Telepresence (Videoconferencing) Market by Component (Hardware, Software and Service), System Type (immersive Telepresence, Personal Telepresence, Holographic Telepresence, and Robotic Telepresence), Industry, and Geography - Global Forecast to 2022

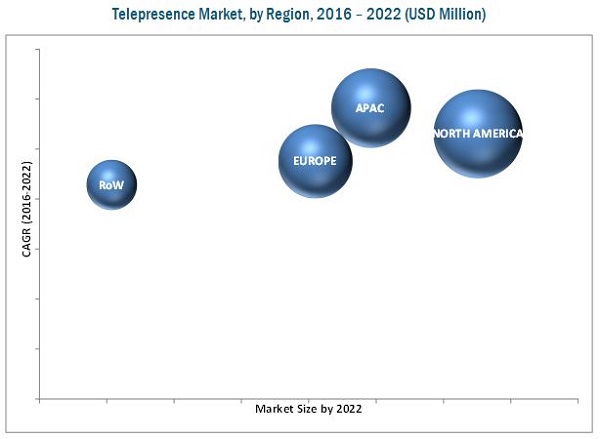

The global telepresence market is expected to reach USD 2.63 Billion by 2022 at a CAGR of 19.6% during the forecast period. In this report, 2015 has been considered as the base year, and the period from 2016 to 2022 has been considered as the forecast period for the study of the telepresence market. The objective of the study of this report is to define, describe, and forecast the global telepresence market on the basis of system type, component & service, industry, and geography. The report also forecasts the market size of various segments with regard to industries and regions. The market based on geography is segmented into North America, Europe, Asia-Pacific, and RoW. Additionally, the report provides detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The opportunities have been analyzed for stakeholders by identifying the high-growth segments of the global telepresence market. The report also profiles key players and comprehensively analyzes their market ranking and core competencies along with detailing the competitive landscape.

The global telepresence market is expected to grow at a CAGR of 19.6% and reach USD 2.63 Billion by 2022. Telepresence helps in lowering the travel costs in small and large enterprises. Also, the growing demand of immediate assistance to the remote patient in the healthcare industry is driving the growth of the overall telepresence market.

Telepresence market is segmented on the basis of component & service into hardware, software, and service. Hardware components held the largest market share in 2015. These include displays, projectors, cameras, sensors, audio devices, lightings, and others.

Telepresence has applications in industries such as healthcare, commercial, consumer, education, manufacturing and others as they help reduce costs and the wastage of productive time in the long run. The enterprise sector held the largest market share in 2015 due to the increasing implementation of these systems across small and large businesses.

The APAC region holds the largest share; it is expected to witness the highest growth rate between 2016 and 2022. The increase in start-ups in this region would also help in market growth.

High initial investments and installation costs are a major restraint for the growth of the telepresence market. High costs are required to design and develop remote telepresence systems for a user to be able to experience a close-to-real presence of a person in another location; these require high-quality video devices. Also, for efficient communication through telepresence, secure data transmission is required, for which firewalls and security software need to be installed. These add to the cost of the system. These factors increase the total cost of a system and its implementation.

Cisco Systems, Inc. (U.S.) is leader in the telepresence market and has played a significant role in the development and promotion of this technology. The company provides communication and collaboration services to its customers. The company offers a wide range of innovative telepresence products that integrate voice, video, data, and software apps. Cisco’s telepresence systems support the H.265 standard for communication that helps users attain high-speed networking; this strengthens the company’s position in the networking market. The company’s innovative technologies enhance its productivity and brand image worldwide. Cisco Systems focuses on strategic acquisitions to expand its business. For instance, in November 2015, the company acquired Acano Ltd. (U.K.). This acquisition would help the company grow dynamically in the telepresence market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency and Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.2 Key Industry Insights

2.3.3 Breakdown of Primaries

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown & Data Triangulation

2.6 Research Assumptions

2.6.1 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Growth Opportunities in the Telepresence Market

4.2 Telepresence Market, By Type

4.3 Telepresence Market, 2015

4.4 U.S. Held the Largest Share of the Telepresence Market

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Evolution of Telepresence

5.3 Market Segmentation

5.3.1 Telepresence Market, By System Type

5.3.2 Telepresence Market, By Component & Service

5.3.3 Telepresence Market, By Industry

5.3.4 Telepresence Market, By Geography

5.3.5 Drivers

5.3.5.1 Growing Need to Reduce Traveling Costs in Small and Large Enterprises

5.3.5.2 Growing Demand for Robotic Telepresence in the Healthcare Industry

5.3.6 Restraints

5.3.6.1 High Initial Investments and Installation Costs

5.3.6.2 Issues Related to Low-Bandwidth Telepresence Systems

5.3.7 Opportunities

5.3.7.1 Development of Screenless Telepresence Systems Using Holograms

5.3.7.2 Advancements and Upgrades in Telepresence Systems

5.3.8 Challenges

5.3.8.1 Communication Delays Due to Networking Issues

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Model

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Market, By Component & Service (Page No. - 50)

7.1 Introduction

7.2 Hardware

7.2.1 Displays

7.2.2 Projectors

7.2.3 Camera

7.2.3.1 Ptz Camera

7.2.3.2 Usb Camera

7.2.3.3 Others

7.2.4 Sensors

7.2.5 Audio Device

7.2.5.1 Conference Phones

7.2.5.2 Desktop Phones

7.2.5.3 Microphones

7.2.5.4 Speakers

7.2.6 Lighting

7.2.7 Processors

7.2.8 Interfaces

7.2.8.1 Graphical User Interface

7.2.8.2 Touch Control Interface

7.2.8.3 Browser-Based Interface

7.2.9 Others

7.2.9.1 Switches

7.2.9.2 Routers

7.2.9.3 Adapters

7.2.9.4 Cables

7.3 Software

7.3.1 Cloud Computing Software

7.3.2 Audio-Video Communication Software

7.3.3 Server

7.4 Services

8 Telepresence Market, By System Type (Page No. - 59)

8.1 Introduction

8.2 Static Telepresence

8.2.1 Immersive Telepresence

8.2.2 Personal Telepresence

8.2.3 Holographic Telepresence

8.3 Remote Telepresence Systems

8.3.1 Robotic Telepresence Systems

9 Telepresence Market, By Industry (Page No. - 81)

9.1 Introduction

9.2 Enterprise Industry

9.2.1 Government

9.2.2 Private

9.3 Healthcare Industry

9.4 Commercial Industry

9.4.1 Retail

9.4.2 Advertisement

9.4.3 Designing

9.5 Consumer Industry

9.5.1 Sports

9.5.2 Entertainment

9.6 Education Industry

9.7 Manufacturing Industry

9.7.1 Energy

9.8 Other Industries

9.8.1 Construction

9.8.2 Engineering

9.8.3 Space Application

10 Telepresence Market, By Geography (Page No. - 99)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 Rest of the World

10.5.1 Middle East and Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 112)

11.1 Introduction

11.2 Market Ranking of Key Players in the Telepresence Market

11.3 Competitive Analysis

11.4 Recent Developments

11.4.1 New Product Developments: Telepresence Market

11.4.2 Agreements, Partnerships, Joint Ventures, Collaborations, & Expansions

11.4.3 Mergers & Acquisitions

11.4.4 Others

12 Company Profile (Page No. - 121)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Cisco Systems, Inc.

12.3 Polycom, Inc.

12.4 Huawei Technologies Co., Ltd.

12.5 ZTE Corp.

12.6 Lifesize, Inc.

12.7 Avaya Inc.

12.8 Vidyo Inc.

12.9 VGO Communications, Inc.

12.10 Teliris Inc.

12.11 Array Telepresence, Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 144)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customization

13.6 Related Reports

List of Tables (68 Tables)

Table 1 Global Telepresence Market, By Component & Service, 2013–2022 (USD Million)

Table 2 Global Telepresence Market for Hardware Component, By System Type, 2013–2022 (USD Million)

Table 3 Telepresence Market, By System Type, 2013–2022 (USD Million)

Table 4 Telepresence Market for Static Telepresence Systems, By Industry, 2013–2022 (USD Million)

Table 5 Telepresence Market for Immersive Telepresence Systems, By Industry, 2013–2022 (USD Million)

Table 6 Immersive Telepresence Systems Market for Enterprise Industry, By Region, 2013–2022 (USD Million)

Table 7 Immersive Telepresence Systems Market for Healthcare Industry, By Region, 2013–2022 (USD Million)

Table 8 Immersive Telepresence Systems Market for Commercial Industry, By Region, 2013–2022 (USD Million)

Table 9 Immersive Telepresence Systems Market for Consumer Industry, By Region, 2013–2022 (USD Million)

Table 10 Immersive Telepresence Systems Market for Manufacturing Industry, By Region, 2013–2022 (USD Million)

Table 11 Immersive Telepresence Systems Market for Education Industry, By Region, 2013–2022 (USD Million)

Table 12 Immersive Telepresence Systems Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 13 Personal Telepresence Systems Market, By Industry, 2013–2022 (USD Million)

Table 14 Personal Telepresence Systems Market for Healthcare Industry, By Region, 2013–2022 (USD Million)

Table 15 Personal Telepresence Systems Market for Consumer Industry, By Region, 2013–2022 (USD Million)

Table 16 Personal Telepresence Systems Market for Manufacturing Industry, By Region, 2013–2022 (USD Million)

Table 17 Personal Telepresence Systems Market for Education Industry, By Region, 2013–2022 (USD Million)

Table 18 Personal Telepresence Systems Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 19 Holographic Telepresence Systems Market , By Industry, 2013–2022 (USD Million)

Table 20 Holographic Telepresence Systems Market for Enterprise Industry, By Region, 2013–2022 (USD Million)

Table 21 Holographic Telepresence Systems Market for Healthcare Industry, By Region, 2013–2022 (USD Million)

Table 22 Holographic Telepresence Systems Market for Commercial Industry, By Region, 2013–2022 (USD Million)

Table 23 Holographic Telepresence Systems Market for Education Industry, By Region, 2013–2022 (USD Million)

Table 24 Holographic Telepresence Systems Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 25 Robotic Telepresence Systems Market, By Industry, 2013–2022 (USD Million)

Table 26 Robotic Telepresence Market for Enterprise Industry, By Region, 2013–2022 (USD Million)

Table 27 Robotic Telepresence Systems Market for Healthcare Industry, By Region, 2013–2022 (USD Million)

Table 28 Robotic Telepresence Systems Market for Commercial Industry, By Region, 2013–2022 (USD Million)

Table 29 Robotic Telepresence Systems Market for Consumer Industry, By Region, 2013–2022 (USD Million)

Table 30 Robotic Telepresence Systems Market for Education Industry, By Region, 2013–2022 (USD Million)

Table 31 Robotic Telepresence Systems Market for Manufacturing Industry, By Region, 2013–2022 (USD Million)

Table 32 Robotic Telepresence Systems Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 33 Telepresence Market, By Industry, 2013–2022 (USD Million)

Table 34 Telepresence Market for Enterprise Industry, By System Type, 2013–2022 (USD Million)

Table 35 Telepresence Market for Enterprise Industry, By Static System Type, 2013–2022 (USD Million)

Table 36 Telepresence Market for Enterprise Industry, By Region, 2013–2022 (USD Million)

Table 37 Telepresence Market for Healthcare Industry, By System Type, 2013–2022 (USD Million)

Table 38 Telepresence Market for Healthcare Industry, By Static System Type, 2013–2022 (USD Million)

Table 39 Telepresence Market for Healthcare Industry, By Region, 2013–2022 (USD Million)

Table 40 Telepresence Market for Commercial Industry, By System Type, 2013–2022 (USD Million)

Table 41 Telepresence Market for Commercial Industry, By Static System Type, 2013–2022 (USD Million)

Table 42 Telepresence Market for Commercial Industry, By Region, 2013–2022 (USD Million)

Table 43 Telepresence Market for Consumer Industry, By System Type, 2013–2022 (USD Million)

Table 44 Telepresence Market for Consumer Industry, By Static System Type, 2013–2022 (USD Million)

Table 45 Telepresence Market for Consumer Industry, By Region, 2013–2022 (USD Million)

Table 46 Telepresence Market for Education Industry, By System Type, 2013–2022 (USD Million)

Table 47 Telepresence Market for Education Industry, By Static System Type, 2013–2022 (USD Million)

Table 48 Telepresence Market for Education Industry, By Region, 2013–2022 (USD Million)

Table 49 Telepresence Market for Manufacturing Industry, By System Type, 2013–2022 (USD Million)

Table 50 Telepresence Market for Manufacturing Industry, By Static System Type, 2013–2022 (USD Million)

Table 51 Telepresence Market for Manufacturing Industry, By Region, 2013–2022 (USD Million)

Table 52 Telepresence Market for Other Industries, By System Type, 2013–2022 (USD Million)

Table 53 Telepresence Market for Other Industries, By Static System Type, 2013–2022 (USD Million)

Table 54 Telepresence Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 55 Global Telepresence Market Size, By Region, 2013–2022 (USD Million)

Table 56 Telepresence Market in North America, By Industry, 2013–2022 (USD Million)

Table 57 Telepresence Market in North America, By Country, 2013–2022 (USD Million)

Table 58 Telepresence Market in Europe, By Industry, 2013–2022 (USD Million)

Table 59 Telepresence Market in Europe, By Country, 2013–2022 (USD Million)

Table 60 Telepresence Market in APAC, By Industry, 2013–2022 (USD Million)

Table 61 Telepresence Market in APAC, By Country, 2013–2022 (USD Million)

Table 62 Telepresence Market in RoW, By Industry, 2013–2022 (USD Million)

Table 63 Telepresence Market in RoW, By Region, 2013–2022 (USD Million)

Table 64 Market Ranking of Top 5 Players in the Telepresence Market

Table 65 New Product Launches and Developments, 2010–2016

Table 66 Agreements, Partnerships, Joint Ventures, Collaborations, and Expansions, 2012–2016

Table 67 Mergers & Acquisitions, 2015

Table 68 Others, 2011–2016

List of Figures (53 Figures)

Figure 1 Markets Covered

Figure 2 Telepresence Market: Research Design

Figure 3 Telepresence Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Telepresence Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions for the Research Study

Figure 6 Telepresence Market, By System Type, 2013–2022 (USD Million)

Figure 7 Enterprise and Education Industries Expected to Hold A Large Share of the Telepresence Market By 2022

Figure 8 APAC to Grow at the Highest Rate in the Telepresence Market

Figure 9 Healthcare Industry Expected to Witness Highest Growth Rate Between 2016 and 2022

Figure 10 North America Held the Largest Market Share in 2015

Figure 11 Telepresence Market Expected to Grow at A High CAGR During the Forecast Period

Figure 12 Static Telepresence Systems to Exhibit High Growth During the Forecast Period

Figure 13 North America Held the Largest Market Share in 2015

Figure 14 Telepresence Market in India Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 15 Evolution of Telepresence

Figure 16 Telepresence Market, By Geography

Figure 17 Growing Demand for Telepresence Systems in Healthcare and Enterprise Sectors is A Driving Factor

Figure 18 Value Chain Analysis (2015): Major Value Added During Research & Product Development and Manufacturing Stages

Figure 19 Porter’s Five Force Analysis, 2015

Figure 20 Porter’s Five Force Analysis for the Telepresence Market, 2015

Figure 21 Impact Analysis of Threat of New Entrants

Figure 22 Impact Analysis of Threat of Substitutes

Figure 23 Impact Analysis of Bargaining Power of Buyers

Figure 24 Impact Analysis of Bargaining Power of Suppliers

Figure 25 Impact Analysis of Intensity of Competitive Rivalry

Figure 26 Software Market Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 27 The Holographic Telepresence Systems Market Expected to Grow at the Highest Rate During Forecast Period

Figure 28 Healthcare Industry Expected to Grow at A High Rate During the Forecast Period for Immersive Telepresence Systems Market

Figure 29 Immersive Telepresence Market for Healthcare Industry in North America Held the Largest Share in 2015

Figure 30 The Healthcare Industry Expected to Grow at the Highest Rate During Forecast Period

Figure 31 Enterprise Industry Held the Largest Share of North America Region in 2015

Figure 32 Robotic Telepresence Systems Market for Consumer Industry Held the Largest Size in 2015

Figure 33 The Healthcare Industry to Grow at A High Rate Between 2016 and 2022

Figure 34 The Immersive Telepresence Systems Held the Largest Share of Healthcare Sector in 2015

Figure 35 Telepresence Market for Consumer Industry Held the Largest Size in APAC

Figure 36 Personal Telepresence System to Grow at the Highest Rate in the Manufacturing Industry During the Forecast Period

Figure 37 Geographic Snapshot: APAC Held the Highest Growth Rate

Figure 38 APAC Region to Grow at the Highest Rate in the Telepresence Market During Forecast Period

Figure 39 North America: Telepresence Market Overview, 2015

Figure 40 APAC: Telepresence Market Overview, 2015

Figure 41 Companies Adopted New Product Launces as the Key Growth Strategy Between 2010 and 2016

Figure 42 Telepresence Market Evaluation Framework, 2013–2016

Figure 43 Battle for Market Share: New Product Launches Was the Key Strategy Between 2013 and 2016

Figure 44 Geographical Revenue Mix of Top 5 Market Players

Figure 45 Cisco Systems, Inc.: Company Snapshot

Figure 46 Cisco Systems, Inc.: SWOT Analysis

Figure 47 Polycom, Inc.: Company Snapshot

Figure 48 Polycom, Inc.: SWOT Analysis

Figure 49 Huawei Technologies Co., Ltd.: SWOT Analysis

Figure 50 ZTE Corp.: Company Snapshot

Figure 51 ZTE Corp.: SWOT Analysis

Figure 52 Lifesize, Inc.: SWOT Analysis

Figure 53 Avaya Inc.: Company Snapshot

This research study involves an extensive usage of secondary sources, directories, and databases (Factiva and OneSource) to identify and collect information useful for technical, market-oriented, and commercial aspects of telepresence technology. Top-down and bottom-up approaches have been implemented to arrive at the size of the telepresence market.

The points below explain the research methodology applied:

- The study of annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with industry experts

- Analysis of the opportunities in the market for stakeholders by identifying high-growth segments

- Analyzing competitive developments such as mergers & acquisitions, new product developments, and research & development

- Carrying out primary and secondary research to derive all the percentage splits and segment breakdown of the market

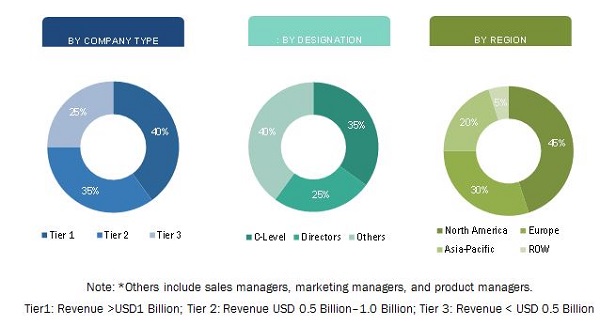

The figure below shows the breakdown of primaries on the basis of companies, designations, and regions, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The telepresence ecosystem comprises key manufacturers such as Cisco Systems, Inc. (U.S.), Polycom Inc. (U.S.), Avaya Inc. (U.S.), ZTE Corp. (U.S.), among others; software manufacturers includes Polycom, Inc. (U.S.), Vidyo Inc. (U.S.) and LifeSize, Inc. (U.S.) among others; and service provider companies include Cisco Systems, Inc. (U.S.), Polycom Inc. (U.S.), and Teliris Inc. (U.K.) among others; these are connected with their partners and distributers for selling the complete systems to end users in various verticals.

Please visit 360Quadrants to see the vendor listing of Video Conferencing Software

Target Audience:

- Telepresence device manufacturers

- Software and service providers

- Research organizations and consulting companies

- Associations, forums, and alliances related to telepresence

- Investors

“Study answers several questions for the target audiences, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.”

Scope of the Report:

This report categorizes the global market for telepresence on the basis of component, system type, industry, and geography.

On the basis of Component & Service:

-

Hardware

- Display

- Projector

-

Camera

- PTZ Camera

- USB Camera

- Other

- Sensor

-

Audio Device

- Conference Phone

- Desktop Phone

- Microphone

- Speaker

- Other

- Lightings

- Processors

-

Others

- Switches

- Routers

- Adapters

- Cables

-

Software

- Cloud Computing Software

- Audio-video Communication Software

- Servers

- Services

On the Basis of System Type:

-

Static Telepresence

- Immersive telepresence

- Personal Telepresence

- Holographic telepresence

- Robotic Telepresence

On the Basis of Industry:

-

Enterprise

- Government

- Private

- Healthcare

-

Commercial

- Retail

- Advertisement

- Designing

-

Consumer

- Sports

- Entertainment

-

Manufacturing Industries

- Energy

- Education

-

Others Industries

- Construction

- Engineering

- Space

On the Basis of Region:

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- U.K.

- France

- Rest of Europe (Spain and Italy)

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia and Netherlands)

-

RoW

- Middle East and Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Telepresence (Videoconferencing) Market

We are planning to enter into robotic telepresence market space and hence would like to understand the dynamics well and the overall market competition too.

We participated in this and apart from complementary executive summary, we would like to get a complimentary copy to check the accuracy of what was ultimately published.

I am an editor for a technology magazine and I would like to know your thoughts on the future of audio-video conferences. Can you help me with the growth projections specifically for niche applications in industries such as education and healthcare?

As a part of my research paper, I'm looking into how businesses are expected to communicate (phone vs teleconference vs slack type software) in the future. Hence, would request you to help me with a sample of the report and some interesting insights for my research paper.

I'm trying to get an understanding of the size and potential growth trajectory of the collaboration / telepresence / system integration industry in South Africa

Do you have a newer version of this report - also what kind of multi-user license can I get? We only need the report for a few folks.

We are planning to enter into telepresence services and hence would like to analyze the growth opportunities in the market in terms of value and attractive industries