Synthetic Rubber Market by Type (SBR, BR, SBC, EPDM, IIR, NBR) Application (Tire, Automotive (Non-tire), Footwear, Industrial Goods, Consumer Goods, Textiles), and Region (North America, Europe, APAC, South America, MEA) - Global Forecast to 2027

Global Synthetic Rubber Market

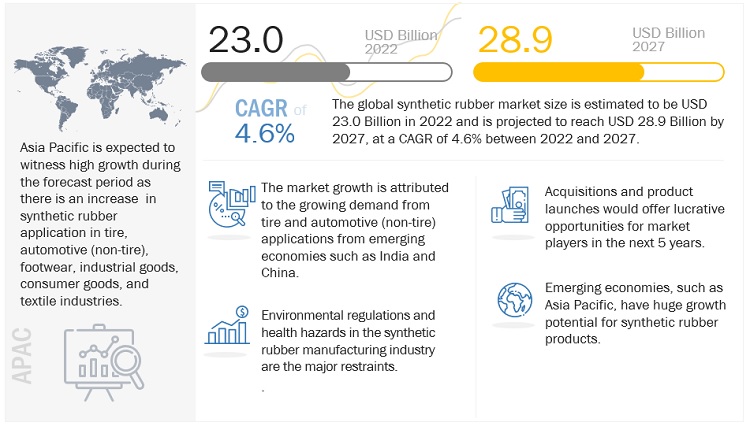

The global synthetic rubber market size was valued at USD 23.0 billion in 2022 and is projected to reach USD 28.9 billion by 2027, growing at a cagr 4.6% from 2022 to 2027. The market is driven by the tire segment, which is the largest end-use segment of synthetic rubber during the forecast period, followed by automotive (non-tire) in terms of volume. The applications of synthetic rubber in the automotive industry will increase as the EV market gains traction. APAC is dominating region for tire and automotive (non-tire) sector in the countries like China, Japan, India, South Korea, Indonesia, Thailand, and Malaysia.

Attractive Opportunities in the Synthetic Rubber Market

To know about the assumptions considered for the study, Request for Free Sample Report

Synthetic Rubber Market Dynamics

Driver: Growing penetration of EVs

Since 2019, decreased sales, shifting consumer preferences toward EVs, changing regulatory frameworks, a trend toward car rentals and ridesharing, declining per-capita spending, and economic depression in various nations have all had an impact on conventional automobile production. The demand for automobiles decreased in 2020 as a result of the COVID-19 pandemic and the subsequent suspension of manufacturing operations. In comparison to 2020, global sales of all vehicle categories increased by 4.72% in 2021.

The National Investment Promotion and Facilitation Agency of India claims that the manufacturing of electric vehicles will surpass 3 million units for the first time in 2020. In the near future, more electric vehicles are anticipated to be in demand. By 2027, the global automobile industry is anticipated to generate USD 300 billion. Synthetic rubber is used in electric vehicles due to its high-performance characteristics compared to traditional metals and other materials. The government's backing of EVS policies and the shifting regulatory scenario both contribute to the synthetic rubber market's expansion. Because of incentives provided through green recovery funds, EV sales in Europe increased by 137% during the COVID-19. In terms of sales, Europe has surpassed China and is expected to increase significantly over the next few years.

More than 50% of the world's automobiles are produced in the Asia-Pacific region. In terms of production, South Asian nations, China, India, and Japan are largely involved. The automotive industry's technological advancements and innovations will further expand the market for synthetic rubber in these countries. By 2022, it is expected that the Asian automobile market will recover with steady improvement in the Chinese automotive industry.

Thus, with the recovery of the automotive industry and increasing penetration of EVs worldwide, the demand for synthetic rubber is expected to increase during the forecast period.

Restraints: Environmental regulation and health hazards in synthetic rubber manufacturing industry

The production of synthetic rubber has been limited as a result of the rigorous environmental regulations. The production of sealants, tire manufacturing facilities, and rubber processing are three primary sources of hazardous air pollutants (HAP) emissions, according to the Environmental Protection Agency (EPA). For instance, the manufacture of butadiene rubber (BR), a type of synthetic rubber, results in the release of dangerous compounds like carbon dioxide, carbon monoxide, and other harmful fumes and gases. There are a number of regulations for the synthetic rubber industry; for instance, butadiene was listed as a toxic substance under the Canadian Environmental Protection Act, 1999 (CEPA 1999). Such regulations have restricted the growth of the global synthetic rubber market.

Butadiene, styrene, acrylonitrile, and polymerization catalysts such as hydrogen peroxide, sodium perborate, and organic peroxides are among the chemicals used in the production of synthetic rubber. For humans, excessive exposure can be fatal. During production, exposure to SBR has caused the death of workers due to leukemia. Additionally, butadiene rubber (BR) exposure has detrimental effects on health. When inhaled, it is regarded as a special health hazard chemical. It is considered to be cancer-causing when it comes into contact with the skin and can irritate the nose, throat, and lungs. Overexposure to polybutadiene has a negative impact on the central nervous system and can cause symptoms like dizziness, vertigo, fatigue, and fainting. These problems collectively prevent the synthetic rubber market from expanding.

Opportunity: Growing demand for high-performance and eco-friendly tires

European and North American countries are adopting stringent regulations, such as Euro VI and CAFE, which make tire manufacturers focus on developing green and high-performance tires. The demand for eco-friendly products like green tires has increased as a result of growing concern over the deteriorating environmental conditions.

According to the 2012 European Tire labelling Regulation, the labelling of tyres must include information about their fuel efficiency, wet grip, and external rolling resistance. This rule has helped in raising consumer awareness of the benefits of using eco-friendly high-performance tyres. OEMs launched fuel-efficient tyres with low rolling resistance as a result, concentrating on tyre performance and fuel economy. Tier 1 manufacturers are using eco-friendly rubber material. For instance, LANXESS provides neodymium rubber that helps in the reduction of rolling resistance, thereby increasing the fuel economy. The company also provides products that are used in green tire manufacturing. Thus, the demand for high-performance and eco-friendly tires provides opportunities for the market players.

Challenges: Volatile raw material prices

One of the main issues that the companies in the synthetic rubber market must deal with is the volatile price of raw materials. Because of the intense competition on the synthetic rubber market, prices might shift significantly depending on how the supply and demand are balanced. The cost structure of synthetic rubber products is mostly determined by the price and availability of raw ingredients. Since crude oil is used as the feedstock for the production of synthetic rubber, any increase in the price of crude oil raises the cost of production and lowers the profit margins for synthetic rubber producers. For many end users in the worldwide synthetic rubber market, cost is a key deciding factor.

High manufacturing costs driven by rising energy prices and high transport costs also have an impact on the synthetic rubber sector. Given that some end-use segments are price sensitive, synthetic rubber manufacturers have responded by passing on such rising prices to consumers, which reduces demand for synthetic rubber.

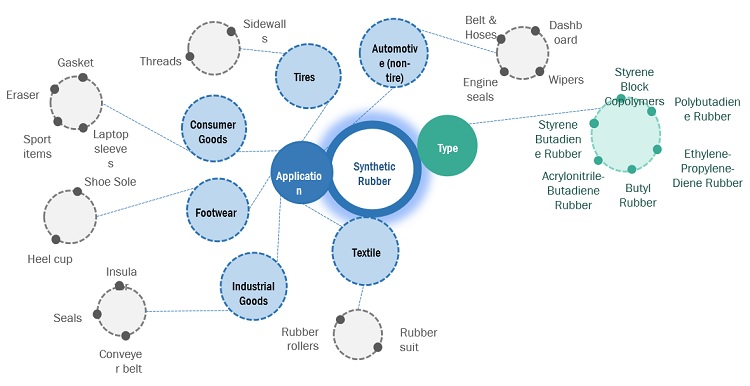

Synthetic Rubber Market Ecosystem Diagram

Automotive (non-tire): the second largest end use application of synthetic rubber market

The automotive industry is the second-largest application of synthetic rubber. They are used in hoses for air-conditioning, engine seals, dashboards, exterior filler panels, wipers, body seals, door & window handles, vibration-damping pads, and vehicle mats. The synthetic rubbers with significant strength are replacing metal parts in vehicles. This reduces the weight of the vehicle and helps in increasing its fuel efficiency without compromising the performance. The trend of reducing greenhouse gas emissions in vehicles has increased the demand for synthetic rubbers in the automotive industry. Synthetic rubbers are also used in various applications such as mastic adhesives, spot sealers, and adhesives used in brakes. The synthetic rubber-based coatings and adhesives have high resistance to moisture, acids, abrasion, corrosion, and slipping. They also provide a controlled grip and remain flexible over a long period without cracking.

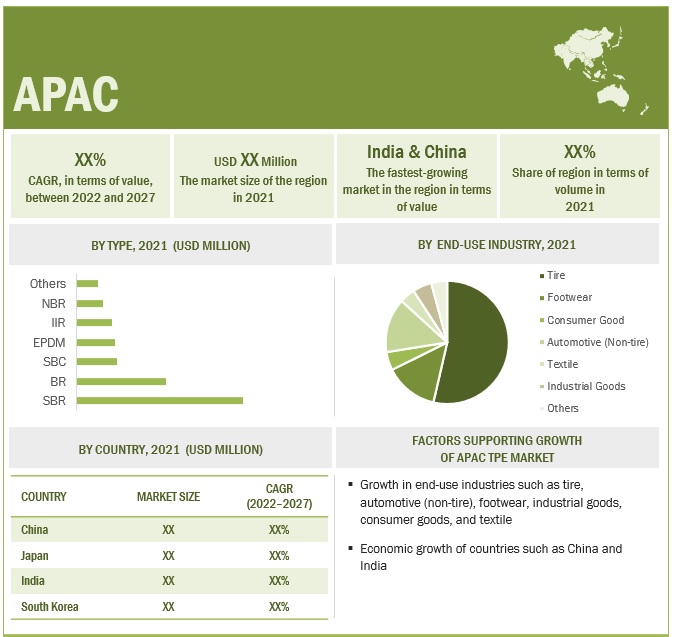

APAC is estimated to be the fastest-growing synthetic rubber market.

In terms of volume and value, APAC dominated the synthetic rubber market in 2021, followed by Europe and North America. The APAC region is anticipated to experience the highest rise in synthetic rubber use throughout the forecast period. The recovery of the automobile (non-tire) and tyre industries in China and Southeast Asian nations is driving this industry. As the EV industry develops pace, international automobile manufacturers are investing in APAC nations to set up their manufacturing facilities in order to strengthen their market presence in the area. China is the world's biggest consumer of synthetic rubber and an important market for automobiles. In China, the automotive industry will be driven by the development of New Energy Vehicles (NEVS) in an effort to minimise carbon emissions, which will boost demand for synthetic rubber throughout the forecast period

To know about the assumptions considered for the study, download the pdf brochure

Synthetic Rubber Market Players

The leading players in the synthetic rubber market are Sinopec (China), DuPont (U.S), The Dow Chemical Company (U.S), ExxonMobil (U.S), Kumho Petrochemical Company Ltd (South Korea), Zeon Corporation (Japan), Nizhnekamskneftekhim (Russia), The Goodyear Tire and Rubber Company (U.S), Mitsui Chemical Inc. (Japan), JSR Corporation (Japan), SABIC (Saudi Arabia), Denka Company Ltd. (Japan), and Asahi Kasei Corporation (Japan).

Synthetic Rubber Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 23.0 Billion |

|

Revenue Forecast in 2027 |

USD 28.9 Billion |

|

CAGR |

4.6% |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million/USD Billion), Volume (Kilotons) |

|

Segments |

Type, Application, and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The major players are Company Sinopec (China), DuPont (U.S), The Dow Chemical Company (U.S), ExxonMobil (U.S), Kumho Petrochemical Company Ltd (South Korea), Trinseo (U.S), Zeon Corporation (Japan), Nizhnekamskneftekhim (Russia), The Goodyear Tire and Rubber Company (U.S), Mitsui Chemical Inc. (Japan), JSR Corporation (Japan), SABIC (Saudi Arabia), Denka Company Ltd. (Japan), and Others. |

This research report categorizes the synthetic rubber market on the basis of type, application, and region.

On the basis of Type:

- Styrene butadiene rubber (SBR)

- Polybutadiene Rubber (BR)

- Styrene block copolymer (SBC)

- Ethylene-propylene-diene rubber (EPDM)

- Butyl rubber (IIR)

- Acrylonitrile-butadiene rubber (NBR)

On the basis of Application:

- Tire

- Automotive (Non-tire)

- Footwear

- Industrial Goods

- Consumer Goods

- Textiles

- Others

On the basis of Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In December 2021, The Dow Chemical Company expanded its fluorosilicone rubber capabilities in Midland, Michigan, by installing a new gum mixer, and a new liquid silicone rubber mixer was added in Zhangjiagang, China. It also invested in a pair of new mixers for thermally conductive technologies at its facility in Songjiang, China.

- In November 2021, DuPont has acquired Rogers Corporation. The company entered into a definitive agreement to acquire Rogers Corporation with the deal size of USD 5.2 billion.

- December 2021, Asahi Kasei Corporation has entered into a Joint Venture with Shell Eastern Petroleum (Pte) Ltd. The company collaborated with Shell to manufacture Solution-Polymerized Styrene-Butadiene Rubber (S-SBR). The company concluded its agreement regarding the supply of butadiene derived from plastic waste and biomass.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the synthetic rubber market?

The major driver influencing the growth of synthetic rubber is the recovery of automotive sector in APAC region. Tire and Automotive (non-tire) application account for the largest share in the synthetic rubber market.

How is the synthetic rubber market segmented by type?

The synthetic rubber market by type is segmented into styrene butadiene rubber (SBR), polybutadiene Rubber (BR), styrene block copolymer (SBC), ethylene-propylene-diene rubber (EPDM), butyl rubber (IIR), acrylonitrile-butadiene rubber (NBR).

How is the synthetic rubber market segmented by application?

The synthetic rubber market by application is segmented in tire, automotive (non-tire), footwear, consumer goods, industrial goods, and textile application.

What are the major challenges in synthetic rubber market?

The major challenge of synthetic rubber market is the volatility of raw material prices.

What are the major opportunities in synthetic rubber market?

Growth in electric vehicle and environmentally friendly technology for production of synthetic rubber are opportunities in synthetic rubber market.

Which region has the largest demand?

APAC has the largest demand for synthetic rubber owing to the influence of automotive industries present in China, India, South Korea, and other Southeast Asian countries.

Who are the major manufacturers of synthetic rubber?

The major manufacturers of synthetic rubber are Sinopec (China), DuPont (U.S), The Dow Chemical Company (U.S), ExxonMobil (U.S), Kumho Petrochemical Company Ltd (South Korea), Trinseo (U.S), Zeon Corporation (Japan), Nizhnekamskneftekhim (Russia), The Goodyear Tire and Rubber Company (U.S), SIBUR (Russia), Mitsui Chemical Inc. (Japan), JSR Corporation (Japan), SABIC (Saudi Arabia), Denka Company Ltd. (Japan), and Asahi Kasei Corporation (Japan). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

FIGURE 1 SYNTHETIC RUBBER MARKET SEGMENTATION

1.2.2 REGIONS COVERED

1.2.3 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

1.4 UNIT CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 SYNTHETIC RUBBER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 MARKET SIZE ESTIMATION (BOTTOM-UP APPROACH): ASSESSMENT OF OVERALL SYNTHETIC RUBBER MARKET SIZE BASED ON INDIVIDUAL PRODUCT MARKET SIZE

FIGURE 3 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION: BY TYPE

2.2.2 ESTIMATING SYNTHETIC RUBBER MARKET SIZE FROM MARKET SHARE OF KEY APPLICATIONS

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 6 SYNTHETIC RUBBER MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 7 SBR ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 8 TIRE SEGMENT DOMINATED SYNTHETIC RUBBER MARKET IN 2021

FIGURE 9 ASIA PACIFIC DOMINATED GLOBAL SYNTHETIC RUBBER MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 OVERVIEW OF SYNTHETIC RUBBER MARKET

FIGURE 10 GROWING DEMAND IN TIRE APPLICATION TO DRIVE MARKET

4.2 ASIA PACIFIC SYNTHETIC RUBBER MARKET, BY TYPE AND COUNTRY (2021)

FIGURE 11 SBR SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

4.3 GLOBAL SYNTHETIC RUBBER MARKET, BY KEY COUNTRIES

FIGURE 12 SAUDI ARABIA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SYNTHETIC RUBBER MARKET

5.2.1 DRIVERS

5.2.1.1 Growing penetration of electric vehicles

TABLE 1 TYPE OF RUBBER USED IN ELECTRIC VEHICLES AND INTERNAL COMBUSTION ENGINES

5.2.1.2 Stringent emission regulations and standards in developed economies

5.2.1.3 Increasing demand in Asia Pacific

5.2.2 RESTRAINTS

5.2.2.1 Health hazards associated with production of synthetic rubber

5.2.2.2 Economic slowdown and impact of COVID-19 on manufacturing sector

FIGURE 14 EUROPE: MANUFACTURING INDUSTRY OUTPUT INDEX

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for high-performance and eco-friendly tires

5.2.4 CHALLENGES

5.2.4.1 Volatile raw material prices

FIGURE 15 FLUCTUATIONS IN CRUDE OIL PRICES DURING 2010–2021

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 SYNTHETIC RUBBER MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 SYNTHETIC RUBBER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 ECOSYSTEM/MARKET MAPPING

5.5 TECHNOLOGY ANALYSIS

5.5.1 ZIEGLER-NATTA CATALYST

5.5.2 METALLOCENE CATALYST

5.5.3 ACE TECHNOLOGY

5.5.4 AMC TECHNOLOGY

5.5.5 BIO-BASED EPDM

5.6 REGULATORY LANDSCAPE

5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7 PRICING ANALYSIS

FIGURE 17 CRUDE OIL PRICES, 2010–2021 (USD/BARREL)

5.8 CASE STUDY

5.8.1 ETHYLENE PROPYLENE DIENE MONOMER RUBBER ROOFING MEMBRANE – IDEAL CHOICE FOR POOLING APPLICATION

5.8.2 ETHYLENE PROPYLENE DIENE MONOMER RUBBER ROOFING MEMBRANE – IDEAL CHOICE FOR GREEN ROOF APPLICATION

5.9 TRADE ANALYSIS

TABLE 6 SYNTHETIC RUBBER EXPORTS, BY COUNTRY, 2021 (USD MILLION)

TABLE 7 SYNTHETIC RUBBER IMPORTS, BY COUNTRY, 2021 (USD MILLION)

TABLE 8 SYNTHETIC RUBBER EXPORTS, BY COUNTRY, 2021 (TON)

TABLE 9 SYNTHETIC RUBBER IMPORTS, BY COUNTRY, 2021 (TON)

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 18 NEXT-GEN MOBILITY, LIGHTWEIGHTING, DIGITALIZATION, AND IMPROVED MEDICAL CARE TO CHANGE REVENUE MIX OF SUPPLIERS

TABLE 10 SYNTHETIC RUBBER MARKET: YC & YCC SHIFT

5.11 MACROECONOMIC INDICATORS

5.11.1 AUTOMOTIVE INDUSTRY

TABLE 11 PRODUCTION OF PASSENGER CARS, COMMERCIAL VEHICLES, TRUCKS, AND BUSES, 2019–2021

TABLE 12 WORLD GDP GROWTH PROJECTION (2021–2023)

5.12 SUPPLY CHAIN ANALYSIS

TABLE 13 SYNTHETIC RUBBER MARKET: SUPPLY CHAIN

FIGURE 19 SYNTHETIC RUBBER MARKET: SUPPLY CHAIN ANALYSIS

5.13 VALUE CHAIN ANALYSIS

5.13.1 INTRODUCTION

FIGURE 20 SYNTHETIC RUBBER MARKET: VALUE CHAIN ANALYSIS

5.14 KEY CONFERENCES & EVENTS IN 2022–2023

5.15 PATENT ANALYSIS

5.15.1 INTRODUCTION

5.15.2 METHODOLOGY

5.15.3 DOCUMENT TYPE

FIGURE 21 TOTAL NUMBER OF PATENTS

5.15.4 PUBLICATION TRENDS

FIGURE 22 NUMBER OF PATENTS YEAR-WISE IN LAST 10 YEARS

5.15.5 TOP PATENT APPLICANTS

FIGURE 23 TOP 10 PATENT APPLICANTS

5.15.6 JURISDICTION ANALYSIS

FIGURE 24 SHARE OF PATENTS, BY JURISDICTION

6 SYNTHETIC RUBBER MARKET, BY TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 25 SBR TO HOLD LARGEST MARKET SHARE BY 2027

TABLE 14 SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 15 SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

6.2 STYRENE BUTADIENE RUBBER (SBR)

6.2.1 GROWTH OF TIRE INDUSTRY TO DRIVE DEMAND

TABLE 16 STYRENE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 17 STYRENE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

6.3 POLYBUTADIENE RUBBER (BR)

6.3.1 INCREASING CONSUMPTION IN ASIA PACIFIC TO SUPPORT MARKET GROWTH

TABLE 18 POLYBUTADIENE RUBBER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 19 POLYBUTADIENE RUBBER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

6.4 STYRENIC BLOCK COPOLYMER (SBC)

6.4.1 GROWTH OF AUTOMOTIVE INDUSTRY TO BOOST MARKET

TABLE 20 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 21 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

6.5 ETHYLENE PROPYLENE DIENE MONOMER (EPDM)

6.5.1 ASIA PACIFIC AUTOMOTIVE INDUSTRY TO DRIVE MARKET

TABLE 22 ETHYLENE PROPYLENE DINE MONOMER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 23 ETHYLENE PROPYLENE DINE MONOMER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

6.6 BUTYL RUBBER (IIR)

6.6.1 FAVORABLE PROPERTIES TO PROPEL MARKET IN AUTOMOTIVE INDUSTRY

FIGURE 26 DEMAND FOR IIR (2020)

TABLE 24 BUTYL RUBBER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 25 BUTYL RUBBER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

6.7 ACRYLONITRILE BUTADIENE RUBBER (NBR)

6.7.1 MARKET IN ASIA PACIFIC TO REGISTER STEADY GROWTH

TABLE 26 ACRYLONITRILE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 27 ACRYLONITRILE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

6.8 OTHERS

TABLE 28 OTHERS: SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 29 OTHERS: SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

7 SYNTHETIC RUBBER MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

FIGURE 27 TIRE SEGMENT TO BE LARGEST APPLICATION OF SYNTHETIC RUBBER

TABLE 30 SYNTHETIC RUBBER MARKET, BY APPLICATION

TABLE 31 SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 32 SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 TIRE

7.2.1 RECOVERY OF AUTOMOTIVE INDUSTRY FROM IMPACT OF COVID-19 TO PROPEL MARKET

FIGURE 28 GLOBAL TIRE MARKET SHARE, BY KEY COMPANIES, 2020

7.2.2 IMPACT OF DISRUPTIVE TECHNOLOGIES ON TIRES AND TUBES

FIGURE 29 EV TIRES: INCREASE IN DEMAND FOR PERFORMANCE

TABLE 33 SYNTHETIC RUBBER MARKET SIZE IN TIRE SEGMENT, BY REGION, 2020–2027 (KILOTON)

TABLE 34 SYNTHETIC RUBBER MARKET SIZE IN TIRE SEGMENT, BY REGION, 2020–2027 (USD MILLION)

7.3 AUTOMOTIVE (NON-TIRE)

7.3.1 GROWING EV PRODUCTION TO DRIVE MARKET

TABLE 35 SYNTHETIC RUBBER MARKET SIZE IN AUTOMOTIVE (NON-TIRE) SEGMENT, BY REGION, 2020–2027 (KILOTON)

TABLE 36 SYNTHETIC RUBBER MARKET SIZE IN AUTOMOTIVE (NON-TIRE) SEGMENT, BY REGION, 2020–2027 (USD MILLION)

7.4 FOOTWEAR

7.4.1 ADVANCED PROPERTIES IMPARTED BY SYNTHETIC RUBBER TO DRIVE MARKET

FIGURE 30 GLOBAL FOOTWEAR PRODUCTION SHARE, BY COUNTRY, 2020

TABLE 37 SYNTHETIC RUBBER MARKET SIZE IN FOOTWEAR SEGMENT, BY REGION, 2020–2027 (KILOTON)

TABLE 38 SYNTHETIC RUBBER MARKET SIZE IN FOOTWEAR SEGMENT, BY REGION, 2020–2027 (USD MILLION)

7.5 INDUSTRIAL GOODS

7.5.1 STEADY RECOVERY IN MANUFACTURING SECTOR TO PROPEL MARKET

FIGURE 31 TOTAL INDUSTRY PRODUCTION OUTPUT INDEX OF OECD COUNTRIES, Q2-2019–Q1-2021

TABLE 39 SYNTHETIC RUBBER MARKET SIZE IN INDUSTRIAL GOODS SEGMENT, BY REGION, 2020–2027 (KILOTON)

TABLE 40 SYNTHETIC RUBBER MARKET SIZE IN INDUSTRIAL GOODS SEGMENT, BY REGION, 2020–2027 (USD MILLION)

7.6 CONSUMER GOODS

7.6.1 CHANGING DEMAND FROM CONSUMERS IN APPAREL AND SPORTSWEAR SEGMENTS TO FAVOR MARKET GROWTH

TABLE 41 SYNTHETIC RUBBER MARKET SIZE IN CONSUMER GOODS SEGMENT, BY REGION, 2020–2027 (KILOTON)

TABLE 42 SYNTHETIC RUBBER MARKET SIZE IN CONSUMER GOODS SEGMENT, BY REGION, 2020–2027 (USD MILLION)

7.7 TEXTILES

7.7.1 INCREASING USE OF SYNTHETIC RUBBER TO CONTRIBUTE TO MARKET GROWTH

TABLE 43 SYNTHETIC RUBBER MARKET SIZE IN TEXTILES SEGMENT, BY REGION, 2020–2027 (KILOTON)

TABLE 44 SYNTHETIC RUBBER MARKET SIZE IN TEXTILES SEGMENT, BY REGION, 2020–2027 (USD MILLION)

7.8 OTHERS

TABLE 45 SYNTHETIC RUBBER MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2020–2027 (KILOTON)

TABLE 46 SYNTHETIC RUBBER MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2020–2027 (USD MILLION)

8 SYNTHETIC RUBBER MARKET, BY REGION (Page No. - 104)

8.1 INTRODUCTION

FIGURE 32 RAPIDLY GROWING MARKETS TO EMERGE AS NEW HOTSPOTS

TABLE 47 SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 48 SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SNAPSHOT

TABLE 49 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 50 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 51 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 52 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 54 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Growing industrialization to drive demand for synthetic rubber

TABLE 55 CHINA: TIRE PRODUCTION IN 2015–2020 (MILLION UNIT)

TABLE 56 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 57 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 59 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.2 JAPAN

8.2.2.1 Emission standards to fuel market

FIGURE 34 JAPAN: AUTOMOBILE PRODUCTION, 2010–2021

TABLE 60 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 61 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 63 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.3 SOUTH KOREA

8.2.3.1 Increasing automobile manufacturing to push demand for synthetic rubber

TABLE 64 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 65 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 67 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.4 INDIA

8.2.4.1 One of fastest-growing markets for synthetic rubber by volume

TABLE 68 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 69 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 71 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.5 ASEAN COUNTRIES

8.2.5.1 Lucrative opportunities for tire manufacturers

TABLE 72 ASEAN COUNTRIES: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 73 ASEAN COUNTRIES: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 ASEAN COUNTRIES: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 75 ASEAN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.6 AUSTRALIA & NEW ZEALAND (ANZ)

8.2.6.1 Growth in automotive sector to drive market

TABLE 76 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 77 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 79 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.7 REST OF ASIA PACIFIC

TABLE 80 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 81 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 83 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: AUTOMOBILE PRODUCTION, 2019–2021

TABLE 84 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 85 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 87 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 89 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.1 US

8.3.1.1 Increasing automotive exports to drive market

TABLE 90 US: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 91 US: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 US: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 93 US: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.2 CANADA

8.3.2.1 Policies related to EV to drive demand for synthetic rubber

TABLE 94 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 95 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 97 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.3 MEXICO

8.3.3.1 Growth in automotive sector to drive market

TABLE 98 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 99 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 101 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4 EUROPE

FIGURE 36 EUROPE: SYNTHETIC RUBBER MARKET SNAPSHOT

FIGURE 37 EUROPE: AUTOMOBILE PRODUCTION AND Y-O-Y GROWTH (%), 2017–2021

TABLE 102 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 103 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 105 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 107 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Government support to boost EV market

FIGURE 38 GERMANY: AUTOMOBILE PRODUCTION AND EXPORTS, 2018–2021

TABLE 108 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 109 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 111 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.2 UK

8.4.2.1 Expected recovery of automotive industry to drive market

TABLE 112 UK: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 113 UK: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 UK: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 115 UK: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.3 FRANCE

8.4.3.1 Growing consumption of synthetic rubber in EV to drive market

TABLE 116 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 117 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 119 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.4 RUSSIA

8.4.4.1 Market hampered by sharp decline in automobile production

TABLE 120 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 121 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 123 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.5 ITALY

8.4.5.1 Increasing EV sales to drive market

TABLE 124 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 125 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 127 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.6 SPAIN

8.4.6.1 Significant recovery of economy and automotive industry to propel market

FIGURE 39 SPAIN: TOTAL AUTOMOBILE PRODUCTION, 2020

TABLE 128 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 129 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 131 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.7 REST OF EUROPE

TABLE 132 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 133 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 135 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 136 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 137 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 139 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 141 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Vision 2030 and other government plans to boost automotive industry

TABLE 142 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 143 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 145 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.2 UAE

8.5.2.1 Steady recovery of end-use industries from impact of COVID-19 to support market growth

TABLE 146 UAE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 147 UAE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 UAE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 149 UAE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.3 SOUTH AFRICA

8.5.3.1 New vehicle market to witness slow demand

TABLE 150 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 151 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 153 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 154 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 155 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 157 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 158 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 159 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 160 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 161 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 163 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Economic growth and growing automobile production to impact synthetic rubber demand

FIGURE 40 BRAZIL: TOTAL VEHICLE PRODUCTION, 2018–2021

TABLE 164 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 165 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 167 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Increasing passenger car sales to drive market

TABLE 168 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 169 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 171 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 172 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 173 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 175 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 170)

9.1 INTRODUCTION

9.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 176 OVERVIEW OF STRATEGIES ADOPTED BY SYNTHETIC RUBBER MANUFACTURERS

9.3 MARKET SHARE ANALYSIS

9.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 41 RANKING OF TOP 5 PLAYERS IN SYNTHETIC RUBBER MARKET, 2021

9.3.2 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 177 SYNTHETIC RUBBER MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 42 SYNTHETIC RUBBER MARKET SHARE ANALYSIS

9.3.2.1 China Petroleum and Chemical Corporation

9.3.2.2 Kumho Petrochemical Co, Ltd.

9.3.2.3 PetroChina Company Limited

9.3.2.4 Exxon Mobil Corporation

9.3.2.5 Taiwan Synthetic Rubber Corporation

9.4 COMPANY EVALUATION QUADRANT

9.4.1 STARS

9.4.2 PERVASIVE PLAYERS

9.4.3 EMERGING LEADERS

9.4.4 PARTICIPANTS

FIGURE 43 SYNTHETIC RUBBER MARKET: COMPANY EVALUATION QUADRANT, 2021

9.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT

9.5.1 PROGRESSIVE COMPANIES

9.5.2 RESPONSIVE COMPANIES

9.5.3 DYNAMIC COMPANIES

9.5.4 STARTING BLOCKS

FIGURE 44 START-UP AND SMALL AND MEDIUM-SIZED ENTERPRISE (SMES) EVALUATION MATRIX, 2021

9.6 COMPETITIVE BENCHMARKING

TABLE 178 SYNTHETIC RUBBER MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 179 SYNTHETIC RUBBER MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

9.7 COMPETITIVE SCENARIO AND TRENDS

9.7.1 DEALS

TABLE 180 SYNTHETIC RUBBER MARKET: DEALS

9.7.2 OTHERS

TABLE 181 SYNTHETIC RUBBER MARKET: OTHERS

10 COMPANY PROFILES (Page No. - 181)

(Business overview, Products offered, Recent Developments, MNM view)*

10.1 EXXON MOBIL CORPORATION

TABLE 182 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

FIGURE 45 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

10.2 THE DOW CHEMICAL COMPANY

TABLE 183 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 46 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

10.3 DUPONT

TABLE 184 DUPONT: COMPANY OVERVIEW

FIGURE 47 DUPONT: COMPANY SNAPSHOT

10.4 CHINA PETROLEUM AND CHEMICAL CORPORATION

TABLE 185 CHINA PETROLEUM AND CHEMICAL CORPORATION: COMPANY OVERVIEW

FIGURE 48 CHINA PETROLEUM AND CHEMICAL CORPORATION: COMPANY SNAPSHOT

10.5 ASAHI KASEI CORPORATION

TABLE 186 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

FIGURE 49 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

10.6 DENKA COMPANY LIMITED

TABLE 187 DENKA COMPANY LIMITED: COMPANY OVERVIEW

FIGURE 50 DENKA COMPANY LIMITED: COMPANY SNAPSHOT

10.7 SABIC

TABLE 188 SABIC: COMPANY OVERVIEW

FIGURE 51 SABIC: COMPANY SNAPSHOT

10.8 RELIANCE INDUSTRIES LTD.

TABLE 189 RELIANCE INDUSTRIES LTD.: COMPANY OVERVIEW

FIGURE 52 RELIANCE INDUSTRIES LTD.: COMPANY SNAPSHOT

10.9 TOSOH CORPORATION

TABLE 190 TOSOH CORPORATION: COMPANY OVERVIEW

FIGURE 53 TOSOH CORPORATION: COMPANY SNAPSHOT

10.10 OTHER PLAYERS

10.10.1 MITSUI CHEMICALS INC.

TABLE 191 MITSUI CHEMICALS INC.: COMPANY OVERVIEW

10.10.2 SIBUR

TABLE 192 SIBUR: COMPANY OVERVIEW

10.10.3 GOODYEAR TIRE AND RUBBER COMPANY

TABLE 193 GOODYEAR TIRE AND RUBBER COMPANY: COMPANY OVERVIEW

10.10.4 NIZHNEKAMSKNEFTEKHIM

TABLE 194 NIZHNEKAMSKNEFTEKHIM: COMPANY OVERVIEW

10.10.5 ZEON CORPORATION

TABLE 195 ZEON CORPORATION: COMPANY OVERVIEW

10.10.6 KUMHO PETROCHEMICAL COMPANY LTD.

TABLE 196 KUMHO PETROCHEMICAL COMPANY LTD.: COMPANY OVERVIEW

10.10.7 PETROCHINA COMPANY LTD.

TABLE 197 PETROCHINA COMPANY LTD.: COMPANY OVERVIEW

10.10.8 TAIWAN SYNTHETIC RUBBER CORP.

TABLE 198 TAIWAN SYNTHETIC RUBBER CORP.: COMPANY OVERVIEW

10.10.9 LION ELASTOMERS

TABLE 199 LION ELASTOMERS: COMPANY OVERVIEW

10.10.10 SYNTHOS

TABLE 200 SYNTHOS: COMPANY OVERVIEW

10.10.11 CHANG RUBBER

TABLE 201 CHANG RUBBER: COMPANY OVERVIEW

10.10.12 NANTEX INDUSTRY CO., LTD

TABLE 202 NANTEX INDUSTRY CO., LTD: COMPANY OVERVIEW

10.10.13 SK GEO CENTRIC CO., LTD.

TABLE 203 SK GEO CENTRIC CO., LTD.: COMPANY OVERVIEW

10.10.14 WARCO (WEST AMERICAN RUBBER COMPANY, LLC)

TABLE 204 WARCO: COMPANY OVERVIEW

10.10.15 LYONDELLBASELL INDUSTRIES N.V

TABLE 205 LYONDELLBASELL INDUSTRIES N.V: COMPANY OVERVIEW

10.10.16 DYNASOL ELASTOMEROS SAU

TABLE 206 DYNASOL ELASTOMEROS SAU: COMPANY OVERVIEW

11 APPENDIX (Page No. - 225)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

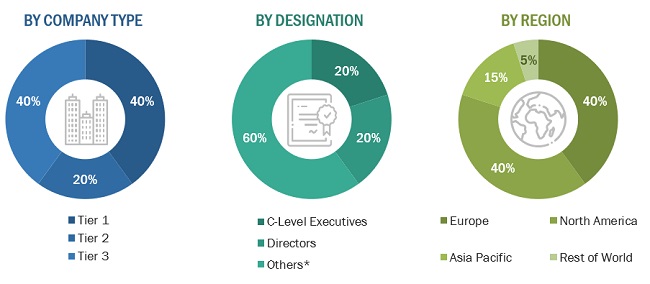

The study involved four major activities for estimating the current size of the global synthetic rubber market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of synthetic rubber through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the synthetic rubber market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, rubber journals & newsletters, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The synthetic rubber market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the synthetic rubber market. Primary sources from the supply side include associations and institutions involved in the synthetic rubber industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

Notes: Others include sales, marketing, and product managers.

Companies have been selected based on recent financials (Tier 1: revenue >USD 5 billion, Tier 2: revenue between USD 1 billion to 5 billion, and Tier 3: revenue below USD 1 billion).

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global synthetic rubber market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the global synthetic rubber market in terms of both volume and value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on application

- To forecast the market size, in terms of volume and value, with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launch, capacity expansion, and merger & acquisition

- To strategically profile the leading players and comprehensively analyze their key developments, such as expansions and mergers & acquisitions, in the synthetic rubber market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Rubber Market Overview

Rubber Market Trends

Top Companies in Rubber Market

Rubber Market Impact on Different Industries

Speak to our Analyst today to know more about Rubber Market!

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Synthetic Rubber Market