Fiber Optics Collimating Lens Market by Type (Fixed and Adjustable), Wavelength, Mode (Single Mode, Multimode), Application (Communication, Medical & Diagnostics, Metrology, Spectroscopy and Microscopy), and Geography (2021-2026)

Updated on : Oct 22, 2024

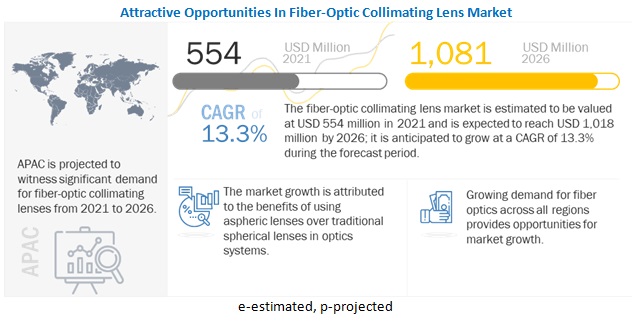

The global fiber optics collimating lens market size is projected to grow from USD 554 million in 2021 to USD 1,081 million by 2026; it is expected to grow at a CAGR of 13.3% from 2021 to 2026.

Growing global demand for computer networking drives the demand for free-space communication, which is likely to boost the demand for fiber optic collimating lenses.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Fiber Optics Collimating Lens Market

The fiber optics collimating lens market witnessed a decline in the first two quarters of 2020, owing to the spread of COVID-19. The outbreak adversely impacted the supply chain of the market, as some of the prominent players are based in China and the US, which were the most affected countries by the pandemic in the first half of 2020. Considering the current situation, key market players are focusing on maintaining and generating operating revenue, which has reduced the number of developments in the market in 2020 and 2021. The need for better internet infrastructure has driven the demand for fiber optics and related components during 2020 and 2021, leading to the strong growth of the market.

Fiber Optics Collimating Lens Market Dynamics

Driver: Benefits of using aspheric lenses over traditional spherical lenses in optics systems

Aspheric lenses are used to eliminate spherical aberrations in a wide range of applications. These lenses have a unique shape, which allows them to deliver better optical performance and image quality than traditional spherical lenses. In traditional spherical manufacturing, the surface is defined by a single radius of curvature. The curvature can be ground and polished into the surface using large tools that work on the entire surface. Aspheric lenses are often used in applications that require an element to focus or collimate light. Aspherical surfaces on collimating and focusing lenses provide improved performance over traditional spherical surfaces in high-power industrial fiber laser and direct diode laser systems. Aspherical optics reduce spherical aberration, resulting in smaller spot size, uniform spot shape, and greater depth of focus.

The systems using spherical lenses need to be equipped with additional elements to address the issue of aberrations. When additional lens elements are further used for correction, they increase the amount of flare and color alteration as well as decrease the contrast while adding to the dimensions and weight of the lens. Hence, aspherical lenses typically produce images with enhanced contrast and colorful images. The systems installed with these lenses are also lighter and easier to use, as they do not use any additional lens element. Therefore, optical designers take advantage of these characteristics of aspheric lenses to design compact optical systems. The compactness of these systems results in reduced weight and complexity as well as fewer alignment requirements and shorter assembly times.

Restraint: High manufacturing cost of aspheric lenses

The manufacturing process of aspheric lenses has undergone tremendous developments in recent years. The manufacturing cost of aspheric lenses is higher than that of traditional spherical lenses. In the manufacturing of traditional spherical lenses, the surface is defined by a single radius of curvature. In contrast, in the case of aspheric lenses, the lenses are not defined by a single radius of curvature. Therefore, smaller subapertures are used with varying radii of curvature at different points along the surface. This creates a need for different manufacturing techniques to address these subapertures in different ways, as the use of a single large tool is not suitable. Majorly, magnetorheological finishing (MRF) and computer numerical control (CNC) grinding and polishing are employed to provide even more control over the surface during manufacturing. CNC production techniques are costly, as these techniques are developed for the metals production application. Therefore, high material and production costs are restraining the growth of the aspheric lens market, which is eventually affecting the growth of the fiber optics collimating lens market.

Opportunity: Need for handling heavy data in manufacturing and logistics sectors

Manufacturing and logistics sectors would benefit from fiber optics because of their operations and services, which are highly dependent on high-speed bandwidth. This sector needs to work on heavy data, such as the number of products manufactured, raw materials received, and bins in the warehouse. Fibers provide scalability; hence, during times of rapid expansion, a company can easily access near unlimited bandwidth and does not have to deal with additional monthly fees or service delays from the ISP. Also, network latency, reliability, and low long-term costs add to the benefits of fiber networks. Fibers are highly secure, as the network itself is privately owned and operated by the lease owner. No other external entity can track or record the data and information being transmitted through the fiber. This level of security is crucial for businesses that need to regularly transmit sensitive data.

In the distant past, fiber optics had a reputation of being too fragile and expensive for the plant floor – a bleeding-edge technology that was just not worth looking at for the day-to-day requirements of industrial facilities. But developments over the past ten years have resulted in fiber-optic systems tailored to the requirements of new and existing process plant and manufacturing environments. These systems can carry a wide variety of signals and data with capabilities wire cannot match to provide a superior solution now and far into the future.

Challenge: Traditional internet wires

Traditional internet wires are made of copper or other conductive materials. These wires use electricity as their medium of communication rather than light. Copper is a cheap and widely used component for network devices connection. Due to the high initial cost of deploying fiber optics in regions such as Africa and Latin America, these regions are still not fully fiber-based and require huge investments to change the entire internet infrastructure. Hence, developing nations are still using copper-based cables for signal transmission. However, in the coming years, with economic growth and advancements in networking infrastructure, the deployment of fiber cables is likely to increase in the coming years.

Fiber optics collimating lens market in APAC held the largest market in 2026

China is one of the world’s largest and fastest-growing economies, with a huge consumer electronics industry and large population base, coupled with increasing per capita income. China’s large-scale industrialization has led to the growing need for laser interferometers. OEMs are continuously looking to improve the production processes in automotive manufacturing through precision measurement, which is expected to drive the laser interferometer market in China. The country is among the world’s largest automotive manufacturers and a leading producer of consumer electronics. The Chinese government has approved in-house production of commercial aircraft, which includes large passenger planes. China designs and manufactures jets, which would, in turn, create a huge opportunity for the laser interferometer market in the country. Therefore, the growth in demand for laser interferometry in the country is likely to boost the demand for its supporting components, including fiber-optic collimating lenses. Therefore, growth of fiber optics collimating lens industry in China is likely to accelerate the market’s growth in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The fiber optics collimating lens companies is dominated by a few globally established players such as AMS Technologies AG, IPG Photonics Corporation, Coherent, Fabrinet, Thorlabs Inc, Daheng New Epoch Technology, Inc (CDHC), Edmund Optics, FS.Com, and Gooch & Housego. The report also profiles the companies such as TRIOPTICS, SCANLAB GmbH, Rochester Precision Optics, LightPath Technologies, CeramOptec, Fiberguide Industries, Inc., OZ Optics, Ltd., Avantes, and Laser Mechanisms.

Scope of the Report

|

Report Metric |

Scope |

|

Estimated Market Size |

USD 554 Million |

|

Projected Market Size |

USD 1081 Million |

|

Growth Rate |

13.3% |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Million Units) |

|

Segments covered |

By Type, By Lens Type, By Mode, By Wavelength, By Application |

|

Geographies covered |

Asia Pacific, Europe, the Americas (North America, South America), and Rest of World |

|

Companies covered |

The key players operating in the fiber-optic collimating lens market are AMS Technologies AG, IPG Photonics Corporation, Coherent, Fabrinet, Thorlabs Inc, Daheng New Epoch Technology, Inc (CDHC), Edmund Optics, FS.Com, and Gooch & Housego. |

The study categorizes the fiber optics collimating lens market based on process type, technology, type, application, technology at the regional and global levels.

Fiber Optics Collimating Lens Market By Mode

- Single Mode

- Multimode

Fiber Optics Collimating Lens Market By Type

- Fixed

- Adjustable

Fiber Optics Collimating Lens Market By Lens Type

- Fiber Lenses

- GRIN Lenses

- Others (C Lens, Aspheric, Others)

Fiber Optics Collimating Lens Market By Wavelength

- <1000 NM

- 1000–1500 NM

- 1500–2000 NM

- >2000 NM

Fiber Optics Collimating Lens Market By Application

- Communication

- Medical Diagnostic & Imaging

- Lasers and Detectors

- Metrology

- Spectroscopy and Microscopy

- Others

Fiber Optics Collimating Lens Market By Region

- North America

- Europe

- APAC

- ROW

Recent Developments

- In November 2019, The new Coherent HighLight FL-ARM with a fiber-to-fiber switch is a high-power (2–8 kW), dual-fiber output laser that can sequentially power two separate workstations or processes.

- In January 2021, Thorlabs released a correlated photon-pair source, its latest addition to its product lineup for the rapidly growing field of quantum photonics. The availability of a robust, high-brightness photon source is critical to the quantum photonics community for any number of applications – spanning from fundamental photon-matter interaction to device characterization.

- In April 2021, Thorlabs release a new passively Q-switched laser producing 500 ps pulses centered at 1030 nm. The microjoule-level pulse energies produced at kHz repetition rates allow for multiple applications, including material processing, harmonic generation, LIDAR, photoacoustic imaging, and laser-induced breakdown spectroscop

Frequently Asked Questions (FAQ):

What is the current size of the global fiber-optic collimating lens market?

The fiber-optic collimating lens market is projected to grow from USD 554 million in 2021 to USD 1,081 million by 2026; it is expected to grow at a CAGR of 13.3% from 2021 to 2026.

who are the key players in fiber-optic collimating lens in the year 2020?

As of 2020, AMS Technologies, IPG Photonics, and Coherent were the major players in the fiber-optic collimating lens market.

What is the key driver for fiber-optic collimating lens market in US?

Metrology is one of the prominent applications of these lenses, and the growth of metrology in US is driving the market’s growth in the country. Automotive and aerospace & defense are the major industries contributing to the growth of the 3D metrology market in the US.

Who are the key players in the aspheric lens segment?

Edmund Optics Inc., Thorlabs, LightPath Technologies Inc., and G&H are a few key players in the aspheric lens segment.

Which are the major companies in the fiber-optic collimating lens market?

AMS Technologies AG, IPG Photonics Corporation, Coherent, Fabrinet, Thorlabs Inc, Daheng New Epoch Technology, Inc (CDHC), Edmund Optics, FS.Com, and Gooch & Housego are the major players in this market. The report also profiles the companies such as TRIOPTICS, SCANLAB GmbH, Rochester Precision Optics, LightPath Technologies, CeramOptec, Fiberguide Industries, Inc., OZ Optics, Ltd., Avantes, and Laser Mechanisms. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 FIBER-OPTIC COLLIMATING LENS MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 FIBER-OPTIC COLLIMATING LENS MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 FIBER-OPTIC COLLIMATING LENS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size by bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—IDENTIFYING MARKET SIZE THROUGH REVENUE GENERATED BY COMPANIES

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size by top-down analysis (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

2.6 RESEARCH LIMITATIONS

TABLE 1 MARKET FORECASTING METHODOLOGY ADOPTED FOR 2020 TO 2026

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 9 1000–1500 NM WAVELENGTH TO DOMINATE FIBER-OPTIC COLLIMATING LENS MARKET DURING FORECAST PERIOD

FIGURE 10 FIBER-OPTIC COLLIMATING LENS MARKET FOR SINGLE MODE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 11 COMMUNICATION TO HOLD LARGEST SHARE OF FIBER-OPTIC COLLIMATING LENS MARKET IN 2021

FIGURE 12 APAC TO CAPTURE LARGEST SHARE OF FIBER-OPTIC COLLIMATING LENS MARKET

FIGURE 13 IMPACT OF COVID-19 ON FIBER-OPTIC COLLIMATING LENS MARKET, 2018–2026 (USD MILLION)

3.1 REALISTIC SCENARIO (POST-COVID-19)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN FIBER-OPTIC COLLIMATING LENS MARKET

FIGURE 14 BENEFITS OF ASPHERIC LENSES OVER TRADITIONAL LENSES WOULD DRIVE MARKET GROWTH

4.2 FIBEROPTICS COLLIMATING LENS MARKET, BY MODE

FIGURE 15 SINGLE MODE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 FIBER-OPTIC COLLIMATING LENS MARKET, BY WAVELENGTH AND REGION

FIGURE 16 1000–1500 NM WAVELENGTH SEGMENT AND APAC HELD LARGEST SHARE OF FIBER-OPTIC COLLIMATING LENS MARKET IN 2020

4.4 FIBER-OPTIC COLLIMATING LENS MARKET, GEOGRAPHIC ANALYSIS

FIGURE 17 FIBER-OPTIC COLLIMATING LENS MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 INCREASING DEMAND FOR ASPHERIC LENSES OVER TRADITIONAL SPHERICAL LENSES DRIVES MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Rising demand for 5G networks

5.2.1.2 Increasing demand for internet bandwidth

5.2.1.3 Growing demand for reliable and secure networks

5.2.1.4 Benefits of using aspheric lenses over traditional spherical lenses in optics systems

FIGURE 19 DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing cost of aspheric lenses

FIGURE 20 RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Telecommunication industry to create lucrative opportunities

5.2.3.2 Need for handling heavy data in manufacturing and logistics sectors

TABLE 2 BENEFITS OF DEPLOYING FIBER OPTICS IN INDUSTRIAL ENVIRONMENT

FIGURE 21 OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Traditional internet wires

TABLE 3 COMPARISON BETWEEN FIBER OPTICS AND COPPER

FIGURE 22 CHALLENGES: IMPACT ANALYSIS

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 FIBER-OPTIC COLLIMATING LENS MARKET: SUPPLY CHAIN ANALYSIS

5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR FIBER-OPTIC COLLIMATING LENS MARKET

FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.5 FIBER-OPTIC COLLIMATING LENS MARKET: ECOSYSTEM

FIGURE 25 FIBER-OPTIC COLLIMATING LENS MARKET: ECOSYSTEM

5.6 FIBER-OPTIC COLLIMATING LENS MARKET: PLAYERS IN ECOSYSTEM

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON FIBER-OPTIC COLLIMATING LENS MARKET

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS: FIBER-OPTIC COLLIMATING LENS MARKET

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 DEGREE OF COMPETITION

TABLE 5 IMPACT OF EACH FORCE ON MARKET, 2020 VS 2026

5.8 CASE STUDIES

TABLE 6 IPG PHOTONIC’S LASERCUBE SOLUTION HELPED SHIM SHACK BOOST PRODUCTIVITY

5.9 TECHNOLOGY ANALYSIS

5.9.1 ADJACENT TECHNOLOGIES

5.9.1.1 Wavelength division multiplexing (WDM)

5.9.1.2 Microwave data transmission technology

5.9.1.3 Dark fiber

5.10 ASP

TABLE 7 AVERAGE SELLING PRICES OF FIBER-OPTIC COLLIMATING LENSES IN 2020 (USD)

FIGURE 27 AVERAGE SELLING PRICES OF FIBER-OPTIC COLLIMATING LENSES (2018–2020) (USD)

5.11 TRADE ANALYSIS

TABLE 8 IMPORTS DATA, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 9 EXPORTS DATA, BY COUNTRY, 2015–2019 (USD MILLION)

5.12 PATENTS ANALYSIS, 2018–2020

TABLE 10 PATENTS RELATED TO FIBER-OPTIC COLLIMATING LENS MARKET, 2018–2020

FIGURE 28 PATENTS RELATED TO FIBER-OPTIC COLLIMATOR LENS PUBLISHED BETWEEN 2010 AND 2020

5.13 TARIFFS AND REGULATORY LANDSCAPE

5.13.1 TARIFFS

5.13.2 REGULATIONS

5.13.2.1 Restriction of Hazardous Substances (RoHS)

5.13.2.2 Regulatory framework for infrastructure providers by Telecom Regulatory Authority of India

5.13.3 STANDARDS

6 FIBER OPTICS COLLIMATOR LENS MARKET, BY LENS TYPE (Page No. - 70)

6.1 INTRODUCTION

FIGURE 29 ASPHERIC LENSES TO RECORD HIGHEST CAGR IN FIBER-OPTIC COLLIMATOR LENS MARKET FROM 2021 TO 2026

TABLE 11 FIBER-OPTIC COLLIMATOR LENS MARKET, BY LENS TYPE, 2018–2020 (USD MILLION)

TABLE 12 FIBER-OPTIC COLLIMATOR LENS MARKET, BY LENS TYPE, 2021–2026 (USD MILLION)

6.2 ASPHERIC LENS

6.2.1 EDMUND OPTICS INC., LIGHTPATH TECHNOLOGIES INC., AND G&H ARE AMONG KEY PLAYERS IN ASPHERIC LENS SEGMENT

TABLE 13 ASPHERIC LENSES OFFERED BY THORLABS

TABLE 14 ASPHERIC FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 15 ASPHERIC FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 GRIN

6.3.1 GRIN FIBER-OPTIC CABLES ARE MAJORLY USED IN TELECOMMUNICATION APPLICATION

TABLE 16 GRIN FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 17 GRIN FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 OTHERS

6.4.1 OTHERS SEGMENT WOULD WITNESS HIGHEST GROWTH RATE IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 18 SPHERICAL SINGLET AND ACHROMATIC LENSES OFFERED BY THORLABS

TABLE 19 OTHER FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 20 OTHER FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

7 FIBER-OPTIC COLLIMATOR LENS MARKET, BY MODE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 30 MULTIMODE SEGMENT TO RECORD HIGHER CAGR IN FIBER-OPTIC COLLIMATOR LENS MARKET FROM 2021 TO 2026

TABLE 21 FIBER-OPTIC COLLIMATOR LENS MARKET, BY MODE, 2018–2020 (USD MILLION)

TABLE 22 FIBER-OPTIC COLLIMATOR LENS MARKET, BY MODE, 2021–2026 (USD MILLION)

7.2 SINGLE MODE

7.2.1 SINGLE-MODE FIBERS OFFER UNMATCHED SPEED BECAUSE OF HIGH BANDWIDTH AND LOW ATTENUATION

TABLE 23 SINGLE-MODE FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 SINGLE-MODE FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 MULTIMODE

7.3.1 MULTIMODE FIBER-OPTIC CABLES MAKE COUPLING OF LIGHT SOURCES EASY

TABLE 25 MULTIMODE FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 26 MULTIMODE FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

8 FIBER-OPTIC COLLIMATOR LENS MARKET, BY TYPE (Page No. - 83)

8.1 INTRODUCTION

FIGURE 31 FIXED SEGMENT TO RECORD HIGHER CAGR IN FIBER-OPTIC COLLIMATOR LENS MARKET FROM 2021 TO 2026

TABLE 27 FIBER-OPTIC COLLIMATOR LENS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 28 FIBER-OPTIC COLLIMATOR LENS MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2 FIXED

8.2.1 FIXED FIBER-OPTIC COLLIMATOR LENSES OFFER UNMATCHED SPEED BECAUSE OF THEIR HIGH BANDWIDTH AND LOW ATTENUATION

TABLE 29 FIXED FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 FIXED FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 ADJUSTABLE

8.3.1 ADJUSTABLE FIBER-OPTIC CABLES MAKE COUPLING OF LIGHT SOURCES EASY

TABLE 31 ADJUSTABLE FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 32 ADJUSTABLE FIBER-OPTIC COLLIMATOR LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

9 FIBER-OPTIC COLLIMATING LENS MARKET, BY WAVELENGTH (Page No. - 88)

9.1 INTRODUCTION

FIGURE 32 1000–1500 WAVELENGTH SEGMENT TO DOMINATE FIBER OPTIC COLLIMATING LENS MARKET DURING FORECAST PERIOD

TABLE 33 FIBER-OPTIC COLLIMATING LENS, BY WAVELENGTH, 2018–2020 (USD MILLION)

TABLE 34 FIBER-OPTIC COLLIMATING LENS, BY WAVELENGTH, 2021–2026 (USD MILLION)

9.2 <1000 NM

9.2.1 MARKET FOR <1000 NM RANGE TO GROW AT HIGHEST RATE IN APAC

TABLE 35 MARKET FOR <1000 NM, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 MARKET FOR <1000 NM, BY REGION, 2021–2026 (USD MILLION)

9.3 1000–1500 NM

9.3.1 1000–1500 NM RANGE TO HOLD LARGEST SIZE OF MARKET

TABLE 37 LENS MARKET FOR 1000–1500 NM, BY REGION, 2018–2020 (USD MILLION)

TABLE 38 MARKET FOR 1000–1500 NM, BY REGION, 2021–2026 (USD MILLION)

9.4 1500–2000 NM

9.4.1 1500-2000 NM WAVELENGTH IS SUITABLE FOR MEDICAL AND INDUSTRIAL APPLICATIONS, WHICH DRIVE THE MARKET

TABLE 39 FIBER-OPTIC COLLIMATING LENS FOR 1500–2000 NM, BY REGION, 2018–2020 (USD MILLION)

TABLE 40 FIBER-OPTIC COLLIMATING LENS FOR 1500–2000 NM, BY REGION, 2021–2026 (USD MILLION)

9.5 >2000 NM

TABLE 41 FIBER-OPTIC COLLIMATING LENS FOR >2000 NM, BY REGION, 2018–2020 (USD MILLION)

TABLE 42 FIBER-OPTIC COLLIMATING LENS FOR >2000 NM, BY REGION, 2021–2026 (USD MILLION)

10 FIBER-OPTIC COLLIMATING LENS MARKET, BY APPLICATION (Page No. - 94)

10.1 INTRODUCTION

FIGURE 33 COMMUNICATION APPLICATION TO LEAD FIBER-OPTIC COLLIMATING LENS MARKET DURING FORECAST PERIOD

TABLE 43 FIBER-OPTIC COLLIMATING LENS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 44 FIBER-OPTIC COLLIMATING LENS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 COMMUNICATION

10.2.1 INCREASING NUMBER OF INTERNET USERS IN APAC IS MAJORLY SUPPORTING GROWTH OF COMMUNICATION APPLICATION

10.3 LASERS AND DETECTORS

10.3.1 INCREASING DEMAND FOR FIBER-OPTIC COLLIMATOR LENSES IN INDUSTRIAL APPLICATIONS IS HELPING IN ROBUST GROWTH OF THIS SEGMENT

10.4 SPECTROSCOPY AND MICROSCOPY

10.4.1 DEMAND FOR SPECTROSCOPY IN DETERMINING REFRACTIVE INDEX OF MATERIALS, PRESENCE OF UNDESIRED WAVELENGTHS, AND COLOR PROPERTIES OF LIGHT SOURCE DRIVE GROWTH OF THIS SEGMENT

10.5 METROLOGY

10.5.1 INTERFEROMETRY

10.5.1.1 Need for interferometry in evaluation of displacement and irregularities in flat and spherical surfaces would boost market growth

10.6 MEDICAL DIAGNOSTIC & IMAGING

10.6.1 INCREASING USE OF FIBER-OPTIC COLLIMATING LENSES IN VARIOUS MEDICAL EQUIPMENT

10.7 OTHERS

10.7.1 INCREASING PENETRATION OF LIDAR TECHNOLOGY IN VARIOUS APPLICATIONS TO PROVIDE GROWTH OPPORTUNITIES FOR FIBER-OPTIC COLLIMATING LENS MARKET

11 GEOGRAPHIC ANALYSIS (Page No. - 104)

11.1 INTRODUCTION

FIGURE 34 FIBER-OPTIC COLLIMATING LENS MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35 APAC TO ACCOUNT FOR LARGEST SIZE OF FIBER-OPTIC COLLIMATING LENS MARKET IN 2026

FIGURE 36 FIGURE 37 FIBER-OPTIC COLLIMATING LENS MARKET, 2018–2026 (MILLION UNITS)

TABLE 45 FIBER-OPTIC COLLIMATING LENS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 46 FIBER-OPTIC COLLIMATING LENS MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: SNAPSHOT OF FIBER OPTIC COLLIMATING LENS MARKET

FIGURE 38 FIBER-OPTICS COLLIMATING LENS IN US TO GROW AT HIGHEST CAGR AMONG ALL NORTH AMERICAN COUNTRIES DURING FORECAST PERIOD

TABLE 47 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 48 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 49 MARKET IN NORTH AMERICA, BY MODE, 2018–2020 (USD MILLION)

TABLE 50 MARKET IN NORTH AMERICA, BY MODE, 2021–2026 (USD MILLION)

TABLE 51 MARKET IN NORTH AMERICA, BY LENS TYPE, 2018–2020 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA, BY LENS TYPE, 2021–2026 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY TYPE, 2018–2020 (USD MILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY WAVELENGTH, 2018–2020 (USD MILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 US accounts for largest size of fiber-optic collimating lens market in North America

11.2.2 CANADA

11.2.2.1 Fiber-optic collimating lens market in Canada to witness significant growth in coming years

11.2.3 MEXICO

11.2.3.1 Rapidly expanding medical manufacturing in Mexico is expected to provide growth prospects for market

11.3 EUROPE

FIGURE 39 EUROPE: SNAPSHOT OF FIBER-OPTIC COLLIMATING LENS MARKET

FIGURE 40 UK TO LEAD FIBER-OPTIC COLLIMATING LENS IN EUROPE IN 2021

TABLE 59 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 60 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 61 MARKET IN EUROPE, BY MODE, 2018–2020 (USD MILLION)

TABLE 62 MARKET IN EUROPE, BY MODE, 2021–2026 (USD MILLION)

TABLE 63 MARKET IN EUROPE, BY LENS TYPE, 2018–2020 (USD MILLION)

TABLE 64 MARKET IN EUROPE, BY LENS TYPE, 2021–2026 (USD MILLION)

TABLE 65 MARKET IN EUROPE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 66 FIBER-OPTIC COLLIMATING LENS MARKET IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 67 FIBER-OPTIC COLLIMATING LENS MARKET IN EUROPE, BY WAVELENGTH, 2018–2020 (USD MILLION)

TABLE 68 MARKET IN EUROPE, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 69 MARKET IN EUROPE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 70 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Growing presence of optic components manufacturers in Germany is expected to drive market growth

11.3.2 UK

11.3.2.1 Increasing demand for medical equipment in UK is propelling demand for fiber-optic collimating lenses

11.3.3 FRANCE

11.3.3.1 Extensive use of LiDAR systems in space exploration, meteorology, and corridor mapping boosts demand for fiber-optic collimating lenses

11.3.4 ITALY

11.3.4.1 Sophisticated healthcare infrastructure in Italy boosts demand for fiber-optic collimating lenses

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 41 APAC: SNAPSHOT OF FIBER-OPTIC COLLIMATING LENS MARKET

FIGURE 42 FIBER-OPTIC COLLIMATING LENS IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 72 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 73 MARKET IN APAC, BY MODE, 2018–2020 (USD MILLION)

TABLE 74 MARKET IN APAC, BY MODE, 2021–2026 (USD MILLION)

TABLE 75 MARKET IN APAC, BY LENS TYPE, 2018–2020 (USD MILLION)

TABLE 76 MARKET IN APAC, BY LENS TYPE, 2021–2026 (USD MILLION)

TABLE 77 MARKET IN APAC, BY TYPE, 2018–2020 (USD MILLION)

TABLE 78 MARKET IN APAC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 79 MARKET IN APAC, BY WAVELENGTH, 2018–2020 (USD MILLION)

TABLE 80 MARKET IN APAC, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 81 FIBER-OPTIC COLLIMATING LENS MARKET IN APAC, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 82 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Laser interferometer application would drive growth of fiber-optic collimating lens market

11.4.2 JAPAN

11.4.2.1 Growth of spectroscopy is anticipated to drive demand for fiber-optic collimating lenses

11.4.3 INDIA

11.4.3.1 Rapid growth of industrial sector is driving fiber-optic collimating lens market

11.4.4 SOUTH KOREA

11.4.4.1 Applications such as light and display measurement, medical, and automobile drive demand for fiber-optic collimating lenses in South Korea

11.4.5 REST OF APAC

11.5 REST OF THE WORLD

FIGURE 43 SOUTH & CENTRAL AMERICA TO DOMINATE FIBER-OPTIC COLLIMATING LENS MARKET IN ROW DURING FORECAST PERIOD

TABLE 83 FIBER-OPTIC COLLIMATING LENS IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 84 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 85 MARKET IN ROW, BY MODE, 2018–2020 (USD MILLION)

TABLE 86 MARKET IN ROW, BY MODE, 2021–2026 (USD MILLION)

TABLE 87 MARKET ROW, BY LENS TYPE, 2018–2020 (USD MILLION)

TABLE 88 MARKET IN ROW, BY LENS TYPE, 2021–2026 (USD MILLION)

TABLE 89 MARKET IN ROW, BY TYPE, 2018–2020 (USD MILLION)

TABLE 90 MARKET IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 91 MARKET IN ROW, BY WAVELENGTH, 2018–2020 (USD MILLION)

TABLE 92 MARKET IN ROW, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 93 MARKET IN ROW, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 94 FIBER-OPTIC COLLIMATING LENS MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.1 SOUTH & CENTRAL AMERICA

11.5.1.1 Brazil and Argentina are expected to witness highest growth rate in fiber-optic collimating lens market in South America

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Countries such as Saudi Arabia, Israel, UAE, and Qatar are major contributors to fiber-optic collimating lens market in Middle East

12 COMPETITIVE LANDSCAPE (Page No. - 136)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 95 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN FIBER-OPTIC COLLIMATING LENS MARKET

12.3 REVENUE ANALYSIS OF TOP THREE COMPANIES

FIGURE 44 FIBER-OPTIC COLLIMATING LENS MARKET: REVENUE ANALYSIS, 2018–2020

12.4 MARKET SHARE ANALYSIS, 2020

TABLE 96 FIBER-OPTIC COLLIMATING LENS MARKET: MARKET SHARE ANALYSIS (2020)

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 45 COMPANY EVALUATION QUADRANT: FIBER-OPTIC COLLIMATING LENS MARKET, 2020

12.5.5 FIBER-OPTIC COLLIMATING LENS MARKET: FOOTPRINT ANALYSIS

TABLE 97 COMPANY FOOTPRINT

TABLE 98 PRODUCT FOOTPRINT OF COMPANIES

TABLE 99 APPLICATION FOOTPRINT OF COMPANIES

TABLE 100 REGIONAL FOOTPRINT OF COMPANIES

12.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2020

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 46 FIBER-OPTICS COLLIMATING LENS MARKET (GLOBAL), SME EVALUATION QUADRANT, 2020

12.7 COMPETITIVE SITUATIONS AND TRENDS

12.7.1 FIBER-OPTIC COLLIMATING LENS MARKET: PRODUCT LAUNCHES, JANUARY 2018–APRIL 2021

12.7.2 FIBER-OPTIC COLLIMATING LENS MARKET: DEALS, JANUARY 2018–APRIL 2021

13 COMPANY PROFILES (Page No. - 149)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 AMS TECHNOLOGIES

TABLE 101 AMS TECHNOLOGIES: BUSINESS OVERVIEW

13.1.2 IPG PHOTONICS CORPORATION

TABLE 102 IPG PHOTONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 47 IPG PHOTONICS CORPORATION: COMPANY SNAPSHOT

13.1.3 COHERENT

TABLE 103 COHERENT: BUSINESS OVERVIEW

FIGURE 48 COHERENT: COMPANY SNAPSHOT

13.1.4 FABRINET

TABLE 104 FABRINET: BUSINESS OVERVIEW

FIGURE 49 FABRINET: COMPANY SNAPSHOT

13.1.5 THORLABS

TABLE 105 THORLABS: BUSINESS OVERVIEW

13.1.6 DAHENG NEW EPOCH TECHNOLOGY

TABLE 106 DAHENG NEW EPOCH TECHNOLOGY: BUSINESS OVERVIEW

13.1.7 EDMUND OPTICS

TABLE 107 EDMUND OPTICS: BUSINESS OVERVIEW

13.1.8 FS

TABLE 108 FS: BUSINESS OVERVIEW

13.1.9 GOOCH & HOUSEGO (G&H)

TABLE 109 GOOCH & HOUSEGO: BUSINESS OVERVIEW

FIGURE 50 GOOCH & HOUSEGO: COMPANY SNAPSHOT

13.1.10 TRIOPTICS

TABLE 110 TRIOPTICS: BUSINESS OVERVIEW

13.2 OTHER PLAYERS

13.2.1 SCANLAB

TABLE 111 SCANLAB: COMPANY OVERVIEW

13.2.2 ROCHESTER PRECISION OPTICS

TABLE 112 ROCHESTER PRECISION OPTICS: COMPANY OVERVIEW

13.2.3 LIGHTPATH TECHNOLOGIES

TABLE 113 LIGHTPATH TECHNOLOGIES: COMPANY OVERVIEW

13.2.4 CERAMOPTEC

TABLE 114 CERAMOPTEC: COMPANY OVERVIEW

13.2.5 FIBERGUIDE INDUSTRIES (PART OF MOLEX)

TABLE 115 FIBERGUIDE INDUSTRIES: COMPANY OVERVIEW

13.2.6 OZ OPTICS

TABLE 116 OZ OPTICS: COMPANY OVERVIEW

13.2.7 AVANTES

TABLE 117 AVANTES: COMPANY OVERVIEW

13.2.8 LASER COMPONENTS

TABLE 118 LASER COMPONENTS: COMPANY OVERVIEW

13.2.9 LASER MECHANISMS

TABLE 119 LASER MECHANISMS: COMPANY OVERVIEW

13.2.10 WORLD PRECISION INSTRUMENTS INC (WPI)

TABLE 120 WORLD PRECISION INSTRUMENTS INC: COMPANY OVERVIEW

13.2.11 OPTICS TECHNOLOGY

TABLE 121 OPTICS TECHNOLOGY: COMPANY OVERVIEW

13.2.12 AXETRIS

TABLE 122 AXETRIS: COMPANY OVERVIEW

13.2.13 DORIC LENSES

TABLE 123 DORIC LENSES: COMPANY OVERVIEW

13.2.14 ELECTRO-OPTICS TECHNOLOGY (EOT)

TABLE 124 ELECTRO-OPTICS TECHNOLOGY: COMPANY OVERVIEW

13.2.15 PRIZMATIX

TABLE 125 PRIZMATIX: COMPANY OVERVIEW

13.2.16 ACCU-GLASS, LLC

TABLE 126 ACCU-GLASS, LLC: COMPANY OVERVIEW

13.2.17 SCHÄFTER+KIRCHHOFF

TABLE 127 SCHÄFTER+KIRCHHOFF: COMPANY OVERVIEW

13.2.18 OCEAN INSIGHT

TABLE 128 OCEAN INSIGHT: COMPANY OVERVIEW

13.2.19 CSRAYZER OPTICAL TECHNOLOGY

TABLE 129 CSRAYZER OPTICAL TECHNOLOGY: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 185)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the size of the fiber-optic collimating lens market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study includes TechCrunch News, Fiber-optic collimating lens, Fraunhofer Data, and Photonics Articles.

In the fiber-optic collimating lens market report, both top-down and bottom-up approaches have been used to estimate and validate the size of the fiber-optic collimating lens market, along with other dependent submarkets. The key players in the fiber-optic collimating lens market have been identified through secondary research, and their market presence has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

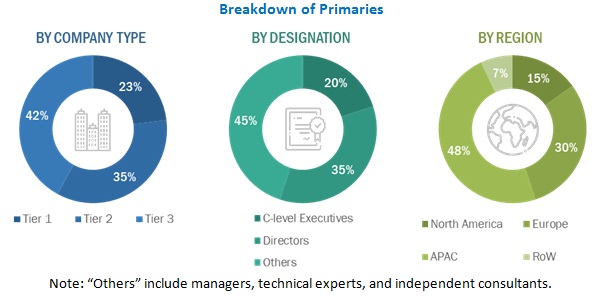

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the fiber-optic collimating lens market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (consumers, industries) and supply-side (fiber-optic collimating lens product manufacturers) players across four major regions, namely, Americas, Europe, Asia Pacific, and Rest of the World (the Middle East & Africa). Approximately 70% and 30% of primary interviews have been conducted from the supply and demand side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

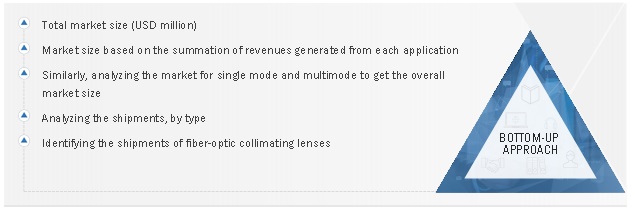

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the fiber-optic collimating lens market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying market for fiber-optic collimating lens-based type(fixed, adjustable) in each country

- Identifying the major applications of fiber-optic collimating lens-related products

- Estimating the size of the market in each region by adding the sizes of country-wise markets

- Tracking the ongoing and upcoming implementation of fiber-optic collimating lens projects by various companies in each region and forecasting the size of the fiber-optic collimating lens market based on these developments and other critical parameters, including COVID-19 related impacts

- Arriving at the size of the global market by adding the sizes of region-wise markets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The main objectives of this study are as follows:

- To define, describe, and forecast the fiber-optic collimating lens market, in terms of value and volume, by type, mode, wavelength, application, lens type, and region

- To forecast the market, for various segments with respect to four main regions—the North Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall fiber-optic collimating lens market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the fiber-optic collimating lens market growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the fiber-optic collimating lens market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the fiber-optic collimating lens market landscape

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the fiber-optic collimating lens market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of fiber-optic collimating lens market

- Profiling of additional market players (up to 5)

- Country-level analysis of type, and application Segment

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fiber Optics Collimating Lens Market