Remote Sensing Services Market by Type (Aerial Photography & Remote Sensing, Data Acquisition & Analytics), Application (Agriculture, Environmental & Weather, Others), Platform, End Use, Resolution, Technology, and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

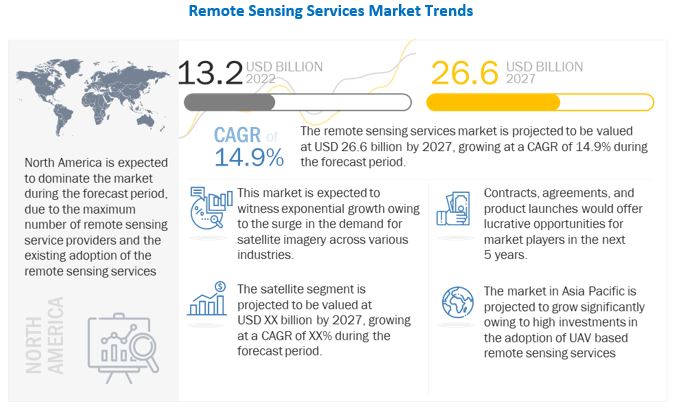

The remote sensing services market is expected to grow, as remote sensing is an effective and flexible way to gather data remotely without any physical intervention. Remote sensing service play a major role in addressing local requirements for the effective utilization of technologies. Companies in the remote sensing services industry are innovating toward the commercial exploration of space products, technical consultancy services, the transfer of technology, and the facilitation of space-related industrial capabilities.

To know about the assumptions considered for the study, Request for Free Sample Report

Remote Sensing Services Market Dynamics

Driver: Significant advancements in geospatial imagery analytics with introduction of AI and big data

Artificial intelligence (AI) is the simulation of human intelligence by various machines, particularly computer-based systems, to perform various tasks quickly with minimal errors. Similarly, deep learning is the ability of computers to recreate the processes or tasks that a human brain can perform. With advancements in geospatial technology, data collection frequency and volume are increasing exponentially. The primary challenge for various businesses across the globe is to manage huge amount of data. With AI and deep learning, machines can process gigabytes of satellite data and provide useful insights.

AI and deep learning are not only being used across various industries, such as healthcare, finance, advertising, retail, manufacturing, and transport, to perform various tasks quickly but are also transforming these industries. Satellite data service providers like Digital Globe (Maxar Technologies) and Planet Labs extensively use AI and deep learning to process large volumes of satellite imagery to automatically identify objects and patterns. Planet Labs has a dedicated solution for machine learning called Planet Analytics, which uses algorithms for processing daily satellite imagery and detecting and classifying objects.

The introduction of big data technology has increased growth opportunities for the emerging remote sensing services market, as big data technology can process large quantities of data in the shortest time possible. Thus, the demand for remote sensing services with AI and big data capabilities is expected to increase.

Restrains: Liability issues associated with UAV operations and services

Drones (UAV) are being adopted in numerous commercial and domestic industries, such as media & entertainment, and transport, logistics, and warehousing. However, they might witness faulty piloting and technical difficulties and fall on public structures, openly parked vehicles, and people, thereby impairing property or civilian injuries. As drones share the air space with airplanes, they can hinder the take-off or landing of a large commercial airplane. While malevolent acts may cause often anticipated worst-case scenarios, accidental or careless acts could also lead to considerable damages. Besides, numerous news stories have been reported of people witnessing drones invading their privacy by flying through their windows, hovering over their backyards, and recording their images at parks, beaches, and other events without permission.

Opportunities: Need for real-time data

Real-time data is an end-to-end solution which ensures that the information supply matches the intervention capability of end users. Decision-makers require up-to-date environmental information to manage natural resources more effectively. Integrated with geographic information system (GIS), remote sensing data can provide useful environmental information related to crops, forest status, coastal zones, natural hazards, and urban growth. However, to generate such information, users need effective and timely access to the data supply. EO provides up-to-the-minute observations for an area of interest.

Resource managers and other end users require relevant information for their decision-making processes. Satellite remote sensing provides timely and reliable information in the right format. Modern applications with a strong (near) real-time requirement are considered the best fit to provide overall monitoring combined with quality information for decision-making.

Challenges: Long-term data continuity for droughts, floods, and other natural disasters

Long-term, sustained data records are essential for operational drought monitoring to provide a meaningful historical context to establish the relative severity of a current drought compared to previous events. From a climate perspective, 30 years is the accepted minimum length of an observational data record required to obtain a representative sample of the distributional characteristics (i.e., normal range of conditions or values) of key drought variables such as precipitation. The observational records of most operational satellite-based instruments are much shorter. Advanced Very High-Resolution Radiometer (AVHRR) is a primary exception, with a series of sensors onboard National Oceanic and Atmospheric Administration (NOAA’s) family of polar-orbiting platforms with collected near-daily global image data since the early 1980s. However, many newer instruments such as MODIS and GRACE, which provide data products increasingly being used for drought monitoring, have data records that approach or exceed a decade in length. It is critical that remote sensing observations and products essential for drought monitoring be identified and that long-term data continuity plans ensure their continued availability into the future. Long-term data continuity is vital for building the historical records necessary for anomaly detection and maintaining a consistent and reliable data input for operational drought monitoring systems. This is the same in the case of floods and other natural disasters.

Need for real-time spatial observations of several atmospheric and land surface variables to predict drought risk is driving the Application segment

A drought is an event of prolonged shortages in the water supply, whether atmospheric, surface water or groundwater. A drought can last for months or years, or as few as 15 days. It can have a substantial impact on the ecosystem and agriculture of the affected region and cause harm to the local economy. As remote sensing provides real-time spatial observations of several atmospheric and land surface variables that can be used to estimate precipitation, evapotranspiration, soil moisture and vegetation conditions, such data can be used for assessment and monitoring of drought characteristics: its intensity, duration and spatial extent. When combined with modelling and forecasting of the water cycle, information on future drought can also be generated for drought preparedness.

Technological advancements and increasing UAVs adoption to drive the platform segment

The rapid development and growth of UAVs as a remote sensing platform, as well as advances in technologies and data systems, have resulted in an increasing demand for UAV-based remote sensing services in commercial and defense applications. Using drones with remote sensors for site characterization is relatively new but is rapidly being used because of several important technological developments, including improved battery efficiency; compact and lightweight onboard computers; increased data-storage capacity; and inexpensive, widely available, and generally reliable high-resolution lightweight cameras. These hardware changes are coupled with new practical features (for example, autonomous flight, which can precisely fly the drone along predetermined flight paths with limited human control). As a result, data collection that required workers to traverse difficult terrain on foot can now be performed with a drone. Drones also can fly into potentially hazardous areas, keeping people out of harm. Under Part 107 (US drone regulation), drones must fly at altitudes less than 400 ft above the ground, which is advantageous to spatial and spectral resolution for both passive and active sensors. Ease of drone deployment supports frequent, routine flight operations, allowing for better recording and understanding of temporal changes. Similarly, the evolution of drones is intricately connected to supporting advances in computer processing, which enables tremendous amounts of data to be acquired and processed in a relatively quick timeframe.

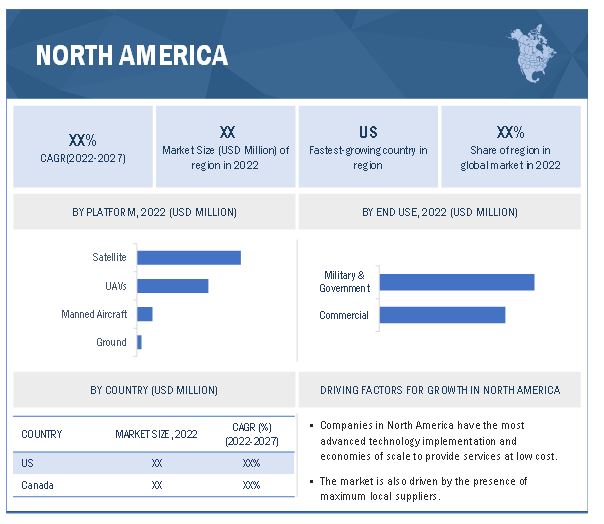

North America likely to emerge as the largest Remote Sensing Services market

The North America market has always been the largest for Remote Sensing Services. The implementation of advanced technology in remote sensing and its applications makes North America a leader in the remote sensing services market. In North America, American firms have begun to operate their imaging satellite systems, aiming to become an important part of the US remote sensing service industry. North America is mainly involved in specializing in remote sensing services, supporting a variety of high-end civil, military, and commercial customers in environmental, forestry, agricultural, industrial, and biomedical markets. It offers a wide range of remote sensing and surveying services, such as hyperspectral imaging, Light Detection and Ranging (LIDAR), and digital and thermal imaging, with resulting data fusion between these systems to provide hybrid products in various GIS and digital mapping formats.

To know about the assumptions considered for the study, download the pdf brochure

Top Remote Sensing Services Companies - Key Market Players

The Remote Sensing Services Companies are dominated by a few globally established players such as Maxar technologies (US), Planet Labs PBC (US), L3 Harris Technologies (US), Airbus SE (Netherlands), Trimble, Inc. (US) among others.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Application, By Platform, By End Use, By Technology, By Resolution, By Type |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Maxar technologies (US), Planet Labs PBC (US), L3 Harris Technologies (US), Airbus SE (Netherlands), Trimble, Inc. (US) are some of the major players of Remote Sensing Services market. (25 Companies) |

The study categorizes the Remote Sensing Services market based on application, platform, end use, resolution, technology, type and region.

By Application

- Agriculture

- Engineering & Infrastructure

- Environmental & Weather

- Energy & power

- Transportation & Logistic

- Defense & Security

- Maritime

- Insurance

- Academic & Research

- Others

By Platform

- Satellite

- UAVs

- Manned Aircraft

- Ground

By End Use

- Military & Government

- Commercial

By Resolution

- Spatial

- Spectral

- Radiometric

- Temporal

By Technology

- Active

- Passive

By Type

- Aerial Photography & Remote Sensing

- Data Acquisition & Analytics

By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

Recent Developments

- In June 2022, Planet Labs, Inc. and Bayer AG signed a contract where Planet Labs will provide SkySat data and professional services to Bayer to create collaborative solutions that help optimize seed production, improve supply chain efficiency and support sustainable agriculture.

- In April 2022, Maxar Technologies announced its strategic investment in Blackshark.ai, one of the leading providers of AI-powered geospatial analytics services. The partnership represents Maxar’s commitment to innovation within its 3D Earth Intelligence product portfolio.

- In December 2021, Maxar Technologies announced contract extensions with three long-standing international defense and intelligence customers. The three agreements worth more than USD 100 million and extend customers’ ability to directly task and download 30 cm-class satellite imagery to their ground stations from Maxar’s current constellation under Maxar’s Direct Access Program.

- In June 2021, The UK Royal Navy awarded a 12-month contract to Airbus covering the continued provision of satellite-based maritime surveillance services for the Joint Maritime Security Centre (JMSC).

Frequently Asked Questions (FAQ):

Which are the major companies in the Remote Sensing Services market? What are their major strategies to strengthen their market presence?

The Remote Sensing Services market is dominated by a few globally established players such as Maxar technologies (US), Planet Labs PBC (US), L3 Harris Technologies (US), Airbus SE (Netherlands), Trimble, Inc. (US) among others.

Contracts were the main strategy adopted by leading players to sustain their position in the Remote Sensing Services market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced Remote Sensing Services equipment

What are the drivers and opportunities for the Remote Sensing Services market?

The market for Remote Sensing Services has grown substantially across the globe, and especially in Asia Pacific, where increase in developing new technologies and procurement of new Remote Sensing Systems in countries such as China, India, and Japan, will offer several opportunities for Remote Sensing Services industry. The rising R&D activities to develop Remote Sensing Services are also expected to boost the growth of the market around the world. Adoption in applications such as precession agriculture, drought risk, asset monitoring, real estate inspection will be major driver for the market

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2022 to 2027, showcasing strong demand for use of Remote Sensing Services system in the region.

Which type of Remote Sensing Services segment is expected to significantly lead in the coming years?

UAV segment of the Remote Sensing Services market is projected to witness the highest CAGR. The growth of the Remote Sensing Services market can be attributed to the increased demand for cost effective services when compared to satellite based remote sensing services.

What are some of the technological advancements in the market?

Various research activities have been conducted by service providers across the globe to enhance Remote Sensing Services. Technologies such as hyperspectral and multiple-spectral imaging, synthetic aperture radar (SAR), advanced very high-resolution radiometer (AVHRR), wide field sensors for regional scale mapping are being widely adopted.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 REMOTE SENSING SERVICES MARKET: MARKETS COVERED

1.3.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN REMOTE SENSING SERVICES MARKET

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

FIGURE 4 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.1.2.2 Key data from primary sources

FIGURE 5 KEY DATA FROM PRIMARY SOURCES

2.1.2.3 Breakdown of primaries

2.1.3 DEMAND-SIDE INDICATORS

2.1.4 SUPPLY-SIDE ANALYSIS

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZING & FORECASTING

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 56)

FIGURE 9 AGRICULTURE SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 UAVS SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 MILITARY & GOVERNMENT SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 12 SPATIAL SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 13 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REMOTE SENSING SERVICES MARKET, 2022–2027

FIGURE 14 INCREASING ADOPTION OF UAVS IN REMOTE SENSING APPLICATIONS

4.2 REMOTE SENSING SERVICE MARKET, BY END USE

FIGURE 15 MILITARY & GOVERNMENT SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4.3 REMOTE SENSING SERVICES MARKET, BY TECHNOLOGY

FIGURE 16 ACTIVE SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 REMOTE SENSING SERVICE MARKET, BY TYPE

FIGURE 17 AERIAL PHOTOGRAPHY & REMOTE SENSING SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 REMOTE SENSING SERVICES MARKET, BY COUNTRY

FIGURE 18 INDIA AND CHINA EXPECTED TO WITNESS SIGNIFICANT GROWTH (2022-2027)

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 REMOTE SENSING SERVICES: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Significant advancements in geospatial imagery analytics with introduction of AI and big data

FIGURE 20 BIG DATA EARTH OBSERVATION VALUE CHAIN

5.2.1.2 Increasing need for remote sensing data in defense and commercial applications

5.2.1.3 Increased adoption of UAVs in agriculture for crop health assessment and precision farming

5.2.1.4 Technological developments and innovations in earth observation applications

FIGURE 23 BIG DATA EARTH OBSERVATION VALUE CHAIN

5.2.2 RESTRAINTS

5.2.2.1 Decreasing use of manned aircraft in remote sensing applications

5.2.2.2 Liability issues associated with UAV operations and services

5.2.3 OPPORTUNITIES

5.2.3.1 Need for real-time data

5.2.3.2 Subscription data and analytic solutions to address commercial market opportunity

5.2.4 CHALLENGES

5.2.4.1 Short-term data continuity for droughts, floods, and other natural disasters

5.2.4.2 Lack of awareness and interoperability issues

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: REMOTE SENSING SERVICES

5.4 OPERATIONAL DATA

TABLE 3 EARTH OBSERVATION SATELLITES: BY APPLICATION (AS OF DECEMBER 2021)

TABLE 4 EARTH OBSERVATION SATELLITES: BY COUNTRY (AS OF DECEMBER 2021)

5.5 TECHNOLOGY ANALYSIS

5.5.1 REAL-TIME ACQUISITION AND PROCESSING OF INTEGRATED DATA SYSTEMS (RAPIDS)

5.6 MARKET ECOSYSTEM

FIGURE 25 MARKET ECOSYSTEM MAP: REMOTE SENSING SERVICES MARKET

TABLE 5 MARKET ECOSYSTEM: REMOTE SENSING SERVICE

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR REMOTE SENSING SERVICE PROVIDERS

FIGURE 26 REVENUE SHIFT FOR REMOTE SENSING SERVICE MARKET

5.8 PRICING ANALYSIS

5.8.1 AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

TABLE 6 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD PER HOUR)

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 REMOTE SENSING SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 REMOTE SENSING SERVICE: PORTER’S FIVE FORCE ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 UNITED NATIONS’ PRINCIPLES ON REMOTE SENSING OF EARTH FROM OUTER SPACE

5.11 KEY CONFERENCES & EVENTS, 2022-2023

TABLE 13 REMOTE SENSING SERVICES MARKET: CONFERENCES & EVENTS

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE PLATFORMS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE PLATFORMS (%)

5.12.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

TABLE 15 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

6 INDUSTRY TRENDS (Page No. - 89)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 HYPERSPECTRAL AND MULTIPLE-SPECTRAL IMAGING

6.2.2 SYNTHETIC APERTURE RADAR (SAR)

6.2.3 ADVANCED VERY HIGH-RESOLUTION RADIOMETER (AVHRR)

6.2.4 WIDE FIELD SENSORS FOR REGIONAL SCALE MAPPING

6.2.5 SPATIAL ANALYSIS & GIS

6.2.6 RADAR INTERFEROMETRY

6.2.7 ADVANCEMENT IN ON-BOARD SENSOR TECHNOLOGIES

6.2.8 DECISION SUPPORT SYSTEM (DSS)

6.2.9 LIDAR REMOTE SENSING

6.3 USE CASES: REMOTE SENSING SERVICES

6.3.1 USE CASE: SATELLITE IMAGERY FOR OIL SPILL RESPONSE

6.3.2 USE CASE: SAR IMAGERY PROVIDED INFORMATION ON FLOODING IN BAHAMAS

6.3.3 USE CASE: PROVISION OF REAL-TIME DATA FOR EMERGENCY SYSTEMS

6.3.4 USE CASE: SATELLITE IMAGERY UNVEILED EXPENSIVE INFRASTRUCTURE WORK

6.4 PATENT ANALYSIS

TABLE 16 PATENTS RELATED TO REMOTE SENSING SERVICES MARKET, GRANTED BETWEEN 2018 AND 2022

6.5 IMPACT OF MEGATRENDS

6.5.1 DEVELOPMENT OF FEASIBLE SOLUTIONS FOR DEBRIS REMOVAL

6.5.2 SHIFT IN GLOBAL ECONOMIC POWER

7 REMOTE SENSING SERVICES MARKET, BY APPLICATION (Page No. - 97)

7.1 INTRODUCTION

FIGURE 30 AGRICULTURE SEGMENT EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 REMOTE SENSING SERVICE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 AGRICULTURE

7.2.1 PRECISION FARMING

7.2.1.1 Need for technology to increase yield

7.2.2 DROUGHT RISK

7.2.2.1 Demand for real-time spatial observation of atmospheric and land surface variables

7.2.3 CROP HEALTH ASSESSMENT

7.2.3.1 Remote sensing imagery to monitor global food supply

7.3 ENGINEERING & INFRASTRUCTURE

7.3.1 INDUSTRIAL AND ASSET MAPPING

7.3.1.1 Satellite date enhances site planning and mapping

7.3.2 LAND & URBAN MANAGEMENT

7.3.2.1 Growing need for remote sensing services for soil sealing, urban greenery, and brownfield monitoring

7.4 ENVIRONMENTAL & WEATHER

7.4.1 GLOBAL CLIMATE CHANGE

7.4.1.1 Remote sensing helps compare climatic factors

7.4.2 LAND COVER & CHANGE DETECTION

7.4.2.1 Need for accurate and updated information on land cover

7.4.3 NATURAL DISASTERS

7.4.3.1 Use of satellite imagery to warn about natural disasters

7.4.4 WEATHER FORECAST

7.4.4.1 Growing use of satellite data in weather monitoring

7.4.5 FOREST COVER MAPPING

7.4.5.1 Use of satellite observations to approximate forest area classes

7.4.6 WETLAND MONITORING

7.4.6.1 Increased demand for remote sensing systems to prevent loss of wetland ecosystems

7.5 ENERGY & POWER

7.5.1 MINING & MINERAL EXPLORATION

7.5.1.1 Increased use of hyperspectral remote sensing services in extraction of mineral deposits

7.5.2 OIL & GAS OPERATION

7.5.2.1 Need for enhanced safety in operations

7.5.3 RENEWABLE ENERGY SOURCES

7.5.3.1 Increased use of satellite and UAV imagery with AI and big data in assessing renewable resources

7.5.4 UTILITY

7.5.4.1 Timeliness, cost-effectiveness, and accuracy of UAVs in monitoring power lines and wind turbines

7.6 TRANSPORTATION & LOGISTICS

7.6.1 TRANSPORTATION ROUTE PLANNING

7.6.1.1 Effectiveness of remote sensing imagery in monitoring road networks

7.6.2 TRANSPORTATION & LOGISTICS SITE PLANNING

7.6.2.1 Growing use of satellite imagery in generating contour maps and locating infrastructure assets

7.6.3 TRAFFIC MANAGEMENT

7.6.3.1 EO satellites relieve congestion on roads and monitor accidents

7.6.4 MONITORING OF AIRPORTS

7.6.4.1 Need for real-time data to track airfield development

7.7 MARITIME

7.7.1 PORT & HARBOR MONITORING

7.7.1.1 Enables operators and users gain information on vessels

7.7.2 COASTAL MANAGEMENT

7.7.2.1 Need for remote sensing techniques to survey waters and track marine activities

7.7.3 SEARCH & RESCUE

7.7.3.1 Increased use of satellite images in rescue and relief

7.7.4 MONITORING ILLEGAL FISHING

7.7.4.1 Growing use of radar imagery in tracking illegal fishing

7.8 DEFENSE & SECURITY

7.8.1 SURVEILLANCE & RECONNAISSANCE

7.8.1.1 Need to monitor enemy movement through reconnaissance satellites

7.8.2 CRITICAL INFRASTRUCTURE PROTECTION

7.8.2.1 Managing assets and ensuring safety standards

7.8.3 CRIME MAPPING

7.8.3.1 Effective use of GIS and satellite imagery in tracking criminals

7.8.4 BORDER SECURITY

7.8.4.1 Adoption of automatic identification system to enhance border security

7.8.5 TARGET TRACKING

7.8.5.1 Need for dynamic information on target areas

7.9 INSURANCE

7.9.1 FLOOD MONITORING

7.9.1.1 Rise in demand for assessment of estimated damage and to verify integrity of claims

7.9.2 PROPERTY DAMAGE ESTIMATION

7.9.2.1 Remote sensing imagery to assist during natural calamities

7.10 ACADEMIC & RESEARCH

7.10.1 GROWING USE OF SATELLITE IMAGERY BY UNIVERSITIES AND STUDENTS

7.11 OTHERS

8 REMOTE SENSING SERVICES MARKET, BY PLATFORM (Page No. - 114)

8.1 INTRODUCTION

FIGURE 31 UAVS SEGMENT EXPECTED TO RECORD HIGHEST CAGR

TABLE 19 MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 20 MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.2 SATELLITES

8.2.1 GEOPOLITICAL AND CLIMATIC EVENTS TO ESCALATE NEED FOR SATELLITE REMOTE SENSING

8.3 UAVS

8.3.1 TECHNOLOGICAL ADVANCEMENTS TO INCREASE ADOPTION OF UAVS

8.4 MANNED AIRCRAFT

8.4.1 GROWING USE OF AIRCRAFT FOR REMOTE SENSING APPLICATIONS

8.5 GROUND

8.5.1 GROWING USE OF GROUND-BASED PLATFORMS AS REMOTE SENSING INSTRUMENTS

9 REMOTE SENSING SERVICES MARKET, BY END USE (Page No. - 119)

9.1 INTRODUCTION

FIGURE 32 COMMERCIAL SEGMENT EXPECTED TO RECORD HIGHER CAGR

TABLE 21 REMOTE SENSING SERVICE MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 22 MARKET, BY END USE, 2022–2027 (USD MILLION)

9.2 MILITARY & GOVERNMENT

9.2.1 GROWING DEMAND FOR GEOGRAPHICAL INFORMATION SYSTEMS FOR MILITARY OPERATIONS

9.3 COMMERCIAL

9.3.1 NEED TO TRACK LARGE PROJECT DEVELOPMENTS, SHIPPING ROUTES, AND CONSTRUCTION SITES

10 REMOTE SENSING SERVICES MARKET, BY RESOLUTION (Page No. - 122)

10.1 INTRODUCTION

FIGURE 33 SPECTRAL SEGMENT EXPECTED TO RECORD HIGHEST CAGR

TABLE 23 REMOTE SENSING SERVICE MARKET, BY RESOLUTION, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY RESOLUTION, 2022–2027 (USD MILLION)

10.2 SPATIAL

10.2.1 CAPTURES MORE DETAIL THROUGH HIGH AND VERY HIGH-RESOLUTION IMAGES (10 TO 100 CM/PIXEL)

10.3 SPECTRAL

10.3.1 SPECTRAL RESOLUTION IMAGES HELP TACKLE CLIMATE CHANGE

10.4 RADIOMETRIC

10.4.1 NEED FOR FINER QUALITY IMAGES

10.5 TEMPORAL

10.5.1 PROVIDES MARITIME CUSTOMERS WITH OPTIMAL ROUTE RECOMMENDATIONS

11 REMOTE SENSING SERVICES MARKET, BY TECHNOLOGY (Page No. - 126)

11.1 INTRODUCTION

FIGURE 34 ACTIVE SEGMENT EXPECTED TO RECORD HIGHER CAGR

TABLE 25 REMOTE SENSING SERVICE MARKET, BY TECHNOLOGY, 2018–2021 (USD BILLION)

TABLE 26 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.2 PASSIVE

11.2.1 PANCHROMATIC IMAGERY

11.2.1.1 Provides higher spatial resolution for multispectral images

11.2.2 MULTI-SPECTRAL IMAGERY

11.2.2.1 Used in agriculture to manage crops, soil, fertilizing, and irrigation

11.2.3 PAN-SHARPENED IMAGERY

11.2.3.1 Provides high-resolution-colored images

11.2.4 HYPERSPECTRAL IMAGERY

11.2.4.1 Facilitates fine discrimination between different features on earth's surface

11.3 ACTIVE

11.3.1 SYNTHETIC APERTURE RADAR (SAR)

11.3.1.1 Provides highly accurate measurement of geophysical parameters

11.3.2 LIDAR

11.3.2.1 Increasing use for precise measurement of topographic features

11.3.3 GNSS REFLECTOMETRY (GNSS-R)

11.3.3.1 Used for effective weather modeling and prediction

12 REMOTE SENSING SERVICES MARKET, BY TYPE (Page No. - 131)

12.1 INTRODUCTION

FIGURE 35 AERIAL PHOTOGRAPHY & REMOTE SENSING SEGMENT EXPECTED TO RECORD HIGHEST CAGR

TABLE 27 REMOTE SENSING SERVICE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2 AERIAL PHOTOGRAPHY & REMOTE SENSING

12.2.1 GROWING DEMAND FOR SATELLITE AND UAV AERIAL PHOTOGRAPHY

12.3 DATA ACQUISITION & ANALYTICS

12.3.1 DEMAND FOR SUBSCRIPTION DATA AND ANALYTIC SOLUTIONS

13 REGIONAL ANALYSIS (Page No. - 134)

13.1 INTRODUCTION

TABLE 29 REMOTE SENSING SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 36 NORTH AMERICA: REMOTE SENSING SERVICE MARKET SNAPSHOT

TABLE 31 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.2.2 US

13.2.2.1 Rapid adoption of AI in satellite and UAV imagery

TABLE 39 US: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 41 US: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 42 US: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 43 US: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 44 US: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.2.3 CANADA

13.2.3.1 Growth of government-backed initiatives to enhance space technologies

TABLE 45 CANADA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 46 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 47 CANADA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 48 CANADA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 49 CANADA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 50 CANADA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.3 EUROPE

13.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 37 EUROPE: REMOTE SENSING SERVICES MARKET SNAPSHOT

TABLE 51 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 53 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Rapid expansion of remote sensing services for marine applications

TABLE 59 UK: REMOTE SENSING SERVICE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 61 UK: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 62 UK: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 63 UK: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 64 UK: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Need for global weather data collection system

TABLE 65 FRANCE: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 67 FRANCE: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 68 FRANCE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 69 FRANCE: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 70 FRANCE: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.3.4 GERMANY

13.3.4.1 Demand for effective monitoring of forests and critical infrastructure

TABLE 71 GERMANY: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 72 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 74 GERMANY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 75 GERMANY: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 76 GERMANY: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Adoption of UAVs to ensure sustainable agriculture

TABLE 77 ITALY: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 79 ITALY: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 80 ITALY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 81 ITALY: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 82 ITALY: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.3.6 SPAIN

13.3.6.1 Use of remote sensing services to aid military operations

TABLE 83 SPAIN: REMOTE SENSING SERVICE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 84 SPAIN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 SPAIN: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 86 SPAIN: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 87 SPAIN: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 88 SPAIN: MARKET, BY END USE, 20222027 (USD MILLION)

13.3.7 REST OF EUROPE

TABLE 89 REST OF EUROPE: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 91 REST OF EUROPE: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 92 REST OF EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

13.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 38 ASIA PACIFIC REMOTE SENSING SERVICES MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.4.2 CHINA

13.4.2.1 Robust network of satellites to monitor natural resources and detect environmental changes

TABLE 103 CHINA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 105 CHINA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 106 CHINA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 107 CHINA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 108 CHINA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Growing agriculture industry to widely adopt remote sensing services

TABLE 109 INDIA: REMOTE SENSING SERVICE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 111 INDIA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 112 INDIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 113 INDIA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 114 INDIA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.4.4 JAPAN

13.4.4.1 Use of remote sensing services to monitor natural disasters

TABLE 115 JAPAN: REMOTE SENSING SERVICE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 117 JAPAN: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 118 JAPAN: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 119 JAPAN: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 120 JAPAN: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.4.5 SOUTH KOREA

13.4.5.1 Growing use of drones to monitor assets and for remote inspection

TABLE 121 SOUTH KOREA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 123 SOUTH KOREA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 124 SOUTH KOREA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 125 SOUTH KOREA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 126 SOUTH KOREA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.4.6 AUSTRALIA

13.4.6.1 Growing use of UAVs in monitoring mines and oilfields

TABLE 127 AUSTRALIA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 128 AUSTRALIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 129 AUSTRALIA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 130 AUSTRALIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 131 AUSTRALIA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 132 AUSTRALIA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

TABLE 133 REST OF ASIA PACIFIC: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 137 REST OF ASIA PACIFIC: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 138 REST OF ASIA PACIFIC: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.5 MIDDLE EAST & AFRICA

13.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 139 MIDDLE EAST & AFRICA: REMOTE SENSING SERVICES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.5.2 SAUDI ARABIA

13.5.2.1 High adoption of remote sensing services to monitor oilfields and shipping routes

TABLE 147 SAUDI ARABIA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 148 SAUDI ARABIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 149 SAUDI ARABIA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 150 SAUDI ARABIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 151 SAUDI ARABIA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 152 SAUDI ARABIA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.5.3 UAE

13.5.3.1 Growing demand for asset monitoring in oil & gas industry

TABLE 153 UAE: REMOTE SENSING SERVICE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 154 UAE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 155 UAE: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 156 UAE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 157 UAE: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 158 UAE: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.5.4 ISRAEL

13.5.4.1 Increasing use of data analytics in environment monitoring

TABLE 159 ISRAEL: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 160 ISRAEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 161 ISRAEL: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 162 ISRAEL: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 163 ISRAEL: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 164 ISRAEL: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.5.5 SOUTH AFRICA

13.5.5.1 Growing demand for UAV remote sensing service for various applications

TABLE 165 SOUTH AFRICA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 166 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 167 SOUTH AFRICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 168 SOUTH AFRICA:MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 169 SOUTH AFRICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AFRICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 171 REST OF MIDDLE EAST & AFRICA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 173 REST OF MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 174 REST OF MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 175 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 176 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.6 LATIN AMERICA

13.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 177 LATIN AMERICA: REMOTE SENSING SERVICES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.6.2 BRAZIL

13.6.2.1 Need for remote sensing and GIS in Amazon forests

TABLE 185 BRAZIL: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 186 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 187 BRAZIL: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 188 BRAZIL: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 189 BRAZIL: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 190 BRAZIL: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.6.3 MEXICO

13.6.3.1 Promoting satellite and UAV imagery to aid agriculture industry

TABLE 191 MEXICO: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 192 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 193 MEXICO: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 194 MEXICO: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 195 MEXICO: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 196 MEXICO: MARKET, BY END USE, 2022–2027 (USD MILLION)

13.6.4 REST OF LATIN AMERICA

TABLE 197 REST OF LATIN AMERICA: REMOTE SENSING SERVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 198 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 199 REST OF LATIN AMERICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 200 REST OF LATIN AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 201 REST OF LATIN AMERICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 202 REST OF LATIN AMERICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

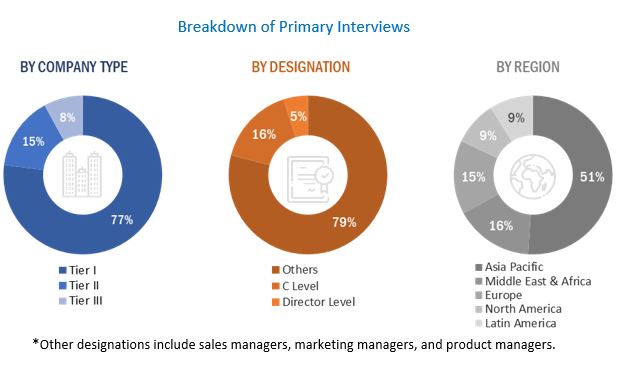

The study involved various activities in estimating the current size of the Remote Sensing Services market. Exhaustive secondary research was done to collect information on the Remote Sensing Services market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Remote Sensing Services market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the service portfolios of major companies. These companies were rated on the basis of performance and quality of their services. These data points were further validated by primary sources.

Secondary sources referred to, for this research study include financial statements of companies offering Remote Sensing Services systems, services and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Remote Sensing Services market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Remote Sensing Services market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Remote Sensing Services market. The research methodology used to estimate the size of the market includes the following details:

The key players in the Remote Sensing Services market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as CEOs, directors, and marketing executives of leading companies operating in the Remote Sensing Services market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Remote Sensing Services market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Remote Sensing Services Market Size: Bottom-Up Approach:

Data Triangulation

After arriving at the overall size of the Remote Sensing Services market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from both, the demand and supply sides. The market size was validated using both, the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the Remote Sensing Services market based on application, platform, end use, resolution, technology, type and region

- To analyze the degree of competition in the market by identifying various parameters, including key market players

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the Remote Sensing Services market

- To analyze the macro and micro indicators of the market and provide a factor analysis

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with the major countries in each region

- To strategically profile key market players and comprehensively analyze their market rankings and core competencies

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, and new product launches & developments of key players in the Remote Sensing Services market

- To identify detailed financial positions, key products, and key developments of leading companies in the Remote Sensing Service market

- To identify industry trends, market trends, and technology trends currently prevailing in the Remote Sensing Service market

- To strategically analyze micro markets with respect to individual technological trends and prospects of the Remote Sensing Services market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Remote Sensing Services market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Remote Sensing Services market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Sensing Services Market