO LAUNCHES SCRUBBER SYSTEM FOR FUME & PARTICULATE HANDLING AND ODOR REMOVAL

5.13.2.1 Problem statement

5.13.2.2 Solution

5.13.3 CR CLEAN AIR FIXES PACKAGED JET-VENTURI FUME SCRUBBER TO REDUCE GENERATION OF TOXIC FUMES IN ACID TANK

5.13.3.1 Problem statement

5.13.3.2 Solution

5.14 TECHNOLOGY ANALYSIS

6 SCRUBBER SYSTEM MARKET, BY PRODUCT TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 31 MARKET, BY PRODUCT TYPE, 2021

TABLE 20 MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

6.2 WET SCRUBBER SYSTEMS

TABLE 21 WET SCRUBBER SYSTEMS: MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 PACKED BED SCRUBBER

6.2.1.1 Offers high contaminant removal efficiency

TABLE 22 PACKED BED SCRUBBER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 SPRAY SCRUBBER

6.2.2.1 Consumes low power

TABLE 23 SPRAY SCRUBBER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.3 VENTURI SCRUBBER

6.2.3.1 Requires lower operating costs than other types of scrubbers

TABLE 24 VENTURI SCRUBBER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 DRY SCRUBBER SYSTEMS

TABLE 25 DRY SCRUBBER SYSTEMS: MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.3.1 DRY SORBENT INJECTION

6.3.1.1 Low capital and operating costs of these systems driving market

TABLE 26 DRY SORBENT INJECTION: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 SPRAY DRYER ADSORBENT

6.3.2.1 High acid-gas removal efficiency fueling demand for these scrubbers

TABLE 27 SPRAY DRYER ADSORBENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 SCRUBBER SYSTEM MARKET, BY END-USER INDUSTRY (Page No. - 91)

7.1 INTRODUCTION

FIGURE 32 MARKET, BY END-USER INDUSTRY, 2021

TABLE 28 MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

7.2 MARINE

7.2.1 ENFORCEMENT OF IMO’S GLOBAL SULFUR CAP LIMIT TO INCREASE DEMAND FOR SCRUBBER SYSTEMS IN SHIPS

TABLE 29 MARINE: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 OIL & GAS

7.3.1 INTENSIVE APPLICATION OF NATURAL GAS AND OIL SCRUBBERS TO FAVOR MARKET GROWTH

TABLE 30 OIL & GAS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 CHEMICAL & PETROCHEMICAL

7.4.1 HEIGHTENED PRODUCTION OF FEEDSTOCKS TO INDUCE DEMAND FOR SCRUBBERS

TABLE 31 CHEMICAL & PETROCHEMICAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 PHARMACEUTICAL

7.5.1 INCREASING INVESTMENT IN PHARMACEUTICAL INDUSTRY IN ASIA PACIFIC TO SUPPORT MARKET GROWTH

TABLE 32 PHARMACEUTICAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.6 GLASS

7.6.1 RAPID EXPANSION OF GLASS INDUSTRY DUE TO INVESTMENTS IN SOLAR POWER TO PROPEL MARKET FOR SCRUBBERS

TABLE 33 GLASS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.7 FOOD, BEVERAGE, & AGRICULTURE

7.7.1 NEED TO REDUCE EMISSIONS FROM ANIMAL FEEDING OPERATIONS TO LEAD TO INSTALLATION OF SCRUBBERS

TABLE 34 FOOD, BEVERAGE, & AGRICULTURE: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.8 METAL & MINING

7.8.1 FOCUS OF MINING INDUSTRY ON REDUCING COKING POLLUTANTS TO GENERATE DEMAND FOR SCRUBBERS

TABLE 35 METAL & MINING: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.9 POWER GENERATION

7.9.1 GOVERNMENT REGULATIONS FOR USING SCRUBBERS IN POWER GENERATION FACILITIES TO ACCELERATE MARKET GROWTH

TABLE 36 POWER GENERATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.10 WATER & WASTEWATER TREATMENT

7.10.1 NEED TO REMOVE H2S FUMES FROM VARIOUS WASTEWATER TREATMENT OPERATIONS TO BOOST DEMAND FOR SCRUBBERS

TABLE 37 WATER & WASTEWATER TREATMENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.11 OTHERS

TABLE 38 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 SCRUBBER SYSTEM MARKET, BY APPLICATION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION, 2021

TABLE 39 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 PARTICULATE CLEANING

8.2.1 NEED FOR REMOVING PARTICULATE MATTER DRIVING MARKET

TABLE 40 PARTICULATE CLEANING: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 GASEOUS/CHEMICAL CLEANING

8.3.1 NEED FOR REMOVING COMPONENTS SUCH AS SOX AND NOX DRIVING MARKET FOR SCRUBBERS

TABLE 41 GASEOUS/CHEMICAL CLEANING: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 SCRUBBER SYSTEM MARKET, BY ORIENTATION (Page No. - 103)

9.1 INTRODUCTION

FIGURE 34 MARKET, BY ORIENTATION, 2021

TABLE 42 MARKET, BY ORIENTATION, 2020–2027 (USD MILLION)

9.2 HORIZONTAL

9.2.1 SUITABLE FOR AREAS WITH LOW CEILINGS OR LITTLE HEADROOM

TABLE 43 HORIZONTAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 VERTICAL

9.3.1 VERTICAL-ORIENTED SCRUBBERS HANDLE CHEMICAL CONTAMINANTS BETTER THAN PARTICLE CONTAMINANTS

TABLE 44 VERTICAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 SCRUBBER SYSTEMS MARKET, BY REGION (Page No. - 106)

10.1 INTRODUCTION

FIGURE 35 MARKET, BY REGION, 2021 (%)

FIGURE 36 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 45 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

10.2.1 BY PRODUCT TYPE

TABLE 46 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET, BY WET SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET, BY DRY SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

10.2.2 BY END-USER INDUSTRY

TABLE 49 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.3 BY APPLICATION

TABLE 50 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.4 BY ORIENTATION

TABLE 51 ASIA PACIFIC: MARKET, BY ORIENTATION, 2020–2027 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 52 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.5.1 China

10.2.5.1.1 Stringent air quality standards to boost market

TABLE 53 CHINA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.2 India

10.2.5.2.1 Pharmaceutical industry to fuel demand for scrubbers

TABLE 54 INDIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.3 Australia

10.2.5.3.1 Favorable government policies for lithium mining and offshore exploration activities to drive market

TABLE 55 AUSTRALIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.4 Japan

10.2.5.4.1 Net zero targets by marine and chemical sectors to augment market growth

TABLE 56 JAPAN: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.5 Malaysia

10.2.5.5.1 Increase in oil & gas operations to create demand for scrubbers

TABLE 57 MALAYSIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.6 Singapore

10.2.5.6.1 Focus of maritime industry on net zero targets to drive demand for scrubbers

TABLE 58 SINGAPORE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.7 Vietnam

10.2.5.7.1 Increasing investments in oil & gas exploration and emission reduction action plans to trigger market growth

TABLE 59 VIETNAM: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.8 Indonesia

10.2.5.8.1 Focus on reducing air pollution to generate demand for scrubbers

TABLE 60 INDONESIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.9 Philippines

10.2.5.9.1 Air pollution control mandates to boost uptake of scrubbers

TABLE 61 PHILIPPINES: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.10 Thailand

10.2.5.10.1 National Ambient Air Quality Standards in Thailand expected to increase demand for scrubber systems

TABLE 62 THAILAND: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2.5.11 Rest of Asia Pacific

TABLE 63 REST OF ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.3 EUROPE

FIGURE 38 EUROPE: MARKET SNAPSHOT

10.3.1 BY PRODUCT TYPE

TABLE 64 EUROPE: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY WET SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY DRY SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

10.3.2 BY END-USER INDUSTRY

TABLE 67 EUROPE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.3.3 BY APPLICATION

TABLE 68 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.4 BY ORIENTATION

TABLE 69 EUROPE: MARKET, BY ORIENTATION, 2020–2027 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 70 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.5.1 UK

10.3.5.1.1 Demand for natural gas-fired power plants to encourage market growth

TABLE 71 UK: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.3.5.2 Germany

10.3.5.2.1 Growth of chemical sector to fuel demand for scrubber systems

TABLE 72 GERMANY: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.3.5.3 Russia

10.3.5.3.1 Surging investments in oil & gas industry to boost market

TABLE 73 RUSSIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.3.5.4 Norway

10.3.5.4.1 Undergoing developments in oil & gas industry to induce demand for scrubbers

TABLE 74 NORWAY: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.3.5.5 Rest of Europe

TABLE 75 REST OF EUROPE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.4 NORTH AMERICA

10.4.1 BY PRODUCT TYPE

TABLE 76 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY WET SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY DRY SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

10.4.2 BY END-USER INDUSTRY

TABLE 79 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.4.3 BY APPLICATION

TABLE 80 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.4 BY ORIENTATION

TABLE 81 NORTH AMERICA: MARKET, BY ORIENTATION, 2020–2027 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 82 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.5.1 US

10.4.5.1.1 Increasing investments in oil & gas and chemical industries to drive market

TABLE 83 US: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.4.5.2 Canada

10.4.5.2.1 Increasing focus on developments of oil & gas and power industries to boost demand for scrubber systems

TABLE 84 CANADA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.4.5.3 Mexico

10.4.5.3.1 Developments in oil & gas industry and policies to reduce air pollution to propel market growth

TABLE 85 MEXICO: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY PRODUCT TYPE

TABLE 86 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA: MARKET, BY WET SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA: MARKET, BY DRY SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

10.5.2 BY END-USER INDUSTRY

TABLE 89 MIDDLE EAST & AFRICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.5.3 BY APPLICATION

TABLE 90 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.4 BY ORIENTATION

TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY ORIENTATION, 2020–2027 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 92 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.5.1 Saudi Arabia

10.5.5.1.1 Developments in oil & gas industry to spur market growth

TABLE 93 SAUDI ARABIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.5.5.2 UAE

10.5.5.2.1 Investments in integrated rigless services to fuel demand for scrubbers

TABLE 94 UAE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.5.5.3 South Africa

10.5.5.3.1 Increasing investments in mining to drive demand for scrubbers

TABLE 95 SOUTH AFRICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.5.5.4 Rest of Middle East & Africa

TABLE 96 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY PRODUCT TYPE

TABLE 97 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 98 SOUTH AMERICA: MARKET, BY WET SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

TABLE 99 SOUTH AMERICA: MARKET, BY DRY SCRUBBER SYSTEM TYPE, 2020–2027 (USD MILLION)

10.6.2 BY END-USER INDUSTRY

TABLE 100 SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.6.3 BY APPLICATION

TABLE 101 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6.4 BY ORIENTATION

TABLE 102 SOUTH AMERICA: MARKET, BY ORIENTATION, 2020–2027 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 103 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.5.1 Brazil

10.6.5.1.1 Increasing investment in mining sector to push market

TABLE 104 BRAZIL: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.6.5.2 Argentina

10.6.5.2.1 Demand from mining and oil & gas industries to underpin market growth

TABLE 105 ARGENTINA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.6.5.3 Colombia

10.6.5.3.1 Developments in oil & gas sector to drive market for scrubbers

TABLE 106 COLOMBIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.6.5.4 Rest of South America

TABLE 107 REST OF SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 153)

11.1 KEY PLAYERS STRATEGIES

TABLE 108 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2022

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 109 MARKET: DEGREE OF COMPETITION

FIGURE 39 MARKET SHARE ANALYSIS, 2021

11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 40 TOP PLAYERS IN MARKET FROM 2017 TO 2021

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 PERVASIVE PLAYERS

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 41 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

11.5 START-UP/SME EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 42 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

11.5.5 COMPETITIVE BENCHMARKING

TABLE 110 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 111 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 112 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY END-USER INDUSTRY

11.6 SCRUBBER SYSTEM MARKET: COMPANY FOOTPRINT

TABLE 113 PRODUCT TYPE: COMPANY FOOTPRINT

TABLE 114 END-USER INDUSTRY: COMPANY FOOTPRINT

TABLE 115 APPLICATION: COMPANY FOOTPRINT

TABLE 116 ORIENTATION: COMPANY FOOTPRINT

TABLE 117 REGION: COMPANY FOOTPRINT

TABLE 118 COMPANY FOOTPRINT

11.7 COMPETITIVE SCENARIOS AND TRENDS

TABLE 119 MARKET: PRODUCT LAUNCHES, JANUARY 2018–MARCH 2022

TABLE 120 MARKET: DEALS, JANUARY 2018–MARCH 2022

TABLE 121 MARKET: OTHERS, JANUARY 2018–MARCH 2022

12 COMPANY PROFILES (Page No. - 171)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 ALFA LAVAL

TABLE 122 ALFA LAVAL: BUSINESS OVERVIEW

FIGURE 43 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 123 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 124 ALFA LAVAL: PRODUCT LAUNCHES

TABLE 125 ALFA LAVAL: DEALS

TABLE 126 ALFA LAVAL: OTHERS

12.1.2 WÄRTSILÄ

TABLE 127 WÄRTSILÄ: BUSINESS OVERVIEW

FIGURE 44 WÄRTSILÄ: COMPANY SNAPSHOT

TABLE 128 WÄRTSILÄ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 129 WÄRTSILÄ: DEALS

TABLE 130 WÄRTSILÄ: OTHERS

12.1.3 GEA

TABLE 131 GEA: BUSINESS OVERVIEW

FIGURE 45 GEA: COMPANY SNAPSHOT

TABLE 132 GEA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 133 GEA: PRODUCT LAUNCHES

TABLE 134 GEA: OTHERS

12.1.4 BABCOCK & WILCOX

TABLE 135 BABCOCK & WILCOX: BUSINESS OVERVIEW

FIGURE 46 BABCOCK & WILCOX: COMPANY SNAPSHOT

TABLE 136 BABCOCK & WILCOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 137 BABCOCK WILCOX: OTHERS

12.1.5 VALMET

TABLE 138 VALMET: BUSINESS OVERVIEW

FIGURE 47 VALMET: COMPANY SNAPSHOT

TABLE 139 VALMET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 140 VALMET: OTHERS

12.1.6 FUJI ELECTRIC

FIGURE 48 FUJI ELECTRIC: COMPANY SNAPSHOT

TABLE 142 FUJI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.7 CECO ENVIRONMENTAL

TABLE 143 CECO ENVIRONMENTAL: BUSINESS OVERVIEW

FIGURE 49 CECO ENVIRONMENTAL: COMPANY SNAPSHOT

TABLE 144 CECO ENVIRONMENTAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 145 CECO ENVIRONMENTAL: DEALS

TABLE 146 CECO ENVIRONMENTAL: OTHERS

12.1.8 ANDRITZ AG

TABLE 147 ANDRITZ AG: BUSINESS OVERVIEW

FIGURE 50 ANDRITZ AG: COMPANY SNAPSHOT

TABLE 148 ANDRITZ AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 149 ANDRITZ AG: DEALS

TABLE 150 ANDRITZ AG: OTHERS

12.1.9 DUKE ENERGY

TABLE 151 DUKE ENERGY: BUSINESS OVERVIEW

FIGURE 51 DUKE ENERGY: COMPANY SNAPSHOT

TABLE 152 DUKE ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.10 BRENNTAG

TABLE 153 BRENNTAG: BUSINESS OVERVIEW

FIGURE 52 BRENNTAG: COMPANY SNAPSHOT

TABLE 154 BRENNTAG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.11 NEDERMAN

TABLE 155 NEDERMAN: BUSINESS OVERVIEW

FIGURE 53 NEDERMAN: COMPANY SNAPSHOT

TABLE 156 NEDERMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 157 NEDERMAN: DEALS

12.1.12 PACIFIC GREEN TECHNOLOGIES

TABLE 158 PACIFIC GREEN TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 54 PACIFIC GREEN TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 159 PACIFIC GREEN TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 PACIFIC GREEN TECHNOLOGIES: OTHERS

12.1.13 VERANTIS ENVIRONMENTAL SOLUTIONS GROUP

TABLE 161 VERANTIS ENVIRONMENTAL SOLUTIONS GROUP: BUSINESS OVERVIEW

TABLE 162 VERANTIS ENVIRONMENTAL SOLUTIONS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 VERANTIS ENVIRONMENTAL SOLUTIONS GROUP: OTHERS

12.1.14 YARA MARINE TECHNOLOGIES

TABLE 164 YARA MARINE TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 165 YARA MARINE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 166 YARA MARINE TECHNOLOGIES: DEALS

12.1.15 POLLUTION SYSTEMS

TABLE 167 POLLUTION SYSTEMS: BUSINESS OVERVIEW

TABLE 168 POLLUTION SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.16 SCHUTTE & KOERTING

TABLE 169 SCHUTTE & KOERTING: BUSINESS OVERVIEW

TABLE 170 SCHUTTE & KOERTING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2 OTHER PLAYERS

12.2.1 KCH

12.2.2 TRI-MER CORPORATION

12.2.3 HITACHI ZOSEN INOVA

12.2.4 CR CLEAN AIR

12.2.5 ERGIL

12.2.6 ANGUIL ENVIRONMENTAL SYSTEMS, INC.

12.2.7 THERMAX

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 227)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

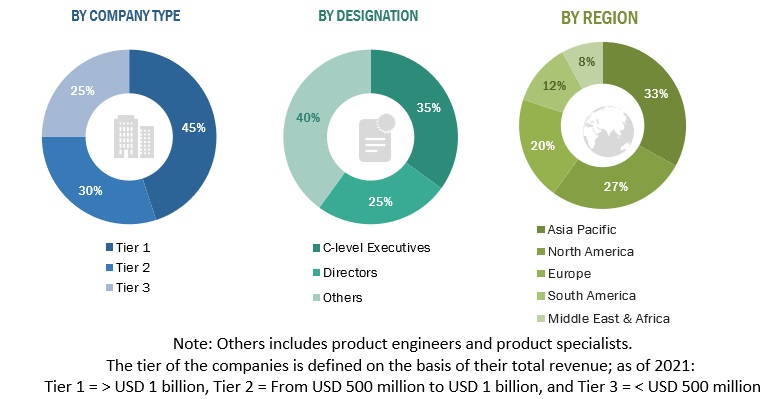

The study involved major activities in estimating the current size of the scrubber system market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the scrubber system market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the scrubber system market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The scrubber system market comprises several stakeholders such as scrubber system manufacturers, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for scrubber system in, marine, oil & gas, metal & mining, power generation, chemical & petrochemical, food, beverage, & agriculture, glass, pharmaceutical, water & wastewater treatment, and other end-user industries. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the scrubber system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Scrubber system Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the scrubber system market, by product type, by application, end-use industry, and by orientation in terms of value

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To provide detailed information on market map, value chain, case studies, technologies, market ecosystem, tariff and regulatory landscape, Porter’s five forces, and trends/disruptions impacting customers’ businesses that are specific to the market

- To analyze market opportunities for stakeholders in the market and draw a competitive landscape for the market players

- To benchmark players within the market using the company evaluation quadrant, which analyzes market players on various parameters within the broad categories of business excellence and strength of product portfolio

- To compare key market players with respect to the market share, product specifications, and end users

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To track and analyze competitive developments in the scrubber system market, such as expansions, product launches, and acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for a report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Scrubber System Market