Security as a Service Market by Component (Solution and Service), Application (Network Security, Endpoint Security, Application Security, and Cloud), Organization Size (SMEs, Large Enterprises), Vertical, and Region (2022 - 2026)

Security as a Service Market Growth & Trends

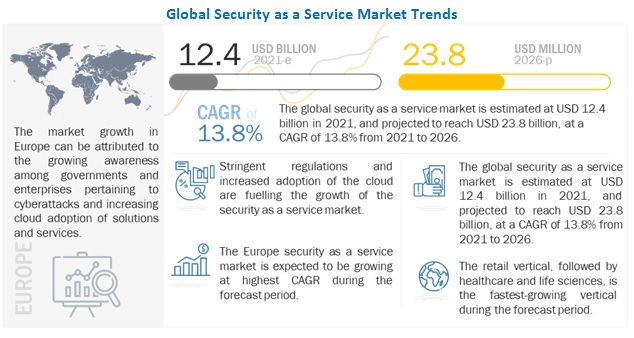

The global Security as a Service Market size was valued at $12.4 billion in 2021 and is projected to reach $23.8 billion by 2026, growing at a CAGR of 13.8% from 2021 to 2026. The key growth driver of the security as a service market are mandates to follow regulatory and data protection laws, increase in demand for cloud-based security solutions among SMEs, and high cost and risks in managing on-premises security solutions.

Security as a Service Market Dynamics

Driver: Increasing need for cloud-based security solutions among SMEs

Cloud implementation allows organizations to combine supplementary infrastructure technologies, such as software-defined perimeters to create robust and highly secure platforms. Governments in several countries issue special guidelines and regulations for cloud platform security, which drives the cyber security market growth across the globe. SMEs constantly seek to modernize their applications and infrastructures by moving to cloud-based platforms, such as Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS). Most SMEs across verticals become a primary target for cybercriminals to exploit vulnerabilities in their security model. Traditional appliance-based firewalls and security gateways are incapable of securing cloud-based applications from cyberattacks, such as malware, ransomware, phishing, and DNS data exfiltration.

With SMEs focusing on the adoption of cloud platforms, security administrators in these SMEs drive the need for cloud-based security as a service solutions to optimize performance and secure web and mobile applications and critical network infrastructures. Cloud-based security as a service solutions eliminates the need to install a stack of security equipment on-premises and can utilize cloud services to secure applications, data, users, and devices. The demand for cloud-based security as a service solutions is expected to increase, presenting growth opportunities in the market as SMEs plan to address data and information security concerns over the cloud.

Restraint: Organizations’ doubts related to cloud-based security

Various organizations are skeptical about the overall level of adoption of cloud-based security solutions due to security reasons. According to Rights Cale’s state of the cloud report 2019, security is one of the major concerns for enterprises across the globe. Despite the economic benefits of cloud-based security, organizations prefer their data and applications to be managed on-premises. IT experts who are comfortable interacting with on-premises security applications often experience more concerns while moving to cloud-based security, as they fear the loss of ownership and control.

In today’s complex IT security environment, the frequency of cyberattacks is growing exponentially. There is also a belief that cloud-based standards are not yet mature to handle IT security demands. Though there is an increase in the adoption of cloud-based security solutions, the awareness of potential risks and threats associated with these solutions is low among organizations. The skepticism of organizations migrating to the cloud is restraining the growth of the security as a service market.

Opportunity: Rapid growth in Bring Your Own Device and Carry Your Own Device trends

Over the last five years, with the introduction of new platforms, BYOD policies, CYOD trends, business applications, and other technologies, the IT infrastructure has become more complex and heterogeneous. The rapid advancements in mobile computing have led to the growing popularity of the BYOD and CYOD trends in corporate environments. These trends offer work flexibility and increased employee productivity, enabling employees to access the organizational data from anywhere, anytime, with their devices. Hence, it is necessary to ensure the confidentiality and integrity of the organizational data by safeguarding it from potential risks.

The BYOD policy is gaining popularity among SMEs and large enterprises and changing how users access organizational data. As the technology related to BYOD is improving, organizations are mobilizing their workforce. With the adoption of the BYOD model, organizations are subscribing to security services to protect devices, such as smartphones, tablets, desktops, and laptops, from cyber threats. With the increasing use of BYOD, enterprises need to secure devices inside office premises and secure those who have remote access to the corporate network. This factor has significantly increased spending on security services, which is expected to drive the growth of the security as a service market.

Challenge:Designing and implementation difficulties in deploying security as a service solution

Deploying the security as a service model on a new or existing infrastructure has various design and implementation challenges. The model forces IT teams in enterprises to rethink their network security to transform from the network perimeter-based approach into a user-based and application-based security model. Redesigning and redeploying web-and mobile-based applications can become exhaustive and time-consuming. Most networks are not designed keeping cybersecurity in mind and upgrading to the cybersecurity model requires an in-depth network analysis of network hardware, services, and traffic. Re-modelling networks using the security as a service model requires an accurate and clear understanding of every user, device, application, and resource.

Security as a service solution is not completely full proof. They do not address all the issues, such as Distributed Denial-of-Service (DDoS) attacks, human errors, and misconfigured devices. The complete implementation of security as a service solution requires IT teams to disengage applications’ access from network access, thus replacing firewalls based on the network-centric approach with NGFWs to secure the entire network. However, most of the security as a service solution focus on role-based user access, micro perimeters, and user analytics while ignoring vulnerabilities of resources to various cyber risks.

Security as a Service Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The services segment is estimated to grow at the highest CAGR during the forecast period

The security as a service market is segmented by component (solution and service), application, organization size, vertical, and region. The market by solution includes business continuity and disaster recovery, continuous monitoring, Data Loss Prevention (DLP), encryption, Identity and Access Management (IAM), intrusion management, Security Information and Event Management (SIEM), vulnerability scanning, and other solutions. The IAM segment in the security as a service solution market is expected to have the largest market size during the forecast period. The market for services segment is growing as individuals, Small and Medium Enterprises (SMEs), and large enterprises are concerned about securing access to their network, endpoint, cloud, and applications.

The network security segment is estimated to constitute the largest market size during the forecast period

Network security is a proactive technique for securing a network from advanced threats by collecting and analyzing different types of network security event information. With the increasing threat landscape, the demand for cloud-based security solutions for network security is increasing as it protects the network by restricting the device management accessibility to terminals, authorized services, management ports, and protocols. Organizations adopt a series of policies and cybersecurity cloud services to prevent unauthorized access and misuse of networking resources.

The SME segment is expected to grow at the highest CAGR during the forecast period

The SME segment is expected to grow at the highest CAGR during the forecast period, owing to the increasing incidences of cyber-attacks. SMEs are small in terms of their size but cater to a large number of customers globally. Robust and comprehensive security solutions are not implemented in SMEs due to financial constraints in these organizations. However, the large enterprise segment accounts for the highest share of the security as a service market in 2021.

Security as a service solutions and services have been deployed across various industry verticals, including Banking, Financial Services, and Insurance (BFSI); government and defense; retail; healthcare and life sciences; IT and telecom; energy and utilities; manufacturing; and others. The retail vertical is expected to grow at the highest CAGR during the forecast period, while the BFSI vertical is estimated to have the largest market size in 2020.

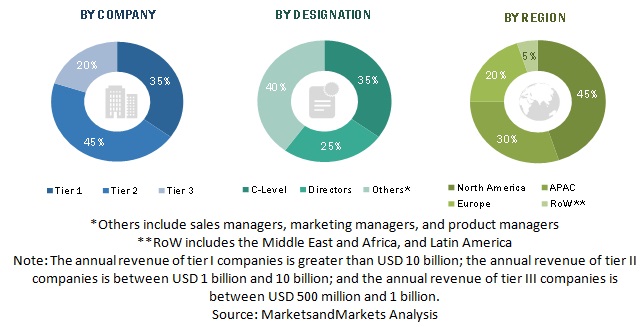

North America is expected to account for the largest market size during the forecast period

The global security as a service market has been segmented based on regions into North America, Europe, APAC, MEA, and Latin America to provide a region-specific analysis in the report. The North American region, followed by Europe, is expected to become the largest revenue-generating region for security as a service solution and service vendors in 2021. Increasing Internet of Things (IoT), cloud adoption, and Bring Your Own Device (BYOD) trend and growing internal and external threats are some of the key factors expected to fuel the growth of the security as a service market in North America.

The Europe security as a service market is gaining traction as the security as a service solutions provide proactive security measures against evolving cyber-attacks. SMEs, as well as large-scale organizations in the Europe region, have become more aware of the increasing cybercrimes and have started adopting security as a service solutions and services to combat them.

Security as a Service Market - Key Players:

The report includes the study of key players, such as Trend Micro (Japan), IBM (US), Microsoft (US), Zscaler (US), McAfee (US), Forcepoint (US), Sophos (UK), Clearswift (UK), Alert Logic (US), Cygilant (US), Barracuda Networks (US), Panda Security (Spain), Cisco (US), Fortinet (US), Radware (China), NortonLifeLock (US), Mindsight (US), Sentinel Technologies (US), Happiest Minds (India), Okta (US), ProofPoint (US), Qualys(US), Kaspersky Lab (US), Stratejm (Canada), and HackerOne (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2021 |

US $12.4 billion |

|

Revenue forecast for 2026 |

US $23.8 billion |

|

Growth Rate |

13.8% CAGR |

|

Largest Market |

North America |

|

Leading Vertical |

BFSI |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Segments covered |

Component, Solution, Service, Application, Organization Size, Vertical, and Region |

|

Regions covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Trend Micro (Japan), IBM (US), Microsoft (US), Zscaler (US), McAfee (US), Forcepoint (US), Sophos (UK), Clearswift (UK), Alert Logic (US), Cygilant (US), Barracuda Networks (US), Panda Security (Spain), Cisco (US), Fortinet (US), Radware (China), NortonLifeLock (US), Mindsight (US), Sentinel Technologies (US), Happiest Minds (India), Okta (US), Proofpoint (US), Qualys (US), Kaspersky Lab (US), Stratejm (Canada), and HackerOne (US). |

This research report categorizes the security as a service market based on component, solution, service, application, organization size, vertical, and region.

Based on Component:

- Solution

- Service

Security as a Service Market Based on Solution:

- Business Continuity and Disaster Recovery

- Continuous Monitoring

- Data Loss Prevention

- Encryption

- Identity and Access Management

- Intrusion Management

- Security Information and Event Management

- Vulnerability Scanning

- Other Solutions (Security Assessment, DDoS mitigation, and Firewall Services)

Based on Service:

- Training and Education

- Consulting

- Support and Maintenance

Security as a Service Market Based on Application:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Other Applications (Email Security, Web Security, and Database Security)

Based on Organization Size

- SMEs

- Large Enterprises

Based on Vertical:

- Banking, Financial Services, and Insurance,

- Government and Defense

- Retail and eCommerce

- Healthcare and Life Sciences

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Other Verticals (Travel and Hospitality, Education and Media and Entertainment)

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia and New Zealand (ANZ)

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- July 2021 - Trend Micro announced a new collaboration with Microsoft that aims to deliver greater impact to cybersecurity for joint customers. The collaboration outlines new cooperation on developing cloud-based cybersecurity solutions on Microsoft Azure and generating co-selling opportunities.

- July 2021 - Through a new multi-year strategic partnership Microsoft and NEC will leverage Microsoft Azure, Microsoft 365, NEC’s network, and IT expertise, including 5G technologies, and each other’s AI and IoT solutions to help enterprise customers and the public sector across multiple markets and industries. They will further accelerate their cloud adoption and digital transformation initiatives.

- July 2021 - McAfee announced a new partnership with Visa that enables Visa financial institution partners in North America and EMEA to offer award-winning internet security to Visa Business cardholders. Visa Business cardholders can save up to 40% on a two-year subscription on comprehensive McAfee solutions that protect sensitive data via email, provide web and firewall protection, offer mobile VPN, and safeguard devices from malware and the latest online threats.

- June 2021 - Microsoft and Morgan Stanley will strike a unique collaboration to unlock the opportunities that Microsoft’s cloud provides with a specific view toward the challenges of financial services enabling Morgan Stanley to accelerate the modernization of its IT environment to enhance client, employee, and developer experiences.

- April 2021 - IBM Security announced its collaboration with HCL to help unify and streamline threat management for clients via a modernized SOC platform.

Frequently Asked Questions (FAQ):

What is Security as a Service?

What are the benefits in the Market of Security as a Service?

What are the Market solutions required for Security as a Service ?

What are the application areas of Security as a Service Market ?

Who are the prominent Market players of Security as a Service ?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 6 SECURITY AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 REVENUE ESTIMATES

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1

2.3.2 DEMAND-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2

2.3.3 TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 – SUPPLY-SIDE ANALYSIS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATIVE EXAMPLE OF TREND MICRO

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (BOTTOM-UP) - SUPPLY SIDE: COLLECTIVE REVENUE FROM TOOLS AND SERVICES

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 54)

TABLE 3 SECURITY AS A SERVICE MARKET SIZE AND GROWTH, 2016–2020 (USD BILLION, Y-O-Y %)

TABLE 4 MARKET SIZE AND GROWTH RATE, 2021–2026 (USD BILLION, Y-O-Y%)

FIGURE 12 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 13 MARKET TO WITNESS SIGNIFICANT GROWTH IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 14 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2021

FIGURE 15 FASTEST-GROWING SEGMENTS OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SECURITY AS A SERVICE MARKET

FIGURE 16 INCREASING CYBERATTACKS, STRINGENT REGULATIONS, AND GROWING CLOUD ADOPTION TO DRIVE THE DEPLOYMENT OF SECURITY AS A SERVICE SOLUTIONS

4.2 MARKET SHARE OF TOP THREE VERTICALS AND REGIONS

FIGURE 17 BFSI VERTICAL AND NORTH AMERICA REGION TO ACCOUNT FOR THE LARGEST MARKET SHARES IN 2021

4.3 MARKET, BY SOLUTION, 2021

FIGURE 18 IDENTITY AND ACCESS MANAGEMENT SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, BY SERVICE, 2021

FIGURE 19 SUPPORT AND MAINTENANCE SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.5 MARKET, BY ORGANIZATION SIZE, 2021

FIGURE 20 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

4.6 MARKET INVESTMENT SCENARIO, BY REGION

FIGURE 21 EUROPE TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SECURITY AS A SERVICE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing need for cloud-based security solutions among SMEs

5.2.1.2 Mandate to follow regulatory and data protection laws

5.2.1.3 Growing demand for cyber-savvy boards

5.2.2 RESTRAINTS

5.2.2.1 Organizations’ doubts related to cloud-based security

5.2.2.2 Availability of free security service and security solution suites

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of cloud-based services among SMEs

5.2.3.2 Rapid growth in Bring Your Own Device and Carry Your Own Device trends

5.2.4 CHALLENGES

5.2.4.1 Designing and implementation difficulties in deploying security as a service solution

5.2.4.2 Lack of skilled IT security professionals

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: SECURITY AS A SERVICE MARKET

TABLE 5 SECURITY AS A SERVICE: SUPPLY CHAIN ANALYSIS

5.5 USE CASES

5.5.1 USE CASE: TREND MICRO

5.5.2 USE CASE: MCAFEE

5.5.3 USE CASE: PROOFPOINT

5.5.4 USE CASE: KASPERSKY LAB

5.6 MARKET ECOSYSTEM

FIGURE 24 MARKET ECOSYSTEM: MARKET

5.7 PORTER’S FIVE FORCES MODEL ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: SECURITY AS A SERVICE MARKET

TABLE 6 PORTER’S FIVE FORCES IMPACT ANALYSIS

5.7.1 THREAT FROM NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.8.2 TOKENIZATION

5.8.3 INTERNET OF THINGS

5.8.4 USER AND ENTITY BEHAVIOR ANALYTICS

5.9 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICE/PRICING MODEL OF SECURITY AS A SERVICE SOLUTIONS

5.10 REGULATORY IMPLICATIONS

5.10.1 GENERAL DATA PROTECTION REGULATION

5.10.2 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.10.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.10.4 SARBANES-OXLEY ACT

5.10.5 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.10.6 GRAMM–LEACH–BLILEY ACT

5.11 PATENT ANALYSIS

FIGURE 26 PATENT ANALYSIS - SECURITY AS A SERVICE MARKET

5.12 TRENDS IMPACTING CUSTOMERS IN THE MARKET

FIGURE 27 TRENDS IMPACTING CUSTOMERS: MARKET

6 SECURITY AS A SERVICE MARKET, BY COMPONENT (Page No. - 83)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 28 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 9 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

TABLE 12 SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 SECURITY AS A SERVICE MARKET, BY SOLUTION (Page No. - 88)

7.1 INTRODUCTION

7.1.1 SOLUTIONS: MARKET DRIVERS

7.1.2 SOLUTIONS: COVID-19 IMPACT

FIGURE 29 ENCRYPTION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 15 MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

7.2 BUSINESS CONTINUITY AND DISASTER MANAGEMENT

TABLE 16 BUSINESS CONTINUITY AND DISASTER MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 BUSINESS CONTINUITY AND DISASTER MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 CONTINUOUS MONITORING

TABLE 18 CONTINUOUS MONITORING: SECURITY AS A SERVICE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 CONTINUOUS MONITORING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 DATA LOSS PREVENTION

TABLE 20 DATA LOSS PREVENTION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 DATA LOSS PREVENTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 ENCRYPTION

TABLE 22 ENCRYPTION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 ENCRYPTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 IDENTITY AND ACCESS MANAGEMENT

TABLE 24 IDENTITY AND ACCESS MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 IDENTITY AND ACCESS MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.7 INTRUSION MANAGEMENT

TABLE 26 INTRUSION MANAGEMENT: SECURITY AS A SERVICE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 INTRUSION MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.8 SECURITY INFORMATION AND EVENT MANAGEMENT

TABLE 28 SECURITY INFORMATION AND EVENT MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 SECURITY INFORMATION AND EVENT MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.9 VULNERABILITY SCANNING

TABLE 30 VULNERABILITY SCANNING: E MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 VULNERABILITY SCANNING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.10 OTHER SOLUTIONS

TABLE 32 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 SECURITY AS A SERVICE MARKET, BY SERVICE (Page No. - 101)

8.1 INTRODUCTION

8.1.1 SERVICES: MARKET DRIVERS

8.1.2 SERVICES: COVID-19 IMPACT

FIGURE 30 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

8.2 TRAINING AND EDUCATION

TABLE 36 TRAINING AND EDUCATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 TRAINING AND EDUCATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CONSULTING

TABLE 38 CONSULTING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 CONSULTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 SUPPORT AND MAINTENANCE

TABLE 40 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 SECURITY AS A SERVICE MARKET, BY APPLICATION (Page No. - 107)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: MARKET DRIVERS

9.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 31 APPLICATION SECURITY SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 42 MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 43 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 NETWORK SECURITY

TABLE 44 NETWORK SECURITY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 NETWORK SECURITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 ENDPOINT SECURITY

TABLE 46 ENDPOINT SECURITY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 ENDPOINT SECURITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 APPLICATION SECURITY

TABLE 48 APPLICATION SECURITY: SECURITY AS A SERVICE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 APPLICATION SECURITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 CLOUD SECURITY

TABLE 50 CLOUD SECURITY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 CLOUD SECURITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 OTHER APPLICATIONS

TABLE 52 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 115)

10.1 INTRODUCTION

10.1.1 ORGANIZATION SIZE: MARKET DRIVERS

10.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 32 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 54 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 55 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 56 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 LARGE ENTERPRISES

TABLE 58 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 SECURITY AS A SERVICE MARKET, BY VERTICAL (Page No. - 120)

11.1 INTRODUCTION

11.1.1 VERTICALS: MARKET DRIVERS

11.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 33 RETAIL VERTICAL TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 60 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 61 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 62 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 GOVERNMENT AND DEFENSE

TABLE 64 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 65 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4 RETAIL AND ECOMMERCE

TABLE 66 RETAIL AND ECOMMERCE: SECURITY AS A SERVICE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 67 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.5 HEALTHCARE AND LIFE SCIENCES

TABLE 68 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.6 IT AND TELECOM

TABLE 70 IT AND TELECOM: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 IT AND TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.7 ENERGY AND UTILITIES

TABLE 72 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.8 MANUFACTURING

TABLE 74 MANUFACTURING: SECURITY AS A SERVICE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 75 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.9 OTHER VERTICALS

TABLE 76 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 77 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 SECURITY AS A SERVICE MARKET, BY REGION (Page No. - 133)

12.1 INTRODUCTION

FIGURE 34 EUROPE TO HOLD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 78 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 79 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 DRIVERS

12.2.3 NORTH AMERICA: REGULATIONS

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.4 UNITED STATES

TABLE 94 UNITED STATES: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 105 UNITED STATES: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.2.5 CANADA

TABLE 106 CANADA: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 114 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 115 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 117 CANADA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: SECURITY AS A SERVICE MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

12.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 118 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.4 UNITED KINGDOM

TABLE 132 UNITED KINGDOM: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 135 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 141 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 142 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 143 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.3.5 GERMANY

TABLE 144 GERMANY: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 145 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 146 GERMANY: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 147 GERMANY: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 148 GERMANY: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 149 GERMANY: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 150 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 151 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 152 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 153 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 154 GERMANY: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 155 GERMANY: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.3.6 FRANCE

TABLE 156 FRANCE: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 157 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 158 FRANCE: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 159 FRANCE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 160 FRANCE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 161 FRANCE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 162 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 163 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 164 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 165 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 166 FRANCE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 167 FRANCE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 168 REST OF EUROPE: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 170 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 172 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 175 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 176 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 177 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 178 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 179 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: SECURITY AS A SERVICE MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

12.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.4 CHINA

TABLE 194 CHINA: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 195 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 196 CHINA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 197 CHINA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 198 CHINA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 199 CHINA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 200 CHINA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 201 CHINA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 202 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 203 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 204 CHINA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 205 CHINA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.4.5 JAPAN

TABLE 206 JAPAN: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 207 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 208 JAPAN: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 209 JAPAN: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 210 JAPAN: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 211 JAPAN: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 212 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 213 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 214 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 215 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 216 JAPAN: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 217 JAPAN: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.4.6 AUSTRALIA AND NEW ZEALAND

TABLE 218 AUSTRALIA AND NEW ZEALAND: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 219 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 220 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 221 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 222 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 223 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 224 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 225 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 226 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 227 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 228 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 229 AUSTRALIA AND NEW ZEALAND: ICE MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.4.7 INDIA

TABLE 230 INDIA: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 231 INDIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 232 INDIA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 233 INDIA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 234 INDIA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 235 INDIA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 236 INDIA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 237 INDIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 238 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 239 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 240 INDIA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 241 INDIA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.4.8 REST OF ASIA PACIFIC

TABLE 242 REST OF ASIA PACIFIC: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 243 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 244 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 245 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 246 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 247 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 248 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 249 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 250 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 251 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 252 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 253 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: SECURITY AS A SERVICE MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 254 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 255 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 256 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 257 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 260 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 261 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 262 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 263 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 264 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 265 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 266 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 267 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.5.4 MIDDLE EAST

TABLE 268 MIDDLE EAST: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 269 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 270 MIDDLE EAST: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 271 MIDDLE EAST: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 272 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 273 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 274 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 275 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 276 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 277 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 278 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 279 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.5.5 AFRICA

TABLE 280 AFRICA: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 281 AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 282 AFRICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 283 AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 284 AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 285 AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 286 AFRICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 287 AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 288 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 289 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 290 AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 291 AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: SECURITY AS A SERVICE MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

12.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 292 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 293 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 294 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 295 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 296 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 297 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 298 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 299 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 300 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 301 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 302 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 303 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 304 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 305 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.4 MEXICO

TABLE 306 MEXICO: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 307 MEXICO: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 308 MEXICO: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 309 MEXICO: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 310 MEXICO: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 311 MEXICO: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 312 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 313 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 314 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 315 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 316 MEXICO: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 317 MEXICO: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.6.5 BRAZIL

TABLE 318 BRAZIL: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 319 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 320 BRAZIL: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 321 BRAZIL: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 322 BRAZIL: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 323 BRAZIL: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 324 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 325 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 326 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 327 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 328 BRAZIL: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 329 BRAZIL: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.6.6 REST OF LATIN AMERICA

TABLE 330 REST OF LATIN AMERICA: SECURITY AS A SERVICE MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 331 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 332 REST OF LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 333 REST OF LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 334 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 335 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 336 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 337 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 338 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 339 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 340 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 341 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 251)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 SECURITY AS A SERVICE: MARKET EVALUATION FRAMEWORK

13.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 38 SECURITY AS A SERVICE MARKET: REVENUE ANALYSIS

13.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 342 MARKET: DEGREE OF COMPETITION

13.5 HISTORICAL REVENUE ANALYSIS

FIGURE 39 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

13.6 COMPETITIVE SCENARIO

TABLE 343 MARKET: DEALS, 2020–2021

TABLE 344 MARKET: NEW LAUNCHES, 2020–2021

TABLE 345 MARKET: OTHERS, 2018–2020

13.7 RANKING OF KEY PLAYERS IN THE SECURITY AS A SERVICE MARKET, 2021

FIGURE 40 KEY PLAYERS RANKING, 2021

13.8 COMPANY EVALUATION MATRIX

13.8.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 346 EVALUATION CRITERIA

13.8.2 STAR

13.8.3 PERVASIVE

13.8.4 EMERGING LEADERS

13.8.5 PARTICIPANTS

TABLE 347 COMPANY PRODUCT FOOTPRINT

TABLE 348 COMPANY INDUSTRY FOOTPRINT

TABLE 349 COMPANY REGION FOOTPRINT

FIGURE 41 SECURITY AS A SERVICE MARKET - COMPANY EVALUATION MATRIX, 2021

13.9 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

13.10 BUSINESS STRATEGY EXCELLENCE

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

13.11 STARTUP/SME EVALUATION MATRIX, 2021

13.11.1 PROGRESSIVE COMPANIES

13.11.2 RESPONSIVE COMPANIES

13.11.3 DYNAMIC COMPANIES

13.11.4 STARTING BLOCKS

FIGURE 44 SECURITY AS A SERVICE MARKET STARTUP/SME EVALUATION MATRIX, 2021

14 COMPANY PROFILES (Page No. - 268)

(Business overview, Products and services offered, Recent developments, Response to COVID-19 & MnM View)*

14.1 MAJOR PLAYERS

14.1.1 TREND MICRO

TABLE 350 TREND MICRO: BUSINESS OVERVIEW

FIGURE 45 TREND MICRO: COMPANY SNAPSHOT

TABLE 351 TREND MICRO: PRODUCTS/SOLUTIONS OFFERED

TABLE 352 TREND MICRO: SECURITY AS A SERVICE: NEW PRODUCT LAUNCHES

TABLE 353 TREND MICRO: SECURITY AS A SERVICE: DEALS

14.1.2 IBM

TABLE 354 IBM: BUSINESS OVERVIEW

FIGURE 46 IBM: COMPANY SNAPSHOT

TABLE 355 IBM: PRODUCTS AND SERVICES OFFERED

TABLE 356 IBM: SECURITY AS A SERVICE: NEW PRODUCT LAUNCHES

TABLE 357 IBM: SECURITY AS A SERVICE: DEALS

14.1.3 MICROSOFT

TABLE 358 MICROSOFT: BUSINESS OVERVIEW

FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

TABLE 359 MICROSOFT: PRODUCTS/SOLUTIONS OFFERED

TABLE 360 MICROSOFT: SECURITY AS A SERVICE: NEW PRODUCT LAUNCHES

TABLE 361 MICROSOFT: SECURITY AS A SERVICE: DEALS

14.1.4 ZSCALER

TABLE 362 ZSCALER: BUSINESS OVERVIEW

FIGURE 48 ZSCALER: COMPANY SNAPSHOT

TABLE 363 ZSCALER: PRODUCTS/SOLUTIONS OFFERED

TABLE 364 ZSCALER: SECURITY AS A SERVICE MARKET: NEW PRODUCT LAUNCHES

TABLE 365 ZSCALER: MARKET: DEALS

14.1.5 MCAFEE

TABLE 366 MCAFEE: BUSINESS OVERVIEW

TABLE 367 MCAFEE: PRODUCTS/SOLUTIONS OFFERED

TABLE 368 MCAFEE: MARKET: NEW PRODUCT LAUNCHES

TABLE 369 MCAFEE: SECURITY AS A SERVICE MARKET: DEALS

14.1.6 FORCEPOINT

TABLE 370 FORCEPOINT: BUSINESS OVERVIEW

TABLE 371 FORCEPOINT: PRODUCTS/SOLUTIONS OFFERED

TABLE 372 FORCEPOINT: SECURITY AS A SERVICE: DEALS

14.1.7 SOPHOS

TABLE 373 SOPHOS: BUSINESS OVERVIEW

TABLE 374 SOPHOS: PRODUCTS/SOLUTIONS OFFERED

TABLE 375 SOPHOS: SECURITY AS A SERVICE: NEW PRODUCT LAUNCHES

TABLE 376 SOPHOS: SECURITY AS A SERVICE: DEALS

14.1.8 CLEARSWIFT

TABLE 377 CLEARSWIFT: BUSINESS OVERVIEW

TABLE 378 CLEARSWIFT: PRODUCTS/SOLUTIONS OFFERED

TABLE 379 CLEARSWIFT: SECURITY AS A SERVICE: DEALS

14.1.9 ALERT LOGIC

TABLE 380 ALERT LOGIC: BUSINESS OVERVIEW

TABLE 381 ALERT LOGIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 382 ALERT LOGIC: SECURITY AS A SERVICE: NEW PRODUCT LAUNCHES

TABLE 383 ALERT LOGIC: SECURITY AS A SERVICE: DEALS

14.1.10 CYGILANT

TABLE 384 CYGILANT: BUSINESS OVERVIEW

TABLE 385 CYGILANT: PRODUCTS/SOLUTIONS OFFERED

TABLE 386 CYGILANT: SECURITY AS A SERVICE: DEALS

14.1.11 BARRACUDA NETWORKS

TABLE 387 BARRACUDA NETWORKS: BUSINESS OVERVIEW

TABLE 388 BARRACUDA NETWORKS: PRODUCTS/SOLUTIONS OFFERED

TABLE 389 BARRACUDA NETWORKS: SECURITY AS A SERVICE: NEW PRODUCT LAUNCHES

TABLE 390 BARRACUDA NETWORKS: SECURITY AS A SERVICE: DEALS

14.1.12 PANDA SECURITY

TABLE 391 PANDA SECURITY: BUSINESS OVERVIEW

TABLE 392 PANDA SECURITY: PRODUCTS/SOLUTIONS OFFERED

*Details on Business overview, Products and services offered, Recent developments, Response to COVID-19 & MnM View might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 CISCO

14.2.2 FORTINET

14.2.3 KASPERSKY LAB

14.2.4 QUALYS

14.2.5 NORTONLIFELOCK

14.2.6 OKTA

14.2.7 PROOFPOINT

14.2.8 RADWARE

14.2.9 MINDSIGHT

14.2.10 SENTINEL TECHNOLOGIES

14.2.11 HAPPIEST MINDS

14.2.12 STRATEJM

14.2.13 HACKERONE

15 ADJACENT MARKETS (Page No. - 315)

15.1 INTRODUCTION

TABLE 393 ADJACENT MARKETS AND FORECASTS

15.2 LIMITATIONS

15.3 CYBERSECURITY MARKET

15.3.1 ADJACENT MARKET: CYBERSECURITY MARKET, BY INDUSTRY VERTICAL

TABLE 394 CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 395 CYBERSECURITY MARKET SIZE FOR AEROSPACE AND DEFENSE, BY REGION, 2020–2026 (USD MILLION)

TABLE 396 CYBERSECURITY MARKET SIZE FOR GOVERNMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 397 CYBERSECURITY MARKET SIZE FOR BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2020–2026 (USD MILLION)

TABLE 398 CYBERSECURITY MARKET SIZE FOR IT, BY REGION, 2020–2026 (USD MILLION)

TABLE 399 CYBERSECURITY MARKET SIZE FOR HEALTHCARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 400 CYBERSECURITY MARKET SIZE FOR RETAIL AND CONSUMER GOODS, BY REGION, 2020–2026 (USD MILLION)

TABLE 401 CYBERSECURITY MARKET SIZE FOR MANUFACTURING, BY REGION, 2020–2026 (USD MILLION)

TABLE 402 CYBERSECURITY MARKET SIZE FOR ENERGY AND UTILITIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 403 CYBERSECURITY MARKET SIZE FOR TELECOMMUNICATIONS, BY REGION, 2020–2026 (USD MILLION)

TABLE 404 CYBERSECURITY MARKET SIZE FOR MEDIA AND ENTERTAINMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 405 CYBERSECURITY MARKET SIZE FOR OTHERS, BY REGION, 2020–2026 (USD MILLION)

15.4 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET

15.4.1 ADJACENT MARKET: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY INDUSTRY VERTICAL

TABLE 406 INFORMATION: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 407 FINANCE AND INSURANCE: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 408 HEALTHCARE AND SOCIAL ASSISTANCE: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 409 RETAIL TRADE: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 410 MANUFACTURING: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 411 UTILITIES: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 412 OTHERS: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

16 APPENDIX (Page No. - 323)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the security as a service market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the market’s segments and subsegments.

Secondary research

The research study involved extensive secondary sources, directories, and journals from renowned agencies and associations. The other paid databases include Factiva, DiscoverOrg, D&B Hoovers, and Bloomberg to identify and collect information useful for a technical, market-oriented, and commercial study of the security as a service market. Secondary research was used to obtain key information about the industry’s supply chain, country-wise technology spends, the total pool of key players, market classification and segmentation, key developments from both market- and technology-oriented perspectives, economic trends, and currency exchange rates. For instance, the market size of companies offering security as a service solution to various verticals is based on the secondary data available through paid databases and publicly available information.

Primary research

Various primary sources were interviewed to obtain qualitative and quantitative information about the market in the primary research process. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, product development/innovation teams, and corporate communications, and related key executives from security as a service vendors, such as IBM, Cygilant, Sophos, Alert Logic, Zscaler, and Okta; system integrators; professional and MSPs; and Securities Industry and Financial Markets Association (SIFMA); independent risk management consultants and importers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to offerings, verticals, and regions.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

The market size of companies offering security as a service was based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating the companies based on their performance and quality.

After confirming these companies through primary interviews with industry experts, MarketsandMarkets estimated their total revenue through annual reports, SEC filings, and paid databases. These companies’ revenue pertaining to the Business Units (BUs) that offer security as a service solution will be identified through similar sources. Through primaries, MarketsandMarkets collected revenue data generated through specific security as a service solutions and services. The collective revenue of key companies that offer security as a service solution and service comprised 50%–70% of the market, again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed by smaller players (part of the unorganized market), the market size of organized players (70%) and unorganized players (30%) collectively was assumed to be the market size of the global security as a service market for the Financial Year (FY) 2019–2020.

Data triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the security as a service market by component, solution, service, application, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the security as a service management market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the security as a service market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players of the security as a service market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the global security as a service market

- To analyze the impact of the COVID-19 outbreak on the growth of the market

SECaaS Market:

SECaaS Market is also known as Security as a Service Market.

SECaaS which refers to the delivery of security services over the internet, including identity and access management, threat detection and response, data loss prevention, and others. The SECaaS market is expected to grow significantly in the coming years, driven by the increasing adoption of cloud-based services and the growing need for cybersecurity solutions.

Futuristic growth use-cases of SECaaS Market:

- Advanced threat detection and response: As the cyber threat landscape continues to evolve, there is a growing need for advanced threat detection and response capabilities. SECaaS providers can offer real-time monitoring, threat intelligence, and incident response services, leveraging advanced technologies such as machine learning and artificial intelligence.

- Zero-trust security: With the growing number of remote workers and cloud-based applications, there is a need for security solutions that can protect against unauthorized access to sensitive data and systems. SECaaS providers can offer zero-trust security solutions, which assume that all network traffic is untrusted and require multiple forms of authentication to access sensitive data or systems.

- Compliance automation: As regulatory requirements around data privacy and security continue to increase, there is a need for solutions that can automate compliance processes. SECaaS providers can offer compliance automation solutions, which use advanced analytics and automation to monitor and report on compliance-related activities.

- Integrated security solutions: With the growing complexity of the cybersecurity landscape, there is a need for solutions that can integrate multiple security services into a single platform. SECaaS providers can offer integrated security solutions, which provide a unified view of an organization's security posture and enable more efficient and effective management of security-related activities.

- IoT security: With the increasing use of connected devices in various industries, there is a need for solutions that can protect against IoT-related cyber threats. SECaaS providers can offer IoT security solutions, which can monitor and protect connected devices from cyber attacks, as well as manage access and permissions for these devices.

Overall, the SECaaS Market is expected to continue growing in the coming years, as organizations seek to improve their security posture and better protect against cyber threats. By leveraging advanced technologies and offering a range of security services, SECaaS providers can help organizations stay ahead of the evolving threat landscape and improve their overall security posture.

Some of the Top companies in SECaaS Market are Microsoft Corporation, Cisco Systems Inc., Symantec Corporation, McAfee LLC, IBM Corporation, Trend Micro Inc., Broadcom Inc. (formerly CA Technologies), Check Point Software Technologies Ltd., Fortinet Inc., Palo Alto Networks Inc.

Industries Getting Impacted in the future by SECaaS Market

- Banking and finance: The banking and finance industry is highly regulated and prone to cyber attacks, making it a prime candidate for SECaaS solutions. SECaaS providers can offer a range of solutions to help financial institutions protect against cyber threats, such as fraud detection, identity and access management, and secure data storage.

- Healthcare: The healthcare industry is also highly regulated and has a growing need for secure data storage and management. SECaaS solutions can help healthcare organizations protect against cyber threats, such as data breaches and ransomware attacks, and ensure compliance with regulations such as HIPAA.

- Government: Governments at all levels are increasingly relying on technology to deliver services and manage operations, making them vulnerable to cyber attacks. SECaaS solutions can help government agencies protect against cyber threats, such as malware and phishing attacks, and ensure the security of sensitive data and systems.

- Retail: The retail industry is increasingly moving online, making it vulnerable to cyber threats such as data breaches and payment fraud. SECaaS solutions can help retailers protect against cyber threats and ensure the security of customer data and payment systems.

- Manufacturing: The manufacturing industry is increasingly adopting connected devices and IoT technology, making it vulnerable to cyber attacks. SECaaS solutions can help manufacturing companies protect against cyber threats, such as malware and ransomware attacks, and ensure the security of connected devices and systems.

Overall, the SECaaS market is expected to impact a wide range of industries in the future, as organizations seek to improve their overall security posture and better protect against cyber threats. By leveraging cloud-based security solutions, organizations can better protect their sensitive data and systems, and ensure compliance with regulatory requirements.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North American security as a service market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin market

- Further breakup of the MEA security as a service market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Security as a Service Market