This market research study primarily relied on secondary sources, directories, and databases to collect information for this technical, market-oriented, and financial analysis of the surgical imaging market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives from major market players, and industry consultants, among others, to gather and verify critical qualitative and quantitative data and assess market prospects. The size of the surgical imaging market was estimated using multiple secondary research methods and confirmed with inputs from primary research to determine the final market size.

Secondary Research

The secondary research process involved extensively using secondary sources, including directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), the Organisation for Economic Co-operation and Development (OECD), Healthcare Information and Management Systems Society (HIMSS), Centers for Disease Control and Prevention (CDC), ClinicalTrials.gov, expert interviews, and MarketsandMarkets analysis.

Secondary research was conducted to gather information for the detailed, technical, market-focused, and commercial analysis of the surgical imaging market. It was also used to collect key information about major players, market classification, and segmentation based on industry trends, down to the most detailed level, along with significant developments related to market and technology perspectives. Additionally, a database of leading industry players was compiled using secondary research.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources mainly include industry experts from core and related industries, preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations involved in all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, such as key industry participants, subject-matter experts (SMEs), C-level executives of leading market players, and industry consultants, among other specialists, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process- which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation- extensive primary research was carried out. This research aimed to gather information and verify the key numbers obtained during the market analysis. Additionally, primary research was used to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of surgical Imaging solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market players.

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to estimate and forecast the market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was conducted on the entire market engineering process to identify key information and insights throughout the report.

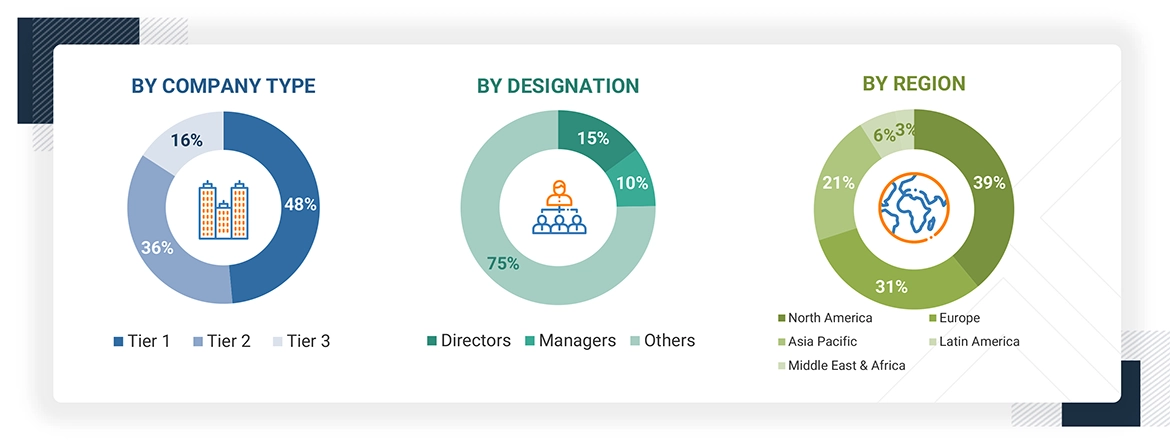

Breakdown of Primary Interviews

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue, as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts in this study are based on a combination of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (evaluation of utilization, adoption, and penetration trends by product, application, end user, and region).

Data Triangulation

After determining the overall market size from the estimation process described above, the surgical imaging market was divided into various segments and subsegments. To finalize the overall market analysis and obtain accurate statistics for all segments and subsegments, data triangulation and market breakdown techniques were used whenever applicable. The data was cross-verified by examining different factors and trends from both the demand and supply sides of the surgical imaging market.

Market Definition

The surgical imaging market includes digital systems, software, and integrated solutions that capture, process, and share medical images in real time during surgical procedures. It combines imaging modalities such as fluoroscopy, intraoperative MRI, cone-beam CT, 3D imaging, and ultrasound with IT infrastructure for connectivity across hospital networks and surgical navigation systems. These technologies, often enhanced by AI analysis, augmented reality, and cloud storage, enable precise visualization, guide interventions, and optimize surgical workflows, improving accuracy, efficiency, and patient safety outcomes.

Stakeholders

-

Surgical imaging vendors & imaging device manufacturers

-

Healthcare Providers (hospitals, outpatient settings, ambulatory surgical centers and specialty clinics, and other healthcare providers)

-

Clinical research organizations (CROs)

-

R&D companies

-

Business research & consulting service providers

-

Medical research laboratories

-

Academic medical centers/universities/hospitals/research institutes

-

Regulatory bodies (FDA, EMA, IAEA)

-

AI & algorithm developers

-

Venture capitalists

-

Advocacy groups

-

Investors & financial institutions

-

Contract manufacturing organizations (CMOs)

-

Contract research organizations (CROs)

Report Objectives

-

To define, describe, and forecast the surgical imaging market by product, brand, application, end user, and region

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing market growth

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall surgical imaging market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

-

To forecast the size of the surgical imaging market in five main regions (and their respective countries): North America, Europe, the Asia Pacific, the Middle East & Africa, and Latin America

-

To provide key industry insights, such as supply chain, regulatory, patent, and recession impact analysis.

-

To profile the key players in the market and comprehensively analyze their core competencies

-

To track and analyze competitive developments, such as product launches & upgrades, collaborations, partnerships, acquisitions, investments, contracts, agreements, alliances, mergers, funding, and expansions of the leading players in the market

-

To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Growth opportunities and latent adjacency in Surgical Imaging Market