Solder Materials Market by Type (With Lead, Lead-Free), Product (Bar, Wire, Paste, Flux), Process (Wave/Reflow, Screen Printing, Robotic, Laser), End-Use Industry (Consumer Electronics, Automotive, Industrial) and Region - Global Forecast to 2027

Updated on : September 02, 2025

Solder Materials Market

The global solder materials market was valued at USD 4.1 billion in 2022 and is projected to reach USD 4.9 billion by 2027, growing at 3.8% cagr from 2022 to 2027. Solder materials are extensively used in the consumer electronics and automotive industries. Thus, the growth of the solder materials market is directly associated with the growth of these sectors. The technological development on printed wiring boards, growth of the electrical and electronics industry, and the impacts of solder materials consumption on the environment & resources affect the use of solder materials. The rise in demand for solder materials from emerging economies and the growth of the semiconductor industry are creating growth opportunities in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact

In 2020, the solder materials market was impacted by the COVID-19 pandemic due to the increasing prices of raw materials. Tin which is a major raw material used for lead-free solders experienced major price hike since the pandemic. The demand of solder materials from end-use industries such as automotive, building and others was impacted due to unavailability of labor, transportation barriers and lack of inventory. The market started recovering from year 2021.

Solder Materials Market Dynamics

Driver: Increasing demand from electronics industry

Electronic solder connects electrical wires to devices and electronic components to printed circuit boards. Inside the solder core, there is a material called flux, which helps improve the electrical contact along with mechanical strength. The commonly used solder type for electronics solder is Lead-free rosin core solder. This type of solder is mainly made of tin/copper alloy. The electronics market includes computers & servers, communications, and consumer goods. Various electronic products need different types and forms of electronic solders. The increasing demand for the miniaturization/automation of mobile devices, touch screens & displays, and medical electronic systems is a driving factor for the PCB and surface mount devices. The growing demand for these products has led to an increase in the consumption of solder materials. The market for solder materials is also expected to expand due to the rising demand for smart devices and the introduction of energy-efficient electronics. Furthermore, increased manufacturing of electronic devices or gadgets in emerging nations, along with the development of a significant electronics aftermarket business, is likely to enhance the demand for solder materials.

Restraint: High cost of lead-free solders

The implementation of the Waste Electrical and Electronic Equipment (WEEE) and Restriction of Hazardous Substances (RoHS) directives in Europe, coupled with the adoption of Lead-free soldering by Japan’s electronics industry, has created unavoidable costs for the global electronics industry.

One-time costs include investment in new equipment, WEEE and RoHS licensing and compliances charges, scrapping old lead-containing stock and inventory, revised packaging requirements, and possible product redesign. Other costs incurred include increased energy consumption and rising raw materials costs. Most Lead-free solders contain tin, and the price of tin has been rising ever since the COVID-19 outbreak. According to the International Tin Association (ITA), tin prices have risen to USD 42,000 per ton in 2022. In recent years, the price of tin was between USD 15,000 and USD 20,000 per ton, but it roughly doubled in 2021.

Some manufacturers replace tin with silver as their lead alternative in Lead-free solders, making them even more expensive. Leaded solder is more cost-effective than Lead-free solders as lead is much cheaper than alternative alloys. Lead is barely one-tenth the price of tin, making leaded solder easily affordable. Thus, the high prices of Lead-free solders act as a restraint to the growth of the market.

Opportunity: Emergence of nanoparticle- based solder materials

In recent years, nano-composite solder fabricated by adding nanoparticles into conventional solder without lead is gaining popularity in the microelectronic packaging materials industry. The addition of nanoparticles into conventional solder pastes can improve the properties of the solder alloy/joints. With the characteristics of minor size and high surface activity, nanoparticles are added to the solder matrix to prepare nano-composite solder. It has been observed that the introduction of nanoparticles into the solder could significantly refine the matrix of the solder, improve the wetting ability, and strengthen the mechanical performance of the solder joints. Nanoparticles particles mainly include metal particles, intermetallic compound particles, metal oxide particles, carbon-based nanoparticles and so on.

In the automotive, aerospace, and oil and gas drilling industries, electronic components are required to withstand elevated temperatures for extended periods. Fatigue failure in the solder joints is a serious problem in these harsh environments. Hardening the solder with the addition of nanoparticles and stabilizing the grain structure increases the reliability of the joint. Thus, nanoparticle-based solder materials provide a great opportunity for the market.

Challenge: Health risks associated with soldering

During the soldering process, exposure to solder fumes is inevitable. Solder fumes usually come from burned rosin-based flux materials that are invariably used to create electrical connections, causing hazards that can be detrimental to employee health. When solder wire is heated, fumes are produced that contain various chemicals. Breathing these fumes can cause asthma or aggravate existing respiratory conditions. The fumes can also cause irritation of the upper respiratory tract, eyes, and skin. Hand soldering offers greater risk because the worker’s head is likely to be in close contact with the fume source. Also, during the manufacturing of electronic devices with the help of lead soldering, workers may get exposed to severe health effects when the lead is not handled properly. The health effects include memory and concentration problems, digestive problems, reproductive problems, and muscle and joint pain. The soldering process releases fumes and dust, which are hazardous to human health.

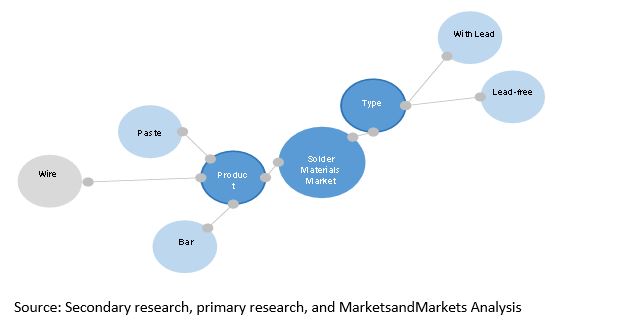

Solder Materials Market Ecosystem

Wave/reflow to be the largest process in solder materials market

The wave/reflow segment accounts for the largest share of the solder materials market, with a share of 53.5%, in terms of value, in 2021. This is attributed to its application in mass production of circuit boards in short duration production time. Manufacturers use wave/reflow for bulk soldering process that enables the manufacturing of many circuit boards in a very short amount of time.

In the global solder materials market consumer electronics end-use industry had the largest share in 2021

The consumer electronic segment dominated the overall solder materials market, in 2021. This is attributed to the broad application of solder materials in the production of electronic devices. Consumer electronics is one of the fastest-growing industries, which is attributed to the emergence of new technologies. Rapid advancements in technology to cater to consumer demands will create growth opportunities for the solder materials market during the forecast period.

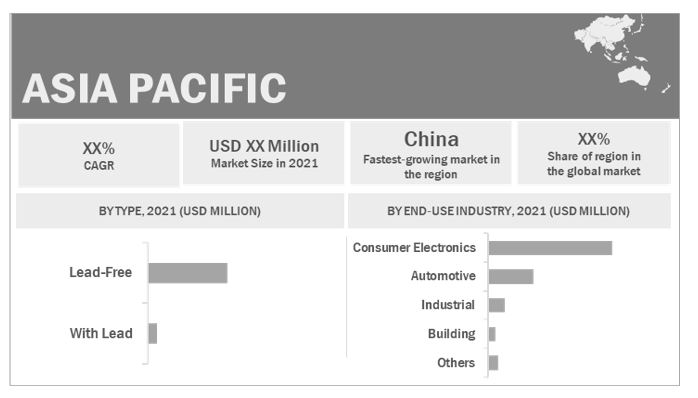

APAC region to lead the global solder materials market by 2027

Asia Pacific was the largest market for solder materials in terms of value, in 2021. Emerging economies in the region are expected to experience significant demand for solder materials because of the expansion of consumer electronics and automotive sectors due to rapid economic development and government initiatives toward economic development. In addition to this, the growing population in these countries represents a strong customer base. Asia Pacific is the fastest-growing market for solder materials globally, in terms of value and volume, during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Solder Materials Market Players

The solder materials market is dominated by a few globally established players, such as Element Solutions, Inc. (US), Lucas Milhaupt Inc. (US), Qualitek International Inc. (US), Fusion Inc. (US), Henkel AG & Co. KGaA (Germany), Senju Metal Industries Co. Ltd. (Japan), Koki Company Limited (Japan), Indium Corporation (US) among others).

Solder Materials Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Ton) |

|

Segments covered |

Type, Product, Process, End-Use Industry and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

The major players include Element Solutions, Inc. |

This research report categorizes the solder materials based on application, floor type, polishing type and region.

Solder Materials Market on the basis of type:

- With Lead

- Lead-Free

Solder Materials Market on the basis of product:

- Wire

- Bar

- Paste

- Flux

- Others

Solder Materials Market on the basis of process:

- Wave/reflow

- Screen Printing’

- Laser

- Robotic

Solder Materials Market on the basis of End-Use Industry:

- Consumer Electronics

- Automotive

- Industrial

- Building

- Others

Solder Materials Market on the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2022, Indium Corporation expanded its portfolio of proven pastes with two new AuSn pastes designed for the higher processing temperatures and assembly needs required in high-power LED module array applications, such as automotive, infrastructure, and horticulture.

- In May 2022 Kester launched ALPHA HRL3 Solder Sphere, Lead-free, high reliability, low temperature alloy for ball mount applications. The alloy is designed to exhibit improved drop shock and thermal cycling performance versus existing low temperature alloys in the market.

Frequently Asked Questions (FAQs):

How big is the Solder Materials Market?

Solder Materials Market worth $4.9 billion by 2027.

What is the growth rate of Solder Materials Market?

Solder Materials Market grows at a CAGR of 3.8% during the forecast period.

What is the current size of global solder materials market?

The global solder materials market is projected to grow from USD 4.1 billion in 2022 to USD 4.9 billion by 2027, at a CAGR of 3.8% from 2022 to 2027.

How is the solder materials market aligned?

The solder materials market is competitive, and have number of manufacturer operating at the regional, and domestic level.

What are the latest ongoing trends in the solder materials market?

The latest ongoing trends in the solder materials market are increasing demand for solder materials in PCB manufacturing of consumer electronics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 SOLDER MATERIALS MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 SOLDER MATERIALS MARKET: RESEARCH DESIGN

2.2 KEY INDUSTRY INSIGHTS

FIGURE 3 DATA VALIDATION THROUGH PRIMARY EXPERTS

TABLE 2 LIST OF STAKEHOLDERS INVOLVED

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3 BASE NUMBER CALCULATION

2.3.1 SUPPLY-SIDE APPROACH – 1

FIGURE 5 SOLDER MATERIALS MARKET: SUPPLY-SIDE APPROACH – 1

2.3.2 SUPPLY-SIDE APPROACH – 2

FIGURE 6 SOLDER MATERIALS MARKET: SUPPLY-SIDE APPROACH – 2

2.3.3 DEMAND-SIDE APPROACH – 1

FIGURE 7 SOLDER MATERIALS MARKET: DEMAND-SIDE APPROACH - 1

2.4 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

2.5.1 SECONDARY DATA

2.5.2 PRIMARY DATA

FIGURE 10 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS & LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 RISK ASSESSMENT

TABLE 3 LIMITATIONS & ASSOCIATED RISKS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

FIGURE 11 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPPORTUNITIES

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 12 LEAD-FREE SEGMENT PROJECTED TO GROW AT FASTER RATE

FIGURE 13 BAR SEGMENT TO DOMINATE SOLDER MATERIALS MARKET DURING FORECAST PERIOD

FIGURE 14 WAVE/REFLOW SEGMENT TO DOMINATE SOLDER MATERIALS MARKET DURING FORECAST PERIOD

FIGURE 15 CONSUMER ELECTRONICS TO BE LARGEST END USER OF SOLDER MATERIALS DURING FORECAST PERIOD

FIGURE 16 ASIA PACIFIC DOMINATED SOLDER MATERIALS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ASIA PACIFIC TO WITNESS RELATIVELY HIGHER DEMAND FOR SOLDER MATERIALS

FIGURE 17 ASIA PACIFIC OFFERS ATTRACTIVE OPPORTUNITIES IN SOLDER MATERIALS MARKET

4.2 ASIA PACIFIC: SOLDER MATERIALS MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 18 CHINA WAS LARGEST MARKET FOR SOLDER MATERIALS IN 2021

4.3 SOLDER MATERIALS MARKET, BY END-USE INDUSTRY

FIGURE 19 CONSUMER ELECTRONICS SEGMENT TO LEAD SOLDER MATERIALS MARKET DURING FORECAST PERIOD

4.4 SOLDER MATERIALS MARKET, BY TYPE

FIGURE 20 LEAD-FREE SEGMENT TO DOMINATE SOLDER MATERIALS MARKET DURING FORECAST PERIOD

4.5 SOLDER MATERIALS MARKET, BY PRODUCT

FIGURE 21 BAR SEGMENT TO LEAD SOLDER MATERIALS MARKET DURING FORECAST PERIOD

4.6 SOLDER MATERIALS MARKET, BY PROCESS

FIGURE 22 SCREEN PRINTING TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4.7 SOLDER MATERIALS MARKET, BY COUNTRY

FIGURE 23 CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SOLDER MATERIALS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand from electronics industry

5.2.1.2 Growing usage in automotive industry

5.2.1.3 Growing demand for lead-free solder materials

5.2.2 RESTRAINTS

5.2.2.1 High cost of lead-free solders

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of nanoparticle-based solder materials

5.2.4 CHALLENGES

5.2.4.1 Health risks associated with soldering

6 INDUSTRY TRENDS (Page No. - 54)

6.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: SOLDER MATERIALS MARKET

TABLE 4 SOLDER MATERIALS MARKET: PORTER'S FIVE FORCE ANALYSIS

6.1.1 BARGAINING POWER OF SUPPLIERS

6.1.2 BARGAINING POWER OF BUYERS

6.1.3 THREAT OF NEW ENTRANTS

6.1.4 THREAT OF SUBSTITUTES

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 26 SOLDER MATERIALS SUPPLY CHAIN

6.3 ECOSYSTEM MAPPING

FIGURE 27 SOLDER MATERIALS MARKET: ECOSYSTEM MAP

6.4 TECHNOLOGY ANALYSIS

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

FIGURE 28 SOLDER MATERIALS MARKET: TRENDS IMPACTING CUSTOMER'S BUSINESS

6.6 TRADE ANALYSIS

6.6.1 IMPORT-EXPORT SCENARIO OF SOLDER MATERIALS MARKET

TABLE 5 IMPORT TRADE DATA FOR TIN, 2021 (USD THOUSAND)

TABLE 6 EXPORT TRADE DATA FOR TIN (USD THOUSAND)

6.7 PRICE ANALYSIS

TABLE 7 SOLDER MATERIALS MARKET: PRICE ANALYSIS

TABLE 8 TIN PRICE ANALYSIS (USD/TON)

6.8 KEY CONFERENCES & EVENTS IN 2022

TABLE 9 SOLDER MATERIALS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.9 REGULATORY ANALYSIS

6.9.1 RESTRICTION OF USE OF HAZARDOUS SUBSTANCES (ROHS) REGULATIONS

6.9.2 ENVIRONMENTAL PROTECTION AGENCY (EPA)

6.9.3 IPC J-STD-001 STANDARD SOLDERING REQUIREMENTS

6.10 PATENT ANALYSIS

6.10.1 INTRODUCTION

6.10.2 METHODOLOGY

6.10.3 DOCUMENT TYPE

FIGURE 29 SOLDER MATERIALS MARKET: REGISTERED PATENTS

6.10.4 PATENT PUBLICATION TRENDS

FIGURE 30 SOLDER MATERIALS MARKET: PATENT PUBLICATION TRENDS (2011-2021)

6.10.5 INSIGHTS

6.10.6 LEGAL STATUS OF PATENTS

FIGURE 31 SOLDER MATERIALS MARKET: LEGAL STATUS

6.10.7 JURISDICTION ANALYSIS

FIGURE 32 SOLDER MATERIALS MARKET: JURISDICTION ANALYSIS

6.10.8 TOP PATENT APPLICANTS

FIGURE 33 SOLDER MATERIALS MARKET: TOP PATENT APPLICANTS

TABLE 10 SENJU METAL INDUSTRY CO.: LIST OF PATENTS

TABLE 11 MITSUBISHI MATERIALS CORPORATION: LIST OF PATENTS

TABLE 12 SOLDER MATERIALS MARKET: LIST OF PATENTS

6.10.9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 13 SOLDER MATERIALS MARKET: LIST TOP 10 PATENT OWNERS (US)

6.11 COMPOSITION AND LIQUIDUS TEMPERATURES OF KEY SOLDER MATERIALS

TABLE 14 KEY SOLDER MATERIALS AND THEIR COMPOSITION

7 SOLDER MATERIALS MARKET, BY TYPE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 34 LEAD-FREE SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET

TABLE 15 SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 16 SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (TON)

7.2 WITH LEAD

7.3 LEAD-FREE

8 SOLDER MATERIALS MARKET, BY PRODUCT (Page No. - 75)

8.1 INTRODUCTION

FIGURE 35 SOLDER BAR SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET IN 2022

TABLE 17 SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 18 SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

8.2 WIRE

8.3 BAR

8.4 PASTE

8.5 FLUX

8.6 OTHERS

9 SOLDER MATERIALS MARKET, BY PROCESS (Page No. - 80)

9.1 INTRODUCTION

FIGURE 36 WAVE/REFLOW SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET DURING FORECAST PERIOD

TABLE 19 SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 20 SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020–2027 (TON)

9.2 WAVE/REFLOW

9.3 SCREEN PRINTING

9.4 ROBOTIC

9.5 LASER

10 SOLDER MATERIALS MARKET, BY END-USE INDUSTRY (Page No. - 84)

10.1 INTRODUCTION

FIGURE 37 CONSUMER ELECTRONICS SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET

TABLE 21 SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 22 SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

10.2 CONSUMER ELECTRONICS

10.3 AUTOMOTIVE

10.4 INDUSTRIAL

10.5 BUILDING

10.6 OTHERS

11 SOLDER MATERIALS MARKET, BY REGION (Page No. - 88)

11.1 INTRODUCTION

FIGURE 38 SOLDER MATERIALS MARKET IN CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 23 SOLDER MATERIAL MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 SOLDER MATERIAL MARKET SIZE, BY REGION, 2020–2027 (TON)

11.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: SOLDER MATERIALS MARKET SNAPSHOT

TABLE 25 ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 27 ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 28 ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 29 ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 30 ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 31 ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 32 ASIA PACIFIC: MARKET SIZE, BY PROCESS, 2020–2027 (TON)

TABLE 33 ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 34 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

11.2.1 CHINA

11.2.1.1 Largest electronic circuit manufacturing output globally

TABLE 35 CHINA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 36 CHINA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 37 CHINA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 38 CHINA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 39 CHINA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 40 CHINA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.2.2 INDIA

11.2.2.1 Growing consumer electronics demand to drive solder materials market

TABLE 41 INDIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 INDIA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 43 INDIA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 44 INDIA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 45 INDIA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 46 INDIA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.2.3 JAPAN

11.2.3.1 Adoption of smart consumer electronics devices to drive demand

TABLE 47 JAPAN: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 JAPAN: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 49 JAPAN: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 50 JAPAN: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 51 JAPAN: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 52 JAPAN: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.2.4 AUSTRALIA

11.2.4.1 Growth in online sales of consumer electronics to drive demand

TABLE 53 AUSTRALIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 AUSTRALIA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 55 AUSTRALIA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 56 AUSTRALIA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 57 AUSTRALIA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 58 AUSTRALIA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.2.5 REST OF ASIA PACIFIC

11.2.5.1 Investment in electronics industry to drive market for solder materials

TABLE 59 REST OF ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 60 REST OF ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 61 REST OF ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 62 REST OF ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 63 REST OF ASIA PACIFIC: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 64 REST OF ASIA PACIFIC: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3 EUROPE

TABLE 65 EUROPE: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: SOLDER MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 67 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 69 EUROPE: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 70 EUROPE: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 71 EUROPE: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 72 EUROPE: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

TABLE 73 EUROPE: SOLDER MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 74 EUROPE: SOLDER MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

11.3.1 GERMANY

11.3.1.1 Presence of major solder materials companies to positively influence market growth

TABLE 75 GERMANY: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 GERMANY: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 77 GERMANY: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 78 GERMANY: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 79 GERMANY: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 80 GERMANY: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3.2 FRANCE

11.3.2.1 Government initiatives and growing industrial electronics manufacturing to drive market

TABLE 81 FRANCE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 FRANCE: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 83 FRANCE: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 84 FRANCE: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 85 FRANCE: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 86 FRANCE: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3.3 ITALY

11.3.3.1 Automotive and aerospace industries to support market growth

TABLE 87 ITALY: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 ITALY: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 89 ITALY: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 ITALY: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 91 ITALY: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 92 ITALY: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3.4 RUSSIA

11.3.4.1 Government investments for modernizing infrastructure to boost market

TABLE 93 RUSSIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 RUSSIA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 95 RUSSIA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 96 RUSSIA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 97 RUSSIA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 98 RUSSIA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3.5 UK

11.3.5.1 High demand from PCB to drive market

TABLE 99 UK: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 UK: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 101 UK: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 102 UK: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 103 UK: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 104 UK: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3.6 SPAIN

11.3.6.1 Automotive industry offering growth opportunities

TABLE 105 SPAIN: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 SPAIN: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 107 SPAIN: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 108 SPAIN: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 109 SPAIN: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 110 SPAIN: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3.7 SWITZERLAND

11.3.7.1 Steady growth of automotive industry to drive market for solder materials

TABLE 111 SWITZERLAND: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 SWITZERLAND: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 113 SWITZERLAND: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 114 SWITZERLAND: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 115 SWITZERLAND: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 116 SWITZERLAND: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.3.8 REST OF EUROPE

TABLE 117 REST OF EUROPE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 REST OF EUROPE: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 119 REST OF EUROPE: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 120 REST OF EUROPE: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 121 REST OF EUROPE: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 122 REST OF EUROPE: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.4 NORTH AMERICA

TABLE 123 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 124 NORTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 125 NORTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 127 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 128 NORTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 130 NORTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 132 NORTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

11.4.1 US

11.4.1.1 Presence of established players to boost market

TABLE 133 US: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 US: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 135 US: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 136 US: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 137 US: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 138 US: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.4.2 CANADA

11.4.2.1 Growing electronics industry to drive market

TABLE 139 CANADA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 CANADA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 141 CANADA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 142 CANADA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 143 CANADA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 144 CANADA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.4.3 MEXICO

11.4.3.1 Favorable trade agreements attracting key market players

TABLE 145 MEXICO: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 MEXICO: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 147 MEXICO: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 148 MEXICO: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 149 MEXICO: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 150 MEXICO: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.5 SOUTH AMERICA

TABLE 151 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 152 SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 153 SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 155 SOUTH AMERICA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 156 SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 157 SOUTH AMERICA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 158 SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

11.5.1 BRAZIL

11.5.1.1 Government support and technological advancement to boost market

TABLE 161 BRAZIL: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 BRAZIL: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 163 BRAZIL: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 164 BRAZIL: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 165 BRAZIL: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 166 BRAZIL: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.5.2 ARGENTINA

11.5.2.1 Growing automotive industry to drive demand for solder materials

TABLE 167 ARGENTINA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 ARGENTINA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 169 ARGENTINA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 170 ARGENTINA: MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 171 ARGENTINA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 172 ARGENTINA: MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.5.3 REST OF SOUTH AMERICA

TABLE 173 REST OF SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 REST OF SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 175 REST OF SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 176 REST OF SOUTH AMERICA: MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 177 REST OF SOUTH AMERICA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA: MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.6 MIDDLE EAST & AFRICA

TABLE 179 MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 181 MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 183 MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

11.6.1 SAUDI ARABIA

11.6.1.1 Increased local car sales to support market growth

TABLE 189 SAUDI ARABIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 190 SAUDI ARABIA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 191 SAUDI ARABIA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 192 SAUDI ARABIA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 193 SAUDI ARABIA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 194 SAUDI ARABIA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.6.2 UAE

11.6.2.1 Growing building & construction industry to drive market

TABLE 195 UAE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 196 UAE: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 197 UAE: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 198 UAE: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 199 UAE: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 200 UAE: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.6.3 SOUTH AFRICA

11.6.3.1 Rapid urbanization to boost demand for solder materials in building and automotive industries

TABLE 201 SOUTH AFRICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 SOUTH AFRICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 203 SOUTH AFRICA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 204 SOUTH AFRICA: MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 205 SOUTH AFRICA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 206 SOUTH AFRICA: MARKET SIZE, BY PROCESS, 2020–2027 (TON)

11.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 207 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 208 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 209 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 210 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY PRODUCT, 2020–2027 (TON)

TABLE 211 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 212 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIAL MARKET SIZE, BY PROCESS, 2020–2027 (TON)

12 COMPETITIVE LANDSCAPE (Page No. - 156)

12.1 OVERVIEW

12.2 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS KEY GROWTH STRATEGY BETWEEN 2017 AND 2022

12.3 MARKET SHARE ANALYSIS

FIGURE 40 SOLDER MATERIALS MARKET: MARKET SHARE ANALYSIS

TABLE 213 SOLDER MATERIALS MARKET: DEGREE OF COMPETITION

12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 41 REVENUE ANALYSIS FOR KEY COMPANIES IN SOLDER MATERIALS MARKET

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE COMPANIES

12.5.4 PARTICIPANTS

FIGURE 42 COMPETITIVE LEADERSHIP MAPPING: SOLDER MATERIALS MARKET, 2021

12.6 SME MATRIX, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 43 SME MATRIX: SOLDER MATERIALS MARKET, 2021

12.7 COMPETITIVE SCENARIO

12.7.1 PARTNERSHIPS

TABLE 214 PARTNERSHIPS, 2017–2022

12.7.2 PRODUCT LAUNCHES

TABLE 215 PRODUCT LAUNCHES, 2017–2022

13 COMPANY PROFILES (Page No. - 165)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1.1 ELEMENT SOLUTIONS INC.

TABLE 216 ELEMENT SOLUTIONS INC.: COMPANY OVERVIEW

FIGURE 44 ELEMENT SOLUTIONS INC.: COMPANY SNAPSHOT

TABLE 217 ELEMENT SOLUTIONS INC.: PRODUCT LAUNCHES

13.1.2 LUCAS MILHAUPT INC.

TABLE 218 LUCAS MILHAUPT INC.: COMPANY OVERVIEW

13.1.3 QUALITEK INTERNATIONAL INC.

TABLE 219 QUALITEK INTERNATIONAL INC.: COMPANY OVERVIEW

13.1.4 FUSION INC.

TABLE 220 FUSION INC.: COMPANY OVERVIEW

13.1.5 HENKEL

TABLE 221 HENKEL: COMPANY OVERVIEW

FIGURE 45 HENKEL: COMPANY SNAPSHOT

13.1.6 SENJU METAL INDUSTRIES CO. LTD.

TABLE 222 SENJU METAL INDUSTRIES. CO. LTD.: COMPANY OVERVIEW

13.1.7 KOKI COMPANY LIMITED

TABLE 223 KOKI COMPANY LIMITED: COMPANY OVERVIEW

13.1.8 INDIUM CORPORATION

TABLE 224 INDIUM CORPORATION: COMPANY OVERVIEW

TABLE 225 INDIUM CORPORATION: PRODUCT LAUNCHES

TABLE 226 INDIUM CORPORATION: DEALS

13.1.9 TAMURA CORPORATION

TABLE 227 TAMURA CORPORATION: COMPANY OVERVIEW

FIGURE 46 TAMURA CORPORATION: COMPANY SNAPSHOT

13.1.10 STANNOL GMBH & CO. KG

TABLE 228 STANNOL GMBH & CO. KG: COMPANY OVERVIEW

TABLE 229 STANNOL GMBH CO. & KG: PRODUCT LAUNCHES

13.2 OTHER PLAYERS

13.2.1 BELMONT METALS

TABLE 230 BELMONT METALS: COMPANY OVERVIEW

13.2.2 GENMA EUROPE

TABLE 231 GENMA EUROPE: COMPANY OVERVIEW

13.2.3 ACCURUS SCIENTIFIC

TABLE 232 ACCURUS SCIENTIFIC: COMPANY OVERVIEW

13.2.4 AIM

TABLE 233 AIM: COMPANY OVERVIEW

13.2.5 WARTON METALS LIMITED

TABLE 234 WARTON METALS LIMITED: COMPANY OVERVIEW

13.2.6 DUKSAN HIMETAL CO. LTD.

TABLE 235 DUKSAN HIMETAL CO. LTD.: COMPANY OVERVIEW

13.2.7 INVENTEC PERFORMANCE CHEMICAL

TABLE 236 INVENTEC PERFORMANCE CHEMICAL: COMPANY OVERVIEW

13.2.8 FAKRI METALS

TABLE 237 FAKRI METALS: COMPANY OVERVIEW

13.2.9 DIGIKEY

TABLE 238 DIGIKEY: COMPANY OVERVIEW

13.2.10 WAYTEK

TABLE 239 WAYTEK: COMPANY OVERVIEW

13.2.11 R.S. HUGHES

TABLE 240 R.S. HUGHES: COMPANY OVERVIEW

13.2.12 SARU SILVER ALLOY PRIVATE LIMITED

TABLE 241 SARU SILVER ALLOY PRIVATE LIMITED: COMPANY OVERVIEW

13.2.13 BALAJI INSULATION CO.

TABLE 242 BALAJI INSULATION CO.: COMPANY OVERVIEW

13.2.14 SUPERIOR FLUX & MFG. CO.

TABLE 243 SUPERIOR FLUX & MFG. CO.: COMPANY OVERVIEW

13.2.15 AGNI SOLDERS

TABLE 244 AGNI SOLDER: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 198)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

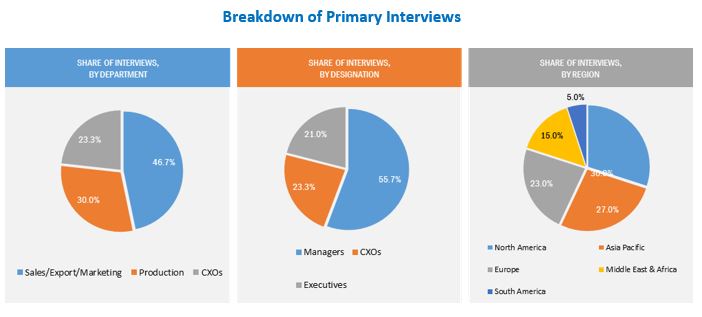

The study involved four major activities for estimating the current global size of the floor grinding tools. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of solder materials through primary research. The supply-side approach was employed to estimate the overall size of the floor grinding tools. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the floor grinding tools. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the solder materials were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the solder materials industry. Primary sources from the demand side include experts and key personnel in various end-use industries.The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

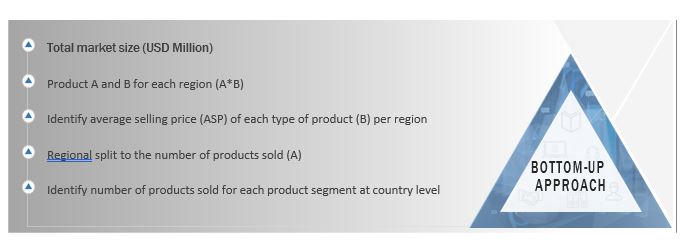

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the solder materials market by product type, end use, and region. The research methodology used to calculate the market size includes the following steps:

- The key players of each type in the solder materials market have been identified through secondary research, and their revenues have been determined through primary and secondary research.

- The market size of the solder materials market has been derived from the aggregation of the market shares of the leading players in each product, and the forecast is based on the analysis of market trends, such as pricing and consumption of solder materials in various end-use industries.

- The market size of the floor grinding tool by region has been calculated by using the market sizes of each product in each end-use.

- The market size for solder materials for each end-use, in terms of value, has been calculated by multiplying the average price of the product with their volumes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Solder materials Market: Bottom-Up Approach

Solder materials Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the overall market has been split into several segments. In order to complete the market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches. It has been then verified through primary interviews. Hence, for every data segment, there are three sources - the top- down approach, the bottom-up approach, and interviews with experts. The data is assumed correct only when the values arrived at from these three sources match.

Report Objectives

- To define, analyze, and project the size of the solder materials in terms of value and volume based on Type, Product, Process, End-Use Industry and Region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments & expansions, and new product launch in the solder materials

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the solder materials report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the solder materials for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solder Materials Market