Spirometer Market by Product (Device, Consumables and Accessories, Software), Mechanism (Flow Sensor, Peak Flow Meter), Application (COPD, Asthma), End User (Hospital, Clinical Laboratory, Homecare, Industrial Setting) & Region - Global Forecast to 2025

Market Growth Outlook Summary

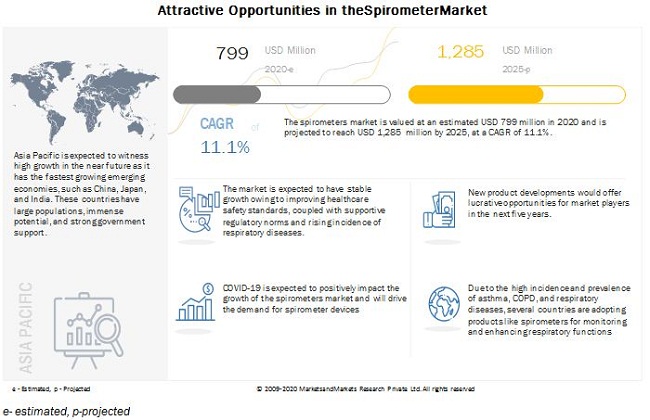

The global spirometer market growth forecasted to transform from $799 million in 2020 to $1.3 billion by 2025, driven by a CAGR of 11.1%. Growth in this market is largely driven by the rising global incidence of respiratory diseases, increasing aging population, and the technological shift in spirometer devices towards smartphone-based data acquisition.

Spirometer Market Dynamics

Driver: Rising Incidence of respiratory diseases

Respiratory diseases are among the leading causes of death in the world, making up five of the top 30 causes. Chronic obstructive pulmonary disease (COPD) is the third-most-leading cause of death. Early detection and diagnosis can go a long way in treating these diseases. Spirometry is a key technology in this aspect and assists in understanding the severity of the infection and avoids misdiagnosis. Thus, with the increasing incidence of such respiratory diseases, the spirometers market can be expected to witness growth. Age reduces the efficacy of vital body organs and processes.

Opportunity: Emerging economies

Emerging economies such as India, Brazil, China, and South Africa provide significant opportunities for players in the spirometry devices market. Of the top 20 most polluted cities in the world, 14 are in India. The use of spirometers for monitoring lung health is at a very low level in these countries.

Restraint: Time required to perform the tests

Performing a spirometry test involves blowing into the mouthpiece at full lung capacity for six seconds. To ensure the accuracy of test results, a patient must perform the test in triplicates, followed by a repeatability test. This makes the test time-consuming and strenuous; it may also affect patient compliance for follow-up tests.

Flow-Sensing segment accounted for the largest share of the spirometer industry, by mechanism, in 2019

Based on mechanism, the spirometer market is segmented into flow-sensing spirometer and peak flow meters. The flow- sensing segment accounted for the larger market share in 2019 and is projected to witness a higher growth rate during the forecast period. This can be attributed to the rising incidence of chronic respiratory diseases and technological advancements.

COPD segment accounted for largest share of the spirometer industry in 2019

Based on application, the spirometer market is segmented into COPD, asthma, and other applications. The COPD segment accounted for the highest segment in 2019. The large share of this segment can be attributed to the high and growing prevalence of COPD globally and the easy diagnosis of COPD offered by spirometry.

Hospitals segment of the spirometer industry to register the highest growth rate during the forecast period

Based on end user, the spirometer market is segmented into hospitals, clinical laboratories, home care settings, and industrial settings. The hospitals segment is expected to account for the highest share in 2019. Rapidly growing aging population, the increase in reimbursements for clinical tests performed in hospitals, and the launch of advanced spirometer devices are the factors driving the growth to this market during the forecasted period.

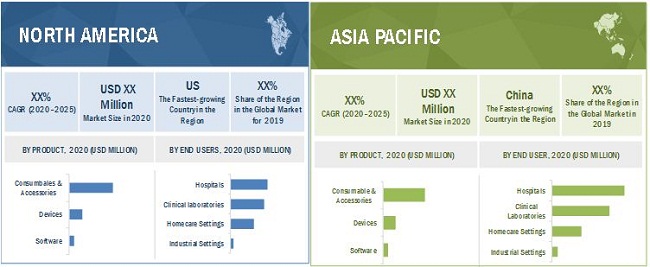

North America is the largest regional market for spirometer industry

The global spirometer market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World (RoW). The North American market is expected to account for the highest market share in 2019. The large share of this market segment can be attributed to the increasing incidence of chronic respiratory diseases and the rising adoption of technologically advanced devices in the region.

Prominent players operating in the global spirometer market are Hill-Rom, Inc. (US), Midmark Corp. (US), Futuremed (US), COSMED (Italy), MGC Diagnostics Corporation (US), Vyaire Medical (US), Medical International Research (Italy), Vitalograph (UK), ndd Medical Technologies (Zurich), Schiller AG (Switzerland), Jones Medical Instrument Company (US), Sibelmed (Spain), MIR, Recorders and Medicare Systems (India), Smiths Medical (US), Medline (US), Teleflex (US), CONTEC (China), Fysiomed (Belgium), Medikro (Finland), Sdi Diagnostics (US), CHEST M.I. (Japan), Inc, FUKUDA SANGYO Co. Ltd. (Japan), Clarity Medical (India), and Guangzhou Medsinglong Medical Equipment Co., Ltd. (China).

Scope of the Spirometer Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$799 million |

|

Projected Revenue Size by 2025 |

$1,285 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 11.1% |

|

Market Driver |

Rising Incidence of respiratory diseases |

|

Market Opportunity |

Emerging economies |

This report categorizes the spirometer market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables & Accessories

-

Devices

- PC- Based Spirometer

- Portable Spirometer

- Table-Top Spirometer

- Software

By Mechanism

- Flow-Sensing Spirometer

- Peak Flow Meters

By Application

- COPD

- Asthma

- Other Applications

By End User

- Hospitals

- Clinical Laboratories

- Homecare Settings

- Industrial Settings

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- Italy

- Spain

- UK

- France

- Switzerland

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Singapore

- Rest of Asia Pacific

-

Rest of the World (RoW)

- Brazil

- Other RoW Countries

Recent Developments of Spirometer Industry:

- In 2018, The Schiller AG opened a new manufacturing site in Guangzhou, China.

- In November 2018, Schiller AG launched CARDIOVIT CS-200 ErgoSpiro System device.

- In 2017, MIR partnered with Tactio Health Group (Canada) to develop telemedicine solutions for COPD.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global spirometer market?

The global spirometer market boasts a total revenue value of $1,285 million by 2025.

What is the estimated growth rate (CAGR) of the global spirometer market?

The global spirometer market has an estimated compound annual growth rate (CAGR) of 11.1% and a revenue size in the region of $799 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 25)

1.1 Objectives Of The Study

1.2 Market Definition

Table 1 Inclusions & Exclusions

1.2.1 Markets Covered

1.2.2 Years Considered For The Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 28)

2.1 Research Data

Figure 1 Research Design

2.2 Secondary Data

2.2.1 Secondary Sources

2.3 Primary Data

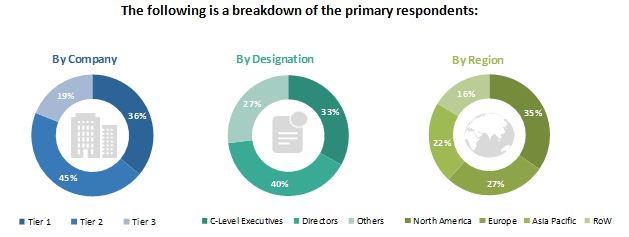

Figure 2 Breakdown Of Primary Interviews: By Company Type, Designation, And Region

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

2.4.2 Top-Down Approach

Figure 4 Market Size Estimation: Top-Down Approach

2.4.3 Growth Forecast

2.5 Market Breakdown And Data Triangulation

Figure 5 Data Triangulation Methodology

2.6 Assumptions For The Study

3 Executive Summary (Page No. - 35)

Figure 6 Spirometer Market, By Product, 2020 Vs. 2025 (USD Million)

Figure 7 Spirometer Industry, By Mechanism, 2020 Vs. 2025 (USD Million)

Figure 8 Market, By Application, 2020 Vs. 2025 (USD Million)

Figure 9 Market, By End User, 2020 Vs. 2025 (USD Million)

Figure 10 Market, By Region, 2020 Vs. 2025 (USD Million)

4 Premium Insights (Page No. - 38)

4.1 Spirometer Market Overview

Figure 11 Rising Global Incidence Of Respiratory Diseases To Drive Market Growth During The Forecast Period

4.2 North American Spirometer Industry Share, By Product

Figure 12 Consumables & Accessories Segment To Dominate The Spirometer Industry In North America

4.3 Geographic Growth Opportunities

Figure 13 Asia Pacific Market To Witness The Highest Growth Rate During The Forecast Period

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

Figure 14 Spirometer Market: Drivers, Restraints, Opportunities, And Challenges

5.2.1 Drivers

5.2.1.1 Rising Incidence Of Respiratory Diseases

5.2.1.2 Growth In The Geriatric Population

Figure 15 Growth In Population, By Age Group

5.2.1.3 Technological Shift Towards Smartphone-Based Data Collection

Table 2 Key Product Launches In The Spirometer Industry

5.2.2 Restraints

5.2.2.1 Time Required To Perform Tests

5.2.3 Opportunities

5.2.3.1 Emerging Economies

5.2.4 Challenges

5.2.4.1 Need For Skilled Professionals And The Possibility Of Inaccuracy

5.3 Covid-19 Impact On The Market, 2020–2025

5.4 Adjacent Markets For The Market

Table 3 Adjacent Markets For The Spirometer Market

6 Spirometer Market, By Product (Page No. - 44)

6.1 Introduction

Table 4 Spirometer Market, By Product, 2016–2019 (USD Million)

Table 5 Spirometer Industry, By Product, 2020–2025 (USD Million)

6.2 Consumables & Accessories

6.2.1 Consumables & Accessories Accounted For The Largest Market Share In 2019

Table 6 Spirometer Consumables & Accessories Market, By Region, 2016–2019 (USD Million)

Table 7 Spirometers Consumables & Accessories Market, By Region, 2020–2025 (USD Million)

6.3 Devices

Table 8 Spirometer Devices Market, By Region, 2016–2019 (USD Million)

Table 9 Spirometer Devices Market, By Region, 2020–2025 (USD Million)

Table 10 Spirometer Devices Market, By Type, 2016–2019 (USD Million)1

Table 11 Spirometer Devices Market, By Type, 2020–2025 (USD Million)

6.3.1 Pc-Based Spirometers

6.3.1.1 Ease Of Use And Low Cost Of Pc-Based Spirometers Make Them An Ideal Option In Hospitals And Clinical Laboratories

Table 12 Pc-Based Spirometers Market, By Region, 2016–2019 (USD Million)

Table 13 Pc-Based Spirometers Market, By Region, 2020–2025 (USD Million)

6.3.2 Portable Spirometers

6.3.2.1 Portable Spirometers Are Easy To Use And Are Thus Predominantly Used In Home Settings As Well As In Industries

Table 14 Portable Spirometers Market, By Region, 2016–2019 (USD Million)

Table 15 Portable Spirometers Market, By Region, 2020–2025 (USD Million)

6.3.3 Table-Top Spirometers

6.3.3.1 Table-Top Spirometers Account For A Relatively Smaller Share Of The Market Due To Their Limited Applications

Table 16 Table-Top Spirometers Market, By Region, 2016–2019 (USD Million)

Table 17 Table-Top Spirometers Market, By Region, 2020–2025 (USD Million)

6.4 Software

6.4.1 Software For Spirometers Helps In Data Capture And Analysis Of Patient Conditions

Table 18 Spirometers Software Market, By Region, 2016–2019 (USD Million)

Table 19 Spirometers Software Market, By Region, 2020–2025 (USD Million)

7 Spirometer Market, By Mechanism (Page No. - 52)

7.1 Introduction

Table 20 Spirometer Market, By Mechanism, 2016–2019 (USD Million)

Table 21 Spirometer Industry, By Mechanism, 2020–2025 (USD Million)

7.2 Flow-Sensing Spirometers

7.2.1 Rising Incidence Of Respiratory Diseases To Drive The Flow-Sensing Spirometers Market

Table 22 Flow-Sensing Spirometers Market, By Region,2016–2019 (USD Million)

Table 23 Flow-Sensing Spirometers Market, By Region,2020–2025 (USD Million)

7.3 Peak Flow Meters

7.3.1 Growing Awareness About Lung Disorders To Drive Market Growth

Table 24 Peak Flow Meters Market, By Region, 2016–2019 (USD Million)

Table 25 Peak Flow Meters Market, By Region, 2020–2025 (USD Million)

8 Spirometer Market, By Application (Page No. - 56)

8.1 Introduction

Table 26 Spirometer Market, By Application, 2016–2019 (USD Million)

Table 27 Spirometer Industry, By Application, 2020–2025 (USD Million)

8.2 Copd

8.2.1 Spirometry Is The Easiest Available Method For Copd Diagnosis

Table 28 Market For Copd, By Region, 2016–2019 (USD Million)

Table 29 Market For Copd, By Region, 2020–2025 (USD Million)

8.3 Asthma

8.3.1 High Prevalence Of Asthma To Drive The Use Of Spirometers For The Early Diagnosis Of The Disease

Table 30 Market For Asthma, By Region,2016–2019 (USD Million)

Table 31 Market For Asthma, By Region,2020–2025 (USD Million)

8.4 Other Applications

Table 32 Spirometer Market For Other Applications, By Region,2016–2019 (USD Million)60

Table 33 Spirometer Market For Other Applications, By Region,2020–2025 (USD Million)

9 Spirometer Market, By End User (Page No. - 61)

9.1 Introduction

Table 34 Spirometer Market, By End User, 2016–2019 (USD Million)

Table 35 Spirometer Industry, By End User, 2020–2025 (USD Million)

9.2 Hospitals

9.2.1 Increase In Reimbursements For Clinical Tests Performed In Hospitals To Drive The Growth Of This End-User Segment

Table 36 Market For Hospitals, By Region, 2016–2019 (USD Million) 63

Table 37 Market For Hospitals, By Region,2020–2025 (USD Million) 63

9.3 Clinical Laboratories

9.3.1 Large Number Of Clinical Laboratories Offer Spirometry Tests 2016–2019 (USD Million) 64

Table 38 Market For Clinical Laboratories, By Region,2016–2019 (USD Million) 64

Table 39 Market For Clinical Laboratories, By Region,2020–2025 (USD Million) 64

9.4 Home Care Settings

9.4.1 Widespread Use Of Incentive Spirometers And Peak Flow Meters In Home Care Settings To Drive Market Growth

Table 40 Market For Home Care Settings, By Region, 2016–2019 (USD Million) 65

Table 41 Market For Home Care Settings, By Region, 2020–2025 (USD Million) 65

9.5 Industrial Settings

9.5.1 Due To Their Ease Of Use, Portable Spirometers Are Predominantly Used In Industrial Settings

Table 42 Spirometer Market For Industrial Settings, By Region, 2016–2019 (USD Million) 66

Table 43 Spirometer Market For Industrial Settings, By Region, 2020–2025 (USD Million) 66

10 Spirometer Market, By Region (Page No. - 67)

10.1 Introduction

Table 44 Spirometer Market, By Region, 2016–2019 (USD Million)

Table 45 Spirometer Industry, By Region, 2020–2025 (USD Million)

10.2 North America

Figure 16 North America: Spirometer Market Snapshot

Table 46 North America: Spirometers Market, By Country,2016–2019 (USD Million) 70

Table 47 North America: Market, By Country, 2020–2025 (USD Million) 70

Table 48 North America: Market, By Product,2016–2019 (USD Million) 70

Table 49 North America: Market, By Product, 2020–2025 (USD Million) 70

Table 50 North America: Market, By Mechanism,2016–2019 (USD Million) 71

Table 51 North America: Spirometer Market, By Mechanism, 2020–2025 (USD Million) 71

Table 52 North America: Market, By Application, 2016–2019 (USD Million) 71

Table 53 North America: Market, By Application, 2020–2025 (USD Million) 71

Table 54 North America: Spirometers Market, By End User,2016–2019 (USD Million) 72

Table 55 North America: Spirometer Industry, By End User, 2020–2025 (USD Million) 72

10.2.1 Us

10.2.1.1 Us Dominates The North American Spirometers Market Due To The High Burden Of Copd In The Country

Figure 17 Us: Ageing Population

10.2.1.2 Us: Covid-19 Impact Analysis

Table 56 Us: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 57 Us: Market, By Product, 2020–2025 (USD Million)

Table 58 Us: Market, By Mechanism, 2016–2019 (USD Million)

Table 59 Us: Market, By Mechanism, 2020–2025 (USD Million)

Table 60 Us: Spirometer Market, By Application, 2016–2019 (USD Million)

Table 61 Us: Market, By Application, 2020–2025 (USD Million)

Table 62 Us: Market, By End User, 2016–2019 (USD Million)

Table 63 Us: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.2.2 Canada

10.2.2.1 Increasing Awareness About Respiratory Care Diagnosis To Drive The Adoption Of Spirometers

10.2.2.2 Canada: Covid-19 Impact Analysis

Table 64 Canada: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 65 Canada: Spirometers Market, By Product, 2020–2025 (USD Million)

Table 66 Canada: Market, By Mechanism,2016–2019 (USD Million) 77

Table 67 Canada: Market, By Mechanism, 2020–2025 (USD Million) 77

Table 68 Canada: Spirometer Market, By Application, 2016–2019 (USD Million) 77

Table 69 Canada: Market, By Application,2020–2025 (USD Million) 77

Table 70 Canada: Market, By End User, 2016–2019 (USD Million) 78

Table 71 Canada: Spirometer Industry, By End User, 2020–2025 (USD Million) 78

10.2.3 Mexico

10.2.3.1 High Burden Of Respiratory Diseases In The Country To Drive The Adoption Of Spirometers

10.2.3.2 Mexico: Covid-19 Impact Analysis

Table 72 Mexico: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 73 Mexico: Spirometers Market, By Product, 2020–2025 (USD Million)

10.3 Europe

Table 74 Europe: Spirometer Market, By Country, 2016–2019 (USD Million)

Table 75 Europe: Market, By Country, 2020–2025 (USD Million)

Table 76 Europe: Spirometers Market, By Product, 2016–2019 (USD Million)

Table 77 Europe: Market, By Product, 2020–2025 (USD Million)

Table 78 Europe: Market, By Mechanism, 2016–2019 (USD Million) 81

Table 79 Europe: Spirometer Market, By Mechanism, 2020–2025 (USD Million) 81

Table 80 Europe: Market, By Application,2016–2019 (USD Million) 81

Table 81 Europe: Market, By Application, 2020–2025 (USD Million) 82

Table 82 Europe: Market, By End User, 2016–2019 (USD Million)

Table 83 Europe: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.3.1 Germany

10.3.1.1 Germany Dominates The European Spirometers Market

Table 84 Germany: Spirometer Market, By Product,2016–2019 (USD Million) 83

Table 85 Germany: Market, By Product,2020–2025 (USD Million) 83

Table 86 Germany: Market, By Mechanism,2016–2019 (USD Million) 84

Table 87 Germany: Market, By Mechanism,2020–2025 (USD Million) 84

Table 88 Germany: Spirometer Market, By Application, 2016–2019 (USD Million) 84

Table 89 Germany: Market, By Application,2020–2025 (USD Million) 84

Table 90 Germany: Market, By End User, 2016–2019 (USD Million) 85

Table 91 Germany: Spirometer Industry By End User, 2020–2025 (USD Million) 85

10.3.2 Italy

10.3.2.1 Large Geriatric Population To Drive The Growth Of The Spirometers Market In Italy

10.3.2.2 Italy: Covid-19 Impact Analysis

Table 92 Italy: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 93 Italy: Market, By Product, 2020–2025 (USD Million)

Table 94 Italy: Market, By Mechanism, 2016–2019 (USD Million)

Table 95 Italy: Market, By Mechanism, 2020–2025 (USD Million)

Table 96 Italy: Spirometer Market, By Application, 2016–2019 (USD Million)

Table 97 Italy: Market, By Application, 2020–2025 (USD Million)

Table 98 Italy: Market, By End User, 2016–2019 (USD Million)

Table 99 Italy: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.3.3 Spain

10.3.3.1 Aging Population In Spain To Drive The Demand For Spirometers

10.3.3.2 Spain: Covid-19 Impact Analysis

Table 100 Spain: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 101 Spain: Spirometers Market, By Product, 2020–2025 (USD Million)

10.3.4 Uk

10.3.4.1 Uk To Register The Highest Growth Rate In The European Spirometers Market During The Forecast Period

Table 102 Uk: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 103 Uk: Spirometers Market, By Product, 2020–2025 (USD Million)

Table 104 Uk: Market, By Mechanism, 2016–2019 (USD Million)

Table 105 Uk: Market, By Mechanism, 2020–2025 (USD Million)

Table 106 Uk: Spirometer Market, By Application, 2016–2019 (USD Million)

Table 107 Uk: Market, By Application, 2020–2025 (USD Million)

Table 108 Uk: Market, By End User, 2016–2019 (USD Million)

Table 109 Uk: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.3.5 France

10.3.5.1 High Burden Of Copd To Drive The Adoption Of Spirometers In France

Table 110 France: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 111 France: Spirometers Market, By Product, 2020–2025 (USD Million)

Table 112 France: Market, By Mechanism,2016–2019 (USD Million) 92

Table 113 France: Market, By Mechanism,92

Table 114 France: Spirometer Market, By Application, 2016–2019 (USD Million) 93

Table 115 France: Market, By Application,2020–2025 (USD Million) 93

Table 116 France: Market, By End User, 2016–2019 (USD Million)

Table 117 France: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.3.6 Switzerland

10.3.6.1 Growing Geriatric Population And The Subsequent Increase In The Prevalence Of Respiratory Conditions To Drive The Market For Spirometers

Table 118 Switzerland: Spirometer Market, By Product, 2016–2019 (USD Million) 94

Table 119 Switzerland: Market, By Product, 2020–2025 (USD Million) 94

10.3.7 Rest Of Europe

Table 120 Roe: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 121 Roe: Market, By Product, 2020–2025 (USD Million)

10.4 Asia Pacific

10.4.1 Asia Pacific: Covid-19 Impact Analysis

Figure 18 Asia Pacific: Spirometer Market Snapshot

Table 122 Asia Pacific: Spirometers Market, By Country, 2016–2019 (USD Million) 97

Table 123 Asia Pacific: Market, By Country, 2020–2025 (USD Million) 97

Table 124 Asia Pacific: Market, By Product, 2016–2019 (USD Million) 97

Table 125 Asia Pacific: Market, By Product,2020–2025 (USD Million) 98

Table 126 Asia Pacific: Market, By Mechanism, 2016–2019 (USD Million)98

Table 127 Asia Pacific: Spirometer Market, By Mechanism,2020–2025 (USD Million) 98

Table 128 Asia Pacific: Market, By Application,2016–2019 (USD Million) 98

Table 129 Asia Pacific: Market, By Application, 2020–2025 (USD Million) 99

Table 130 Asia Pacific: Market, By End User, 2016–2019 (USD Million) 99

Table 131 Asia Pacific: Spirometer Industry, By End User , 2020–2025 (USD Million) 99

10.4.2 China

10.4.2.1 China To Register The Highest Growth Rate In The Apac Spirometers Market Due To The High Burden Of Copd In The Country

Table 132 China: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 133 China: Spirometers Market, By Product, 2020–2025 (USD Million)

Table 134 China: Market, By Mechanism, 2016–2019 (USD Million)

Table 135 China: Market, By Mechanism, 2020–2025 (USD Million)

Table 136 China: Market, By Application, 2016–2019 (USD Million)

Table 137 China: Spirometer Market, By Application, 2020–2025 (USD Million)

Table 138 China: Market, By End User, 2016–2019 (USD Million)

Table 139 China: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.4.3 Japan

10.4.3.1 Large Geriatric Population To Drive The Demand For Spirometers In The Country

Table 140 Japan: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 141 Japan: Spirometers Market, By Product, 2020–2025 (USD Million)

Table 142 Japan: Market, By Mechanism, 2016–2019 (USD Million)

Table 143 Japan: Market, By Mechanism, 2020–2025 (USD Million)

Table 144 Japan: Market, By Application, 2016–2019 (USD Million)

Table 145 Japan: Spirometer Market, By Application, 2020–2025 (USD Million)

Table 146 Japan: Market, By End User, 2016–2019 (USD Million)

Table 147 Japan: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.4.4 India

10.4.4.1 Increasing Incidence Of Copd Is Driving Market Growth

Table 148 India: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 149 India: Spirometers Market, By Product, 2020–2025 (USD Million)

Table 150 India: Market, By Mechanism, 2016–2019 (USD Million)

Table 151 India: Market, By Mechanism, 2020–2025 (USD Million)

Table 152 India: Market, By Application,2016–2019 (USD Million)

Table 153 India: Market, By Application, 2020–2025 (USD Million)

Table 154 India: Spirometer Market, By End User, 2016–2019 (USD Million)

Table 155 India: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.4.5 Australia

10.4.5.1 High Incidence Of Respiratory Diseases To Propel Market Growth

Table 156 Australia: Spirometer Market, By Product,2016–2019 (USD Million)

Table 157 Australia: Spirometers Market, By Product, 2020–2025 (USD Million)

10.4.6 South Korea

10.4.6.1 Growing Geriatric Population To Drive The Growth Of The Spirometers Market In The Country

Table 158 South Korea: Spirometer Market, By Product,2016–2019 (USD Million)

Table 159 South Korea: Spirometers Market, By Product, 2020–2025 (USD Million)

10.4.7 Singapore

10.4.7.1 Aging Population To Drive The Adoption Of Spirometers

Table 160 Singapore: Spirometer Market, By Product,2016–2019 (USD Million) 109

Table 161 Singapore: Spirometer Industry, By Product, 2020–2025 (USD Million) 109

10.4.8 Rest Of Asia Pacific

Table 162 Roapac: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 163 Roapac: Market, By Product, 2020–2025 (USD Million)

10.5 Rest Of The World

Table 164 Row: Spirometer Market, By Country, 2016–2019 (USD Million)

Table 165 Row: Spirometers Market, By Country, 2020–2025 (USD Million)

Table 166 Row: Market, By Product, 2016–2019 (USD Million)

Table 167 Row: Market, By Product, 2020–2025 (USD Million)

Table 168 Row: Market, By Mechanism, 2016–2019 (USD Million)

Table 169 Row: Market, By Mechanism, 2020–2025 (USD Million)

Table 170 Row: Spirometer Market, By Application, 2016–2019 (USD Million)

Table 171 Row: Market, By Application, 2020–2025 (USD Million)

Table 172 Row: Market, By End User, 2016–2019 (USD Million)

Table 173 Row: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.5.1 Brazil

10.5.1.1 High Burden Of Respiratory Diseases To Drive Market Growth

Table 174 Brazil: Spirometer Market, By Product, 2016–2019 (USD Million)

Table 175 Brazil: Spirometers Market, By Product, 2020–2025 (USD Million)

Table 176 Brazil: Market, By Mechanism, 2016–2019 (USD Million) 114

Table 177 Brazil: Market, By Mechanism, 2020–2025 (USD Million) 115

Table 178 Brazil: Market, By Application, 2016–2019 (USD Million) 115

Table 179 Brazil: Spirometer Market, By Application, 2020–2025 (USD Million) 115

Table 180 Brazil: Market, By End User, 2016–2019 (USD Million)

Table 181 Brazil: Spirometer Industry, By End User, 2020–2025 (USD Million)

10.5.2 Other Row Countries

Table 182 Other Row Countries: Spirometer Market, By Product, 2016–2019 (USD Million) 116

Table 183 Other Row Countries: Spirometer Industry, By Product, 2020–2025 (USD Million) 116

11 Competitive Landscape (Page No. - 117)

11.1 Overview

Figure 19 Key Developments In The Spirometer Market From 2017 To 2020

11.2 Market Ranking Analysis, 2019

Figure 20 Spirometer Market Ranking, By Key Player, 2019

11.3 Key Strategies

11.3.1 Product Launches, 2017–2020

11.3.2 Expansions, 2017–2020

11.3.3 Partnerships, 2017–2020

11.4 Competitive Leadership Mapping (2019)

11.4.1 Vendor Inclusion Criteria

11.4.2 Visionary Leaders

11.4.3 Innovators

11.4.4 Dynamic Differentiators

11.4.5 Emerging Companies

Figure 21 Mnm Dive-Vendor Comparison Matrix: Spirometer Market

11.5 Competitive Leadership Mapping For Startups (2019)

11.5.1 Progressive Companies

11.5.2 Starting Blocks

11.5.3 Responsive Companies

11.5.4 Dynamic Companies

Figure 22 Mnm Dive-Vendor Comparison Matrix For Start-Ups: Spirometer Market

12 Company Profiles (Page No. - 123)

(Business Overview, Products Offered, Recent Developments & Mnm View)*

12.1 Hill-Rom

Figure 23 Hill-Rom: Company Snapshot

12.2 Teleflex Incorporated

Figure 24 Teleflex Incorporated: Company Snapshot

12.3 Vyaire Medical

12.4 Fukuda Sangyo

12.5 Chest M.I.

12.6 Medical International Research

12.7 Schiller Ag

12.8 Mgc Diagnostics

12.9 Ndd Medizintechnik Ag

12.1 Vitalograph

12.11 Midmark Corporation

12.12 Smiths Medical, Inc.

12.13 Sdi Diagnostics, Inc.

12.14 Futuremed America, Inc.

12.15 Cosmed Srl

12.16 Sibelmed

12.17 Fysiomed

12.18 Jones Medical Instrument Company

12.19 Recorders & Medicare Systems Pvt. Ltd.

12.2 Medline Industries, Inc.

12.21 Contec Medical Systems Co. Ltd.

12.22 Medriko

12.23 Clarity Medical Pvt. Ltd.

12.24 Guangzhou Medsinglong Medical Equipment Co. Ltd.

*Details On Business Overview, Products Offered, Recent Developments & Mnm View Might Not Be Captured In Case Of Unlisted Companies.

13 Adjacent/Related Markets (Page No. - 147)

13.1 Introduction

13.2 Resuscitation Market

13.2.1 Market Definition

13.2.2 Limitations

13.2.3 Market Overview

13.2.4 Resuscitation Market, By Product

13.2.4.1 Introduction

Table 184 Resuscitation Devices Market, By Product, 2018–2025 (USD Million) 148

13.2.4.2 Airway Management Devices

Table 185 Airway Management Devices Market, By Region, 2018–2025 (USD Million) 149

13.2.4.3 Ventilators

Table 186 Ventilators Market, By Region, 2018–2025 (USD Million)

13.2.4.4 Endotracheal Tubes

13.2.4.4.1 Growing Number Of Surgical Procedures Is Expected To Drive The Demand For Endotracheal Tubes

Table 187 Endotracheal Tubes Market, By Region, 2018–2025 (USD Million)

13.2.4.5 Tracheostomy Tubes

13.2.4.5.1 Introduction Of Advanced And Ergonomic Products Will Drive Market Growth

Table 188 Tracheostomy Tubes Market, By Region, 2018–2025 (USD Million)

13.2.4.6 Laryngeal Mask Airways

13.2.4.6.1 Increasing Usage Of Lmas Outside Operating Room Settings—A Key Factor Driving Market Growth

Table 189 Laryngeal Mask Airways Market, By Region, 2018–2025 (USD Million) 151

13.2.4.7 Laryngoscopes

Table 190 Laryngoscopes Market, By Region, 2018–2025 (USD Million)

13.2.4.8 Nasopharyngeal Airways

13.2.4.8.1 Possibility Of Complications Has Reduced The Overall Use Of Nasopharyngeal Airways

Table 191 Nasopharyngeal Airways Market, By Region, 2018–2025 (USD Million) 153

13.2.4.9 Oropharyngeal Airways

13.2.4.9.1 Risks Associated With Opas To Restrain Market Growth

Table 192 Oropharyngeal Airways Market, By Region, 2018–2025 (USD Million) 153

13.2.4.9.2 External Defibrillators

Table 193 External Defibrillators Market, By Region, 2018–2025 (USD Million) 154

13.2.4.10 Semi-Automated External Defibrillators

13.2.4.10.1 Launch Of Technologically Advanced Devices To Support Market Growth

Table 194 Semi-Automated External Defibrillators Market, By Region, 2018–2025 (USD Million)

13.2.4.11 Fully Automated External Defibrillators

13.2.4.11.1 Increasing Installation Of These Devices In Public Places To Drive Market Growth

Table 195 Fully-Automated External Defibrillators Market, By Region, 2018–2025 (USD Million)

13.2.4.12 Wearable Cardioverter Defibrillators

13.2.4.12.1 Concerns Associated With The Use Of Wcds Are Expected To Hamper Their Adoption

Table 196 Wearable Cardioverter Defibrillators Market, By Region, 2018–2025 (USD Million)

13.2.4.13 Convective Warming Blankets

13.2.4.13.1 Rising Adoption Of Convective Warming Blankets Among Hospitals To Drive Market Growth

Table 197 Convective Warming Blankets Market, By Region, 2018–2025 (USD Million)

13.2.4.14 Other Resuscitation Devices

Table 198 Other Resuscitation Devices Market, By Region, 2018–2025 (USD Million)

14 Appendix (Page No. - 158)

14.1 Insights Of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

This study involved four major activities in estimating the current size of the spirometer market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the spirometer equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the spirometer equipment market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the spirometer equipment market based on product, mechanism, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, opportunities, challenges and COVID-19 impact analysis)

- To strategically analyze micromarkets with respect to their individual growth trends, prospects, and contributions to the overall spirometer equipment market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, the Asia Pacific and Rest of the World.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such acquisitions; product launches; expansions; agreements, partnerships, and collaborations; and R&D activities in the spirometer equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

Spirometer equipment market size and growth rate estimates for counties in Rest of Europe, the Rest of Asia Pacific and the Rest of the World Countries

Company Profiles

Additional five company profiles of players operating in the spirometer equipment market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Spirometer Market