Sports Protective Gear Market by Type (Helmets, Shin Guards, Knee Pads), Sports Type (Soccer, Skating, Cycling), Area of Protection, Distribution Channel (Exclusive Stores, Multi-retail Stores, E-commerce Portals) and Region - Global Forecast to 2027

Updated on : September 02, 2025

Sports Protective Gear Market

The global sports protective gear market was valued at USD 5.3 billion in 2022 and is projected to reach USD 7.1 billion by 2027, growing at 6.0% cagr from 2022 to 2027. The market has grown considerably in recent years and is expected to grow in the coming years. Factors such as consumer awareness regarding health and fitness, increase in international and national sports events are expected to boost the market during forecast year. The growth of the sports protective gear market can also be credited to the surge in sports and fitness awareness across the world. Since the COVID-19 pandemic, people all over the world have become aware of the importance of leading a healthy lifestyle. It is because of this reason, fitness has become a trend for a majority of people, leading to a rapid increase in the size and popularity of the global fitness and sports industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Sports Protective Gear Market

The pandemic is estimated to have a negative impact on the global sports protective gear market. According to the Federation of the European Sporting Goods Industry (FESI) worldwide closure of physical and mortar retailers, as well as changes in customer behaviour, resulted in significant decline in sales of sporting goods. A majority of businesses battled fixed costs, causing significant liquidity shortages. According to the findings of FESI's survey, the impact of the outbreak on production is influenced by a number of factors, including government social distancing measures, the evolution of the COVID-19 virus in each country, order cancellations from clients, and the companies' overall lack of short- and long-term visibility. In terms of e-commerce, the survey affirmed that digitalization is a crucial driver for the sports goods industry, and that businesses with effective omni-channel retail strategies are better positioned to survive. In many countries operations of e-commerce platforms which were majorly responsible for delivering sports goods were shut down during the first wave of pandemic to avoid the spread of virus. In 2020, most major sporting events at the international, regional, and national levels were cancelled or postponed such as marathons to football tournaments, athletics championships to basketball games, handball to ice hockey, rugby, cricket, sailing, skiing, weightlifting to wrestling, and more to protect the health of athletes and others. For the first time in modern games history, the Olympics and Paralympics were also postponed.

Sports Protective Gear Market Dynamics

Driver: Prominence of National & International Sports Events

Sporting events are increasing rapidly owing to the growing passion of individuals for sports, which has resulted in the formation of numerous teams representing various countries. In the last five to six years there were many major sporting events which are driving the sports protective gear market. The major events which include were the Rugby World Cup (England), Cricket World Cup ( Australia and New Zealand),Rio Olympics and Paralympics, ICC World Twenty20 (India), Cycling (Switzerland), Baseball World Series (USA), Pyeongchang Winter Olympics, FIFA World Cup (Russia) , Asian Games, Commonwealth Games (Australia) and and. Sporting events which occur every year such as Super Bowl, IPL (Indian Premier League), UEFA Champions League are gaining popularity and attracting more players.

Restraint: Rising costs of raw and auxiliary materials

Rising costs of raw and auxiliary materials is a major restraint for the sports protective gear market. The price of composite resins along with cost of other raw and auxiliary materials has consistently increased not only in 2020, but also during the first three quarters of 2021. This is in addition to the increasing cost of freight, logistics, and packaging costs. This has resulted in an overall surge in the price of resins as well. A comparison between general-purpose products and specialty products yields that price is a direct function of performance. This is helpful in understanding as to why the price of glass fiber has been increasing, further restricting the growth of this market.

Opportunity: Rise in trend of online retail

Over the last few years, there has been a paradigm shift in how to sports goods industry sells its products to consumers. Distribution of goods has moved from conventional channels to e-commerce portals, applications, and platforms. Manufacturers who could not previously capitalize on sales due to lack of organized retail have now found a new means to increase their revenues, by entering the e-commerce market. Online sales channels have become popular in the last few years and as per an estimate this channel has grown approximately 30% during this tenure. Rise in per capita income, and disposable income has strengthened the consumer expenditure. As a result, the average consumer is willing to spend more on products such as sports protective equipment compared to previous years.

Challenge: Increasing number of counterfeit products

Global companies who engage in providing consumer goods to the market face a major problem in the name of counterfeiting. This issue although prevalent since a long time, has been gaining traction in the last few years specifically. Fake or counterfeit goods not only put the user in grave danger of injuries but indirectly this also results in financial setbacks, job losses, and tax loss to governments. It is important to note that the strongest medium of selling counterfeit products is through the online sales channels. Sellers are easily able to hide their identities and consumers due to lack of ‘touch and feel’ are convinced about the genuinety of the product. However, these counterfeit products are made of substandard material. Such material does not undergo quality or performance checks and hence users are put in risk of injuries.

Sports Protective Gear Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The helmets, in by type segment of the global sports protective gear market is projected to grow at a significant CAGR during the forecast period.

Helmet is an equipment which is used to prevent or minimize head or brain injuries in various sports such as boxers, cricketers, football players, cyclists, skiers, baseball and motor sports. These helmets are specially designed and tested according to the impacts of different types of sports, so a baseball helmet cannot be worn by a cyclist or boxer. The helmet should fit the player's head properly to also prevent damage from wear as these helmets reduce the risk of head injuries by 75%–85%.

Soccer is projected to witness robust growth in by sport type segment of the sports protective gear market during the forecast period.

The most popular international team sport, soccer, is gaining popularity in the United States. As more people are playing soccer, the number of soccer-related injuries is increasing. Usage of shin guards to help protect the lower legs. In most soccer tournaments, the records show that lower leg injuries are most often caused by inadequate shin guards.

The head & face segment in by area of protection segment is estimated to witness promising growth in the sports protective gear market.

Amongst American children and adolescents, sports and recreational activities contribute to over 21% of all traumatic brain injuries according to the CDC. Brain injuries cause more deaths than any other sports injury. In football, brain injuries account for 65% to 95% of all fatalities. Football injuries associated with the brain occur at the rate of one in every 5.5 games. In any given season, 10% of all players and 20% of all high school players sustain brain injuries. Sports-related head & face injury research has led to the development of head protective gear that has evolved over the years. Headgears have been designed to protect athletes from skull fractures, subdural hemorrhages and concussions.

The E-commerce portals segment of the distribution channel segment is estimated to witness promising growth in the sports protective gear market.

Advancements in technology and internet accessibility have enabled the development of new channel of selling products i.e. e-commerce. This mode of distribution is primarily used by companies to offer its products to consumers who are situated at far-off locations or in other countries. E-commerce distribution helps companies in generating revenue without the need for an acutal brick-and-mortar shop. In recent times, businesses have increased their reach and business potential by setting online shops, platforms, or smartphone applications enabling people from different countries to access and buy their products. Some examples of e-commerce portals are Amazon, Alibaba, Flipkart, and eBay.

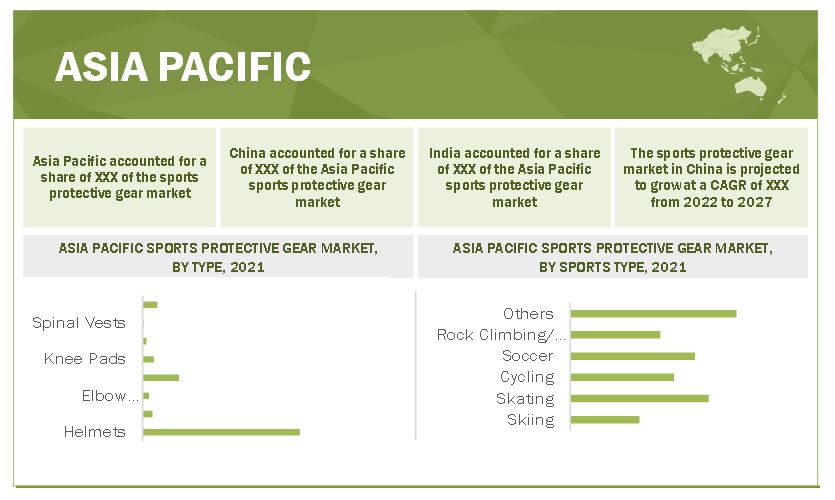

Asia Pacific accounted for the largest share of the sports protective gear market in 2021.

Asia Pacific is the leading consumer of sports protective gear. The large market share is due to the growing popularity of sports in countries such as India, China, Japan, South Korea, Singapore and Australia. China accounted for the largest share of the Asia Pacific sports protective gear market in 2021, due to the vast population base, and increased interest in sporting activities. India is the second largest market for sports protective gear in the Asia Pacific region.

Sports Protective Gear Market Players

Nike, Inc (US), Adidas AG (Germany), PUMA SE (Germany), Under Armour, Inc (US), ASICS Corporation (Japan), Mizuno Corporation (Japan), Vista Outdoor (US), Amer Sports (Finland), Harrow Sports Inc (US), Bauer Hockey (US), BRG Sports (US), United Sports Brands (US), Xenith (US), Franklin sports (US), Dunlop Sports (UK) are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Sports Protective Gear Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million and USD Billion) |

|

Segments Covered |

Type, Sports Type, Area of Protection, ,Distribution Channel and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Nike, Inc (US), Adidas AG (Germany), PUMA SE (Germany), Under Armour, Inc (US), ASICS Corporation (Japan), Mizuno Corporation (Japan), Vista Outdoor (US), Amer Sports (Finland), Harrow Sports Inc (US), Bauer Hockey (US), BRG Sports (US), United Sports Brands (US), Xenith (US), Franklin sports (US), Dunlop Sports (UK). |

This research report categorizes the Sports Protective Gear Market based on type, area of protection, distribution channel, sport type and region.

Based on Type, the sports protective gear market has been segmented as follows:

- Helmets

- Shoulder Guards

- Elbow Guards

- Shin Guards

- Knee Pads

- Wrist Gaurds

- Spinal Vest

-

Others

- Chest Protector

- Armguard

- Mouth Guard

Based on Distribution Channel, the sports protective gear market has been segmented as follows:

- Exclusive Stores

- Multi-retail Stores

- E-commerce portals

Based on Area of Protection, the sports protective gear market has been segmented as follows:

- Head & Face

- Trunk & Thorax

- Upper Extremity

- Lower Extremity

Based on Sports Type, the sports protective gear market has been segmented as follows:

- Skiing

- Skating

- Cycling

- Soccer

- Rock Climbing/ Mountaineering

-

Others

- Tennis

- Cricket

- Hockey

- Air sports

Based on Distribution Channel, the sports protective gear market has been segmented as follows:

- Pharmacy & Drug Stores

- Supermarket & Hypermarket

- Specialty Stores

- E-commerce

Based on Region, the sports protective gear market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What are sports protective gears?

Protective gears are key elements of injury prevention in contact sports. Sports protective gears generally refer to equipment used by sports professionals which are specially designed to protect the professional’s body from injury.

What are different types of sports protective gears?

Equipment such as helmets, shouder guards, elbow guards, shin guards, knee pads, spinal vests, wrist guards, mouth guards, chest protector, arm guards are categorized as sports protective gears.

Which are the key companies operating in the global sports protective gear market?

Companies such as Nike, Inc (US), Adidas AG (Germany), PUMA SE (Germany), Under Armour, Inc (US), ASICS Corporation (Japan), Mizuno Corporation (Japan), Vista Outdoor (US), Amer Sports (Finland), Harrow Sports Inc (US), Bauer Hockey (US), BRG Sports (US), United Sports Brands (US), Xenith (US), Franklin sports (US), Dunlop Sports (UK).

What is a key strategy adopted by the market players?

One of the most important differentiating factors providing a competitive edge to companies in the market is the extensive adoption of strategies such as new product launch, expansions, acquisitions, partnerships, which gives them a head start in enhancing their presence in the evolving sports protection gear market.

What is the COVID-19 impact on sports protection gear market?

COVID-19 outbreak had a major negative impact on the global demand for sports protective gear. The outbreak and the spread of the COVID-19 led to cancellation of most major sporting events at the international, regional, and national levels .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 SPORTS PROTECTIVE GEAR, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 2 SPORTS PROTECTIVE GEAR, BY DISTRIBUTION CHANNEL: INCLUSIONS & EXCLUSIONS

TABLE 3 SPORTS PROTECTIVE GEAR, BY AREA OF PROTECTIVE : INCLUSIONS & EXCLUSIONS

TABLE 4 SPORTS PROTECTIVE GEAR, BY SPORT TYPE: INCLUSIONS & EXCLUSIONS

TABLE 5 SPORTS PROTECTIVE GEAR MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.3.1 MARKET SCOPE

FIGURE 1 SPORTS PROTECTIVE GEAR MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 SPORTS PROTECTIVE GEAR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

FIGURE 5 MARKET SIZE ESTIMATION (SUPPLY-SIDE): SPORTS PROTECTIVE GEAR MARKET

FIGURE 6 MARKET SIZE ESTIMATION (DEMAND-SIDE): SPORTS PROTECTIVE GEAR MARKET

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 6 SPORTS PROTECTIVE GEAR MARKET SNAPSHOT, 2022 & 2027

FIGURE 7 HELMETS TYPE SEGMENT ACCOUNTED FOR LARGEST SHARE OF SPORTS PROTECTIVE GEAR MARKET

FIGURE 8 SOCCER SEGMENT ACCOUNTED FOR LARGER SHARE OF SPORTS PROTECTIVE GEAR MARKET

FIGURE 9 HEAD & FACE AREA OF PROTECTION ACCOUNTED FOR LARGEST SHARE OF SPORTS PROTECTIVE GEAR MARKET

FIGURE 10 MULTI-RETAIL STORES DISTRIBUTION CHANNEL ACCOUNTED FOR LARGEST SHARE OF SPORTS PROTECTIVE GEAR MARKET

FIGURE 11 ASIA PACIFIC EXPECTED TO LEAD SPORTS PROTECTIVE GEAR MARKET

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN SPORTS PROTECTIVE GEAR MARKET

FIGURE 12 INCREASING AWARENESS FOR HEALTH & FITNESS AND POPULARITY OF SPORTS IS DRIVING SPORTS PROTECTIVE GEAR MARKET

4.2 SPORTS PROTECTIVE GEAR MARKET, BY REGION

FIGURE 13 SPORTS PROTECTIVE GEAR MARKET IN NORTH AMERICA PROJECTED TO GROW AT HIGHEST RATE

4.3 ASIA PACIFIC SPORTS PROTECTIVE GEAR MARKET, BY TYPE AND COUNTRY

FIGURE 14 HELMETS AND CHINA TO ACCOUNT FOR LARGEST SHARES OF ASIA PACIFIC SPORTS PROTECTIVE GEAR MARKET

4.4 SPORTS PROTECTIVE GEAR MARKET: MAJOR COUNTRIES

FIGURE 15 SPORTS PROTECTIVE GEAR MARKET IN US PROJECTED TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SPORTS PROTECTIVE GEAR MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in consumer awareness regarding health & fitness

FIGURE 17 AVERAGE PERCENTAGE OF US POPULATION ENGAGED IN SPORTS AND EXERCISE PER DAY FROM 2010 TO 2020

5.2.1.2 Prominence of national & international sporting events

5.2.1.3 Rising participation of women in sporting events

FIGURE 18 PERCENTAGE OF WOMEN'S PARTICIPATION IN SUMMER OLYMPIC GAMES

5.2.2 RESTRAINTS

5.2.2.1 Rising costs of raw and auxiliary materials

5.2.3 OPPORTUNITIES

5.2.3.1 Rising trend of online retail

5.2.4 CHALLENGES

5.2.4.1 Increasing number of counterfeit products

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 PORTER'S FIVE FORCES ANALYSIS: SPORTS PROTECTIVE GEAR MARKET

TABLE 7 SPORTS PROTECTIVE GEAR MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF RIVALRY

5.4 COVID-19 IMPACT ANALYSIS

5.4.1 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 21 ECONOMIC OUTPUT OF DIFFERENT COUNTRIES, 2020 VS 2021

5.4.2 IMPACT OF COVID-19 ON SPORTS PROTECTIVE GEAR MARKET

5.4.2.1 Impact on sporting goods industry

5.4.2.2 Impact on sporting events

5.5 PATENT ANALYSIS

5.5.1 METHODOLOGY

5.5.2 PATENT PUBLICATION TRENDS

FIGURE 22 NUMBER OF PATENTS YEAR-WISE DURING LAST TEN YEARS

5.5.3 INSIGHT

5.5.4 JURISDICTION ANALYSIS

FIGURE 23 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

5.5.5 TOP COMPANIES/APPLICANTS

FIGURE 24 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

5.5.5.1 List of major patents

5.6 KEY CONFERENCES & EVENTS IN 2021-2022

TABLE 8 SPORTS PROTECTIVE GEAR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.7 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: HIGHEST VALUE ADDED DURING MANUFACTURING PHASE

5.8 ECOSYSTEM FOR SPORTS PROTECTIVE GEAR MARKET

FIGURE 26 ECOSYSTEM MAP OF SPORTS PROTECTIVE GEAR MARKET

TABLE 9 SPORTS PROTECTIVE GEAR MARKET: ECOSYSTEM

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

FIGURE 27 FIGURE TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.10 AVERAGE SELLING PRICE ANALYSIS

FIGURE 28 AVERAGE SELLING PRICE OF DIFFERENT SPORTS PROTECTIVE GEAR

5.11 REGULATORY LANDSCAPE

5.11.1 NORTH AMERICA: SPORTS PROTECTIVE GEAR STANDARDS

5.11.2 EUROPE: SPORTS PROTECTIVE GEAR STANDARDS

6 SPORTS PROTECTIVE GEAR MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 29 HELMETS TO BE FASTEST-GROWING SPORTS PROTECTIVE GEAR DURING THE FORECAST PERIOD

TABLE 10 SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 11 SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

6.2 HELMETS

6.2.1 ACCOUNTED FOR LARGEST SHARE IN SPORTS PROTECTIVE GEAR MARKET

TABLE 12 SPORTS PROTECTIVE GEAR MARKET SIZE FOR HELMETS, BY REGION, 2019–2027 (USD MILLION)

TABLE 13 SPORTS PROTECTIVE GEAR MARKET SIZE FOR HELMETS, BY REGION, 2019–2027 (THOUSAND UNITS)

6.3 SHOULDER GUARDS

6.3.1 SHOULDER GUARDS ARE WIDELY USED TO PREVENT SHOULDER DISLOCATIONS

TABLE 14 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SHOULDER GUARDS, BY REGION, 2019–2027 (USD MILLION)

TABLE 15 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SHOULDER GUARDS, BY REGION, 2019–2027 (THOUSAND UNITS)

6.4 ELBOW GUARDS

6.4.1 CYCLING AND CRICKET TO DRIVE MARKET FOR ELBOW GUARDS

TABLE 16 SPORTS PROTECTIVE GEAR MARKET SIZE FOR ELBOW GUARDS, BY REGION 2019–2027 (USD MILLION)

TABLE 17 SPORTS PROTECTIVE GEAR MARKET SIZE FOR ELBOW GUARDS, BY REGION 2019–2027 (THOUSAND UNITS)

6.5 SHIN GUARDS

6.5.1 SOCCER TO SPUR MARKET GROWTH FOR SHIN GUARDS

TABLE 18 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SHIN GUARDS, BY REGION 2019–2027 (USD MILLION)

TABLE 19 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SHIN GUARDS, BY REGION 2019–2027 (THOUSAND UNITS)

6.6 WRIST GUARDS

6.6.1 WIDELY USED IN SKIING TO PREVENT WRIST INJURIES

TABLE 20 SPORTS PROTECTIVE GEAR MARKET SIZE FOR WRIST GUARDS, BY REGION, 2019–2027 (USD MILLION)

TABLE 21 SPORTS PROTECTIVE GEAR MARKET SIZE FOR WRIST GUARDS, BY REGION, 2019–2027 (THOUSAND UNITS)

6.7 KNEE PADS

6.7.1 EXTENSIVELY USED IN SKATING TO PREVENT KNEE INJURIES

TABLE 22 SPORTS PROTECTIVE GEAR MARKET SIZE FOR KNEE PADS, BY REGION, 2019–2027 (USD MILLION)

TABLE 23 SPORTS PROTECTIVE GEAR MARKET SIZE FOR KNEE PADS, BY REGION, 2019–2027 (THOUSAND UNITS)

6.8 SPINAL VESTS

6.8.1 SKIING AND CYCLING TO DRIVE MARKET GROWTH FOR SPINAL VESTS

TABLE 24 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SPINAL VESTS, BY REGION, 2019–2027 (USD MILLION)

TABLE 25 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SPINAL VESTS, BY REGION, 2019–2027 (THOUSAND UNITS)

6.9 OTHERS

TABLE 26 SPORTS PROTECTIVE GEAR MARKET SIZE FOR OTHER TYPES, BY REGION, 2019–2027 (USD MILLION)

TABLE 27 SPORTS PROTECTIVE GEAR MARKET SIZE FOR OTHER TYPES, BY REGION, 2019–2027 (THOUSAND UNITS)

7 SPORTS PROTECTIVE GEAR MARKET, BY SPORT TYPE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 30 SOCCER TO LEAD SPORTS PROTECTIVE MARKET BY SPORT TYPE

TABLE 28 SPORTS PROTECTIVE GEAR MARKET SIZE, BY SPORT TYPE, 2019–2027 (THOUSAND UNITS)

TABLE 29 SPORTS PROTECTIVE GEAR MARKET SIZE, BY SPORT TYPE, 2019–2027 (USD MILLION)

7.2 SKIING

7.2.1 SKIING TO ACHIEVE HIGHEST GROWTH IN NORTH AMERICAN REGION

TABLE 30 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SKIING, BY REGION, 2019–2027 (THOUSAND UNITS)

TABLE 31 SPORTS PROTECTIVE GEAR MARKET SIZE, FOR SKIING, BY REGION, 2019–2027 (USD MILLION)

7.3 SKATING

7.3.1 ASIA PACIFIC, NORTH AMERICA, AND EUROPE TO PROVIDE HIGH GROWTH OPPORTUNITIES

TABLE 32 SPORTS PROTECTIVE GEAR MARKET SIZE, FOR SKATING, BY REGION, 2019–2027 (THOUSAND UNITS)

TABLE 33 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SKATING, BY REGION, 2019–2027 (USD MILLION)

7.4 CYCLING

7.4.1 DEVELOPED EUROPEAN COUNTRIES TO OFFER HIGH GROWTH OPPORTUNITIES

TABLE 34 SPORTS PROTECTIVE GEAR MARKET SIZE FOR CYCLING, BY REGION, 2019–2027 (THOUSAND UNITS)

TABLE 35 SPORTS PROTECTIVE GEAR MARKET SIZE FOR CYCLING, BY REGION, 2019–2027 (USD MILLION)

7.5 SOCCER

7.5.1 MOST POPULAR SPORT GLOBALLY

TABLE 36 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SOCCER, BY REGION, 2019–2027 (THOUSAND UNITS)

TABLE 37 SPORTS PROTECTIVE GEAR MARKET SIZE FOR SOCCER, BY REGION, 2019–2027 (USD MILLION)

7.6 ROCK CLIMBING/MOUNTAINEERING

7.6.1 HIGH RISK OF INJURY TO CLIMBERS DRIVES MARKET DEMAND

TABLE 38 SPORTS PROTECTIVE GEAR MARKET SIZE FOR ROCK CLIMBING/MOUNTAINEERING, BY REGION, 2019–2027 (THOUSAND UNITS)

TABLE 39 SPORTS PROTECTIVE GEAR MARKET SIZE FOR ROCK CLIMBING/MOUNTAINEERING, BY REGION, 2019–2027 (USD MILLION)

7.7 OTHERS

TABLE 40 SPORTS PROTECTIVE GEAR MARKET SIZE FOR OTHER SPORT TYPES, BY REGION, 2019–2027 (THOUSAND UNITS)

TABLE 41 SPORTS PROTECTIVE GEAR MARKET SIZE FOR OTHER SPORT TYPES, BY REGION, 2019–2027 (USD MILLION)

8 SPORTS PROTECTIVE GEAR MARKET, BY AREA OF PROTECTION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 31 HEAD & FACE SEGMENT TO WITNESS HIGHEST GROWTH

TABLE 42 SPORTS PROTECTIVE GEAR MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (MILLION UNITS)

TABLE 43 SPORTS PROTECTIVE GEAR MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (USD MILLION)

8.2 HEAD & FACE

8.2.1 SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

TABLE 44 SPORTS PROTECTIVE GEAR MARKET SIZE FOR HEAD & FACE, BY REGION, 2019–2027 (MILLION UNITS)

TABLE 45 SPORTS PROTECTIVE GEAR MARKET SIZE FOR HEAD & FACE, BY REGION, 2019–2027 (USD MILLION)

8.3 TRUNK & THORAX

8.3.1 SEGMENT TO WITNESS HIGHEST DEMAND IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 46 SPORTS PROTECTIVE GEAR MARKET SIZE FOR TRUNK & THORAX, BY REGION, 2019–2027 (MILLION UNITS)

TABLE 47 SPORTS PROTECTIVE GEAR MARKET SIZE FOR TRUNK & THORAX, BY REGION, 2019–2027 (USD MILLION)

8.4 UPPER EXTREMITY

8.4.1 ACCOUNTS FOR SECOND-LARGEST DEMAND GLOBALLY IN TERMS OF VOLUME

TABLE 48 SPORTS PROTECTIVE GEAR MARKET SIZE FOR UPPER EXTREMITY, BY REGION, 2019–2027 (MILLION UNITS)

TABLE 49 SPORTS PROTECTIVE GEAR MARKET SIZE FOR UPPER EXTREMITY, BY REGION, 2019–2027 (USD MILLION)

8.5 LOWER EXTREMITY

8.5.1 CONTACT SPORTS LIKE FOOTBALL AND SKIING TO DRIVE MARKET DEMAND

TABLE 50 SPORTS PROTECTIVE GEAR MARKET SIZE FOR LOWER EXTREMITY, BY REGION, 2019–2027 (MILLION UNITS)

TABLE 51 SPORTS PROTECTIVE GEAR MARKET SIZE FOR LOWER EXTREMITY, BY REGION, 2019–2027 (USD MILLION)

9 SPORTS PROTECTIVE GEAR MARKET, BY DISTRIBUTION CHANNEL (Page No. - 100)

9.1 INTRODUCTION

FIGURE 32 E-COMMERCE PORTALS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 52 SPORTS PROTECTIVE GEAR MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2027 (USD MILLION)

9.2 EXCLUSIVE STORES

9.2.1 COMPANIES ARE WORKING TO INCREASE THEIR EXCLUSIVE STORES

TABLE 53 SPORTS PROTECTIVE GEAR MARKET SIZE FOR EXCLUSIVE STORES, BY REGION, 2019–2027 (USD MILLION)

9.3 MULTI-RETAIL STORES

9.3.1 RISING GROWTH OF MULTI-RETAIL STORES TO BOOST MARKET

TABLE 54 SPORTS PROTECTIVE GEAR MARKET SIZE FOR MULTI-RETAIL STORES, BY REGION, 2019–2027 (USD MILLION)

9.4 E-COMMERCE PORTALS

9.4.1 E-COMMERCE PORTALS ARE MOST WIDELY USED DISTRIBUTION CHANNEL

TABLE 55 SPORTS PROTECTIVE GEAR MARKET SIZE FOR E-COMMERCE PORTALS, BY REGION 2019–2027 (USD MILLION)

10 SPORTS PROTECTIVE GEAR MARKET, BY REGION (Page No. - 105)

10.1 INTRODUCTION

FIGURE 33 US TO OFFER LUCRATIVE GROWTH OPPORTUNITIES TO SPORTS PROTECTIVE GEAR MARKET DURING FORECAST PERIOD

TABLE 56 SPORTS PROTECTIVE GEAR MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 57 SPORTS PROTECTIVE GEAR MARKET SIZE, BY REGION, 2019–2027 (MILLION UNITS)

10.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: SPORTS PROTECTIVE GEAR MARKET SNAPSHOT

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2027 (THOUSAND UNITS)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (MILLION UNITS)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY SPORT TYPE, 2019–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY SPORT TYPE, 2019–2027 (THOUSAND UNITS)

10.2.1 CHINA

10.2.1.1 China is one of fastest-growing markets for sports protective gear

TABLE 67 CHINA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 68 CHINA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.2.2 INDIA

10.2.2.1 Many popular sports played in country, which is driving sports protective gear market

TABLE 69 INDIA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 70 INDIA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.2.3 JAPAN

10.2.3.1 Rising interest in sports to drive sports protective gear market

TABLE 71 JAPAN: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 72 JAPAN: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.2.4 SOUTH KOREA

10.2.4.1 South Korea has improved its position in international sports community

TABLE 73 SOUTH KOREA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 74 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.2.5 SINGAPORE

10.2.5.1 Active participation in sports activities has increased the demand for sports protective gear

TABLE 75 SINGAPORE: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 76 SINGAPORE: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.2.6 AUSTRALIA

10.2.6.1 Australia organizes various sports leagues

TABLE 77 AUSTRALIA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 78 AUSTRALIA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.2.7 REST OF ASIA PACIFIC

TABLE 79 REST OF ASIA PACIFIC: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 80 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: SPORTS PROTECTIVE GEAR MARKET SNAPSHOT

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2027 (THOUSAND UNITS)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (MILLION UNITS)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY SPORT TYPE, 2019–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY SPORT TYPE, 2019–2027 (THOUSAND UNITS)

10.3.1 US

10.3.1.1 Largest market for sports protective gear in region

TABLE 90 US: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 91 US: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.3.2 CANADA

10.3.2.1 Hockey to drive the sports protective gear market

TABLE 92 CANADA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.3.3 MEXICO

10.3.3.1 Popularity of soccer drives demand for sports protective gear

TABLE 94 MEXICO: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 95 MEXICO: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.4 EUROPE

FIGURE 36 EUROPE: SPORTS PROTECTIVE GEAR MARKET SNAPSHOT

TABLE 96 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2027 (THOUSAND UNITS)

TABLE 98 EUROPE: MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

TABLE 100 EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (MILLION UNITS)

TABLE 103 EUROPE: MARKET SIZE, BY SPORT TYPE, 2019–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY SPORT TYPE, 2019–2027 (THOUSAND UNITS)

10.4.1 GERMANY

10.4.1.1 Accounts for largest market share in Europe

TABLE 105 GERMANY: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 106 GERMANY: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.4.2 UK

10.4.2.1 Initiatives by governing bodies and sports associations to drive the market in UK

TABLE 107 UK: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 108 UK: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.4.3 FRANCE

10.4.3.1 Cycling to spur the market for sports protective gear

TABLE 109 FRANCE: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 110 FRANCE: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.4.4 SPAIN

10.4.4.1 Soccer to drive the sports protective gear market

TABLE 111 SPAIN: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 112 SPAIN: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.4.5 REST OF EUROPE

TABLE 113 REST OF EUROPE: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.5 MIDDLE EAST & AFRICA

TABLE 115 MIDDLE EAST & AFRICA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2027 (THOUSAND UNITS)

TABLE 117 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

TABLE 119 MIDDLE EAST & AFRICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2027 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: MARKET SIZE, BY AREA OF PROTECTION ,2019–2027 (USD MILLION)

TABLE 121 MIDDLE EAST & AFRICA: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (MILLION UNITS)

TABLE 122 MIDDLE EAST & AFRICA: MARKET SIZE, BY SPORT TYPE, 2019–2027 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: MARKET SIZE, BY SPORT TYPE, 2019–2027 (THOUSAND UNITS)

10.5.1 UAE

10.5.1.1 Government initiatives to drive market in UAE

TABLE 124 UAE: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 125 UAE: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.5.2 SAUDI ARABIA

10.5.2.1 Rising number of international events to spur market growth

TABLE 126 SAUDI ARABIA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 127 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.5.3 SOUTH AFRICA

10.5.3.1 Accounted for largest market share in Middle East & Africa

TABLE 128 SOUTH AFRICA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 129 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 130 REST OF MIDDLE EAST & AFRICA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 131 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.6 SOUTH AMERICA

TABLE 132 SOUTH AMERICA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 133 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2027 (THOUSAND UNITS)

TABLE 134 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 135 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

TABLE 136 SOUTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2027 (USD MILLION)

TABLE 137 SOUTH AMERICA: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (USD MILLION)

TABLE 138 SOUTH AMERICA: MARKET SIZE, BY AREA OF PROTECTION, 2019–2027 (MILLION UNITS)

TABLE 139 SOUTH AMERICA: MARKET SIZE, BY SPORT TYPE, 2019–2027 (USD MILLION)

TABLE 140 SOUTH AMERICA: MARKET SIZE, BY SPORT TYPE, 2019–2027 (THOUSAND UNITS)

10.6.1 BRAZIL

10.6.1.1 Largest market for sports protective gear in region

TABLE 141 BRAZIL: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 142 BRAZIL: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.6.2 ARGENTINA

10.6.2.1 Popularity of sports like soccer drives demand for shin guards

TABLE 143 ARGENTINA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 144 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

10.6.3 REST OF SOUTH AMERICA

TABLE 145 REST OF SOUTH AMERICA: SPORTS PROTECTIVE GEAR MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 146 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2027 (THOUSAND UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 154)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

TABLE 147 OVERVIEW OF STRATEGIES ADOPTED BY SPORTS PROTECTIVE GEAR MANUFACTURERS

11.3 REVENUE ANALYSIS

11.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN SPORTS PROTECTIVE GEAR MARKET

FIGURE 37 TOP PLAYERS – REVENUE ANALYSIS (2017–2021)

11.4 MARKET SHARE ANALYSIS: SPORTS PROTECTIVE GEAR

FIGURE 38 MARKET SHARE: SPORTS PROTECTIVE GEAR

11.5 COMPETITIVE BENCHMARKING

11.5.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SPORTS PROTECTIVE GEAR MARKET

11.5.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 40 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SPORTS PROTECTIVE GEAR MARKET

TABLE 148 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 149 COMPANY AREA OF PROTECTION TYPE FOOTPRINT

TABLE 150 COMPANY REGION TYPE FOOTPRINT

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

FIGURE 41 SPORTS PROTECTIVE GEAR MARKET: COMPANY EVALUATION MATRIX

11.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX

11.7.1 PROGRESSIVE COMPANIES

11.7.2 DYNAMIC COMPANIES

11.7.3 RESPONSIVE COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 42 SPORTS PROTECTIVE GEAR MARKET: COMPANY EVALUATION MATRIX OF SMES

11.8 KEY STARTUP/SMES

TABLE 151 SPORTS PROTECTIVE GEAR MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 152 SPORTS PROTECTIVE GEAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

11.9 COMPETITIVE SCENARIO AND TRENDS

TABLE 153 SPORTS PROTECTIVE GEAR MARKET: NEW PRODUCT LAUNCHES, 2016-2022

TABLE 154 SPORTS PROTECTIVE GEAR MARKET: DEALS, 2016-2022

TABLE 155 SPORTS PROTECTIVE GEAR MARKET: OTHERS, 2016-2022

12 COMPANY PROFILES (Page No. - 169)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, New product launches, Related developments, MnM view, Right to win, Strategic choices made, Weakness and competitive threats)*

12.1.1 NIKE, INC.

TABLE 156 NIKE, INC.: COMPANY OVERVIEW

FIGURE 43 NIKE, INC.: COMPANY SNAPSHOT

12.1.2 ADIDAS AG

TABLE 157 ADIDAS AG: COMPANY OVERVIEW

FIGURE 44 ADIDAS AG: COMPANY SNAPSHOT

12.1.3 PUMA SE

TABLE 158 PUMA SE: COMPANY OVERVIEW

FIGURE 45 PUMA SE: COMPANY SNAPSHOT

12.1.4 UNDER ARMOUR, INC.

TABLE 159 UNDER ARMOUR, INC: COMPANY OVERVIEW

FIGURE 46 UNDER ARMOUR, INC: COMPANY SNAPSHOT

12.1.5 ASICS CORPORATION

TABLE 160 ASICS CORPORATION: COMPANY OVERVIEW

FIGURE 47 ASICS CORPORATION: COMPANY SNAPSHOT

12.1.6 MIZUNO CORPORATION

TABLE 161 MIZUNO CORPORATION: COMPANY OVERVIEW

FIGURE 48 MIZUNO CORPORATION: COMPANY SNAPSHOT

12.1.7 VISTA OUTDOOR

TABLE 162 VISTA OUTDOOR: COMPANY OVERVIEW

FIGURE 49 VISTA OUTDOOR: COMPANY SNAPSHOT

12.1.8 AMER SPORTS

TABLE 163 AMER SPORTS: COMPANY OVERVIEW

12.1.9 HARROW SPORTS INC

TABLE 164 HARROW SPORTS INC: COMPANY OVERVIEW

12.1.10 BAUER HOCKEY

TABLE 165 BAUER HOCKEY: COMPANY OVERVIEW

12.1.11 BRG SPORTS

TABLE 166 BRG SPORTS: COMPANY OVERVIEW

12.1.12 UNITED SPORTS BRANDS

TABLE 167 UNITED SPORTS BRANDS: COMPANY OVERVIEW

12.1.13 XENITH

TABLE 168 XENITH: COMPANY OVERVIEW

12.1.14 FRANKLIN SPORTS

TABLE 169 FRANKLIN SPORTS: COMPANY OVERVIEW

12.1.15 DUNLOP SPORT

TABLE 170 DUNLOP SPORT: COMPANY OVERVIEW

12.2 OTHER PLAYERS

12.2.1 GRAYS OF CAMBRIDGE (INTERNATIONAL) LTD.

TABLE 171 GRAYS OF CAMBRIDGE (INTERNATIONAL) LTD.: COMPANY OVERVIEW

12.2.2 ALPINESTARS

TABLE 172 ALPINESTARS: COMPANY OVERVIEW

12.2.3 DELTA PLUS

TABLE 173 DELTA PLUS: COMPANY OVERVIEW

12.2.4 MUELLER SPORTS MEDICINE INC

TABLE 174 MUELLER SPORTS MEDICINE INC: COMPANY OVERVIEW

12.2.5 NEW BALANCE ATHLETICS INC.

TABLE 175 NEW BALANCE ATHLETICS INC: COMPANY OVERVIEW

12.2.6 VIZARI SPORT USA

TABLE 176 VIZARI SPORT USA: COMPANY OVERVIEW

12.2.7 G-FORM

TABLE 177 G-FORM: COMPANY OVERVIEW

12.2.8 SOFTGUARDS

TABLE 178 SOFTGUARDS: COMPANY OVERVIEW

12.2.9 NOVA SPORTS USA

TABLE 179 NOVA SPORTS USA: COMPANY OVERVIEW

12.2.10 INTERPADS MANUFACTURING LTD

TABLE 180 INTERPADS MANUFACTURING LTD: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, New product launches, Related developments, MnM view, Right to win, Strategic choices made, Weakness and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 204)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

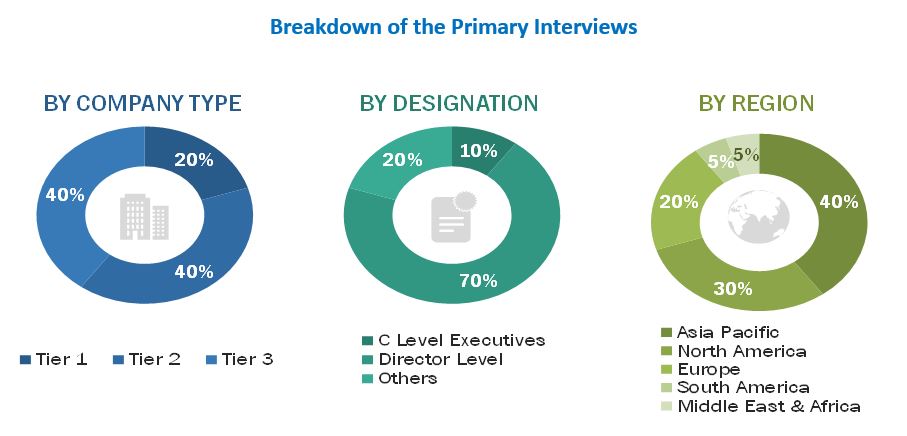

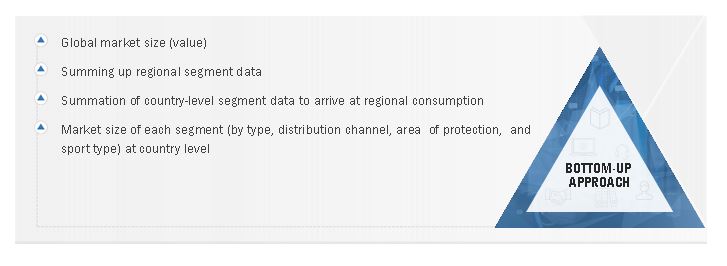

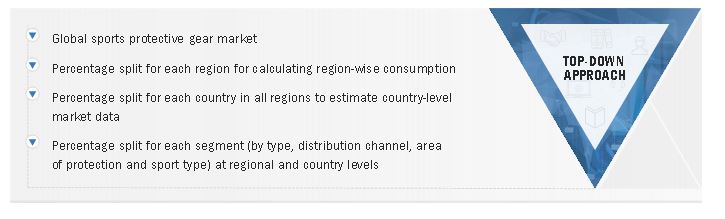

The study involved four major activities in estimating the current size of the sports protective gear market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the sports protective gear value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Secondary Research

The sports protective gear market comprises several stakeholders, such as raw material suppliers, manufacturers, raw material manufacturers, distributors, traders, suppliers, healthcare institutions, contract manufacturing organizations, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the sports protective gear market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various key companies and organizations operating in the sports protective gear market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the sports protective gear market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the sports protective gear market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the sports protective gear market based on type, area of protection, distribution channel, sport type, and region.

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing market growth.

- To forecast the size of the various segments of the sports protective gear market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions.

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders.

- To analyze recent developments, such as expansions, agreements, contracts, partnerships, acquisitions and collaboration in the sports protective gear market.

- To strategically profile the key players in the market and comprehensively analyze their core competencies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the sports protective gear market

- A further breakdown of a region of the sports protective gear market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sports Protective Gear Market