Fluoroelastomers Market by Type (FKM, FVMQ, FFKM), Application (O-rings, seals & gaskets, Hoses), End-use (Automotive, Aerospace, Chemicals, Oil & Gas, Pharmaceutical & Food, Energy & Power) and Region - Global Forecast to 2025

Updated on : April 04, 2024

Fluoroelastomers Market

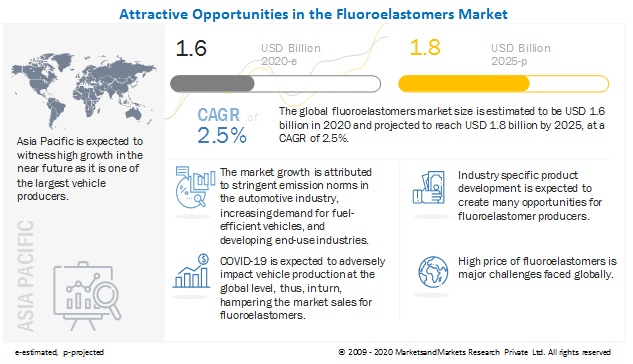

The global fluoroelastomers market size was valued at USD 1.6 billion in 2020 and is projected to reach USD 1.8 billion by 2025, growing at 2.5% cagr from 2020 to 2025. The demand for fluoroelastomers can be attributed to its growing use in various end-use industries due to their superior properties and stringent emission norms.

COVD-19 Impact on the Global Fluoroelastomers

Automotive and aerospace industry are the largest consumers fluoroelastomers globally, and due to the current COVID 19 crisis as these industries have seen a significant decline.

- The automotive industry is struggling with an abrupt and widespread stoppage of economic activity, as workers are told to stay at home, supply chains grind to a halt, and factories closed. Lockdown prohibiting the movement of people, and the sudden closure of economic activity caused a severe contraction in sectoral output and gross domestic product (GDP). It is estimated that factory closures in Europe and North America have caused some millions of passenger vehicles to be removed from production schedules. These production declines have a cascading effect affecting the OEMs and material suppliers. All these factors have also affected the demand for fluoroelastomers

- The pandemic has had a significant impact on aircraft manufacturing as well. For instance, Airbus - one of the largest commercial aircraft manufacturing companies globally, has reduced its aircraft production rates by roughly one-third due to the COVID-19 pandemic. Boeing has also reported a first-quarter loss of USD 641 million. This has significantly affected the use of fluoroelastomers used in new aircraft production, as well as MRO operations

Fluoroelastomers Market Dynamics

Driver: Growing demand for more fuel-efficient vehicles

Various automotive automobile manufacturers are changing their vehicle designs and focusing on lightweighting through the substitution of materials to cope up with the growing demand for more fuel-efficient vehicles. IHenceHence, vehicle manufacturers are reducing the size of powertrain, engine, and engine compartments. Apart from these, the advanced air management system is also integrated to improve fuel efficiency. These changes result in issues, such as elevation of temperature and involvement of corrosive fluids and fumes. These factors reduce the life of components made from elastomers, such as o- - rings, gaskets, and hoses.

Restraint: Rising environmental concerns

Environmental sustainability is one of the major concerns for the fluoroelastomers industry. Fluoroelastomers are non-biodegradable chemicals, as they consist of the fluorine atom in their molecular structure. Fluoroelastomers’ high resistance to moisture, heat, and common chemicals, has proven to be advantageous in terms of industrial performance. However, these properties also make them non-biodegradable, thereby damaging the environment. Thus, they are likely to be considered a threat to humans, animals, and the overall environment.

Opportunities: Industry-specific product development

Application areas requiring materials with extreme resistance to heat and chemicals are expected to drive the usage and development of fluoroelastomers during the forecast period. The developments existing fluoroelastomers for better performance are expected to be the emerging opportunities in the field. Many companies have started to manufacture pharmaceutical- and food-grade fluoroelastomers, certified by respective authorities. For instance, in 2019, AGC Chemical acquired Food Contact Notifications from the US FDA (Food and Drug Association) for three of its fluoroelastomer products: namely AFLAS Series 100S, 100H, and 150P

Challenges: High price of fluoroelastomers

Fluoroelastomers are relatively expensive specialty polymers, in comparison to other elastomers. The high cost of fluoroelastomers limits their use in many applications. Consequently, attempts have been made to provide less-expensive compositions that have performance characteristics like those of fluoroelastomers. For instance, the blending of fluoroelastomers with hydrocarbon elastomers. However, the properties of such compositions are not satisfactory, as the two classes of elastomers are essentially incompatible

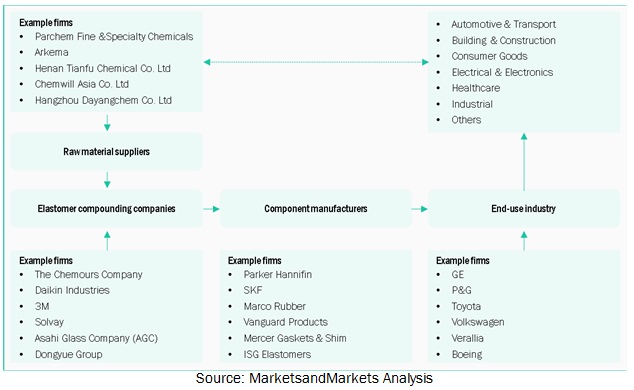

Ecosystem Diagram

Fluorocarbon type segment projected to lead fluoroelastomers market from 2020 to 2025

Based on type, the fluorocarbon segment is expected to be the largest market for fluoroelastomers. The dominant market position of the fluorocarbon segment can be attributed to its usage in the production of components to be used in an extreme environment and cheaper cost than the others

The automotive industry is estimated to be the largest end-user of fluoroelastomers.

The automotive industry is expected to be the largest end-user of fluoroelastomers, both in terms of value and volume. Most of the fluoroelastomers produced are used in the automotive industry. Fluoroelastomers are used to manufacture vehicle components which are used in drive trains and fuel handling systems. They are preferred over conventional rubber as they help in reducing emission and increase fuel efficiency.

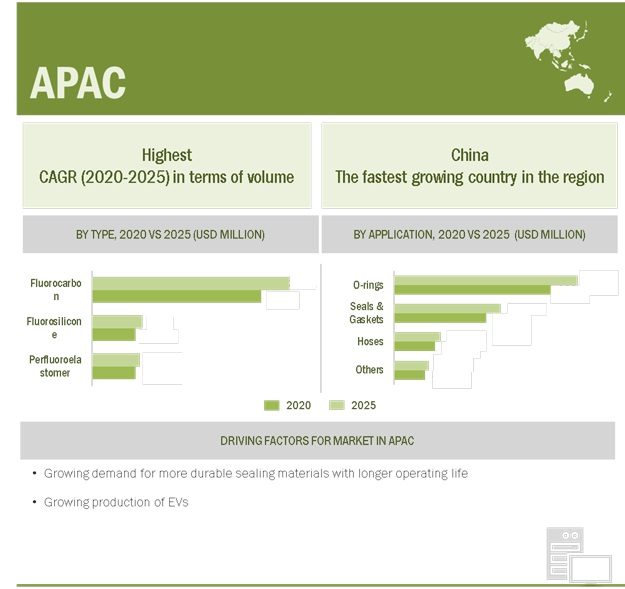

APAC estimated to account for the highest share of the global fluoroelastomers market in terms of volume.

The APAC region is projected to lead the global fluoroelastomers market from 2020 to 2025. This is due to the presence of countries like China, Japan, India, and South Korea. Some of these countries are the largest manufacturer of combustion vehicles in the world. Apart from that growing production of EVs in China is also boosting the demand.

Fluoroelastomers Market Players

Key players such as The Chemours Company (US), Solvay SA (Belgium), and 3M (US), Asahi Glass Company (Japan), Daikin Industries (Japan), and Gujarat Fluorochemicals Limited (India) have adopted various strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the fluoroelastomers market.

Fluoroelastomers Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Ton) |

|

Segments covered |

Type, Application, End-Use, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

The Chemours Company (US), Solvay SA (Belgium), and 3M (US), Daikin Industries (Japan) and Gujarat Fluorochemicals Limited (India), Asahi Glass Company (Japan), Dongyue Group (China), Halopolymer OJSC (Russia), James Walker & Co. (UK), and Shin-Etsu Chemicals (Japan) are the top players in the market. |

This research report categorizes the Fluoroelastomers market based on base oil, application, end-use industry, and region.

Fluoroelastomers Market by Type

- Fluorocarbon

- Fluorosilicone

- Perfluoroelastomers

Fluoroelastomers Market by Application

- O-rings

- Seals & Gaskets

- Hoses

- Others

Fluoroelastomers Market by End-use Industry

- Automotive

- Aerospace

- Chemicals

- Oil & Gas

- Energy & Power

- Pharmaceutical & Food

Fluoroelastomers Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In October 2019, Solvay announced plans to increase the production capacity of Tecnoflon FKM peroxide curable fluoroelastomer at its Spinetta Marengo plant in Italy. The company has taken this step to cater to the growing demand for sealing applications from the automotive, oil & gas, and semiconductor industries

- In May 2017, Asahi Glass Company launched AFLAS 600X FEPM material, which offers performance and processing advantages over BRE, FKMs, and other AFLAS grades, making it ideal for molded products, such as durable packers, bladders, gaskets, and O-rings.

- In August 2017, Daikin Industries acquired Heroflon S.p.A, an Italian fluoropolymer producer. The step has been taken to enhance its fluoropolymer products portfolio for the automotive, construction, electrical, and chemical industries.

Frequently Asked Questions (FAQ):

What is the importance of fluoroelastomers?

Fluoroelastomers are a high fluorine-containing synthetic rubber with excellent resistance to heat, flame, ozone, oxidizers, oils, and various chemicals. Due to these properties, they are used for sealing applications under extreme conditions in various industries.

What is the major end-use industry for fluoroelastomers?

The major end-use industries of fluoroelastomers are automotive, aerospace, chemicals, oil & gas, food & pharmaceutical, and energy & power. Fluoroelastomers are used as sealing applications in these industries.

What are the major applications using fluoroelastomers?

Fluoroelastomers are used for the production of o-rings, seals & gasket, and hoses. These are used for sealing applications under extreme conditions due to their excellent heat and chemical resistant properties.

What are the factors driving the growth of the fluoroelastomers market?

Some of the factors driving the demand for fluoroelastomers are the increasing demand for more fuel-efficient vehicles, stringent emission norms in the automotive industry, and the growing demand for more durable sealing products.

Are there any restraints faced by the players in the fluoroelastomers market?

Some chemicals used in the production of fluoroelastomers are seen to have an adverse effect on human health, such as Perfluorooctanoic acid (PFOA). Manufacturers have to be careful during the production to keep these chemicals from being exposed to the environment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 FLUOROELASTOMERS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 FLUOROELASTOMERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 DEMAND SIDE

2.2.1.1 Ascertaining demand for fluoroelastomers in the automotive industry

FIGURE 2 MARKET SIZE ESTIMATION: BASED ON THE DEMAND FOR FLUOROELASTOMERS IN AUTOMOTIVE INDUSTRY

2.2.2 SUPPLY SIDE

2.2.2.1 Assessment of global market size from 2017 production capacity

FIGURE 3 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 4 FLUOROELASTOMERS MARKET: DATA TRIANGULATION

2.4 FLUOROELASTOMERS MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.4.1 FLUOROELASTOMERS MARKET ANALYSIS THROUGH SECONDARY SOURCES

2.4.2 ASSUMPTIONS

2.4.3 INCLUSIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 5 FLUOROCARBON SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN 2019

FIGURE 6 O-RINGS APPLICATION ACCOUNTED FOR THE LARGEST SHARE IN 2019

FIGURE 7 AUTOMOTIVE SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN 2019

FIGURE 8 APAC TO BE THE FASTEST-GROWING MARKET BETWEEN 2020 AND 2025

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 SIGNIFICANT OPPORTUNITIES IN THE FLUOROELASTOMERS MARKET

FIGURE 9 STRINGENT EMISSION NORMS IN AUTOMOTIVE INDUSTRY TO HELP IN THE RECOVERY OF THE MARKET BETWEEN 2020 AND 2025

4.2 APAC: FLUOROELASTOMERS MARKET, BY TYPE AND COUNTRY

FIGURE 10 CHINA AND FLUOROCARBON SEGMENT ACCOUNTED FOR LARGEST SHARES

4.3 FLUOROELASTOMERS MARKET, BY KEY COUNTRIES

FIGURE 11 CHINA TO GROW AT THE HIGHEST RATE BETWEEN 2020 AND 2025

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE FLUOROELASTOMERS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand for fuel-efficient vehicles

5.2.1.2 Stringent emission norms in the automotive industry

5.2.1.3 Growth in major end-use industries

5.2.2 RESTRAINTS

5.2.2.1 Rising environmental concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Industry-specific product development

5.2.4 CHALLENGES

5.2.4.1 High price of fluoroelastomers

5.2.4.2 Lower capacity utilization due to the pandemic

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS OF FLUOROELASTOMERS MARKET

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT FROM NEW ENTRANTS

5.3.4 THREAT FROM SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN & ECOSYSTEM ANALYSIS

5.4.1 SUPPLY CHAIN OF FLUOROELASTOMERS MARKET

5.4.2 IMPACT OF COVID-19 ON SUPPLY CHAIN

6 INDUSTRY TRENDS (Page No. - 54)

6.1 MACROECONOMIC INDICATORS

6.1.1 AUTOMOTIVE INDUSTRY

TABLE 1 GLOBAL VEHICLE PRODUCTION 2018-2019 (UNITS)

6.1.2 AEROSPACE INDUSTRY

TABLE 2 AIRCRAFT DELIVERIES FORECAST, 2018-2038 (UNITS)

6.2 YC & YCC DRIVERS

6.3 FLUOROELASTOMERS MARKET GROWTH IMPACT FACTORS

6.3.1 AUTOMOTIVE INDUSTRY

FIGURE 14 LOCKDOWN SITUATION OF AUTO MANUFACTURING COMPANIES ACROSS THE WORLD (FEBRUARY 2020-MAY 2020)

6.3.2 AEROSPACE INDUSTRY

6.3.3 CHEMICAL INDUSTRY

6.4 FLUOROELASTOMERS PATENT ANALYSIS

6.4.1 METHODOLOGY

6.4.2 DOCUMENT TYPE

6.4.3 PUBLICATION TRENDS - LAST 5 YEARS

6.4.4 INSIGHTS

6.4.5 JURISDICTION ANALYSIS.

6.4.6 TOP APPLICANTS

TABLE 3 LIST OF PATENTS BY SOLVAY SPECIALTY POLYMERS

TABLE 4 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

TABLE 5 LIST OF PATENTS BY DU PONT

7 FLUOROELASTOMERS MARKET, BY TYPE (Page No. - 64)

7.1 INTRODUCTION

FIGURE 15 FLUOROCARBON ELASTOMERS TO LEAD THE MARKET, 2020-2025

TABLE 6 FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 7 FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

7.2 FLUOROCARBON ELASTOMERS (FKM)

7.2.1 FLUOROCARBON TO BE THE FASTEST-GROWING TYPE

TABLE 8 FLUOROCARBON ELASTOMERS MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 9 FLUOROCARBON ELASTOMERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 FLUOROSILICONE ELASTOMERS (FVMQ)

7.3.1 CHANGING AEROSPACE INDUSTRY TO DRIVE THE MARKET

TABLE 10 FLUOROSILICONE ELASTOMERS MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 11 FLUOROSILICONE ELASTOMERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.4 PERFLUOROELASTOMERS (FFKM)

7.4.1 MOST EXPENSIVE FLUOROELASTOMERS

TABLE 12 PERFLUOROELASTOMERS MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 13 PERFLUOROELASTOMERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 FLUOROELASTOMERS MARKET, BY APPLICATION (Page No. - 69)

8.1 INTRODUCTION

FIGURE 16 O-RINGS SEGMENT TO LEAD THE FLUOROELASTOMERS MARKET

TABLE 14 FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 15 FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 O-RINGS

8.2.1 O-RINGS TO BE THE LARGEST APPLICATION OF FLUOROELASTOMERS

TABLE 16 FLUOROELASTOMERS MARKET SIZE FOR O-RINGS, BY REGION, 2018–2025 (TON)

TABLE 17 FLUOROELASTOMERS MARKET SIZE FOR O-RINGS, BY REGION, 2018–2025 (USD MILLION)

8.3 SEALS & GASKETS

8.3.1 HIGH RESISTANCE TO MINERAL OILS, FUELS, AND NON-POLAR SOLVENTS TO PROPEL THE DEMAND

TABLE 18 FLUOROELASTOMERS MARKET SIZE FOR SEALS & GASKETS, BY REGION, 2018–2025 (TON)

TABLE 19 FLUOROELASTOMERS MARKET SIZE FOR SEALS & GASKETS, BY REGION, 2018–2025 (USD MILLION)

8.4 HOSES

8.4.1 PREFERRED OVER CONVENTIONAL RUBBER PRODUCTS

TABLE 20 FLUOROELASTOMERS MARKET SIZE FOR HOSES, BY REGION, 2018–2025 (TON)

TABLE 21 FLUOROELASTOMERS MARKET SIZE FOR HOSES, BY REGION, 2018–2025 (USD MILLION)

8.5 OTHERS

TABLE 22 FLUOROELASTOMERS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (TON)

TABLE 23 FLUOROELASTOMERS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

9 FLUOROELASTOMERS MARKET, BY END-USE INDUSTRY (Page No. - 75)

9.1 INTRODUCTION

FIGURE 17 AUTOMOTIVE WAS THE LARGEST END-USE INDUSTRY IN 2019

TABLE 24 FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 25 FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

9.2 AUTOMOTIVE

9.2.1 STRINGENT EMISSION NORMS IN THE INDUSTRY TO DRIVE THE MARKET

TABLE 26 FLUOROELASTOMERS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 27 FLUOROELASTOMERS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

9.3 AEROSPACE

9.3.1 GROWING DEMAND FOR PRODUCTS THAT OPERATE UNDER EXTREME TEMPERATURES TO BOOST THE MARKET IN THIS SEGMENT

TABLE 28 FLUOROELASTOMERS MARKET SIZE IN AEROSPACE END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 29 FLUOROELASTOMERS MARKET SIZE IN AEROSPACE END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

9.4 CHEMICAL

9.4.1 APAC TO BE A KEY MARKET FOR FLUOROELASTOMERS IN CHEMICAL INDUSTRY

TABLE 30 FLUOROELASTOMERS MARKET SIZE IN CHEMICAL END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 31 FLUOROELASTOMERS MARKET SIZE IN CHEMICAL END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

9.5 OIL & GAS

9.5.1 NORTH AMERICA TO BE THE FASTEST-RECOVERING MARKET IN THIS SEGMENT

TABLE 32 FLUOROELASTOMERS MARKET SIZE IN OIL & GAS END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 33 FLUOROELASTOMERS MARKET SIZE IN OIL & GAS END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

9.6 ENERGY & POWER

9.6.1 INCREASING NUMBER OF NUCLEAR REACTORS TO FUEL THE MARKET

TABLE 34 FLUOROELASTOMERS MARKET SIZE IN ENERGY & POWER END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 35 FLUOROELASTOMERS MARKET SIZE IN ENERGY & POWER END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

9.7 PHARMACEUTICAL & FOOD

9.7.1 DEMAND FOR PURITY IN SEALING MATERIALS TO PROPEL THE MARKET

TABLE 36 FLUOROELASTOMERS MARKET SIZE IN PHARMACEUTICAL & FOOD END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 37 FLUOROELASTOMERS MARKET SIZE IN PHARMACEUTICAL & FOOD END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

9.8 OTHERS

TABLE 38 FLUOROELASTOMERS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (TON)

TABLE 39 FLUOROELASTOMERS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

10 FLUOROELASTOMERS MARKET, BY REGION (Page No. - 85)

10.1 INTRODUCTION

FIGURE 18 APAC TO LEAD THE MARKET BETWEEN 2020 AND 2025

TABLE 40 FLUOROELASTOMERS MARKET, BY REGION, 2018-2025 (TON)

TABLE 41 FLUOROELASTOMERS MARKET, BY REGION, 2018-2025 (USD MILLION)

10.2 APAC

FIGURE 19 APAC: FLUOROELASTOMERS MARKET SNAPSHOT

TABLE 42 APAC: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018-2025 (TON)

TABLE 43 APAC: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 44 APAC: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 45 APAC: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 46 APAC: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 47 APAC: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 48 APAC: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 49 APAC: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Largest market in the region in terms of both value and volume

TABLE 50 CHINA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 51 CHINA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 52 CHINA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 53 CHINA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 54 CHINA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 55 CHINA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Second-largest vehicle manufacturer in APAC

TABLE 56 JAPAN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 57 JAPAN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 58 JAPAN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 59 JAPAN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 60 JAPAN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 61 JAPAN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.2.3 INDIA

10.2.3.1 Automotive to be the fastest-growing end-use industry

TABLE 62 INDIA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 63 INDIA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 64 INDIA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 65 INDIA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 66 INDIA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 67 INDIA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 O-rings to be the fastest-growing application

TABLE 68 SOUTH KOREA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 69 SOUTH KOREA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 70 SOUTH KOREA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 71 SOUTH KOREA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 72 SOUTH KOREA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 73 SOUTH KOREA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.2.5 THAILAND

10.2.5.1 Growing EV industry to favor the market growth

TABLE 74 THAILAND: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 75 THAILAND: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 76 THAILAND: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 77 THAILAND: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 78 THAILAND: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 79 THAILAND: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.2.6 TAIWAN

10.2.6.1 Automotive industry – the largest consumer of fluoroelastomers

TABLE 80 TAIWAN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 81 TAIWAN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 82 TAIWAN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 83 TAIWAN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 84 TAIWAN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 85 TAIWAN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.2.7 REST OF APAC

TABLE 86 REST OF APAC: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (TON)

TABLE 87 REST OF APAC: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 88 REST OF APAC: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 89 REST OF APAC: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 90 REST OF APAC: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 91 REST OF APAC: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 20 NORTH AMERICA: FLUOROELASTOMERS MARKET SNAPSHOT

TABLE 92 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 93 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 95 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 97 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 99 NORTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.3.1 US

10.3.1.1 EVs to provide opportunities for the fluoroelastomers market in the country

TABLE 100 US: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 101 US: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 US: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 103 US: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 104 US: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 105 US: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Policies relating to EVs to drive the demand for fluoroelastomers post COVID-19

TABLE 106 CANADA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 107 CANADA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 CANADA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 109 CANADA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 110 CANADA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 111 CANADA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Automotive industry to drive the demand for fluoroelastomers in Mexico

TABLE 112 MEXICO: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 113 MEXICO: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 MEXICO: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 115 MEXICO: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 116 MEXICO: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 117 MEXICO: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4 EUROPE

TABLE 118 COVID-19 IMPACT ON THE EUROPEAN AUTOMOTIVE INDUSTRY: PRODUCTION LOSSES IN KEY AUTOMOBILE MANUFACTURING COUNTRIES IN THE REGION

TABLE 119 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 120 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 121 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 122 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 124 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 125 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 126 EUROPE: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Largest market in Europe

TABLE 127 GERMANY: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 128 GERMANY: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 129 GERMANY: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 130 GERMANY: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 131 GERMANY: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 132 GERMANY: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4.2 FRANCE

10.4.2.1 Government incentives promoting EVs to drive the demand for fluoroelastomers post COVID-19

TABLE 133 FRANCE: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 134 FRANCE: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 FRANCE: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 136 FRANCE: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 137 FRANCE: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 138 FRANCE: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4.3 ITALY

10.4.3.1 Large scale demand from the automotive industry to drive the demand for fluoroelastomers

TABLE 139 ITALY: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 140 ITALY: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 141 ITALY: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 142 ITALY: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 143 ITALY: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 144 ITALY: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4.4 SPAIN

10.4.4.1 Market hampered by sharp decline in automobile production

TABLE 145 SPAIN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 146 SPAIN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 147 SPAIN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 148 SPAIN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 149 SPAIN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 150 SPAIN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4.5 UK

10.4.5.1 Automotive industry dominates the fluoroelastomers market in the country

TABLE 151 UK: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 152 UK: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 153 UK: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 154 UK: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 155 UK: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 156 UK: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4.6 REST OF EUROPE

TABLE 157 REST OF EUROPE: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 158 REST OF EUROPE: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 159 REST OF EUROPE: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 160 REST OF EUROPE: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 161 REST OF EUROPE: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 162 REST OF EUROPE: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 163 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 164 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 165 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 166 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 167 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 168 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 169 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 170 SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Fluorocarbon to be the fastest-growing segment during the forecast period

TABLE 171 BRAZIL: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 172 BRAZIL: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 BRAZIL: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 174 BRAZIL: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 175 BRAZIL: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 176 BRAZIL: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Economic uncertainty to affect the consumption of fluoroelastomers in the country

TABLE 177 ARGENTINA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 178 ARGENTINA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 179 ARGENTINA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 180 ARGENTINA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 181 ARGENTINA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 182 ARGENTINA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 183 REST OF SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 184 REST OF SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 185 REST OF SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 186 REST OF SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 187 REST OF SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 188 REST OF SOUTH AMERICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

TABLE 189 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 190 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 192 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 194 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 196 MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.6.1 SOUTH AFRICA

10.6.1.1 Nuclear power industry has prospects for market growth

TABLE 197 SOUTH AFRICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 198 SOUTH AFRICA: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 199 SOUTH AFRICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 200 SOUTH AFRICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 201 SOUTH AFRICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 202 SOUTH AFRICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.6.2 IRAN

10.6.2.1 Major end-use industries affected by sanctions

TABLE 203 IRAN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 204 IRAN: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 205 IRAN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 206 IRAN: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 207 IRAN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 208 IRAN: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.6.3 EGYPT

10.6.3.1 O-rings to be the largest application

TABLE 209 EGYPT: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 210 EGYPT: FLUOROELASTOMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 211 EGYPT: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 212 EGYPT: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 213 EGYPT: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 214 EGYPT: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 215 REST OF MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET, BY TYPE, 2018–2025 (TON)

TABLE 216 REST OF MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 217 REST OF MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 218 REST OF MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 219 REST OF MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 220 REST OF MIDDLE EAST & AFRICA: FLUOROELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 152)

11.1 INTRODUCTION

FIGURE 21 COMPANIES MAINLY ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN 2017 AND 2020

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 DYNAMIC DIFFERENTIATORS

11.2.2 INNOVATORS

11.2.3 VISIONARY LEADERS

11.2.4 EMERGING PLAYERS

FIGURE 22 FLUOROELASTOMERS MARKET: (GLOBAL) COMPETITIVE LEADERSHIP MAPPING

11.3 MARKET SHARE ANALYSIS OF KEY PLAYERS

FIGURE 23 MARKET SHARE OF TOP 5-7 KEY PLAYERS, 2019

FIGURE 24 THE CHEMOURS COMPANY LED THE FLUOROELASTOMERS MARKET IN 2019

11.4 COMPETITIVE SCENARIO

11.4.1 EXPANSION

11.4.2 MERGER & ACQUISITION

11.4.3 PRODUCT LAUNCH

12 COMPANY PROFILES (Page No. - 157)

12.1 THE CHEMOURS COMPANY

12.1.1 BUSINESS OVERVIEW

FIGURE 25 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

12.1.2 IMPACT OF COVID-19 ON THE BUSINESS SEGMENT

12.1.3 PRODUCTION PLANT LOCATION

12.1.4 PRODUCTS OFFERED

12.1.5 WINNING IMPERATIVES

12.1.6 CURRENT FOCUS AND STRATEGY

12.1.7 RIGHT TO WIN

12.2 DAIKIN INDUSTRIES

12.2.1 BUSINESS OVERVIEW

FIGURE 26 DAIKIN INDUSTRIES: COMPANY SNAPSHOT

12.2.2 IMPACT OF COVID-19 ON THE BUSINESS SEGMENT

12.2.3 PRODUCTS OFFERED

12.2.4 RECENT DEVELOPMENTS

12.2.5 WINNING IMPERATIVES

12.2.6 CURRENT FOCUS AND STRATEGY

12.2.7 RIGHT TO WIN

12.3 SOLVAY SA

12.3.1 BUSINESS OVERVIEW

FIGURE 27 SOLVAY: COMPANY SNAPSHOT

12.3.2 IMPACT OF COVID-19 ON THE BUSINESS SEGMENT

12.3.3 PRODUCTS OFFERED

12.3.4 RECENT DEVELOPMENTS

12.3.5 WINNING IMPERATIVES

12.3.6 CURRENT FOCUS AND STRATEGY

12.3.7 RIGHT TO WIN

12.4 3M

12.4.1 BUSINESS OVERVIEW

FIGURE 28 3M: COMPANY SNAPSHOT

12.4.2 IMPACT OF COVID-19 ON THE BUSINESS SEGMENT

12.4.3 PRODUCTS OFFERED

12.4.4 RECENT DEVELOPMENTS

12.4.5 WINNING IMPERATIVE

12.4.6 CURRENT FOCUS AND STRATEGY

12.4.7 RIGHT TO WIN

12.5 ASAHI GLASS COMPANY (AGC)

12.5.1 BUSINESS OVERVIEW

FIGURE 29 AGC: COMPANY SNAPSHOT

12.5.2 IMPACT OF COVID-19 ON THE BUSINESS SEGMENT

12.5.3 PRODUCTS OFFERED

12.5.4 RECENT DEVELOPMENTS

12.5.5 WINNING IMPERATIVES

12.5.6 CURRENT FOCUS AND STRATEGY

12.5.7 RIGHT TO WIN

12.6 DONGYUE GROUP

12.6.1 BUSINESS OVERVIEW

FIGURE 30 DONGYUE GROUP: COMPANY SNAPSHOT

12.6.2 PRODUCTS OFFERED

12.7 GUJARAT FLUOROCHEMICALS LIMITED

12.7.1 BUSINESS OVERVIEW

FIGURE 31 GUJARAT FLUOROCHEMICALS LIMITED: COMPANY SNAPSHOT

12.7.2 PRODUCTS OFFERED

12.8 SHIN-ETSU CHEMICALS

12.8.1 BUSINESS OVERVIEW

FIGURE 32 SHIN-ETSU CHEMICALS: COMPANY SNAPSHOT

12.8.2 PRODUCTS OFFERED

12.9 HALOPOLYMER OJSC

12.9.1 BUSINESS OVERVIEW

12.9.2 PRODUCTS OFFERED

12.10 AIRBOSS OF AMERICA CO.

12.10.1 BUSINESS OVERVIEW

FIGURE 33 AIRBOSS OF AMERICA: COMPANY SNAPSHOT

12.10.2 PRODUCTS OFFERED

12.11 OTHER COMPANIES

12.11.1 EAGLE ELASTOMERS INC.

12.11.2 GREENE, TWEED & CO.

12.11.3 SHANGHAI FLUORON CHEMICALS

12.11.4 CHENGUANG FLUORO & SILICONE ELASTOMERS

12.11.5 ZHONGHAO CHENGUANG RESEARCH INSTITUTE OF CHEMICAL INDUSTRY

12.11.6 POLYCOMP BV

12.11.7 PRECISION POLYMER ENGINEERING

12.11.8 JAMES WALKER & CO.

12.11.9 DYNAFLUON

12.11.10 MARCO RUBBER & PLASTIC PRODUCTS, INC.

13 APPENDIX (Page No. - 180)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

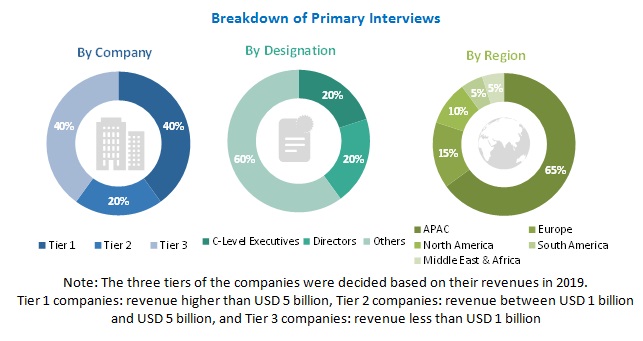

The study involved four major activities for estimating the current size of the global fluoroelastomers market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of fluoroelastomers through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the fluoroelastomers market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the fluoroelastomers market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies; trade directories; and databases.

Primary Research

Various primary sources from both the supply and demand sides of the fluoroelastomers market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the fluoroelastomers industry. The primary sources from the demand-side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global fluoroelastomers market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the fluoroelastomers market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the fluoroelastomers market in terms of value and volume based on base oil type, application, end-use, and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the fluoroelastomers market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the Fluoroelastomers report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the fluoroelastomers market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Fluoroelastomers Market

Interested in FKM market