Teleradiology Market by Product & Service (Services, Hardware, Software (PACS, RIS)), Imaging Technique (MRI, CT, X-ray, Ultrasound, Mammography, Nuclear Imaging), End User (Hospitals, Diagnostic Centers & Laboratories) & Region - Global Forecast to 2026

Market Growth Outlook Summary

The global teleradiology market forecasted to transform from $7.3 billion in 2021 to $14.8 billion by 2026, driven by a CAGR of 15.3%. Key growth drivers include the rising elderly population, increased imaging procedures, a shortage of radiologists, and technological advancements like cloud-based solutions and artificial intelligence (AI). The market faces challenges such as declining reimbursements and limited internet access in rural areas. AI integration presents significant growth opportunities, while cybersecurity and data privacy concerns pose challenges. Major players include Philips Healthcare, GE Healthcare, Medica Group, and Cerner Corporation, with hospitals and clinics being the largest end-users. Asia-Pacific is expected to witness the highest growth due to increased healthcare awareness and infrastructure improvements.

To know about the assumptions considered for the study, Request for Free Sample Report

Teleradiology Market Dynamics

Driver: growing number of advanced imaging procedures and a shortage of skilled radiologists

The rise in imaging procedures is expected to drive the demand for advanced teleradiology solutions for reliability and efficiency. According to a University College London article published in July 2020, the NHS performs approximately 5 million CT scans per year; in the United States, the number of CT scans performed annually exceeds 80 million. CT scanning accounts for a quarter of Americans' total exposure to radiation. A high degree of technical skill and expertise is required to handle advanced and sophisticated diagnostic imaging systems, thus fueling the growing complexity of cases with a shortage of adequate resources. The adoption of teleradiology solutions has significantly helped bridge the rural-urban disparity in many emerging countries, including India and Brazil, as well as in developed economies like the US, the UK, and Germany. These solutions are more convenient and cost-effective, as they eliminate the need for travel and allow radiologists to work from anywhere. A dearth of qualified radiologists has further increased the demand for teleradiology services.

Restraint: Limited access to high-speed internet in rural areas

With teleradiology, patients and experts in rural areas can get high-quality imaging advice without travelling to more populated urban areas with more advanced healthcare systems. Moreover, radiologists working remotely need a good internet connection. However, the lack of high-speed broadband connections affects expanding access to teleradiology services in rural areas. For instance, according to the 2018 Broadband Deployment Report, only 69.3% of rural areas and 64.6% of tribal areas had access to high-speed broadband internet that met the minimum benchmark set by the Federal Communications Commission (FCC).

The limited access to high-speed internet connections affects the ability of radiologists to participate in video consultations, transmit medical image reports, and monitor patients’ health conditions remotely. Workflows can quickly become frustrating and, potentially, affect patient care if a slow connection bottlenecks image-rich studies. Furthermore, information technology services are required to ensure that images are sent in a HIPAA-compliant manner. Hence, the lack of a reliable internet connection or poor broadband connections in rural areas is a major restraint on the steady expansion of the global market.

Opportunity: Adoption of artificial intelligence in teleradiology

Artificial intelligence is one of the most promising breakthroughs in the field of teleradiology. In the past 10 years, it is estimated that the number of publications on AI in radiology increased from an average of 100–150 research publications per year to 700–800 per year. Of all the major imaging modalities, the adoption of AI is higher in CT and MRI systems; likewise, based on applications, AI is heavily used in neuroradiology. Several players in this market have increased their offerings in the field of AI. For instance, in the 2018 Radiology Society of North America (RSNA) annual conference, about 104 companies exhibited AI-based technologies in the medical imaging space, of which 25 were first-time exhibitors. AI can assist in the development of an in-built system that prioritises cases based on protocol requirements. For example, cases of trauma and stroke can be prioritised and assigned to the radiologist’s work lists, thereby saving many lives.

Challenge: Data breach and cybersecurity risks

Teleradiology enables the sharing of medical images to facilitate the delivery of care. However, cybersecurity measures to protect patient health information are often not implemented. There are ethical and legal obligations for healthcare providers to preserve the privacy and confidentiality of patient information, which can contain some of the most intimate information about an individual. Most clinical picture archiving and communication systems (PACS) use digital imaging and communications in medicine (DICOM) as the standard image format for medical images. PACS could result in significant data loss, could serve as an avenue to cause disruption through a hospital’s system, or should the information be altered or misdirected, could impede timely diagnosis and treatment, thereby challenging the growth of this market.

The software segment is estimated to grow at the highest CAGR in the teleradiology industry, by products and services.

Based on product and service, the teleradiology market is segmented into teleradiology services, software, and hardware. The teleradiology services segment accounted for the largest share. The software segment is estimated to grow at the highest CAGR during the forecast period. The increasing demand for healthcare software has driven software companies to improve interoperability, enhance technical capabilities, and increase data transparency. Moreover, the COVID-19 outbreak has led to an increased need for better management of large amounts of patient data. Due to this, many hospitals are deploying teleradiology solutions to improve the efficiency of healthcare providers and improve patient outcomes. Moreover, the software segment is further classified as RIS and PACS.

The CT segment will dominate the teleradiology industry during the forecast period.

Based on imaging technique, the teleradiology market is segmented into X-ray, computed tomography (CT), ultrasound, magnetic resonance imaging (MRI), nuclear imaging, fluoroscopy, and mammography. The computed tomography segment accounted for the largest market share. Computed tomography (CT) is used in a wide range of applications, such as cardiology, oncology, neurology, abdominal and pelvic imaging, and spine and musculoskeletal imaging. Factors such as the growing need for effective and early diagnosis, technological advancements, and digitalization in this field are driving the growth of the market in this segment. According to the WHO, more than 100 million CT scans are performed every year across the globe. The need to prevent exploratory surgeries and improvements in cancer diagnosis and treatment have increased the demand for CT scans over other imaging techniques.

Hospitals and clinics are the largest end users of the teleradiology industry.

Based on end users, the teleradiology market is segmented into hospitals and clinics; diagnostic imaging centers and laboratories; long-term care centers, nursing homes, and assisted living facilities; and other end users. The hospitals and clinics segment accounted for the largest share of revenue. The large share of this segment can be attributed to the rising number of diagnostic imaging procedures performed in hospitals, the growing inclination of hospitals towards the automation and digitization of patient records, and the growing need to improve the quality of patient care. Moreover, a shortage of radiologists due to the COVID-19 pandemic and the rising adoption of advanced imaging modalities to improve workflow efficiency in hospitals are expected to further support the growth of this end-user segment.

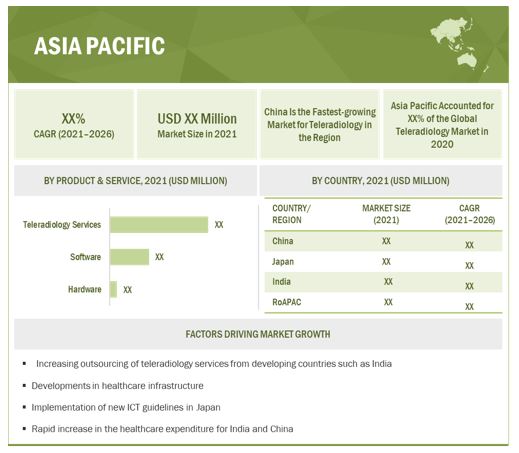

Asia Pacific witnesses the highest growth in the teleradiology industry.

The teleradiology market is divided into five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. These regions are further analysed at the country level. North America held the largest share of this market, followed by Europe and the Asia Pacific. The Asia-Pacific market is projected to grow at the highest CAGR. Market growth in the APAC region is mainly driven by growing awareness about the benefits of early disease diagnosis, improvements in healthcare systems, a growing medical tourism market in APAC countries, increasing healthcare expenditure, and increasing government initiatives for modernising the healthcare infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the teleradiology market are dominated by a few globally established players, such as Philips Healthcare (Netherlands), GE Healthcare (US), Medica Group Plc. (UK), and Cerner Corporation (US).

Scope of the Teleradiology Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$7.3 billion |

|

Projected Revenue Size by 2026 |

$14.8 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 15.3% |

|

Market Driver |

Growing number of advanced imaging procedures and a shortage of skilled radiologists |

|

Market Opportunity |

Adoption of artificial intelligence in teleradiology |

The study categorizes the global teleradiology market to forecast revenue and analyze trends in each of the following submarkets:

By Products and Services

- Teleradiology Services

-

Software

- PACS

- RIS

By Imaging Technique

- CT

- MRI

- Ultrasound

- X-ray

- Mammography

- Nuclear Imaging

- Fluoroscopy

By End Users

- Hospitals and Clinics

- Diagnostic Imaging Center and Laboratories

- Long term care centers, nursing homes, assisted living facilities.

- Others

Recent Developments of Teleradiology Industry

- In August 2021, GE Healthcare (US) launched a cloud-based Edison True PACS that provides innovative and AI-enabled decision-making tools that help enhance reading speed, reduce errors, improve diagnostic precision, and enable confident diagnoses.

- In January 2021, Medica Group (UK) partnered with Sectra AB (Sweden) to provide a new Picture Archive and Communication System (PACS) for elective and emergency NightHawk reporting. This development is expected to help hospitals read a wide range of emergency imaging reports in an average of 23 minutes.

- In December 2021, McKesson Corporation (US) launched Stratus Imaging PACS, a cloud-native, zero-footprint picture archiving and communication system.

- In March 2020, USARAD Holdings Inc. (US) partnered with Medical Diagnostic Web (MDW), a blockchain-powered marketplace that provides access to hundreds of radiologists ready to provide diagnostic assistance. The new programme allows providers to upload images through USARAD’s online service, available 24 hours a day. Radiologists will be available to help either diagnose or rule out COVID-19.

- In March 2020, USARAD Holdings Inc. (US) collaborated with Nanox Imaging (Israel) to facilitate bringing Nanox’s mobile imaging system to high-risk areas, supporting COVID-19 screening efforts in these locations.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global teleradiology market?

The global teleradiology market boasts a total revenue value of $14.8 billion by 2026.

What is the estimated growth rate (CAGR) of the global teleradiology market?

The global teleradiology market has an estimated compound annual growth rate (CAGR) of 15.3% and a revenue size in the region of $7.3 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 TELERADIOLOGY INDUSTRY DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 TELERADIOLOGY MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH APPROACH

FIGURE 2 TELERADIOLOGY MARKET: RESEARCH METHODOLOGY STEPS

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

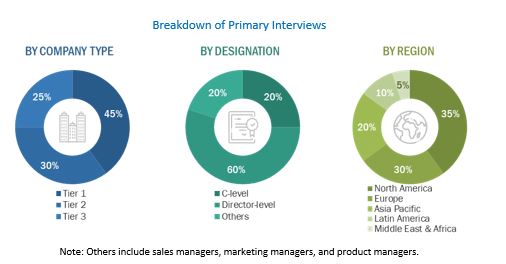

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION: PARENT MARKET

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MARKET (2021–2026)

2.3 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO IN THE MARKET

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 11 MARKET DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 12 TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 TELERADIOLOGY INDUSTRY, BY IMAGING TECHNIQUE, 2020 VS. 2026 (USD MILLION)

FIGURE 14 TELERADIOLOGY INDUSTRY, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF THE TELERADIOLOGY INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 TELERADIOLOGY MARKET OVERVIEW

FIGURE 16 SHORTAGE OF SKILLED RADIOLOGISTS & THE INCREASING ADOPTION OF CLOUD-BASED SOLUTIONS ARE KEY FACTORS DRIVING THE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE AND COUNTRY (2020)

FIGURE 17 THE TELERADIOLOGY SERVICES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2020

4.3 TELERADIOLOGY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: MARKET (2021−2026)

FIGURE 19 NORTH AMERICA WILL CONTINUE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 TELERADIOLOGY MARKET: DEVELOPING VS. DEVELOPED MARKETS

FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 TELERADIOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Rising geriatric population and the subsequent increase in age-associated diseases

TABLE 2 AGE-RELATED DISEASES AND ASSOCIATED IMAGING SYSTEMS

5.2.1.2 Growing number of advanced imaging procedures and a shortage of skilled radiologists

5.2.1.3 Advancements in teleradiology solutions

TABLE 3 TECHNOLOGICAL ADVANCEMENTS IN TELERADIOLOGY SYSTEMS

5.2.1.4 Rising demand for cloud-based solutions

5.2.2 RESTRAINTS

5.2.2.1 Limited access to high-speed internet in rural areas

5.2.2.2 Declining reimbursements and increasing regulatory burden in the US

TABLE 4 MEDICARE REIMBURSEMENT TRENDS, BY IMAGING MODALITY, 2007–2019

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of Artificial Intelligence (AI) in Teleradiology

5.2.3.2 Use of blockchain in teleradiology

5.2.3.3 High growth opportunities in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Data breach and cybersecurity risks

5.3 INDUSTRY TRENDS

5.3.1 GROWING ADOPTION OF TELEHEALTH SOLUTIONS

5.3.2 DEMAND FOR SUBSPECIALTY SERVICES

5.4 PRICING ANALYSIS

TABLE 5 PRICING ANALYSIS OF TELERADIOLOGY SERVICES PER SCAN BY IMAGING TECHNIQUE IN THE US, 2020 (USD)

TABLE 6 PRICING ANALYSIS OF KEY IMAGING SCANS, BY REGION, 2020 (USD)

5.5 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS

5.6 ECOSYSTEM ANALYSIS

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 BARGAINING POWER OF BUYERS

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 THREAT OF NEW ENTRANTS

5.8.4 THREAT OF SUBSTITUTES

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 REGULATORY ANALYSIS

TABLE 8 KEY REGULATIONS & STANDARDS GOVERNING TELERADIOLOGY SOLUTIONS

5.10 IMPACT OF COVID-19 ON THE MARKET

6 TELERADIOLOGY MARKET, BY PRODUCT & SERVICE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 24 SOFTWARE SEGMENT TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 9 TELERADIOLOGY INDUSTRY, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

6.2 TELERADIOLOGY SERVICES

6.2.1 RISING DEMAND FOR EMERGENCY & CONSULTING SERVICES TO DRIVE THE MARKET GROWTH FOR THIS SEGMENT

TABLE 10 SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 11 TELERADIOLOGY SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 SOFTWARE

TABLE 12 TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 13 TELERADIOLOGY SOFTWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1 PICTURE ARCHIVING & COMMUNICATION SYSTEMS (PACS)

6.3.1.1 Frequent need for upgrades & improvements in software applications to drive the growth of the PACS segment

TABLE 14 PACS SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 15 PACS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.2 RADIOLOGY INFORMATION SYSTEMS (RIS)

6.3.2.1 RIS is often used with PACS and VNA

TABLE 16 RIS SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 17 RIS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4 HARDWARE

6.4.1 FASTER DATA EXCHANGE & BETTER INTEROPERABILITY ARE FACTORS DRIVING THE DEMAND FOR HARDWARE DEVICES

TABLE 18 TELERADIOLOGY HARDWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7 TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE (Page No. - 82)

7.1 INTRODUCTION

FIGURE 25 CT SEGMENT WILL CONTINUE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 19 TELERADIOLOGY INDUSTRY, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

7.2 COMPUTED TOMOGRAPHY

7.2.1 INCREASING INCIDENCE OF CVD IS DRIVING THE DEMAND FOR CT SCANS

TABLE 20 MARKET FOR COMPUTED TOMOGRAPHY, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 MAGNETIC RESONANCE IMAGING (MRI)

7.3.1 INCREASING PREVALENCE OF NEUROLOGICAL DISORDERS TO DRIVE THE MARKET GROWTH

TABLE 21 MARKET FOR MAGNETIC RESONANCE IMAGING, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 ULTRASOUND

7.4.1 INCREASING PREVALENCE OF TARGET DISEASES & THE DEVELOPMENT OF POC ULTRASOUND SYSTEMS TO SUPPORT THE MARKET GROWTH

TABLE 22 TELERADIOLOGY MARKET FOR ULTRASOUND IMAGING, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 X-RAY

7.5.1 HIGH USAGE IN PRIMARY DIAGNOSIS HAS INCREASED THE DEMAND FOR X-RAY IMAGING TECHNOLOGY

TABLE 23 MARKET FOR X-RAY IMAGING, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 MAMMOGRAPHY

7.6.1 INCREASING INCIDENCE OF BREAST CANCER AMONG WOMEN TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 24 MARKET FOR MAMMOGRAPHY IMAGING, BY COUNTRY, 2019–2026 (USD MILLION)

7.7 NUCLEAR IMAGING

7.7.1 RISING PREVALENCE OF CANCER TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 25 MARKET FOR NUCLEAR IMAGING, BY COUNTRY, 2019–2026 (USD MILLION)

7.8 FLUOROSCOPY

7.8.1 HIGH RADIATION DOSE - A MAJOR DRAWBACK ASSOCIATED WITH FLUOROSCOPY PROCEDURES

TABLE 26 MARKET FOR FLUOROSCOPY IMAGING, BY COUNTRY, 2019–2026 (USD MILLION)

8 TELERADIOLOGY MARKET, BY END USER (Page No. - 94)

8.1 INTRODUCTION

FIGURE 26 HOSPITALS AND CLINICS ARE THE MAJOR END USERS OF TELERADIOLOGY SOLUTIONS

TABLE 27 TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

8.2 HOSPITALS AND CLINICS

8.2.1 LARGE HOSPITALS HAVE BEEN EARLY ADOPTERS OF TELERADIOLOGY SOLUTIONS

TABLE 28 MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 DIAGNOSTIC IMAGING CENTERS AND LABORATORIES

8.3.1 GROWING NUMBER OF PRIVATE IMAGING CENTERS TO SUPPORT THE MARKET GROWTH

TABLE 29 TELERADIOLOGY MARKET FOR DIAGNOSTIC IMAGING CENTERS AND LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 LONG-TERM CARE CENTERS, NURSING HOMES, & ASSISTED LIVING FACILITIES

8.4.1 GRADUAL SHIFT OF PATIENT CARE FROM INPATIENT TO OUTPATIENT SETTINGS TO DRIVE THE GROWTH OF THIS END-USER SEGMENT

TABLE 30 MARKET FOR LONG-TERM CARE CENTERS, NURSING HOMES, & ASSISTED LIVING FACILITIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 OTHER END USERS

TABLE 31 MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

9 TELERADIOLOGY MARKET, BY REGION (Page No. - 102)

9.1 INTRODUCTION

FIGURE 27 GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 32 TELERADIOLOGY INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: TELERADIOLOGY MARKET SNAPSHOT

TABLE 33 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: TELERADIOLOGY INDUSTRY, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominates the North American teleradiology market

TABLE 38 US: MAJOR INDICATORS OF MARKET GROWTH

TABLE 39 US: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 40 US: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 41 US: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 42 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Presence of a large number of diagnostic imaging centers in Canada to drive the market growth

TABLE 43 CANADA: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 44 CANADA: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 CANADA: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 46 CANADA: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.3 EUROPE

FIGURE 29 EUROPE: CANCER PREVALENCE, BY COUNTRY, 2012–2030

TABLE 47 EUROPE: TELERADIOLOGY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 48 EUROPE: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 49 EUROPE: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 51 EUROPE: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 High healthcare spending to support the adoption of teleradiology solutions in Germany

TABLE 52 INCREASE IN DISEASE INCIDENCE IN GERMANY

TABLE 53 GERMANY: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 54 GERMANY: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 GERMANY: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 56 GERMANY: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Increasing government healthcare expenditure and rising adoption of teleradiology services to drive market growth in the UK

TABLE 57 UK: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 58 UK: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 UK: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 60 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 COVID-19 has significantly increased the demand for teleradiology solutions in the country

TABLE 61 FRANCE: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 62 FRANCE: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 FRANCE: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 64 FRANCE: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 The growing burden of several diseases and a shortage of radiologists to support the market for teleradiology services in Italy

TABLE 65 ITALY: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 66 ITALY: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 ITALY: TELERADIOLOGY INDUSTRY, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 68 ITALY: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Growing awareness about teleradiology technologies among healthcare professionals to support the market growth in Spain

TABLE 69 SPAIN: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 70 SPAIN: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 SPAIN: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 72 SPAIN: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 73 ROE: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 74 ROE: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 ROE: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 76 ROE: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: CANCER PREVALENCE, 2012–2030

FIGURE 31 ASIA PACIFIC: TELERADIOLOGY MARKET SNAPSHOT

TABLE 77 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 79 ASIA PACIFIC: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 81 ASIA PACIFIC: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Government initiatives in the form of healthcare reforms & investments to drive the market growth in China

TABLE 82 CHINA: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 83 CHINA: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 CHINA: TELERADIOLOGY INDUSTRY, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 85 CHINA: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 High adoption of advanced technologies in Japan to support the market growth for teleradiology solutions

TABLE 86 JAPAN: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 87 JAPAN: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 JAPAN: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 89 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising healthcare needs in remote locations and the robust expansion of healthcare infrastructure to drive the market growth in India

TABLE 90 INDIA: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 91 INDIA: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 INDIA: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 93 INDIA: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 94 ROAPAC: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 95 ROAPAC: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 ROAPAC: TELERADIOLOGY INDUSTRY, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 97 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA (LATAM)

TABLE 98 LATIN AMERICA: TELERADIOLOGY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 100 LATIN AMERICA: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 102 LATIN AMERICA: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 High incidence of chronic diseases drive the demand for teleradiology services in the country

TABLE 103 BRAZIL: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 104 BRAZIL: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 BRAZIL: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 106 BRAZIL: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Rising adoption of digital healthcare to drive the growth of the teleradiology market in Mexico

TABLE 107 MEXICO: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 108 MEXICO: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 MEXICO: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 110 MEXICO: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 111 ROLATAM: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 112 ROLATAM: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 ROLATAM: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 114 ROLATAM: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA (MEA)

9.6.1 DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO DRIVE THE MARKET GROWTH FOR TELERADIOLOGY SOLUTIONS IN THE MEA REGION

TABLE 115 MIDDLE EAST & AFRICA: TELERADIOLOGY MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: TELERADIOLOGY SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY IMAGING TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: TELERADIOLOGY INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 150)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 32 TELERADIOLOGY INDUSTRY EVALUATION FRAMEWORK: PARTNERSHIPS, AGREEMENTS, & COLLABORATIONS WERE THE MOST WIDELY ADOPTED STRATEGIES

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

10.3.4 EMERGING COMPANIES

FIGURE 33 TELERADIOLOGY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

10.4 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2020)

10.4.1 PROGRESSIVE COMPANIES

10.4.2 STARTING BLOCKS

10.4.3 RESPONSIVE COMPANIES

10.4.4 DYNAMIC COMPANIES

FIGURE 34 TELERADIOLOGY MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2020

10.5 COMPETITIVE BENCHMARKING

TABLE 119 FOOTPRINT OF COMPANIES IN THE TELERADIOLOGY MARKET

10.6 COMPANY PRODUCT & IMAGING TECHNIQUE FOOTPRINT

TABLE 120 PRODUCT AND IMAGING TECHNIQUE FOOTPRINT ANALYSIS OF TOP PLAYERS IN THE TELERADIOLOGY MARKET

10.7 MARKET RANKING ANALYSIS

FIGURE 35 TELERADIOLOGY MARKET RANKING ANALYSIS, BY PLAYER, 2020

10.8 TELERADIOLOGY INDUSTRY: COMPETITIVE SITUATIONS & TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 121 KEY PRODUCT LAUNCHES

10.8.2 DEALS

TABLE 122 KEY PARTNERSHIPS, AGREEMENTS, COLLABORATIONS, AND ACQUISITIONS

11 COMPANY PROFILES (Page No. - 162)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.2 GE HEALTHCARE

TABLE 124 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 37 GE HEALTHCARE: COMPANY SNAPSHOT (2020)

11.1.3 MEDICA GROUP PLC.

TABLE 125 MEDICA GROUP PLC.: BUSINESS OVERVIEW

FIGURE 38 MEDICA GROUP PLC.: COMPANY SNAPSHOT (2020)

11.1.4 SERVICES OFFERED

11.1.5 CERNER CORPORATION

TABLE 126 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 39 CERNER CORPORATION: COMPANY SNAPSHOT (2020)

11.1.6 MCKESSON CORPORATION

TABLE 127 MCKESSON CORPORATION: BUSINESS OVERVIEW

FIGURE 40 MCKESSON CORPORATION: COMPANY SNAPSHOT (2020)

11.2 OTHER PLAYERS

11.2.1 AGFA HEALTHCARE

TABLE 128 AGFA HEALTHCARE: BUSINESS OVERVIEW

FIGURE 41 AGFA HEALTHCARE: COMPANY SNAPSHOT (2020)

11.2.2 SIEMENS HEALTHINEERS

TABLE 129 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

FIGURE 42 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2020)

11.2.3 FUJIFILM HOLDINGS CORPORATION

TABLE 130 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 43 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2020)

11.2.4 4WAYS HEALTHCARE

TABLE 131 4WAYS HEALTHCARE LTD.: BUSINESS OVERVIEW

11.2.5 TELERADIOLOGY SOLUTIONS

TABLE 132 TELERADIOLOGY SOLUTIONS: BUSINESS OVERVIEW

11.2.6 ONRAD, INC.

TABLE 133 ONRAD, INC: BUSINESS OVERVIEW

11.2.7 RAMSOFT, INC.

TABLE 134 RAMSOFT, INC.: BUSINESS OVERVIEW

11.2.8 NOVARAD CORPORATION

TABLE 135 NOVARAD CORPORATION: BUSINESS OVERVIEW

11.2.9 TELEDIAGNOSTIC SOLUTIONS PVT. LTD.

TABLE 136 TELEDIAGNOSTIC SOLUTIONS PVT. LTD.: BUSINESS OVERVIEW

11.2.10 STATRAD LLC

TABLE 137 STATRAD LLC: BUSINESS OVERVIEW

11.2.11 MEDWEB LLC

TABLE 138 MEDWEB LLC.: BUSINESS OVERVIEW

11.2.12 NAUTILUS MEDICAL

TABLE 139 NAUTILUS MEDICAL: BUSINESS OVERVIEW

11.2.13 MIRADA MEDICAL

TABLE 140 MIRADA MEDICAL LTD.: BUSINESS OVERVIEW

11.2.14 TELERAD TECH

TABLE 141 TELERAD TECH: BUSINESS OVERVIEW

11.2.15 USARAD HOLDINGS, INC.

TABLE 142 USARAD HOLDINGS, INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 215)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities for estimating the current size of the teleradiology market. Exhaustive secondary research was conducted to collect information on the market as well as its peer and parent markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Revenue Share Analysis, Parent Market and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the teleradiology market. Primary sources from the demand side include experts from hospitals and diagnostic labs and research and academic laboratories. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the teleradiology market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the teleradiology market

The size of the teleradiology market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global teleradiology market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the teleradiology market on the basis of product and service, imaging technique, and end user

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, along with major countries in these regions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 in the teleradiology market

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, new product developments, geographic expansions, and research and development activities in the teleradiology market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, New Zealand, Australia, Singapore, and other countries

- Further breakdown of the RoE market into Russia, the Netherlands, Switzerland, and other countries

Company Information

- Detailed analysis and profiling of additional market players, up to five

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Teleradiology Market

Which industries will be heavily influenced by teleradiology in the future?

Which segment accounted for the largest market share for the teleradiology market?

I would like to know more about the key factors driving the teleradiology market growth.