Vehicle Electrification Market

Vehicle Electrification Market by Product Type (Start-Stop, EPS, EHPS, Liquid Heater PTC, Electric A/C Compressor, Electric Vacuum Pump, Electric Oil Pump, Electric Water Pump, ISG), Propulsion, DOH, Vehicle Type, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

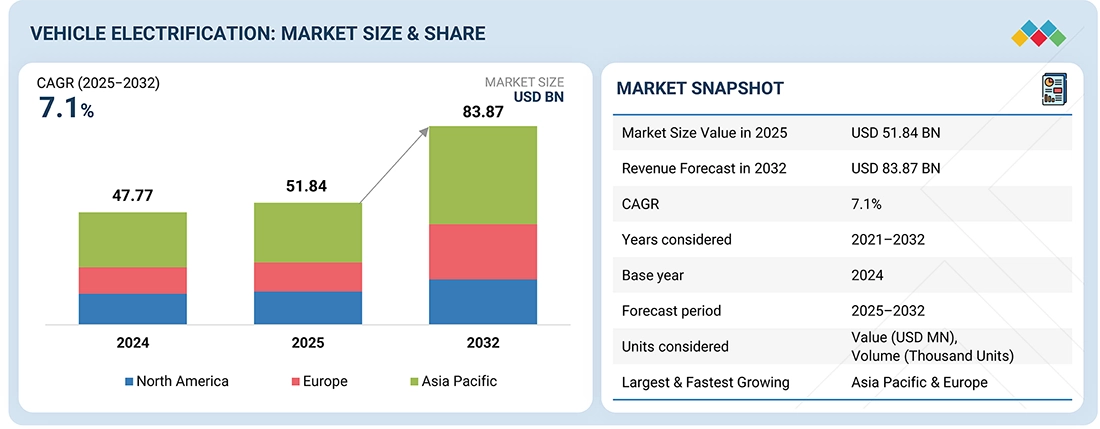

The global vehicle electrification market is projected to grow from USD 51.84 billion in 2025 to USD 83.87 billion by 2032 at a CAGR of 7.1% driven by the accelerating adoption of electric and hybrid vehicles worldwide. In electrified architectures, components can run only when needed, optimize energy use, improve response times, and support advanced thermal and comfort management for hybrid and electric vehicles. lower parasitic losses, allow for modular system design, and facilitate predictive diagnostics and easy integration with smart energy management. Challenges include higher upfront cost, packaging constraints, increased system complexity, and the need for more robust thermal management and software integration, especially as battery voltage, duty cycles, and load profiles vary under real-world operating conditions

KEY TAKEAWAYS

-

BY NAVIGATION TECHNOLOGYLaser-guided navigation holds a dominant position in the autonomous forklift market owing to its high precision offering millimeter-level accuracy and its ability to function without reliance on physical markers or magnetic tapes. This makes it particularly suitable for high-density and dynamically changing warehouse environments. Its capability to generate and update spatial maps in real time ensures consistent operational performance even under low light or reflective surfaces, where vision or magnetic based systems often struggle. The Asia Pacific region is projected to account for the largest share of this technology, primarily due to its lower implementation cost relative to LiDAR-based systems, making it a preferred choice in cost-sensitive markets.

-

BY APPLICATIONThe material handling segment holds the largest share of the autonomous forklift market, as tasks like stacking and precise load placement require advanced navigation and accurate localization to coordinate with automated storage systems and prevent collisions. In manufacturing, autonomous forklifts are commonly used to store and retrieve materials for production processes. Models below 5 tons are particularly favored by OEMs, incorporating technologies such as barcodes, cameras, and RFID to enable fast and reliable product identification.

-

BY TONNAGE CAPACITYBelow 3-ton autonomous forklifts are used primarily for indoor applications in e-commerce, retail, and 3PL warehouses to handle lighter loads such as pallets and cartons. These forklifts operate efficiently in narrow aisles and can be easily retrofitted into existing warehouse layouts, making them the most practical and scalable platform for automation deployment. Whereas above 5-ton autonomous forklifts are heavy-duty machines used in steel plants, metal factories, and logistics yards. Typically powered by diesel or gasoline engines used mainly for outdoor industrial operations.

-

BY FUEL SOURCEElectric autonomous forklifts are projected to dominate the market in 2025, driven by their ability to integrate seamlessly with automated warehouse systems, improving operational efficiency and reducing overall costs. Meanwhile, hydrogen fuel cell forklifts are gaining traction among companies prioritizing sustainability, as they deliver zero emissions during operation. Leading manufacturers such as Toyota, Hyster-Yale, and Linde are at the forefront of offering a diverse range of hydrogen-powered forklift solution

-

BY TYPECountries such as China, Japan, South Korea, and India are experiencing rapid industrial growth, driving the demand for automation in warehouses and manufacturing facilities. The rise of e-commerce players like Lazada (China), Rakuten (Japan), and Flipkart (India) has also led to a surge in warehouse automation, where indoor autonomous forklifts improve efficiency and throughput.

-

BY FORKLIFT TYPEPallet jack segment holds the largest share of the autonomous forklift market in 2025 due to its cost-effectiveness, compact design, and suitability for handling lighter loads in confined spaces. The versatility and efficiency of pallet jacks make them suitable for industries requiring frequent material movement, especially over short distances. These jacks are widely used in the e-commerce, retail, and food & beverage industries.

-

BY SALES CHANNELLeasing autonomous forklifts offers companies, especially small and medium-sized enterprises (SMEs), a cost-effective way to access advanced material handling equipment without the significant upfront capital expenditure. This makes it attractive to businesses looking to improve operational efficiency without a significant financial burden.

-

BY END-USE INDUSTRYThe food & beverage industry is at the forefront of adopting autonomous forklifts, driven by the need to handle perishable goods and the demand for automated processes. Major production hubs such as China and India are expanding their manufacturing and warehousing capabilities, while government initiatives support automation and infrastructure development.

-

BY REGIONAsia Pacific is expected to dominate the autonomous forklift market by 2032, subject to rapid industrialization, expansion of manufacturing hubs, and the growth of e-commerce in China, India, and Japan. According to the National Bureau of Statistics, China alone added USD 5,524.45 million (39,910.3 billion yuan) to the industrial sector in 2023, up by 4.2% over the previous year. This offers a lucrative opportunity for the autonomous forklift market in the region.

-

COMPETITIVE LANDSCAPEThe autonomous forklift market is led by globally established players such as Toyota Industries Corporation (Japan), KION Group AG (Germany), Jungheinrich AG (Germany), and Hyster-Yale Materials Handling, Inc. (US). These companies adopted product launches/developments, partnerships, agreements, mergers & acquisitions, expansions, and contracts to gain traction in the high-growth autonomous forklift market.

The adoption of Industry 4.0 practices and the demand for seamless data exchange with warehouse management and ERP systems are fueling interest in connected, software-defined forklifts capable of collaborative operation within smart factories. Emerging applications in healthcare logistics supported by partnerships between robotics firms and healthcare providers are also expanding market opportunities. However, the industry continues to face challenges such as high initial investment costs, limited interoperability between autonomous systems and legacy infrastructure, and the need for extensive mapping and integration customization, all of which can constrain large-scale deployment across diverse facilities.

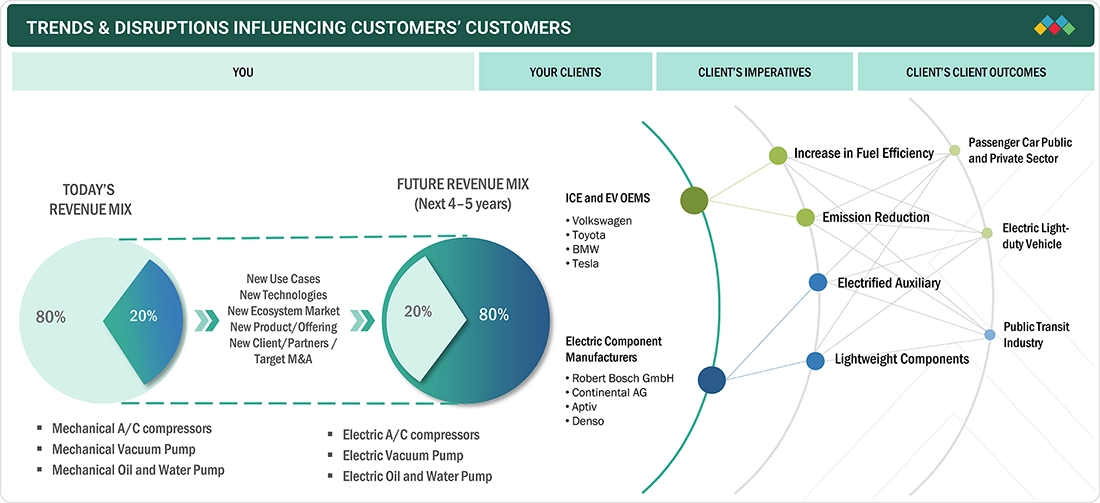

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The vehicle electrification market at the component level is being reshaped by the rapid shift from mechanical to electric auxiliary systems such as EPS, e-pumps, and ISG, driven by stringent emission norms and fuel-efficiency regulations. Advancements in 48V mild-hybrid and high-voltage architectures are accelerating adoption across segments. Additionally, trends like thermal management optimization, lightweight integration, and software-driven control of electrified components are disrupting traditional supply chains and creating new opportunities for Tier-1 suppliers and OEM collaborations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Elevated consumer demand for safety and convenience features

-

•Rise in global adoption of EV

Level

-

•High cost of electric components

Level

-

•Shift toward software-defined vehicles

-

•Need for intelligent thermal management

Level

-

•Complex integration with ICE platforms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Electrification of Auxiliary Vehicle Components

Electrification of auxiliary vehicle components is increasing at a rapid pace as it decouples them from the combustion engine, enabling precise on-demand operation, smaller packaging, and easier integration into EVs and hybrids. While full electrification of these systems can raise vehicle bill of materials costs by approximately 5–8%, it typically delivers 10–15% lifecycle energy savings> the savings are owing to lower parasitic losses, faster warm-up/cooling, reduced maintenance, and these also support compliance with fleet CO2/efficiency targets. Strategically, OEMs view this as a cost-to-value trade-up that enhances customer TCO, simplifies platform modularity, and positions them for future zero-emission regulations

Restraint: High Cost and Technical Challenges of Electric Components

The shift from mechanical to electric auxiliary systems such as pumps, compressors, and steering units creates major cost challenges for OEMs and suppliers. Electrified components with brushless motors, sensors, and control electronics are two to four times more expensive than conventional parts, significantly raising the Bill of Materials (BOM). Added software requirements, customization for voltage and packaging, and retrofit difficulties further increase complexity and R&D spending. In cost-sensitive markets like India, these higher expenses outweigh efficiency and noise benefits, making cost and scalability key barriers to wider adoption. Along with cost, there are other key hurdles too. Managing heat under heavy loads (like PTC heaters in cold climates), finding space for extra cooling and power electronics, and balancing electrical loads all add complexity. These issues increase R&D efforts, reduce efficiency if not handled well, and sometimes force redesigns of vehicle systems. Together, they slow down adoption in lower-priced vehicles and cost-sensitive markets

Opportunity: Intelligent Thermal Management

The shift to electrified mobility in BEVs, PHEVs, and advanced ICE platforms has made smart thermal management critical for performance. Unlike fixed-speed mechanical pumps, electric cooling systems adjust flow and pressure in real time, cutting energy use, extending life, and improving efficiency. Integrated with sensors and connectivity, components like electric pumps and compressors enable predictive maintenance and reliability for fleets and premium vehicles. Advanced designs manage batteries, electronics, and cabins under all conditions, with innovations like HIGHLY Group’s lightweight thermal modules and low-temperature heat pump compressors. As 400V–800V architectures grow, intelligent thermal management is becoming essential for durability, efficiency, and sustainability

Challenge: Integration with ICE Platforms

Integrating electrified components into existing ICE platforms poses major engineering and cost challenges. Conventional ICEs depend on belt-driven auxiliaries, while replacing them with electric systems requires redesigning electrical, thermal, and mechanical architectures. Many legacy platforms lack high-voltage wiring, control units, and communication protocols, demanding added ECUs, sensors, and software for effective operation. Retrofitting raises BOM costs, extends development timelines, and often requires custom designs per OEM. In cost-sensitive segments, the efficiency gains may not outweigh the added complexity and expense, slowing adoption

vehicle-electrification-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Replace hydraulic steering with a motor-driven, electronically-controlled steering assist (servo/EPS) that integrates with ADAS and steer-by-wire. Used across passenger cars and light commercial vehicles | Eliminates hydraulic pump parasitic losses, improves vehicle electrical efficiency. Enables easy integration with ADAS |

|

Electrically-driven PTC liquid heaters (or PTC water heaters) provide fast cabin warm-up and local heating for battery thermal management in BEVs / PHEVs where engine waste heat is not available. | Fast cabin heating improves perceived range (less heater draw from HV battery at cold start). Precise thermal control for battery life & charge performance. |

|

ISG replaces conventional starter & alternator with a single motor/generator that enables smooth start/stop, torque assist (mild hybrid), and regenerative energy capture. Common in 48V and high-voltage mild hybrids. | Improves fuel economy through longer engine-off operation and regenerative recovery. Seamless, fast restarts and added low-end torque for drivability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The vehicle electrification market ecosystem connects raw material suppliers, component manufacturers, Tier-1 integrators, OEMs, and end users, with regulatory bodies and R&D, driving compliance and innovation. Raw materials like lithium and copper flow into components such as motors, inverters, and pumps, which Tier-1s assemble into systems for OEMs. Adoption by customers and fleets fuels demand and market growth

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

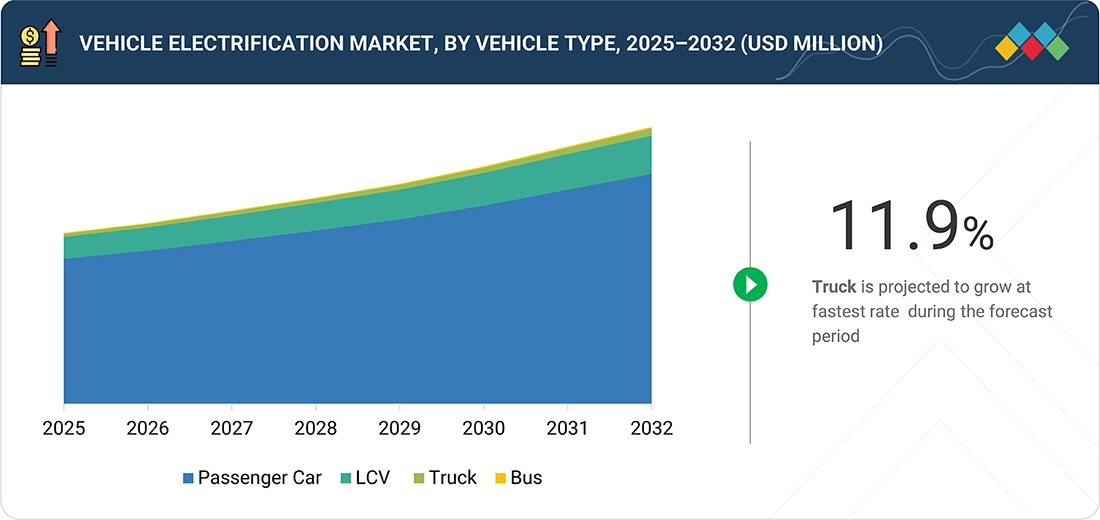

Vehicle Electrification Market, By Vehicle Type

Passenger car holds the largest market of vehicle electrification by vehicle type. ICE passenger cars such as full-size SUVs predominantly adopt EHPS for higher torque demand, whereas sedans, mid-size vehicles, compact SUVs, and hatchbacks are equipped with EPS for better efficiency and lighter packaging. Mild hybrids with 48V batteries help cars use less fuel and produce fewer emissions by powering electric pumps, starters, and power steering. Increasing production volumes of EVs and the growing need for advanced driver assistance systems (ADAS) make EPS modules, electric oil pumps, and electric brake boosters some of the largest and fastest-growing components in PCs. In trucks and buses, demand is shifting toward high-output electric water/oil pumps, liquid heater PTCs, and 24V/48V EPS/EHPS systems, which are critical for thermal management and steering. These components are expanding quickly as OEMs electrify powertrains and adopt stricter emission standards.

Vehicle Electrification Market, By DOH

BEVs are growing at the fastest rate, led by countries in Europe and China. The biggest share comes from large batteries and fast-charging systems, while electric motors and heat pumps are among the fastest-growing parts. In HEVs, small batteries and motors dominate, but electric pumps and A/C compressors are gaining importance as more functions get electrified. PHEVs rely most on medium batteries and charging ports, with Europe leading adoption. Across all types, batteries remain the largest cost driver, while electric pumps, compressors, and heaters are seeing the fastest growth

Vehicle Electrification Market, By Propulsion & Product Type

Electrification is moving at faster rate in auxiliary components like electric compressors, pumps, and PTC heaters, which replace belt-driven parts and support hybrid/EV systems. OEMs focus on 48V and high-voltage platforms to meet fuel-saving and emission goals, while Tier-1 suppliers compete on efficiency and packaging strategies. Batteries remain the cost drivers, but smart electrified auxiliaries are emerging as the key differentiators in the market

REGION

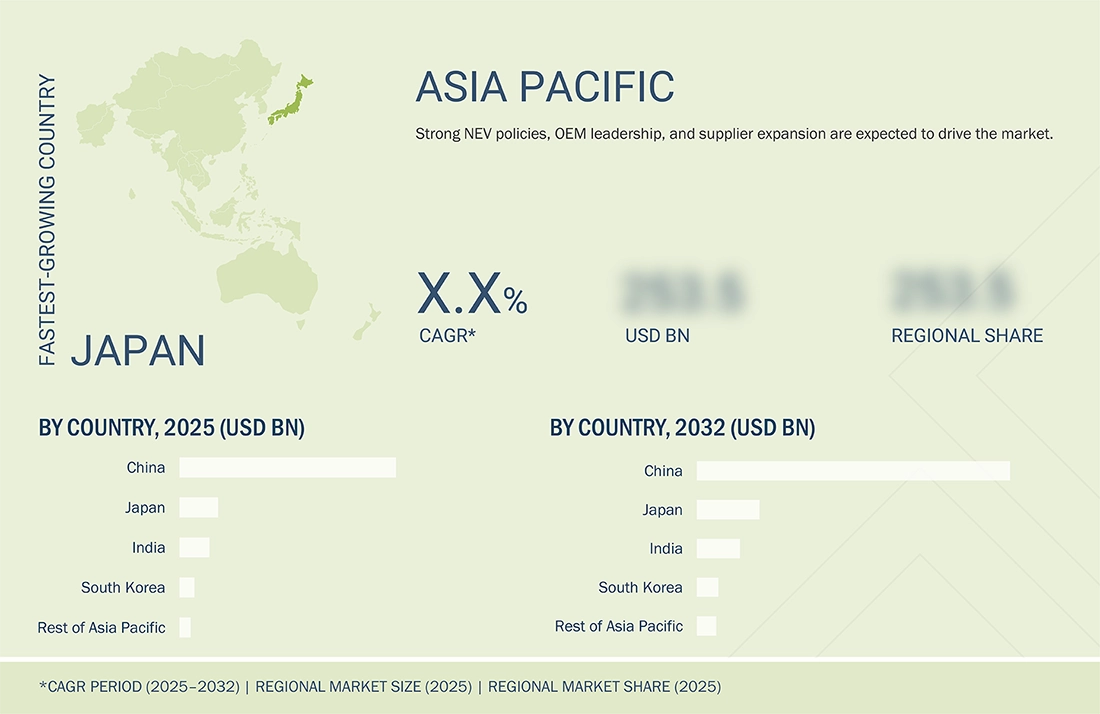

Asia Pacific to be the largest region in the global vehicle electrification market during forecast period

Asia Pacific leads the vehicle electrification market, driven by regulations, local manufacturing, and rapid EV and hybrid adoption. China dominates with NEV mandates and dual-credit policies, boosting demand for EPS, e-compressors, and electric pumps across ICE, HEV, and PHEV platforms. Key technologies driving this growth are electric pumps, efficient battery systems, and e-axles, which support better range and performance.

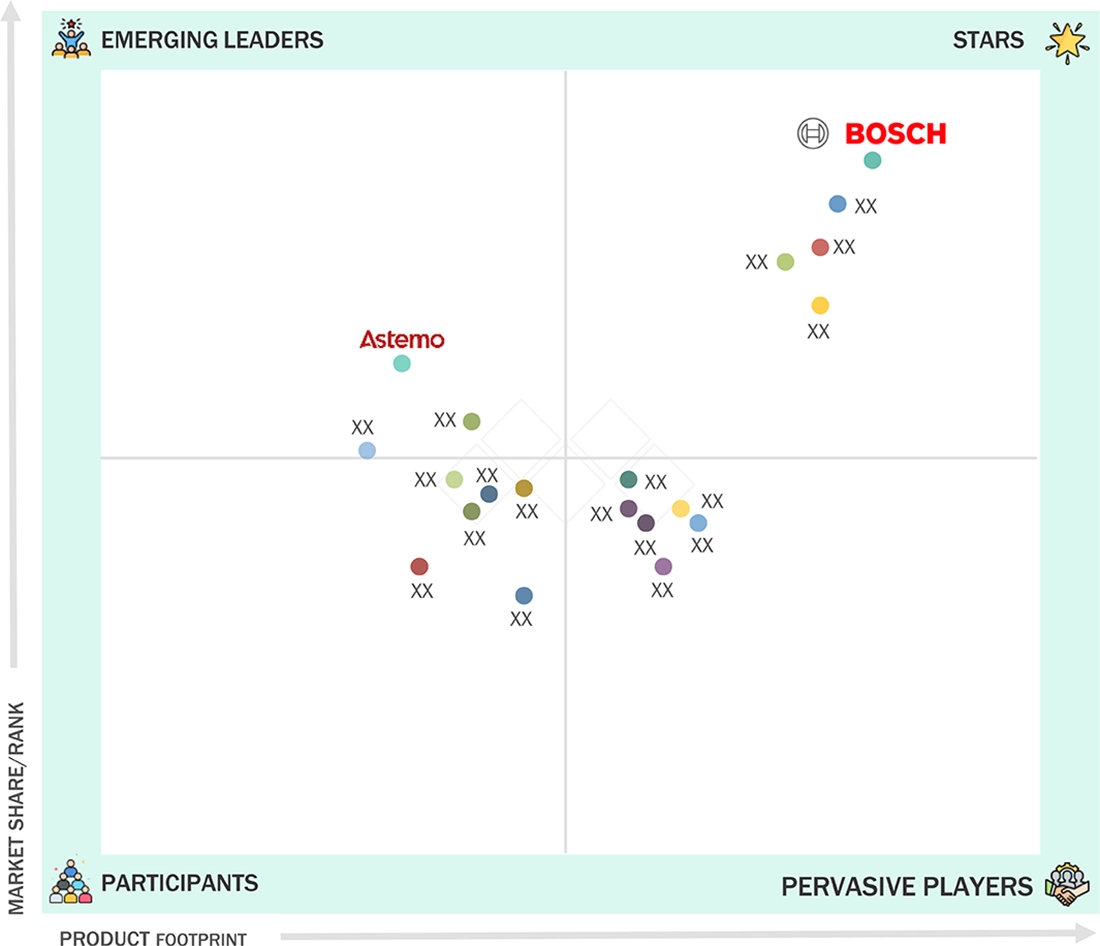

vehicle-electrification-market: COMPANY EVALUATION MATRIX

Microquadrant provides information on major players that offer vehicle electrification products and outlines the findings and analysis of how well each vendor performs within the predefined criteria. The company evaluation matrix for the vehicle electrification market positions players based on market share/rank and product footprint. Firms in the Stars quadrant, Robert Bosch GmbH, leads the vehicle electrification market with strong market presence and wide product portfolios

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Robert Bosch GmbH

- Continental AG

- Aptiv

- DENSO Corporation

- Borgwarner Inc.

- • Mitsubishi Motor Corporation

- • Magna International Inc

- • Aisin Corporation

- • Nidec Corporation

- • Valeo

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 51.84 BILLION |

| Market Size Forecast in 2032 | USD 83.87 BILLION |

| Growth Rate | 7.1% |

| Actual data | 2021 – 2032 |

| Base year | 2024 |

| Forecast period | 2025 - 2032 |

| Units considered | USD MILLION AND THOUSAND UNITS |

| Report Coverage | Revenue forecast, Regional Market Shares, Competitive Landscape, Driving factors, Trends & Disruption, and others |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America and Rest of the World |

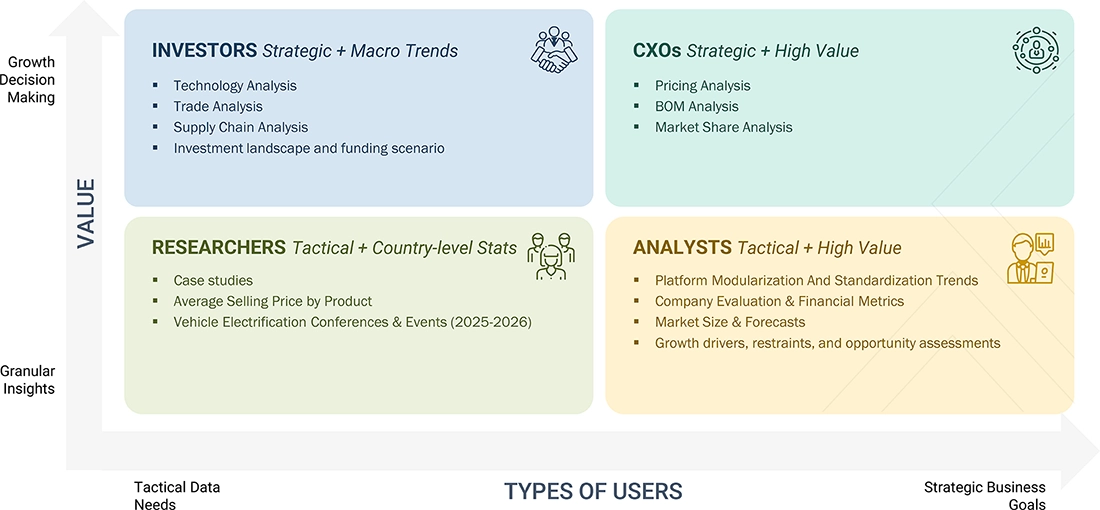

WHAT IS IN IT FOR YOU: vehicle-electrification-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| 48V MARKET, BY COMPONENT AND REGION | • Regional level makret for components auch a Start-Stop System, Electric Power Steering (EPS), Liquid Heater PTC, Electric A/C Compressor, Electric Vacuum Pump, Electric Oil Pump, Electric Water Pump, Integrated starter generator is given | • Granular understanding of electrification maturity by region. |

RECENT DEVELOPMENTS

- August 2025 : DENSO, BluE Nexus Corporation, and AISIN Corporation jointly developed an eAxle system, which is now installed in Isuzu’s inaugural battery-electric pickup truck, the D-MAX EV. The D-MAX EV has recently entered production (April 2025) and is being rolled out across major regions, including Europe, demonstrating the suitability of the eAxle solution for diverse markets.

- May 2025 : DENSO and ROHM partnered to co-develop analog ICs and automotive semiconductors supporting vehicle electrification and vehicle intelligence, deepening their collaboration in semiconductor innovation

- April 2025 : Mitsubishi Electric Mobility, a division of Mitsubishi Motors Corporation, signed an integration agreement with Stanley Electric to form a new joint venture focused on advanced automotive lamps for next-generation EVs and xEVs. This reinforces their ecosystem expansion around electrified vehicle components and intelligent systems

- October 2024 : Bosch and JMCG formed a joint venture (JV) (Bosch 60%/JMCG 40%) to develop and produce electric drive axles for light-duty commercial vehicles, with registered capital of EUR 63 million (USD 73.7 million).

- October 2024 : Mitsubishi Electric Mobility and AISIN entered a collaboration to develop components for next-generation electrified vehicle platforms. This includes work on motor generators, inverters, and integrated systems to support new hybrid and EV product lines

Table of Contents

Methodology

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, EV magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the vehicle electrification market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

Secondary sources for this research study included the vehicle electrification industry association, internal databases, corporate filings (such as annual reports, investor presentations, and financial statements), and data from trade and business. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

In the primary research process, several primary interviews were conducted with market experts from the demand and supply sides across major regions: North America, Europe, Asia Pacific, and the RoW. 32%, 40% and 26% of primary interviews were conducted with the OEMs, Tier 1 players, and Tier 2 players, respectively.

Primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to validate the findings from the primaries. This and insights by in-house subject-matter experts led to the conclusions described in the remainder of this report.

Note: Others include sales, marketing, and product managers.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The bottom-up approach derived the market size based on volume and value. This was followed by primary interviews and feature mapping on a regional basis from the MarketsandMarkets repository.

- The market size was validated through in-depth interviews with industry experts—excerpts available in the discussion guide in the appendix—and secondary research. The report-writing phase begins after arriving at the final numbers for the market size.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach was used to estimate and validate the size of the vehicle electrification market. In this approach, the country-level sales of each vehicle type (passenger cars, LCVs, trucks, and buses) was identified through country-level associations, paid databases like Marklines, EV Volumes, and non-profit organizations like OICA. The vehicle sales forecast in each country was carried out based on multiple factors, such as country-wise macroeconomic indicators, emission regulations, automotive industry growth, GDP growth, and government initiatives.

Further, determining the vehicle electrification market in terms of volume, country-level penetration/ installation trends for each electrified component in each vehicle type was identified through model mapping for each country. The number of electric components per vehicle type was derived through secondary research and validated by industry experts.

The country-level vehicle type sales was then multiplied by the country-level penetration/ installation trend of each electrified component in each vehicle type, and the number of electric components installed in each vehicle type gave the country-level vehicle electrification market by vehicle type and by product type in terms of volume.

The country-level average selling price of each component installed in each vehicle type was derived through secondary sources and further validated by industry experts. The country-level vehicle electrification market volume, by product type, was multiplied by the average selling price of component, gives the vehicle electrification market in terms of value (USD million) by vehicle type and product type.

Further, the summation of country-level markets provided the regional-level markets in terms of volume (thousand units) and value (USD million). A further summation of regional-level markets provided the global vehicle electrification market in terms of volume (thousand units) and value (USD million) by region and product type.

A similar methodology has been followed for the vehicle electrification market of EVs (BEV, HEV, and PHEV) based on component.

Vehicle Electrification Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition

The electrification of the conventional mechanically operated systems and components in the vehicle can be referred to as vehicle electrification. Over the last ten years, the automotive sector has shifted its focus to vehicle electrification, owing to certain key influencing factors such as the increasing and volatile oil prices, deteriorating urban air quality, and climate change. The electrification of systems and components improves efficiency and helps reduce weight. Weight reduction further helps improve the fuel economy and reduce emissions.

Stakeholders

- Automotive sector associations, government authorities, and research organizations

- Automobile manufacturers

- Component manufacturers of various electrification products

- Raw material suppliers for electrification product manufacturers

- Traders, distributors, and suppliers of vehicle electrification systems/components

Report Objectives

-

To define, describe, and forecast the size of the global vehicle electrification market in terms of value (USD million) and volume (thousand units)

- By Vehicle Type (Passenger Car, LCV, Truck, Bus)

- By Degree of Hybridization (ICE & Micro Hybrid Vehicle, BEV, PHEV, HEV)

- By Propulsion & Product Type (ICE –[Start-Stop, EPS, EHPS, Liquid heater PTC, Electric A/C Compressor, Electric Vacuum Pump, Electric Oil Pump, Electric Water Pump, Integrated Starter Generator], BEV – [EHPS, Liquid heater PTC, Electric A/C Compressor, Electric Vacuum Pump, Electric Water Pump], PHEV – [Start-Stop, EPS, EHPS, Liquid heater PTC, Electric A/C Compressor, Electric Vacuum Pump, Electric Oil Pump, Electric Water Pump, Integrated Starter Generator], HEV – [Start-Stop, EPS, Liquid heater PTC, Electric A/C Compressor, Electric Vacuum Pump, Electric Oil Pump, Electric Water Pump, Integrated Starter Generator])

- Country-level analysis of product type segments (Asia Pacific, Europe, North America, and RoW)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To strategically analyze the market with trade analysis, pricing analysis, case study analysis, patent analysis, technology analysis, regulatory analysis, key conferences and events, trends/disruptions impacting buyers, investment, and funding case scenario

- To analyze the competitive landscape of the global players in the market, along with their market share/ranking

- To analyze the competitive leadership mapping of the global and regional vehicle electrification product suppliers in the market

- To analyze a detailed listing of mergers & acquisitions, partnerships, collaborations, joint ventures, expansions, and product launches/developments undertaken by critical participants in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations per company-specific needs.

The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Vehicle Electrification market, by product type, at the country level

- Vehicle Electrification market, by propulsion type, at the country level

- Vehicle Electrification market, by vehicle type, at the country level

Key Questions Addressed by the Report

What is the current size of the global vehicle electrification market?

The global vehicle electrification market is projected to reach USD 83.87 billion by 2032 from USD 51.84 billion in 2025, with the Asia Pacific dominating the market.

Which vehicle type is currently leading the vehicle electrification market?

Passenger cars are leading the vehicle type segment of the vehicle electrification market.

Many companies operate in the vehicle electrification market worldwide. Do you know who the front leaders are and what strategies they have adopted?

The vehicle electrification market is dominated by major players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (Japan), BorgWarner Inc. (US), and Aptiv (Ireland). Major companies' key strategies to maintain their position in the global market are vital global networking, mergers & acquisitions, partnerships, and technological advancements.

How does the demand for vehicle electrification vary by region?

Asia Pacific is the largest vehicle electrification market in terms of value and volume. In 2025, China was the largest market, followed by Japan, India, and South Korea, in the Asia Pacific.

What are the drivers and opportunities for vehicle electrification component suppliers?

The growth in the vehicle electrification market is expected mainly due to driving factors for the market, such as rising consumer demand for safety and convenience features, rising EV adoption, accelerating the vehicle electrification ecosystem, and the technical benefits of electrified components over conventional mechanical systems.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Vehicle Electrification Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Vehicle Electrification Market

Athur

Dec, 2022

Interested in knowing more about the Vehicle Electrification Market and competitive landscape.

Ronak

Dec, 2022

What are the growth estimates for the vehicle electrification market till 2025?.