Software-Defined Networking Market Size, Share, Growth & Latest Trends

Software-Defined Networking Market by Offering (SDN Infrastructure, Software, and Services), SDN Type (Open SDN, SDN via Overlay, SDN via API, Hybrid SDN), Application (SD-WAN, SD-LAN, Security), End User, Vertical and Region - Global Forecast to 2030

OVERVIEW

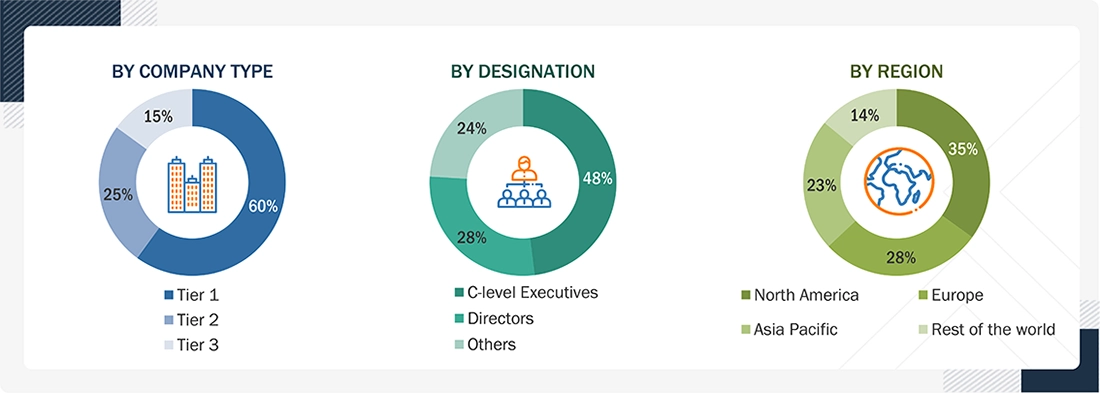

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global software-defined networking market size is estimated to reach USD 82.59 billion by 2030 from the estimated USD 35.74 billion in 2025, registering a CAGR of 18.2% during the forecast period. The sdn market is gaining momentum as organizations adapt their networks to support a mix of on-premises systems and public cloud platforms. Applications are no longer tied to a single data center and are now spread across on-premises systems and public cloud platforms. This shift is making traditional network control methods harder to manage. SDN allows network functions to be handled through software, which gives teams more flexibility to adjust capacity and maintain consistent performance as usage patterns change.

KEY TAKEAWAYS

-

By OfferingBy offering, the services segment is expected to register the highest CAGR of 20.2% during the forecast period.

-

By SDN TypeBy SDN type, the hybrid SDN segment is projected to grow at the fastest rate from 2025 to 2030.

-

By ApplicationBy application, the SD-WAN segment is expected to dominate the market.

-

By VerticalBy vertical, the retail & e-commerce segment is projected to grow at the fastest rate during the forecast period.

-

Competitive Landscape - Key PlayersCisco (US), Huawei (China), VMware (US), HPE (US), and Nokia (Finland) are identified as some of the star players in the software-defined networking market, given their strong market share and product footprint.

-

Competitive Landscape - Startup/SMEsScale Computing (US), Zeetta Networks (UK), and Pica8 (US) have distinguished themselves among startups and SMEs in the software-defined networking market.

Networks today support a wide mix of applications, users, and connected devices across many locations. Managing traffic flows and policy changes manually is becoming less practical, especially as networks grow in size. SDN helps mitigate these aspects by allowing increased visibility into network activity. This reduces operational workload and shortens response times when issues occur. Over time, automation also helps with lower operating costs and improves service reliability. As digital services expand and uptime requirements become increasingly stringent, organizations are turning to SDN to maintain control over complex network environments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The SDN market increasingly determines customers’ business outcomes through its role in simplifying how networks are built, managed, and scaled. As organizations move beyond hardware-led networking, SDN shifts value toward software platforms that reduce manual configuration and support consistent operations across on-premises and cloud environments. Large enterprises, service providers, and public sector networks are using SDN to gain better visibility into traffic flows, improve scalability, and lower operating costs. These changes directly influence service reliability, application performance, and response times experienced by end users. Over time, the transition from device-centric tools to subscription-based software, automation, and analytics is reshaping how network value is created and delivered, linking SDN adoption closely to uptime, responsiveness, and user experience outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift toward cloud and hybrid network operations

-

Rising dependence on software-led network provisioning

Level

-

Complexity of integrating SDN with existing network environments

-

Skills gap in software-oriented network operations

Level

-

Rising demand for network automation and operational efficiency

-

Growing role of SDN in edge and distributed computing models

Level

-

Maintaining network security in software-driven architectures

-

Aligning SDN strategy with existing IT governance models

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift toward cloud and hybrid network operations

Network architectures are evolving as applications and workloads move across on-premises data centers, public cloud environments, and edge locations. This shift has made traditional hardware-centric networking models harder to manage, particularly where traffic patterns change frequently. As networks grow more distributed, manual configuration and static controls are becoming less effective. Organizations are therefore looking for ways to manage connectivity and policies more centrally without replacing existing infrastructure. Software-defined networking addresses this need by separating network control from physical devices and enabling policy changes through software. As hybrid deployment models become standard across enterprises and service providers, SDN is increasingly viewed as a practical approach to improving network flexibility and operational control.

Restraint: Complexity of integrating SDN with existing network environments

Many organizations considering SDN already operate large networks built over long investment cycles. These environments often include legacy hardware, vendor-specific configurations, and operating practices designed for static control models. When SDN is introduced, it must coexist with these existing systems rather than replace them outright. This creates integration challenges, particularly where older equipment lacks support for open interfaces or centralized control. As a result, deployments are frequently limited to specific segments of the network instead of being applied end to end. The need to balance modernization with continuity continues to slow broader SDN adoption, especially in large enterprise and telecom environments.

Opportunity: Rising demand for network automation and operational efficiency

As networks carry more application traffic, operational complexity is increasing across both enterprise and service provider environments. Manual configuration and troubleshooting are becoming harder to sustain as network scale and service expectations grow. This has led operators to seek approaches that reduce repetitive tasks and improve consistency. SDN platforms support this shift by enabling automated policy enforcement and centralized network control. Over time, these capabilities also generate operational data that can be used for capacity planning and performance optimization. As organizations place greater emphasis on uptime, efficiency, and predictable service delivery, automation-focused SDN deployments represent a growing area of opportunity.

Challenge: Maintaining network security in software-driven architectures

The transition toward programmable networks changes how security is managed and enforced. Centralized controllers and open interfaces increase flexibility, but they also introduce new points of access that must be carefully governed. In distributed environments, misconfigurations or weak controls can affect large portions of the network. These issues tend to surface more often in multi-tenant data centers and telecom networks, where shared infrastructure supports a wide range of services. In such environments, small configuration errors can have wider impact and are harder to isolate. As SDN adoption increases, security teams are being pushed to adjust existing controls and workflows rather than rely on legacy approaches. The challenge lies in maintaining strong safeguards while allowing networks to remain flexible, especially in large or business-critical deployments.

SOFTWARE-DEFINED NETWORKING MARKET SIZE, SHARE, GROWTH & LATEST TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cisco deployed its Application Centric Infrastructure (ACI) for a global financial services institution to modernize its data center network. The SDN-based fabric replaced manual configuration with centralized policy control, enabling automated provisioning across compute, storage, and network layers. The deployment supported hybrid cloud workloads and improved application visibility. | Faster application deployment | Reduced configuration errors | Improved network visibility | Consistent policy enforcement |

|

VMware implemented its NSX software-defined networking platform for a multinational retail enterprise operating across multiple regions. NSX was used to introduce network virtualization, micro-segmentation, and centralized security policies across on-premises and cloud environments. This allowed the customer to scale digital services without redesigning the physical network. | Improved security control | Faster network changes | Reduced dependency on hardware upgrades | Simplified hybrid cloud operations |

|

Nokia deployed its SDN controllers and orchestration software for a Tier-1 telecom operator to support virtualized network functions and 5G-ready infrastructure. SDN-enabled centralized traffic control across transport and core networks, allowing the operator to introduce new services more quickly. | Faster service rollout | Better traffic optimization | Lower operating complexity | Support for network virtualization |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The SDN ecosystem shown includes solution providers such as Cisco, Extreme Networks, VMware, Hewlett Packard Enterprise, Juniper Networks, and Nokia, which develop SDN software platforms, controllers, and network virtualization solutions. Service providers such as IBM, Oracle, Arista Networks, and Cisco support SDN deployment, integration, and ongoing network operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

SDN Market, By Offering

The services segment is expected to gain momentum in the SDN market as deployment and operational complexity increase. SDN adoption often requires changes to existing network designs and integration with legacy infrastructure. Many organizations lack in-house teams with the skills needed to manage these changes at scale. As a result, demand for SDN services is increasing for consulting, implementation, integration, and managed services. These services help organizations reduce deployment risks and maintain stable network performance over time. In multi-site and hybrid environments, ongoing monitoring, configuration updates, and troubleshooting are becoming more complex. This is encouraging organizations to rely on external service providers to ensure network stability and reduce operational risk.

SDN Market, By SDN Type

Open software-defined networking account for the largest share of the SDN market, due to its flexibility and compatibility across multi-vendor environments. Open SDN is built on standardized interfaces rather than vendor-specific controls. This allows organizations to mix network components without redesigning the entire environment. The approach is especially relevant in data centers and hybrid cloud setups, where infrastructure is rarely uniform. Open SDN also supports centralized control while allowing incremental expansion. For service providers and large enterprises, this reduces long-term dependency on a single vendor. Over time, these operational and cost-related considerations have reinforced the adoption of open SDN architectures.

SDNt Market, By Application

The software-defined wide area network (SD-WAN) segment represents the largest application area within the SDN market. This is closely tied to the way organizations now operate across multiple locations. Managing traditional wide-area networks has become more difficult as cloud usage and remote access increase. SD-WAN simplifies this by centralizing traffic control across different connection types. It also provides clearer visibility into application performance between sites. For many enterprises, this improves reliability without significantly increasing costs. As distributed operations become standard rather than optional, SD-WAN is often adopted before other SDN technologies. This has helped it maintain a leading position within the application segment.

REGION

Asia Pacific to be fastest-growing region in global SDN market during forecast period

Asia Pacific is expected to witness steady growth in the software-defined networking (SDN) market as network complexity increases across enterprise and service provider environments. The region is experiencing sustained growth in cloud adoption, data center expansion, and digital services, which is putting pressure on traditional network architectures. Enterprises operating across multiple sites are finding it harder to manage traffic, security policies, and performance using hardware-led networks. As a result, software-based network control is gaining relevance as it allows centralized management and faster configuration changes. Telecom operators in Asia Pacific are also modernizing their networks to support 5G Services services, which require flexible traffic handling and efficient resource allocation. In parallel, sectors such as banking, manufacturing, and e-commerce are adopting SDN to improve network visibility and reduce operational overhead across distributed operations. While adoption varies by country depending on infrastructure readiness, the broader shift toward virtualized and cloud-based networks is supporting consistent SDN adoption across the region.

SOFTWARE-DEFINED NETWORKING MARKET SIZE, SHARE, GROWTH & LATEST TRENDS: COMPANY EVALUATION MATRIX

In the SDN market matrix, Cisco (Star) leads the market through its broad ACI fabrics, SD-WAN solutions, and policy-driven controllers that run most data centers plus telco 5G setups. Ciena (Emerging Leader) gains momentum through its Blue Planet platform, paired with optics designed for flexible metro networks, and advances with Ai Orchestration and open APIs. Cisco leads through extensive scale and widespread enterprise adoption, while Ciena shows strong potential to reach leader status as demand for disaggregated optical SDN grows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Cisco (US)

- Huawei (China)

- VMware (US)

- Hewlett Packard Enterprise (US)

- Nokia (Finland)

- Dell EMC (US)

- IBM (US)

- Ericsson (Sweden)

- Ciena (US)

- Arista Networks (US)

- Extreme Networks (US)

- NEC (Japan)

- Pica8 (US)

- Fujitsu (Japan)

- Zeetta Networks (UK)

- Intel (US)

- Citrix (US)

- Palo Alto Networks (US)

- Oracle (US)

- NVIDIA (US)

- Kyndryl (US)

- Wipro (US)

- NetApp (US)

- Fortinet (US)

- Riverbed Technology (US)

- Scale Computing (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 35.74 Billion |

| Market Forecast in 2030 (Value) | USD 82.59 Billion |

| Growth Rate | CAGR of 18.2% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Software-Defined Networking Market Report Customization Scope | Get 10% Free Customization on report |

| Pricing & Purchase Enquiry Options | Avail customized purchase options as per your requirement. Enquire Now |

WHAT IS IN IT FOR YOU: SOFTWARE-DEFINED NETWORKING MARKET SIZE, SHARE, GROWTH & LATEST TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Regional Analysis: - Further breakdown of the North American software-defined networking (SDN) market - Further breakdown of the European software-defined networking (SDN) market - Further breakdown of the Asia Pacific software-defined networking (SDN) market - Further breakdown of the Middle Eastern & African software-defined networking (SDN) market - Further breakdown of the Latin American software-defined networking (SDN) market |

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- Mar 2024 : IBM acquired Pliant, a network and IT automation platform, to enhance SDN capabilities. It integrates with IBM Cloud Pak for Network Automation (CP4NA) and Hybrid Cloud Mesh for observability, control, and automation across hybrid environments.

- Jan 2024 : Hewlett-Packard Enterprise (HPE) acquired Juniper Networks for USD 14B. The deal combines HPE's edge-to-cloud portfolio with Juniper's AI-Native networking and Mist SDN platforms for unified enterprise solutions.

- Nov 2023 : VMware unveiled Software-Defined Edge solutions and partnerships at VMware Explore 2023. It expands SDN integrations with Microsoft Security Copilot and Symantec for secure edge automation and Digital Transformation

- Feb 2023 : ETSI released TearaFlowSDN Release 2, n open-source cloud-native SDN controller for transport networks. It supports end-to-end slicing across IP/optical domains for autonomous networks and cybersecurity use cases.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the SDN market. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the SDN market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, related key executives from various vendors providing SDN solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect The secondary research was mainly used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

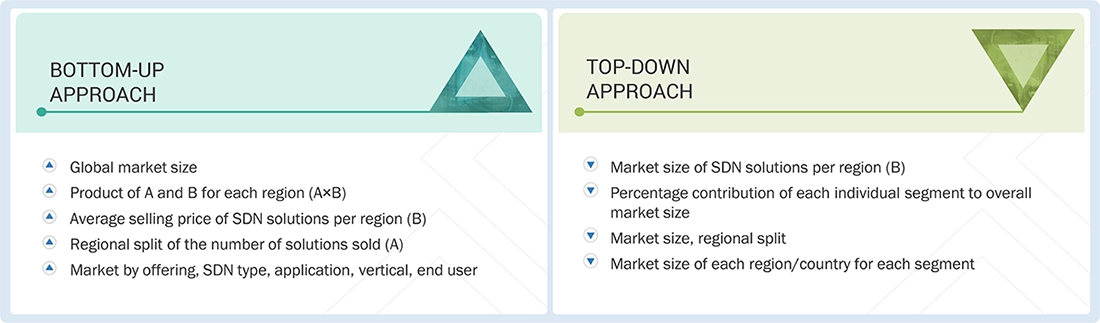

In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Tier 1 companies have revenues over USD 10 billion; Tier 2 companies’ revenue ranges between USD 1 billion and 10 billion; and Tier 3 companies’ revenue ranges between USD 500 million and USD 1 billion. Others include senior-level managers, sales executives, and independent consultants.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the SDN market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the SDN market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Software-Defined Networking Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the SDN market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Software-defined networking (SDN) is a networking architecture that separates the control plane from the data plane in the networking equipment. The controller is the brain of SDN that enables centralized management and control, automation, and policy enforcement across physical and virtual network environments.

Key Stakeholders

- Telecommunication Providers

- Mobile Network Operators

- IT Suppliers

- Cloud Service Providers

- Enterprise Data Center Professionals

- Networking and Telecommunication Companies

- Data Center Software Vendors

- Infrastructure Architects

- Government Councils

- Standardization Bodies

- Communication Service Providers (CSPs)

- Managed Service Providers (MSPs)

Report Objectives

- To define, describe, and forecast the software-defined networking (SDN) market based on offering, SDN type, end user, application, vertical, and region.

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze subsegments with respect to the individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market.

- To forecast the revenues of market segments with respect to all the major regions, such as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their recent developments and positioning related to the SDN market.

- To analyze competitive developments, such as mergers and acquisitions, new product developments, partnerships and collaborations, and research and development (R&D) activities, in the market.

Available customizations:

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Software-Defined Networking Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Software-Defined Networking Market

Asim

Aug, 2017

Interested in knowing the market trends.

Arvind

Aug, 2019

Interested in knowing the Software-defined Networking and Network Function Virtualization market trends.

Yogesh

Dec, 2018

Interested in knowing the Software-defined Networking and Network Function Virtualization market trends from telco perspective.

Thennavan

Oct, 2017

Interested in knowing the Software-defined Networking and Network Function Virtualization market trends.

William

Aug, 2018

Interested in knowing the Software-defined Networking and Network Function Virtualization end-user market trends.

Mark

Jul, 2017

Interested in knowing the Software-defined Networking and Network Function Virtualization market trends.

Mark

Jul, 2017

Interested in knowing the Software-defined Networking and Network Function Virtualization market trends.

Pitter

Mar, 2022

Looking for SDN, SDWAN, next generation wireless growth market with relevant CAGR for next 3 to 5 years . And also the products and services total addressable market with niche players market share in services market..