Fluoroscopy Equipment Market by Product (Fixed C-Arms, Fluoroscopy Systems (Remote Controlled, Patient Side), Mobile C-arms), and Application (Diagnostic (Cardio, Gastroenterology, Nephrology), Surgical (Ortho, Neuro, Cardio) - Global Forecast to 2025

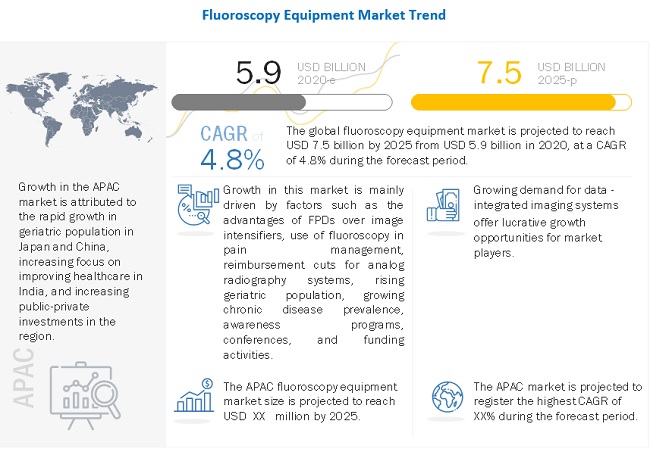

[187 Pages Report] The market for fluoroscopy equipment is expected to grow from USD 5.9 billion in 2020 to USD 7.5 billion by 2025, at a CAGR of 4.8% during the forecast period. Growth in the fluoroscopy equipment market is attributed to factors such as advantages of FPDs over image intensifiers, the use of fluoroscopy in pain management, reimbursement cuts for analog radiography systems, rising geriatric population, and the growing prevalence of chronic diseases.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global fluoroscopy equipment market

The COVID-19 pandemic has significantly impacted the buying capacity of hospitals, especially small-scale hospitals and scanning centers. According to an article in the Livemint, private hospitals in India have faced revenue losses of up to 90% due to the COVID-19 pandemic. The pandemic has also impacted the operation of manufacturing companies. Companies are functioning with a limited workforce. Moreover, the turnaround time for the delivery of products and services is affected due to newer packaging protocols and lockdown measures imposed by countries. All these factors are negatively impacting the manufacturing and supply chain of fluoroscopy products.

FLUOROSCOPY EQUIPMENT Market Dynamics

Driver: Advantages of FPDs over image intensifiers

The evolution of fluoroscopy systems and C-arms from traditional X-ray image intensifier technology to digital flat-panel detectors (FPDs) has brought about significant advancements in fluoroscopic imaging. FPDs have a number of advantages over image intensifiers, including compact sizes and reduced radiation dose. Systems with FPDs have the potential for higher image resolution than their predecessors.

Although resolution varies from model to model, overall, FPDs have the ability to produce a more consistent and high-quality digital image. Moreover, while the quality of images generated from traditional image intensifiers deteriorates as the system ages, this is not the case with FPDs. They continue to deliver the same image quality even years after use and can provide a wider and more dynamic range of imaging compared to image intensifiers. Additionally, the field of vision reduces with higher magnification in the case of image intensifiers, which does not happen if FPDs are used.

FPDs offer no image distortion, greater sensitivity, and better patient coverage. Due to their advantages, many hospitals are now opting for FPD fluoroscopes. The growing preference for advanced technologies, and the need to shift to new, more efficient products, will be a key factor driving the growth of this market segment.

Restraint : Radiationexposure

Although fluoroscopic procedures ensure minimally invasive diagnosis, they come with the risk of radiation exposure. Fluoroscopic procedures can result in high radiation dose exposure for complex procedures, such as stent placement. These procedures are time-consuming, which greatly increases the radiation that patients are exposed to and the risk of hazards such as radiation-induced injuries to the skin and underlying tissues. The long-term side-effects of prolonged radiation exposure can also include cancer.

This has served to push users towards non-radiation modalities, particularly in the case of pediatric patients. For instance, the ACR (American College of Radiology) Appropriateness Criteria specify that for infants younger than two months, ultrasound should be considered before a fluoroscopic examination. Additionally, CT examinations can completely eliminate the need for a fluoroscopic examination, as a CT scan is noninvasive as opposed to the minimally invasive fluoroscopic imaging.

The growing prominence of other non-radiation imaging modalities, like ultrasound, is likely to restrain market growth.

Challenge: Increased adoption of refurbished diagnostic imaging systems

Many hospitals in developing countries are unable to invest in fluoroscopy equipment due to their high costs, poor reimbursement rates, and budget constraints, and therefore prefer refurbished systems. These systems are less expensive than new systemsapproximately 40% to 60% of the original price.

As a result, many market leaders are promoting refurbished devices. Siemens Medical Proven Excellence Program, GE Healthcares GoldSeal Program, and Philips Diamond Select Program are some noteworthy global refurbishing programs that promote the utilization of refurbished imaging systems. Increasing demand for refurbished devices poses a major challenge to the sales of new instrumentsand, subsequently, to the growth of market players and small manufacturers.

Opportunity: Growing demand for data - integrated imaging systems

Data-integrated imaging systems enable the processing and reconstruction of images, computer-assisted recognition of medical conditions, generation of 3D images, and the use of appropriate quality control systems. These systems come with a software package that helps store patient information. With the help of data integration, physicians can easily compare scans to effectively observe disease progression.To devise a treatment plan, clinicians are demanding access to integrated, comprehensive data on the patients diagnostic history. In addition to data integration, there lies a huge opportunity for making data available through mobile technologies. This will help doctors to view and study scans wherever they are. Due to their advantages, convenience, and huge demand from clinicians, data integrated systems offer a huge opportunity for market growth.

By product, the mobile C-arms segment is expected to grow at the highest CAGR during the forecast period.

On the basis of product, the fluoroscopy equipment market is segmented into fixed C-arms, fluoroscopy systems, and mobile C-arms. The mobile C-arms segment is projected to register the highest growth during the forecast period. The rising prevalence of cardiovascular diseases and the increasing number of orthopedic surgeries are some of the major factors driving the growth of the mobile C-arms market. C-arms are used for a wide range of applications, including surgeries for cardiovascular diseases, neurosurgeries, and surgeries for gastroenterology, orthopedics, traumatology, and urology disorders.

By application, cardiology accounted for the largest share of the diagnostic applications market in 2019

On the basis of diagnostic applications, the fluoroscopy equipment market is segmented into cardiology, gastroenterology, urology & nephrology, and other diagnostic applications. Cardiology is the largest diagnostic application segment of the fluoroscopy equipment market. The large share of this segment is attributed to the high burden of cardiovascular diseases (CVDs) worldwide and the convenience and better results offered by fluoroscopy systems during the diagnosis and treatment of various cardiac disorders.

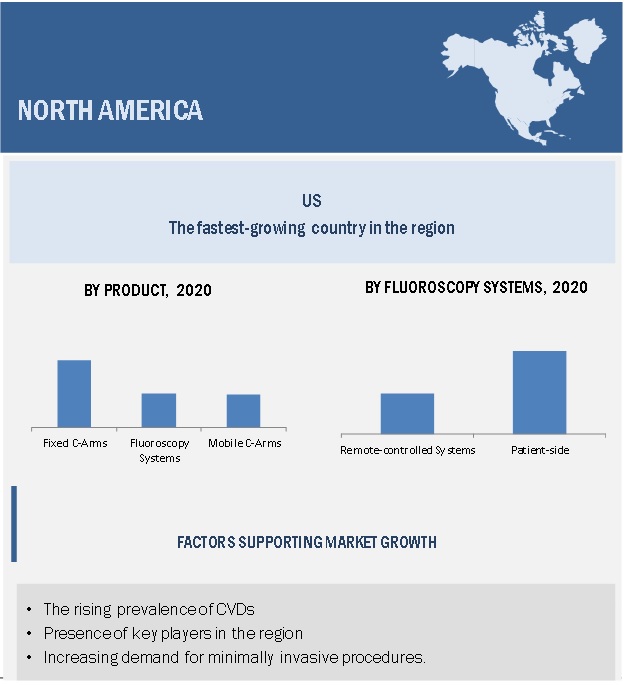

North America accounted for the largest share of the fluoroscopy equipment market in 2018, while the Asia Pacific market is expected to register the highest growth during the forecast period

In 2019, North America accounted for the largest share of the fluoroscopy equipment market. Factors such as the increasing incidence of overuse sports injuries, rising prevalence of CVD, and the increasing number of hip and knee replacement surgeries are driving the growth of the North American fluoroscopy equipment market. However, the Asia Pacific market is projected to register the highest CAGR during the forecast period primarily due to the growing geriatric population in Japan and China and the healthcare reforms and government initiatives & investments in several APAC countries.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the fluoroscopy equipment market are Siemens Healthineers (Germany), GE Healthcare (US), and Philips (Netherlands). These companies together accounted for a share of ~80% of the fluoroscopy equipment market in 2018. Other players in the market include Shimadzu Corporation (Japan), Ziehm Imaging GmbH (Germany), Toshiba Medical Systems Corporation (Japan), Hitachi Ltd. (Japan), Carestream Health, Inc. (US), Hologic, Inc. (US), Lepu Medical Technology Co., Ltd. (China), Agfa-Gevaert Group (Belgium), and ADANI Systems Inc. (Belarus) among others.

Scope of Market

|

Report Metric |

Details |

|

Market Size Available for Years |

20172025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

20202025 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Product, Applicationand Region |

|

Geographies Covered |

North America (US and Canada), Europe (Germany, France, UK, and the RoE), Asia Pacific (Japan, China, India, and RoAPAC), Latin America, and the Middle East & Africa |

|

Companies Covered |

Siemens Healthineers (Germany), GE Healthcare (US), Philips (Netherlands), Shimadzu Corporation (Japan), Ziehm Imaging (Germany), Canon Medical Systems (Japan), Hitachi (Japan), Carestream Health (US), Hologic (US), Lepu Medical Technology (China), Agfa-Gevaert Group (Belgium), ADANI Systems (Belarus), GENORAY (South Korea), Medtronic (US), OrthoScan (US), Allengers Medical Systems (India), STEPHANIX (France), MS Westfalia (Russia), ITALRAY (Italy), Eurocolumbus (Italy), Omega Medical Imaging (US), LISTEM Corporation (South Korea), Xcelsitas AG (Germany), General Medical Merate (Italy), and SternMed (Germany). |

This research report categorizes the fluoroscopy equipment market into the following segments:

Fluoroscopy equipment Market, by Product

- Fixed C-arms

- Fluoroscopy Systems

- Remote Controlled Systems

- Patient-Side Controlled Systems

- Mobile C-arms System Type

Fluoroscopy equipment Market, by Application

- Diagnostics

- Cardiology

- Gastroenterology

- Urology & Nephrology

- Other Diagnostic Applications

- Surgical Applications

- Orthopedic & Trauma Surgeries

- Neurosurgeries

- Cardiovascular Surgeries

- Gastrointestinal Surgerie

- Other Surgical Applications

Fluoroscopy equipment Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments:

- In 2019, Siemens Healthineers (Germany) launched the Artis icono biplane, an angiography system with special functions for neuroradiology.

- In 2019, Philips (Netherlands) launched the Zenition mobile C-arm platform.

Frequently Asked Questions (FAQ):

Which product segment will dominate the fluoroscopy equipment market in the future?

The fixed C-arms segment will dominate the fluoroscopy equipment market in the future

Emerging countries have immense opportunities for the growth and adoption of fluoroscopy equipment; will this scenario continue in the next five years?

Asia Pacific is expected to register the highest CAGR during the forecast period, owing to the rapid growth in the geriatric population in Japan and China, increasing focus on improving healthcare in India, and increasing public-private investments in the region.

Who are the leading players in the fluoroscopy equipment market?

Prominent players in the market are Siemens Healthineers (Germany), GE Healthcare (US), Philips (Netherlands), Shimadzu Corporation (Japan), Ziehm Imaging (Germany), Canon Medical Systems (Japan), Hitachi (Japan), Carestream Health (US), Hologic (US), Lepu Medical Technology (China), Agfa-Gevaert Group (Belgium), ADANI Systems (Belarus)

What are the major applications in the fluoroscopy equipment market?

Diagnostic applications, which are segmented into cardiology, gastroenterology, urology and nephrology, and other diagnostic applications (orthopedics, neurology, and gynecology).are the major applications of fluoroscopy equipment market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH METHODOLOGY STEPS

2.1.1 SECONDARY AND PRIMARY RESEARCH METHODOLOGY

2.1.1.1 Secondary research

2.1.2 SECONDARY SOURCES

2.1.2.1 Primary research

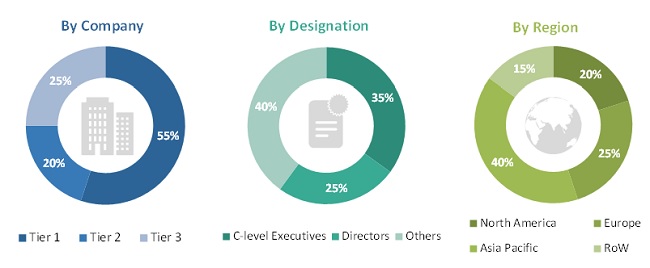

FIGURE 1 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.3 PRIMARY SOURCES

2.1.4 KEY INSIGHTS FROM PRIMARY SOURCES

2.1.5 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 2 FLUOROSCOPY EQUIPMENT MARKET: BOTTOM-UP APPROACH

FIGURE 3 FLUOROSCOPY EQUIPMENT MARKET: TOP-DOWN APPROACH

2.1.6 RESEARCH DESIGN

2.1.7 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.1.8 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 5 FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 6 FLUOROSCOPY EQUIPMENT MARKET IN DIAGNOSTIC APPLICATIONS, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 FLUOROSCOPY EQUIPMENT MARKET IN SURGICAL APPLICATIONS, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 FLUOROSCOPY MARKET EQUIPMENT, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 FLUOROSCOPY EQUIPMENT: MARKET OVERVIEW

FIGURE 9 INCREASING USE OF FLUOROSCOPY IN PAIN MANAGEMENT IS EXPECTED TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET, BY FLUOROSCOPY SYSTEMS, BY TYPE (2020)

FIGURE 10 REMOTE-CONTROLLED SYSTEMS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET

4.3 FLUOROSCOPY EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 11 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.1.1 MARKET DYNAMICS

FIGURE 12 FLUOROSCOPY EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.2 DRIVERS

5.1.2.1 Advantages of FPDs over image intensifiers

5.1.2.2 Use of fluoroscopy in pain management

5.1.2.3 Reimbursement cuts for analog radiography systems

5.1.2.4 Rising geriatric population and growing chronic disease prevalence

TABLE 1 INCREASE IN GERIATRIC POPULATION, BY REGION

5.1.2.5 Awareness programs, conferences, and funding activities

5.1.3 RESTRAINTS

5.1.3.1 Radiation exposure

5.1.4 OPPORTUNITIES

5.1.4.1 Growing demand for data-integrated imaging systems

5.1.5 CHALLENGES

5.1.5.1 Increased adoption of refurbished diagnostic imaging systems

5.1.6 COVID-19 IMPACT/EFFECT

6 FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT (Page No. - 51)

6.1 INTRODUCTION

TABLE 2 FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 3 FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

6.2 FIXED C-ARMS

6.2.1 TECHNOLOGICAL ADVANCEMENTS IN FIXED C-ARMS TO SUPPORT MARKET GROWTH

TABLE 4 PRODUCT HIGHLIGHTS

TABLE 5 FIXED C-ARMS MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 6 FIXED C-ARMS MARKET, BY REGION, 20202025 (USD MILLION)

6.3 FLUOROSCOPY SYSTEMS

6.3.1 INCREASING DEMAND FOR HIGH-END REMOTE-CONTROLLED FLUOROSCOPY SYSTEMS EXPECTED TO BOOST MARKET GROWTH

TABLE 7 FLUOROSCOPY SYSTEMS PRICING

TABLE 8 FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 9 FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 10 FLUOROSCOPY SYSTEMS MARKET, 20172019 (USD MILLION)

TABLE 11 FLUOROSCOPY SYSTEMS MARKET, BY REGION, 20202025 (USD MILLION)

6.3.2 REMOTE CONTROLLED SYSTEMS

TABLE 12 REMOTE-CONTROLLED SYSTEMS MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 13 REMOTE-CONTROLLED SYSTEMS MARKET, BY REGION, 20202025 (USD MILLION)

6.3.3 PATIENT-SIDE CONTROLLED SYSTEMS

TABLE 14 PATIENT-SIDE CONTROLLED SYSTEMS MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 15 PATIENT-SIDE CONTROLLED SYSTEMS MARKET, BY REGION, 20202025 (USD MILLION)

6.4 MOBILE C-ARMS

6.4.1 LOW PRICE AND MULTIFUNCTIONAL CAPABILITIES OF C-ARMS EXPECTED TO INCREASE THEIR ADOPTION IN HOSPITALS

TABLE 16 MOBILE C-ARMS PRODUCT HIGHLIGHTS

TABLE 17 MOBILE C-ARMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 18 MOBILE C-ARMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 19 MOBILE C-ARMS MARKET, BY TYPE, 20172019 (UNITS)

TABLE 20 MOBILE C-ARMS MARKET, BY TYPE, 20202025 (UNITS)

TABLE 21 MOBILE C-ARMS MARKET, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 22 MOBILE C-ARMS MARKET, BY TECHNOLOGY, 20202025 (USD MILLION)

TABLE 23 MOBILE C-ARMS MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 24 MOBILE C-ARMS MARKET, BY REGION, 20202025 (USD MILLION)

7 FLUOROSCOPY EQUIPMENT MARKET, BY APPLICATION (Page No. - 62)

7.1 INTRODUCTION

TABLE 25 FLUOROSCOPY EQUIPMENT MARKET, BY APPLICATION, 20172019 (USD MILLION)

TABLE 26 FLUOROSCOPY EQUIPMENT MARKET, BY APPLICATION, 20202025 (USD MILLION)

7.2 DIAGNOSTIC APPLICATIONS

TABLE 27 FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 28 FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

7.2.1 CARDIOLOGY

7.2.1.1 Increasing prevalence of cardiac conditions to drive the adoption of fluoroscopy equipment

TABLE 29 FLUOROSCOPY EQUIPMENT MARKET FOR CARDIOLOGY, BY REGION, 20172019 (USD MILLION)

TABLE 30 FLUOROSCOPY EQUIPMENT MARKET FOR CARDIOLOGY, BY REGION, 20202025 (USD MILLION)

7.2.2 GASTROENTEROLOGY

7.2.2.1 Rising prevalence of digestive diseases to support market growth

TABLE 31 FLUOROSCOPY EQUIPMENT MARKET FOR GASTROENTEROLOGY, BY REGION, 20172019 (USD MILLION)

TABLE 32 FLUOROSCOPY EQUIPMENT MARKET FOR GASTROENTEROLOGY, BY REGION, 20202025 (USD MILLION)

7.2.3 UROLOGY & NEPHROLOGY

7.2.3.1 High burden of kidney diseases across the globe to drive the demand for fluoroscopy equipment

TABLE 33 FLUOROSCOPY EQUIPMENT MARKET FOR UROLOGY & NEPHROLOGY, BY REGION, 20172019 (USD MILLION)

TABLE 34 FLUOROSCOPY EQUIPMENT MARKET FOR UROLOGY & NEPHROLOGY, BY REGION, 20202025 (USD MILLION)

7.2.4 OTHER DIAGNOSTIC APPLICATIONS

TABLE 35 FLUOROSCOPY EQUIPMENT MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY REGION, 20172019 (USD MILLION)

TABLE 36 FLUOROSCOPY EQUIPMENT MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY REGION, 20202025 (USD MILLION)

7.3 SURGICAL APPLICATIONS

TABLE 37 FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 38 FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

7.3.1 ORTHOPEDIC & TRAUMA SURGERIES

7.3.1.1 Rising geriatric population & rising obesity rates have driven the number of orthopedic surgeries performed

TABLE 39 FLUOROSCOPY EQUIPMENT MARKET FOR ORTHOPEDIC & TRAUMA SURGERIES, BY REGION, 20172019 (USD MILLION)

TABLE 40 FLUOROSCOPY EQUIPMENT MARKET FOR ORTHOPEDIC & TRAUMA SURGERIES, BY REGION, 20202025 (USD MILLION)

7.3.2 NEUROSURGERIES

7.3.2.1 Increasing number of neurosurgeries performed worldwide to drive the adoption of fluoroscopy equipment

TABLE 41 FLUOROSCOPY EQUIPMENT MARKET FOR NEUROSURGERIES, BY REGION, 20172019 (USD MILLION)

TABLE 42 FLUOROSCOPY EQUIPMENT MARKET FOR NEUROSURGERIES, BY REGION, 20202025 (USD MILLION)

7.3.3 CARDIOVASCULAR SURGERIES

7.3.3.1 Increasing prevalence of cardiovascular diseases to support market growth

TABLE 43 FLUOROSCOPY EQUIPMENT MARKET FOR CARDIOVASCULAR SURGERIES, BY REGION, 20172019 (USD MILLION)

TABLE 44 FLUOROSCOPY EQUIPMENT MARKET FOR CARDIOVASCULAR SURGERIES, BY REGION, 20202025 (USD MILLION)

7.3.4 GASTROINTESTINAL SURGERIES

7.3.4.1 Increasing prevalence of GI disorders to drive the demand for C-arms

TABLE 45 FLUOROSCOPY EQUIPMENT MARKET FOR GASTROINTESTINAL SURGERIES, BY REGION, 20172019 (USD MILLION)

TABLE 46 FLUOROSCOPY EQUIPMENT MARKET FOR GASTROINTESTINAL SURGERIES, BY REGION, 20202025 (USD MILLION)

7.3.5 OTHER SURGICAL APPLICATIONS

TABLE 47 FLUOROSCOPY EQUIPMENT MARKET FOR OTHER SURGICAL APPLICATIONS, BY REGION, 20172019 (USD MILLION)

TABLE 48 FLUOROSCOPY EQUIPMENT MARKET FOR OTHER SURGICAL APPLICATIONS, BY REGION, 20202025 (USD MILLION)

8 FLUOROSCOPY EQUIPMENT MARKET, BY REGION (Page No. - 76)

8.1 INTRODUCTION

FIGURE 13 NORTH AMERICA WILL CONTINUE TO DOMINATE THE FLUOROSCOPY EQUIPMENT MARKET IN 2025

TABLE 49 FLUOROSCOPY EQUIPMENT MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 50 FLUOROSCOPY EQUIPMENT MARKET, BY REGION, 20202025 (USD MILLION)

8.2 NORTH AMERICA

8.2.1 COVID-19 EFFECT/IMPACT

FIGURE 14 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET SNAPSHOT

TABLE 51 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20172019 (USD MILLION)

TABLE 52 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20202025 (USD MILLION)

TABLE 53 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 54 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 55 NORTH AMERICA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 56 NORTH AMERICA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 57 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 58 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

TABLE 59 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 60 NORTH AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.2.2 US

8.2.2.1 US dominated North American fluoroscopy equipment market in 2019

TABLE 61 US: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 62 US: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 63 US: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 64 US: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 65 US: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 66 US: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20202025 (USD MILLION)

TABLE 67 US: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 68 US: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20202025 (USD MILLION)

8.2.3 CANADA

8.2.3.1 Rise in number of grants awarded to research organizations driving market growth in Canada

TABLE 69 CANADA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 70 CANADA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20182025 (USD MILLION)

TABLE 71 CANADA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 72 CANADA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 73 CANADA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 74 CANADA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20202025 (USD MILLION)

TABLE 75 CANADA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 76 CANADA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20202025 (USD MILLION)

8.3 EUROPE

8.3.1 COVID-19 EFFECT/IMPACT

TABLE 77 EUROPE: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20172019 (USD MILLION)

TABLE 78 EUROPE: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20202025 (USD MILLION)

TABLE 79 EUROPE: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 80 EUROPE: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 81 EUROPE: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 82 EUROPE: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 83 EUROPE: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 84 EUROPE: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20202025 (USD MILLION)

TABLE 85 EUROPE: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 86 EUROPE: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20202025 (USD MILLION)

8.3.2 GERMANY

8.3.2.1 Growth in the geriatric population is a major factor driving market growth in Germany

TABLE 87 GERMANY: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 88 GERMANY: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 89 GERMANY: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 90 GERMANY: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 91 GERMANY: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 92 GERMANY: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20202025 (USD MILLION)

TABLE 93 GERMANY: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 94 GERMANY: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20202025 (USD MILLION)

8.3.3 UK

8.3.3.1 Large number of diagnostic imaging centers and increasing number of diagnostic imaging procedures to drive demand

TABLE 95 UK: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 96 UK: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20182025 (USD MILLION)

TABLE 97 UK: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 98 UK: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 99 UK: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 100 UK: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20202025 (USD MILLION)

TABLE 101 UK: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 102 UK: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20202025 (USD MILLION)

8.3.4 FRANCE

8.3.4.1 Growing medical tourism industry in France to support market growth

TABLE 103 FRANCE: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 104 FRANCE: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 105 FRANCE: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 106 FRANCE: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 107 FRANCE: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 108 FRANCE: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20202025 (USD MILLION)

TABLE 109 FRANCE: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 110 FRANCE: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20202025 (USD MILLION)

8.3.5 ROE

TABLE 111 ROE: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 112 ROE: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 113 ROE: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 114 ROE: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 115 ROE: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 116 ROE: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATION, BY TYPE, 20202025 (USD MILLION)

TABLE 117 ROE: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20172019 (USD MILLION)

TABLE 118 ROE: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATION, BY TYPE, 20202025 (USD MILLION)

8.4 ASIA PACIFIC

TABLE 119 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20172019 (USD MILLION)

TABLE 120 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20202025 (USD MILLION)

TABLE 121 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 122 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 123 ASIA PACIFIC: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 124 ASIA PACIFIC: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 125 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 126 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

TABLE 127 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 128 ASIA PACIFIC: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.4.1 JAPAN

8.4.1.1 Japan dominates Asia Pacific fluoroscopy equipment market

TABLE 129 JAPAN: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 130 JAPAN: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20182025 (USD MILLION)

TABLE 131 JAPAN: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 132 JAPAN: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 133 JAPAN: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 134 JAPAN: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

TABLE 135 JAPAN: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 136 JAPAN: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.4.2 CHINA

8.4.2.1 China to register highest growth in Asia Pacific fluoroscopy equipment market

TABLE 137 CHINA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 138 CHINA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 139 CHINA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 140 CHINA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 141 CHINA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 142 CHINA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 143 CHINA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 144 CHINA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Large patient population to boost market growth

TABLE 145 INDIA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 146 INDIA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 147 INDIA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 148 INDIA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 149 INDIA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 150 INDIA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172017 (USD MILLION)

TABLE 151 INDIA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20192025 (USD MILLION)

TABLE 152 INDIA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.4.4 ROAPAC

TABLE 153 ROAPAC: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 154 ROAPAC: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 155 ROAPAC: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 156 ROAPAC: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 157 ROAPAC: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 158 ROAPAC: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 159 ROAPAC: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 160 ROAPAC: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.5 ROW

TABLE 161 ROW: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20172019 (USD MILLION)

TABLE 162 ROW: FLUOROSCOPY EQUIPMENT MARKET, BY COUNTRY, 20202025 (USD MILLION)

TABLE 163 ROW: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 164 ROW: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 165 ROW: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 166 ROW: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 167 ROW: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 168 ROW: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

TABLE 169 ROW: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 170 ROW: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.5.1 LATIN AMERICA

8.5.1.1 Lack of adequate healthcare infrastructure to hamper market growth in the region

8.5.1.2 COVID-19 EFFECT/IMPACT

TABLE 171 LATIN AMERICA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 172 LATIN AMERICA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 173 LATIN AMERICA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 174 LATIN AMERICA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 175 LATIN AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 176 LATIN AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 177 LATIN AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 178 LATIN AMERICA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.5.2 MIDDLE EAST & AFRICA

8.5.2.1 COVID-19 EFFECT/IMPACT

TABLE 179 MIDDLE EAST & AFRICA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

8.5.2.2 Israel

8.5.2.2.1 Growth in geriatric population to support growth of fluoroscopy equipment market

TABLE 187 ISRAEL: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20172019 (USD MILLION)

TABLE 188 ISRAEL: FLUOROSCOPY EQUIPMENT MARKET, BY PRODUCT, 20202025 (USD MILLION)

TABLE 189 ISRAEL: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20172019 (USD MILLION)

TABLE 190 ISRAEL: FLUOROSCOPY SYSTEMS MARKET, BY TYPE, 20202025 (USD MILLION)

TABLE 191 ISRAEL: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 192 ISRAEL: FLUOROSCOPY EQUIPMENT MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 193 ISRAEL: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20172019 (USD MILLION)

TABLE 194 ISRAEL: FLUOROSCOPY EQUIPMENT MARKET FOR SURGICAL APPLICATIONS, BY TYPE, 20202025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 133)

9.1 OVERVIEW

FIGURE 15 KEY DEVELOPMENTS IN THE FLUOROSCOPY EQUIPMENT MARKET, 2016 OCTOBER 2020

9.2 MARKET SHARE ANALYSIS

9.2.1 INTRODUCTION

FIGURE 16 MARKET SHARE ANALYSIS, BY KEY PLAYERS (2019)

10 COMPANY EVALUATION MATRIX (Page No. - 136)

10.1 INTRODUCTION

10.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 195 COMPANY EVALUATION MATRIX: CRITERIA

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 PARTICIPANTS

FIGURE 17 FLUOROSCOPY EQUIPMENT MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

10.3 COMPETITIVE LEADERSHIP MAPPING (EMERGING PLAYERS)

10.3.1 PROGRESSIVE COMPANIES

10.3.2 EMERGING BLOCKS

10.3.3 RESPONSIVE COMPANIES

10.3.4 DYNAMIC COMPANIES

FIGURE 18 COMPETITIVE LEADERSHIP MAPPING (EMERGING COMPANIES)

10.4 COMPETITIVE SCENARIO

10.4.1 PRODUCT LAUNCHES

TABLE 196 PRODUCT LAUNCHES (2016OCTOBER 2020)

10.4.2 ACQUISITIONS

TABLE 197 ACQUISITIONS (2016OCTOBER 2020)

10.4.3 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 198 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS (2016OCTOBER 2020)

10.4.4 EXPANSIONS

TABLE 199 EXPANSIONS (2016OCTOBER 2020)

11 COMPANY PROFILES (Page No. - 144)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 SIEMENS HEALTHINEERS

FIGURE 19 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2019)

11.2 GE HEALTHCARE (A SUBSIDIARY OF GENERAL ELECTRIC COMPANY)

FIGURE 20 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

11.3 PHILIPS

FIGURE 21 KONINKLIJKE PHILIPS: COMPANY SNAPSHOT (2019)

11.4 SHIMADZU

FIGURE 22 SHIMADZU: COMPANY SNAPSHOT (2019)

11.5 ZIEHM IMAGING GMBH

11.6 CANON MEDICAL SYSTEMS

FIGURE 23 CANON: COMPANY SNAPSHOT (2019)

11.7 HITACHI, LTD.

FIGURE 24 HITACHI, LTD.: COMPANY SNAPSHOT (2019)

11.8 CARESTREAM HEALTH, INC. (A SUBSIDIARY OF ONEX CORPORATION)

FIGURE 25 ONEX CORPORATION: COMPANY SNAPSHOT (2018)

11.9 HOLOGIC, INC.

FIGURE 26 HOLOGIC, INC.: COMPANY SNAPSHOT (2019)

11.10 ADANI SYSTEMS, INC.

11.11 GENORAY CO.

11.12 ORTHOSCAN, INC.

11.13 OMEGA MEDICAL IMAGING, LLC.

11.14 ITALRAY

11.15 MS WESTFALIA GMBH

11.16 MEDTRONIC

11.17 AGFA-GEVAERT N.V.

11.18 LEPU MEDICAL TECHNOLOGY CO., LTD.

11.19 STERNMED GMBH

11.20 ALLENGERS

11.21 LISTEM

11.22 IDETEC MEDICAL IMAGING

11.23 TRIVITRON HEALTHCARE

11.24 MEDIRAY HEALTHCARE

11.25 BMI BIOMEDICAL INTERNATIONAL S.R.L.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 181)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for fluoroscopy equipment. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The fluoroscopy equipment market comprises several stakeholders such as fluoroscopy and C-arms manufacturers and distributors, healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies), medical device vendors/service providers, research institutes, niche companies manufacturing fluoroscopic imaging systems, and research and consulting firms. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Mentioned below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fluoroscopy equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and to arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the fluoroscopy industry.

Report Objectives

- To define, describe, and measure the fluoroscopy equipment market by product, application, and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, growth opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the fluoroscopy equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in North America, Europe, Asia Pacific (APAC), and the Rest of the world (RoW)

- To strategically analyze the market structure and profile key players and their core competencies3 in the fluoroscopy equipment market

- To track and analyze competitive developments such as product launches, expansions, acquisitions, and partnerships & collaborations in the fluoroscopy equipment market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the present fluoroscopy equipment market report:

Product Analysis

- Product matrix which gives a detailed comparison of the software portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fluoroscopy Equipment Market