Software-Defined Wide Area Network (SD-WAN) for Government Market Stakeholder Profile, Market Dynamics, Industry Trends, and Use Cases for Civil Agencies, National Security Agencies, and Defense Agencies - Global Forecast to 2023

[55 Pages Report] The global Software-Defined Wide Area Network (SD-WAN) for government market size is expected to grow from USD 27 million in 2018 to USD 103 million by 2023, at a Compound Annual Growth Rate (CAGR) of 30.5% during the forecast period. The demand for SD-WAN solution in government vertical is growing to manage the complex and diverse network infrastructure at a low cost. The cloud application demands more bandwidth and low latency while optimizing the bandwidth, which is fulfilled by SD-WAN solutions. SD-WAN simplifies the network complexities including configuration, management, and optimization aligned with Wide Area Network (WAN) SD-WAN delivers robust branch connectivity over the traditional WAN architecture by reducing overall Capital Expenditure (CAPEX) and improving network capacity effectively. Governments across the globe are adopting SD-WAN solutions to procure secure IT systems, and address potential vulnerabilities in businesses processes to ensure highest level of data protection and security.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) |

|

Verticals Covered |

Civil, National Security, and Defense |

The SD-WAN for government market is categorized into civil agencies, national security agencies, and defense agencies in each of the following subsegments:

SD-WAN: Civil

- Stakeholder profile

- Stakeholder persona

- Ideal stakeholder profile – business, technical, and political

- Stakeholder drivers and challenges

- Industry positioning and use cases

- Current state vs future state

- Use cases

SD-WAN: National Security

- Stakeholder profile

- Stakeholder persona

- Ideal stakeholder profile – business, technical, and political

- Stakeholder drivers and challenges

- Industry positioning and use cases

- Current state vs future state

- Use cases

SD-WAN: Defense

- Stakeholder profile

- Stakeholder persona

- Ideal stakeholder profile – business, technical, and political

- Stakeholder drivers and challenges

- Industry positioning and use cases

- Current state vs future state

- Use cases

Key pointers addressed by the report

- Analysis of the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the SD-WAN for government market

- The report provides various use cases of SD-WAN solutions in the civil agencies, national security agencies, and defense agencies

- Key insights on current state infrastructure and future state infrastructure in defense, civil, and security agencies

- In-depth analysis of 3 ideal stakeholder personas, namely, business leadership, technical leadership, and political leadership

Frequently Asked Questions (FAQ):

What is the market definition of SD-WAN for government market?

What are the major verticals for SD-WAN for government market?

What are the advantages of SD-WAN for government market?

What is the market size of SD-WAN for government market?

What are the major opportunities in the SD-WAN for government market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 SD-WAN: Civil

3.1 Stakeholder Profile

3.1.1 Stakeholder Persona

3.1.2 Ideal Stakeholder Profile – Business, Technical, and Political

3.1.3 Stakeholder Drivers and Challenges

3.2 Industry Positioning and Use Cases

3.2.1 Current State vs Future State

3.2.2 Use Cases

4 SD-WAN: National Security

4.1 Stakeholder Profile

4.1.1 Stakeholder Persona

4.1.2 Ideal Stakeholder Profile –Business, Technical, and Political

4.1.3 Stakeholder Drivers and Challenges

4.2 Industry Positioning and Use Cases

4.2.1 Current State vs Future State

4.2.2 Use Cases

5 SD-WAN: Defense

5.1 Stakeholder Profile

5.1.1 Stakeholder Persona

5.1.2 Ideal Stakeholder Profile – Business, Technical, and Political

5.1.3 Stakeholder Drivers and Challenges

5.2 Industry Positioning and Use Cases

5.2.1 Current State vs Future State

5.2.2 Use Cases

6 Appendix

The study involved 4 major activities to estimate the current market size for the Software-Defined Wide Area Network (SD-WAN) for government market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the SD-WAN for government market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; crypto asset management technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

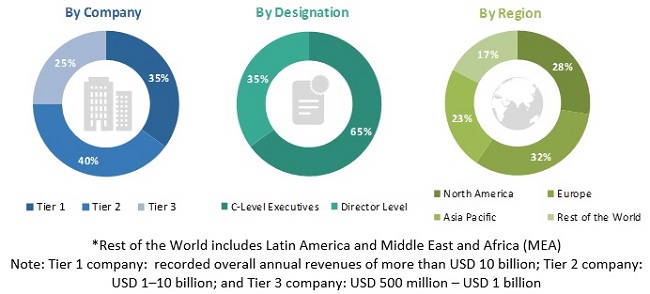

Various primary sources from both the supply and demand sides of the SD-WAN for government market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs); Vice Presidents (VPs); marketing directors; technology and innovation directors; and related key executives from various vendors who provide SD-WAN solutions operating in the targeted regions. All possible parameters that affect the market covered in this research have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For drawing market estimates and forecasting the SD-WAN for government market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global SD-WAN for government market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size includes the following

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the global SD-WAN for government market

- To provide detailed information related to the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the SD-WAN for government market

- To analyze various use cases in the SD-WAN for government market

Growth opportunities and latent adjacency in Software-Defined Wide Area Network (SD-WAN) for Government Market