Dairy Testing Market

Dairy Testing Market by Test Type (Safety Testing and Quality Testing), Product Type (Milk & Milk Powder, Cheese, Butter & Spreads, Infant Foods, Ice-creams & Desserts, Yogurt), Technology (Traditional, Rapid), and Region - Global Forecast 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The dairy testing market is estimated to be USD 7.42 billion in 2025 and is projected to reach USD 11.05 billion by 2030, at a CAGR of 8.3%. The dairy testing market is growing as stricter food safety regulations, rising dairy exports, and increasing demand for clean-label and functional products drive the need for advanced testing solutions. Producers are adopting rapid microbial detection, nutritional validation, and digital traceability tools to ensure product safety, quality, and transparency. Additionally, the shift toward plant-based and sustainable dairy alternatives is expanding testing scope, making the industry more data- and insight-driven rather than purely compliance-focused.

KEY TAKEAWAYS

- The European dairy testing market accounted for a 43.8% revenue share in 2025.

- By product type, the milk & milk powder segment is expected to register the highest CAGR of 8.7%.

- By technology, the rapid segment is expected to dominate the market.

- By test type, the safety testing segment is expected to dominate the market, growing at a higher CAGR of 8.5%.

- SGS Institut Fresenius, Bureau Veritas, and Eurofins Scientific were identified as some of the star players in the dairy testing market, given their strong market share and service offerings.

- Envitro Laboratories, Microbial Research Inc., and Tentamus, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The rising global demand for dairy products, by the growing production in regions like the EU and India, directly correlates with an increased need for stringent quality control and safety measures. With large volumes of milk processed into diverse dairy products such as cheese and butter, ensuring the safety and quality of dairy products becomes essential. This drives the demand for dairy testing services, focusing on detecting contaminants like pathogens, assessing nutritional content, and maintaining compliance with regulatory standards.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The dairy testing market is shifting from traditional, lab-based methods toward advanced, data-driven solutions that address rising regulatory, safety, and consumer demands. Increasing scrutiny around dairy products safety is driving adoption of rapid, non-destructive, and automated testing platforms. At the same time, increasing use of dairy products in daily life is pushing brands to validate purity, shelf-life, and health claims with greater accuracy. Digital technologies, from smart sensors to predictive analytics, are transforming testing from a compliance-driven necessity into a strategic enabler of consumer trust, brand differentiation, and supply chain transparency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in outbreaks of foodborne illnesses

-

Globalization of dairy trade

Level

-

Inadequate supporting infrastructure in developing economies

-

High cost of dairy testing

Level

-

Technological advancements in testing industry

-

The increased adoption of dairy testing

Level

-

Lack of harmonization of food safety standards

-

Time-consuming testing methods

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in outbreaks of foodborne illnesses

Food safety issues remain a pressing global concern, with contaminated food causing illnesses, deaths, and economic losses. Dairy products, among other food categories, face recalls due to microbial contamination, underscoring the importance of stringent testing to ensure public health and safety. An FSANZ article (April 2024) revealed 836 food recalls from 2014 to 2023, with an increasing annual trend, reaching 87 recalls in 2023. Processed and mixed foods were the most recalled categories, followed by dairy products. The rising prevalence of foodborne illnesses, as demonstrated by the WHO’s data, and increasing food recalls, as indicated by FSANZ, emphasize the critical need for robust food safety systems. Dairy, being a frequently recalled category, drives the demand for advanced testing methods to ensure microbial safety, nutritional quality, and compliance with regulatory standards. Recalls such as Rizo-López Foods’ Listeria incident underline the vulnerability of dairy products to contamination, necessitating rigorous microbiological and pathogen testing. Moreover, as public awareness of food safety grows, regulatory bodies are enforcing stricter guidelines, compelling dairy manufacturers to adopt cutting-edge testing solutions. Together, these factors propel the dairy testing market forward, fostering innovation in rapid detection technologies and predictive analytics to mitigate risks and enhance consumer trust.

Restraint: Inadequate supporting infrastructure in developing economies

The dairy market in developing countries is highly fragmented and dominated by small milk farms. Hence, as milk and dairy products pass through the processing, storage, and distribution chain, they face a higher risk of exposure to contamination or adulteration. The testing of food samples requires proper enforcement measures and coordination between market stakeholders, as well as supporting infrastructure. However, several developing economies lack these requirements; this acts as a restraint to the growth of the dairy testing market. Several other factors, such as a lack of institutional coordination, equipment, technical skills, and expertise for implementing legislation at the grassroots levels and, in certain countries, the lack of updated standards, are inhibiting the growth of the market for food sample testing. Inadequate basic supporting infrastructure to set up testing laboratories also acts as a restraint to market growth, especially in developing countries. Thus, strengthening dairy safety and quality control services requires considerable development of infrastructure, interaction, and cooperation between the industry and the government. These factors have been acting as a bottleneck for the growth of the dairy testing market in some developing regions.

Opportunity: Technological advancements in testing industry

The focus on reducing lead time, sample utilization, cost of testing, and drawbacks associated with several technologies have resulted in the development of new technologies in spectrometry and chromatography. The wide-scale adoption of these technologies provides an opportunity for medium- and small-scale laboratories to expand their service offerings and compete with large market players in the industry, as these technologies offer benefits such as higher sensitivity, accurate results, reliability, multi-contaminant, and non-targeted screening with low turnaround time. The dairy testing market is witnessing several technological innovations with major players offering newer, faster, and more accurate technologies such as LC (Liquid Chromatography), HPLC (High Performance Liquid Chromatography), and ICP-MS (Inductively Coupled Plasma Mass Spectrometry).

Challenge: Lack of harmonization of food safety standards

The increasing number of national standards for food safety management has led to ambiguity and created the need for their harmonization. The leading industries in the food sector have recognized the higher costs and inefficiencies created by the development of multiple food safety standards. Audits are conducted to ensure compliance with government regulatory legislation. Neither ingredient suppliers nor retailers or foodservice companies are well served when duplicative standards and audits raise the total costs for food certification without enhancing or ensuring the overall safety of food. Industrial experts have often suggested uniform and harmonized food safety standards to reduce the multiplicity of food laws for better efficiency. In order to eliminate duplication and overlapping of multiple standards, the government and private-sector stakeholders should work together to create transparent and uniform food certification standards.

Dairy Testing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides comprehensive various analyses in the fields of microbiology (hygiene, germ contamination), molecular biology (genetically modified organisms, animal species identification), and food chemistry (ingredients). It also examines foreign substances and pollutants such as veterinary medicines’ residues, cleaning agents, and disinfectants. | Global testing expertise; ensures compliance with international food safety standards (EU, US, APAC); supports dairy products manufacturers with rapid turnaround and digital reporting. |

|

Intertek offers comprehensive shelf-life testing for dairy products. It includes microbial and environmental testing, sensory evaluations, and stability studies to ensure product safety, quality, and regulatory compliance. | Enhances traceability and quality assurance; enables faster product validation and launch cycles; builds consumer trust with verified labeling claims. |

|

Eurofins offers testing to ensure the nutritional, chemical, microbiological, and physical quality of milk and dairy products, ensuring compliance with safety standards and consumer expectations. | Aids businesses in enhancing the overall quality of their products, addressing any potential risks, and improving consumer safety. |

|

Delivers end-to-end quality testing solutions for dairy processors, from raw material assessment to packaging integrity verification; leverages global food testing infrastructure. | Improves process efficiency and risk mitigation; ensures consistent quality across multi-site production operations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The dairy testing market ecosystem unites stakeholders across quality assurance, processing, regulation, and research to ensure food safety and efficiency. Leading players like Eurofins, SGS, ALS, and Intertek provide essential testing and certification for global compliance. Major processors such as Danone, Nestlé, Tyson, and JBS depend on these services to maintain quality and trust. Regulatory bodies (USDA, EFSA, FAO, FDA) enforce safety standards, while institutions like Wageningen University and UCD drive innovation in testing methods. Together, they create a collaborative network that upholds global safety, compliance, and consumer confidence in dairy products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dairy Testing Market, By Test Type

By test type, the dairy testing market is dominated by the safety testing segment. Safety testing of dairy largely includes testing for pathogens, pesticides, GMOs, mycotoxins, allergens, and heavy metals. The consumption of contaminated milk and dairy products can lead to foodborne illnesses and cause several health issues for consumers. Thus, significant emphasis is being laid on safety testing of food output by the regulatory authorities who are focusing on addressing regulatory loopholes, preventing adulteration & malpractices, labeling mandates, implementing several practices, such as GMP & HACCP, and continued research to determine the maximum residue limits for contaminants in food. As a result, safety testing for dairy has gained vital importance over the years.

Dairy Testing Market, By Technology

Rapid testing segment dominate the dairy testing market. There is an increasing demand from food manufacturers for rapid testing technologies to expedite results, thereby accelerating supply chain activities. Rapid testing methods offer higher accuracy, reliability, sensitivity, and the ability to test a broader range of contaminants than the traditional technology.

REGION

Europe to be the fastest-growing region in global dairy testing market during forecast period

Europe has stringent regulations for dairy testing, which undergo frequent updates and revisions. The world’s highest number of sample tests for both safety as well as quality are conducted in Europe. Strict compliance with MRLs and measures to prevent microbial contamination are preconditions for entering the European market. Europe dominates the dairy testing market because of its stringent food safety regulations enforced by bodies like the European Food Safety Authority (EFSA), advanced technological infrastructure, and mature market demand for high-quality, safe dairy products. The region's robust regulatory framework requires comprehensive testing to ensure products are free from contaminants, pathogens, and adulterants, which drives widespread adoption of sophisticated testing technologies. Europe also has a well-established network of leading testing service providers and dairy producers, especially in countries like Germany, France, and the UK, known for integrating advanced analytical methods such as spectrometry and chromatography. Consumer demand for premium, clean-label, and organic dairy products, combined with substantial export activities that require compliance with international standards, further accelerates the market. These factors collectively give Europe a competitive edge in dominating the global dairy testing market.

Dairy Testing Market: COMPANY EVALUATION MATRIX

Eurofins Scientific (Luxembourg), positioned as a Star player, stands as a prominent leader in the dairy testing market,Eurofins is one of the world’s leading food (dairy) safety testing service providers. Its strong service infrastructure helps it cope with the increasing testing demand from clients. The company’s major strengths are its widespread global network, its superior testing services, and regulatory thoroughness.The company is achieving substantial growth through acquisitions, aiming to enter new market segments. For instance, Eurofins acquired Craft Technologies, Inc., North Carolina, to diversify into testing biologically active components. Symbio Labs (Australia) is an emerging player in the market. Symbio Laboratories offers a comprehensive portfolio of dairy testing services with rapid turnaround for the food, agricultural, and environmental industries in Australia. It has a strong presence in the country. Symbio Laboratories focuses on the acquisition strategy to improve its service offerings and increase its share in the market. Symbio adheres to rigorous standards, with all testing methods based on Australian Standards or internationally recognized references such as AOAC, AOCS, AACC, APHA, and USEPA.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.89 Billion |

| Revenue Forecast in 2030 | USD 11.05 Billion |

| Growth Rate | CAGR of 8.3% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Product Type: Milk & milk powder, cheese, butter & spreads, ice-creams & desserts, infant food, yogurt and others. By Technology: Traditional and Rapid technology By Test type: Safety testing and Quality testing By End User: Dairy producers, dairy processors, food & beverage manufacturers, regulatory authorities, and others |

| Regions Covered | North America, Europe, Asia Pacific, South America, Rest of the World |

WHAT IS IN IT FOR YOU: Dairy Testing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Dairy Manufacturers & Brand Owners | – Quality & safety test benchmarking by product type (milk&milk powder, cheese, butter&spreads, infant foods, ice-creams&dessert and others) | - Faster compliance & market entry |

| Dairy Testing Labs & Analytical Service Providers | - Technology adoption roadmap (manual vs instrument-based) | - Optimized lab workflows |

| Regulatory Authorities & Food Safety Agencies | - Comprehensive testing standard reviews across product types | - Improved oversight effectiveness |

RECENT DEVELOPMENTS

- October 2024 : Mérieux NutriSciences (US) announced its agreement to acquire Bureau Veritas’ food testing business for USD 373 million. This strategic move, backed by Institut Mérieux, strengthens Mérieux NutriSciences’ global position in food safety and sustainability, aligning with its commitment to improving food systems worldwide. The acquisition enhances its capabilities to ensure safer, healthier, and more sustainable food production across global markets.

- October 2024 : Certified Laboratories (US) partnered with the contract laboratory network certified laboratories, previously known as Micro Quality Labs, officially joined the Contract Laboratory Network, expanding its reach and capabilities in providing testing services for food, pharmaceuticals, nutritional products, and household items. This partnership allows for a broader array of testing solutions across these industries.

- August 2024 : ALS Limited (Australia) acquired Wessling Group, an independent testing organization specializing in environmental, pharmaceutical, and food testing, with a strong footprint across 26 sites in Germany, France, Switzerland, and Romania. The acquisition marks a further step in ALS’ strategic growth agenda and establishes a significant presence in Germany and France, Europe’s largest TIC markets, complementing its existing reach in Europe.

- June 2024 : At the Asia Summit on Global Health, SGS, in collaboration with The Hong Kong Polytechnic University’s PocNAT Limited and industry partners such as Maxim’s Group, Hotel ICON, and International Gourmets Food (DCH Group), introduced Gold-LAMP. This portable, ultra-fast nucleic acid testing system is designed for detecting pathogens in food and the environment.

- May 2024 : AsureQuality (US) introduced a new testing service for A1 and A2 proteins in milk products, utilizing its advanced Capillary Zone Electrophoresis (CZE) method. This innovative method has been specifically developed and validated for the analysis of bovine milk-based infant formula, milk, and milk powders. The CZE technique offers the ability to simultaneously determine the presence of both A1 and A2 β-caseins, providing precise measurements above the established limit of reporting value of 27 mg/100 g (0.027%).

Table of Contents

Methodology

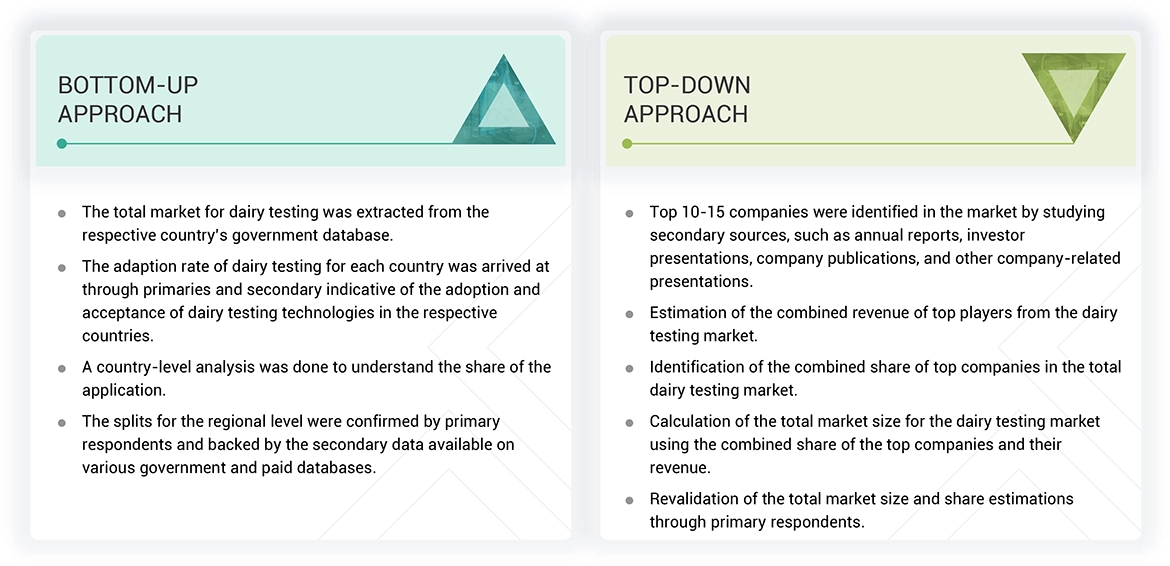

The study involved two major approaches in estimating the current size of the dairy testing market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

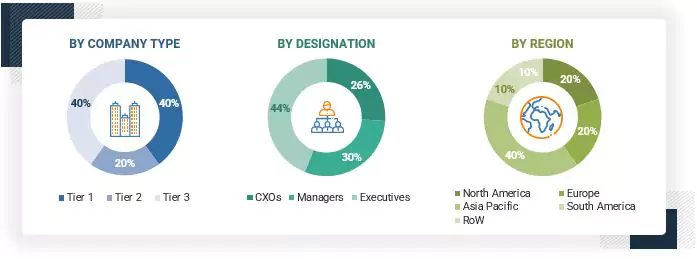

Primary Research

Extensive primary research was conducted after obtaining information regarding the dairy testing market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to dairy testing source, nature, grade, product type, application, technology type, function, form, and region. Stakeholders from the demand side, such as food associations, dealers, distributors, and government agencies, were interviewed to understand the demand side perspective on the suppliers, products, and their current usage of dairy testing and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per

the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD 1 billion; Tier 3: Revenue < USD

100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Eurofins Scientific (France) |

Regional Sales Manager |

|

SGS Institut Fresenius (Switzerland) |

Senior Vice President |

|

Intertek Group Plc (UK) |

General Manager |

|

Bureau Veritas (France) |

Director of Business Development |

|

ALS (Australia) |

Product Specialist |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the dairy testing market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CXOs, directors, and marketing executives.

Dairy Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall dairy testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Dairy testing involves testing dairy products to ensure that they meet safety, quality, and regulatory standards. This involves the analysis of contaminants such as pathogens e.g., Salmonella, E. coli, chemical residues e.g., antibiotics, pesticides, mycotoxins, allergens, and other detrimental substances that may result in adverse effects on consumers' health. Dairy testing can also be done by assessing the nutritional content, shelf-life stability, and overall quality of milk, cheese, yogurt, and milk powder.

Stakeholders

- Supply side: Dairy farmers, dairy testing service providers, processing and transformation, and end users.

- Demand side: Food & beverages manufacturers, dairy producers, dairy processors, and companies that are actively involved in the R&D phase to develop dairy products.

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies.

- Associations and industry bodies such as the United States Department of Agriculture (USDA), Food and Drug Administration (FDA), European Food Safety Authority (EFSA), the Food Safety and Standards Authority of India (FSSAI)

Report Objectives

MARKET INTELLIGENCE

- Determining and projecting the size of the dairy testing market based on product type, test type, technology, end users, and region from 2025to 2030

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

This research report categorizes the dairy testing market based on product type, test type, technology, end users, and region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe dairy testing market into key countries.

- Further breakdown of the Rest of Asia Pacific dairy testing market into key countries.

- Further breakdown of the Rest of South America dairy testing market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dairy Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dairy Testing Market