Small Satellite Services Market by Platform (CubeSat, Nanosatellite, Microsatellite, Minisatellite), Vertical (Government & Military, Non-Profit Organizations, Commercial), Application (Remote Sensing, Communication), and Region - Global Forecast to 2022

The small satellite services market is projected to reach USD 53.22 Billion by 2022, at a CAGR of 29.03% during forecast period.

Small Satellite Service Market Dynamics

Increasing focus on reducing mission costs

The cost incurred, with respect to launching a large satellite, acts as a restraint to the growth of the nascent space industry, and space-related research and exploration activities. The demand for small satellites is rising, owing to the increasing focus on reducing the total mission cost. Moreover, small satellites tend to cost less, especially in cases where mission payloads have less demanding accommodation requirements. Furthermore, small satellites can be launched on small launch vehicles that are cost-efficient. This decline in cost is anticipated to provide impetus to small satellite missions and spacecraft buses that support the same. In addition, technological advancements are expected to further enhance the capabilities of small satellites and cost less.

The improvements in computer-aided designs, early definition of design requirements, interface control documents, and hardware and software reuse are expected to lower the cost of operations and mission.

Programmatic and scientific risks involved in the production of small satellites

An increase in the number of private entrants in the small satellite market has led to a decline in dependence on governments for investments. Although this has opened several investment opportunities, it has increased the risk of failures due to negligence in the development process.

These companies make the most of the shorter development span and low cost of production of small satellites without a thorough analysis. This leads to a high risk of launch failures. Satellite development needs a thorough understanding of numerical modeling, as well as practical analysis and any flaw in the loop leads to failure of the launch mission. It is of utmost importance to understand and mitigate the flaw, and respond to it as quickly as possible. The immediate launch of the next mission is one way of mitigating the failure.

The small satellite concept carries risks concerning scientific returns as well. Rapid development missions do not offer ample time to focus on long-term issues and are generally focused on smaller problems. Such missions are generally a part of technology demonstrations and are not designed for long durations. Such programmatic and scientific risks pose restraints to the growth of the market.

Proposed development of satellite networks to provide internet access to areas without broadband connectivity

Some players, such as SpaceX (US), have proposed to launch a constellation of small satellites to provide broadband internet services around the globe. These players also aim to address latency issues by positioning the satellites physically closer to the Earth than previous satellites.

These efforts are being made by companies to capitalize on the opportunity to provide internet in those parts of the world where there is minimal infrastructure and connectivity. Although the global telecommunications industry has built a robust internet network comprising fiber optic cables, radio, and microwave towers for terrestrial communications, along with undersea cables, a significant section of the population across the globe continues to remain disconnected.

This situation is due to factors, such as lower Average Revenue Per User (ARPU), and lack of infrastructure in rural and remote areas. The proposed satellite networks are expected to capitalize on their inherent advantage of height, which would enable them to cover larger areas (footprint) than the current generation of cell towers with limited coverage.

Increasing number of proposed small satellites may lead to regulatory challenges

The International Telecommunication Union (ITU) is a United Nations agency that regulates orbital slots and radio frequencies. The proposed launch of low-orbiting constellations of small satellites by private players, which aim to offer global Internet access, is expected to lead to various regulatory challenges, as these companies seek frequency coordination at the agency. Furthermore, the current ITU rules are considered to be ill-fitting for small satellites, which are deployed to orbit as piggyback passengers, as the main satellite payload determines the orbital injection point.

Moreover, coordination of these constellations’ broadcast frequencies, which generally lie in the Ku- and Ka-band with pre-existing satellite systems, is expected to be highly complicated.

Objective of the Study:

The objective of this study is to analyze the small satellite service market, along with statistics from 2016 to 2022 as well as to define, describe, and forecast the small satellite services market, and map the segments and subsegments across major regions, namely, North America, Europe, Asia Pacific, and RoW. On the basis of platform, the small satellite service market has been segmented into CubeSat, Nanosatellite, Microsatellite, and Minisatellite. On the basis of vertical, the small satellite service market has been segmented into government & military, non-profit organizations, and commercial.

Based on application, the small satellite services market has been segmented into communication, remote sensing, science & technology and education, and others.

The report provides in-depth market intelligence regarding the market dynamics and major factors, such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the small satellite service market, along with an analysis of micromarkets with respect to individual growth trends, future prospects, and their contributions to the small satellite service market.

The report also covers competitive developments, such as long-term contracts, joint ventures, mergers & acquisitions, new product launches and developments, and research & development activities in the small satellite service market, in addition to business and corporate strategies adopted by the key market players.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the small satellite services market comprises small satellite service providers, small satellite manufacturers, subsystem manufacturers, technology support providers, ministry of defense, and scientific research centers, among others. Globalstar, Inc. (US), EchoStar Corporation (US), KVH Industries, Inc. (US), Inmarsat plc (UK), Singapore Telecommunications Limited (Singapore), and Eutelsat Communications S.A. (France), among others, are the major players in the small satellite service market. They offer advanced services and related solutions.

Target Audience

- Small Satellite Service Providers

- Small Satellite Manufacturers

- Subsystem Manufacturers

- Technology Support Providers

- Ministry of Defense

- Scientific Research Centers

- Software/Hardware/Service and Solution Providers

“The study answers several questions for stakeholders, primarily, which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments.”

Scope of the Report

This research report categorizes the small satellite service market into the following segments and subsegments:

- Small Satellite Services Market, By Platform

- CubeSat

- Nanosatellite

- Microsatellite

- Minisatellite

- Small Satellite Service Market, By Vertical

- Government & Military

- Non-profit Organizations

- Commercial

- Small Satellite Service Market, By Application

- Communication

- Remote Sensing

- Science & Technology and Education

- Others

- Small Satellite Service Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

- Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The small satellite service market is projected to grow from an estimated USD 14.88 Billion in 2017 and is projected to reach USD 53.22 Billion by 2022, at a CAGR of 29.03% from 2017 to 2022. Factors, such as satellite miniaturization, and increasing demand for earth observation and satellite broadband services are expected to fuel the growth of the small satellite service market.

Based on platform, the nanosatellite segment of the small satellite service market is projected to grow at the highest rate during the forecast period. Due to their low mass and small size, several satellites can be launched simultaneously from a single vehicle launcher. These satellites are designed for specific tasks, such as communication, earth observation, and space exploration, and together, in a group, perform a mission. Moreover, the low mission cost of nanosatellites has led to their adoption in the defense sector.

Based on vertical, the commercial segment of the small satellite services market is projected to grow at the highest CAGR during the forecast period, due to the increase in R&D activities for technological innovations in the telecommunication sector. In addition, several countries are engaged in the production and development of small satellites to be used for telecommunication and broadcast, and navigation worldwide, which is driving the commercial segment.

Based on application, the remote sensing segment of the small satellite service market is projected to grow at the highest CAGR during the forecast period. Remote sensing data collection and analysis services are used extensively in all commercial industries, such as agriculture, energy & power, and weather forecasting, among others.

The demand for satellite broadband services is increasing in the US and Canada. Broadband service providers are witnessing a surge in demand for broadband services from urban as well as rural populations.

Factors, such as lack of dedicated launch vehicles, scarce intellectual assets, and design related limitations may act as restraints for the growth of the small satellite services market.

Key players profiled in the small satellite service market report include Singapore Telecommunications Limited (Singapore), Eutelsat Communications S.A. (France), EchoStar Corporation (US), Inmarsat plc (UK) and Viasat, Inc. (US), among others. Contracts was among the key strategies adopted by the leading players to sustain their positions and enhance their revenues and service offerings in the small satellite service market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

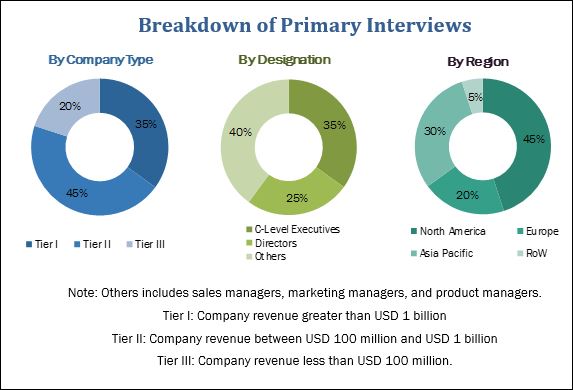

2.1.2.2 Breakdown of Primaries

2.2 Demand-Side and Supply-Side Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increasing Use of Satellite Imagery By Government and Commercial Agencies

2.2.2.2 Improved Accuracy and Reliability of Earth Observation (EO) Data

2.2.2.3 Rising Applicability of Big Data

2.2.3 Supply-Side Indicators

2.2.3.1 Miniaturization of Electronics and Subcomponents Used in Small Satellites

2.2.3.2 Advancements in Microsatellite and Nanosatellite Technologies

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Demand for Remote Sensing Services and Situational Awareness is Expected to Offer Several Untapped Opportunities in the Small Satellite Services Market

4.2 Communication Application Segment, By Subsegment

4.3 Remote Sensing Application Segment, By Subsegment

4.4 Commercial Vertical Segment, By Subsegment

4.5 Remote Sensing Application Segment, By Region

4.6 Commercial Vertical Segment, By Region

4.7 Nanosatellite (1–10 Kg) Platform Segment, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Platform

5.2.2 By Vertical

5.2.3 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Satellite Miniaturization

5.3.1.2 Increasing Focus on Reducing Mission Cost

5.3.1.3 High Investments By Venture Companies in the Small Satellite Service Market

5.3.1.4 Growth of Cloud Computing Market

5.3.1.5 Increasing Use of Small Satellite Remote Sensing Services

5.3.1.6 Increased Demand for Situational Awareness (SA)

5.3.2 Restraints

5.3.2.1 Programmatic and Scientific Risks Involved in the Production of Small Satellites

5.3.2.2 Lack of Dedicated Launch Vehicles for Small Satellite

5.3.2.3 Design-Related Limitations of Small Satellites

5.3.3 Opportunities

5.3.3.1 High Data Rate Communication

5.3.3.2 Proposed Development of Satellite Networks to Provide Internet Access Without Broadband Connectivity

5.3.3.3 Demand for Leo-Based Services

5.3.4 Challenges

5.3.4.1 Radio Spectrum Availability Issues

5.3.4.2 Scarce Intellectual Asset

5.3.4.3 Increasing Number of Proposed Small Satellites May Lead to Regulatory Challenges

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Technology Trends

6.2.1 Radio Occultation

6.2.2 Full Motion Video

6.2.3 Hyper-Spectral and Multi-Spectral Imaging

6.2.4 Automated Meter Reading (AMR)

6.2.5 Vehicle Fleet Tracking

6.2.6 Use of Small Satellites to Provide Enhanced Space Imagery

6.3 Future Developments

6.3.1 Power Subsystems

6.3.2 Altitude Determination and Control

6.3.3 Propulsion

6.3.4 Structures, Materials, and Mechanisms

6.3.5 Communication

6.3.6 Launch Capability

6.4 Emerging Trends

6.4.1 Technological Advancements in Earth Observation Services

6.4.2 Space Debris Removal

6.4.3 Synthetic Aperture Radar (SAR)

6.4.4 Satellite Photography and Multispectral Imaging

6.4.5 Real-Time Acquisition and Processing Integrated Data Systems (RAPIDS)

6.4.6 Transportable Ground Receiving Station (GRS)

6.5 Venture Capital (VC) Funding

6.6 Cost Estimation/Comparison

6.6.1 Imagery and Radar Data From Space

6.6.2 Electro-Optic (EO) and Synthetic Aperture Radar (SAR) Image Pricing

6.6.3 Orthorectified Image

6.6.4 Coherently Combined Images

6.6.4.1 Change Detection

6.6.5 Digital Terrain Elevation Detection

6.7 Small Satellite Manufacturing - Supply Chain Analysis

6.7.1 Reasons for the Prevalence Or Probability of Satellite Failure

6.8 Reasons for Failure of Satellite Bus Components

6.8.1 Satellite Vulnerability Analysis

6.9 Space Launch Statistics, 2017

6.10 Reasons for Satellite Failure Or Backlog

6.11 Innovation & Patent Registrations

7 Small Satellite Services Market, By Platform (Page No. - 72)

7.1 Introduction

7.2 Cubesat

7.3 Nanosatellite (1-10 Kg)

7.4 Microsatellite (11-100 Kg)

7.5 Minisatellite (101-500 Kg)

8 Small Satellite Service Market, By Vertical (Page No. - 76)

8.1 Introduction

8.2 Commercial, By Application

8.3 Government & Military, By Application

8.4 Non-Profit Organization, By Application

9 Small Satellite Service Market, By Application (Page No. - 82)

9.1 Introduction

9.2 Communication

9.2.1 Mobile Satellite Services

9.2.2 Fixed Satellite Services

9.2.3 Broadcast Satellite Services

9.3 Remote Sensing

9.3.1 Earth Imaging Services

9.3.2 Meteorology Services

9.3.3 Mapping & Monitoring Services

9.3.4 Others

9.4 Science & Technology and Education

9.5 Others

10 Regional Analysis (Page No. - 89)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Russia

10.3.2 France

10.3.3 Germany

10.3.4 UK

10.3.5 Italy

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Middle East

10.5.2 South America

10.5.3 Africa

11 Competitive Landscape (Page No. - 118)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Contracts

11.3.2 New Product Launches

11.3.3 Agreements/Collaborations/Joint Ventures/Acquisitions/Partnerships

12 Company Profiles (Page No. - 128)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Antrix

12.3 Astro Digital

12.4 Capella Space

12.5 Digitalglobe

12.6 Eutelsat

12.7 Echostar

12.8 Globalstar

12.9 Inmarsat

12.10 Iridium Communication

12.11 Iceye

12.12 KVH Industries

12.13 Mallon Technology

12.14 Remote Sensing Solutions

12.15 Singapore Telecommunications

12.16 Satellite Imaging Corporation

12.17 Satellogic

12.18 The Sanborn Map Company

12.19 Telesat

12.20 Viasat

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 174)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (86 Tables)

Table 1 Small Satellite Services Market, By Platform

Table 2 Small Satellite Service Market, By Vertical

Table 3 Small Satellite Service Market, By Application

Table 4 Nanosatellite and Cubesats Launched Worldwide ( 2015- 2017)

Table 5 VC Funding Companies in the Satellite Industry (2015-2016)

Table 6 Mono High & Medium-Resolution Satellite Imagery

Table 7 Stereo High & Medium-Resolution Satellite Imagery

Table 8 Electro-Optic Image Price

Table 9 Synthetic Aperture Radar (SAR) Image Pricing

Table 10 Orthorectified Image Pricing

Table 11 Change Detection Image Pricing

Table 12 Maritime Package

Table 13 Interferometric Stack Package

Table 14 Digital Terrain Model & Digital Surface Model Pricing List

Table 15 Reasons for the Prevalence Or Probability of Satellite Failure

Table 16 Orbital Launch Attempts By Country

Table 17 Innovation & Patent Registrations, 2010-2016

Table 18 Small Satellite Services Market Size, By Platform, 2015-2022 (USD Million)

Table 19 Cubesat Segment, By Region, 2015-2022 (USD Million)

Table 20 Nanosatellite (1-10 Kg) Segment, By Region, 2015-2022 (USD Million)

Table 21 Microsatellite (11-100 Kg) Segment, By Region, 2015-2022 (USD Million)

Table 22 Minisatellite (101-500 Kg) Segment, By Region, 2015-2022 (USD Million)

Table 23 Small Satellite Services Market Size, By Vertical, 2015-2022 (USD Million)

Table 24 Commercial Segment, By Application, 2015-2022 (USD Million)

Table 25 Commercial Segment, By Region, 2015-2022 (USD Million)

Table 26 Commercial Segment, By Subsegment, 2015-2022 (USD Million)

Table 27 Government & Military Segment, By Application, 2015-2022 (USD Million)

Table 28 Government & Military Segment, By Region, 2015-2022 (USD Million)

Table 29 Non-Profit Organization, By Application, 2015-2022 (USD Million)

Table 30 Non-Profit Organization Segment, By Region, 2015-2022 (USD Million)

Table 31 Small Satellite Service Market Size, By Application, 2015-2022 (USD Million)

Table 32 Communication Segment, By Region, 2015-2022 (USD Million)

Table 33 Communication Segment, By Subsegment, 2015-2022 (USD Million)

Table 34 Remote Sensing Segment, By Region, 2015-2022 (USD Million)

Table 35 Remote Sensing Segment, By Subsegment, 2015-2022 (USD Million)

Table 36 Science & Technology and Education Segment, By Region, 2015-2022 (USD Million)

Table 37 Others Segment, By Region, 2015-2022 (USD Million)

Table 38 Small Satellite Services Market Size, By Region, 2015-2022(USD Million)

Table 39 North America: Small Satellite Service Market Size, By Platform, 2015-2022 (USD Million)

Table 40 North America: Market Size, By Application, 2015-2022(USD Million)

Table 41 North America: Market Size, By Vertical, 2015-2022 (USD Million)

Table 42 North America: Market Size, By Country, 2015-2022(USD Million)

Table 43 US: Small Satellite Service Market Size, By Platform, 2015-2022 (USD Million)

Table 44 US: Market Size, By Vertical, 2015-2022 (USD Million)

Table 45 Canada: Market Size, By Platform, 2015-2022 (USD Million)

Table 46 Canada: Market Size, By Vertical, 2015-2022 (USD Million)

Table 47 Europe: Market Size, By Platform, 2015-2022(USD Million)

Table 48 Europe: Market Size, By Application, 2015-2022(USD Million)

Table 49 Europe: Market Size, By Vertical, 2015-2022(USD Million)

Table 50 Europe: Market Size, By Country, 2015-2022(USD Million)

Table 51 Russia: Market Size, By Platform, 2015-2022 (USD Million)

Table 52 Russia: Market Size, By Vertical, 2015-2022 (USD Million)

Table 53 France: Market Size, By Platform, 2015-2022 (USD Million)

Table 54 France: Market Size, By Vertical, 2015-2022 (USD Million)

Table 55 Germany: Market Size, By Platform, 2015-2022 (USD Million)

Table 56 Germany: Market Size, By Vertical, 2015-2022 (USD Million)

Table 57 UK: Market Size, By Platform, 2015-2022 (USD Million)

Table 58 UK: Market Size, By Vertical, 2015-2022 (USD Million)

Table 59 Italy: Market Size, By Platform, 2015-2022 (USD Million)

Table 60 Italy: Market Size, By Vertical, 2015-2022 (USD Million)

Table 61 Rest of Europe: Small Satellite Service Market Size, By Platform, 2015-2022 (USD Million)

Table 62 Rest of Europe: Market Size, By Vertical, 2015-2022 (USD Million)

Table 63 Asia Pacific: Market Size, By Platform, 2015-2022(USD Million)

Table 64 Asia Pacific: Market Size, By Application, 2015-2022 (USD Million)

Table 65 Asia Pacific: Market Size, By Vertical, 2015-2022 (USD Million)

Table 66 Asia Pacific: Market Size, By Country, 2015-2022 (USD Million)

Table 67 China: Small Satellite Service Market Size, By Platform, 2015-2022 (USD Million)

Table 68 China: Market Size, By Vertical, 2015-2022 (USD Million)

Table 69 Japan: Market Size, By Platform, 2015-2022 (USD Million)

Table 70 Japan: Market Size, By Vertical, 2015-2022 (USD Million)

Table 71 India: Market Size, By Platform, 2015-2022 (USD Million)

Table 72 India: Market Size, By Vertical, 2015-2022 (USD Million)

Table 73 South Korea: Small Satellite Service Market Size, By Platform, 2015-2022 (USD Million)

Table 74 South Korea: Market Size, By Vertical, 2015-2022 (USD Million)

Table 75 Rest of Asia Pacific: Market Size, By Platform, 2015-2022 (USD Million)

Table 76 Rest of Asia Pacific: Market Size, By Vertical, 2015-2022 (USD Million)

Table 77 Rest of the World: Market Size, By Platform, 2015-2022(USD Million)

Table 78 Rest of the World: Market Size, By Application, 2015-2022(USD Million)

Table 79 Rest of the World: Market Size, By Vertical, 2015-2022(USD Million)

Table 80 Rest of the World: Market Size, By Country, 2015-2022 (USD Million)

Table 81 Middle East: Market Size, By Platform, 2015-2022 (USD Million)

Table 82 Middle East: Market Size, By Vertical, 2015-2022 (USD Million)

Table 83 South America: Market Size, By Platform, 2015-2022 (USD Million)

Table 84 South America: Market Size, By Vertical, 2015-2022 (USD Million)

Table 85 Africa: Market Size, By Platform, 2015-2022 (USD Million)

Table 86 Africa: Market Size, By Vertical, 2015-2022 (USD Million)

List of Figures (48 Figures)

Figure 1 Small Satellite Services Market Segmentation

Figure 2 Research Flow

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Nanosatellite Platform Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 10 Commercial Vertical Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 Remote Sensing Application Segment is Projected to Lead the Small Satellite Services Market During the Forecast Period

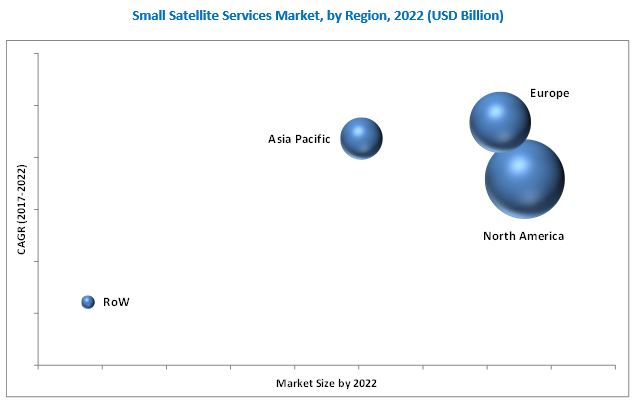

Figure 12 North America is Estimated to Lead the Small Satellite Services Market in 2017

Figure 13 Attractive Growth Opportunities in the Small Satellite Service Market From 2017 to 2022

Figure 14 Mobile Satellite Services Subsegment is Expected to Lead the Communication Application Segment From 2017 and 2022

Figure 15 Earth Imaging Services Subsegment is Expected to Lead the Remote Sensing Application Segment From 2017 to 2022

Figure 16 Media & Entertainment Subsegment is Expected to Lead the Commercial Vertical Segment From 2017 to 2022

Figure 17 North America is Expected to Lead the Remote Sensing Application Segment From 2017 to 2022

Figure 18 North America is Expected to Lead the Commercial Vertical Segment From 2017 to 2022

Figure 19 North America is Expected to Lead the Nanosatellite (1–10 Kg) Platform Segment From 2017 to 2022

Figure 20 Small Satellite Service Market, By Platform

Figure 21 Market, By Vertical

Figure 22 Market, By Application

Figure 23 Market Dynamics for Small Satellite Service Market

Figure 24 Nanosatellite (1–10 Kg) Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Commercial Vertical Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Remote Sensing Application Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Small Satellite Service Market: Regional Snapshot

Figure 28 North America Market Snapshot

Figure 29 Europe Market Snapshot

Figure 30 Asia Pacific Market Snapshot

Figure 31 Companies Adopted Contracts as the Key Growth Strategy Between July 2011 and December 2017

Figure 32 Market Ranking Analysis (2017)

Figure 33 Antrix: Company Snapshot

Figure 34 Antrix: SWOT Analysis

Figure 35 Digitalglobe: Company Snapshot

Figure 36 Digitalglobe: SWOT Analysis

Figure 37 Eutelsat: Company Snapshot

Figure 38 Eutelsat: SWOT Analysis

Figure 39 Echostar: Company Snapshot

Figure 40 Echostar: SWOT Analysis

Figure 41 Globalstar: Company Snapshot

Figure 42 Inmarsat: Company Snapshot

Figure 43 Iridium Communication: Company Snapshot

Figure 44 KVH Industries: Company Snapshot

Figure 45 Singapore Telecommunications: Company Snapshot

Figure 46 Singapore Telecommunications: SWOT Analysis

Figure 47 Telesat: Company Snapshot

Figure 48 Viasat: Company Snapshot

Growth opportunities and latent adjacency in Small Satellite Services Market

Do you know any small space satellite companies with around USD 450 Million capitalization whose shares are below USD 10/- right now?