Smart Parking Market by System (Guided & Smart Park), Technology (Ultrasonic, Radar, Image), Component, Parking Management by Solution (Security & Surveillance, Valet & Parking Reservation, License Plate Recognition), and Vertical - Global Forecast to 2021

The global smart parking market was valued at USD 2.13 billion in 2015 and is expected to reach USD 5.25 billion by 2021, at a CAGR of 17.94 % during the forecast period 2015-2021.The market is driven by factors such as increased consumer preference towards comfort and luxury, and increased competition between OEMs to offer such driver assistance features. Additionally, government policies supporting smart parking systems is also a major demand driver for passenger car market. The U.S. National Highway Traffic Safety Administration (NHTSA) ruled that all new passenger cars shall be equipped with rear view cameras from 2018 onwards and also the Indian Ministry of Road Transport and Highway (MoRTH) is expected to make rear view sensors mandatory for all passenger vehicles in India. The base year considered for the study is 2015, and the forecast period is 2016 to 2021.

Market Dynamics

Drivers

- Increased demand of vehicles leading to parking concerns

- Increasing demand for (IoT) based technology

Restraints

- High implementation cost and increased cost of vehicle

Opportunities

- Initiative of developing 'smart cities'

- Advancements in autonomous cars and smart park technology

Challenges

- System integration

- Non-availability of supporting infrastructure

Ultrasonic sensor to be the largest sensor technology used in market

The following are the major objectives of the study.

- To describe and forecast the smart parking system, in terms of value, by system type, component, sensor technology, vertical, solution and region

- To describe and forecast the smart parking market, in terms of volume, by system type, component, sensor technology, vertical, solution and region

- To describe and forecast the smart parking system, in terms of value, by region–Asia Oceania (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of smart parking system

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the smart parking ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the smart parking system market

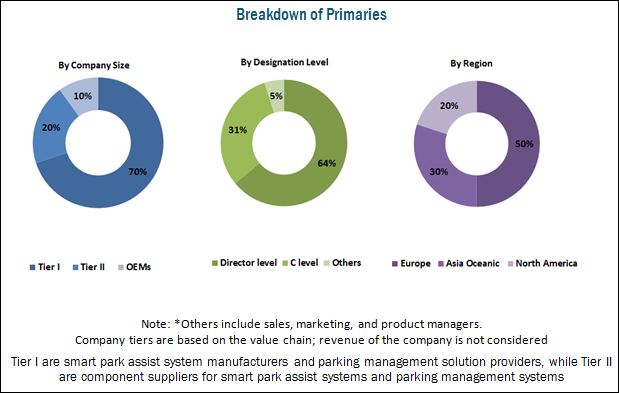

The research methodology used in the report involves primary and secondary sources and follows a bottom-up as well as top-down approach for the purpose of data triangulation. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor vehicle Administrators (AAMVA), Automotive Components Manufacturers Association of India (ACMAI) and paid databases and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends of the smart parking system market for passenger cars and parking management solutions market. The park assist market for passenger cars, in terms of volume (‘000/million units) and value (USD million/billion), for system type and various regions, by components and sensor technology has been derived by forecasting techniques based on production of smart parking system equipped passenger cars and the parking management market in terms of value (USD million) for vertical and solutions type has been derived by forecasting techniques based on the key solutions providers around the globe and summation of their segmental revenues. The OEM prices of smart parking system,sensor technology and components have been verified through primary sources.

The smart parking market for passenger cars ecosystem consists of component suppliers such as Robert Bosch GmbH (Germany), Continental AG (Germany), Aisin Seiki (Japan) etc. These components are supplied to park assist system suppliers such as Valeo S.A. (France) and this system is supplied to automotive OEMs such as BMW Group (Germany), Daimler AG (Germany), Volkswagen AG (Germany), and others. The parking management market ecosystem consists of parking management solution providers such as Siemens AG (Germany), Xerox Corporation (U.S.), Cubic Corporation (U.S.) among others.

Major Market Developments

- In December 2016, based on the Thai government's 4.0 initiative, Robert Bosch aims to create automated valet parking by 2018.

- In November 2014, Continental AG (Germany) opened a new automotive R&D center for Surround View system, in Lewes East Sussex (U.K.). The Surround View system uses cameras to provide drivers with a 360-degree view of the vehicle. The new center will monitor the ongoing and future trends of the Surround View systems. Future Surround View systems will provide 3D views to the driver of the vehicle and improve situational awareness. The company aims to realize fully automated parking based on camera technology from 2018.

- In February 2014, Valeo S.A. (France) signed a partnership agreement with Leddartech (Canada), a manufacturer of advanced detection and ranging solutions. The agreement enables both companies to develop an infrared sensor for obstacle detection on road and tracking functions. This partnership is in line with Valeo S.A.'s goal of developing high end ultrasonic sensors, radar, cameras, laser scanners and software to make cars safer and more intuitive driven.

Target Audience

- Automotive smart park assist system manufacturers & component suppliers

- Parking Management Solution Providers

- Parking Management Hardware and Services Providers

- Automotive OEMs, Industry Associations, and other driver assistance manufacturers

- The automobile industry and related end-user industries

Report Scope

By System Type

- Guided Park Assist

- Smart parking

By Component

- Parking Sensors

- Steering Angle Sensors

- Electronic Control Unit (ECU)

- Display Unit

By Sensor Technology:

- Ultrasonic Sensor

- Radar Sensor

- Image Sensor

By Vertical

- Government

- Commercial

By Solution

- Security and Surveillance

- Parking Reservation Management

- Valet Parking Management

- License Plate Recognition

By Region:

- Asia-Oceania

- Europe

- North America

- Rest of the World

- Critical questions which the report answers

- What are new application areas which the smart parking companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs. Geographic Analysis

- Smart Parking Market, by Country

- Europe, other countries

- Asia-Oceania, other countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The Smart Parking market is projected to grow at a CAGR of 17.94% from 2016 to 2021, to reach a market size of USD 5.25 billion by 2021. The market is driven by factors such as limited parking space availability, growing number of accidents caused by vehicles reversing out of parking spaces and growing consumer demand for advanced vehicle and passenger safety systems in passenger cars.

Smart Parking market is defined as a consolidation of several information and communication technology systems which includes numerous electronic devices such as LCD displays, sensors (image, ultrasonic, radar), electronic control unit, and others. It also includes software platforms such as smartphone applications and vehicle on board navigation software systems which interacts with hardware platforms such as vehicle on board sensors and electronic devices, to integrate a system that helps drivers in finding a vacant spot for parking a vehicle and also guides the infrastructure outside the vehicles with parking solutions.

Parking management solutions have seen rapid deployment across all the major verticals. The verticals have been segmented as government and commercial. Commercial parking management market includes the academic, recreational, transportation, retail, and hospitality sectors, among others. The proliferation of younger workforce in various sectors, coupled with an increased demand for vehicles worldwide, has led to increased traffic congestion as well as vehicular pollution, which has given rise to demand for parking management solutions. Growth in the parking management market is expected to increase during the forecast period, due to companies introducing new technologies in the field of parking management and entering into strategic mergers and acquisitions. Parking management solutions are required by varied industry verticals that require a smooth flow of vehicles in order to perform their day-to-day activities.

Asia-Oceania is estimated to be the fastest growing smart parking market for parking sensors due to an increase in consumer awareness about smart parking systems in the region. Growing number of vehicles on the road combined with government initiatives such as smart cities are expected to develop better traffic and parking management solutions in Asia-Oceania, in the future. Parking management solutions use parking sensors such as cameras and ultrasonic sensors within an infrastructure that may or may not interact with in vehicle parking sensors to guide the vehicle to a suitable parking space. The demand for parking sensors will increase with an increase in implementation of parking management solutions that reduce time taken in finding a parking space and ease traffic congestion.

Smart parking verticals like government and commercial drive the growth of market

Government

Commercial

The commercial sector is the backbone of the economy and plays a significant role in development of the country. For the corporate and commercial parks industry, parking management solutions mainly include the installation of automated pay stations and advanced parking garages. These advanced parking garages are equipped with automated valet parking systems. The major challenge faced by the corporate and commercial parks industry is the management of a single parking facility for multiple companies with regular users. The efficient use of parking management solutions in this vertical results in optimized performance, increased productivity, and reduced delivery times for the people working in this sector.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for smart parking systems?

A key factor restraining the growth of smart parking components is the high cost of implementing the smart parking system in a passenger car. Adequate smart parking infrastructure is also crucial to the growth of smart parking market. An integration of in vehicle smart parking with smart parking infrastructure will drive higher growth of the smart parking components market in the coming years. The market for passenger cars is dominated by a few global players, and comprises several regional players.

Key players in the smart parking market include Valeo S.A. (France), Continental AG (Germany), Robert Bosch GmbH (Germany), Kapsch TrafficCom AG (Austria), Cubic Corporation (U.S.), TKH Group-Park Assist (Netherlands). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Smart Parking Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Impact of Per Capita Income on Total Vehicle Sales

2.4.2.2 Increasing Consumer Preference for Smart Park Assist Technology

2.4.3 Supply-Side Analysis

2.4.3.1 Technological Advancements in Autonomous Vehicles

2.5 Smart Parking Market Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top Down Approach

2.5.3 Market Breakdown & Data Triangulation

2.5.4 Assumptions

3 Executive Summary (Page No. - 29)

3.1 Passenger Car Park Assist Market, By System Type

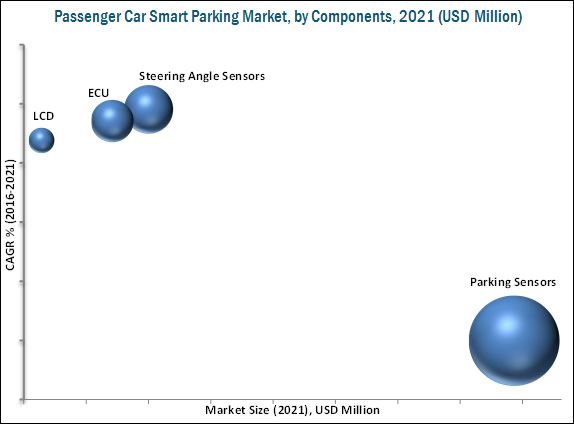

3.2 Passenger Car Smart Parking Market, By Component

3.3 Passenger Car Market, By Sensor Technology

3.4 Parking Management Market, By Vertical

3.5 Parking Management Market, By Solution

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Market

4.2 Smart Parking Market, By Country

4.3 Market, By Sensor Technology

4.4 Market, By Type

4.5 Market, By Component

4.6 Parking Management Market, By Solution

5 Smart Parking Market Overview (Page No. - 39)

5.1 Introduction

5.1.1 Market - Key Players in the Supply Chain

5.2 Drivers

5.2.1 Increased Demand of Vehicles Leading to Parking Concerns

5.2.2 Increasing Demand for (IoT) Based Technology

5.3 Restraints

5.3.1 High Implementation Cost and Increased Cost of Vehicle

5.4 Opportunities

5.4.1 Initiative of Developing ‘Smart Cities’

5.4.2 Advancements in Autonomous Cars and Smart Park Technology

5.5 Challenges

5.5.1 System Integration

5.5.2 Non-Availability of Supporting Infrastructure

5.6 Porter’s Five Forces Analysis

5.6.1 Smart Park Assist Market for Passenger Cars

5.6.2 Competitive Rivalry

5.6.3 Threat of New Entrants

5.6.4 Threat of Substitutes

5.6.5 Bargaining Power of Suppliers

5.6.6 Bargaining Power of Buyer’s

6 Automotive Park Assist System Market, By System Type & Region (Page No. - 53)

6.1 Introduction

6.2 Automotive Park Assist Market, By System Type & Region

6.2.1 Guided Park Assist System, By Region

6.2.1.1 Asia-Oceania: Guided Park Assist Market, By Country

6.2.1.2 Europe: Guided Park Assist Market, By Country

6.2.1.3 North America: Guided Park Assist Market, By Country

6.2.1.4 RoW: Guided Park Assist Market, By Country

6.2.2 Smart Park Assist System, By Region

6.2.2.1 Asia–Oceania: Smart Park Assist System, By Country

6.2.2.2 Europe: Smart Park Assist System, By Country

6.2.2.3 North America: Smart Park Assist System, By Country

6.2.2.4 Rest of the World (RoW): Smart Park Assist System, By Country

7 Passenger Car Smart Parking Market, By Component (Page No. - 68)

7.1 Introduction

7.2 Market, By Component

7.2.1 Market, By Region

7.2.2 Market, By Region

7.2.3 Market, By Region

7.2.4 Market, By Region

8 Passenger Car Smart Parking Market, By Sensor Technology (Page No. - 76)

8.1 Introduction

8.2 Passenger Car Smart Parking Market, By Sensor Technology

8.2.1 Ultrasonic Sensor Market

8.2.1.1 Asia-Oceania: Market Size, By Country

8.2.1.2 Europe: Market Size, By Country

8.2.1.3 North America: Market Size, By Country

8.2.1.4 Rest of the World: Market Size, By Country

8.2.2 Radar Sensor Market

8.2.2.1 Asia-Oceania: Market Size, By Country

8.2.2.2 Europe: Market Size, By Country

8.2.2.3 North America: Market Size, By Country

8.2.2.4 Rest of the World: Market Size, By Country

8.2.3 Image Sensor Market

8.2.3.1 Asia-Oceania: Market Size, By Country

8.2.3.2 Europe: Market Size, By Country

8.2.3.3 North America: Market Size, By Country

8.2.3.4 Rest of the World: Market Size, By Country

9 Parking Management Market, By Vertical (Page No. - 94)

9.1 Introduction

9.2 Parking Management Market, By Vertical

9.3 Government

9.3.1 Government Parking Management Market, By Region

9.4 Commercial

9.4.1 Commercial Parking Management Market, By Region

10 Parking Management Market, By Solution (Page No. - 98)

10.1 Introduction

10.2 Parking Management Market, By Solution

10.3 Security and Surveillance

10.3.1 Security and Surveillance Parking Management Market, By Region

10.4 Parking Reservation Management

10.4.1 Parking Reservation Management Market, By Region

10.5 Valet Parking Management

10.5.1 Valet Parking Management Market, By Region

10.6 License Plate Recognition

10.6.1 License Plate Recognition Market, By Region

11 Competitive Landscape (Page No. - 102)

11.1 Introduction

11.2 Competitive Situation & Trends

11.3 New Product Development

11.4 Mergers & Acquisitions and Others

11.5 Joint Ventures, Agreements & Partnerships

11.6 Expansions

12 Company Profiles (Page No. - 117)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Smart Park Providers and Component Manufacturers

12.1.1 Robert Bosch GmbH

12.1.2 Continental AG

12.1.3 Valeo S.A.

12.1.4 Delphi Automotive PLC

12.1.5 Aisin Seiki Co., Ltd

12.2 Smart Parking Solution Providers

12.2.1 Siemens AG

12.2.2 Xerox Corporation

12.2.3 Cubic Corporation

12.2.4 Amano Corporation

12.2.5 Kapsch Trafficcom AG

12.2.6 TKH Group–Park Assist

12.2.7 Nedap Identification Systems

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 155)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.5.1 Smart Parking Sensor Technology Market, By Country

13.5.1.1 Radar Sensor for Smart Parking Market, By Country

13.5.1.2 Lidar Sensor for Market, By Country

13.5.1.3 Image Sensor for Market, By Country

13.5.2 Smart Parking Component Market, By Country

13.5.2.1 Display Unit for Market, By Country

13.5.2.2 ECU for g Market, By Country

13.5.3 Market, By Country

13.5.3.1 Europe, Other Countries

13.5.3.2 Asia-Oceania, Other Countries

13.5.4 Company Information

13.5.4.1 Detailed Analysis and Profiling of Additional Market Players (Up to 5)

13.6 Related Reports

13.7 Author Details

List of Tables (78 Tables)

Table 1 Key Players in the Supply Chain

Table 2 Porter’s Five Force Analysis

Table 3 Automotive Park Assist System Market, By System Type, 2014–2021 (Million Units)

Table 4 Automotive Park Assist System Market, By System Type, 2014–2021 (USD Million)

Table 5 Guided Park Assist System: Automotive Guided Park Assist System Market Size, By Region, 2014–2021 (‘000 Units)

Table 6 Guided Park Assist System: Automotive Guided Park Assist System Market Size, By Region, 2014–2021 (USD Million)

Table 7 Asia-Oceania: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 8 Asia-Oceania: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 9 Europe: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 10 Europe: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 11 North America: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 12 North America: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 13 RoW: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 14 RoW: Automotive Guided Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 15 Automotive Smart Park Assist System: Automotive Smart Park Assist System Market Size, By Region, 2014–2021 (‘000 Units)

Table 16 Automotive Smart Park Assist System: Automotive Smart Park Assist System Market Size, By Region, 2014–2021 (USD Million)

Table 17 Asia-Oceania: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 18 Asia-Oceania: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 19 Europe: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 20 Europe: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 21 North America: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 22 North America: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 23 RoW: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (‘000 Units)

Table 24 RoW: Automotive Smart Park Assist System Market Size, By Country, 2014–2021 (USD Million)

Table 25 Passenger Car Smart Parking Market, By Component, 2014–2021 (Million Units)

Table 26 Market, By Component, 2014–2021 (USD Million)

Table 27 Market : Parking Sensors Market Size, By Region, 2014–2021 (‘000 Units)

Table 28 Market : Parking Sensors Market Size, By Region, 2014–2021 (USD Million)

Table 29 Market : Steering Angle Sensors Market Size, By Region, 2014–2021 (‘000 Units)

Table 30 Market : Steering Angle Sensors Market Size, By Region, 2014–2021 (USD Million)

Table 31 Market : ECU Market Size, By Region, 2014–2021 (‘000 Units)

Table 32 Market: ECU Market Size, By Region, 2014–2021 (USD Million)

Table 33 Market : Display Unit Market Size, By Region, 2014–2021 (‘000 Units)

Table 34 Market : Display Unit Market Size, By Region, 2014–2021 (USD Million)

Table 35 Market, By Sensor Technology, 2014–2021 (Million Units)

Table 36 Market, By Sensor Technology, 2014–2021 (USD Million)

Table 37 Market: Ultrasonic Sensor Technology, By Region, 2014–2021 (‘000 Units)

Table 38 Market: Ultrasonic Sensor Technology, By Region, 2014–2021 (USD Million)

Table 39 Asia-Oceania: Market Size, By Country, 2014–2021 (‘000 Units)

Table 40 Asia-Oceania: Market Size, By Country, 2014–2021 (USD Million)

Table 41 Europe: Market Size, By Country, 2014–2021 (‘000 Units)

Table 42 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 43 North America: Market Size, By Country, 2014–2021 (‘000 Units)

Table 44 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 45 RoW: Market Size, By Country, 2014–2021 (‘000 Units)

Table 46 RoW: Market Size, By Country, 2014–2021 (USD Million)

Table 47 Market: Radar Sensor Technology Market Size, By Region, 2014–2021 (‘000 Units)

Table 48 Market : Radar Sensor Technology Market Size, By Region 2014–2021 (USD Million)

Table 49 Asia-Oceania: Market Size, By Country, 2014–2021 (‘000 Units)

Table 50 Asia-Oceania: Market Size, By Country, 2014–2021 (USD Million)

Table 51 Europe: Market Size, By Country, 2014–2021 (‘000 Units)

Table 52 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 53 North America: Market Size, By Country, 2014–2021 (‘000 Units)

Table 54 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 55 RoW: Market Size, By Country, 2014–2021 (‘000 Units)

Table 56 RoW: Market Size, By Country, 2014–2021 (USD Million)

Table 57 Market: Image Sensor Technology Market Size, By Region, 2014–2021 (‘000 Units)

Table 58 Market: Image Sensor Technology Market Size, By Region, 2014–2021 (USD Million)

Table 59 Asia-Oceania: Market Size, By Country, 2014–2021 (‘000 Units)

Table 60 Asia-Oceania: Market Size, By Country, 2014–2021 (USD Million)

Table 61 Europe: Market Size, By Country, 2014–2021 (‘000 Units)

Table 62 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 63 North America: Market Size, By Country, 2014–2021 (‘000 Units)

Table 64 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 65 RoW: Market Size, By Country, 2014–2021 (‘000 Units)

Table 66 RoW: Market Size, By Country, 2014–2021 (USD Million)

Table 67 Market, By Vertical, 2016–2021 (USD Million)

Table 68 Government: Market, By Region, 2014 – 2021 (USD Million)

Table 69 Commercial: Market, By Region, 2014 – 2021 (USD Million)

Table 70 Market, By Solution, 2014–2021 (USD Million)

Table 71 Security and Surveillance Market, By Region, 2014–2021 (USD Million)

Table 72 Parking Reservation Management Market, By Region, 2014–2021 (USD Million)

Table 73 Valet Parking Management Market, By Region, 2014–2021 (USD Million)

Table 74 License Plate Recognition Smart Parking Market, By Region, 2014–2021 (USD Million)

Table 75 New Product Development, 2012–2016

Table 76 Mergers, Acquisitions and Other Developments, 2012–2016

Table 77 Agreements, Joint Ventures & Partnerships, 2012–2016

Table 78 Expansions –2012- 2016

List of Figures (58 Figures)

Figure 1 Smart Parking Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Impact of Per Capita Income on Total Vehicle Sales, 2014

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top Down Approach

Figure 8 Data Triangulation

Figure 9 Guided Park Assist is Estimated to Hold the Largest Market Value, (USD Billion), 2016

Figure 10 Parking Sensors Component is Estimated to Hold the Largest Market Value in 2016

Figure 11 Ultrasonic Sensor Technology is Estimated to Hold the Largest Market Value During the Forecast Period, 2016 vs 2021

Figure 12 Commercial Vertical is Estimated to Hold the Largest Size in the Parking Management Market, 2016

Figure 13 Security & Surveillance is Estimated to Hold the Largest Size in the Parking Management Solutions Market, 2016

Figure 14 Rising Trend of Vehicle Automation to Drive the Market for Market

Figure 15 Chinese Market to Witness the Highest Growth From 2016 to 2021

Figure 16 Ultrasonic Sensor Technology to Lead the Market in 2016

Figure 17 Market is Poised to Grow at A CAGR of 17.94% From 2016 to 2021

Figure 18 Parking Sensor to Hold the Largest Market Size in 2016

Figure 19 Security & Surveillance Solution Segment Estimated to Lead Parking Management Market in 2016

Figure 20 Smart Parking Market:Market Dynamics

Figure 21 Vehicle PARC vs Passenger Car Sales, 2014

Figure 22 Automotive IoT Market, By Region, 2016 vs 2021 (USD Million)

Figure 23 Porter’s Five Forces Analysis: Market for Passenger Cars

Figure 24 Competitive Rivalry is Medium in the Global Market for Passenger Cars

Figure 25 Less Number of Players and High Innovation Leads to Medium Degree of Competition in the Global Market for Passenger Cars

Figure 26 High R&D Expenditure and Capital Cost has the Highest Impact on New Entrants in the Global Market for Passenger Cars

Figure 27 Low Availability of Substitutes Makes Threat of Substitutes Low

Figure 28 Presence of Low Number of Suppliers in Market Makes Bargaining Power Moderate for Suppliers

Figure 29 Low Number of Suppliers in the Market Impacts the Bargaining Power of Buyers

Figure 30 Smart Park Assist System Segment is Set to Register the Highest Growth in Automotive Park Assist System Smart Parking Market From 2016 to 2021

Figure 31 Parking Sensors are Estimated to Have the Largest Market Share of the Passenger Car Market, By Component, 2016–2021 (USD Million)

Figure 32 Ultrasonic Sensor Technology Estimated to Be the Largest Market in Automotive Park Assist System Market, 2016–2021 (USD Million)

Figure 33 Parking Management Market, By Vertical, 2016 vs 2021

Figure 34 Parking Management Market, By Solution, 2016 vs 2021

Figure 35 Companies Adopted New Product Development as the Key Growth Strategy From 2012 to 2016

Figure 36 Smart Parking Market Evolution Framework - New Product Development Boosted Growth From 2012 to 2016

Figure 37 Battle for Market Share: New Product Development is the Key Strategy

Figure 38 Robert Bosch GmbH: Company Snapshot

Figure 39 Robert Bosch GmbH: SWOT Analysis

Figure 40 Continental AG : Company Snapshot

Figure 41 Continental AG: SWOT Analysis

Figure 42 Valeo S.A.: Company Snapshot

Figure 43 Valeo S.A.: SWOT Analysis

Figure 44 Delphi Automotive PLC: Company Snapshot

Figure 45 Delphi Automotive PLC : SWOT Analysis

Figure 46 Aisin Seiki: Company Snapshot

Figure 47 Siemens AG: Company Snapshot

Figure 48 Siemens AG : SWOT Analysis

Figure 49 Xerox Corporation: Company Snapshot

Figure 50 Xerox Corporation : SWOT Analysis

Figure 51 Cubic Corporation: Company Snapshot

Figure 52 Cubic Corporation : SWOT Analysis

Figure 53 Amano Corporation: Company Snapshot

Figure 54 Amano Corporation: SWOT Analysis

Figure 55 Kapsch Trafficcom AG: Company Snapshot

Figure 56 Kapsch Trafficcom AG: SWOT Analysis

Figure 57 TKH Group: Company Snapshot

Figure 58 Nedap Identification Systems: Company Snapshot

Growth opportunities and latent adjacency in Smart Parking Market