Space Situational Awareness Market

Space Situational Awareness Market by Capability (Observation & Detection, Orbit Determination, Object Data Management, Event Detection, Re-entry Assessment, Risk Prediction), Solution, Object Type, End User, and Region - Global Forecast to 2030

OVERVIEW

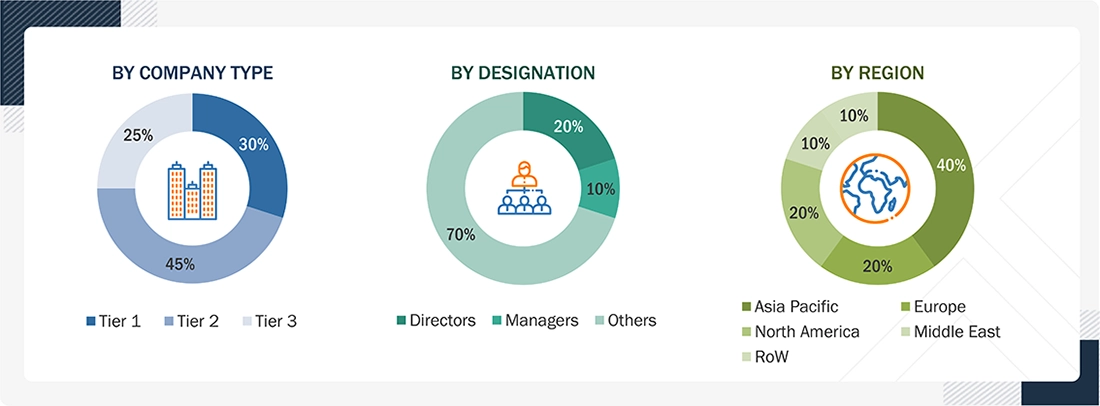

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Space Situational Awareness Market is projected to grow from USD 1.73 billion in 2025 to USD 2.79 billion by 2030, at a CAGR of 10.0%. The growth is driven by rapid increases in satellite deployments and orbital congestion, which are forcing operators and governments to invest in continuous tracking, collision avoidance, and space traffic management capabilities.

KEY TAKEAWAYS

-

By RegionNorth America accounted for a share o 61.1% of the space situational awareness market in 2025.

-

By SolutionBy solution, the payload systems segment is expected to register the highest CAGR of 10.2% during the forecast period.

-

By End UserBy end user, the government & defense segment is expected to account for the largest share of 92.8% of the space situational awareness market in 2025.

-

Competitive LandscapeLockheed Martin Corporation, L3Harris Technologies, Inc., and Kratos Defense & Security Solutions, Inc. were identified as some of the star players in the space situational awareness market (global), given their strong market share and product footprint.

The Space Situational Awareness Industry is growing steadily as governments and satellite operators increasingly rely on continuous monitoring to protect space-based assets. Rising satellite deployments, expanding commercial constellations, and growing reliance on space for communication, navigation, and defense are driving demand for tracking, collision-avoidance, and space traffic management capabilities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ customers in the space situational awareness market stems from the growing need for safe, uninterrupted satellite operations in increasingly congested orbits. Rising satellite launches, large constellations, and higher debris density are pushing operators to rely on real-time tracking, collision avoidance, and risk analytics. At the same time, greater use of automated analytics, AI-driven alerts, and integrated SSA platforms is changing how operational decisions are made. This is increasing demand for scalable SSA services, data integration, and continuous monitoring solutions that support resilient and sustainable space operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth of satellite constellations and orbital congestion

-

Increasing regulatory focus on space safety and debris mitigation

Level

-

High capital intensity of SSA infrastructure

-

Limited global standardization and data interoperability

Level

-

Expansion of commercial SSA-as-a-service models

-

Growth of in-orbit servicing, proximity operations, and debris removal missions

Level

-

Increasing complexity of orbital environment

-

Managing false alerts and decision uncertainty

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth of satellite constellations and orbital congestion

The rapid increase in satellite launches and large LEO constellations is sharply raising orbital congestion. Operators face a higher risk of close approaches and service disruptions, making continuous tracking and collision avoidance essential. This directly increases demand for real-time SSA data, analytics, and operational support services.

Restraint: High capital intensity of SSA infrastructure

Building and maintaining SSA infrastructure requires significant upfront investment in radar systems, optical sensors, data processing, and secure ground networks. Smaller operators and emerging space nations often rely on shared or outsourced SSA services due to cost constraints. This limits standalone infrastructure expansion and slows adoption in cost sensitive markets.

Opportunity: Expansion of commercial SSA-as-a-service models

Commercial operators increasingly prefer subscription-based SSA services over owning infrastructure. SSA-as-a-service enables access to high-quality tracking, analytics, and alerts without significant capital investment. This creates strong growth opportunities for service providers offering scalable, automated, and integrated SSA platforms.

Challenge: Increasing complexity of orbital environment

The orbital environment is becoming more complex due to mixed orbits, frequent maneuvers, and rising debris density. Tracking small objects and predicting interactions across multiple regimes remains technically challenging. This complexity increases operational uncertainty and places pressure on SSA providers to improve data accuracy and decision support.

SPACE SITUATIONAL AWARENESS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Satellite operators in congested LEO environments require frequent, precise tracking to manage rising collision risks from active satellites and debris | LeoLabs provides high-refresh-rate tracking and conjunction assessment using its global ground-based radar network | Improves visibility into collision risk, supports timely maneuver decisions, and reduces unnecessary fuel consumption | Enhances operational safety and mission continuity |

|

Large satellite constellations need scalable SSA solutions to monitor thousands of satellites and manage high volumes of conjunction events | COMSPOC delivers automated SSA analytics that integrate multiple data sources for fleet-wide monitoring | Enables automated collision risk management, faster decision making, and seamless integration of SSA insights into mission operations at scale |

|

Space agencies and satellite operators face rising long-term risks from inactive satellites and fragmentation debris, especially small objects with limited visibility | ESA delivers debris monitoring and orbital environment assessment by combining radar, optical sensors, and analytical models | Improves understanding of debris density and collision risk, supports safer mission planning, and enables regulatory compliance for sustainable space operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The space situational awareness market ecosystem includes large system integrators and solution providers such as Airbus, Lockheed Martin, RTX, and Parsons, along with specialized sensor and analytics players like L3Harris, Hensoldt, LeoLabs, Ansys, GMV, ExoAnalytic, and Deimos. These companies combine space-based and ground-based sensors, analytics software, and mission operations to deliver end-to-end SSA capabilities rather than standalone tools. Close collaboration with end users, including defense organizations, civil space agencies, and commercial satellite operators, supports effective tracking, collision avoidance, and space traffic management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Space Situational Awareness Market, by Solution

Services dominate the space situational awareness market as operators require continuous tracking, conjunction assessment, and alerting rather than one-time system purchases. Ongoing services support real-time decision making and long-term mission safety in congested orbits.

Space Situational Awareness Market, by Object Type

The debris segment holds the largest share due to the growing volume of inactive satellites and fragmentation debris. Continuous monitoring and catalog maintenance are essential to reduce collision risk and support safe space operations.

Space Situational Awareness Market, by Capability

Tracking, orbit determination, and custody lead the market as they are core to collision avoidance and operational decision making. Accurate orbital data enables timely response to threats and sustained mission assurance.

Space Situational Awareness Market, by Orbit Type

Near-Earth orbit dominates due to the high density of active satellites and debris, especially in LEO. Frequent maneuvers and congestion drive demand for high-update-rate tracking and monitoring services.

REGION

Asia Pacific to be fastest-growing region in space situational awareness market during forecast period

The Asia Pacific space situational awareness market is expected to grow at the fastest rate during the forecast period. This is driven by expanding national space programs, rising satellite deployments, and increasing focus on space safety and traffic management. Higher government and defense spending on SSA capabilities across countries such as China, India, Japan, and South Korea is strengthening regional infrastructure.

SPACE SITUATIONAL AWARENESS MARKET: COMPANY EVALUATION MATRIX

In the space situational awareness (SSA) market matrix, Lockheed Martin (Star) leads with a strong market share and a broad product footprint, supported by its integrated space command and control platforms, sensor fusion capabilities, and deep involvement in national security space programs. Ansys (Emerging Leader) is strengthening its position through advanced simulation, modeling, and analytics tools that support orbit prediction, collision analysis, and mission planning. While Lockheed Martin maintains leadership through scale and long-standing government integration, Ansys shows strong potential to move toward the leaders’ quadrant as demand grows for software-driven, analytics-led SSA solutions across commercial and government operators.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Space Situational Awareness Market Companies

- Lockheed Martin Corporation (US)

- L3Harris Technologies, Inc. (US)

- RTX Corporation (US)

- Airbus SE (Netherlands)

- Parsons Corporation (US)

- ANSYS, Inc. (US)

- LeoLabs, Inc. (US)

- Hensoldt AG (Germany)

- GMV Innovating Solutions S.L. (Spain)

- QinetiQ (UK)

- ExoAnalytic Solutions, Inc. (US)

- Slingshot Aerospace, Inc. (US)

- Kratos Defense & Security Solutions, Inc. (US)

- Deimos (Spain)

- SpaceNav (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.85 Billion |

| Market Forecast in 2030 (Value) | USD 2.79 Billion |

| Growth Rate | CAGR of 10.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, and the Rest of the World |

WHAT IS IN IT FOR YOU: SPACE SITUATIONAL AWARENESS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/subsegments covered at the regional/global level to gain an understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding of the total addressable market |

RECENT DEVELOPMENTS

- November 2025 : Raytheon UK, an RTX business, was awarded a contract by the UK Space Agency to deliver an orbital analyst capability supporting space domain awareness. The capability enhances analysis, monitoring, and assessment of objects in orbit, contributing to national space safety and security objectives.

- August 2025 : L3Harris Technologies has upgraded US Space Force's 35-year-old Ground-Based Electro-Optical Deep Space Surveillance telescopes at White Sands Missile Range, New Mexico, under the GBOSS program, earning operational acceptance.? The enhancements boost space situational awareness, enabling better detection, tracking, and countering of orbital threats to protect national interests.

- September 2024 : Parsons Corporation successfully delivered a critical program milestone for NOAA’s Traffic Coordination System for Space (TraCSS), demonstrating progress in system integration, data processing, and operational readiness supporting space domain awareness related ground infrastructure.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the space situational awareness market. Exhaustive secondary research was done to collect information on the space situational awareness market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analysis was conducted to estimate the overall market size. After that, market breakdown and data triangulation procedures were employed to estimate the sizes of various segments and subsegments within the space situational awareness market.

Secondary Research

During the secondary research process, various sources were consulted to identify and collect information for this study. The secondary sources included government sources, such as SIPRI; corporate filings, including annual reports, press releases, and investor presentations from companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the space situational awareness market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

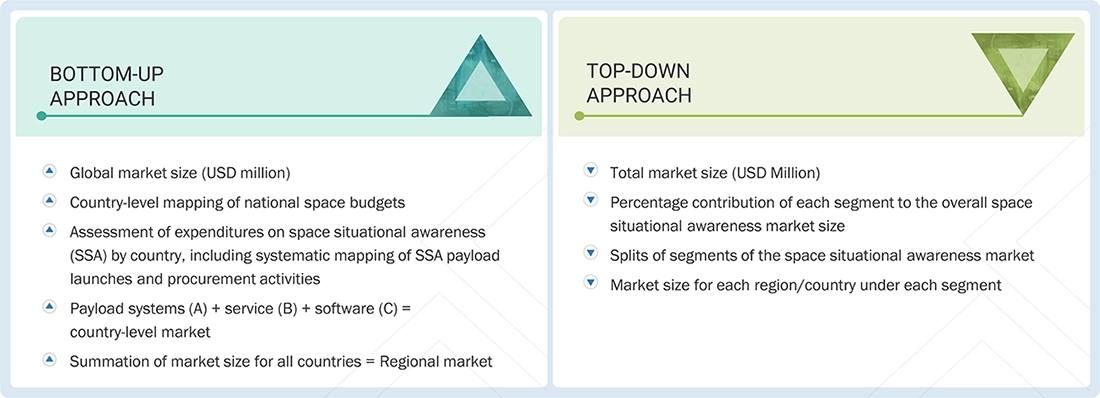

The top-down and bottom-up approaches were used to estimate and validate the size of the space situational awareness market. The research methodology used to estimate the size of the market included the following details:

- Key players in the space situational awareness market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the space situational awareness market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Space Situational Awareness Market Size: Bottom-up & Top-down Approach

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

Space situational awareness (SSA) involves detecting and cataloguing active satellites, inactive spacecraft, and space debris, monitoring their positions and movements, and predicting close approaches or abnormal behavior that could threaten space missions. SSA systems combine data from ground-based radars, optical telescopes, and space-based sensors with advanced analytics to generate collision warnings, re-entry forecasts, and anomaly alerts. These insights enable satellite operators, governments, and commercial users to make informed operational decisions, protect critical space assets, and reduce the risk of collisions in an increasingly congested orbital environment.

Key Stakeholders

- Government and Research Organizations

- Space Situational Awareness System Manufacturers

- Defense and National Security Agencies

- Civil Space Agencies

- Commercial Satellite Operators

- Space Traffic Management Authorities

- Ground-Based Sensor and Radar Infrastructure Providers

- Data Analytics and SSA Software Providers

- Launch Service Providers

- Academic Institutions and Research Universities

Report Objectives

- To define, describe, and forecast the size of the space situational awareness market based on solution, object type, capability, end user, and region

- To forecast the size of the various segments of the space situational awareness market based on four regions—North America, Europe, Asia Pacific, and the Rest of the World, along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Space situational awareness Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the space situational awareness market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Space Situational Awareness Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Space Situational Awareness Market

Leila

Jun, 2019

I am very interested in the market sizing of satellite tracking and monitoring specifically. Also, what the competitors are charging for a monthly subscription model for satellite tracking data..

Leila

Jul, 2019

Hi, Does this report cover the subscription prices that satellite operators are currently paying for satellite tracking data?.