Cloud ERP Market

Cloud ERP Market by Software (Full Suite, Modules), Application (Financial Management, Project Management, Human Resources Management, Supply Chain Management, Inventory Management, Other Applications), Vertical - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global cloud ERP market is expected to grow substantially, projected to rise from USD 87.73 billion in 2024 to USD 172.74 billion by 2029 at a CAGR of 14.5%. This surge is driven by escalating demand for integrated, scalable, and AI-enabled business solutions across mission-critical enterprise operations. Cloud ERP systems are increasingly adopted in manufacturing plants, IT & ITeS firms, healthcare organizations, and large enterprises, where real-time data access, process automation, and multi-site integration are essential for operational efficiency and business continuity. These systems offer centralized workflows, seamless analytics, and flexible deployment options. This growth trajectory reflects the accelerating shift of enterprises toward intelligent, scalable, and AI-powered ERP platforms that support mission-critical business operations.

KEY TAKEAWAYS

- The North America cloud ERP market accounted for a 39.1% revenue share in 2024.

- By offering, the professional services segment is expected to register the highest CAGR of 15.7%.

- By deployment type , hybrid cloud segment is projected to grow at highest CAGR.

- By organization size, large enterprises segment will hold the largest market share.

- By application, the inventory management segment is expected to dominate the cloud ERP market.

- By vertical, the IT & ITeS segment is projected to grow the at the fastest rate of 16.2% during the forecast period.

- Company SAP, Oracle, and Microsoft were identified as some of the star players in the cloud ERP market (global), given their strong market share and product footprint.

- Companies Plex System, Acumatica, and Epicor, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The surge in digital transformation, remote workforce enablement, and AI-driven business workflows is intensifying the need for flexible, scalable, and integrated enterprise systems. At the core of this evolution, cloud ERP platforms are becoming foundational to modern business operations by offering centralized data management across critical functions such as finance, human resources, supply chain, and manufacturing, real-time analytics and intelligent automation that empower organizations to make data-driven decisions, enhance operational visibility, and improve process efficiency, and seamless integration with AI/ML, IoT, and business intelligence tools, enabling predictive insights and proactive resource planning.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The rising demand for digital transformation and real-time business insights creates mounting pressure on enterprises to streamline operations and maintain agility. Cloud ERP systems, supported by automated workflows, AI-driven analytics, and integrated modules across finance, HR, and supply chain, help organizations improve efficiency, reduce operational bottlenecks, and enable data-driven decision-making. These solutions lower administrative overhead, enhance process visibility, and support scalable growth. Changes in technology adoption, regulatory requirements, or workforce dynamics directly influence these outcomes and drive growth for Cloud ERP providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

AI/ML Integration for intelligent ERP

-

Increased cloud spending

Level

-

Data security risks

-

Limited personalization

Level

-

Mobile & remote workforce enablement

-

SME market expansion

Level

-

Legacy system integration

-

Vendor selection complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased cloud spending

The global shift from on-premise IT infrastructure to cloud-first strategies is accelerating Cloud ERP adoption. With cloud computing projected to exceed USD 2 trillion by 2030 (Goldman Sachs), enterprises are increasing budgets for subscription-based ERP platforms that offer rapid deployment without heavy upfront capital expenditure, elastic scalability to match business growth or seasonal demand, and seamless integration of AI, advanced analytics, and automation tools. This trend aligns with vendor offerings that emphasize low TCO, modular ERP suites, and cloud-native architectures.

Restraint: Data security risks

Despite the benefits, data security concerns remain a major barrier to cloud ERP adoption. Enterprises are cautious about migrating sensitive financial, customer, and proprietary data to cloud environments due to the risks of unauthorized access, insider threats, and service disruptions, lack of manual patching & reliance on continuous updates, and the risk of security breaches (32.3% of organizations cite security breaches as the primary deterrent). Vendors must address this through zero-trust architectures, end-to-end encryption, compliance certifications, and robust access controls.

Opportunity: Mobile & remote workforce enablement

The rise of remote and hybrid work models is creating new opportunities for cloud ERP platforms. With digital jobs projected to grow 25% by 2030 (WEF), enterprises need ERP systems that support anywhere-access to applications and data for mobile teams, centralized collaboration across departments and geographies, and AI-powered workflows and real-time insights for operational efficiency. This aligns with vendor strategies focused on mobile-first ERP interfaces, cloud collaboration tools, and workflow automation engines.

Challenge:Legacy system integration

Integrating cloud ERP with legacy on-premise systems remains a significant challenge, especially in regulated industries. Key issues include years-old infrastructure with limited API support, compatibility gaps with modern cloud platforms, the risk of operational bottlenecks, security vulnerabilities, and higher implementation costs. Phased or hybrid deployments often delay full realization of cloud ERP benefits. Vendors must offer integration accelerators, middleware solutions, and industry-specific migration frameworks to overcome these hurdles.

Cloud ERP Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Lexington Medical Center modernized its financial operations by transitioning from Oracle PeopleSoft to Oracle Fusion Cloud ERP, leveraging Oracle Soar accelerators to streamline migration and eliminate manual inefficiencies. Key solution features include 40% faster data conversion using Oracle Soar, automated procure-to-pay workflows powered by Intelligent Document Recognition (IDR), digital approvals replacing legacy paper-based processes, and integrated expense reporting for faster reimbursement cycles. | 85% reduction in processing time | Reimbursement cycles shortened from weeks to days | Policy-enforced automated approvals improving compliance | Complete audit trails enhancing financial transparency |

|

TASi Measurement deployed Epicor Kinetic Cloud ERP to unify fragmented systems across 16 global business units, enabling standardized processes, automated financial workflows, and enterprise scalability. Its features include a unified ERP platform across geographies for consistent operations, automated intercompany transactions, and financial workflows. | Optimized space utilization for power infrastructure | Sustainable reliability via long-lasting lithium-ion batteries | Redundant, scalable architecture supporting mission-critical workloads |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent Cloud ERP market companies serve manufacturing, financial & accounting, project-based & services, and sales & order management sectors. These vendors offer comprehensive ERP modules and professional services, leveraging cloud-native architectures, AI-powered analytics, and integrated workflows to ensure process efficiency, real-time insights, and scalable operations across diverse enterprise environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cloud ERP Market, By Offering

The cloud ERP software segment is expected to dominate the market throughout the forecast period, driven by enterprise demand for centralized and real-time data management across departments, automation of mission-critical business processes (including finance, HR, supply chain, and manufacturing), seamless integration with AI, analytics, and enterprise applications, and scalable, multi-location deployment supporting global operations. These capabilities empower organizations to accelerate their digital transformation, improve operational efficiency, and enable data-driven decision-making. Vendors are increasingly offering modular ERP suites, low-code platforms, and industry-specific configurations to meet evolving enterprise needs.

Cloud ERP Market, By Application

Financial Management ERP applications are projected to grow at the fastest rate due to their pivotal role in automating financial operations such as accounts payable/receivable, general ledger, and reconciliations Enhancing financial reporting, real-time visibility, and compliance with global standards, and integrating with other ERP modules for end-to-end business process orchestration. Key features include streamlined procure-to-pay and order-to-cash workflows, real-time dashboards for financial insights and strategic planning, automated expense management and audit-ready reporting, and scalable deployment across multi-site and multi-entity organizations. These solutions are critical for CFOs and finance teams aiming to modernize legacy systems and adopt cloud-native financial platforms.

Cloud ERP Market, By Deployment Type

Hybrid Cloud ERP deployments are projected to grow at the fastest rate, driven by enterprise demand for flexible infrastructure that blends on-premises control with cloud scalability, enhanced data governance and security compliance for sensitive workloads, seamless integration with legacy systems and existing enterprise applications, and optimized cost-performance balance across departments and geographies. This deployment model is particularly favored in manufacturing, IT & ITeS, and healthcare, where multi-site operations, remote workforce enablement, and regulatory compliance are mission-critical.

Cloud ERP Market, By Vertical

The manufacturing sector is expected to hold the largest market share in the Cloud ERP market, as enterprises seek solutions that streamline production planning, shop floor scheduling, and resource allocation, optimize inventory management, procurement, and supply chain operations, provide real-time operational and financial visibility, and integrate with IoT, manufacturing execution systems (MES), and quality control platforms. Cloud ERP platforms enable manufacturers to reduce operational costs, enhance product quality, and scale rapidly across global markets. Key industries driving adoption include automotive, electronics, consumer goods, and industrial manufacturing.

REGION

North America is expected to hold largest market share in the cloud ERP market during the forecast period.

North America is emerging as the dominant region in the global Cloud ERP market, fueled by a combination of enterprise innovation, government support, and technology maturity. Key factors driving this surge include: 1. Technology-Driven Enterprises & Early Adoption Culture North American enterprises are among the earliest adopters of cloud-native ERP platforms, embracing AI, machine learning, and advanced analytics to modernize operations. High digital maturity and a strong focus on data-driven decision-making make the region ideal for intelligent ERP deployments. 2. Government-Led Cloud Modernization Initiatives In 2024, Amazon Web Services (AWS) signed a USD 1 billion agreement with the U.S. Government via the General Services Administration (GSA) to provide cloud credits through 2028. This initiative is accelerating cloud adoption across federal agencies, promoting ERP modernization, cost efficiency, and digital transformation in the public sector. 3. Specialized ERP Solutions for Public Sector Vendors like Oracle are launching tailored offerings such as Oracle Cloud Federal Financials, designed to meet the unique needs of government finance, compliance, and reporting. These solutions enhance transparency, auditability, and policy enforcement, making cloud ERP a strategic fit for public institutions.

Cloud ERP Market: COMPANY EVALUATION MATRIX

SAP (Star) leads the cloud ERP market with a robust global presence, offering comprehensive, industry-specific ERP solutions for manufacturing, IT & ITeS, healthcare, and other sectors. Its scale, continuous innovation in AI, analytics, and cloud-native ERP modules, and extensive implementation network make it a preferred choice for enterprises seeking end-to-end digital transformation. Plex Systems (Emerging Leader) is growing with cloud-based manufacturing ERP solutions, focusing on flexible deployment, real-time shop floor visibility, and rapid scalability. While SAP dominates through breadth, global reach, and enterprise-grade capabilities, Plex Systems shows strong potential in specialized, cloud-native manufacturing applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 87.73 BN |

| Market Forecast in 2029 (Value) | USD 172.74 BN |

| Growth Rate | CAGR of 14.5% from 2024-2029 |

| Years Considered | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering: Software, Professional Services I By Deployment Type: Private Cloud, Public Cloud, Hybrid Cloud I By Application: Financial Management, Project Management, Human Resource Management, Inventory Management, Sales & Order Management, Business Intelligence & Analytics, Supply Chain Management, Other Applications I By Organization Size: Large Enterprises, SMEs I By Vertical: IT & ITeS, Telecommunications, Healthcare & Life Sciences, BFSI, Manufacturing, Retail & E-commerce, Government & Public Sector, Education, Other Verticals |

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Cloud ERP Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | In-depth segmentation of the North American Cloud ERP market and extended regional breakdowns for Europe, Asia Pacific, Middle East & Africa, and Latin America. | Identified high-growth regional opportunities across manufacturing, IT & ITeS, and healthcare & life sciences, driven by: Digital transformation mandates Cloud-first enterprise strategies Regulatory modernization and compliance needs Enabled tailored market entry strategies by mapping localized demand drivers, cloud adoption maturity, and industry-specific ERP requirements Supported optimized resource allocation and investment prioritization based on region-specific trends in: Hybrid cloud deployment AI-enabled ERP adoption Remote workforce enablement |

| Leading Solution Provider (EU) | Detailed profiling of up to 5 additional market players, including: Product portfolios Strategic initiatives Regional presence | Enhanced competitive intelligence to inform strategic planning and go-to-market execution Revealed market gaps and white spaces for differentiation and innovation Supported targeted growth initiatives by aligning: Product development with unmet customer needs Sales strategies with emerging demand clusters across verticals and geographies |

RECENT DEVELOPMENTS

- February 2025 : SAP announced the “SAP ERP, private edition, transition option”, launching in Q2 2025, to support large enterprises migrating from legacy SAP ERP systems to SAP Cloud ERP. This initiative reflects rising demand for flexible migration paths, customized cloud environments, and ongoing vendor support, especially among large enterprises with complex IT landscapes.

- February 2025 : Miraka, a Maori-owned sustainable milk company, partnered with Rockwell Automation to deploy Plex ERP, enhancing efficiency, sustainability, and agility across its farm-to-customer operations. This highlights the increasing adoption of industry-specific cloud ERP solutions in agriculture and food manufacturing, driven by sustainability goals and supply chain digitization.

- January 2025 : Sage partnered with Tractics to integrate Sage Intacct Construction with Tractics’ cloud-native platform, offering real-time updates, financial visibility, and workflow automation for heavy civil contractors. The construction sector is embracing cloud ERP to manage project complexity, compliance, and cost control, especially in infrastructure-heavy regions.

- Novemeber 2024 : Icertis deepened its collaboration with Microsoft to integrate Gen AI-powered contract intelligence into Dynamics 365 Supply Chain Management, helping enterprises control costs, mitigate risks, and enhance supplier relationships. The integration of generative AI into ERP platforms is a major catalyst for growth, enabling smarter decision-making and automated contract lifecycle management.

- October 2024 : Epicor acquired Acadia Software to enhance its ERP offerings with real-time insights, digital work instructions, and task management tools for frontline workers. This reflects the growing need for worker-centric ERP features in manufacturing and supply chain operations, supporting continuous improvement and operational agility.

Table of Contents

Methodology

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the global cloud ERP market. A few other market-related reports and analyses published by various industry associations and consortiums, such as the National Security Agency (NSA) and SC Magazine, were considered while doing the extensive secondary research. The primary sources were mainly the industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of this industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the prospects. The market has been estimated by analyzing various driving factors, such as improving organizational compliance requirements, enhancing operational efficiency, and requiring simplified workflows to eliminate bottlenecks.

Secondary Research

The market size of companies offering cloud ERP was arrived at based on secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain essential information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the cloud ERP market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various technologies-related trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of governments/end users using cloud ERP and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall cloud ERP market.

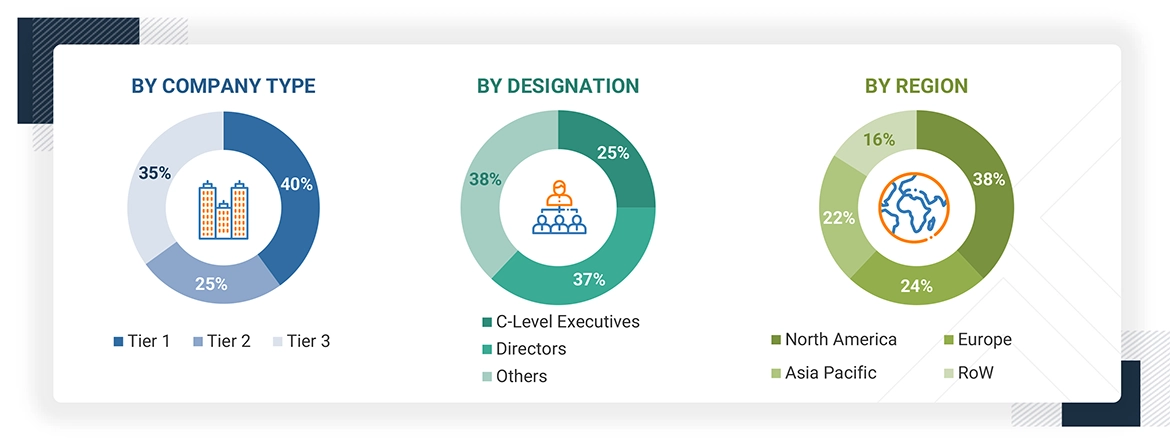

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range between USD 1 and 10 billion; and tier 3 companies' revenues range between USD 500 million and 1 billion

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The cloud ERP and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

- We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Cloud ERP Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines a Cloud ERP (Enterprise Resource Planning) as a software solution that enables businesses to manage core operations such as finance, supply chain, manufacturing, human resources, and customer relationships through a cloud-based platform. Unlike traditional on-premises ERP systems, cloud ERP is hosted on remote servers and accessed via the Internet, reducing the need for costly hardware and IT maintenance. It offers real-time data access, scalability, and seamless integration with other cloud applications, improving operational efficiency and decision-making. Businesses benefit from automatic updates, enhanced security, and lower upfront costs, making it ideal for companies of all sizes.

Stakeholders

- Cloud ERP provider

- Implementation Partners & System Integrators

- Enterprise Customers

- Technology Infrastructure Providers

- Regulatory Bodies & Compliance Organizations

- Consulting & Advisory Firms

- Investors & Venture Capitalists

- End Users & Employees

- Open-source & Niche ERP Developers

- Cloud service providers

Report Objectives

- To define, describe, and forecast the global cloud ERP market based on offering (software and professional services), deployment type (private cloud, public cloud, and hybrid cloud), and applications (financial management, project management, human resource management, inventory management, sales & order management, business intelligence & analytics, supply chain management and other application, vertical (IT & ITES, telecommunications, BFSI, healthcare & life science, manufacturing, retail & e-commerce, government & public sector, education and other verticals) and region.

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/GenAI on the global cloud ERP market.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market.

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the cloud ERP market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

Key clients adopting the cloud ERP platforms include: -

- Cloud ERP Provider

- Implementation Partners & System Integrators

- Enterprise Customers

- Technology Infrastructure Providers

- Regulatory Bodies & Compliance Organizations

- Consulting & Advisory Firms

- Investors & Venture Capitalists

- End Users & Employees

- Open Source & Niche ERP Developers

- Cloud Service Providers

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cloud ERP Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cloud ERP Market