Single Loop Controller Market Type, Display Type (LCD, LED), Panel Cutout Size, Application (Oil & Gas Plants, Petrochemical Plants, Iron & Steel Plants, Power Plants, Chemical Plants), and Geography - Global Forecast to 2024

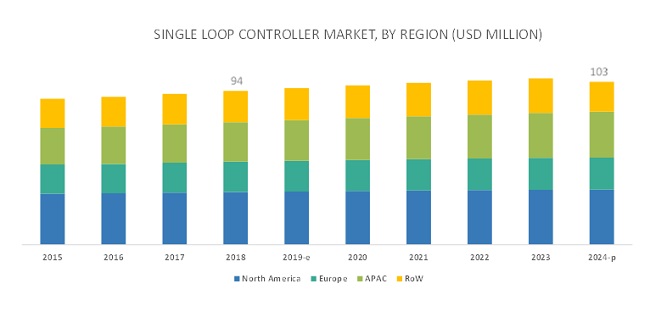

The single loop controller market is expected to reach USD 103 million by 2024, at a CAGR of 1.4% during the forecast period. Changing energy trends such as increasing demand for unconventional energy sources, booming power sector, and growing investments toward power generation projects drive the growth of the market.

Impact of AI in Single Loop Controller Market

The integration of artificial intelligence (AI) in the single loop controller market is revolutionizing process automation by enhancing precision, adaptability, and efficiency in industrial control systems. AI enables these controllers to perform advanced functions such as predictive maintenance, real-time process optimization, and anomaly detection, reducing downtime and improving overall system reliability. In industries like oil & gas, chemicals, and manufacturing, AI-driven single loop controllers offer smarter decision-making capabilities, allowing for self-tuning and adaptive control strategies that respond dynamically to changing process conditions. This advancement not only improves operational efficiency but also contributes to cost savings and better resource utilization, driving the growth and adoption of AI-enabled control technologies.

Single Loop Controller Market Segment Overview

By type, temperature controllers hold the largest market share for the single loop controller market during the forecast period

Precise control of these variables is critical in industrial settings as it improves the quality of products while enabling automation, allowing smaller staff to monitor, and control complex processes from a central location.

The reason behind the largest share of temperature controllers is their extensive usage across several applications in industries such as oil & gas, petrochemicals, food & beverages, and power plants. The growth of the single loop temperature controller market is also fueled by the factors such as their ability to improve process efficiency, minimize waste, and flexible communication options and the introduction of hybrid temperature controllers as an alternative to a PLC device.

Liquid Crystal Display to grow at the highest CAGR for single loop controller market during the forecast period

The demand for LCD single loop controllers is expected to record a higher CAGR during the forecast period. LCD stands for liquid crystal display.

It is a combination of two states of matter, the solid and the liquid. LCD uses a liquid crystal to produce a visible image. LCD controllers are used for improving visual work performance, eliminate distortion and flicker, and reduce glare and associated eyestrain, which helps increase productivity and well-being of an operator.

Single loop controller market for oil & gas plants expected to hold the largest market share

Oil & gas plants held the largest market share of the market in 2018. Single loop controllers can control oil & gas plants remotely, and the operators can gain information about inventories and equipment conditions regularly.

Moreover, remote monitoring can compensate for the shortage of skilled workforce for the collection of data related to equipment. Furthermore, remote monitoring reduces the risk to the lives of the workforce and improves the overall safety and efficiency. As several of oil & gas companies are establishing their drilling operations in remote offshore locations, the focus of these companies on safety and efficiency is driving the need for continuous monitoring within the industry, which, in turn, propels the growth of the single loop controller market.

APAC to grow at the highest CAGR for single loop controller market

The market in APAC is expected to grow at the highest CAGR during the forecasted period owing to the increasing adoption of advanced technologies such as Industry 4.0 and smart factory.

The adoption of industrial automation solutions in APAC is high due to the growing manufacturing sector in the region. The dense population and growing per capita income of this region, along with large-scale industrialization and urbanization, are the factors driving the growth of the single loop controller market in APAC.

Key Market Players in Single Loop Controller Market

The leading players in the single loop controller market include WEST Control Solutions (UK), Eurotherm (UK), Honeywell (US), ABB (Switzerland), OMRON (Japan), Sure Controls (UK), Yokogawa (Japan), Gefran (Italy), Azbil Corporation (Japan), Mitsubishi (Tokyo), Carotek (US), and PSG Plastic Service GmbH (Europe), among others.

West Control Solutions (UK) operates as a subsidiary of Danaher Corp. West Control Solutions is a global specialist in process and temperature control. The company provides temperature and process control solutions and has a broader range of products for control solutions. West Control is among the top leaders in the single loop controller market. The company has an extensive portfolio of single loop controllers that find their applications in plastics, ovens & furnaces, as well as in packaging, food & beverages, and life sciences industries. The company continues to invest in research & development and is the worldwide center of excellence for the development & manufacturing of temperature and process controllers for its entire business group.

Single Loop Controller Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 93 Million |

| Projected Market Size | USD 103 Million |

| CAGR | 1.4% |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units |

Value, USD |

|

Segments covered |

Type, Display Type, Panel Cutout Size, Application |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

ABB (Switzerland), Honeywell (US), WEST Control Solutions (UK), Sure Controls (UK), Eurotherm (UK), Yokogawa (Japan), OMRON (Japan), Gefran (Italy), Mitsubishi (Tokyo), Azbil Corporation (Japan), PSG Plastic Service GmbH (Europe), Carotek (US) |

This report categorizes the single loop controller market based on offering, product, application, end-user industry, and region.

Single Loop Controller Market, By Type:

- Temperature Controller

- Pressure Controller

- Flow Controller

Market, By Display Type:

- Liquid Crystal Display (LCD)

- Light Emitting Diode (LED)

Market, By Panel Cutout Size:

- 1/4 DIN

- 1/8 DIN

- 1/16 DIN

- 1/32 DIN

Single Loop Controller Market, By Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Recent Developments in Single Loop Controller Industry

- In April 2017, Yokogawa released an enhanced version of the STARDOM network-based control system that consists of components such as HMI and FAST/TOOLSTM SCADA. Monitoring, operation, control, data collection, and storage are the major applications of the control system.

- In January 2017, Yokogawa announced that its subsidiary, Yokogawa United Kingdom Ltd., signed a contract with British Pipeline Agency Limited (BPA) to offer enterprise pipeline management solution (EPMS) and supervisory control and data acquisition (SCADA) systems for major multi-product fuel pipeline project in the UK.

- In September 2017, ABB acquired GE Industrial Solutions, GE’s global electrification solutions business. With GE Industrial Solutions, the company strengthened its position in electrification, globally, and expanded its access to the attractive North American market.

- In April 2017, Gefran launched a new family of PID controllers including three models: 850/1650/1850. The new series offers numerous integrated functions permitting reduction of the number of devices installed on a machine, simplifying configuration and, therefore, saving time and money.

Key questions addressed by the report

- Which are the major applications of the single loop controller market? How big is the opportunity for their growth in the developing economies in the next five years?

- Which are the major companies in the market? What are their key strategies to strengthen their market presence?

- Which are the leading countries in the market? What would be the share of North America and Europe in this market for the next five years?

- Where will all these developments in the market take the industry in the mid to long term?

- What are the upcoming industry applications for single loop controller?

Frequently Asked Questions (FAQ):

What are the different types of segmentation for Single Loop Controller Market?

Single Loop Controller is segmented on the basis of type, display type, panel cut out size , applications and geography for this study.

Which are the major companies in the Single Loop Controller market?

The major players in Single Loop Controller market are ABB (Switzerland), Honeywell (US), WEST Control Solutions (UK), Sure Controls (UK), Eurotherm (UK), Yokogawa (Japan), OMRON (Japan), Gefran (Italy), Mitsubishi (Tokyo), Azbil Corporation (Japan), PSG Plastic Service GmbH (Europe), Carotek (US) among others.

What are the opportunities for new market entrants?

Changing energy trends such as increasing demand for unconventional energy sources, booming power sector, and growing investments toward power generation projects drive the growth of the market.

What are the different applications of Single Loop Controller market?

Different applications for Single Loop Controller market in Oil & Gas plants, Petrochemical Plants, Power Plants, Chemical Plants, Iron & Steel Plants and others. Single loop controllers can control these plants remotely, and the operators can gain information about inventories and equipment conditions regularly.

What are the different types of single loop controller available in the market?

Different tupesof single loop controller available in th emarket are Temperature Controller, Pressure Controller and Level Controllers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Secondary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in Market

4.2 Market, By Type

4.3 Market, By Display Type

4.4 Market, By Panel Cutout Size

4.5 Market, By Region and Application

4.6 US Held Largest Share of Global Market in 2018

5 Market Overview (Page No. - 33)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Changing Energy Trends and Increasing Demand for Unconventional Energy Sources

5.1.1.2 Booming Power Sector and Increasing Investments Toward Power Generation Projects

5.1.2 Restraints

5.1.2.1 High Initial Cost of Automating Manufacturing Plants and Requirement for Huge Capital for System Maintenance and Modification

5.1.2.2 Stagnant Growth of Oil & Gas Industry

5.1.3 Opportunities

5.1.3.1 Changing Trends of Manufacturing Industry in Middle East

5.1.4 Challenges

5.1.4.1 Stagnant Industrial Growth in Developed Countries in North America and Europe

6 Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Temperature Controllers

6.3 Pressure Controllers

6.4 Level Controllers

7 Market, By Display Type (Page No. - 41)

7.1 Introduction

7.2 LCD

7.2.1 LCD Display Type is Largely Used for Single Loop Controller

7.3 LED

7.3.1 High Efficiency and Low Energy Consumption Drives the Demand for LED Display

8 Market, By Panel Cutout Size (Page No. - 45)

8.1 Introduction

8.2 1/4 Din

8.3 1/8 Din

8.4 1/16 Din

8.5 1/32 Din

9 Market, By Application (Page No. - 50)

9.1 Introduction

9.2 Oil and Gas Plants

9.3 Petrochemical Plants

9.4 Power Plants

9.5 Chemical Plants

9.6 Iron and Steel Plants

9.7 Other Applications

10 Geographic Analysis (Page No. - 60)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Growing Investment for Manufacturing High-Quality Products and Rising Adoption of Automation Technology Drive Market Growth in Us

10.2.2 Canada

10.2.2.1 Increasing Government Support for Adoption of Advanced Manufacturing Technologies Propel Market Growth

10.2.3 Mexico

10.2.3.1 Ongoing Developments in Process and Discrete Industries Boost Growth of Market

10.3 Europe

10.3.1 UK

10.3.1.1 Rising Adoption of Smart Manufacturing in UK Drives Market Growth

10.3.2 Germany

10.3.2.1 Rising Demand for Automation in Germany Drives Market Growth

10.3.3 France

10.3.3.1 Government Initiatives Toward Increasing Production Efficiency Fuel Demand for Single Loop Controllers in France

10.3.4 Italy

10.3.4.1 High Adoption of Smart Factory Solutions in Italy Drives Demand for Single Loop Controllers in This Country

10.3.5 Rest of Europe

10.4 APAC

10.4.1 China

10.4.1.1 Increasing Labor Costs in China Leading to High Adoption of Advanced Automation Solutions, Which, in Turn, Drives Market Growth

10.4.2 Japan

10.4.2.1 Ongoing Developments in Smart Manufacturing Processes in Country to Surge Demand for Single Loop Controllers

10.4.3 South Korea

10.4.3.1 Increasing Investments By Government Toward Development of Manufacturing Sector Promote Growth of Market

10.4.4 India

10.4.4.1 Make in India Campaign Encourages Growth of Manufacturing Industry, Thereby Surging Demand for Single Loop Controllers to Fulfill Controlling and Monitoring Requirements of Industrial Automation

10.4.5 Rest of APAC

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Middle East and Africa

10.5.2.1 High Adoption of Advanced Manufacturing Solutions in Oil & Gas Industry Drives Demand for Single Loop Controllers in Middle East and Africa

11 Competitive Landscape (Page No. - 74)

11.1 Overview

11.2 Product Launches and Developments

11.3 Partnerships, Contracts, Agreements, and Collaborations

11.4 Mergers & Acquisitions

11.5 Competitive Leadership Mapping

11.5.1 Visionary Leaders

11.5.2 Dynamic Differentiators

11.5.3 Innovators

11.5.4 Emerging Companies

11.6 Strength of Product Offering ( 15 Companies)

11.7 Business Strategy Excellence (15 Companies)

12 Company Profiles (Page No. - 81)

12.1 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

12.1.1 ABB Ltd.

12.1.2 Honeywell International Inc.

12.1.3 West Control Solutions

12.1.4 Sure Controls

12.1.5 Eurotherm

12.1.6 Yokogawa Electric Corporation

12.1.7 Omron

12.1.8 Gefran

12.1.9 Mitsubishi Electric Corporation

12.1.10 Azbil Corporation

12.1.11 PSG Plastic Service GmbH

12.1.12 Carotek

12.2 Other Players

12.2.1 PMA Controls India Ltd.

12.2.2 Athena Controls

12.2.3 M-System

12.2.4 Electronics Systems & Devices (ESD)

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 107)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Author Details

List of Tables (37 Tables)

Table 1 Single Loop Controller Market, By Type, 2015–2024 (USD Million)

Table 2 Single Loop Temperature Controller Market, By Application, 2015–2024 (USD Million)

Table 3 Single Loop Pressure Controller Market, By Application, 2015–2024 (USD Million)

Table 4 Single Loop Level Controller Market, By Application, 2015–2024 (USD Million)

Table 5 Market, By Display Type, 2015–2024 (USD Million)

Table 6 Market for LCD, By Panel Cutout Size, 2015–2024 (USD Million)

Table 7 Market for LED, By Panel Cutout Size, 2015–2024 (USD Million)

Table 8 Market, By Panel Cutout Size, 2015–2024 (USD Million)

Table 9 ¼ Din Single Loop Controller Market, By Display Type, 2015–2024 (USD Million)

Table 10 1/8 Din Market, By Display Type, 2015–2024 (USD Million)

Table 11 1/16 Din Market, By Display Type, 2015–2024 (USD Million)

Table 12 1/32 Din Market, By Display Type, 2015–2024 (USD Million)

Table 13 Market, By Application, 2015–2024 (USD Million)

Table 14 Market for Oil and Gas Plants, By Type, 2015–2024 (USD Thousand)

Table 15 Market for Oil and Gas Plants, By Region, 2015–2024 (USD Million)

Table 16 Market for Petrochemical Plants, By Type, 2015–2024 (USD Thousand)

Table 17 Market for Petrochemical Plants, By Region, 2015–2024 (USD Million)

Table 18 Market for Power Plants, By Type, 2015–2024 (USD Thousand)

Table 19 Market for Power Plants, By Region, 2015–2024 (USD Thousand)

Table 20 Market for Chemical Plants, By Type, 2015–2024 (USD Thousand)

Table 21 Market for Chemical Plants, By Region, 2015–2024 (USD Thousand)

Table 22 Market for Iron and Steel Plants, By Type, 2015–2024 (USD Thousand)

Table 23 Market for Iron and Steel Plants, By Region, 2015–2024 (USD Thousand)

Table 24 Market for Other Applications, By Type, 2015–2024 (USD Thousand)

Table 25 Market for Other Applications, By Region, 2015–2024 (USD Thousand)

Table 26 Market, By Region, 2015–2024 (USD Million)

Table 27 Market in North America, By Application, 2015–2024 (USD Million)

Table 28 Market in North America, By Country, 2015–2024 (USD Million)

Table 29 Market in Europe, By Application, 2015–2024 (USD Million)

Table 30 Market in Europe, By Country, 2015–2024 (USD Million)

Table 31 Market in APAC, By Application, 2015–2024 (USD Million)

Table 32 Market in APAC, By Country, 2015–2024 (USD Million)

Table 33 Market in RoW, By Application, 2015–2024 (USD Million)

Table 34 Market in RoW, By Region, 2015–2024 (USD Million)

Table 35 Product Launches and Developments, 2017

Table 36 Partnerships, Agreements, Collaborations, and Contracts, 2017

Table 37 Mergers & Acquisitions, 2017

List of Figures (39 Figures)

Figure 1 Single Loop Controller Market Segmentation

Figure 2 Market: Research Design

Figure 3 Process Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Triangulation

Figure 7 Market, By Type, 2018vs. 2024

Figure 8 Market, By Cutout Display Size, 2018 vs 2024

Figure 9 Market, By Display Type, 2018 vs 2024

Figure 10 Market, By Application, 2018 vs 2024

Figure 11 Market, By Region, 2018

Figure 12 Market Expected to Grow at High Rate From 2019 to 2024

Figure 13 Temperature Controllers are Expected to Continue to Dominate Market in Coming Years

Figure 14 LCD Segment Expected to Command Market From 2019 and 2024

Figure 15 Comparison of Single Loop Controllers, By Panel Cutout Size, 2018 vs 2024

Figure 16 North America and Oil & Gas Plants Accounted for Largest Share of Market in 2018

Figure 17 China Expected to Witness Highest CAGR From 2019 and 2024

Figure 18 Changing Energy Trends and Increasing Demand for Unconventional Energy Sources Expected to Drive the Market

Figure 19 Temperature Controllers Expected to Lead Market During Forecast Period

Figure 20 LCD to Command Market From 2019 to 2024

Figure 21 Market for 1/8 Din Single Loop Controllers to Grow at Highest CAGR From 2019 to 2024

Figure 22 LCD Segment Likely to Dominate 1/8 Din Market From 2019 to 2024

Figure 23 Oil & Gas Plants Expected to Lead Market From 2019 to 2024

Figure 24 Temperature Controllers to Command Market for Power Plants From 2019 to 2024

Figure 25 North America to Account for Largest Size of Market for Iron and Steel Plants From 2019 to 2024

Figure 26 Geographic Snapshot: Global Market

Figure 27 Snapshot: Market in North America

Figure 28 Snapshot: Market in Europe

Figure 29 Snapshot: Market in APAC

Figure 30 Ranking Analysis of Market Players (2018)

Figure 31 Key Strategies Adopted By Top Players

Figure 32 Market (Global) Competitive Leadership Mapping, Xxxx

Figure 33 ABB Ltd.: Company Snapshot

Figure 34 Honeywell International Inc.: Company Snapshot

Figure 35 Yokogawa Electric Corporation: Company Snapshot

Figure 36 Omron Corporation: Company Snapshot

Figure 37 Gefran: Company Snapshot

Figure 38 Mitsubishi Electric Corporation: Company Snapshot

Figure 39 Azbil Corporation: Company Snapshot

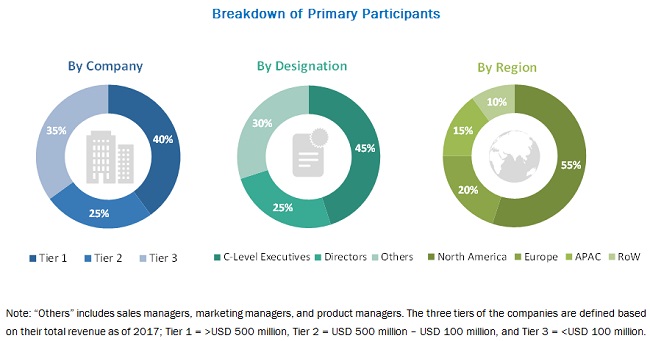

The study involved four major activities in estimating the current size of the single loop controller market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the single loop controller market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the market. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to a single loop controller market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the single loop controller market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the market, in terms of value, by offering, product, application, and end-user industry

- To describe and forecast the market, in terms of volume, by product

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with regards to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

- Comprehensive coverage of funding/M&A activities, regulations followed in each region (North America, APAC, Europe, and RoW)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Single Loop Controller Market