Solid State Drives Market by Form Factor (2.5”, 3.5”, M.2, U.2/SFF 8639, FHHL/HHHL), Interface (SATA, SAS, PCIe), Technology (SLC, MLC, TLC), End-user (Enterprise, Client, Industrial, Automotive), and Geography - Global Forecast to 2023

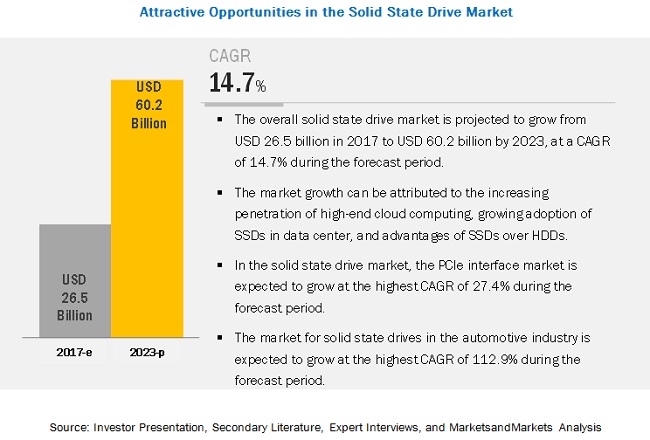

Solid state drives market to grow from USD 26.5 billion in 2018 to USD 60.2 million by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast period. Some of the key factors driving this market are increasing penetration of high-end cloud computing, growing adoption of SSDs in data centers, and advantages of SSDs over HDDs. The objective of the report is to define, describe, and forecast the solid state drives market size based on by interface, form factor, technology, storage, end-user, and region.

Helped leading solid-state drive providers to target opportunities worth ~USD 400 million in the US

Client’s Problem Statement

Leading solid-state drive providers were considering developing versions of its products, in form factors that are typically associated with SSDs, specifically the form factors that use PCI Express and SATA interfaces. Therefore, the client wanted to get an understanding of the adoption of various form factors.

MnM Approach

The client engaged MnM to provide insights on various data points.

• Finer-grade break down of form factors such as 1.8”/2.5”, 3.5”, M.2, U.2 (SFF 8639), FHHL and HHHL

• Analysis of each of the form-factor for adoption across SATA, SAS and PCIe interfaces

• Recommendations for high adoption form factor within the PCIe and SATA interface

Revenue Impact (RI)

This has helped the client to target opportunities worth ~USD 400 million in the US

The SSD market for SATA interface–based solid state drive accounted for the largest market in 2016

The large market of SATA interface solid state drive is mainly attributed to low-cost interface design. SATA interface also offers lower cable size and cost, faster data transfer through higher signaling rates, and more efficient transfer through an I/O queuing protocol, lower cable size and cost, faster data transfer through higher signaling rates, and more efficient transfer through an I/O queuing protocol.

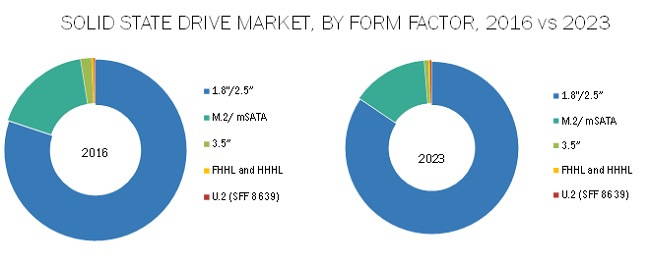

The market for half height, half length (HHHL); or; even bigger form factor; full height, half length (FHHL) is expected to grow at the highest rate during the forecast period

These form factors offer high performance as PCIe bus (with direct contact) offers a very low latency.

The solid state drives market for TLC Planar held the largest market in 2016

With the shift in the usage of technology from SLC to MLC and from MLC to TLC, the price per GB of SSDs becomes cheaper. Therefore, TLC offers the cheapest solutions among all other technologies, along with high storage density. This leads to the increasing adoption of TLC SSDs in consumer applications such as notebooks, tablets, and others

The solid state drives market in automotive is expected to grow at the highest rate during the forecast period

The increasing demand for automotive infotainment systems and next-generation connected cars is expected to boost the growth of the solid state drives market, as connected car applications require high-performance graphics, communications, and data storage, and SSDs meet all of these requirements. SSD is a flash storage solution that enables reliable, high-performance storage in a wide range of in-vehicle applications such as 3D mapping and advanced augmented reality in navigation systems, entertainment systems, intuitive driver-assist technology, and data event recorders.

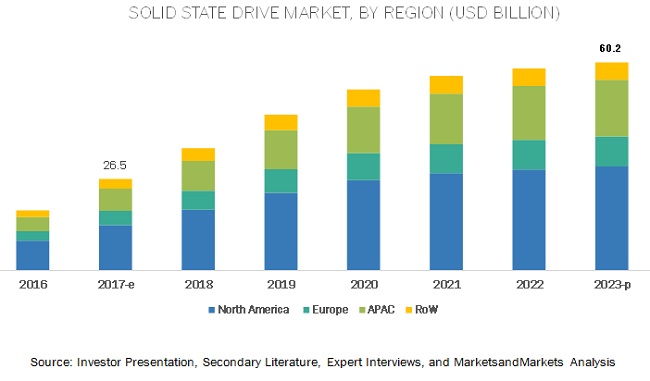

North America acquired the largest market for solid state drive in 2016

Leading companies in North America are providing most developed SSDs as advanced storage solutions to various industries. Enterprises in America are increasing their spending on IT infrastructure to gain a competitive edge and increase their business productivity. Therefore, there has been a strong push for using SSDs in IT infrastructure devices to save time, speed up data transfer, and achieve high-performance level. In addition, the replacement rate of traditional hard disk drives with SSDs is high in North America.

SSD Market Dynamics

Increasing penetration of high-end cloud computing

Cloud computing is becoming one of the preferred options for enterprises and consumers to back up and archive their data. The demand for SSDs has been rapidly increasing with the emerging number of cloud platforms—from the traditional corporate private and new public clouds to personal clouds in homes.

Technical advancements in the solid state storage have given rise to SSDs with new interfaces such as PCIe, NVMe, and others. Improved features such as high speed and quick data access encourage the adoption of PCIe SSDs for cloud computing.

New PCIe SSDs offer high performance with high frequency and reduced latency. A solid state drive with these features is required for various complex operations in data-sensitive industries such as financial services, life sciences, and energy management, where each microsecond of latency causes a huge loss in revenues.

Several major players manage their cloud platforms and address the growing customers’ demand for SSDs. For instance, Google (US) uses persistent SSD storage in open beta for compute engine users, providing high-input/output operations per second (IOPS) and allows google cloud platform users access SSDs faster on workloads. These operations provide faster input/output (I/O) delivery and are less redundant compared to the traditional magnetic media. Facebook Inc. (US) uses PCIe flash cards for its MySQL databases instead of HDD to take the advantage of FusionIO's logging system, which protects data in case of power failure. This has helped in decreasing latency by 50% and increasing throughput by 33% compared to the equivalent HDD storage. The use of SSDs helps in reducing infrastructure cost and improving response time. SSDs also offer much more inputs and outputs (I/Os) for mega-clouds and virtualized servers.

According to global cloud index, data center traffic has shown increasing requirements for data storage. The high-traffic data center would further drive the demand for SSDs owing to their high density and high-performance features.

Restraint: High cost and smaller life span of SSDs

The price of 1 GB of an SSD is higher than that of an HDD. For instance, 1 TB internal HDD costs around USD 0.07 per GB, whereas an SSD of the same capacity costs around USD 0.30 per GB. Recently, there has been a dramatic reduction in the price of NAND flash memory; even then the price of SSDs is more than HDDs. However, this trend may not continue in the future with the introduction of 3D NAND storage solutions. 3D NAND has become a game changer for the storage industry because of the increasing SSD capacities and dropping SSD prices. 3D NAND would allow SSDs to increase capacities well beyond the size of hard drives. Also, the lifespan of SSD is less than HDD; SSD has a limited write cycle as the flash memories in SSDs can be used for a definite number of writes. This is also one of the parameters associated with the cost of storage infrastructure using SSDs.

Opportunity: Relational analytics using smart SSDs

Relational analytics deals with data processing and code execution techniques. Smart SSDs are flash storage devices that consist of memory and computing resources for relational analytic query processing. The performance of relational analytics will be improved for widely distributed data using the computation functionality in SSDs itself. This reduces the processing power required in the host machine or increases the effective computing power of servers or appliances.

Instead of the traditional processors, smart SSD use its own processor, which is of high efficiency from the overall price/performance perspective ($/MHz ratio). So, integrating data processing in smart SSDs can reduce the energy consumption of the overall database server/appliance. This will eventually reduce the total cost of operating the database system. Also, in relational databases, metadata can be placed in SSDs as cache. This will help accelerate databases with high magnitude when it comes to queries, sorts, and calculations.

So, smart SSDs eventually provide an opportunity to commoditize a new style of data processing. At the same time, hardware and software vendors have to collaborate to explore this opportunity.

Challenge: Design complexity

Solid state drives are gaining popularity among people; at the same time, the increasing demand comes with high expectations for a variety of features and functionalities. To meet the expectations, manufacturers in this solid state storage industry are facing a challenge in terms of design considerations.

Challenges pertaining to SSD design are associated with different parameters such as performance, reliability, endurance, security, and flexibility. To get the desired performance, the host interface and the flash interface require a careful coordination, which sometimes needs the use of parallelism for multiple die programming. Managing temperature is another critical criterion while regulating performance and write speed. Also, the controllers needed to be designed according to the different characteristics of flash memories, which are used to manufacture SSDs. Every flash memory differs regarding page/block size, spare area, response time, and other factors.

Table of Content

1 Introduction

1.1 Objectives of the study

1.2 Market definition

1.3 Study scope

1.3.1 Market Scope

1.3.2 Years considered for the study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key data from secondary sources

2.1.2 Primary data

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 Market size estimation

2.3 Data triangulation

2.4 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

6 Industry Trends

6.1 Market Evolution

6.2 Value Chain Analysis

7 Market by Interface

7.1 Introduction

7.2 SATA

7.3 SAS

7.4 PCIe

8 Market by Form Factor

8.1 Introduction

8.2 1.8”/2.5”

8.3 3.5”

8.4 M.2

8.5 U.2 (SFF 8639)

8.6 FHHL and HHHL

9 Market by Technology

9.1 Introduction

9.2 SLC

9.3 MLC Planar

9.4 MLC 3D

9.5 TLC Planar

9.6 TLC 3D

10 Storage

10.1 Under 500 GB

10.2 500 GB–1 TB

10.3 1 TB – 2 TB

10.4 Above 2 TB

11 Market by End-User

11.1 Introduction

11.2 Enterprise

11.2.1 Server attached

11.2.2 Storage attached

11.3 Client

11.3.1 Desktop PC

11.3.2 Notebook

11.3.3 Tablet

11.3.4 Others

11.4 Industrial

11.5 Automotive

12 Geographic Analysis

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Rest of Europe

12.4 APAC

12.4.1 China

12.4.2 Taiwan

12.4.3 South Korea

12.4.4 India

12.4.5 Rest of APAC

12.5 Rest of the World

12.5.1 Africa

12.5.2 Latin America

12.5.3 Middle East

13 Competitive Landscape

13.1 Overview

13.2 Market Ranking (Key Player Analysis)

13.3 Competitive Situation & Trends

13.3.1 New Product Launches

13.3.2 Agreements & Collaborations

13.3.3 Mergers & Acquisitions

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Dynamic Differentiators

13.4.3 Innovators

13.4.4 Emerging Companies

14 Company Profiles

14.1 Key Companies

14.1.1 Samsung

14.1.2 Intel

14.1.3 Western Digital

14.1.4 Micron

14.1.5 Toshiba

14.1.6 Seagate

14.1.7 Microsemi

14.1.8 Lite-On

14.1.9 SK Hynix

14.1.10 Kingston

14.2 Other Key Companies

14.2.1 Viking

14.2.2 Adata

14.2.3 Bitmicro Networks

14.2.4 Mushkin

14.2.5 NetApp

14.2.6 Lexar Media

14.2.7 Crossbar

14.2.8 G.Skill

14.2.9 Violin Memory

14.2.10 Corsair Components

15 Appendix

List of Tables (108 Tables)

Table 1 Differentiation Between SSD and HDD

Table 2 Solid State Drives Market, By Form Factor, 2015–2023, (USD Billion)

Table 3 Market, By Form Factor, 2015–2023 (Thousand Units)

Table 4 Market for 1.8"/2.5”, By Interface, 2015–2023 (USD Million)

Table 5 Market for 1.8"/2.5”, By Region, 2015–2023 (USD Million)

Table 6 Market for 1.8"/2.5”, By Region, 2015–2023 (Million Units)

Table 7 Market for 3.5”, By Interface, 2015–2023 (USD Million)

Table 8 3.5” Solid State Drive Market, By Region, 2015–2023 (USD Million)

Table 9 Market for 3.5”, By Region, 2015–2023 (Thousand Units)

Table 10 Market for M.2/Msata, By Interface, 2015–2023 (USD Million)

Table 11 Market for M.2/Msata, By Region, 2015–2023 (USD Million)

Table 12 Market for M.2/Msata, By Region, 2015–2023 (Million Units)

Table 13 Market for U.2 (SFF 8639), By Interface, 2015–2023 (USD Million)

Table 14 Market for U.2 (SFF 8639), By Region, 2015–2023 (USD Million)

Table 15 Market for U.2 (SFF 8639), By Region, 2015–2023 (Thousand Units)

Table 16 Market for FHHL and HHHL, By Interface, 2015–2023 (USD Million)

Table 17 Market for FHHL and HHHL, By Region, 2015–2023 (USD Million)

Table 18 Market for FHHL and HHHL, By Region, 2015–2023 (Thousand Units)

Table 19 Market, By Interface, 2015–2023 (USD Billion)

Table 20 Market, By Interface, 2015–2023 (Million Units)

Table 21 Market for SATA, By End User, 2015–2023 (USD Million)

Table 22 Market for SATA, By End User, 2015–2023 (Million Units)

Table 23 Market for SATA, By Region, 2015–2023 (USD Million)

Table 24 SATA Solid State Drive Market, By Form Factor, 2015-2023 (USD Million)

Table 25 Market for SAS, By Region, 2015–2023 (USD Million)

Table 26 SAS Solid State Drive Market, By Form Factor, 2015-2023 (USD Million)

Table 27 Market for PCIE, By End User, 2015–2023 (USD Million)

Table 28 Market for PCIE, By End User, 2015–2023 (Thousand Units)

Table 29 Market for PCIE, By Region, 2015–2023 (USD Million)

Table 30 Solid State Drive Market, By Form Factor, 2015-2023 (USD Million)

Table 31 Market, By Technology, 2015–2023 (USD Billion)

Table 32 Market, By Technology, 2015–2023 (Million Units)

Table 33 TLC Planar vs TLC 3D Comparison

Table 34 Solid State Drive Market, By Storage, 2015–2023 (USD Million)

Table 35 Market, By End-User, 2015–2023 (USD Million)

Table 36 Market, By End-User, 2015–2023 (Million Units)

Table 37 Enterprise Solid State Drive Market, By Application, (USD Million)

Table 38 Enterprise Market, By Region, 2015–2023 (USD Million)

Table 39 Enterprise Market, By Interface, 2015–2023 (USD Million)

Table 40 Enterprise Market, By Interface, 2015–2023 (Million Units)

Table 41 Client Solid State Drive Market, By Application (USD Million)

Table 42 Client Market, By Region, 2015–2023 (USD Million)

Table 43 Client Market, By Interface, 2015–2023 (USD Million)

Table 44 Client Market, By Interface, 2015–2023 (Million Units)

Table 45 Industrial Solid State Drive Market, By Region, 2015–2023 (USD Million)

Table 46 Industrial Market, By Interface, 2015–2023 (USD Million)

Table 47 Industrial Market, By Interface, 2015–2023 (Million Units)

Table 48 Automotive Solid State Drive Market, By Region, 2015–2023 (USD Million)

Table 49 Automotive Market, By Interface, 2015–2023 (USD Million)

Table 50 Automotive Market, By Interface, 2015–2023 (Thousand Units)

Table 51 Market, By Region, 2015–2023 (USD Billion)

Table 52 Market, By Region, 2015–2023 (Million Units)

Table 53 Market in North America, By Country, 2015–2023 (USD Million)

Table 54 Market in North America, By Form Factor, 2015–2023 (USD Million)

Table 55 Market in North America, By Form Factor, 2015–2023, (Thousand Units)

Table 56 Market in North America, By Interface, 2015–2023, (USD Million)

Table 57 Market in North America, By End User, 2015–2023 (USD Million)

Table 58 Market for Enterprise in North America, By Country, 2015–2023 (USD Million)

Table 59 Market for Client in North America, By Country, 2015–2023 (USD Million)

Table 60 Market for Industrial in North America, By Country, 2015–2023 (USD Million)

Table 61 Market for Automotive in North America, By Country, 2015–2023 (USD Million)

Table 62 Market in US, By End User, 2015–2023 (USD Million)

Table 63 Market in Canada, By End User, 2015–2023 (USD Million)

Table 64 Market in Mexico, By End User, 2015–2023 (USD Million)

Table 65 Market in Europe, By Country, 2015–2023 (USD Million)

Table 66 Market in Europe, By Form Factor, 2015–2023, (USD Million)

Table 67 Market in Europe, By Form Factor, 2015–2023, (Thousand Units)

Table 68 Market in Europe, By Interface, 2015–2023, (USD Million)

Table 69 Market in Europe, By End-User, 2015–2023 (USD Million)

Table 70 Market for Enterprise in Europe, By Country, 2015–2023 (USD Million)

Table 71 Market for Client in Europe, By Country, 2015–2023 (USD Million)

Table 72 Market for Industrial in Europe, By Country, 2015–2023 (USD Million)

Table 73 Market for Automotive in Europe, By Country, 2015–2023 (USD Million)

Table 74 Market in UK, By End User, 2015–2023 (USD Million)

Table 75 Market in Germany, By End User, 2015–2023 (USD Million)

Table 76 Market in France, By End User, 2015–2023 (USD Million)

Table 77 Market in Rest of Europe, By End User, 2015–2023 (USD Million)

Table 78 Market in APAC, By Country, 2015–2023 (USD Million)

Table 79 Market in APAC, By Form Factor, 2015–2023, (USD Million)

Table 80 Solid State Drive Market in APAC, By Form Factor, 2015–2023, (Thousand Units)

Table 81 Market in APAC, By Interface, 2015–2023, (USD Million)

Table 82 Market in APAC, By End-User, 2015–2023 (USD Million)

Table 83 Market for Enterprise in APAC, By Country, 2015–2023 (USD Million)

Table 84 Market for Client in APAC, By Country, 2015–2023 (USD Million)

Table 85 Market for Industrial in APAC, By Country, 2015–2023 (USD Million)

Table 86 Market for Automotive in APAC, By Country, 2015–2023 (USD Million)

Table 87 Market in China, By End User, 2015–2023 (USD Million)

Table 88 Market in India, By End User, 2015–2023 (USD Million)

Table 89 Market in Taiwan, By End User, 2015–2023 (USD Million)

Table 90 Market in South Korea, By End User, 2015–2023 (USD Million)

Table 91 Market in Rest of APAC, By End User, 2015–2023 (USD Million)

Table 92 Market in RoW, By Geography, 2015–2023 (USD Million)

Table 93 Market in RoW, By Form Factor, 2015–2023, (USD Million)

Table 94 Market in RoW, By Form Factor, 2015–2023, (Thousand Units)

Table 95 Market in RoW, By Interface, 2015–2023, (USD Million)

Table 96 Market in RoW, By End-User, 2015–2023 (USD Million)

Table 97 Market for Enterprise in RoW, By Region, 2015–2023 (USD Million)

Table 98 Market for Client in RoW, By Region, 2015–2023 (USD Million)

Table 99 Market for Industrial in RoW, By Region, 2015–2023 (USD Million)

Table 100 Market for Automotive in RoW, By Region, 2015–2023 (USD Million)

Table 101 Market in Africa, By End User, 2015–2023 (USD Million)

Table 102 Market in Latin America, By End User, 2015–2023 (USD Million)

Table 103 Market in Middle East, By End User, 2015–2023 (USD Million)

Table 104 Market Share Analysis of the Players in the Solid State Drives Market in 2016

Table 105 Product Launches, 2016 – 2017

Table 106 Partnerships, Agreements, and Collaborations, 2015–2017

Table 107 Acquisitions, 2014–2016

Table 108 Investments and Expansions, 2016–2017

List of Figures (46 Figures)

Figure 1 Solid State Drives Market Segmentation

Figure 2 Research Flow

Figure 3 Solid State Drive Market: Research Design

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Solid State Drive Market for PCIE Interface SSD Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 8 The Market for “1.8/2.5” Form Factors is Expected to Hold the Largest Share During the Forecast Period

Figure 9 Market for TLC 3D is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 SSD Market for Automotive Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 North America Accounted for the Largest Market Share in 2016

Figure 12 SSD Market to Provide Attractive Growth Opportunities During the Forecast Period

Figure 13 Market PCIE Interface in Automotive Industry is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Enterprise Industry Held the Largest Market Share of the Market in APAC in 2016

Figure 15 SSD Market in China Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Solid State Drives Market in China Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Increasing Penetration of High-End Cloud Computing and the Growing Adoption of SSDS in Data Center are Driving the Growth of the Market

Figure 18 Data Center Traffic

Figure 19 Evolution of Market

Figure 20 Value Chain: Market, 2016

Figure 21 Market for FHHL and HHHL Form Factor is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 SSD Market for 1.8"/2.5” in APAC is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 SSD Market for M.2 in APAC is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 SSD Market for PCIE Interface is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Market for SATA in Automotive is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Solid State Drives Market for TLC 3D is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 SSD Market for the Automotive Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Enterprise SSD Market for Storage-Attached Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Client Market for Tablets is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Industrial SSD Market in APAC is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Automotive SSD Market for PCIE Interface is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Geographic Snapshot: Rapidly Growing Countries Such as Taiwan and China Emerging as High-Potential Markets (2017–2023)

Figure 33 Market in APAC Estimated to Grow at the Highest CAGR Between 2017 and 2023

Figure 34 North America: Solid State Drive Market Snapshot

Figure 35 Europe: Market Snapshot

Figure 36 APAC: Market Snapshot

Figure 37 Companies Adopted Product Launch as the Key Growth Strategy Over the Last 4 Years (2014– August 2017)

Figure 38 Samsung: Company Snapshot

Figure 39 Intel: Company Snapshot

Figure 40 Western Digital: Company Snapshot

Figure 41 Micron: Company Snapshot

Figure 42 Toshiba: Company Snapshot

Figure 43 Seagate: Company Snapshot

Figure 44 Microsemi: Company Snapshot

Figure 45 Lite-On: Company Snapshot

Figure 46 SK Hynix: Company Snapshot

With the increasing adoption of SSDs, security is becoming a major concern. Ideally, hardware-based encryption is preferred over software-based encryption as software encryption is more vulnerable to crashes. At the same time, the improper designing of hardware-based encryption may hinder the overall performance. Advanced SSD controllers coordinate with various encryption standards such as ATA, TCG’s Opal/Enterprise, IEEE 1667, and others to improve the design. Therefore, overcoming design problems of SSDs is a challenge for the solid state drives market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015-2023 |

|

Base year considered |

2016 |

|

Forecast period |

2017-2023 |

|

Forecast units |

Value (USD) in million |

|

Segments covered |

Interface, form factor, technology, storage, end-user, and region |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Samsung (South Korea), Intel (US), Western Digital (US), Micron (US), Toshiba (Japan), Kingston (US), Lite-On (Taiwan), Seagate (Ireland), SK hynix (South Korea), Microsemi (US), Viking (US), Adata (Taiwan), Bitmicro Networks (US), Mushkin (US), NetApp (US), Lexar Media (US), Crossbar (US), G.Skill (Taiwan), Violin Memory (US), Corsair Components (US). |

This research report categorizes the solid state drives market based on interface, form factor, technology, storage, end-user, and region.

Solid State Drives Market, by interface

- SATA

- SAS

- PCIe

Solid State Drives Market, by Form Factor

- 1.8”/2.5”

- 3.5”

- M.2

- U.2 (SFF 8639)

- FHHL and HHHL

Solid State Drives Market, by Technology

- SLC

- MLC Planar

- MLC 3D

- TLC Planar

- TLC 3D

SSD Market, by Storage:

- Under 500 GB

- 500 GB–1 TB

- 1 TB – 2 TB

- Above 2 TB

SSD Market, by End-User:

- Enterprise

- Client

- Industrial

- Automotive

SSD Market, by Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Key Market Players:

Key players in the solid state drives market include Samsung (South Korea), Intel (US), Western Digital (US), Micron (US), Toshiba (Japan), Kingston (US), Lite-On (Taiwan), Seagate (Ireland), SK hynix (South Korea), Microsemi (US), Viking (US), Adata (Taiwan), Bitmicro Networks (US), Mushkin (US), NetApp (US), Lexar Media (US), Crossbar (US), G.Skill (Taiwan), Violin Memory (US), Corsair Components (US).

Samsung Electronics Co., Ltd. (South Korea) has been at the top position because of its wide contribution to the parent market share and high financial power. The company accounted for a share of around 38.87% of the solid state drive market in 2016. The company has a strong technical expertise and a broad product portfolio in the solid state drives market. The company is one of the leading global brands in the storage industry and has a wide geographic reach through various distribution networks. The company’s innovative offering, V-NAND, improves the latency in its SSD products. The Charge Trap Flash (CTF) technology prevents data corruption caused by cell-to-cell interference and also leads to improved speed, power efficiency, and endurance.

Recent Developments:

- In May 2018, Western Digital launched 3D NAND SATA SSD with 64-layer 3D NAND technology for high capacity and reduced cell–cell interference for enhanced reliability.

- In August 2017, Samsung launched Portable SSD T5, the latest 64-layer V-NAND technology, which delivers industry-leading transfer speed with encrypted data security.

- In August 2017, Micron expanded its manufacturing facility in Boise, Idaho, US. The investment in R&D is dedicated toward developing new semiconductor manufacturing processes and designs for the company's future memory and storage technologies.

Critical questions the report answers:

- Where will all the developments take the industry in the mid to long term?

- What are the emerging applications that are expected to drive the solid state drives market?

- What are the key strategies adopted by leading companies in the solid state drives market?

- What are the trends prevalent in the solid state drives market?

- What advanced technologies are expected to gain traction in the solid state drives market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Solid State Drives Market