Surgical Snare Market by Usability (Singel Use, Reusable), Application (GI Endoscopy, Laparoscopy, Urology Endoscopy, Gynecology Endoscopy, Arthroscopy, Bronchoscopy, Mediastinoscopy, Laryngoscopy), End User (Hospital, ASC) & Region - Global Forecasts to 2023

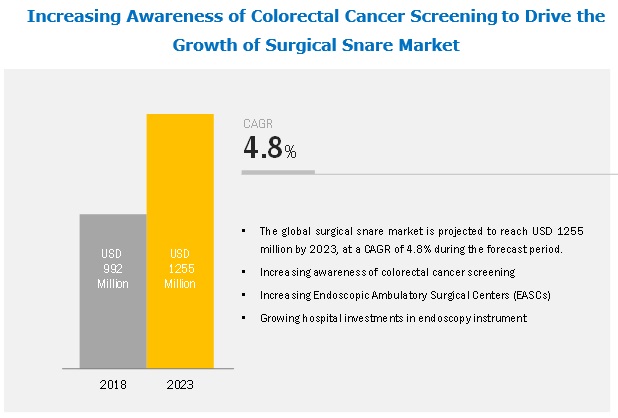

The surgical snare Market is projected to USD 1,255 million by 2023, at a CAGR of 4.8%. The study involved 4 major activities in estimating the current market size for surgical snares. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet have been referred to, so as to identify and collect information useful for a technical, market-oriented, and commercial study of the surgical snares market. These secondary sources included annual reports, press releases & investor presentations of companies, Bio-Process Systems Alliance (BPSA), BioProcess International, National Center for Biotechnology Information (NCBI), International Society for Pharmaceutical Engineering (ISPE), World Intellectual Property Organization (WIPO), and Life Science Leader Journal. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation, according to the industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

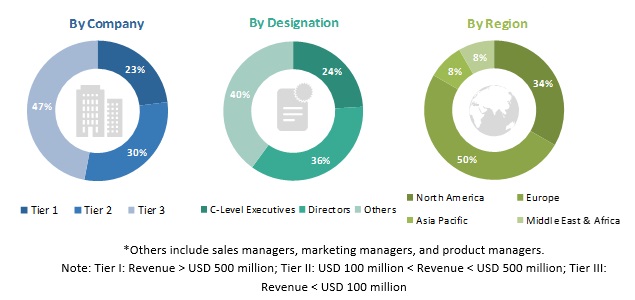

The surgical snare market comprises several stakeholders such as raw material suppliers, manufacturers of surgical snare, and regulatory organizations in the supply chain. The demand side of this market is characterized by consumers of surgical snares. The supply side is characterized by surgical snare manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the surgical industry and surgeons of leading hospitals. The primary sources from the supply side include research institutions involved in R&D for the introduction and development of surgical snares, key opinion leaders, distributors, and surgical snare manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the surgical snares market. These approaches were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players have been identified through extensive secondary research

- The surgical snares industry’s value chain and market size, in terms of value have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the surgical snares industry.

Report Objectives

- To define, segment, and project the global market size for surgical snares

- To understand the structure of the surgical snares market by identifying its various sub-segments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To project the size of the market and its sub-markets, in terms of value and volume, with respect to 4 regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, and acquisitions in the surgical snares market

Surgical Snare Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Values (USD Million) |

|

Segments covered |

Usability, Application, End User and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Olympus Corporation (Japan), Boston Scientific Corporation (US) Cook Medical (US) 11 major players covered, in total |

This research report categorizes the surgical snare market based on usability, application, end user and region.

On the basis of usability, the surgical snare market is segmented as follows:

- Reusable

- Single -use

On the basis of application, the surgical snare market is segmented as follows:

- GI Endoscopy

- Laparoscopy

- Gynecology/Obstetrics Endoscopy

- Arthroscopy

- Urology Endoscopy

- Bronchoscopy

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

- Retinal Endoscopy

- Neuroendoscopy

- Other Applications (endoscopic tonsillectomy, retinal endoscopy, rhinoscopy, neuroendoscopy, and thoracoscopy.)

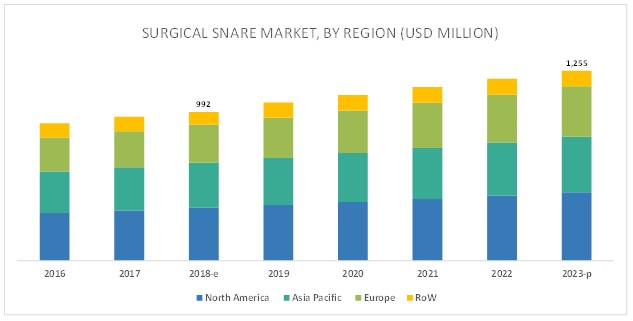

On the basis of region, the surgical snare market is segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of Asia Pacific surgical snares market, by key country

- Further breakdown of the Rest of Europe surgical snares market, by key country

The major driving factors in the surgical snare market are increasing number for colon polypectomy procedures, growth of the endoscopic ambulatory surgical centers, and a rising preference for minimally invasive surgeries are the key factors.

By Usability, the single use surgical snare segment is expected to be the faster-growing in the surgical snare market during the forecast period.

Reusable surgical snares are conventional instruments that are used for polyp and tumor removal in endoscopy procedures. These instruments are more cost-effective as compared to disposable instruments and help reduce the cost of endoscopy procedures. Also, these instruments are easily detachable and can be sterilized.

By application, the GI Endoscopy segment is growing at the fastest rate during the forecast period.

The GI Endoscopy segment, is projected to be the fastest-growing application market. GI endoscopy helps in the diagnosis as well as treatment of gastrointestinal (GI) diseases. This procedure enables the examination of the inside lining of the digestive tract. The other parts examined in GI endoscopy are the entire lower GI tract (colon or large bowel/intestine), also known as colonoscopy, and the lowest portion of the colon (sigmoid colon and rectum) or sigmoidoscopy. Colonoscopy is a widely used endoscopic procedure in the US and is considered the gold standard for colorectal cancer screening; approximately 15 million colonoscopies are performed per year, leads to the market growth.

North America is expected to account for the largest market share during the forecast period.

The surgical snare market is divided into four major regions North America, Europe, Asia Pacific, and the Rest of the World (RoW). In 2018, North America is expected to account for the largest share of this market, followed by Europe. This is mainly attributed to the increasing prevalence of colon cancer and rising awareness of screening, diagnosis, and treatment procedures. The high incidence of colorectal cancer (CRC) in the US has resulted in the provision of reimbursements to increase the affordability of CRC screening procedures in the country. This has increased the affordability of CRC screening procedures, which in turn is driving the number of endoscopic procedures using the snaring technique performed in the US.

The major surgical snares vendors include Olympus (Japan), Boston Scientific (US), Cook Medical (US), CONMED Corporation (US), Medline Industries (US), Medtronic (Ireland), Steris (US), Merit Medical Systems (US), and Avalign Technologies (US).

Olympus Corporation is the largest player operating in the surgical snare market. The company offers an extensive product portfolio of surgical snares through its Medical Business segment. Olympus operates across the globe and has a significant presence in North America, Europe, and Asia. Its wide geographical presence and innovation-centric approach provide the company with a competitive edge in the market.

Boston Scientific Corporation is the second-largest player in the surgical snare market. The company is considered to be a major player in the global medical devices market and has particular expertise in the sphere of surgical snares manufacturing. Boston operates in the US, Japan, and other key countries to enhance its presence in this market. It has also adopted the organic strategy of product launches to improve and maintain its position in the surgical snares market.

Recent Developments:

- In 2018, Cook Medical launched two new products, Cook Lead Extraction System and Cook Needle’s Eye Snare.

- In 2017, Merit Medical Systems acquired the critical care product portfolio of Argon Medical Devices and Catheter Connections, Inc. This helped Merits to broaden its product offerings and expand geographic presence in the surgical snare market.

Key questions addressed by the report:

- Who are the major market players in surgical snare market?

- What are the regional growth trends and the largest revenue-generating region for surgical snare market?

- What are the major drivers and challenges of the surgical snare market?

- What are the major applications of surgical snare?

- What are the major end user for surgical snare market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Covered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.3.1.1 Key Industry Insights

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Surgical Snare Market: Overview

4.2 North America: Market, By Country and End User (2018)

4.3 Global Market, By Usability

4.4 Geographical Snapshot of the Global Market

5 Market Overview (Page No. - 30)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Awareness on Colorectal Cancer Screening

5.1.1.2 Growth of the Endoscopic Ambulatory Surgery Centers Segment

5.1.1.3 Hospital Investments in Endoscopy Instruments

5.1.1.4 Rising Patient Preference for Minimally Invasive Surgeries

5.1.2 Restraints

5.1.2.1 Clinical Complications in Surgeries

5.1.3 Challenges

5.1.3.1 Dearth of Trained Physicians and Endoscopists

6 Surgical Snare Market, By Usability (Page No. - 34)

6.1 Introduction

6.2 Reusable Surgical Snares

6.2.1 Reusable Surgical Snares to Account for the Largest Market Share in 2018

6.3 Single-Use Surgical Snares

6.3.1 Single-Use Surgical Snares to Register the Highest Growth During the Forecast Period

7 Surgical Snare Market, By Application (Page No. - 39)

7.1 Introduction

7.2 Gastrointestinal (GI) Endoscopy

7.2.1 GI Endoscopy is Expected to Account for the Largest Share of the Surgical Snares Market

7.3 Laparoscopy

7.3.1 Laparoscopy is the Method of Choice for Gallbladder Removal

7.4 Gynecology/Obstetrics Endoscopy

7.4.1 Increasing New Cervical Cancer Cases Will Fuel the Growth of the Gynecology/Obstetrics Endoscopy Market

7.5 Arthroscopy

7.5.1 Advancements in the Field of Hip Arthroscopy are Driving Growth in the Arthroscopy Application Segment

7.6 Urology Endoscopy (Cystoscopy)

7.6.1 Cystoscopy is the Primary Diagnostic Modality for the Diagnosis of Bladder Carcinoma

7.7 Bronchoscopy

7.7.1 Bronchoscopy Techniques are Extensively Used for the Detection and Staging of Lung Cancer

7.8 Mediastinoscopy

7.8.1 Increasing Number of New TB Cases Will Likely Drive the Mediastinoscopy Application Segment in the Coming Years

7.9 Otoscopy

7.9.1 Otoscopy Helps Reveal Signs of Acute Otitis Media, Bulging Eardrums, and Blisters

7.10 Laryngoscopy

7.10.1 Laryngoscopy is Used to Determine the Causes of Throat and Ear Pain

7.11 Retinal Endoscopy

7.11.1 Endoscopy-Assisted Vitrectomy Eliminates Delays in Treatment Times That Could Cause Additional Issues in Traumatized Eyes

7.12 Neuroendoscopy

7.12.1 Growing Prevalence of Neurological Disorders to Support the Growth of the Surgical Snares Market for Neuroendoscopy

7.13 Other Applications

8 Surgical Snare Market, By End User (Page No. - 58)

8.1 Introduction

8.2 Hospitals

8.2.1 Hospitals to Dominate the Surgical Snares End-User Market

8.3 Ambulatory Surgical Centers

8.3.1 ASCS Provide Outpatient Procedures That Do Not Require an Overnight Stay and Significantly Help Improve Quality

8.4 Other End Users

9 Surgical Snare Market, By Region (Page No. - 64)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US to Dominate the North American Surgical Snares Market in 2018

9.2.2 Canada

9.2.2.1 Incresing Incidence of Colon Cancer to Drive Market Growth in Canada

9.3 Europe

9.3.1 Europe to Account for the Second-Largest Share of the Surgical Snares Market in 2018

9.4 Asia Pacific

9.4.1 Asia Pacific Market to Grow at the Highest CAGR During the Forecast Period

9.5 Rest of the World

9.5.1 Increasing Investment in Healthcare Infrastructure Will Drive Market Growth in the RoW

10 Competitive Landscape (Page No. - 81)

10.1 Market Overview

10.2 Market Ranking Analysis, 2017

10.3 Competitive Situation and Trends

10.3.1 Product Launches

10.3.2 Acquisitions

10.3.3 Expansions

11 Company Profiles (Page No. - 84)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Olympus

11.2 Boston Scientific

11.3 Cook Medical

11.4 CONMED

11.5 Medline Industries

11.6 Medtronic

11.7 Steris

11.8 Merit Medical Systems

11.9 Hill-Rom Holdings

11.10 Sklar Surgical Instruments

11.11 Avalign Technologies

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 102)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (67 Tables)

Table 1 Surgical Snare Market, By Usability, 2016–2023 (USD Million)

Table 2 Reusable Surgical Snares Market, By Region, 2016–2023 (USD Million)

Table 3 Reusable Surgical Snares Market, By Region, 2016–2023 (Units)

Table 4 North America: Reusable Surgical Snares Market, By Country, 2016–2023 (USD Million)

Table 5 Single-Use Surgical Snares Market, By Region, 2016–2023 (USD Million)

Table 6 Single Use Surgical Snares Market, By Region, 2016–2023 (Units)

Table 7 North America: Single-Use Surgical Snares Market, By Country, 2016–2023 (USD Million)

Table 8 Surgical Snare Market, By Application, 2016–2023 (USD Million)

Table 9 Estimated New GI Cancer Cases and Deaths in the US, 2016

Table 10 Surgical Snares Market for GI Endoscopy, By Region, 2016–2023 (USD Million)

Table 11 North America: Surgical Snares Market for GI Endoscopy, By Country, 2016–2023 (USD Million)

Table 12 Surgical Snares Market for Laparoscopy, By Region, 2016–2023 (USD Million)

Table 13 North America: Surgical Snares Market for Laparoscopy, By Country, 2016–2023 (USD Million)

Table 14 Surgical Snares Market for Gynecology/Obstetrics Endoscopy, By Region, 2016–2023 (USD Million)

Table 15 North America: Surgical Snares Market for Gynecology/Obstetrics Endoscopy, By Country, 2016–2023 (USD Million)

Table 16 Surgical Snare Market for Arthroscopy, By Region, 2016–2023 (USD Million)

Table 17 North America: Surgical Snares Market for Arthroscopy, By Country, 2016–2023 (USD Million)

Table 18 Surgical Snares Market for Urology Endoscopy, By Region, 2016–2023 (USD Million)

Table 19 North America: Surgical Snares Market for Urology Endoscopy, By Country, 2016–2023 (USD Million)

Table 20 Surgical Snares Market for Bronchoscopy, By Region, 2016–2023 (USD Million)

Table 21 North America: Surgical Snares Market for Bronchoscopy, By Country, 2016–2023 (USD Million)

Table 22 Surgical Snares Market for Mediastinoscopy, By Region, 2016–2023 (USD Million)

Table 23 North America: Surgical Snares Market for Mediastinoscopy, By Country, 2016–2023 (USD Million)

Table 24 Surgical Snares Market for Otoscopy, By Region, 2016–2023 (USD Million)

Table 25 North America: Surgical Snares Market for Otoscopy, By Country, 2016–2023 (USD Million)

Table 26 Surgical Snare Market for Laryngoscopy, By Region, 2016–2023 (USD Million)

Table 27 North America: Surgical Snares Market for Laryngoscopy, By Country, 2016–2023 (USD Million)

Table 28 Surgical Snares Market for Retinal Endoscopy, By Region, 2016–2023 (USD Million)

Table 29 North America: Surgical Snares Market for Retinal Endoscopy, By Country, 2016–2023 (USD Million)

Table 30 Surgical Snares Market for Neuroendoscopy, By Region, 2016–2023 (USD Million)

Table 31 North America: Surgical Snares Market for Neuroendoscopy, By Country, 2016–2023 (USD Million)

Table 32 Surgical Snares Market for Other Applications, By Region, 2016–2023 (USD Million)

Table 33 North America: Surgical Snares Market for Other Applications, By Country, 2016–2023 (USD Million)

Table 34 Surgical Snare Market, By End User, 2016–2023 (USD Million)

Table 35 Surgical Snares Market for Hospitals, By Region, 2016–2023 (USD Million)

Table 36 North America: Surgical Snares Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 37 Number of Medicare-Certified ASCS in the US (2000–2015)

Table 38 Surgical Snares Market for Ambulatory Surgical Centers, By Region, 2016–2023 (USD Million)

Table 39 North America: Surgical Snares Market for Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 40 Surgical Snare Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 41 North America: Surgical Snares Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 42 Surgical Snares Market, By Region, 2016–2023 (USD Million)

Table 43 North America: Surgical Snares Market, By Country, 2016–2023 (USD Million)

Table 44 North America: Surgical Snares Market, By Usability, 2016–2023 (USD Million)

Table 45 North America: Surgical Snares Market, By Application, 2016–2023 (USD Million)

Table 46 North America: Surgical Snares Market, By End User, 2016–2023 (USD Million)

Table 47 Medicare National Average Coverage for Endoscopic Procedures Using the Snare Technique, 2018

Table 48 US: Surgical Snare Market, By Usability, 2016–2023 (USD Million)

Table 49 US: Surgical Snares Market, By Application, 2016–2023 (USD Million)

Table 50 US: Surgical Snares Market, By End User, 2016–2023 (USD Million)

Table 51 Canada: Surgical Snares Market, By Usability, 2016–2023 (USD Million)

Table 52 Canada: Surgical Snares Market, By Application, 2016–2023 (USD Million)

Table 53 Canada: Surgical Snares Market, By End User, 2016–2023 (USD Million)

Table 54 Europe: Surgical Snares Market, By Country, 2016–2023 (USD Million)

Table 55 Europe: Surgical Snares Market, By Usability, 2016–2023 (USD Million)

Table 56 Europe: Surgical Snares Market, By Application, 2016–2023 (USD Million)

Table 57 Europe: Surgical Snares Market, By End User, 2016–2023 (USD Million)

Table 58 Asia Pacific: Surgical Snare Market, By Usability, 2016–2023 (USD Million)

Table 59 Asia Pacific: Surgical Snares Market, By Application, 2016–2023 (USD Million)

Table 60 Asia Pacific: Surgical Snares Market, By End User, 2016–2023 (USD Million)

Table 61 RoW: Surgical Snares Market, By Usability, 2016–2023 (USD Million)

Table 62 RoW: Surgical Snares Market, By Application, 2016–2023 (USD Million)

Table 63 RoW: Surgical Snares Market, By End User, 2016–2023 (USD Million)

Table 64 Surgical Snares Market Ranking, By Key Player (2017)

Table 65 Product Launches, 2015 to 2018

Table 66 Acquisitions, 2015-2018

Table 67 Expansions, 2015 to 2018

List of Figures (22 Figures)

Figure 1 Research Design

Figure 2 Primary Sources

Figure 3 Top-Down Approach

Figure 4 Bottom-Up Approach

Figure 5 Data Triangulation Methodology

Figure 6 Surgical Snare Market, By Usability, 2018 vs 2023 (USD Million)

Figure 7 Surgical Snares Market, By Application, 2018 vs 2023 (USD Million)

Figure 8 Surgical Snares Market, By End User, 2018 vs 2023 (USD Million)

Figure 9 Geographical Snapshot of the Surgical Snares Market

Figure 10 Growing Awareness on the Need for Colorectal Cancer Screening to Drive the Growth of the Market

Figure 11 Single-Use Surgical Snares Will Continue to Dominate the Market in 2023

Figure 12 UK to Be the Fastest-Growing Market Segment From 2018 to 2023

Figure 13 Surgical Snare Market: Drivers, Restraints, and Challenges

Figure 14 North America: Surgical Snares Market Snapshot

Figure 15 Asia Pacific: Surgical Snares Market Snapshot

Figure 16 Olympus: Company Snapshot

Figure 17 Boston Scientific : Company Snapshot (2017)

Figure 18 CONMED: Company Snapshot (2017)

Figure 19 Medtronic: Company Snapshot (2017)

Figure 20 Steris: Company Snapshot (2018)

Figure 21 Merit Medical Systems: Company Snapshot (2017)

Figure 22 Hill-Rom Holdings: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Snare Market