Specimen Retrieval Market by Bag Size (5, 10, 15, 25 mm), Type (Detachable, Non-detachable), Application (Gynecology, Urology, Gastrointestinal Surgery), End User (Hospitals, Ambulatory Surgical Centers, Nursing Home) & Region - Global Forecasts to 2024

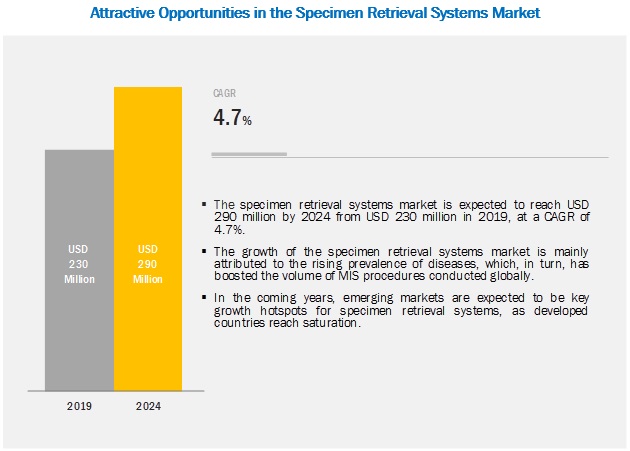

The specimen retrieval market is projected to reach USD 290 million by 2024, at a CAGR of 4.7%. Growth in this market is mainly driven by the increasing prevalence of diseases requiring surgical treatment, especially laparoscopic surgeries. However, the high cost of specimen retrieval systems is a major challenge for this market, particularly in emerging countries.

“Non-detachable specimen retrieval systems are expected to fuel the growth of the specimen retrieval systems market over the forecast period.”

By product, the specimen retrieval systems market is segmented into detachable and non-detachable specimen retrieval systems. The non-detachable specimen retrieval systems segment accounted for a share of 60.5% in 2018 and is anticipated to grow at a CAGR of 5.6% during the forecast period. This growth can be attributed to the increasing number of MIS procedures, especially in emerging markets.

“Increasing use of specimen retrieval systems in gastrointestinal surgery to drive market growth during the forecast period”

Based on application, the specimen retrieval systems market is segmented into gastrointestinal surgery, gynecological surgery, urological surgery, and other applications such as cardiovascular and bariatric applications. The gastrointestinal surgery segment is anticipated to drive growth in the market at a CAGR of 6.2% over the forecast period. This growth can be attributed to the increase in the incidence of gastrointestinal diseases such as appendicitis, and gallstones. Additionally, with technological advancements in gastrointestinal robotic surgery, the demand for specimen retrieval systems is anticipated to increase.

“Asia Pacific to grow at the highest rate during the forecast period (2018–2023)”

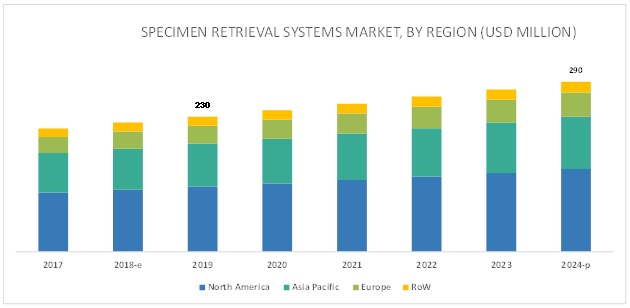

The specimen retrieval systems market is geographically segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). While North America dominated the market in 2018, Asia Pacific is expected to register the highest CAGR in the market during the forecast period. Growth in the APAC is largely driven by the rising patient population and increasing infrastructural development in the region.

Some of the prominent players in the global specimen retrieval market are Johnson & Johnson Services, Inc. (US), Teleflex Incorporated (US), Applied Medical Resources Corporation (US), CONMED Corporation (US), Cooper Surgical, Inc. (US), Genicon (US), B. Braun Melsungen AG (Germany), Laprosurge (UK), Purple Surgical (UK) and Medtronic (Ireland).

Johnson & Johnson (Ethicon) is the largest player in the specimen retrieval systems market. It has a strong foothold in the specimen retrieval systems market. Ethicon has a strong global distribution network and a good brand reputation among end users. The company’s strong presence and wide distribution channels across the globe have helped it in maintaining its leading position in the specimen retrieval systems market.

Medtronic (Covidien) is a major player in the specimen retrieval systems market. The company operates in four major segments, namely, Cardiac & Vascular Group, Restorative Therapies Group, Minimally Invasive Therapies Group, and Diabetes group. The company offers the Reliacatch Specimen Retrieval Bag, Endo Catch Gold Specimen Retrieval Pouch, and EndoBag Specimen Retrieval System through its Minimally Invasive Therapies Group. The company offers a wide range of specimen retrieval bags that include specimen retrieval bags for various introducer sizes and volumes as per requirement. Moreover, Medtronic’s strong geographical presence has helped the company in sustaining its position in the specimen retrieval systems market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Types, introducer sizes, applications, end users, and regions |

|

Geographies Covered |

North America (US and Canada), Europe (Germany, France, UK, and RoE), APAC (China, Japan, India, and RoAPAC), and the RoW (Latin America and the Middle East & Africa) |

|

Companies Covered |

Major 10 players covered, including |

This research report categorizes the specimen retrieval systems market into the following segments and subsegments:

Specimen retrieval systems market, by type

- Detachable specimen retrieval systems

- Non-detachable specimen retrieval systems

Specimen retrieval systems market, by introducer size

- 5/8 mm

- 10 mm

- 12/15 mm

- 25 mm

Specimen retrieval systems market, by application

- Gastrointestinal Surgeries

- Urological Surgeries

- Gynecological Surgeries

- Other Applications (cardiovascular and bariatric surgeries)

Specimen retrieval systems market, by end user

- Hospitals

- Other End Users (ambulatory surgical centers and nursing homes)

Specimen Retrieval Systems Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Africa

Recent developments:

- In 2018, Genicon, Inc. entered into a distribution agreement with Greenpine Pharma, China to distribute its complete range of products in China.

- In 2017, B. Braun opened five new production and administration facilities in Penang to cater to end users in Malaysia. The company aims to manufacture medical devices for infusion therapy, pharmaceutical solutions, and surgical instruments in these facilities.

Key questions addressed in the report:

- What are the growth opportunities in the specimen retrieval systems market across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of specimen retrieval systems. Will this scenario continue during the next five years?

- Where will all the advancements in products offered by various companies take the industry in the mid- to long-term?

- What are the various specimen retrieval systems and their respective market shares in the overall market?

- What are the new trends and advancements in the specimen retrieval systems market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Specimen Retrieval Systems: Market Overview

4.2 North America: Specimen Retrieval Systems Market, By Type

4.3 Geographical Snapshot of the Specimen Retrieval Systems Market

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Minimally Invasive Surgery

5.2.1.2 Awareness Programs for Minimally Invasive Surgeries

5.2.2 Market Opportunities

5.2.2.1 Growth Potential of Emerging Economies

5.2.3 Market Challenge

5.2.3.1 Restricted Access to Systems in Emerging Countries

6 Specimen Retrieval Systems Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Non-Detachable Specimen Retrieval Systems

6.2.1 Non-Detachable Specimen Retrieval Systems to Dominate the Market During the Forecast Period

6.3 Detachable Specimen Retrieval Systems

6.3.1 The Preference for Non-Detachable Specimen Retrieval Systems is Lower Majorly Due to the Fact That These Systems Do Not Have an Introducer Attached to Them

7 Specimen Retrieval Systems Market, By Introducer Size (Page No. - 39)

7.1 Introduction

7.2 5/8 mm Introducer Size

7.2.1 Systems With an Introducer Size of 5/8 mm are Used in Surgeries That Can Be Performed By Making Smaller Incisions

7.3 10 mm Introducer Size

7.3.1 B. Braun Melsungen Ag, Ethicon, and Covidien are Some of the Major Players Offering 10 mm Introducer Size Specimen Retrieval Systems

7.4 12/15 mm Introducer Size

7.4.1 12/15 mm Introducer Size Specimen Retrieval Systems Segment to Dominate the Market During the Forecast Period

7.5 25 mm Introducer Size

7.5.1 Systems With an Introducer Size of 25 mm are Used in Procedures That Require Larger Incisions

8 Specimen Retrieval Systems Market, By Application (Page No. - 44)

8.1 Introduction

8.2 Gastrointestinal Surgeries

8.2.1 Increasing Incidence of Colon/Gastrointestinal Cancer, Inguinal Hernia, and Gall Bladder Stones—A Major Factor Driving Market Growth

8.3 Urological Surgeries

8.3.1 Technological Advancements Like Laparoscopic Nephrectomy and Robotic-Assisted Techniques in Urologic Surgeries to Drive Growth in This Segment

8.4 Gynecological Surgeries

8.4.1 Increasing Prevalence of Ovarian and Cervical Cancer—A Major Factor Driving Growth in the Market for Gynecological Surgeries

8.5 Other Applications

9 Specimen Retrieval Systems Market, By End User (Page No. - 50)

9.1 Introduction

9.2 Hospitals

9.2.1 Increasing Incidence of Cancer has Driven the Number of Hospital Visits

9.3 Other End Users

9.3.1 Rising Number of Ambulatory Surgical Centers Will Support Market Growth

10 Specimen Retrieval Systems Market, By Region (Page No. - 53)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Rising Incidence of Chronic Diseases and High Inpatient Visits Driving the Growth of the US Specimen Retrieval Systems Market

10.2.2 Canada

10.2.2.1 Market in Canada Driven By the Increasing Incidence of Obesity and Large Number of Laparoscopic Surgeries Performed

10.3 Europe

10.3.1 UK

10.3.1.1 Number of Cholecystectomy Procedures Performed in the UK Expected to Rise in the Coming Years

10.3.2 Germany

10.3.2.1 High Incidence of Hysterectomy and Inguinal Hernia Surgical Procedures Likely to Drive Market Growth

10.3.3 France

10.3.3.1 Increasing Colorectal and Gastrointestinal Cancer Prevalence Will Drive the Specimen Retrieval Systems Market

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 High Disposable Income and Rising Geriatric Population are Growth Factors for the Market in China

10.4.2 India

10.4.2.1 Significant Rise in Obesity Prevalence in India Expected in the Coming Years

10.4.3 Japan

10.4.3.1 Increase in Geriatric Population Will Boost Total Laparoscopic Procedures Conducted in Japan

10.4.4 Rest of Asia Pacific

10.5 Rest of World

11 Competitive Landscape (Page No. - 86)

11.1 Overview

11.2 Market Ranking Analysis, 2017

11.3 Key Strategies

11.3.1 Acquisitions, 2015–2018

11.3.2 Expansions, 2015–2018

11.3.3 Agreements and Collaborations, 2015–2018

11.4 Competitive Leadership Mapping (2017)

11.4.1 Visionary Leaders

11.4.2 Innovators

11.4.3 Dynamic Differentiators

11.4.4 Emerging Companies

12 Company Profiles (Page No. - 92)

12.1 Medtronic

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments

12.1.4 MnM View

12.2 Johnson & Johnson Services, Inc.

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 MnM View

12.3 The Cooper Companies, Inc.

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 MnM View

12.4 Conmed Corporation.

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 MnM View

12.5 B. Braun Melsungen AG

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 MnM View

12.6 Teleflex Incorporated

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.4 MnM View

12.7 Purple Surgical

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.8 Applied Medical Resources Corporation

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Development

12.8.4 MnM View

12.9 Laprosurge

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Development

12.9.4 MnM View

12.10 Genicon, Inc.

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 MnM View

13 Appendix (Page No. - 111)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (78 Tables)

Table 1 Laparoscopic Procedures Data Per 100,000 Inhabitants in Hospitals, 2010 vs 2015

Table 2 Minimally Invasive Surgery Initiatives

Table 3 Specimen Retrieval Systems Market, By Type, 2017–2024 (USD Million)

Table 4 Non-Detachable Specimen Retrieval Systems Market, By Region, 2017–2024 (USD Million)

Table 5 Detachable Specimen Retrieval Systems Market, By Region, 2017–2024 (USD Million)

Table 6 Specimen Retrieval Systems Market, By Introducer Size, 2017–2024 (USD Million)

Table 7 5/8 mm Introducer Size Specimen Retrieval Systems Market, By Region, 2017–2024 (USD Million)

Table 8 10 mm Introducer Size Specimen Retrieval Systems Market, By Region, 2017–2024 (USD Million)

Table 9 12/15 mm Introducer Size Specimen Retrieval Systems Market, By Region, 2017–2024 (USD Million)

Table 10 25 mm Introducer Size Specimen Retrieval Systems Market, By Region, 2017–2024 (USD Million)

Table 11 Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 12 Specimen Retrieval Market for Gastrointestinal Surgeries, By Region, 2017–2024 (USD Million)

Table 13 Specimen Retrieval Market for Urological Surgeries, By Region, 2017–2024 (USD Million)

Table 14 Specimen Retrieval Market for Gynecological Surgeries, By Region, 2017–2024 (USD Million)

Table 15 Specimen Retrieval Market for Other Applications, By Region, 2017–2024 (USD Million)

Table 16 Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 17 Specimen Retrieval Market for Hospitals, By Region, 2017–2024 (USD Million)

Table 18 Specimen Retrieval Market for Other End Users, By Region, 2017–2024 (USD Million)

Table 19 Specimen Retrieval Market, By Region, 2017–2024 (USD Million)

Table 20 North America: Specimen Retrieval Market, By Country, 2017–2024 (USD Million)

Table 21 North America: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 22 North America: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 23 North America: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 24 North America: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 25 US: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 26 US: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 27 US: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 28 US: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 29 Canada: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 30 Canada: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 31 Canada: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 32 Canada: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 33 Europe: Specimen Retrieval Market, By Country, 2017–2024 (USD Million)

Table 34 Europe: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 35 Europe: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 36 Europe: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 37 Europe: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 38 UK: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 39 UK: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 40 UK: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 41 UK: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 42 Germany: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 43 Germany: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 44 Germany: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 45 Germany: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 46 France: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 47 France: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 48 France: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 49 France: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 50 Rest of Europe: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 51 Rest of Europe: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 52 Rest of Europe: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 53 Rest of Europe: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 54 Asia Pacific: Specimen Retrieval Market, By Country, 2017–2024 (USD Million)

Table 55 Asia Pacific: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 56 Asia Pacific: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 57 Asia Pacific: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 58 Asia Pacific: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 59 China: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 60 China: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 61 China: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 62 China: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 63 India: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 64 India: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 65 India: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 66 India: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 67 Japan: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 68 Japan: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 69 Japan: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 70 Japan: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 71 Rest of Asia Pacific: Specimen Retrieval Market, By Type, 2017–2024 (USD Million)

Table 72 Rest of Asia Pacific: Specimen Retrieval Market, By Introducer Size, 2017–2024 (USD Million)

Table 73 Rest of Asia Pacific: Specimen Retrieval Market, By Application, 2017–2024 (USD Million)

Table 74 Rest of Asia Pacific: Specimen Retrieval Market, By End User, 2017–2024 (USD Million)

Table 75 RoW: Specimen Retrieval Systems Market, By Type, 2017–2024 (USD Million)

Table 76 RoW: Specimen Retrieval Systems Market, By Introducer Size, 2017–2024 (USD Million)

Table 77 RoW: Specimen Retrieval Systems Market, By Application, 2017–2024 (USD Million)

Table 78 RoW: Specimen Retrieval Systems Market, By End User, 2017–2024 (USD Million)

List of Figures (25 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Specimen Retrieval Systems Market: Bottom-Up Approach

Figure 4 Specimen Retrieval Systems Market: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Specimen Retrieval Systems Market, By Type, 2019 vs 2024 (USD Million)

Figure 7 Specimen Retrieval Systems Market, By Introducer Size, 2019 vs 2024 (USD Million)

Figure 8 Specimen Retrieval Systems Market, By Application, 2019 vs 2024 (USD Million)

Figure 9 Specimen Retrieval Systems Market, By End User, 2019 vs 2024 (USD Million)

Figure 10 Specimen Retrieval Systems Market, By Region, 2019 vs 2024 (USD Million)

Figure 11 Rising Global Demand for Minimally Invasive Surgical Procedures to Drive Market Growth During the Forecast Period

Figure 12 Non-Detachable Specimen Retrieval Systems Dominated the North American Specimen Retrieval Systems Market in 2018

Figure 13 Countries in Asia Pacific to Register A Higher Growth Rate During the Forecast Period

Figure 14 Specimen Retrieval Systems Market: Drivers, Restraint, and Opportunities

Figure 15 North America: Specimen Retrieval Systems Market Snapshot

Figure 16 Asia Pacific: Specimen Retrieval Systems Market Snapshot

Figure 17 Key Developments in the Specimen Retrieval Systems Market From 2015 to 2018

Figure 18 Specimen Retrieval Systems Market Ranking, By Key Player, 2017

Figure 19 MnM Dive-Vendor Comparison Matrix: Specimen Retrieval Systems Market

Figure 20 Medtronic: Company Snapshot

Figure 21 Johnson & Johnson Services, Inc.: Company Snapshot

Figure 22 The Cooper Companies, Inc.: Company Snapshot

Figure 23 Conmed Corporation: Company Snapshot

Figure 24 B. Braun Melsungen AG: Company Snapshot

Figure 25 Teleflex Incorporated: Company Snapshot

The study involved four major activities in estimating the current size of the specimen retrieval systems market. Exhaustive secondary research was conducted to collect information on the market and its subsegments. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

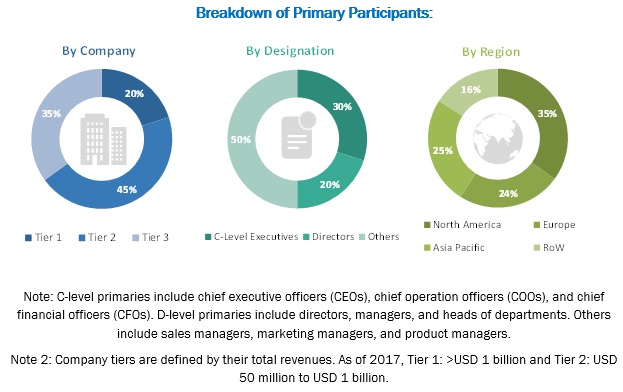

Several stakeholders such as specimen retrieval system manufacturers, vendors, distributors and surgeons, and doctors were consulted for this report. The demand side of this market is characterized by the significant use of non-detachable specimen retrieval systems due to their high preference among surgeons, owing to their capacity for multiple use in a single procedure. The supply side is characterized by advancements in laparoscopic procedures and the increasing number of gastrointestinal and urological surgeries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the specimen retrieval systems market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size using the market size estimation processes the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the specimen retrieval systems industry.

Report Objectives

- To define, describe, and forecast the specimen retrieval systems market by type, introducer size, application, end user, and region

- To forecast the revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To identify the micromarkets with respect to drivers, industry-specific challenges, opportunities, and trends affecting the growth of the market

- To analyze market segments and subsegments with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their market shares and core competencies, in terms of market developments and growth strategies

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, product launches, and R&D activities in the specimen retrieval systems market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the European, Asia Pacific, and the RoW regional segments into their respective countries for this market

- Company Information: Detailed analysis and profiling of additional market players (up to 5)

- Volume Data: Customization options for volume data (number of units sold) and customization options for volume data (number of tests)

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Specimen Retrieval Market