Shelf-life Testing Market by Parameter (Microbial Contamination, Rancidity, Nutrient Stability, Organoleptic Properties), Method (Real-time and Accelerated), Technology, Food Tested, and Region - Global Forecast to 2023

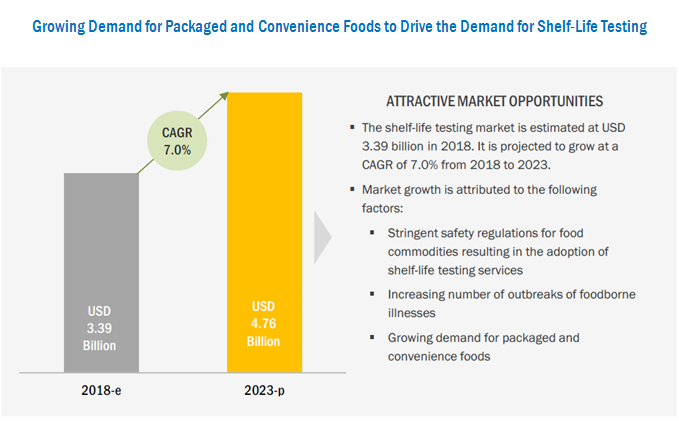

[138 Pages Report] The shelf-life testing market was valued at USD 3.19 billion in 2017 and it is projected to reach USD 4.76 billion by 2023, at a CAGR of 7.0% during the forecast period. Stringent safety regulations for food products, increase in the outbreak of foodborne illnesses, and growth in demand for packaged and convenience food are factors driving this market.

For More details on this research, Request Free Sample Report

The periodization considered for the study is as follows:

- Base year: 2017

- Forecast period: 2018 to 2023

Objectives of the report

- Determining and projecting the size of the shelf-life testing market with respect to parameter, food tested, method, technology, and regional markets, over a five-year period ranging from 2018 to 2023

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the further segments and subsegments of the global market included in the report with respect to individual growth trends, future prospects, and their contribution to the global market

- Identifying and profiling the key market players in the market

- Determining the market ranking of the key players operating in the market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Service offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the market dynamics and competitive situations & trends across regions and their impact on prominent market players

Research Methodology:

- The key regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to find the value of the shelf-life testing market for regions such as Europe, North America, Asia Pacific, and RoW

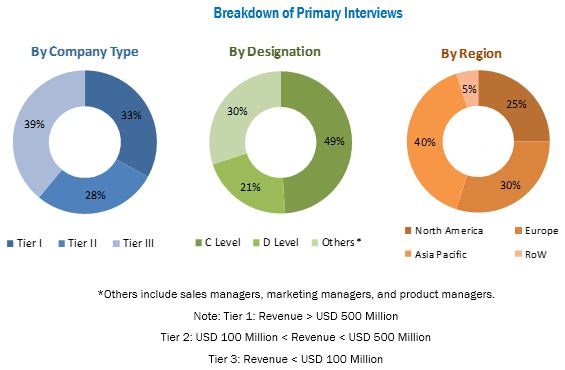

- The key players were identified through secondary sources such as the Food and Agriculture Organization (FAO), the US Department of Agriculture (USDA), International Monetary Fund (IMF), World Bank, and Organisation for Economic Co-operation and Development (OECD), while their market shares in the respective regions were determined through both, primary and secondary research processes. The research methodology included the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the market.

The various contributors involved in the value chain of the shelf-life testing market include raw material suppliers, R&D institutes, shelf-life testing service providers [such as SGS (Switzerland), Bureau Veritas (France), Intertek (UK), Eurofins (Luxembourg), and ALS Limited (Australia)], shelf-life testing equipment manufacturing companies, and government bodies & regulatory associations [such as the US Department of Agriculture (USDA), the Food and Drug Administration (FDA), and the European Food Safety Authority (EFSA)].

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report are as follows:

- Food & beverage manufacturers

- R&D institutes & laboratories

- Shelf-life testing service providers and third-party testing & certification laboratories

-

Regulatory bodies

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Food Safety Commission of Japan, the Agri-Food & Veterinary Authority of Singapore (AVA) (Singapore)

- Canadian Food Inspection Agency

- Government agencies and NGOs

-

Component suppliers

- Reagent manufacturers & suppliers

- Diagnostic instrument & kit manufacturers/suppliers

Drivers

Stringent safety regulations for food products result in the adoption of shelf-life testing services

The rise in the level of intricacies and an increase in the number of supply chain participants have made it difficult for manufacturers to be able to uniformly adopt hygienic and sanitized manufacturing practices. Such factors have further led to an increase in the number of food contamination incidences, thereby compelling various governments across the globe to implement and further develop stringent food safety regulations. This has fueled the growth of the testing, inspection, and certification market, with different regulatory bodies such as the United States Department of Agriculture (USDA) and European Food Safety Authority (EFSA) introducing guidelines for testing, inspection, and sampling services for the safety and quality assurance of food products. Similar guidelines are adopted by other countries, worldwide, with variations and exceptions in laws.

Increase in outbreaks of foodborne illnesses

Incidences of foodborne illnesses occur primarily due to the consumption of food contaminated by pathogens or the growth of yeasts and molds that may or may not be pathogenic. This could also happen when a food commodity exceeds its date of expiry, whereby it ceases to be microbiologically safe for consumption. According to a WHO estimate released in 2015, around 600 million people in the world fall ill after eating contaminated food, of which 420,000 die every year. According to a Centers for Disease Control and Prevention (CDC) estimate released in 2012, each year nearly 48 million people get sick, 128,000 get hospitalized, and 3,000 die, due to foodborne illnesses, in the US. According to the Food Standards Agency (FSA), every year around 1 million people are affected by foodborne illness, and nearly 20,000 people receive medical treatment for foodborne illnesses in the UK. Furthermore, about 500 death cases are reported as a result of food poisoning, costing approximately USD 2.0 billion, in the country.

Restraints

Lack of market coordination & standardization and improper enforcement of regulatory laws & supporting infrastructure in developing economies

The food industry in developing countries remains highly fragmented and is predominated by small and unorganized players, who may have not necessarily adopted proper food testing and shelf-life testing practices, leading to a greater risk of their contamination. Testing of food & beverage products, such as packaged foods, dairy products, beverages, and meat products, among other samples require proper enforcement measures, coordination between market stakeholders and supporting infrastructure. However, many countries that are classified in the cluster of developing economies lack these factors acting as a restraint for the shelf-life testing industry.

Scope of the Report

This research report categorizes the shelf-life testing market based on parameter, food tested, method, technology, and region.

Based on parameter the market has been segmented as follows:

- Microbial contamination

- Rancidity

- Nutrient stability

- Organoleptic properties

- Others (water activity, pH, and moisture content)

Based on food tested, the market has been segmented as follows:

- Packaged food

- Beverages

- Bakery & confectionery products

- Meat & meat products

- Dairy, dairy products, and desserts

- Processed fruits & vegetables

- Others (fats & oils and food additives & ingredients)

Based on method, the market has been segmented as follows:

- Real-time

- Accelerated

Based on technology, the market has been segmented as follows:

- Equipment- & kit-based

- Manual tests

Based on region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America, Africa, and the Middle East)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Service Analysis

- Service matrix, which gives a detailed comparison of the service portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific shelf-life testing market, by key country

- Further breakdown of the Rest of European shelf-life testing market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

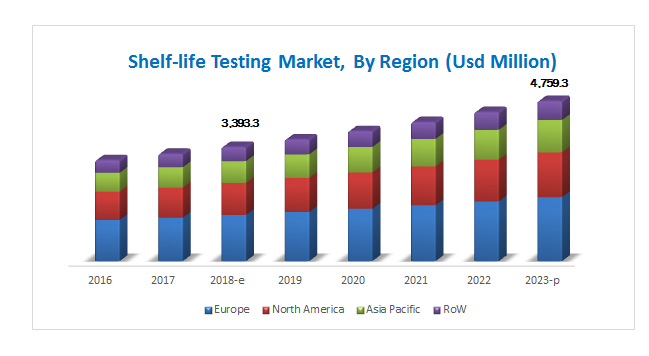

The shelf-life testing market is estimated to be valued at USD 3.39 billion in 2018 and is projected to reach USD 4.76 billion by 2024, at a CAGR of 7.0% during the forecast period. The market is driven by stringent safety regulations for food products, increase in the outbreak of foodborne illnesses, and growth in demand for packaged and convenience foods.

The market, based on parameter, has been segmented into microbial contamination, rancidity, nutrient stability, organoleptic properties, and others. The market for microbial contamination is estimated to dominate in 2018, and is also projected to be the fastest-growing segment during the forecast period. Microbiological hazards are a major food safety concern in the food & beverage sector, causing serious foodborne illnesses among consumers. As a result, shelf-life testing is essential to ensure that the microbial content is limited to only a certain level throughout the shelf life of the food products

The market, by food tested, has been segmented into packaged food, beverages, bakery & confectionery products, meat & meat products, dairy, dairy products, and desserts, processed fruits & vegetables, and others. The packaged food segment is estimated to dominate the market in 2018 and is projected to grow at the highest CAGR by 2023. Rapid urbanization has led to changes in consumer lifestyles. Higher employment opportunities and higher disposable incomes have led to an increased consumption of packaged food products. The contamination of most packaged foods occurs from the processing machinery or product formulations, which could then lead to faulty shelf-life claims. In order to avoid such instances, product manufacturers are increasingly conducting shelf-life tests to provide consumers with proper product information.

The market, by technology, has been segmented into equipment- & kit-based and manual tests. It was dominated by the equipment- & kit-based segment in 2018. More reliable results and quick turnaround time drive this segment, which consists of both traditional and rapid systems and is highly preferred by manufacturers.

For More details on this research, Request Free Sample Report

Europe dominated the shelf-life testing market in 2017 as it has the highest number of testing laboratories with a high number of samples tested in the world. Further, the region has the most stringent regulations that also undergo frequent updates. As a result of strict regulatory enforcement throughout the stages in the food supply chain, the highest number of sample tests are conducted in Europe for both safety as well as quality purposes. The Asia Pacific market is projected to grow at the highest CAGR from 2018 to 2023. Growth in the Asia Pacific region can be attributed to factors such as growth in the number of shelf-life testing laboratories in India and China, the rise in the number of incidences of bacterial infectious diseases in the region, and growing adoption of convenience and packaged food in the region.

The lack of market coordination & standardization and improper enforcement of regulatory laws & supporting infrastructure in developing economies restrain the market growth for shelf-life testing.

The global market for shelf-life testing is dominated by large-scale players such as SGS (Switzerland), Bureau Veritas (France), Intertek (UK), Eurofins (Luxembourg), and ALS Limited (Australia).

TÜV SÜD (Germany), TÜV NORD GROUP (Germany), Mérieux (US), AsureQuality (New Zealand), RJ Hill Laboratories (New Zealand), SCS Global (US), Agrifood Technology (Australia), Symbio Laboratories (Australia), Microchem Lab Services (Pty) Ltd (South Africa), and Premier Analytical Services (UK) are other players that hold a significant share of the shelf-life testing market.

Opportunities

Adoption of newer technologies

The focus on reducing lead time, sample utilization, cost of testing, and drawbacks associated with several technologies have resulted in technological innovations and the development of new technologies in the spectrometry segment. Greater adoption of these technologies, with financial support from government authorities, is an opportunity for medium- and small-scale laboratories to expand their service offerings and compete with large market players in the industry, as these technologies offer higher sensitivity, accuracy in results, reliability, multi-contaminant and non-targeted screening with a low turnaround time, and cost-effectiveness, among other benefits.

Challenges

High costs associated with procurement of rapid shelf-life testing equipment

Instruments and related consumables of high-end technologies such as chromatography and spectrometry used for effective shelf-life testing of food samples are associated with high costs. Furthermore, an increased focus on R&D activities, coupled with the necessity for accuracy and reliability of readings, is increasing the price of these instruments. Since most of these testing instruments are exported in large quantities from developed countries in North America and Europe, it adds to the cost of procuring these technologies, especially in developing economies.

Lack of harmonization of shelf-life regulations

The growing number of national standards for food shelf-life management has led to ambiguity, and there is a need for harmonization of these shelf-life standards. Leading industries in the food sector have increasingly recognized the cost and inefficiencies resulting from the development of multiple shelf-life standards. Neither ingredient suppliers nor retailers or food manufacturing companies are well served when duplicative standards and audits raise total costs for shelf-life certifications without enhancing or ensuring the overall safety of food.

Acquisitions

|

DATE |

COMPANY |

DEVELOPMENT |

|

April 2018 |

Eurofins |

Eurofins signed an agreement with LabCorp to acquire its food testing and consulting business, i.e., Covance Food Solutions for USD 670 million. This is expected to help Eurofins expand its presence in North America, the UK, and Asia since Covance Food Solutions operates an integrated network of 12 facilities across the globe with 9 in the US, 2 in the UK, and 1 in Asia. |

|

January 2018 |

SGS |

SGS acquired Vanguard Sciences Inc. (US) which is a provider of microbiological, chemical, and physical testing of food products. This is expected to help the company in expanding their existing testing capabilities in the US. |

Expansions & Investments

|

DATE |

COMPANY |

DEVELOPMENT |

|

May 2018 |

Eurofins |

Eurofins set up a new 3,900 square meter food testing laboratory in Suzhou (China). This new laboratory highlights the company’s commitment to serving its clients in Asia Pacific with world-class testing services. This project represents a total investment close to USD 3.3 million. |

|

July 2017 |

SGS |

SGS expanded its presence in Russia by opening a new food testing laboratory in Moscow, Russia. The laboratory provides testing services for detection and assessment of heavy metals, mycotoxins, histamines, polychlorinated biphenyl (PCB), radionuclides, preservatives, pesticides, and nitrates. |

Agreements & Partnerships

|

DATE |

COMPANY |

DEVELOPMENT |

|

July 2016 |

Mérieux |

Mérieux signed a strategic partnership agreement with FOSS (Denmark), a manufacturer of analytical instruments for the food and agricultural sector. This agreement helped the company to enhance its analytical services. |

|

November 2015 |

Mérieux |

Mérieux signed an agreement to form a global food safety partnership with Danone (France). |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Shelf-Life Testing Market

4.2 Shelf-Life Testing Market, By Key Country

4.3 Europe: Shelf-Life Testing Market, By Parameter & Key Country

4.4 Shelf-Life Testing Market, By Method & Region

4.5 Shelf-Life Testing Market, By Food Tested & Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Safety Regulations for Food Products Result in the Adoption of Shelf-Life Testing Services

5.2.1.2 Increase in Outbreaks of Foodborne Illnesses

5.2.1.3 Growth in Demand for Packaged and Convenience Foods

5.2.2 Restraints

5.2.2.1 Lack of Market Coordination & Standardization and Improper Enforcement of Regulatory Laws & Supporting Infrastructure in Developing Economies

5.2.3 Opportunities

5.2.3.1 Adoption of Newer Technologies

5.2.4 Challenges

5.2.4.1 High Costs Associated With Procurement of Rapid Shelf-Life Testing Equipment

5.2.4.2 Lack of Harmonization of Shelf-Life Regulations

5.3 Supply Chain Analysis

5.3.1 Upstream Process

5.3.1.1 R&D

5.3.1.2 Sample Collection

5.3.2 Midstream Process

5.3.2.1 Transportation

5.3.2.2 Testing of Sample

5.3.3 Downstream Process

5.3.3.1 Final Preparation

5.3.3.2 Distribution

5.4 Regulatory Framework

5.4.1 US

5.4.2 European Union

5.4.3 China

5.4.4 Japan

5.4.5 India

5.4.6 Australia

6 Shelf-Life Testing Market, By Parameter (Page No. - 47)

6.1 Introduction

6.2 Microbial Contamination

6.2.1 Pathogens

6.2.1.1 Salmonella

6.2.1.2 Campylobacter

6.2.1.3 E. Coli

6.2.1.4 Listeria

6.2.1.5 Others

6.2.2 Yeasts & Molds

6.3 Rancidity

6.4 Nutrient Stability

6.5 Organoleptic Properties

6.6 Others

7 Shelf-Life Testing Market, By Food Tested (Page No. - 55)

7.1 Introduction

7.2 Packaged Food

7.3 Beverages

7.4 Bakery & Confectionery Products

7.5 Meat & Meat Products

7.6 Dairy, Dairy Products, and Desserts

7.7 Processed Fruits & Vegetables

7.8 Others

8 Shelf-Life Testing Market, By Method (Page No. - 63)

8.1 Introduction

8.2 Real-Time Shelf Life Testing

8.3 Accelerated Shelf-Life Testing

9 Shelf Life Testing Market, By Technology (Page No. - 67)

9.1 Introduction

9.2 Equipment- & Kit-Based

9.2.1 Culture-Based

9.2.2 Chromatography & Spectroscopy

9.2.3 Enzyme-Linked Immunosorbent Assay (ELISA)

9.2.4 Polymerase Chain Reaction (PCR)

9.3 Manual Tests

10 Shelf-Life Testing Market, By Region (Page No. - 72)

10.1 Introduction

10.2 Europe

10.2.1 Germany

10.2.2 UK

10.2.3 France

10.2.4 Italy

10.2.5 Spain

10.2.6 Poland

10.2.7 Rest of Europe

10.3 North America

10.3.1 US

10.3.2 Canada

10.3.3 Mexico

10.4 Asia Pacific

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Africa

10.5.3 Middle East

11 Competitive Landscape (Page No. - 96)

11.1 Overview

11.2 Competitive Scenario

11.3 Market Ranking Analysis

11.3.1 Acquisitions

11.3.2 Expansions & Investments

11.3.3 Agreements & Partnerships

12 Company Profiles (Page No. - 100)

12.1 SGS

12.2 Eurofins

12.3 Intertek

12.4 Bureau Veritas

12.5 Als Limited

12.6 Tüv Süd

12.7 Tüv Nord Group

12.8 Mérieux

12.9 Asurequality

12.1 Rj Hill Laboratories

12.11 Scs Global

12.12 Agrifood Technology

12.13 Symbio Laboratories

12.14 Microchem Lab Services (PTY) Ltd

12.15 Premier Analytical Services

13 Appendix (Page No. - 131)

13.1 Discussion Guide

13.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.2 Available Customizations

13.3 Related Reports

13.4 Author Details

List of Tables (67 Tables)

Table 1 US Dollar Exchange Rate Considered for the Study, 2013–2018

Table 2 Shelf-Life Testing Market Snapshot, 2018 vs. 2023

Table 3 Shelf-Life Testing Market Size, By Parameter, 2016–2023 (USD Million)

Table 4 Microbial Contamination Testing Market Size, By Region, 2015–2022 (USD Million)

Table 5 Microorganisms Testing Market Size, By Type, 2016–2023 (USD Million)

Table 6 Pathogen Testing Market Size, By Type, 2016–2023 (USD Million)

Table 7 Rancidity Testing Market Size, By Region, 2016–2023 (USD Million)

Table 8 Nutrient Stability Testing Market Size, By Region, 2016–2023 (USD Million)

Table 9 Organoleptic Property Testing Market Size, By Region, 2016–2023 (USD Million)

Table 10 Other Shelf-Life Testing Parameters Market Size, By Region, 2016–2023 (USD Million)

Table 11 Market for Shelf-Life Testing Size, By Food Tested, 2016–2023 (USD Million)

Table 12 Shelf-Life Testing Market Size in Packaged Food, By Region, 2016–2023 (USD Million)

Table 13 Market for Shelf-Life Testing Size in Beverages, By Region, 2016–2023 (USD Million)

Table 14 Market for Shelf-Life Testing Size in Bakery & Confectionery Products, By Region, 2016–2023 (USD Million)

Table 15 Market for Shelf-Life Testing Size in Meat & Meat Products, By Region, 2016–2023 (USD Million)

Table 16 Market for Shelf-Life Testing Size in Dairy, Dairy Products, and Desserts, By Region, 2016–2023 (USD Million)

Table 17 Market for Shelf-Life Testing Size in Processed Fruits & Vegetables, By Region, 2016–2023 (USD Million)

Table 18 Market for Shelf-Life Testing Size in Other Food Tested, By Region, 2016–2023 (USD Million)

Table 19 Market for Shelf-Life Testing Size, By Method, 2016–2023 (USD Million)

Table 20 Real-Time Shelf-Life Testing Market Size, By Region, 2016–2023 (USD Million)

Table 21 Accelerated Shelf-Life Testing Market Size, By Region, 2016–2023 (USD Million)

Table 22 Market for Shelf-Life Testing Size, By Technology, 2016–2023 (USD Million)

Table 23 Equipment- & Kit-Based: Market for Shelf-Life Testing Size, By Region, 2015–2022 (USD Million)

Table 24 Equipment- & Kit-Based: Market for Shelf-Life Testing Size, By Type, 2016–2023 (USD Million)

Table 25 Manual Tests: Market for Shelf-Life Testing Size, By Region, 2016–2023 (USD Million)

Table 26 Shelf-Life Testing Market Size, By Region, 2016–2023 (USD Million)

Table 27 Europe: Market for Shelf-Life Testing Size, By Country, 2016–2023 (USD Million)

Table 28 Europe: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 29 Europe: Shelf-Life Testing Services Market Size, By Food Tested, 2016–2023 (USD Million)

Table 30 Europe: Shelf-Life Testing Market Size, By Method, 2016–2023 (USD Million)

Table 31 Europe: Market for Shelf-Life Testing Size, By Technology, 2016–2023 (USD Million)

Table 32 Germany:Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 33 UK: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 34 France: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 35 Italy: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 36 Spain: Shelf-Life Testing Market Size, By Parameter, 2016–2023 (USD Million)

Table 37 Poland: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 38 Rest of Europe: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 39 North America: Market for Shelf-Life Testing Size, By Country, 2016–2023 (USD Million)

Table 40 North America: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 41 North America: Shelf-Life Testing Services Market Size, By Food Tested, 2016–2023 (USD Million)

Table 42 North America: Shelf-Life Testing Market Size, By Method, 2016–2023 (USD Million)

Table 43 North America: Market for Shelf-Life Testing Size, By Technology, 2016–2023 (USD Million)

Table 44 Us: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 45 Canada: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 46 Mexico: Market for Shelf-Life Testing Size, By Parameter, 2016-2023 (USD Million)

Table 47 Asia Pacific: Market for Shelf-Life Testing Size, By Country/Region, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 49 Asia Pacific: Shelf-Life Testing Services Market Size, By Food Tested, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market for Shelf-Life Testing Size, By Method, 2016–2023 (USD Million)

Table 51 Asia Pacific: Shelf-Life Testing Market Size, By Technology, 2016–2023 (USD Million)

Table 52 Japan: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 53 China: Shelf-Life Testing Market Size, By Parameter, 2016–2023 (USD Million)

Table 54 India: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 55 Australia & New Zealand: Shelf-Life Testing Market Size, By Parameter, 2016–2023 (USD Million)

Table 56 Rest of Asia Pacific: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 57 RoW: Shelf-Life Testing Market Size, By Region, 2016–2023 (USD Million)

Table 58 RoW: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 59 RoW: Shelf-Life Testing Services Market Size, By Food Tested, 2016–2023 (USD Million)

Table 60 RoW: Market for Shelf-Life Testing Size, By Method, 2016–2023 (USD Million)

Table 61 RoW: Market for Shelf-Life Testing Size, By Technology, 2016–2023 (USD Million)

Table 62 South America: Shelf-Life Testing Market Size, By Parameter, 2016–2023 (USD Million)

Table 63 Africa: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 64 Middle East: Market for Shelf-Life Testing Size, By Parameter, 2016–2023 (USD Million)

Table 65 Acquisitions, 2013–2018

Table 66 Expansions & Investments, 2013–2018

Table 67 Agreements & Partnerships, 2013–2018

List of Figures (38 Figures)

Figure 1 Shelf-Life Testing Market Segmentation

Figure 2 Regional Scope

Figure 3 Shelf-Life Testing Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Research Assumptions

Figure 8 Research Limitations

Figure 9 Shelf-Life Testing Market Size, By Parameter, 2018 vs. 2023 (USD Million)

Figure 10 Market for Shelf-Life Testing Size, By Food Tested, 2018 vs. 2023 (USD Million)

Figure 11 Market for Shelf-Life Testing Size, By Method, 2018 vs. 2023 (USD Million)

Figure 12 Market for Shelf-Life Testing Size, By Technology, 2018 vs. 2023 (USD Million)

Figure 13 Market for Shelf-Life Testing Share (Value), By Region, 2017

Figure 14 Growing Demand for Packaged and Convenience Foods to Drive the Demand for Shelf-Life Testing

Figure 15 China is Projected to Be the Fastest-Growing Market for Shelf-Life Testing Between 2018 and 2023

Figure 16 Microbial Contamination Accounted for the Largest Share of the European Shelf-Life Testing Market

Figure 17 Europe to Dominate the Market Across Both Methods Through 2023

Figure 18 Beverages to Be the Fastest-Growing Segment During the Forecast Period

Figure 19 Market Dynamics: Shelf-Life Testing Market

Figure 20 Supply Chain Analysis: Shelf-Life Testing

Figure 21 Shelf-Life Testing Market Share (Value), By Parameter, 2018 vs. 2023

Figure 22 Market for Shelf-Life Testing Share, By Food Tested, 2018 vs. 2023

Figure 23 Market for Shelf-Life Testing Share, By Method, 2018 vs. 2023

Figure 24 Market for Shelf-Life Testing Share for Safety Testing, By Technology, 2018 vs. 2023

Figure 25 US Accounted for the Largest Share in the Shelf-Life Testing Market in 2017

Figure 26 Europe: Shelf-Life Testing Market Snapshot

Figure 27 Asia Pacific: Market for Shelf-Life Testing Snapshot

Figure 28 Key Developments By Leading Players in the Market, 2013–2018

Figure 29 Number of Developments Between 2015 and 2017

Figure 30 Ranking of Key Players in the Shelf-Life Testing Market

Figure 31 SGS: Company Snapshot

Figure 32 Eurofins: Company Snapshot

Figure 33 Intertek: Company Snapshot

Figure 34 Bureau Veritas: Company Snapshot

Figure 35 Als Limited: Company Snapshot

Figure 36 Tüv Süd: Company Snapshot

Figure 37 Tüv Nord Group: Company Snapshot

Figure 38 Asurequality: Company Snapshot

Growth opportunities and latent adjacency in Shelf-life Testing Market