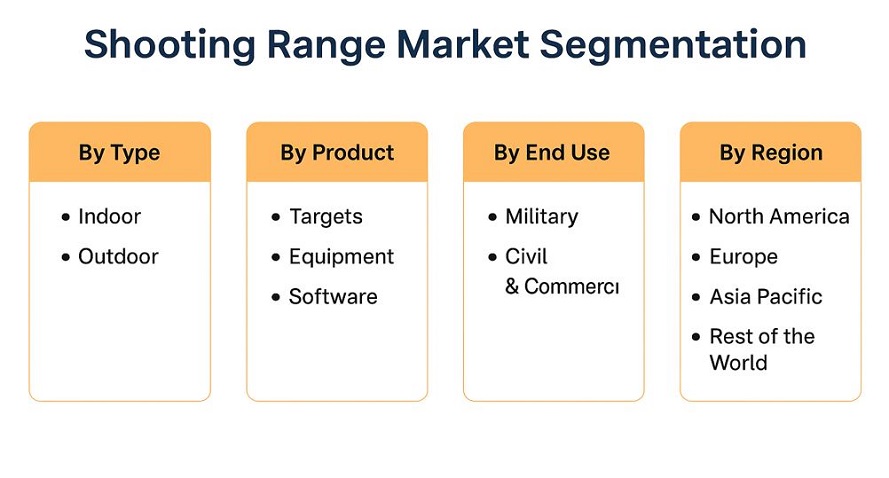

Shooting Ranges Market by Product (Indoor, Outdoor), by Sub-products (Virtual Simulator, Targets), by Indoor & Outdoor Targets – Sub-products, by Application (Civil, Military), & by Geography - Forecast to 2036

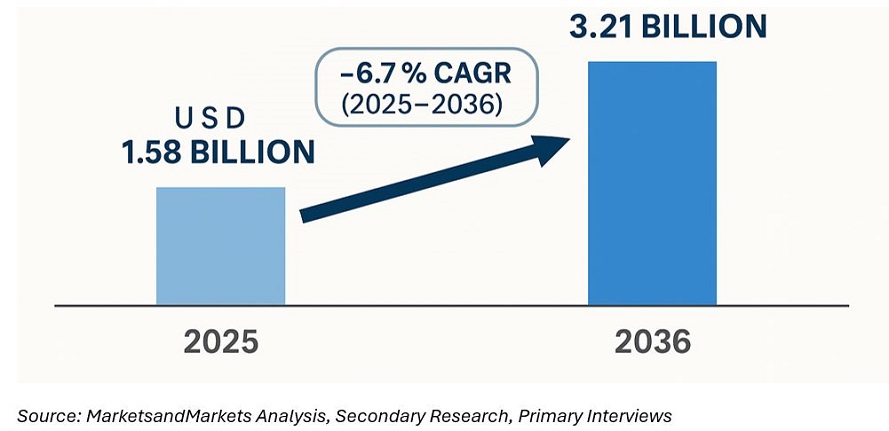

The shooting range market continues to expand as defence agencies recapitalise live-fire training infrastructure, law-enforcement academies standardise scenario-based marksmanship curricula, and commercial operators upgrade facilities to meet stricter environmental and noise standards. Using 2025 as base, the shooting range market is estimated at ~USD 1.58 billion and is projected to reach ~USD 3.21 billion by 2036, reflecting a ~6.7% CAGR (2025–2036).

Over the last two years, procurement momentum has been visible in multi-award IDIQs for U.S. live-training ranges and combat training centres, where lifecycle support and technology refresh cycles are budgeted for most of the decade. Outside the U.S., governments are also adding or reopening facilities; Finland, for example, has signalled plans to expand access to public and defence-linked ranges as part of a broader societal-defence model. Together these signals support steady demand across fixed outdoor ranges, modern indoor complexes, deployable facilities, and hybrid/virtual training sites.

Market definition and Regulatory Framework

For this page, the shooting range market covers range infrastructure and systems (outdoor earth-backstop or baffled ranges; indoor ballistic enclosures), electronic target and scoring systems, bullet traps and lead-dust capture, ventilation and acoustic containment, control, safety and monitoring systems, range design–build and compliance services, O&M and remediation, and software-enabled training aids that are deployed in or integral to a live-fire facility. Regulatory and good-practice anchors include national firearms and environmental law, workplace safety standards, and range-design handbooks. Representative sources include the NRA Range Design & Safety Handbook (UK), which details ventilation and lead-dust mitigation, while U.S. programmes reference OSHA/EPA norms and range-specific guidance.

Growth Trends

The shooting range market benefits from three durable demand streams. First, defence & gendarmerie training prioritises live-fire realism and throughput; recapitalization programs fund moving-target lanes, automated scoring, pop-up infantry targets, and instrumented after-action systems under multiyear IDIQs. Second, law-enforcement & academy upgrades focus on indoor ranges with enhanced ventilation, frangible-ammo compatibility, and judgement-training bays, reflecting both safety and community noise constraints. Third, commercial and club operators modernise with programmable targets, better sound isolation, lead reclamation, and member-experience software to raise utilisation and ancillary revenue. The combined effect is a stable, mid-single-digit growth path, with services and compliance-driven retrofits steadily increasing their share of lifetime value.

Segmentation analysis

By range type, outdoor facilities remain the largest installed base worldwide thanks to lower capex per lane and flexible layouts for long-range rifle and tactical courses. Indoor ranges account for a rising share of new projects in urban belts where land, weather, and noise constraints favour enclosed designs with certified ventilation and acoustic assemblies. Hybrid & mobile/deployable ranges appear in defence and training-centre portfolios where temporary or expeditionary siting is required, and virtual/laser and blended lanes are increasingly used to pre-train, cut ammo waste, and shorten qualification cycles; however, they complement rather than replace live-fire lanes.

By component, demand concentrates in electronic target & scoring systems, bullet traps and lead-recovery, ventilation and environmental control, acoustic containment & baffles, and range control/monitoring. Electronics are seeing the fastest functional refresh (wireless carriers, hit-sensing, lane automation), while lead management and HVAC upgrades drive a meaningful retrofit cycle in legacy indoor ranges given today’s compliance expectations. The design-build & remediation services layer forms recurring revenue through inspections, cleaning, and periodic flight-like “range inspections” mandated by permits or insurers.

By end user, defence and gendarmerie account for high-value projects (multi-lane tactical villages, moving infantry target fields, shoot-house complexes), whereas law-enforcement focuses on 25–50 m indoor pistol/carbine ranges with scenario bays. Commercial public ranges and private clubs emphasise member experience, throughput, and retail adjacency (training classrooms, simulator rooms); education and sport federations add Olympic-discipline and youth-safe configurations. In the U.S., the NRA Range Services programme and state grants have historically supported planning and upgrades for civilian facilities, reinforcing steady long-tail demand.

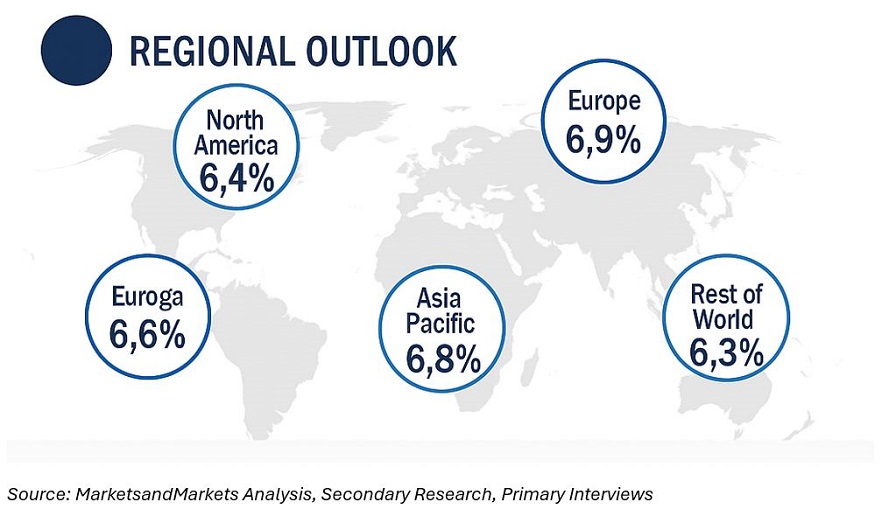

By region, North America retains the largest share, supported by a dense installed base and continuous modernisation at federal, state, and municipal agencies.

Europe exhibits balanced growth as environmental and noise standards steer capex to enclosed or baffled designs; Eastern and Northern Europe have seen renewed investment in defence-linked training sites since 2022. Asia–Pacific records the fastest structural growth in absolute lane additions, with India and Southeast Asia adding police and paramilitary training capacity; Japan, Australia, and South Korea sustain steady niche upgrades; and several Pacific states rely on defence partnerships for range access. Latin America and the Middle East & Africa are expanding capacity at national training centres and selected metropolitan academies, with private-operated indoor ranges proliferating where local regulation permits. Public reporting on live-fire training-centre contracts and national expansion initiatives corroborates this regional mix.

Competitive landscape

The shooting range market is structurally fragmented. At the high-end of defence live-fire systems, multi-award IDIQs bring together prime contractors and specialists supplying moving-target mechanisms, pop-up infantry target (PIT) lines, range instrumentation, and after-action systems; recent U.S. awards underscore an eight-year lifecycle-support window that sustains modernization and tech refresh. In law-enforcement and commercial indoor, competition features design-build integrators, ventilation and acoustic specialists, bullet-trap manufacturers, target carriers/scoring vendors, and maintenance providers. Vendors increasingly differentiate through environmental compliance packages (ventilation + filtration + lead reclamation), noise-footprint management, and software-defined training that shortens qualification cycles and increases lane utilisation.

Sustainability box

Modern range design reduces environmental and community impact. Closed-loop bullet traps and scheduled lead reclamation cut soil contamination risk; high-efficiency HVAC with HEPA filtration and negative-pressure bays protect users and staff; baffles and acoustic panels lower off-site noise; and frangible ammunition plus pre-qualification on simulators reduce particulate load and waste. Several national handbooks now explicitly tie ventilation performance and cleaning regimes to compliance—turning ESG-aligned retrofits into a tangible share of project cost and a recurring O&M revenue stream.

Outlook and Key Statistics

2025: ~USD 1.58 billion

2036: ~USD 3.21 billion

CAGR (2025–2036): ~6.7%

FAQs

Where is spending most visible right now?

Multi-year live-training range contracts and combat-training-centre sustainment packages continue to anchor defence demand, while metropolitan law-enforcement academies upgrade indoor ranges for ventilation, acoustic containment, and digital scoring. Commercial operators focus on member experience and compliance-driven retrofits.

Are virtual simulators displacing live-fire?

No. Virtual and laser-based systems reduce ammo burn and prepare recruits, but qualification standards and realism needs keep live-fire lanes essential. The result is blended curricula in which simulators shorten training cycles and live-fire confirms proficiency.

What compliance factors drive retrofit ROI?

Lead management, air-quality and noise requirements dominate project scope. Facilities that add modern bullet traps, filtration, and baffles typically reduce operating risk and insurance load while improving user throughput—raising utilisation and revenue.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Periodization

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1.1 Secondary Data

2.1.2 Key Data Taken From Secondary Sources

2.1.3 Primary Data

2.1.4 Key Data From Primary Sources

2.1.4.1 Key Industry Insights

2.1.4.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Civil Activities Requiring Licensing

2.2.2.2 Cold Wars, Territorial Disputes, and Political Conflicts

2.2.3 Supply-Side Indicators

2.2.3.1 Physical Characteristics at Ranges; Risks and Benefits Associated With Range Operations

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Market Opportunities in Market

4.2 Outdoor Shooting Ranges Market - By Moving Targets

4.3 Market, By Product

4.4 Europe: Market, By Indoor Product

4.5 Market, By Application

4.6 Market Share Analysis, By Region

4.7 Market: Emerging V/S Matured Nations

4.8 Shooting Ranges, By Indoor Products

4.9 Virtual Simulators Life Cycle Analysis, By Region

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Market, By Product

5.3.2 Market, By Indoor Product Type

5.3.3 Market, By Outdoor Product Type

5.3.4 Market, By Application

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Demand for Enhanced Training

5.4.1.2 Cost-Effectiveness of Virtual Simulators

5.4.1.3 Technological Advancements in Market

5.4.2 Restraints

5.4.2.1 Less Investment By the Ministry of Defense in Shooting Range Simulation and Training

5.4.2.2 Increase in the Cost of Live Training Systems

5.4.3 Opportunities

5.4.3.1 Retrofitting Old Ranges

5.4.3.2 Integrating Ranges With Other Training Systems

5.4.4 Challenges

5.4.4.1 Installation of Shooting Houses

5.4.4.2 Environmental Constraints

5.4.5 Burning Issue

5.4.5.1 Virtual Training Can Help Avert Readiness

6 Industry Trends (Page No. - 51)

6.1 Value Chain Analysis

6.2 Supply Chain Analysis

6.2.1 Key Influencers

6.3 Market Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Threat From New Entrants

6.4.2 Threat From Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Pestle Analysis

6.5.1 Political Factors

6.5.2 Economic Factors

6.5.3 Social Factors

6.5.4 Technological Factors

6.5.5 Legal Factors

6.5.6 Environmental Factors

6.6 Strategic Benchmarking

6.6.1 Technological Integration & Product Enhancement

7 Shooting Ranges Market, By Application (Page No. - 60)

7.1 Introduction

7.2 Military Application

7.3 Civil Application

8 Shooting Ranges Market, By Product (Page No. - 67)

8.1 Introduction

8.2 Outdoor Shooting Ranges

8.2.1 Outdoor Moving Targets

8.2.1.1 Turning Targets

8.2.1.2 Multi-Purpose Targets

8.2.1.3 Pop-Up Targets

8.2.1.4 Smart Targets

8.2.2 Outdoor Fixed Targets

8.3 Indoor Shooting Ranges

8.3.1 Indoor Virtual Simulators

8.3.2 Indoor Targets

8.3.2.1 Moving Targets

8.3.2.1.1 Duel Moving Targets

8.3.2.1.2 Pop-Up

8.3.2.1.3 Turning

8.3.2.2 Fixed Targets

8.3.2.2.1 Electronic Targets

8.3.2.2.2 Knock-Down Targets

9 Shooting Ranges Market, By Geography (Page No. - 87)

9.1 Introduction

9.2 North America

9.2.1 North America: Market Size, By Country

9.2.2 North America: Market Size, By Product

9.2.3 North America: Indoor Shooting Ranges Market Size, By Sub-Product

9.2.4 North America: Market Size, By Application

9.2.5 U.S.

9.2.5.1 U.S.: Market Size, By Product

9.2.5.2 U.S.: Indoor Shooting Ranges Market Size, By Sub-Product

9.2.5.3 U.S.: Market Size, By Application

9.2.6 Canada

9.2.6.1 Canada: Market Size, By Product

9.2.6.2 Canada: Indoor Shooting Ranges Market Size, By Sub-Product

9.2.6.3 Canada: Market Size, By Application

9.3 Europe

9.3.1 Europe: Market Size, By Country

9.3.2 Europe: Market Size, By Product

9.3.3 Europe: Indoor Shooting Ranges Market Size, By Sub-Product

9.3.4 Europe: Market Size, By Application

9.3.5 U.K.

9.3.5.1 U.K.: Market Size, By Product

9.3.5.2 U.K.: Indoor Shooting Ranges Market Size, By Sub-Product

9.3.5.3 U.K.: Market Size, By Application

9.3.6 Germany

9.3.6.1 Germany: Market Size, By Product

9.3.6.2 Germany: Indoor Shooting Ranges Market Size, By Sub-Product

9.3.6.3 Germany: Market Size, By Application

9.3.7 Russia

9.3.7.1 Russia: Market Size, By Product

9.3.7.2 Russia: Indoor Shooting Ranges Market Size, By Sub-Product

9.3.7.3 Russia: Market Size, By Application

9.4 Asia-Pacific

9.4.1 Asia-Pacific: Market Size, By Country

9.4.2 Asia-Pacific: Market Size, By Product

9.4.3 Asia-Pacific: Indoor Shooting Ranges Market Size, By Sub-Product

9.4.4 Asia-Pacific: Market Size, By Application

9.4.5 China

9.4.5.1 China: Market Size, By Product

9.4.5.2 China Indoor Shooting Ranges Market Size, By Sub-Product

9.4.5.3 China: Market Size, By Application

9.4.6 Australia

9.4.6.1 Australia: Market Size, By Product

9.4.6.2 Australia: Indoor Shooting Ranges Market Size, By Sub-Product

9.4.6.3 Australia: Market Size, By Application

9.4.7 India

9.4.7.1 India: Market Size, By Product

9.4.7.2 India: Indoor Shooting Ranges Market Size, By Sub-Product

9.4.7.3 India: Market Size, By Application

9.5 The Middle East

9.5.1 The Middle East: Market Size, By Country

9.5.2 The Middle East: Market Size, By Product

9.5.3 The Middle East: Indoor Shooting Ranges Market Size, By Sub-Product

9.5.4 The Middle East: Market Size, By Application

9.5.5 United Arab Emirates

9.5.5.1 United Arab Emirates: Market Size, By Product

9.5.5.2 United Arab Emirates: Indoor Shooting Ranges Market Size, By Sub-Product

9.5.5.3 United Arab Emirates: Market Size, By Application

9.5.6 Israel

9.5.6.1 Israel: Market Size, By Product

9.5.6.2 Israel: Indoor Shooting Ranges Market Size, By Sub-Product

9.5.6.3 Israel: Market Size, By Application

9.6 Rest of the World

9.6.1 Latin America

9.6.2 Latin America: Market Size, By Product

9.6.3 Latin America: Indoor Shooting Ranges Market Size, By Sub-Product

9.6.4 Latin America: Market Size, By Application

9.6.5 Africa

9.6.6 Africa: Market Size, By Product

9.6.7 Africa: Indoor Shooting Ranges Market Size, By Sub-Product

9.6.8 Africa: Market Size, By Application

10 Competitive Landscape (Page No. - 117)

10.1 Introduction

10.2 Market Share Analysis of Market

10.3 Competitive Situation and Trends

10.3.1 Contracts

10.3.2 New Product Launches & Services

10.3.3 Expansions

10.3.4 Partnerships, Collaborations and Joint Ventures

10.3.5 Mergers & Acquisitions

11 Company Profiles (Page No. - 127)

11.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.2 SAAB AB (Training & Simulation)

11.3 Meggitt Training Systems, Inc.

11.4 Theissen Training Systems Gmbh

11.5 Range Systems, Inc.

11.6 Polytronic International AG

11.7 Cubic Corporation

11.8 Action Target, Inc.

11.9 Laser Shot, Inc.

11.10 Virtra Training Systems, Inc.

11.11 ELI Military Simulations Ltd.

11.12 Savage Range Systems, Inc.

11.13 Shooting Range Industries, LLC

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 161)

12.1 Discussion Guide

12.2 Introducing RT: Real Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

List of Tables (80 Tables)

Table 1 Civil Activities Requiring Licensing, By Country

Table 2 Increasing Demand for Enhanced Training is Driving Growth of Market

Table 3 Increasing Cost of Live Training Systems Limiting Market Progress

Table 4 Retrofitting Old Ranges With New Training Devices Offers Low Up Gradation Costs

Table 5 Installation of Shooting Houses & Environmental Constraints Pose Challenges in the Market

Table 6 Market Size, By Application, 2013-2020 ($Million)

Table 7 Military Shooting Ranges Market Size, By Region, 2013-2020 ($Million)

Table 8 Civil Shooting Ranges Market Size, By Region, 2013-2020 ($Million)

Table 9 Market Size, By Product, 2013-2020 (Thousand Units)

Table 10 Market Size, By Product, 2013-2020 ($Million)

Table 11 Outdoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 (Thousand Units)

Table 12 Outdoor Shooting Ranges Market Size, By Sub-Product,2013-2020 ($Million)

Table 13 Outdoor Moving Targets Market Size, By Sub-Product, 2013-2020 (Thousand Units)

Table 14 Outdoor Moving Targets Market Size, By Sub-Product,2013-2020 ($Million)

Table 15 Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 (Thousand Units)

Table 16 Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 17 Indoor Targets Market Size, By Sub-Product,2013-2020 (Thousand Units)

Table 18 Indoor Targets Market Size, By Sub-Product , 2013-2020 ($Million)

Table 19 Indoor Moving Targets Market Size, By Sub-Product, 2013-2020 (Thousand Units)

Table 20 Indoor Moving Targets Market Size, By Sub-Product,2013-2020 ($Million)

Table 21 Indoor Fixed Targets Market Size, By Sub-Product, 2013-2020 (Thousand Units)

Table 22 Indoor Fixed Targets Market Size, By Sub-Product, 2013-2020 ($Million)

Table 23 Market Size, By Region, 2013-2020 ($Million)

Table 24 North America: Market Size, By Country, 2013-2020 ($Million)

Table 25 North America: Market Size, By Product, 2013-2020 ($Million)

Table 26 North America: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 27 North America: Market Size, By Application, 2013-2020 ($Million)

Table 28 U.S.: Market Size, By Product, 2013-2020 ($Million)

Table 29 U.S.: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 30 U.S.: Market Size, By Application, 2013-2020 ($Million)

Table 31 Canada: Market Size, By Product, 2013-2020 ($Million)

Table 32 Canada: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 33 Canada: Market Size, By Application,2013-2020 ($Million)

Table 34 Europe: Market Size, By Country, 2013-2020 ($Million)

Table 35 Europe: Market Size, By Product, 2013-2020 ($Million)

Table 36 Europe: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 37 Europe: Market Size, By Application,2013-2020 ($Million)

Table 38 U.K.: Market Size, By Product, 2013-2020 ($Million)

Table 39 U.K.: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 40 U.K.: Market Size, By Application, 2013-2020 ($Million)

Table 41 Germany: Market Size, By Product,2013-2020 ($Million)

Table 42 Germany: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 43 Germany: Market Size, By Application,2013-2020 ($Million)

Table 44 Russia: Market Size, By Product, 2013-2020 ($Million)

Table 45 Russia: Indoor Shooting Ranges Market Size, By Sub-Product,2013-2020 ($Million)

Table 46 Russia: Market Size, By Application,2013-2020 ($Million)

Table 47 Asia-Pacific: Market Size, By Country,2013-2020 ($Million)

Table 48 Asia-Pacific: Market Size, By Product,2013-2020 ($Million)

Table 49 Asia-Pacific: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 50 Asia-Pacific: Market Size, By Application, 2013-2020 ($Million)

Table 51 China: Market Size, By Product, 2013-2020 ($Million)

Table 52 China: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 53 China: Market Size, By Application,2013-2020 ($Million)

Table 54 Australia: Market Size, By Product,2013-2020 ($Million)

Table 55 Australia: Indoor Shooting Ranges Market Size, By Sub-Product,2013-2020 ($Million)

Table 56 Australia: Market Size, By Application,2013-2020 ($Million)

Table 57 India: Market Size, By Product, 2013-2020 ($Million)

Table 58 India: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 59 India: Market Size, By Application, 2013-2020 ($Million)

Table 60 The Middle East: Market Size, By Country, 2013-2020 ($Million)

Table 61 The Middle East: Market Size, By Product,2013-2020 ($Million)

Table 62 The Middle East: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 63 The Middle East: Market Size, By Application, 2013-2020 ($Million)

Table 64 United Arab Emirates: Market Size, By Product, 2013-2020 ($Million)

Table 65 United Arab Emirates: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 66 United Arab Emirates: Market Size, By Application, 2013-2020 ($Million)

Table 67 Israel: Market Size, By Product, 2013-2020 ($Million)

Table 68 Israel: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 69 Israel: Market Size, By Application,2013-2020 ($Million)

Table 70 Latin America: Market Size, By Product,2013-2020 ($Million)

Table 71 Latin America: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 72 Latin America: Market Size, By Application, 2013-2020 ($Million)

Table 73 Africa: Market Size, By Product, 2013-2020 ($Million)

Table 74 Africa: Indoor Shooting Ranges Market Size, By Sub-Product, 2013-2020 ($Million)

Table 75 Africa: Market Size, By Application,2013-2020 ($Million)

Table 76 Contracts, 2012-2015

Table 77 New Product Launches & Services, 2012-2015

Table 78 Expansions, 2012-2015

Table 79 Partnerships, Collaborations and Joint Ventures, 2012–2015

Table 80 Mergers & Acquisitions, 2012-2015

List of Figures (72 Figures)

Figure 1 Market Scope: Shooting Ranges

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Number of Conflicts By Intensity Across Various Regions, 2013

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Evolution of Firearms Training Simulation

Figure 9 Market Snapshot (2015 vs. 2020): Market for Virtual Simulation is Projected to Increase By 80% in the Next Five Years

Figure 10 North America Leads the Market, 2013-2020

Figure 11 North America to Witness Remarkable Growth

Figure 12 The U.S. to Be the Most Prospective Market to Invest in the Next Five Years

Figure 13 Contracts Fueled the Demand for Market

Figure 14 Attractive Market Opportunities in Market, 2015-2020

Figure 15 Multi-Purpose Target Segment Expected to Be the Most Lucrative Among Moving Outdoor Targets, (2014-2020)

Figure 16 Market, By Indoor & Outdoor Products, 2015-2020

Figure 17 Virtual Simulator Segment Estimated to Capture the Major Share in Europe, 2015

Figure 18 Market, By Application, 2014-2020

Figure 19 U.S. & China to Grow at High CAGR During the Forecast Period

Figure 20 Emerging Markets to Grow at A Higher Rate Than Matured Markets in Next Five Years

Figure 21 Virtual Simulator Segment to See Favorable Growth By 2020

Figure 22 Latin American Market to Soon Enter Rapid Growth Phase

Figure 23 Evolution of Firearms Training Simulation

Figure 24 Market, By Product

Figure 25 Market, By Indoor Product Type

Figure 26 Market, By Outdoor Product Type

Figure 27 Market, By Application

Figure 28 Virtual Simulation & Increasing Demand for Advanced Training are Driving the Shooting Range Market

Figure 29 Shooting Ranges Value Chain Analysis

Figure 30 Shooting Ranges Supply Chain Analysis

Figure 31 Growing Demand of Lomah Systems is the Latest Trend in the Market

Figure 32 Porter’s Five Forces Analysis (2014): Continuous Improvement of Technologies has A Positive Impact in the Global Market

Figure 33 New Product Launches & Contracts

Figure 34 Advanced Training Requirements to Push the Growth of Military Segment From 2015 to 2020

Figure 35 Military Segment Projected to Dominate Market During the Forecast Period

Figure 36 Military Segment Projected to Grow Rapidly in North America Over the Next Six Years

Figure 37 Country-Level Share Analysis of Military Shooting Ranges Market, 2015

Figure 38 North America to Capture Largest Share in Civil Segment Throughout the Forecast Period

Figure 39 Country-Level Share Analysis of Civil Shooting Ranges Market, 2015

Figure 40 Advanced Simulation-Based Training Demand to Boost Indoor Shooting Ranges Segment Growth From 2015 to 2020

Figure 41 Outdoor Segment is Projected to Dominate the Market, By Volume, By 2020

Figure 42 Outdoor Segment Projected to Dominate the Market During the Forecast Period

Figure 43 Outdoor Moving Targets Projected to Hold the Largest Share, By Volume, During the Forecast Period

Figure 44 Outdoor Moving Targets Segment is Projected to Have the Highest Potential From 2015 to 2020

Figure 45 Multi-Purpose Targets Segment Projected to Lead the Market By Volume By 2020

Figure 46 Turning Targets Segment Estimated to Account for ~33% Market Share in 2015

Figure 47 Outdoor Fixed Targets Segment Projected to Increase Its Market Share By 6% By 2020

Figure 48 Indoor Targets Segment Projected to Contribute Maximum Volume Share Over the Forecast Period

Figure 49 Virtual Simulators Segment is Expected to Grow at A Higher CAGR Than Targets During the Forecast Period

Figure 50 Virtual Simulators Segment is Projected to Capture 59% Share By 2020

Figure 51 Indoor Moving Targets Segment Projected to Account for 61% Market Volume By 2020

Figure 52 Indoor Moving Targets Segment Projected to Grow By $53 Million By 2020

Figure 53 Duel Moving Targets Segment Expected to Hold Around 43% Market Share By Volume By 2020

Figure 54 Duel Moving Targets Segment Projected to Grow at the Highest CAGR From 2015 to 2020

Figure 55 Knock-Down Targets Projected to Capture the Largest Market Size, By Volume Through the Forecast Period

Figure 56 Electronic Targets Segment Projected to Continue Market Dominance During the Forecast Period

Figure 57 Geographic Snapshot: Shooting Ranges, 2015-2020

Figure 58 North American Market Snapshot: U.S. Commands the Largest Market Share

Figure 59 European Market Snapshot, 2020 ($Million)

Figure 60 Asia-Pacific Market Snapshot

Figure 61 The Middle East: Market Snapshot

Figure 62 RoW Market Snapshot

Figure 63 Companies Adopted Contracts & New Product Launches as Key Growth Strategies From 2012 to 2015

Figure 64 Market Share Analysis, By Key Player, 2014

Figure 65 North American Region has the Maximum Number of Key Players in the Market, 2014

Figure 66 Market has Witnessed Substantial Growth From 2012 to 2014

Figure 67 Contract Was the Key Growth Strategy, 2012 – 2015

Figure 68 Geographic Revenue Mix of Top Two Market Players, 2014

Figure 69 SAAB AB: Company Snapshot

Figure 70 Meggitt Training Systems, Inc.: Company Snapshot

Figure 71 Cubic Corporation: Company Snapshot

Figure 72 Virtra Training Systems, Inc.: Company Snapshot

Increase in demand for advanced training and technological advancement in shooting ranges are some of the key factors that are fueling the growth of this market. Low investment by the Ministry of Defense on shooting range simulation and training and increase in the cost of live training systems are some of the factors hampering the growth of the shooting range market. The purpose of the market report is to identify various types and technologies involved, and the major drivers & restraints of the market. The key players of the market are covered in the report.

Retrofitting old ranges and integrating ranges with other training systems provide opportunities for the players in this market. Installation of shooting houses and environmental constraints pose a challenge for the market.

Emerging markets include nations such as China and India which have become attractive for companies in the development of shooting ranges. In 2014, SAAB Training and Simulation held the dominant position in the global market. It has maintained this position by adopting strategies such as acquisitions and strategic contracts over the period of the last three years. Other key players include Meggitt Training Systems, Inc., Theissen Training Systems GmbH, and Range Systems, Inc. which held a noticeable market share.

Apart from the general overview of the companies, this report also provides financial analysis, products, services, and the key developments of the major players in the industry. The industry value chain, market revenue, and volumes are determined through primary and secondary research. All percentage shares, splits, and breakdowns are determined using secondary sources and verified through primary sources.

In a nutshell, this research report is consolidated business intelligence on the shooting range market. It will also help the indoor and outdoor shooting range industry, and its stakeholders to identify hot revenue pockets in this market.

Scope of the Report

This research report categorizes the global market into the following segments and sub-segments:

Indoor Shooting Range Market, by Product

- Virtual Simulators

-

Targets

-

Moving Targets

- Dual Moving Targets

- Pop-up Targets

- Turning Targets

-

Fixed Targets

- Electronic Targets

- Knock-down Targets

-

Moving Targets

Outdoor Shooting Range Market, by Type

-

Targets

-

Moving Targets

- Turning Targets

- Multi-purpose Targets

- Pop-up Targets

- Smart Targets

- Fixed Targets

-

Moving Targets

Shooting Range Market, by Application

- Civil

- Military

Global Shooting Range Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- Russia

-

Asia-Pacific

- China

- India

- Australia

-

Middle East

- Israel

- UAE

-

Rest of the World

- Latin America

- Africa

Growth opportunities and latent adjacency in Shooting Ranges Market

I am creating a business plan for a new shooting range facility. The market research is to establish a 3-year financial plan and verify market stability for this business venture.

I am interested in opening a Virtual Shooting/Training operation. I am looking for a current market research on the subject.