The research study involved four major activities in estimating the secure access service edge (SASE) market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering SASE solutions to various end users was arrived at based on the secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

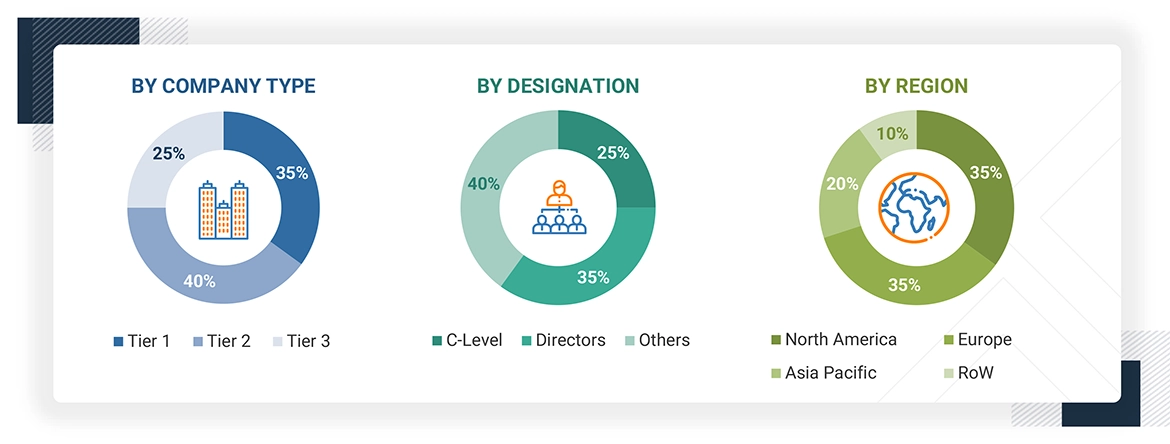

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, Such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from SASE solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use SASE solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current use of SASE solutions which is expected to affect the overall SASE market growth.

Notes: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies range between USD 500

million and 1 billion in overall revenues, and Tier 3 companies have revenues less than USD 500 million.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the SASE market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Secure Access Service Edge (SASE) Market : Top-Down and Bottom-Up Approach

Data Triangulation

The SASE market has been split into several segments and sub-segments after arriving at the overall market size from the above estimation process. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The SASE market size has been validated using top-down and bottom-up approaches.

Market Definition

According to Cisco, SASE is a network architecture combining VPN and SD-WAN capabilities with cloud-native security functions, such as secure web gateways, cloud access security brokers, firewalls, and zero-trust network access. These functions are delivered from the cloud and provided by the SASE vendor as a service. According to Cloudflare, SASE, is a cloud-based IT model that bundles software-defined networking with network security functions and delivers them from a single service provider. As per Fortinet, SASE is a cloud-delivered service combining network and security functions with WAN capabilities to support today's hybrid organizations' dynamic, secure access needs. Conceptually, SASE extends networking and security capabilities beyond where they’re typically available. This lets users, regardless of location, take advantage of the firewall as a service (FWaaS), secure web gateway (SWG), zero-trust network access (ZTNA), and a medley of threat detection functions.

Stakeholders

-

System Integrators

-

SD-WAN/SSE Vendors

-

Technology Vendors

-

Project Managers

-

Independent Software Vendors (ISVs)

-

Managed Service Providers (MSPs)

-

Compliance Regulatory Authorities

-

Government Authorities

-

Investment Firms

-

SASE Alliances/Groups

-

Cloud Service Providers

-

Enterprises/Businesses

Report Objectives

-

To determine, segment, and forecast the secure access service edge (SASE) market based on offering, organization size, end user, and region

-

To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

-

To study the complete supply chain and related industry segments and perform a supply chain analysis of the market landscape

-

To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the industry trends, pricing data, patents, and innovations related to the market

-

To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

-

To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

-

To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

-

Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further break-up of the North American market into countries contributing 75% to the regional market size

-

Further break-up of the Latin American market into countries contributing 75% to the regional market size

-

Further break-up of the Middle East African market into countries contributing 75% to the regional market size

-

Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Secure Access Service Edge (SASE) Market