Space Militarization Market by Capability (Defense (Weapons, ISR, Electronic Warfare) Support (Navigation, Communications, Others), Solution (Space-based Equipment (Space Stations, Satellites), Ground-based Equipment, Logistics & Services)) and Region - Global Forecast to 2030

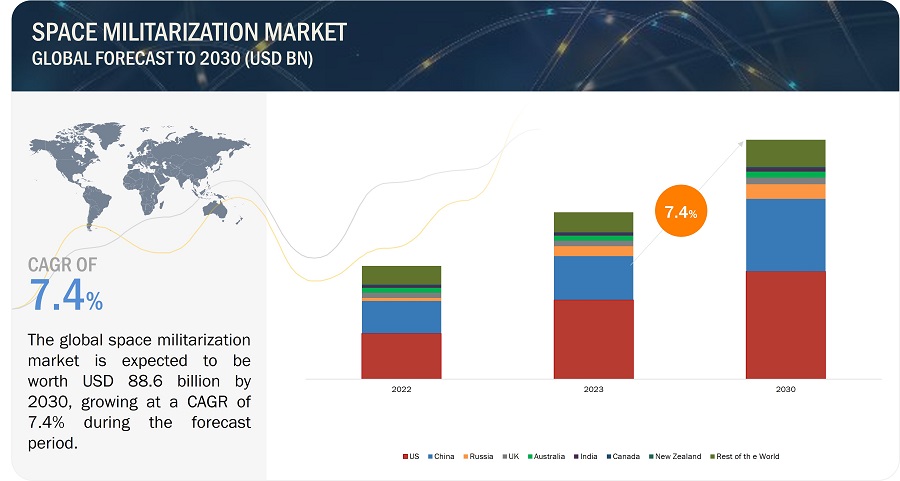

The Space Militarization market is projected to grow from USD 53.7 billion in 2023 to USD 88.6 billion by 2030, at a CAGR of 7.4%. The increasing importance of space for military applications, driven using space-based assets for communication, navigation, intelligence, surveillance, and reconnaissance, contributes to the growth of the space militarization market. As space continues to play a vital role in military operations, the demand for space militarization is on the rise. However, China faces competition from other countries, such as the United States and Russia, which also invest in space militarization to develop their own space-based assets for military purposes.

This growing competition pushes China to invest further in space militarization to keep its military advantage and strategic positioning in space. Furthermore, technological advances are playing a crucial role in driving the expansion of the space militarization market in China. Emerging technologies like artificial intelligence (AI) and directed energy weapons are being developed and adapted for use in space. These advancements are significantly enhancing military capabilities in space and making it a more contested and potentially hazardous domain. Consequently, the demand for space militarization increases as China looks to use these cutting-edge technologies to bolster its space-based military assets and maintain a competitive edge.

Space Militarization Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Space Militarization Market Dynamics

Driver: Technological Advancements in the Space Sector

Technological advancements have played a significant role in driving the growth of the space militarization market. Several key developments have contributed to the increased capabilities and efficiency of space-based military systems. These advancements can be categorized into miniaturization, improved sensors, and communications systems. Miniaturization: The miniaturization of space technologies has revolutionized the development of space-based military systems. It involves reducing the size, weight, and power requirements of components, enabling the deployment of smaller and more agile spacecraft. Miniaturization allows for the integration of advanced functionalities into compact packages, making it possible to deploy multiple satellites or payloads simultaneously. This capability enhances military operations by enabling better surveillance, reconnaissance, and intelligence gathering. Improved Sensors: Advances in sensor technologies have significantly enhanced the capabilities of space-based military systems. These sensors include high-resolution optical imagers, synthetic aperture radar (SAR), infrared sensors, and advanced electronic warfare (EW) systems. High-resolution optical imagers supply detailed imagery and enable precise target identification and tracking. SAR sensors offer all-weather and day-and-night imaging capabilities, supplying critical situational awareness in challenging conditions. Infrared sensors are used for heat detection, allowing the identification of thermal signatures and tracking of targets. Advanced EW systems supply enhanced detection, jamming, and countermeasure capabilities, protecting space assets from hostile threats. Communications Systems: Improved communications systems are crucial for effective command, control, and coordination of space-based military assets. These systems enable real-time data transmission, secure communication links, and networked operations. Advancements in satellite communication technologies, such as high-frequency bands, signal processing techniques, and phased array antennas, have increased the ability, speed, and reliability of space-based communications. These developments support seamless integration and interoperability among different military platforms, enhancing overall operational effectiveness. These advancements have enhanced the capabilities of space assets, enabling improved surveillance, reconnaissance, intelligence gathering, communication, and operational effectiveness. However, it is important to note that the militarization of space raises concerns about the weaponization of outer space and the potential for an arms race, needing careful consideration of international regulations and agreements.

Restraints: Space Sustainability and Long-term Environmental Impacts

Space sustainability and long-term environmental impacts are significant concerns associated with the militarization of space. The deployment of space-based military assets can contribute to the accumulation of space debris, which poses risks to operational satellites and other space infrastructure. This proliferation of space debris can have detrimental effects on the long-term sustainability of space activities and give rise to potential collisions that worsen the debris problem. The militarization of space can add to the existing population of space debris through activities such as missile tests, anti-satellite weapons demonstrations, or the destruction of satellites. The presence of space debris poses a threat to operational satellites and spacecraft. Collisions with even small debris particles can cause significant damage or complete destruction of vital assets. This poses risks to communication, navigation, weather monitoring, and other critical services that depend on satellites. The loss of these capabilities can have far-reaching implications for both military and civilian operations.

Efforts are underway within the international space community to address the issue of space debris and promote sustainable space practices. However, the militarization of space adds complexity to these efforts, needing careful consideration of the potential environmental impacts and the implementation of mitigation measures to ensure the long-term viability of space activities.

Opportunities: Increased focus on Space Situational Awareness (SSA)

Space Situational Awareness (SSA) is becoming increasingly important as the number of satellites and space debris in orbit continues to rise. To effectively check, track, and predict potential collisions or threats in space, there is a growing opportunity for the development of advanced sensors, tracking systems, and analytical tools to enhance SSA capabilities. Advanced sensors play a vital role in improving SSA. These sensors can be deployed on satellites, ground-based telescopes, or dedicated space surveillance platforms. They must have high-resolution imaging capabilities and be capable of detecting and tracking small objects in space. Sensor technologies such as adaptive optics, interferometry, and advanced focal plane arrays can enhance the precision and sensitivity of space object detection. Tracking systems are essential for accurately deciding the positions and trajectories of satellites and space debris. These systems employ radar, laser ranging, or radio frequency techniques to gather data on objects in space. The development of high-precision tracking systems that can run across a wide range of orbits and supply real-time tracking updates is a promising opportunity in SSA. Analytical tools are crucial for processing and analyzing the vast amount of data collected by sensors and tracking systems. Machine learning algorithms, data fusion techniques, and predictive modeling can be applied to improve object identification, trajectory prediction, and collision avoidance capabilities. These tools can help find potential threats, assess collision risks, and perfect orbital maneuvers for satellites. Furthermore, advancements in data integration and fusion can ease the creation of comprehensive space object catalogs and databases. These repositories would store information on the characteristics, orbits, and ownership of satellites and space debris. By using artificial intelligence and data analytics, operators can gain actionable insights from these catalogs, enabling informed decision-making in space operations. Overall, the growing need for improved SSA presents significant opportunities for the development of advanced sensors, tracking systems, and analytical tools. These advancements will contribute to safer and more efficient space operations, mitigating the risks posed by the increasing congestion of objects in orbit.

Challenges: Concern over space debris

Space debris, formed of defunct satellites and remnants from past space missions, presents a substantial challenge to the space militarization market. The accumulation of debris in Earth's orbit intensifies the likelihood of collisions, which could trigger a cascade of further collisions known as the Kessler Syndrome. This scenario would result in a significant increase in space debris, making certain orbits hazardous or even inaccessible for military operations. To ensure the long-term sustainability of space militarization efforts, it is imperative to implement effective strategies for debris mitigation and removal. Debris mitigation involves adopting measures during satellite design and operation to minimize the creation of new space debris. This includes strategies such as designing satellites with propulsion systems for deorbiting at the end of their operational life, using deployable structures to reduce the risk of fragmentation, and employing collision avoidance maneuvers to evade potential collisions with other objects. International collaboration is vital for the development and implementation of effective debris mitigation and removal strategies. Efforts such as information sharing, coordination of space operations, and the establishment of standards and guidelines contribute to reducing space debris and ensuring the safety of space-based military operations.

To maintain the long-term sustainability of space militarization, it is imperative to prioritize the implementation of robust debris mitigation measures, accelerate research and development in active debris removal technologies, and foster international cooperation in space traffic management and debris mitigation efforts. These efforts are essential to mitigate collision risks, preserve orbital access, and safeguard the future viability of space-based military capabilities.

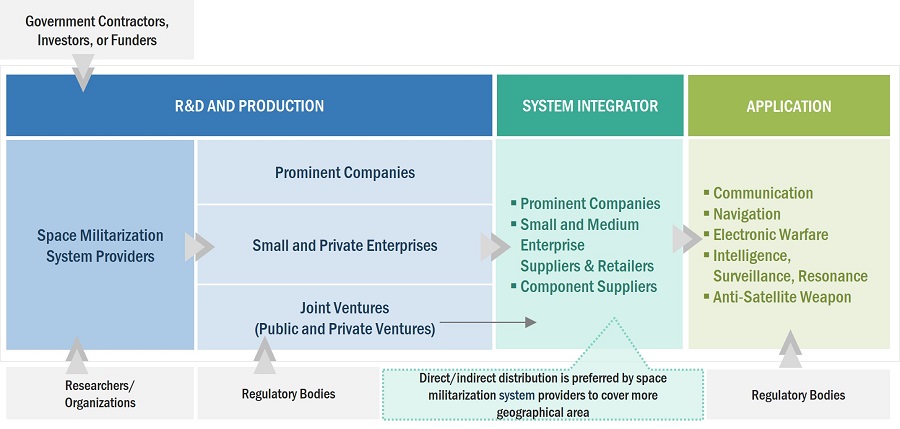

Space Militarization Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Space Militarization systems and platforms. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include General Dynamics Corporation (US), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Airbus SE (Netherlands), Lockheed Martin Corporation (US), and L3Harris Technologies, Inc. (US).

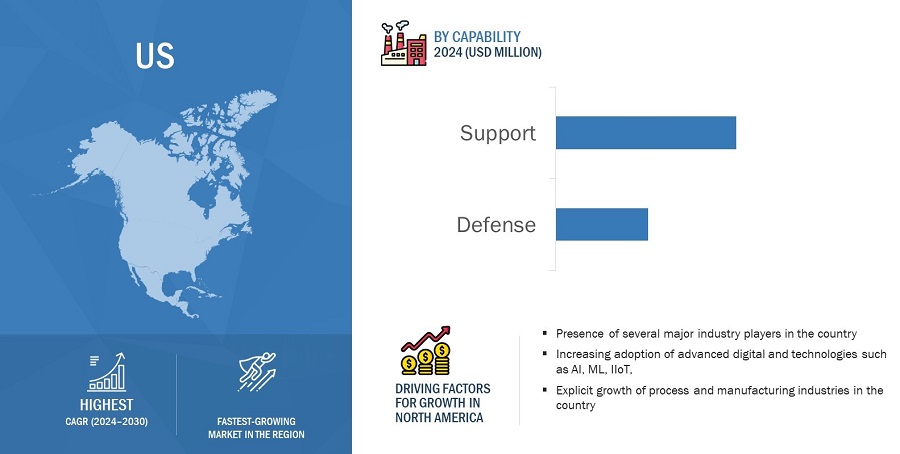

Based on Capability, the Defense segment is estimated to account for the largest market share of the Space Militarization market.

Based on Capability, the Defense segment is estimated to account for the largest market share. The growing market for space militarization is primarily driven by geopolitical factors, national security concerns, technological advancements, and the pursuit of military modernization. Space-based assets offer essential capabilities that improve situational awareness, and intelligence gathering, thus strengthening a nation's defense capabilities in the modern era. As countries recognize the strategic importance of space, they invest in developing and deploying military technologies that can protect their assets, project power, and potentially counter threats in space. However, the pursuit of space militarization also raises ethical, legal, and diplomatic considerations as efforts to maintain a balance between peaceful uses and potential weaponization of space continue.

The China market is projected to witness the highest growth rate for the Space Militarization market.

China is expected to hold the highest growth rate in the Space Militarization market during the forecast period. The growing importance of space for military purposes has led to an increase in demand for space militarization. Space-based assets play a crucial role in various military applications such as communication, navigation, intelligence gathering, surveillance, and reconnaissance. As nations continue to rely on these capabilities for their military operations, the need to protect and enhance their space assets becomes more prominent. This trend suggests that the space militarization market is expected to grow as countries invest in technologies and strategies to bolster their military capabilities in space. However, it is important to consider the geopolitical implications and international agreements surrounding the weaponization of space.

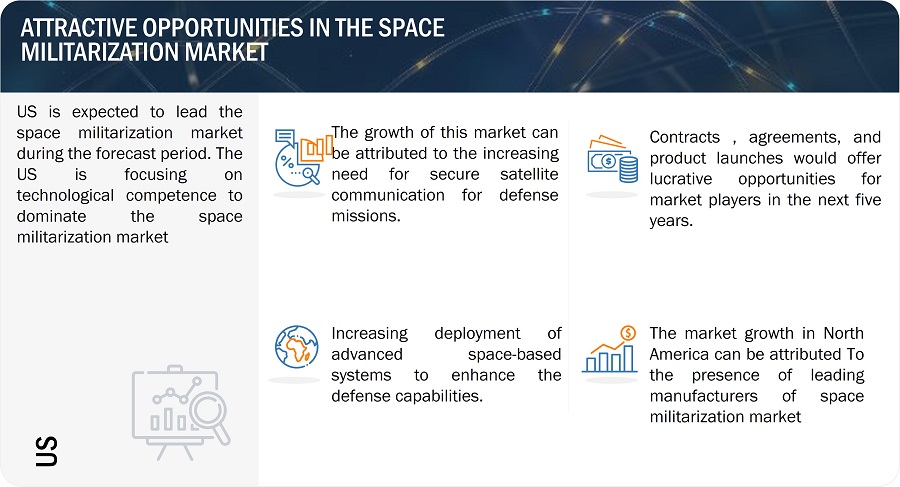

The US market is projected to dominate the Space Militarization market.

Europe is expected to hold the highest growth rate in the Space Militarization market during the forecast period. The growing importance of space for the US economy highlights its increasing reliance on space-based assets. These assets play crucial roles in communication, navigation, weather forecasting, and more. The US economy heavily depends on the smooth functioning of these space-based systems. Any disruption or loss of these assets can have far-reaching consequences, impacting sectors such as telecommunications, finance, and national security. Protecting and ensuring the resilience of space-based assets becomes crucial to safeguard the US economy from potential disruptions and maintain the continuity of essential services provided by these systems.

Space Militarization Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Space Militarization companies is dominated by a few globally established players such as General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Airbus SE (Netherlands), Lockheed Martin Corporation (US), and L3Harris Technologies Inc. (US) are some of the leading players operating in the space militarization market, are the key manufacturers that secured space militarization contracts in the last few years. A major focus was given to the contracts and new product development due to the changing requirements of commercial, government and, military & space users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

$53.7 billion in 2023 |

|

Projected Market Size |

$88.6 billion by 2030 |

|

CAGR |

7.4% |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Capability, By Solution |

|

Geographies covered |

US, UK, New Zealand, India, Russia, China, Australia, Canada and Rest of the World |

|

Companies covered |

General Dynamics Corporation (US), Raytheon Technologies Corporation (US), The Boeing Company (US), Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), and Thales (France) and among others. |

Space Militarization Market Highlights

The study categorizes the Space Militarization market based on Capability, Solution, and Region.

|

Segment |

Subsegment |

|

By Capability |

|

|

By Solution |

|

|

By Countries |

|

Recent Developments

- In November 2022, Northrop Grumman Corporation: - Northrop Grumman Corporation demonstrated its prototype Tactical Intelligence Targeting Access Node (TITAN). It is an all-domain ground station that will provide rapid satellite images and data to command centers across the borders.

- In June 2021, Lockheed Martin Corporation: - Lockheed Martin Corporation developed cloud-based software for ground control systems. Verge is a service that uses a network of low-cost receivers combined with cloud computing and storage power.

Frequently Asked Questions (FAQ):

Which are the major companies in the Space Militarization market? What are their major strategies to strengthen their market presence?

Some of the key players in the Space Militarization market are General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Airbus SE (Netherlands), Lockheed Martin Corporation (US), and L3Harris Technologies, Inc. (US) among others, are the key manufacturers that secured Space Militarization system contracts in the last few years.

What are the drivers and opportunities for the Space Militarization market?

The market for Space Militarization equipment has grown substantially across the globe, especially in North America. With new capabilities, including faster data rates, better imaging resolution, and increased dependability, satellite technology is growing vigorously quickly. Due to this increased demand, there is an increased need for space-based applications with the necessary capabilities, such as antennas that can receive higher-frequency signals and data processing systems that can manage bigger data loads.

Which region is expected to grow at the highest rate in the next six years?

The market in the China region is projected to grow at the highest CAGR from 2024 to 2030, showcasing strong demand for Space Militarization in the region. Several European countries and organizations are also actively investing in the deployment of Space-based capability around Europe.

What is the CAGR of the Space Militarization Market?

The CAGR of the Satellite Ground Market is 7.4%

Which function of Space Militarization is expected to lead significantly in the coming years?

The intelligence, Surveillance, and Reconnaissance segment of the Space Militarization market is projected to see the highest CAGR.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing reliance on space assets- Global space dominance- National security imperatives- Technological advancements of space-based military systemsRESTRAINTS- Space sustainability and long-term environmental impacts- Technical problems in space-based military systems- International relations and diplomatic consideration- Cost and budget constraints for space technologiesOPPORTUNITIES- Increasing focus on space situational awareness- Development of anti-satellite technologies- Commercial space ventures in military industryCHALLENGES- Concern over space debris- Cost and resource allocation

- 5.3 RECESSION IMPACT ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR SPACE MILITARIZATION SYSTEM MANUFACTURERS

-

5.6 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICREST OF THE WORLD

- 5.9 TRADE ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.11 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Development of active electronically scanned array- Advancement of space-based missile defense systems- Miniaturization in space technologySUPPORTING TECHNOLOGIES- AI in space militarization

-

5.12 USE CASE ANALYSISSPACE-BASED ANTI-SATELLITE SYSTEMSPACE-BASED INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCESPACE-BASED SATELLITE COMMUNICATION RELAY NETWORK

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSSPACE-BASED SENSOR NETWORKCYBERSECURITY AND SPACE DEFENSEAUTONOMOUS AND AI-ENABLED SPACE SYSTEMSPACE-BASED LASER SYSTEM

-

6.4 IMPACT OF MEGATRENDSINTELLIGENT COMMUNICATION NETWORKSENSOR FUSION AND INTELLIGENCE SHARINGQUANTUM COMPUTING

- 7.1 INTRODUCTION

-

7.2 DEFENSEWEAPONS- Development of ASAT weapons for space militarization to drive marketINTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE- Growing significance of ISR capabilities in space militarization to boost marketELECTRONIC WARFARE- Development of cyber warfare to enhance space capabilities

-

7.3 SUPPORTNAVIGATION- Harnessing power of global navigation satellite systems to propel marketCOMMUNICATIONS- Securing military-grade SATCOM systems for resilient operations to promote market growthOTHERS

- 8.1 INTRODUCTION

-

8.2 SPACED-BASED EQUIPMENTSPACE STATIONS- Equipped with advanced communication systems to acquire ISR dataSATELLITES- LEO Satellites- MEO Satellites- GEO Satellites- IGSO Satellites

-

8.3 GROUND-BASED EQUIPMENTGROUND-BASED SPACE SURVEILLANCE NETWORK- Comprises strategically distributed assemblage of ground-based radars, telescopes, and additional sensory apparatusesGROUND CONTROL STATIONS- Help with stable space-based communication platform for IoT devicesANTI-SATELLITE SYSTEMS- Critical component of country’s defense strategyLAUNCH FACILITIES- Incorporate cutting-edge technologies and infrastructure to serve distinctive requisites of military space missionsTRACKING AND SURVEILLANCE SYSTEMS- Facilitate military forces in obtaining real-time intelligence and identifying potential threats

-

8.4 SLOGISTICS & SERVICESLOGISTICS- Growing number of military assets in orbit to drive marketSPACE LAUNCH SERVICES- Several players offering range of launch vehicles and services to increase competition in marketSPACE SITUATIONAL AWARENESS- Proliferation of space debris to drive demand

- 9.1 INTRODUCTION

- 9.2 RECESSION IMPACT ANALYSIS

-

9.3 USTO BE DOMINANT SPACE MILITARIZATION MARKET

-

9.4 CHINAINCREASED GOVERNMENT INVESTMENTS FOR VARIOUS SPACE INITIATIVES TO DRIVE MARKET

-

9.5 UKINCREASING DEMAND FOR SATELLITE-BASED SERVICES TO BOOST MARKET

-

9.6 INDIAGROWING RELIANCE ON SELF-DEVELOPED SPACE SYSTEMS TO PROPEL MARKET

-

9.7 AUSTRALIADEVELOPMENT OF SELF-DEVELOPED SPACE SYSTEMS TO DRIVE MARKET

-

9.8 CANADAINNOVATIONS IN SPACE MILITARIZATION TECHNOLOGIES TO DRIVE MARKET

-

9.9 NEW ZEALANDINCREASING GOVERNMENT INVESTMENT IN SPACE-BASED TECHNOLOGIES TO DRIVE MARKET

-

9.10 RUSSIADEVELOPMENT OF ANTI-SATELLITE WEAPON SYSTEMS TO DRIVE MARKET

- 9.11 REST OF THE WORLD

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 10.3 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHER DEALS/DEVELOPMENTS

-

11.1 LOCKHEED MARTIN CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.2 RAYTHEON TECHNOLOGIES CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.3 NORTHROP GRUMMAN CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.4 L3HARRIS TECHNOLOGIES, INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.5 GENERAL DYNAMICS CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.6 THE BOEING COMPANYBUSINESS OVERVIEWPRODUCT/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.7 ASELSAN A.S.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.8 AIRBUSBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.9 SAAB ABBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.10 THALES GROUPBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.11 SPACE EXPLORATION TECHNOLOGIES CORPORATION (SPACEX)BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.12 TELEDYNE TECHNOLOGIES INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.13 BAE SYSTEMS PLCBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.14 LEONARDO S.P.A.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.15 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.16 ISRAEL AEROSPACE INDUSTRIES LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.1 DISCUSSION GUIDESPACE MILITARIZATION MARKET (2023–2030)- Introduction- Market dynamics

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 SPACE MILITARIZATION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN NORTH AMERICA

- TABLE 5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN EUROPE

- TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN ASIA PACIFIC

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN REST OF THE WORLD

- TABLE 8 SPACE MILITARIZATION MARKET: TOP IMPORTERS, 2019–2022 (USD BILLION)

- TABLE 9 MARKET: COUNTRY-WISE IMPORTS, 2019–2022 (USD THOUSAND)

- TABLE 10 MARKET: COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 11 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 12 MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 13 SPACE MILITARIZATION MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 14 DEFENSE CAPABILITY: MARKET, BY SUB-SEGMENT, 2019–2022 (USD BILLION)

- TABLE 15 DEFENSE CAPABILITY: MARKET, BY SUB-SEGMENT, 2023–2030 (USD BILLION)

- TABLE 16 MARKET, BY SUPPORT CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 17 MARKET, BY SUPPORT CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 18 MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 19 MARKET, BY COUNTRY, 2023–2030 (USD BILLION)

- TABLE 20 US: MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 21 US: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 22 CHINA: SPACE MILITARIZATION MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 23 CHINA: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 24 UK: MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 25 UK: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 26 INDIA: SPACE MILITARIZATION MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 27 INDIA: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 28 AUSTRALIA: SPACE MILITARIZATION MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 29 AUSTRALIA: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 30 CANADA: SPACE MILITARIZATION MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 31 CANADA: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 32 NEW ZEALAND: SPACE MILITARIZATION MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 33 NEW ZEALAND: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 34 RUSSIA: MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 35 RUSSIA: MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 36 REST OF THE WORLD: SPACE MILITARIZATION MARKET, BY CAPABILITY, 2019–2022 (USD BILLION)

- TABLE 37 REST OF THE WORLD:MARKET, BY CAPABILITY, 2023–2030 (USD BILLION)

- TABLE 38 SPACE MILITARIZATION MARKET: DEGREE OF COMPETITION

- TABLE 39 KEY DEVELOPMENTS BY LEADING PLAYERS IN SPACE MILITARIZATION MARKET, 2019–2022

- TABLE 40 COMPANY FOOTPRINT

- TABLE 41 COMPANY REGION FOOTPRINT

- TABLE 42 SPACE MILITARIZATION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2019–MAY 2023

- TABLE 43 MARKET: DEALS, JULY 2019–JUNE 2023

- TABLE 44 SPACE MILITARIZATION MARKET: OTHER DEALS/DEVELOPMENTS, MARCH 2019–MARCH 2023

- TABLE 45 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 46 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 47 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 48 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 49 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 50 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 51 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 52 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 53 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 54 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 55 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 56 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 57 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 58 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 59 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 60 THE BOEING COMPANY: DEALS

- TABLE 61 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 62 ASELSAN A.S.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 63 ASELSAN A.S.: DEALS

- TABLE 64 AIRBUS: COMPANY OVERVIEW

- TABLE 65 AIRBUS: DEALS

- TABLE 66 SAAB AB: COMPANY OVERVIEW

- TABLE 67 THALES GROUP: COMPANY OVERVIEW

- TABLE 68 THALES GROUP: DEALS

- TABLE 69 SPACE EXPLORATION TECHNOLOGIES CORPORATION (SPACEX): COMPANY OVERVIEW

- TABLE 70 SPACE EXPLORATION TECHNOLOGIES CORPORATION (SPACEX): DEALS

- TABLE 71 TELEDYNE TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 72 TELEDYNE TECHNOLOGIES INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 73 TELEDYNE TECHNOLOGIES INC.: DEALS

- TABLE 74 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 75 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 76 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 77 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 78 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- FIGURE 1 SPACE MILITARIZATION MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 SPACE MILITARIZATION MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SUPPORT SEGMENT TO LEAD MARKET FROM 2023 TO 2030

- FIGURE 9 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE SEGMENT TO LEAD MARKET FROM 2023 TO 2030

- FIGURE 10 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 DEPLOYMENT OF ADVANCED TRACKING, MONITORING, AND SURVEILLANCE SYSTEMS TO DRIVE MARKET

- FIGURE 12 US TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 NAVIGATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SPACE MILITARIZATION MARKET

- FIGURE 15 SPACE MILITARIZATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 16 REVENUE SHIFT CURVE IN SPACE MILITARIZATION MARKET

- FIGURE 17 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 18 SPACE MILITARIZATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 19 DEFENSE SEGMENT TO GROW AT HIGHER CAGR FROM 2023 TO 2030

- FIGURE 20 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE SEGMENT TO GROW AT HIGHER CAGR FROM 2023 TO 2030

- FIGURE 21 COMMUNICATION SEGMENT TO GROW AT HIGHER CAGR FROM 2023 TO 2030

- FIGURE 22 CHINA TO GROW AT HIGHEST RATE IN SPACE MILITARIZATION MARKET

- FIGURE 23 US TO HOLD LARGEST MARKET SHARE IN SPACE MILITARIZATION MARKET

- FIGURE 24 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 25 US: SPACE MILITARIZATION MARKET, BY CAPABILITY

- FIGURE 26 CHINA: MARKET, BY CAPABILITY

- FIGURE 27 UK: MARKET, BY CAPABILITY

- FIGURE 28 INDIA: SPACE MILITARIZATION MARKET, BY CAPABILITY

- FIGURE 29 AUSTRALIA:MARKET, BY CAPABILITY

- FIGURE 30 CANADA: MARKET, BY CAPABILITY

- FIGURE 31 NEW ZEALAND: SPACE MILITARIZATION MARKET, BY CAPABILITY

- FIGURE 32 RUSSIA: SPACE MILITARIZATION MARKET, BY CAPABILITY

- FIGURE 33 REST OF THE WORLD: MARKET, BY CAPABILITY

- FIGURE 34 SHARE OF TOP PLAYERS IN SPACE MILITARIZATION MARKET, 2022

- FIGURE 35 RANKING OF LEADING PLAYERS IN SPACE MILITARIZATION MARKET, 2022

- FIGURE 36 SPACE MILITARIZATION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 41 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 43 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 44 AIRBUS: COMPANY SNAPSHOT

- FIGURE 45 SAAB AB: COMPANY SNAPSHOT

- FIGURE 46 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 47 TELEDYNE TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 48 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 49 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 50 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

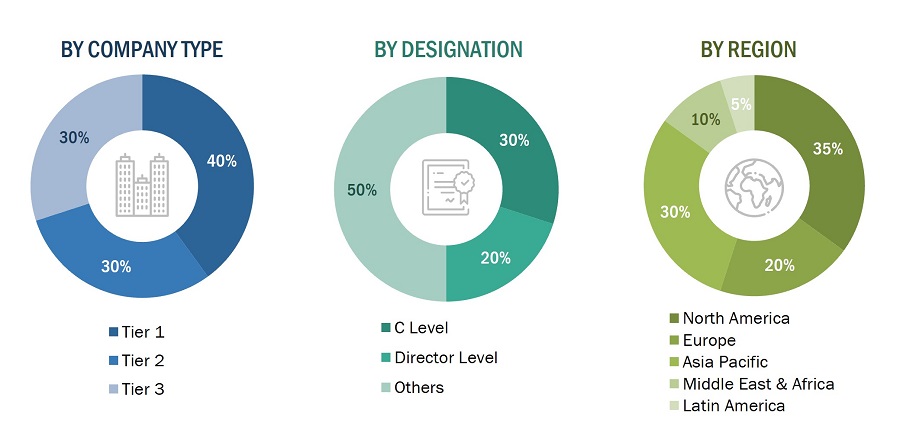

The study involved four major activities in estimating the current size of the Space Militarization market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the space militarization market was carried out using secondary data from paid and unpaid sources and analyzing their product and service offerings. These companies were rated based on the performance and quality of their products. Primary sources further validated the data points.

Secondary sources referred to for this research study included the European Space Agency (ESA), the Indian Space Research Organization (ISRO), the National Aeronautics and Space Administration (NASA), the United Nations Conference on Trade and Development (UNCTAD), the Satellite Industry Association (SIA), and corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Space Militarization market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions of North America, Europe, Asia-Pacific, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from Space Militarization vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various technology, application, vertical, and regional trends. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using Space Militarization, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Space Militarization and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Space Militarization market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the Space Militarization market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

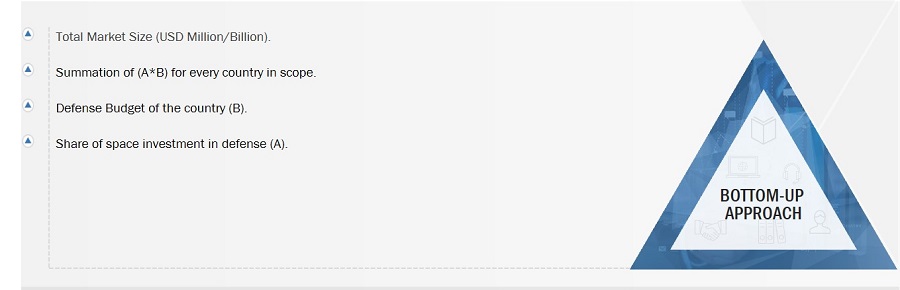

Global Space Militarization market size: Bottom-Up Approach

The space militarization market, by region, was used for estimating and projecting the global market size from 2023 to 2030.

The market size was calculated by adding the platform subsegments mentioned below, and different methodologies adopted for each to arrive at the market numbers are delineated below:

Space militarization market = Sum of share of space investments from the defense budget for each country

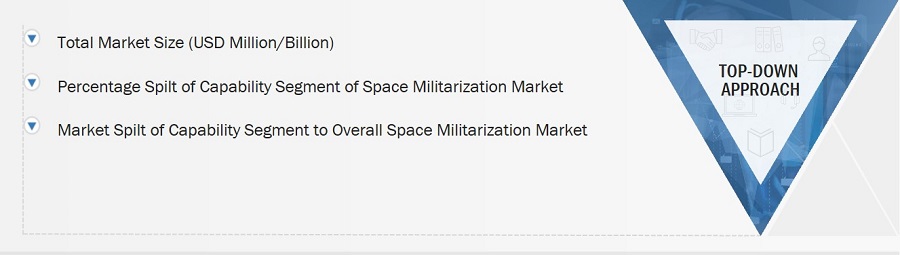

Global Space Militarization Market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. The size of the immediate parent market was used to implement the top-down approach and calculate specific market segments. The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

- Companies manufacturing space militarization equipment/provides space-based services to defense organizations are included in the report.

- Companies’ total revenue was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees, sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to space militarization were mapped and summed up.

- Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), each segment's share of the space militarization market was estimated.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the Space Militarization market based on capability, solution, and region

- To forecast the market size of segments with respect to countries from the four major regions, including North America, Europe, Asia-Pacific, and the Rest of the World.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Space Militarization market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with a market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies.

Market Definition

Space militarization refers to the process by which nations develop and deploy military capabilities and assets in outer space to enhance their strategic and defense objectives. It involves utilizing space-based technologies, systems, and infrastructure for military purposes, including intelligence gathering, surveillance, communication, and missile defense.

Space militarization encompasses designing, manufacturing, and operating satellites, spacecraft, and associated ground infrastructure for military applications. It involves deploying advanced technologies, such as anti-satellite weapons, space-based sensors, and defensive countermeasures, to protect national interests and ensure superiority in space-based operations.

Market Stakeholders

- Satellite Manufacturers

- Satellite Integrators

- Satellite Ground Stations Manufacturers

- ASAT Systems Manufacturers

- Electronic Warfare Manufacturers

- Launch Service Providers

- Government and Civil Organizations Related to the Market

- Defense Contractors

- Space Agencies

- Intelligence and Surveillance Agencies

- Technologists

- R&D Staff

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Space Militarization market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Space Militarization market

Growth opportunities and latent adjacency in Space Militarization Market