Tax Management Market by Component (Software and Services), Deployment Mode (Cloud and On-Premises), Tax Type (Indirect Tax and Direct Tax), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2027

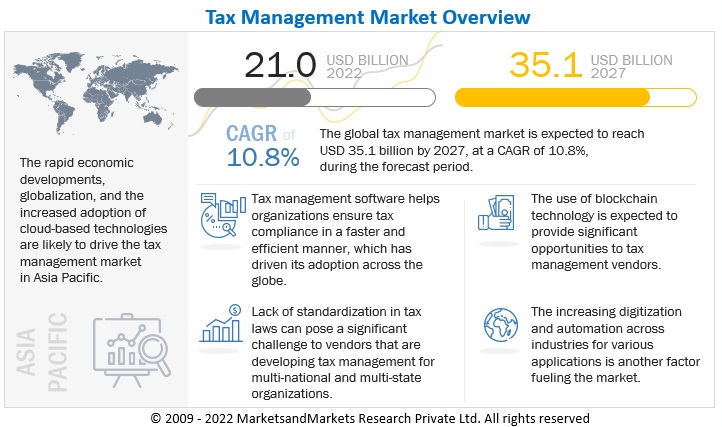

[250 Pages Report] MarketsandMarkets estimates the global tax management market is expected to grow from USD 21.0 billion in 2022 to USD 35.1 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 10.8% during the forecast period. Factors driving the growth of the tax management market include the increasing volume of financial transactions across verticals due to digitalization, changes to the global tax legislative landscape, maintenance of compliance with real-time insights into the status, mitigated risks, and high-quality tax data within the system of the record itself, lowering of the cost of compliance with automation implementation.

To know about the assumptions considered for the study, Request for Free Sample Report

Tax Management Market Dynamics

Driver: Automated compliance helps lower the burden on tax management and drives the overall market

Increased transparency helps ensure compliance and optimize tax strategies. Due to automation, the risk is mitigated, and high-quality tax data is recorded within the system. Standardizing tax compliance processes to scale operations globally, minimize risk, fulfill tax obligations with lesser effort, and lowers compliance cost. Tax management efficiency can be triggered by eliminating workarounds and offline data reconciliations or manipulations, thereby increasing transparency for tax audits and automating compliance tasks with AI & ML.

Restraint: Limitation in VAT design and administrative reforms as a setback for tax management market

Although VAT has been adopted in most developing countries, it often suffers from being incomplete in one aspect or another periodically. The cost has increased for business owners throughout the chain of production. This is due to the fact that VAT is calculated at every step of the sales process; bookkeeping alone results in a massive burden for a company, which then passes on the additional cost to the end consumer. Many crucial sectors, most notably the services, wholesale and retail sectors, are non-inclusive of the VAT net, or the credit mechanism is highly restrictive. This means there are greater delays in the provision of proper credits for VAT on inputs, especially when it comes to capital goods. As these features allow a substantial increase in the tax burden for the final user, they reduce the benefits of introducing VAT in the first place.

Opportunity: Indirect tax management and compliance offer a significant opportunity for the market to scale

Indirect tax offers notable opportunities to leverage analytics. Indirect tax management and compliance are handled by operating business units (BUs) in many organizations. Every transaction an organization enters into requires an indirect tax decision to be made, even if the decision is such that the transaction is/be exempt(ed) from indirect taxes. Hence, the volume of information that surrounds the ultimate indirect tax outcomes can be magnanimous. The process is mostly automated but relies on manual information entry as well, to a certain extent. Effective Tax management is often expected to handle and address indirect tax controversy and disputes without having day-to-day control over the processes that create and report liabilities.

Challenge: The absence of standardized tax rules is a challenge in the current tax management market

Government and tax departments continuously work to improve the tax collection process while bringing efficiency and fairness. However, several countries, such as the US and India, have different tax rules for each stateThe US has a separate tax rate at the federal, state, and local levels. The tax system in China is complex as taxes are imposed differently based on provinces. For instance, there are over 30 provinces in China, each with different tax laws. As per the data of the World Bank, 263 hours are consumed annually to prepare taxes in China.

Due to rapid globalization, cross-border activities are increasing. However, each country has different norms and tax rates for each type of good and service. This acts as a major challenge for tax management solution providers because, for each country or state, the solution needs to be compliant with both state and central tax rates.

By Component, the services segment to grow at a higher CAGR during the forecast period

With the increasing adoption of tax management software across major verticals, the demand for supporting services is growing among organizations. Services play a crucial role in helping organizations across industries to take complete advantage of tax management software. Tax management services include consulting; integration and deployment; and training, maintenance, and support. Organizations are adopting these services to enhance their tax management processes. Consulting services help an organization choose between a set of tax management software to match the latter’s specific requirements. These services advise end users and help them integrate and deploy software configured as per their requirements. They also help identify what type of integration organizations require to meet their tax demand. Moreover, they assist companies at every step of software usage.

By Tax type, the Direct tax to record a higher CAGR during the forecast period

Direct taxes are paid by taxpayers directly to the government without any intermediaries. They are levied on enterprises and are considered in the scope of the study. Some of the direct taxes considered include corporate tax, wealth tax, estate duty, gift tax, fringe benefits tax, and professional tax. Vendors are offering intuitive and comprehensive direct tax solutions for changing market needs. Direct tax software can file multiple types of returns and provide a centralized user administration that helps simplify tax compliance processes. Multi-state and multi-national organizations face challenges related to tax filing due to the differences in jurisdictions. However, direct tax management software help in filing state, local, and international returns more accurately, quickly, and securely.

By Deployment mode, the cloud deployment model to continue with the higher CAGR during the forecast period

Organizations increasingly prefer cloud-based tax management software. Cloud-based deployment allows users to access the solution from anywhere on any device, such as personal computers, laptops, and mobiles. Cloud solutions eliminate the burden of system administration and maintenance so a business’s management can focus on value-added activities. Cloud deployment mode is designed to always be online and negate data loss. This makes cloud well-suited for indirect tax because those taxes must be calculated, retained and collected on a transaction-by-transaction basis, which is of a higher frequency. A company can efficiently conduct business if the platform it uses for indirect tax is always active and can move parallelly at the speed those transactions occur.

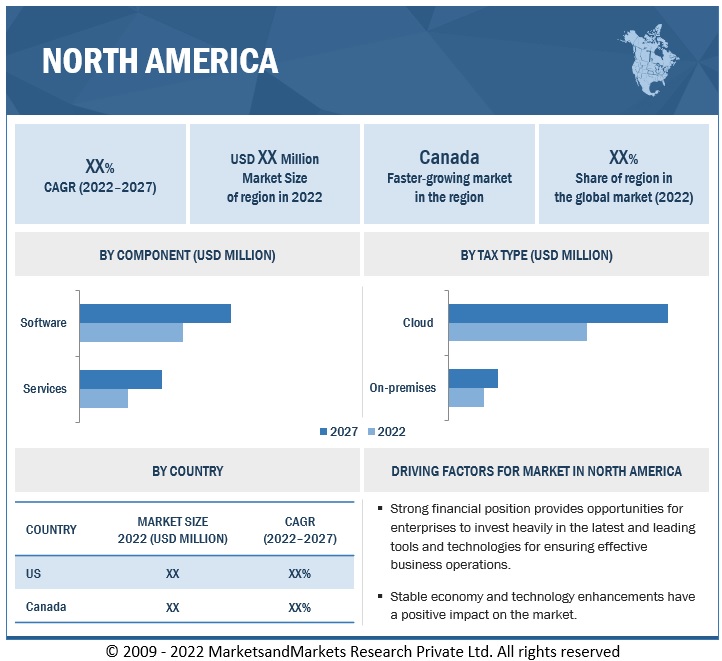

By Region, North America to exhibit significant growth during the forecast period

In terms of market size, North America is expected to be the major contributor to the global tax management market during the forecast period. The US and Canada are expected to be the major revenue contributors to the North American tax management market. The adoption of tax management solutions offers benefits, such as reduced deductible amounts, easy tax calculations, saving time, automatic tax filing, and a reduction in the number of errors. The developed economies in North America have been witnessing higher adoption of tax management solutions compared to other countries across the globe. The major tax management vendors in North America include Avalara, ADP, Intuit, and H&R Block. They have adopted several business strategies to enhance their existing product portfolios and expand their geographic presence in the tax management market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the tax management market are Thomson Reuters (Canada), Intuit (US), H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), SAP SE (Germany), Blucora (US), Taxback International (Ireland), Vertex (US), Sailotech (US), TaxSlayer (US), Defmacro Software (India), DAVO Technologies (US), Xero (New Zealand), Sovos Compliance (US), Drake Enterprises (US), Sales Tax DataLINK (US), Canopy Tax (US), LOVAT Software (UK), TaxJar (US), Webgility (US), SafeSend (US), EXEMPTAX (US), Shoeboxed (US), TaxCloud (US), and SAXTAX (US). These players have adopted various strategies to grow in the global tax management market.

The study includes an in-depth competitive analysis of key players in the tax management market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component, Tax Type, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and Middle East & Africa |

|

Companies covered |

Thomson Reuters (Canada), Intuit (US), H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), SAP SE (Germany), Blucora (US), Sovos Compliance (US), Vertex (US), Sailotech (US), Defmacro Software (India), DAVO Technologies (US), Xero (New Zealand), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), and SAXTAX (US). |

This research report categorizes the tax management market based on component, tax type, deployment mode, organization size, vertical, and region.

Based on components, the tax management market has been segmented as follows:

- Software

- Services

Based on tax type, the tax management market has been segmented as follows:

- Indirect Tax

- Direct Tax

Based on deployment mode, the tax management market has been segmented as follows:

- Cloud

- On-premises

Based on organization size, the tax management market has been segmented as follows:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on vertical, the tax management market has been segmented as follows:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Manufacturing

- Energy and Utilities

- Retail

- Healthcare and Life Sciences

- Media and Entertainment

- Others (real estate and construction, and transportation and logistics)

Based on region, the tax management market has been segmented as follows:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- India

- Japan

- Rest of APAC

-

Middle East and Africa

- South Africa

- Saudi Arabia

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2022, Intuit led its innovation at scale for consumers and small businesses, along with speeding time to market for new products and services with its AI-driven Virtual Expert Platform. Combining Intuit’s AI technology and its network of experts, along with the software that connects them—via its TurboTax Live and QuickBooks Live offerings, customers will have automated digital assistance with its AI-enabled platform.

- In September 2022, Avalara integrated with 18 wide variety of solutions. The integration is expected to, moving ahead, enable customers of Avalara partner solutions to benefit from Avalara’s real-time calculation of applicable taxes for billing line items. The broad variety of solutions is namely Apparel21, B2B Wave, Cleverbridge, Commonsku, HappsNow, Karmak Fusion, LOU by Evosus, Naviga, Omnia 360, ONE platform, Rain POS, Response CRM, Seradex, shopVOX, Softbase systems 3.0, Thoroughbred s/w, TrulinX by Tribute, and vinSUITE.

- In September 2022, Intuit partnered with Ignition. This partnership is expected to elevate the experience for experts and the public in professional services. Ignition’s Tax Planning and Advisory Proposal templates combine and extend upon Intuit’s recently launched Intuit Tax Advisor, which seamlessly integrates with Lacerte and ProConnect Tax software to provide automated tax insights and strategies for accounting professionals.

Frequently Asked Questions (FAQ):

What is the projected market value of the global tax management market?

The global tax market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% during the forecast period, to reach USD 35.1 billion by 2027 from USD 21.0 billion in 2022.

Which region has the highest market share in the tax management market?

Asia Pacific and Europe regions hold the larger market share in the tax management market, where these two regions together contribute almost more than half of the global tax management market in the year 2022.

Which submarkets are expected to witness high adoption in the coming years?

The indirect taxes segment holds a larger market size as these kinds of taxes are paid more frequently than direct taxes. Hence, they demand advanced systems for faster and more accurate calculations.

Who are the major vendors in the tax management market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as Avalara (US), Automatic Data Processing (US), Wolters Kluwer NV (Netherlands), Thomson Reuters (Canada), Intuit (US), H&R Block (US), SAP SE (Germany), Blucora (US), Sovos Compliance (US), and Vertex (US).

What are some of the latest trends that will shape the tax management market in the future?

The surge in the number of digital transactions, the complex nature of tax laws, and the adoption of blockchain technology by tax management vendors are expected to shape the market in the coming years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current market size for tax management software and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. This research study used secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Bloomberg, Factiva, data center associations, vendor data sheets, product demos, Green Grid, Uptime Institute, and BusinessWeek. All these sources were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the tax management market.

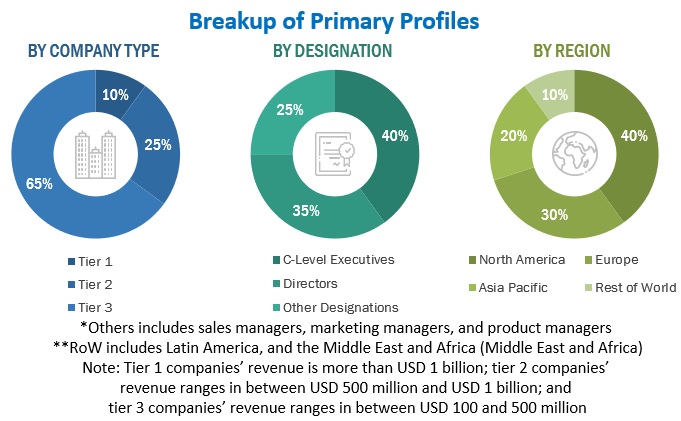

The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. The primary sources were mainly several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of the companies offering tax management software and services was based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and database

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the tax management market along with the associated service providers, and System Integrators (SIS) operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the tax management market, and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global tax management market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides of the tax market.

Report Objectives

- To define, describe, and forecast the tax management market by component (software and services), tax type, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the tax management market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the tax management market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa, and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as new product launches and product enhancements, partnerships, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to five

Market Scope of Tax Compliance Solutions

Tax compliance solutions are an essential part of the tax management market, as they provide tools and software that enable businesses and individuals to comply with tax regulations. Tax compliance solutions are software tools that help businesses and individuals to meet their tax obligations, including timely and accurate filing of tax returns, payment of taxes, and maintaining proper tax records. These solutions automate the tax compliance process by using algorithms and artificial intelligence to collect, analyze and report tax-related data. Tax compliance solutions can also provide alerts for upcoming tax deadlines, identify tax-saving opportunities, and calculate taxes.

Futuristic Growth Use-Cases of Tax Compliance Solutions Market

- Predictive Analytics: Tax compliance solutions can use predictive analytics to forecast potential tax liabilities and identify areas where tax savings can be achieved. This can be particularly useful for businesses that operate in multiple jurisdictions with complex tax rules.

- Blockchain-Based Solutions: Blockchain-based tax compliance solutions can offer a high level of security, transparency, and immutability, which can be particularly useful in situations where there is a need to maintain a complete and accurate audit trail of all tax-related transactions.

- Artificial Intelligence (AI) and Machine Learning (ML): Tax compliance solutions that use AI and ML algorithms can automate routine tax-related processes, reduce the risk of errors, and identify potential tax savings opportunities.

- Robotic Process Automation (RPA): RPA can automate repetitive tasks and free up tax professionals to focus on more complex and strategic tasks. RPA can also improve data accuracy and reduce the time required to complete tax-related tasks.

- Cloud-Based Solutions: Cloud-based tax compliance solutions offer greater flexibility, scalability, and cost-effectiveness than traditional on-premise solutions. Cloud-based solutions can also offer enhanced data security and improved accessibility.

Industries Getting Impacted in Future by Tax Compliance Solutions Market

- Banking and Financial Services: Banks and financial institutions are required to comply with tax regulations in multiple jurisdictions. Tax compliance solutions can help banks and financial institutions automate the tax compliance process and ensure they are meeting their regulatory obligations.

- Healthcare: Healthcare providers, including hospitals, clinics, and other healthcare organizations, must comply with tax regulations related to medical expenses, insurance premiums, and other healthcare-related tax matters. Tax compliance solutions can help healthcare providers ensure they are in compliance with tax regulations and reduce the risk of errors.

- E-commerce: Online retailers must comply with tax regulations related to sales taxes and other tax matters. Tax compliance solutions can help e-commerce businesses automate the calculation and reporting of sales taxes and other tax-related activities.

- Real Estate: Real estate companies and property owners must comply with tax regulations related to property taxes, rental income, and other tax matters. Tax compliance solutions can help real estate companies and property owners automate the calculation and reporting of property taxes and other tax-related activities.

- Manufacturing: Manufacturers must comply with tax regulations related to sales taxes, excise taxes, and other tax matters. Tax compliance solutions can help manufacturers automate the calculation and reporting of taxes and ensure they are in compliance with tax regulations.

Top Players in Tax Compliance Solutions Market

- Thomson Reuters

- Wolters Kluwer

- Avalara

- Vertex

- Sovos

- CCH Tagetik

- ONESOURCE

New Business Opportunities in Tax Compliance Solutions Market

- Cloud-Based Solutions: As more businesses move their operations to the cloud, there is a growing demand for cloud-based tax compliance solutions that offer greater flexibility, scalability, and cost-effectiveness than traditional on-premise solutions. This provides an opportunity for companies that offer cloud-based tax compliance solutions to tap into this growing market.

- Artificial Intelligence and Machine Learning: AI and ML are increasingly being used in tax compliance solutions to automate routine tasks and improve accuracy. Companies that can leverage AI and ML in their tax compliance solutions can differentiate themselves in the market and offer a competitive advantage to their customers.

- Global Tax Compliance: As businesses expand globally, there is a growing need for tax compliance solutions that can handle multiple tax jurisdictions and compliance requirements. Companies that can provide global tax compliance solutions can tap into this growing market and provide a competitive advantage to their customers.

- Integrated Tax and Accounting Solutions: There is a growing trend towards integrated tax and accounting solutions that can help businesses streamline their financial management processes. Companies that can offer integrated tax and accounting solutions can tap into this growing market and provide a competitive advantage to their customers.

- Blockchain-Based Solutions: Blockchain technology has the potential to revolutionize the tax compliance industry by providing a high level of security, transparency, and immutability. Companies that can offer blockchain-based tax compliance solutions can tap into this emerging market and provide a competitive advantage to their customers.

Key Challenges for Growing Tax Compliance Solutions Business in the Future

- Increasing Competition: As the market for tax compliance solutions continues to grow, there will be increased competition among providers, which could lead to price pressure and decreased profit margins. Companies will need to differentiate themselves through innovative solutions, superior customer service, and strategic partnerships.

- Evolving Regulatory Landscape: Tax regulations are constantly evolving, with new laws and regulations being introduced at the local, state, and federal levels. Companies will need to stay up-to-date with the latest regulations and adapt their solutions accordingly to remain compliant and competitive.

- Cybersecurity Risks: Tax compliance solutions often involve handling sensitive financial and personal data, which makes them a target for cybercriminals. Companies will need to invest in robust cybersecurity measures to protect their customers' data and ensure compliance with data privacy regulations.

- Integration with Legacy Systems: Many businesses still rely on legacy systems for their tax compliance processes, which can make it challenging to integrate new tax compliance solutions. Companies will need to invest in seamless integration capabilities to make their solutions compatible with existing systems.

- Change Management: Implementing new tax compliance solutions can be disruptive to a business's existing processes and workflows. Companies will need to invest in change management strategies to ensure a smooth transition and minimize the risk of business interruption.

Speak to our Analyst today to know more about "Tax compliance solutions Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tax Management Market