Telecom Managed Services Market by Service Type (Managed Data Center, Managed Network, Managed Data and Information, Managed Mobility, Managed Communication, and Managed Security), Organization Size, and Region - Global Forecast to 2022

[146 Pages Report] The telecom managed services market size is expected to grow from USD 11.90 billion in 2017 to USD 22.58 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.7%. Managed services is a common phenomenon for CSPs to move their Capital Expenditure (CapEx) model to Operational Expenditure (OpEx) model in order to achieve operational efficiency in the business processes. It also helps CSPs to focus on their core business activities and take a new role in the value chain with new business model. In managed services, enterprises outsourced their business operation specifically services related to ICT ecosystem on Service Level Agreements (SLA). It basically includes maintenance and operation of the day-to-day business processes of enterprises network infrastructure and services. The base year considered for the study is 2016 and the forecast period has been determined from 2017 to 2022.

Market Dynamics

Drivers

- Cost reduction in managing enterprise infrastructure

- Improved operational efficiency, reliability, and agility in the business process

- Better focus on core business and core activities

- Minimize the risks associated with business operations in terms of security

Restraints

- Concerns over revealing the confidential info to MSPs

- Lack of awareness regarding internal and external threats

Opportunities

- Convergence in the tech industry

- Emerging trends such as mobility, BYOD, IoT, and 5G

Challenges

- Impact of cloud managed service providers

- Ensuring the optimum business functionality of the customers

Cost reduction in managing enterprise infrastructure

The businesses are growing rapidly at a higher pace, due to which, enterprises are steadily relying on MSPs. An MSP helps enterprises to achieve high business outcomes by providing a high level of services. The enterprises are facing a lot of challenges in terms of revenue, cost implementation, business transformation, and increased competition in the marketplace in the telecommunications sector due to which they have decided to rely on MNOs and CSPs. The service provider maintains all the network infrastructure at a very low price. It also helps them to move costs from CapEx to OpEx with a greater flexibility. Cost reduction is one of the main drivers that enterprises are opting for adopting telecom managed services market.

The objectives of the report are

- To define, describe, and forecast the telecom managed services market on the basis of service types, organization sizes, and regions.

- To provide detailed information regarding the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To track and analyze the market scenario on the basis of technological developments, product launches, and mergers & acquisitions

- To forecast the market size of market segments with respect to five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

This research study involves extensive usage of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial aspects of the market. The below points explain the research methodology:

- Analysis of the telecom managed services market begins with capturing data on key vendor revenues through secondary research sources such as company websites, white papers, blogs, and annual reports

- Market coverage includes telecom managed services vendors such as Ericsson, Huawei, IBM, Cisco, and Nokia Corporation who are changing their offerings to meet new customer expectations

- Insights through in-depth interviews with the top management and thought leaders of the organization are taken into account

- The vendor offerings are also taken into consideration to determine the market segmentation

- The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the telecom managed services market

- Overall market size values are finalized by triangulation with the supply side data, which include the product developments, supply chain, and value chain of telecom managed services across the globe

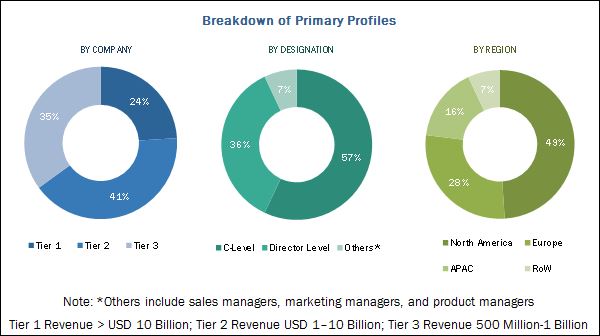

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below shows the breakdown of the primaries on the basis of company, designation, and region, conducted during the research study.

The figure below shows the break-down of the primaries on the basis of the company, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The major vendors in the telecom managed services market are Accenture (Ireland), Amdocs (US), AT&T (US), CenturyLink (US), Cisco (US), Comarch (Poland), Comcast (US), Ericsson (Sweden), Fujitsu (Japan), GTT (US), Huawei (China), IBM (US), Juniper Networks (US), Motorola (US), Nokia Corporation (Finland), NTT Data (Japan), Sprint (US), Tech Mahindra (India), Unisys (US), Verizon (US), Vodafone (UK), Windstream (US), Wipro (India), Zayo (US), and ZTE Corporation (China).

Major Market Developments

- In 2015, Cisco and Telecom Italia entered into a partnership in which Telecom Italia provided new Cisco-enabled managed business services, including Cisco Meraki, to organizations all over Italy as a part of its advanced LAN management offering.

- In 2014, Ericsson entered into an agreement with Reliance Communications Limited for seven-year in order to operate and manage their wireline and wireless networks across India for 2G, CDMA, and 3G mobile networks.

Key Target Audience for Telecom Managed Services Market

- Communications Service Provider

- Managed Service Providers

- Consultants

- Government Agencies

- IT Security Agencies

- Mobile Network Operators

- Mobile Virtual Network Operators

- Infrastructure Architects

- Open-Source Platform Providers

- System Integrators

- External Service Providers

Scope of the Telecom Managed Services Market Research Report

The report is broadly segmented into services type, organization size, and region.

Service Type

- Managed Data Center

- Managed Network Services

- Managed Data and Information Services

- Managed Mobility Services

- Managed Communications Services

- Managed Security Services

Organization Size

- Small and Medium-sized Enterprises

- Large Enterprises

Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC market into countries contributing 75% to the regional market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries contributing 75% to the regional market size

- Further breakdown of the MEA market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (Up to 5).

The telecom managed services market is expected to grow from USD 11.90 billion in 2017 to USD 22.58 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.7%. The cost reduction in managing enterprise infrastructure, management of business outcomes and core activities, and minimizing the risk associated with business operation in terms of security has led to the increased demand for telecom managed services solutions.

The telecom sector has changed dramatically in the recent years, in terms of advancement in technologies, penetration of data services, tech-savvy customers, and mergers and acquisitions of the key players, which enforced CSPs to realign their business models to deliver a high Quality of Service (QoS) to the customers and achieve a viable growth in business. The industry needs to strengthen its business strategies owing to increased competition from Over-The-Top (OTT) players, high cost of network infrastructure, decline in the core revenue, and business transformation.

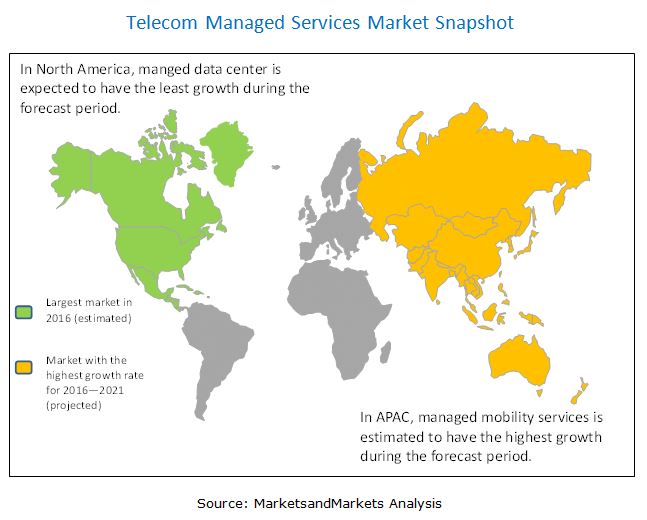

The telecom managed services market has been segmented on the basis of service types, organization sizes, and regions. The managed mobility services segment is expected to grow at the highest CAGR during the forecast period, while the managed data center segment is estimated to have the largest market size in 2016, in the market. Enterprise mobility is prevalent in the organization due to the increasing trend of BYOD and Corporate Owned Personal Device (COPD) across the globe. It is very important for the enterprises to have more focus towards the management and security of mobility devices. The key trends which are driving this market include growing consumption in productivity applications, workforce decentralization, globalization of business, prominence of cloud-based enterprise mobility management, and robust environment for smartphones and tablets across the organizations.

The Small and Medium Enterprises (SMEs) segment is expected to grow at the highest CAGR in the telecom managed services market during the forecast period. With the increasing number of SMEs worldwide, the requirement of managed services is also increasing. The SMEs has the limited in-house network and IT infrastructure capabilities; therefore, they mostly prefer to be outsourced managed service from service providers. Managed services have become the central part of the business process due to its flexibility and ease of use and are expected to grow in the coming years.

Cost reduction in managing enterprise infrastructure is driving the overall growth of the telecom managed service market

Managed data center

The demand for managing data center services is increasing across all regions. With the proliferation of smartphones and tablets across enterprises, and the increased use of social media in the consumer segment have produced a huge amount of data. In addition, IoT is another major area where the amount of data has been generating exponentially day by day, thus increasing the demand for high-speed processors and storage.

Managed colocation

Colocation is a data center facility, which is also known as Colo. It is a process of keeping the network equipment, servers, and other data center-related hardware on different locations apart from its own data center, which is known as colocation center. Businesses mostly prefer to rent spaces for servers, racks, and other devices in colocation centers, which is beneficial to them in terms of cost. A colocation center provider would offer a range of benefits to its customers, such as cooling system facility for equipment, higher bandwidth, IP allocation, and power required for the equipment.

Managed hosting

In managed hosting, the managed hosting provider has its own dedicated hardware and servers, which is utilized by the enterprise customers. The hardware and servers are installed on customer premises, managed and maintained by the managed hosting provider. Managed hosting helps the enterprise customers to proactively manage and run the IT infrastructure by emphasizing on fundamental business processes.

Managed storage

In todays digital era, the data is the most important aspect of enterprises. It is very necessary for business processes to ensure that the data becomes available at any time, whenever required. Managed storage is the process of offloading enterprise data storage to MSPs storage. Basically, the enterprise data has been stored on third-party servers, which are managed and maintained by the managed storage service provider. The enterprise customers do not require dedicated servers to store their data while employing managed storage

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the leading service areas of telecom managed services market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

North America is estimated to have the largest market share in 2016, whereas the Asia Pacific (APAC) region is expected to grow at the highest CAGR from 2016 to 2022 in the telecom managed services market. The growth in the market size of North America is driven by technological advancement and its adoption in telecom sector is not an exception. Managed business services and network services are expected to see huge growth in this region due to the convergence of IT and telecom sector in the region. The growth in APAC is mainly driven by increasing internet and mobile services and establishments of new data centers in China, India, Singapore, and Australia. Managed service provider offers an extensive set of services such as data center services, security services, BSS/OSS services, and mobility services, which will benefit the enterprise's customer.

Cost reduction in managing enterprise infrastructure, minimize risk associated with business operations in terms of security, and increased operational efficiency of business systems are the prime factors that are driving the adoption of the telecom managed services market. However, concerns over revealing the confidential information to MSPs and ensuring the optimum business functionality of the customers are acting as challenges in the adoption of telecom managed services solutions.

The 15 players profiled in the market include top vanguards, innovators, dynamic, and emerging. The companies are Amdocs (Missouri, US), AT&T (Texas, US), CenturyLink (Louisiana, US), Cisco Systems, Inc. (California, US), Comarch S.A. (Krakσw, Poland), Ericsson AB (Stockholm, Sweden), GTT Communications, Inc. (Virginia, US), Huawei Technologies Co., Ltd. (Shenzhen, China), IBM (New York, US), NTT Data (Tokyo, Japan), Sprint.com (Kansas, US), Tech Mahindra (Mumbai, India), Unisys (Pennsylvania, US), Verizon (New York, US), and Windstream (Arkansas, US). These players have adopted various strategies such as new product developments; mergers & acquisitions; partnerships, agreements, contracts, and collaborations; and business expansions to cater to the telecom managed services market.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Research Data

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.2.1 Breakdown of Primaries

2.2.2.2 Key Industry Insights

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Research Assumptions and Limitations

2.4.1 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Telecom Managed Services Market

4.2 Market, By Region, 20172022

4.3 Market, By Service Type, 20172022

4.4 Lifecycle Analysis, By Region, 20172022

5 Telecom Managed Services Market Overview and Industry Trends (Page No. - 36)

5.1 Introduction

5.2 Strategic Benchmarking

5.3 Innovation Spotlight

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Cost Reduction in Managing Enterprise Infrastructure

5.4.1.2 Improved Operational Efficiency, Reliability, and Agility in the Business Process

5.4.1.3 Better Focus on Core Business and Core Activities

5.4.1.4 Minimize the Risks Associated With Business Operations in Terms of Security

5.4.2 Opportunities

5.4.2.1 Convergence in the Tech Industry

5.4.2.2 Emerging Trends Such as Mobility, BYOD, IoT, and 5G

5.4.3 Challenges

5.4.3.1 Impact of Cloud Managed Service Providers

5.4.3.2 Ensuring the Optimum Business Functionality of the Customers

5.4.4 Restraints

5.4.4.1 Concerns Over Revealing the Confidential Info to MSP's

6 Telecom Managed Services Market Analysis, By Service Type (Page No. - 42)

6.1 Introduction

6.2 Managed Data Center

6.2.1 Managed Colocation

6.2.2 Managed Hosting

6.2.3 Managed Storage

6.3 Managed Network Services

6.3.1 Managed Network Monitoring and Maintenance

6.3.2 Managed MPLS and VPN

6.3.3 Others

6.4 Managed Data and Information Services

6.4.1 Managed OSS/BSS

6.4.2 Managed Database

6.4.3 Others

6.5 Managed Mobility Services

6.5.1 Managed Device Management

6.5.2 Managed Application Management

6.5.3 Managed Content Management

6.6 Managed Communication Services

6.7 Managed Security Services

6.7.1 Threat Management

6.7.2 Vulnerability Management

6.7.3 Compliance Management

6.7.4 Incident Management

6.7.5 Others

7 Telecom Managed Services Market Analysis, By Organization Size (Page No. - 65)

7.1 Introduction

7.2 Small and Medium Enterprises

7.3 Large Enterprises

8 Geographic Analysis (Page No. - 69)

8.1 Introduction

8.2 North America

8.3 Europe

8.4 Asia Pacific

8.5 Middle East and Africa

8.6 Latin America

9 Competitive Landscape (Page No. - 93)

9.1 Introduction

9.1.1 Vanguards

9.1.2 Innovators

9.1.3 Dynamic

9.1.4 Emerging

9.2 Competitive Benchmarking

9.2.1 Business Strategies

10 Company Profiles (Page No. - 97)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.1 Cisco Systems, Inc.

10.2 Ericsson AB

10.3 Huawei Technologies Co., Ltd.

10.4 International Business Machines Corporation

10.5 Verizon Communications Inc.

10.6 AT&T Inc.

10.7 Centurylink

10.8 NTT Data Corporation

10.9 Comarch SA

10.10 GTT Communications, Inc.

10.11 Sprint.Com

10.12 Unisys

10.13 Amdocs Inc.

10.14 Tech Mahindra Limited

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 139)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (79 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Telecom Managed Services Market Size, By Service Type, 20172022 (USD Million)

Table 3 Managed Data Center Market Size, By Type, 20172022 (USD Million)

Table 4 Managed Data Center Market Size, By Region, 20172022 (USD Million)

Table 5 Managed Colocation: Managed Data Center Market Size, By Region, 20172022 (USD Million)

Table 6 Managed Hosting: Managed Data Center Market Size, By Region, 20172022 (USD Million)

Table 7 Managed Storage: Managed Data Center Market Size, By Region, 20172022 (USD Million)

Table 8 Managed Network Services Market Size, By Type, 20172022 (USD Million)

Table 9 Managed Network Services Market Size, By Region, 20172022 (USD Million)

Table 10 Managed Network Monitoring and Maintenance: Managed Network Services Market Size, By Region, 20172022 (USD Million)

Table 11 Managed MPLS and VPN: Managed Network Services Market Size, By Region, 20172022 (USD Million)

Table 12 Others: Managed Network Services Market Size, By Region, 20172022 (USD Million)

Table 13 Managed Data and Information Services Market Size, By Type, 20172022 (USD Million)

Table 14 Managed Data and Information Services Market Size, By Region, 20172022 (USD Million)

Table 15 Managed OSS/BSS: Managed Data and Information Services Market Size, By Region, 20172022 (USD Million)

Table 16 Managed Database: Managed Data and Information Services Market Size, By Region, 20172022 (USD Million)

Table 17 Others: Managed Data and Information Services Market Size, By Region, 20172022 (USD Million)

Table 18 Telecom Managed Services Market Mobility Services Market Size, By Type, 20172022 (USD Million)

Table 19 Managed Mobility Services Market Size, By Region, 20172022 (USD Million)

Table 20 Managed Device Management: Managed Mobility Services Market Size, By Region, 20172022 (USD Million)

Table 21 Managed Application Management: Managed Mobility Services Market Size, By Region, 20172022 (USD Million)

Table 22 Managed Content Management: Managed Mobility Services Market Size, By Region, 20172022 (USD Million)

Table 23 Managed Communication Services Market Size, By Region, 20172022 (USD Million)

Table 24 Managed Security Services Market Size, By Type, 20172022 (USD Million)

Table 25 Managed Security Services Market Size, By Region, 20172022 (USD Million)

Table 26 Threat Management: Managed Security Services Market Size, By Region, 20172022 (USD Million)

Table 27 Vulnerability Management: Managed Security Services Market Size, By Region, 20172022 (USD Million)

Table 28 Compliance Management: Managed Security Services Market Size, By Region, 20172022 (USD Million)

Table 29 Incident Management: Managed Security Services Market Size, By Region, 20172022 (USD Million)

Table 30 Others: Managed Security Services Market Size, By Region, 20172022 (USD Million)

Table 31 Telecom Managed Services Market Size, By Organization Size, 20172022 (USD Million)

Table 32 Small and Medium-Sized Enterprises: Market Size, By Region, 20172022 (USD Million)

Table 33 Large Enterprises: Market Size, By Region, 20172022 (USD Million)

Table 34 Market Size, By Region, 20172022 (USD Million)

Table 35 North America: Telecom Managed Services Market Size, By Country, 20172022 (USD Million)

Table 36 North America: Market Size, By Service Type, 20172022 (USD Million)

Table 37 North America: Market Size, By Managed Data Center, 20172022 (USD Million)

Table 38 North America: Market Size, By Managed Network Service, 20172022 (USD Million)

Table 39 North America: Market Size, By Managed Data and Information Service, 20172022 (USD Million)

Table 40 North America: Market Size, By Managed Mobility Service, 20172022 (USD Million)

Table 41 North America: Market Size, By Managed Communication Service, 20172022 (USD Million)

Table 42 North America: Market Size, By Managed Security Service, 20172022 (USD Million)

Table 43 North America: Market Size, By Organization Size, 20172022 (USD Million)

Table 44 Europe: Telecom Managed Services Market Size, By Country, 20172022 (USD Million)

Table 45 Europe: Market Size, By Service Type, 20172022 (USD Million)

Table 46 Europe: Market Size, By Managed Data Center, 20172022 (USD Million)

Table 47 Europe: Market Size, By Managed Network Service, 20172022 (USD Million)

Table 48 Europe: Market Size, By Managed Data and Information Service, 20172022 (USD Million)

Table 49 Europe: Market Size, By Managed Mobility Service, 20172022 (USD Million)

Table 50 Europe: Market Size, By Managed Communication Service, 20172022 (USD Million)

Table 51 Europe: Market Size, By Managed Security Service, 20172022 (USD Million)

Table 52 Europe: Market Size, By Organization Size, 20172022 (USD Million)

Table 53 Asia Pacific: Telecom Managed Services Market Size, By Country, 20172022 (USD Million)

Table 54 Asia Pacific: Market Size, By Service Type, 20172022 (USD Million)

Table 55 Asia Pacific: Market Size, By Managed Data Center, 20172022 (USD Million)

Table 56 Asia Pacific: Market Size, By Managed Network Service, 20172022 (USD Million)

Table 57 Asia Pacific: Market Size, By Managed Data and Information Service, 20172022 (USD Million)

Table 58 Asia Pacific: Market Size, By Managed Mobility Service, 20172022 (USD Million)

Table 59 Asia Pacific: Market Size, By Managed Communication Service, 20172022 (USD Million)

Table 60 Asia Pacific: Market Size, By Managed Security Service, 20172022 (USD Million)

Table 61 Asia Pacific: Market Size, By Organization Size, 20172022 (USD Million)

Table 62 Middle East and Africa: Telecom Managed Services Market Size, By Subregion, 20172022 (USD Million)

Table 63 Middle East and Africa: Market Size, By Service Type, 20172022 (USD Million)

Table 64 Middle East and Africa: Market Size, By Managed Data Center, 20172022 (USD Million)

Table 65 Middle East and Africa: Market Size, By Managed Network Service, 20172022 (USD Million)

Table 66 Middle East and Africa: Market Size, By Managed Data and Information Service, 20172022 (USD Million)

Table 67 Middle East and Africa: Market Size, By Managed Mobility Service, 20172022 (USD Million)

Table 68 Middle East and Africa: Market Size, By Managed Communication Service, 20172022 (USD Million)

Table 69 Middle East and Africa: Market Size, By Managed Security Service, 20172022 (USD Million)

Table 70 Middle East and Africa: Market Size, By Organization Size, 20172022 (USD Million)

Table 71 Latin America: Telecom Managed Services Market Size, By Country, 20172022 (USD Million)

Table 72 Latin America: Market Size, By Service Type, 20172022 (USD Million)

Table 73 Latin America: Market Size, By Managed Data Center, 20172022 (USD Million)

Table 74 Latin America: Market Size, By Managed Network Service, 20172022 (USD Million)

Table 75 Latin America: Market Size, By Managed Data and Information Service, 20172022 (USD Million)

Table 76 Latin America: Market Size, By Managed Mobility Service, 20172022 (USD Million)

Table 77 Latin America: Market Size, By Managed Communication Service, 20172022 (USD Million)

Table 78 Latin America: Market Size, By Managed Security Service, 20172022 (USD Million)

Table 79 Latin America: Market Size, By Organization Size, 20172022 (USD Million)

List of Figures (72 Figures)

Figure 1 Global Telecom Managed Services Market: Market Segmentation

Figure 2 Regional Scope

Figure 3 Global Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Telecom Managed Services Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Managed Mobility Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Managed Colocation Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 11 North America is Estimated to Hold the Largest Market Share in 2017

Figure 12 Cost Reduction in Managing Enterprise Infrastructure is Driving the Overall Growth of the Market in the Forecast Period

Figure 13 Asia Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 14 Managed Mobility Services Segment is Expected to Have the Highest CAGR in the Telecom Managed Services Market During the Forecast Period

Figure 15 Regional Lifecycle: Asia Pacific is Expected to Exhibit the Highest Growth Potential During the Forecast Period

Figure 16 Market Investment Scenario: Asia Pacific is Expected to Rise as the Best Opportunity Market for Investment in the Next 5 Years

Figure 17 Strategic Benchmarking: Partnerships and Agreements of the Top Vendors

Figure 18 Telecom Managed Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Managed Mobility Services Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 20 Managed Colocation Services Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 21 Managed Network Monitoring and Maintenance Services Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 22 Managed Database Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 23 Managed Content Management Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 24 Compliance Management Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 25 Small and Medium-Sized Enterprises Segment is Expected to Exhibit the Highest CAGR in the Forecast Period

Figure 26 Asia Pacific is Expected to Exhibit the Highest CAGR in the Telecom Managed Services Market During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Microquadrant

Figure 30 Product Offerings

Figure 31 Cisco Systems, Inc.: Company Snapshot

Figure 32 Cisco Systems, Inc.: Product Offering Scorecard

Figure 33 Cisco Systems, Inc.: Business Strategy Scorecard

Figure 34 Ericsson AB: Company Snapshot

Figure 35 Ericsson AB: Product Offering Scorecard

Figure 36 Ericsson AB: Business Strategy Scorecard

Figure 37 Huawei Technologies Co., Ltd.: Company Snapshot

Figure 38 Huawei Technologies Co., Ltd.: Product Offering Scorecard

Figure 39 Huawei Technologies Co., Ltd.: Business Strategy Scorecard

Figure 40 International Business Machines Corporation: Company Snapshot

Figure 41 International Business Machines Corporation: Product Offering Scorecard

Figure 42 International Business Machines Corporation: Business Strategy Scorecard

Figure 43 Verizon Communications Inc.: Company Snapshot

Figure 44 Verizon Communications Inc: Product Offering Scorecard

Figure 45 Verizon Communications Inc: Business Strategy Scorecard

Figure 46 AT&T Inc.: Company Snapshot

Figure 47 AT&T Inc.: Product Offering Scorecard

Figure 48 AT&T Inc.: Business Strategy Scorecard

Figure 49 Centurylink: Company Snapshot

Figure 50 Centurylink: Product Offering Scorecard

Figure 51 Centurylink: Business Strategy Scorecard

Figure 52 NTT Data Corporation: Company Snapshot

Figure 53 NTT Data Corporation: Product Offering Scorecard

Figure 54 NTT Data Corporation: Business Strategy Scorecard

Figure 55 Comarch SA: Company Snapshot

Figure 56 Comarch SA: Product Offering Scorecard

Figure 57 Comarch SA: Business Strategy Scorecard

Figure 58 GTT Communications, Inc.: Company Snapshot

Figure 59 GTT Communications, Inc.: Product Offering Scorecard

Figure 60 GTT Communications, Inc.: Business Strategy Scorecard

Figure 61 Sprint.Com: Company Snapshot

Figure 62 Sprint.Com: Product Offering Scorecard

Figure 63 Sprint.Com: Business Strategy Scorecard

Figure 64 Unisys: Company Snapshot

Figure 65 Unisys: Product Offering Scorecard

Figure 66 Unisys: Business Strategy Scorecard

Figure 67 Amdocs Inc.: Company Snapshot

Figure 68 Amdocs Inc.: Product Offering Scorecard

Figure 69 Amdocs Inc.: Business Strategy Scorecard

Figure 70 Tech Mahindra Limited: Company Snapshot

Figure 71 Tech Mahindra Limited: Product Offering Scorecard

Figure 72 Tech Mahindra Limited: Business Strategy Scorecard

Growth opportunities and latent adjacency in Telecom Managed Services Market